| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

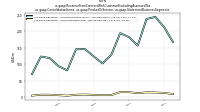

| Common Stock Value | 0.12 | 0.11 | 0.11 | 0.11 | 0.11 | 0.11 | 0.11 | 0.11 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.08 | 0.08 | 0.08 | 0.08 | 0.01 | NA | 0.01 | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 114.59 | 111.68 | 110.10 | NA | 108.62 | 107.40 | 106.66 | NA | 105.14 | 104.39 | 103.43 | NA | 107.61 | 98.79 | 93.44 | NA | 97.17 | 91.22 | NA | NA | 94.64 | 90.74 | NA | NA | 58.87 | 14.91 | NA | NA | 17.86 | 74.08 | |

| Weighted Average Number Of Shares Outstanding Basic | 114.59 | 111.68 | 110.10 | NA | 108.62 | 107.40 | 106.66 | NA | 105.14 | 104.39 | 103.43 | NA | 99.84 | 98.79 | 93.44 | NA | 91.99 | 91.22 | NA | NA | 87.74 | 83.16 | NA | NA | 58.87 | 14.91 | NA | NA | 14.44 | 14.34 | |

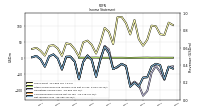

| Earnings Per Share Basic | -0.17 | -0.25 | -0.55 | -0.57 | -0.83 | -0.73 | -0.86 | -0.27 | -0.20 | -0.29 | -0.37 | 0.13 | 0.32 | -0.08 | -0.64 | -0.08 | 0.07 | -0.14 | NA | NA | 0.04 | 0.04 | NA | NA | -0.50 | -7.15 | NA | NA | 0.04 | 0.95 | |

| Earnings Per Share Diluted | -0.17 | -0.25 | -0.55 | -0.57 | -0.83 | -0.73 | -0.86 | -0.27 | -0.20 | -0.29 | -0.37 | 0.13 | 0.30 | -0.08 | -0.64 | -0.08 | 0.07 | -0.14 | NA | NA | 0.04 | 0.04 | NA | NA | -0.50 | -7.15 | NA | NA | 0.03 | 0.02 | |

| Income Loss From Continuing Operations Per Basic Share | -0.00 | -0.00 | NA | NA | -0.00 | -0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Loss From Continuing Operations Per Diluted Share | -0.00 | -0.00 | NA | NA | -0.00 | -0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

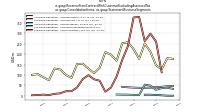

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

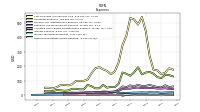

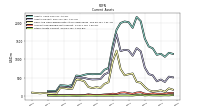

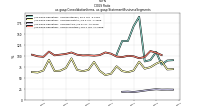

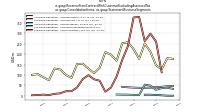

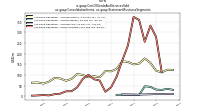

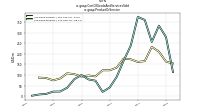

| Revenue From Contract With Customer Excluding Assessed Tax | 268.96 | 275.56 | 325.66 | 479.66 | 600.52 | 606.91 | 597.35 | 643.06 | 540.07 | 471.31 | 268.32 | 244.52 | 236.92 | 213.66 | 191.00 | 233.19 | 238.68 | 197.78 | 110.14 | 124.13 | 140.25 | 142.64 | 79.89 | 95.75 | 109.48 | 104.94 | 59.87 | 66.78 | 81.06 | 77.71 | |

| Cost Of Goods And Services Sold | 170.62 | 175.37 | 269.45 | 442.23 | 542.44 | 488.91 | 524.81 | 535.03 | 412.77 | 345.18 | 225.96 | 164.40 | 143.84 | 167.63 | 178.12 | 193.57 | 185.31 | 149.43 | 107.39 | 97.92 | 97.95 | 97.43 | 74.20 | 66.58 | 70.17 | 67.97 | 53.49 | 45.50 | 50.15 | 50.30 | |

| Gross Profit | 98.34 | 100.19 | 56.21 | 37.44 | 58.08 | 118.00 | 72.54 | 108.02 | 127.30 | 126.14 | 42.36 | 80.12 | 93.07 | 46.04 | 12.88 | 39.62 | 53.38 | 48.35 | 2.75 | 26.21 | 42.30 | 45.21 | 5.70 | 29.17 | 39.31 | 36.96 | 6.38 | 21.29 | 30.92 | 27.41 | |

