| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.86 | 0.86 | 0.86 | 0.85 | 0.84 | 0.84 | 0.84 | 0.84 | 0.83 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.79 | 0.79 | 0.79 | 0.79 | |

| Weighted Average Number Of Diluted Shares Outstanding | 85.70 | 85.64 | 85.57 | NA | 84.86 | 85.26 | 85.58 | NA | 88.85 | 88.60 | 81.12 | NA | 80.05 | 79.98 | 79.91 | NA | 80.54 | 80.16 | 79.93 | NA | 80.45 | 79.62 | 79.57 | NA | 86.26 | 79.53 | 79.48 | |

| Weighted Average Number Of Shares Outstanding Basic | 85.70 | 85.64 | 85.57 | NA | 84.26 | 84.16 | 83.97 | NA | 80.42 | 80.16 | 80.10 | NA | 80.05 | 79.98 | 79.91 | NA | 79.85 | 79.76 | 79.74 | NA | 79.71 | 79.52 | 79.42 | NA | 79.38 | 79.34 | 79.30 | |

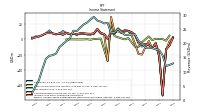

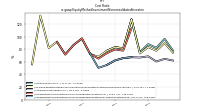

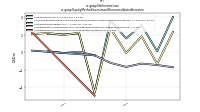

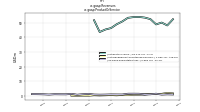

| Earnings Per Share Basic | -0.09 | -0.02 | -0.01 | 0.67 | 0.13 | 0.06 | 0.05 | -0.16 | 0.30 | 0.43 | 0.19 | -0.09 | -0.05 | -0.06 | -0.02 | 0.89 | 0.05 | 0.01 | 0.11 | -0.07 | 0.10 | 0.03 | 0.07 | 0.24 | 0.34 | 0.05 | 0.14 | |

| Earnings Per Share Diluted | -0.09 | -0.02 | -0.01 | 0.66 | 0.13 | 0.06 | 0.05 | -0.14 | 0.29 | 0.41 | 0.19 | -0.09 | -0.05 | -0.06 | -0.02 | 0.83 | 0.05 | 0.01 | 0.11 | -0.07 | 0.10 | 0.03 | 0.07 | 0.24 | 0.33 | 0.05 | 0.14 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

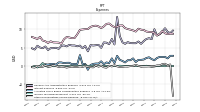

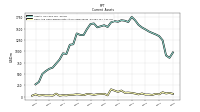

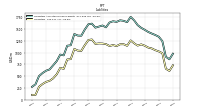

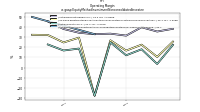

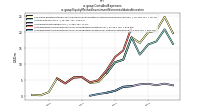

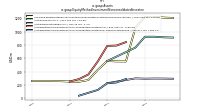

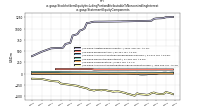

| Revenue From Contract With Customer Excluding Assessed Tax | 54.89 | 51.05 | 52.25 | 51.55 | 54.73 | 55.29 | 56.09 | 56.00 | 55.17 | 52.22 | 50.09 | 47.72 | 46.49 | 44.63 | 52.88 | 58.10 | 58.92 | 57.36 | 59.71 | 63.72 | 64.22 | 69.97 | 62.72 | 64.26 | 65.93 | 67.06 | 67.83 | |

| Revenues | 54.89 | 51.05 | 52.25 | 51.55 | 54.73 | 55.29 | 56.09 | 56.00 | 55.17 | 52.22 | 50.09 | 47.72 | 46.49 | 44.63 | 52.88 | 58.10 | 58.92 | 57.36 | 59.71 | 63.