| Operating Expenses | 123.87 | 148.04 | 160.12 | 155.97 | 143.10 | 192.66 | 157.66 | 133.25 | 147.20 | 156.45 | 76.87 | 54.48 | 56.06 | 50.47 | 70.31 | 46.44 | 45.94 | 60.77 | 70.20 | 38.72 | 39.02 | 42.76 | 42.87 | 31.54 | 29.07 | 32.69 | 34.50 | 26.71 | 25.25 | 26.07 | |

| Research And Development Expense | 44.39 | 47.14 | 48.19 | 47.04 | 48.06 | 51.51 | 49.64 | 43.89 | 43.66 | 41.49 | 27.68 | 23.61 | 22.45 | 17.96 | 20.27 | 19.34 | 18.80 | 16.06 | 15.56 | 13.69 | 14.31 | 13.03 | 12.76 | 11.29 | 11.48 | 10.09 | 9.67 | 8.85 | 9.78 | 8.06 | |

| General And Administrative Expense | 55.38 | 61.77 | 69.96 | 62.89 | 61.01 | 71.73 | 58.97 | 66.96 | 54.40 | 59.57 | 37.39 | 23.60 | 21.19 | 23.02 | 24.33 | 18.99 | 18.78 | 17.65 | 21.45 | 16.97 | 16.47 | 15.29 | 16.77 | 14.18 | 11.99 | 12.47 | 14.37 | 12.42 | 10.04 | 9.53 | |

| Operating Income Loss | -25.53 | -47.85 | -103.91 | -118.53 | -85.02 | -74.66 | -85.12 | -25.23 | -19.89 | -30.32 | -34.51 | 25.64 | 37.01 | -4.43 | -57.43 | -6.81 | 7.44 | -12.42 | -67.45 | -12.51 | 3.29 | 2.46 | -37.17 | -2.37 | 10.25 | 4.27 | -28.12 | -5.42 | 5.66 | 1.34 | |

| Interest Expense | 1.60 | 1.77 | 1.92 | 4.90 | 5.36 | 3.62 | 3.86 | 3.94 | 3.67 | 2.81 | 1.34 | 11.86 | 2.52 | 2.67 | 2.44 | 2.36 | 2.27 | 2.15 | 2.14 | 2.07 | 1.61 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | |

| Interest Paid Net | 5.17 | 3.76 | 4.61 | 7.22 | 6.31 | 3.20 | 3.38 | 2.05 | 3.50 | 1.06 | 0.97 | 1.96 | 0.87 | 0.55 | 1.58 | 0.00 | 1.26 | 0.00 | 1.20 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | |

| Gains Losses On Extinguishment Of Debt | 6.50 | 20.08 | 42.27 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 18.80 | 17.55 | 19.03 | 16.59 | 18.07 | 16.81 | 16.79 | 15.28 | 13.11 | 13.74 | 12.58 | 11.21 | 11.35 | 7.21 | 7.21 | 8.02 | 7.51 | 5.88 | 6.41 | 5.97 | 5.50 | 4.78 | 4.20 | 3.07 | 2.71 | 2.64 | 2.68 | 2.52 | 2.15 | 1.91 | |

| Income Loss From Continuing Operations | -18.97 | -27.21 | NA | NA | -46.25 | -74.52 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 0.24 | 0.23 | 0.41 | -0.30 | 0.13 | 0.16 | 0.13 | -0.74 | -0.31 | -5.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | 0.20 | -0.02 | 0.37 | NA | -0.06 | -0.25 | -0.56 | NA | -0.03 | -0.08 | -0.05 | NA | -0.13 | -0.13 | 0.53 | NA | -0.02 | 0.04 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | -18.97 | -27.36 | -60.80 | -61.95 | -90.25 | -78.15 | -90.81 | -27.00 | -18.95 | -27.88 | -35.78 | 14.04 | 34.17 | -6.61 | -60.12 | -7.78 | 6.78 | -12.62 | -67.18 | -12.22 | 3.48 | 3.21 | -36.44 | -1.80 | 10.56 | 4.30 | -28.07 | -5.33 | 5.70 | 1.39 | |

| Comprehensive Income Net Of Tax | -18.78 | -27.38 | -61.16 | -62.20 | -90.18 | -77.89 | -90.24 | -26.78 | -18.92 | -27.79 | -35.83 | 13.94 | 34.03 | -6.75 | -59.58 | -7.77 | 6.76 | -12.58 | -67.18 | -12.22 | 3.48 | 3.21 | -36.44 | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | -19.31 | -27.66 | -61.02 | -62.09 | -90.52 | -78.50 | -91.60 | -28.40 | -20.61 | -29.76 | -38.12 | 12.39 | 31.98 | -7.89 | -60.12 | -7.78 | 6.78 | -12.62 | -67.18 | -12.22 | 3.48 | 3.21 | -36.44 | -1.80 | -29.67 | -106.62 | -52.84 | -86.17 | 0.55 | 13.66 | |

| Net Income Loss Available To Common Stockholders Diluted | NA | NA | -61.02 | -62.09 | -90.52 | -78.50 | -91.60 | -28.40 | -20.61 | -29.76 | -38.12 | 12.39 | 31.98 | -7.89 | -60.12 | -7.78 | 6.78 | NA | NA | -12.22 | 3.48 | 3.21 | -36.44 | -1.80 | -29.67 | -106.62 | -52.84 | -60.84 | 0.55 | 1.39 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

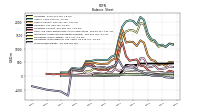

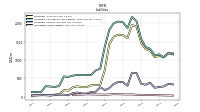

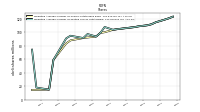

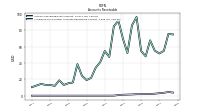

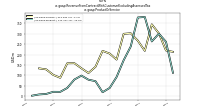

| Assets | 1125.87 | 1303.61 | 1354.44 | 1574.20 | 2050.94 | 2167.73 | 1867.15 | 2021.97 | 2043.35 | 2001.08 | 1816.58 | 1360.52 | 763.25 | 715.34 | 594.83 | 596.21 | 591.99 | 599.57 | 574.61 | 542.82 | 554.92 | 296.98 | 269.95 | 281.95 | 289.08 | 131.42 | NA | 133.48 | NA | NA | |

| Liabilities | 1080.16 | 1254.17 | 1293.85 | 1470.34 | 1903.65 | 1946.58 | 1591.65 | 1672.25 | 1685.61 | 1635.63 | 1433.11 | 730.14 | 323.16 | 320.28 | 314.65 | 264.77 | 264.26 | 287.32 | 260.26 | 170.88 | 182.17 | 71.37 | 60.70 | 46.52 | 55.58 | 57.03 | NA | 41.80 | NA | NA | |

| Liabilities And Stockholders Equity | 1125.87 | 1303.61 | 1354.44 | 1574.20 | 2050.94 | 2167.73 | 1867.15 | 2021.97 | 2043.35 | 2001.08 | 1816.58 | 1360.52 | 763.25 | 715.34 | 594.83 | 596.21 | 591.99 | 599.57 | 574.61 | 542.82 | 554.92 | 296.98 | 269.95 | 281.95 | 289.08 | 131.42 | NA | 133.48 | NA | NA | |

| Stockholders Equity | 5.75 | 9.50 | 20.66 | 63.95 | 107.39 | 181.25 | 235.62 | 309.85 | 317.88 | 325.60 | 343.63 | 590.56 | 400.28 | 355.26 | 280.19 | 331.45 | 327.72 | 312.25 | 314.35 | 371.94 | 372.75 | 225.61 | 209.25 | 235.43 | 233.51 | -716.72 | NA | -563.73 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 396.83 | 560.50 | 593.04 | 776.46 | 1222.04 | 1309.82 | 1099.23 | 1246.06 | 1263.35 | 1227.87 | 1694.36 | 1240.83 | 638.66 | 586.75 | 457.35 | 451.59 | 447.57 | 461.73 | 489.98 | 496.25 | 512.19 | 253.81 | 227.66 | 240.21 | 247.95 | 87.46 | NA | 93.39 | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 125.80 | 118.78 | 149.94 | 239.84 | 359.72 | 379.92 | 612.68 | 591.00 | 562.71 | 735.39 | 1241.26 | 925.28 | 371.57 | 325.35 | 213.94 | 234.68 | 209.23 | 241.10 | 395.62 | 432.61 | 448.97 | 194.24 | 190.77 | 208.34 | 212.44 | 54.21 | NA | 64.03 | 75.03 | 64.74 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 127.22 | 121.26 | 152.36 | 242.25 | 403.72 | 408.20 | 648.73 | 718.28 | 637.25 | 787.68 | 1343.05 | 945.82 | 387.97 | 360.45 | 230.71 | 247.45 | 219.22 | 259.24 | 406.09 | 439.06 | 460.94 | 211.65 | 201.90 | 212.66 | 222.54 | 66.06 | 44.87 | 67.84 | NA | NA | |

| Short Term Investments | 41.75 | 100.64 | 140.53 | 122.26 | NA | NA | NA | 33.74 | 28.58 | 29.61 | 140.84 | 131.56 | 129.81 | 128.06 | 75.05 | 70.03 | 62.05 | 35.37 | NA | 0.00 | NA | NA | NA | 0.00 | 1.26 | 1.50 | NA | 1.75 | NA | NA | |

| Accounts Receivable Net Current | 55.12 | 67.75 | 48.14 | 54.88 | 96.34 | 86.08 | 52.28 | 69.59 | 91.93 | 84.76 | 47.42 | 54.72 | 41.09 | 34.18 | 21.82 | 19.22 | 24.43 | 38.69 | 16.25 | 15.36 | 13.25 | 18.90 | 12.09 | 13.33 | 13.34 | 14.51 | NA | 10.62 | NA | NA | |

| Inventory Net | NA | NA | 10.69 | 114.27 | 301.23 | 377.52 | 245.49 | 358.22 | 435.14 | 249.00 | 97.37 | 49.16 | 24.99 | 9.44 | 70.65 | 74.59 | 105.46 | 85.65 | 38.31 | 22.69 | 25.16 | 14.52 | NA | 3.38 | NA | NA | NA | NA | NA | NA | |

| Other Assets Current | 8.81 | 9.98 | 14.92 | 8.69 | 26.74 | 18.38 | 6.75 | 7.52 | 8.54 | 7.15 | 7.01 | 4.90 | 5.19 | 4.55 | 5.24 | 3.50 | 5.76 | 5.86 | NA | 2.31 | 0.99 | 1.83 | 7.43 | 3.71 | 5.62 | 2.30 | NA | 8.78 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

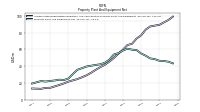

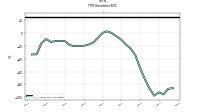

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 88.43 | 87.39 | 83.57 | 76.79 | 72.93 | 66.67 | 65.24 | 59.77 | 54.78 | 49.71 | 45.25 | 41.61 | 38.79 | 35.53 | 32.09 | 29.05 | 26.73 | 24.58 | 23.05 | 21.53 | 19.31 | 17.48 | 15.78 | 14.14 | 14.03 | 12.91 | NA | 13.27 | NA | NA | |

| Amortization Of Intangible Assets | 9.75 | 9.75 | 9.75 | 9.75 | 9.75 | 9.75 | 8.93 | 8.93 | 8.93 | 8.93 | 0.12 | 0.37 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.49 | 0.00 | 0.12 | |

| Property Plant And Equipment Net | 48.41 | 49.24 | 52.55 | 55.10 | 59.24 | 59.71 | 60.84 | 58.67 | 55.53 | 53.91 | 47.65 | 43.99 | 42.21 | 41.41 | 40.50 | 39.58 | 37.56 | 35.67 | 30.62 | 25.19 | 23.36 | 23.86 | 22.88 | 22.32 | 21.60 | 22.14 | NA | 19.23 | NA | NA | |

| Long Term Investments | 5.47 | 5.47 | 9.57 | 29.48 | 41.68 | 52.99 | 56.19 | 54.83 | 53.49 | 36.09 | 6.91 | 11.92 | 17.07 | 18.79 | 26.71 | 30.98 | 38.48 | 34.95 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

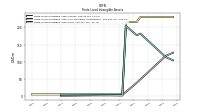

| Goodwill | 461.35 | 461.35 | 461.35 | 461.35 | 461.35 | 461.35 | 409.38 | 409.38 | 407.23 | 407.23 | NA | 9.19 | NA | NA | NA | 9.19 | NA | NA | NA | 9.19 | 9.19 | 9.19 | 9.19 | 9.19 | 9.19 | 9.19 | NA | 9.19 | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 133.03 | 142.78 | 152.53 | 162.27 | 172.02 | 181.77 | 177.00 | 185.93 | 194.86 | 203.78 | NA | 1.83 | NA | NA | NA | 11.50 | NA | NA | NA | 2.81 | 2.93 | 3.05 | 3.17 | 3.29 | 3.42 | 3.54 | NA | 3.78 | NA | NA | |

| Finite Lived Intangible Assets Net | 133.03 | 142.78 | 152.53 | 162.27 | 172.02 | 181.77 | 177.00 | 185.93 | 194.86 | 203.78 | 1.71 | 1.83 | 1.95 | 2.07 | 2.20 | 2.32 | 2.44 | 2.56 | 2.68 | 2.81 | 2.93 | 3.05 | 3.17 | 3.29 | 3.42 | 3.54 | NA | 3.78 | NA | NA | |

| Other Assets Noncurrent | 10.86 | 11.49 | 11.41 | 11.25 | 12.05 | 12.72 | 13.09 | 12.90 | 13.13 | 14.06 | 8.84 | 8.62 | 8.78 | 9.43 | 8.92 | 10.56 | 11.24 | 10.63 | 9.40 | 9.39 | 7.25 | 7.08 | 7.05 | 6.95 | 6.93 | 6.80 | NA | 7.17 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Liabilities Current | 248.82 | 384.81 | 329.19 | 354.64 | 645.74 | 655.06 | 300.37 | 401.81 | 406.36 | 354.06 | 235.99 | 185.72 | 262.85 | 139.37 | 136.10 | 85.18 | 93.05 | 118.07 | 103.60 | 46.22 | 59.78 | 60.56 | 50.36 | 35.86 | 45.21 | 46.56 | NA | 32.94 | NA | NA | |

| Accounts Payable Current | 12.00 | 14.66 | 10.15 | 11.82 | 12.42 | 20.24 | 22.69 | 12.55 | 10.07 | 26.09 | 15.57 | 5.64 | 3.38 | 3.39 | 2.91 | 2.12 | 3.17 | 4.22 | 17.53 | 2.52 | 2.60 | 3.85 | 2.93 | 1.90 | 3.34 | 3.08 | NA | 5.38 | NA | NA | |

| Other Accrued Liabilities Current | 24.14 | 27.08 | 27.85 | 27.54 | 34.68 | 39.29 | 20.18 | 25.22 | 20.02 | 16.36 | 10.97 | 9.72 | 13.29 | 15.99 | 21.16 | 7.52 | 10.63 | 24.16 | 20.29 | 7.68 | 7.89 | 7.91 | 5.95 | 4.83 | 5.62 | 6.44 | NA | 2.80 | NA | NA | |

| Accrued Liabilities Current | NA | NA | NA | NA | 133.88 | 161.80 | 103.45 | 118.12 | 102.03 | 102.34 | 75.75 | 69.46 | 57.52 | 48.97 | 58.46 | 37.98 | 50.87 | 57.42 | 54.06 | 30.84 | 37.53 | 34.05 | 33.87 | 26.61 | 30.20 | 30.25 | NA | 22.25 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deferred Income Tax Liabilities Net | 0.26 | 0.26 | 0.25 | 0.24 | 0.34 | 0.73 | 0.98 | 1.20 | 0.88 | 1.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

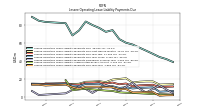

| Operating Lease Liability Noncurrent | 31.42 | 34.38 | 35.76 | 37.30 | 39.80 | 50.92 | 51.72 | 55.22 | 57.76 | 60.96 | 53.33 | 49.34 | 51.60 | 54.36 | 57.25 | 59.87 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 5.75 | 9.50 | 20.66 | 63.95 | 107.39 | 181.25 | 235.62 | 309.85 | 317.88 | 325.60 | 343.63 | 590.56 | 400.28 | 355.26 | 280.19 | 331.45 | 327.72 | 312.25 | 314.35 | 371.94 | 372.75 | 225.61 | 209.25 | 235.43 | 233.51 | -716.72 | NA | -563.73 | NA | NA | |

| Common Stock Value | 0.12 | 0.11 | 0.11 | 0.11 | 0.11 | 0.11 | 0.11 | 0.11 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.08 | 0.08 | 0.08 | 0.08 | 0.01 | NA | 0.01 | NA | NA | |

| Additional Paid In Capital | 806.33 | 791.30 | 775.09 | 757.95 | 739.69 | 723.25 | 699.23 | 682.08 | 662.89 | 651.63 | 641.70 | 860.56 | 684.22 | 673.23 | 591.42 | 583.10 | 571.61 | 562.89 | 552.42 | 542.83 | 531.42 | 387.76 | 374.61 | 364.35 | 360.63 | 0.00 | NA | 0.00 | NA | NA | |

| Retained Earnings Accumulated Deficit | -800.43 | -781.46 | -754.11 | -693.31 | -631.36 | -541.12 | -462.97 | -372.16 | -345.16 | -326.21 | -298.33 | -270.31 | -284.35 | -318.51 | -311.90 | -251.79 | -244.00 | -250.78 | -238.16 | -170.98 | -158.76 | -162.24 | -165.44 | -129.00 | -127.20 | -716.73 | NA | -563.75 | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -0.26 | -0.45 | -0.43 | -0.80 | -1.05 | -0.99 | -0.74 | -0.17 | 0.05 | 0.08 | 0.16 | 0.21 | 0.31 | 0.44 | 0.57 | 0.04 | 0.03 | 0.04 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 19.77 | 18.62 | 20.16 | 17.26 | 19.00 | 17.73 | 17.92 | 16.60 | 14.14 | 14.73 | 13.32 | 11.84 | 11.91 | 7.85 | 7.71 | 8.37 | 7.88 | 6.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

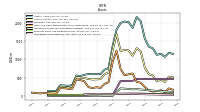

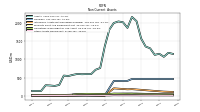

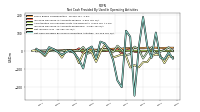

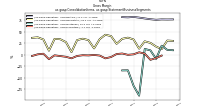

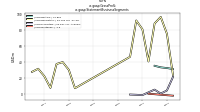

| Net Cash Provided By Used In Operating Activities | 102.54 | -37.82 | 26.70 | 188.98 | 20.01 | -247.50 | 79.00 | 112.55 | -200.48 | -162.87 | -50.77 | 9.73 | 42.79 | 52.19 | -43.45 | 25.03 | 10.97 | -96.45 | -47.16 | -15.89 | 5.43 | -5.75 | -20.49 | -5.20 | 10.92 | 21.44 | -21.81 | -2.83 | 12.14 | NA | |

| Net Cash Provided By Used In Investing Activities | 56.56 | 41.38 | 0.02 | -3.23 | -21.82 | -86.09 | -73.19 | -13.44 | -18.78 | -534.50 | -9.57 | -0.96 | -4.89 | -47.79 | -3.47 | -2.93 | -33.26 | -76.56 | -3.15 | -4.78 | -1.48 | -1.74 | -2.31 | -0.36 | -0.82 | -4.41 | -4.78 | -8.45 | -2.46 | NA | |

| Net Cash Provided By Used In Financing Activities | -153.13 | -34.65 | -116.56 | -347.19 | -2.65 | 93.11 | -75.36 | -18.07 | 68.83 | 142.02 | 457.56 | 549.07 | -10.39 | 125.34 | 30.21 | 6.13 | -17.72 | 26.13 | 17.34 | -1.21 | 245.34 | 17.24 | 12.04 | 1.96 | 148.12 | -3.88 | 3.62 | 0.68 | 0.61 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 102.54 | -37.82 | 26.70 | 188.98 | 20.01 | -247.50 | 79.00 | 112.55 | -200.48 | -162.87 | -50.77 | 9.73 | 42.79 | 52.19 | -43.45 | 25.03 | 10.97 | -96.45 | -47.16 | -15.89 | 5.43 | -5.75 | -20.49 | -5.20 | 10.92 | 21.44 | -21.81 | -2.83 | 12.14 | NA | |

| Net Income Loss | -18.97 | -27.36 | -60.80 | -61.95 | -90.25 | -78.15 | -90.81 | -27.00 | -18.95 | -27.88 | -35.78 | 14.04 | 34.17 | -6.61 | -60.12 | -7.78 | 6.78 | -12.62 | -67.18 | -12.22 | 3.48 | 3.21 | -36.44 | -1.80 | 10.56 | 4.30 | -28.07 | -5.33 | 5.70 | 1.39 | |

| Depreciation Depletion And Amortization | 14.30 | 17.13 | 17.01 | 17.47 | 16.30 | 16.33 | 14.81 | 14.60 | 14.29 | 13.68 | 4.34 | 3.98 | 3.72 | 3.56 | 3.31 | 2.86 | 2.56 | 2.17 | 1.64 | 2.34 | 2.22 | 1.90 | 2.00 | 1.85 | 1.79 | 1.63 | 1.91 | 1.76 | 1.60 | NA | |

| Increase Decrease In Accounts Receivable | -13.83 | 20.81 | -6.74 | -41.46 | 10.26 | 24.10 | -17.31 | -22.34 | 7.17 | 29.61 | -7.30 | 13.63 | 6.90 | 12.36 | 2.60 | -5.21 | -14.25 | 22.43 | 0.89 | 2.11 | -5.65 | 6.81 | -1.24 | -0.00 | -1.17 | 2.23 | 1.65 | -0.40 | -1.75 | NA | |

| Increase Decrease In Inventories | 0.00 | -10.64 | -103.59 | -186.96 | -76.29 | 132.03 | -112.73 | -76.92 | 186.14 | 151.63 | 48.21 | 24.16 | 15.56 | -61.21 | -3.94 | -30.87 | 19.81 | 47.35 | 15.61 | -2.47 | 10.64 | 7.85 | 3.29 | -2.02 | 3.82 | NA | NA | NA | NA | NA | |

| Increase Decrease In Accounts Payable | -2.63 | 4.49 | -1.68 | -0.60 | -7.84 | -3.91 | 9.88 | 2.44 | -15.15 | 9.82 | 5.95 | 1.24 | -0.19 | 0.53 | 0.51 | -0.97 | -0.77 | -13.50 | 14.85 | -0.09 | -1.23 | 0.91 | 1.03 | -1.48 | 0.33 | 3.81 | -2.91 | -1.22 | 1.53 | NA | |

| Share Based Compensation | 18.80 | 17.55 | 19.03 | 16.59 | 18.07 | 16.81 | 16.79 | 15.28 | 13.11 | 13.74 | 12.58 | 11.21 | 11.35 | 7.21 | 7.21 | 8.02 | 7.51 | 5.88 | 6.41 | 5.97 | 5.50 | 4.78 | 4.20 | 3.07 | 2.71 | 2.64 | 2.68 | 2.52 | 2.16 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 56.56 | 41.38 | 0.02 | -3.23 | -21.82 | -86.09 | -73.19 | -13.44 | -18.78 | -534.50 | -9.57 | -0.96 | -4.89 | -47.79 | -3.47 | -2.93 | -33.26 | -76.56 | -3.15 | -4.78 | -1.48 | -1.74 | -2.31 | -0.36 | -0.82 | -4.41 | -4.78 | -8.45 | -2.46 | NA | |

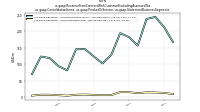

| Payments To Acquire Property Plant And Equipment | 3.02 | 3.29 | 2.92 | 4.04 | 5.37 | 4.69 | 7.44 | 6.92 | 7.00 | 8.29 | 5.29 | 4.29 | 4.32 | 2.67 | 3.41 | 2.71 | 3.32 | 6.35 | 3.15 | 2.77 | 1.48 | 1.74 | 2.31 | 1.61 | 1.06 | 4.65 | 4.78 | 8.45 | 2.46 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -153.13 | -34.65 | -116.56 | -347.19 | -2.65 | 93.11 | -75.36 | -18.07 | 68.83 | 142.02 | 457.56 | 549.07 | -10.39 | 125.34 | 30.21 | 6.13 | -17.72 | 26.13 | 17.34 | -1.21 | 245.34 | 17.24 | 12.04 | 1.96 | 148.12 | -3.88 | 3.62 | 0.68 | 0.61 | NA |

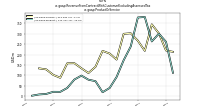

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

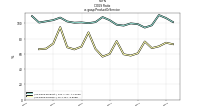

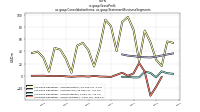

| Revenue From Contract With Customer Excluding Assessed Tax | 268.96 | 275.56 | 325.66 | 479.66 | 600.52 | 606.91 | 597.35 | 643.06 | 540.07 | 471.31 | 268.32 | 244.52 | 236.92 | 213.66 | 191.00 | 233.19 | 238.68 | 197.78 | 110.14 | 124.13 | 140.25 | 142.64 | 79.89 | 95.75 | 109.48 | 104.94 | 59.87 | 66.78 | 81.06 | 77.71 | |

| Corporate Non | 10.87 | 11.13 | 7.43 | 6.34 | 7.08 | 5.89 | 4.37 | -12.47 | 8.21 | 8.52 | 9.36 | -7.62 | 8.50 | 7.25 | 4.25 | -1.95 | 5.16 | 5.28 | 3.05 | NA | 2.64 | 2.80 | 1.92 | NA | 2.25 | 2.30 | NA | NA | NA | NA | |

| Intersegment Elimination | NA | NA | -1.15 | -2.90 | -4.92 | -4.74 | -5.22 | -5.01 | -4.75 | -4.40 | -2.37 | -0.77 | -0.45 | -0.81 | NA | NA | NA | -0.26 | -0.17 | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Brokerage Revenue, Real Estate | NA | NA | NA | NA | NA | NA | 167.87 | 211.76 | 243.57 | 237.51 | 156.45 | 182.24 | 194.38 | 128.54 | 102.35 | 123.67 | 146.10 | 145.40 | 81.31 | 93.99 | 118.81 | 123.36 | 70.14 | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Partner Revenue, Real Estate | NA | NA | NA | NA | NA | NA | 9.62 | 12.98 | 14.22 | 14.69 | 12.16 | 15.43 | 15.48 | 6.51 | 6.29 | 7.01 | 8.03 | 7.45 | 4.58 | 6.13 | 7.46 | 7.50 | 4.78 | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Discontinued Properties | 0.00 | 0.10 | NA | NA | 4.92 | 4.74 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Mortgage | 32.92 | 38.43 | 36.49 | 28.42 | 48.47 | 53.10 | 2.92 | 4.00 | 5.01 | 5.10 | 5.71 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Properties | NA | NA | 112.73 | 260.63 | 299.66 | 262.61 | 379.75 | 377.06 | 238.42 | 172.44 | 92.73 | 39.40 | 19.00 | 72.18 | 79.10 | 99.06 | 80.16 | 39.91 | 21.37 | 21.61 | 11.35 | 8.99 | 3.05 | 5.15 | 3.36 | 1.98 | NA | NA | NA | NA | |

| Operating, Real Estate | 177.75 | 180.64 | 127.30 | 146.24 | 211.54 | 251.81 | 177.49 | 224.73 | 257.80 | 252.20 | 168.61 | 197.67 | 209.85 | 135.05 | 108.64 | 130.68 | 154.13 | 152.85 | 85.89 | 100.12 | 126.27 | 130.86 | 74.92 | 88.68 | 103.86 | 100.66 | NA | NA | NA | NA | |

| Operating, Rentals | 47.41 | 45.36 | 42.87 | 40.93 | 38.69 | 38.25 | 38.04 | 38.92 | 40.41 | 42.55 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Product | NA | NA | 112.73 | 260.54 | 299.66 | 262.61 | 379.75 | 377.06 | 238.42 | 172.44 | 92.73 | 40.06 | 19.64 | 72.53 | 79.52 | 99.06 | 80.16 | 39.91 | 21.37 | 21.61 | 11.35 | 8.99 | 3.05 | NA | NA | NA | NA | NA | NA | NA | |

| Service | NA | NA | 212.93 | 219.12 | 300.85 | 344.31 | 217.59 | 265.99 | 301.66 | 298.87 | 175.59 | 204.45 | 217.28 | 141.13 | 111.48 | 134.13 | 158.52 | 157.87 | 88.77 | 102.52 | 128.91 | 133.66 | NA | NA | NA | NA | NA | NA | NA | NA |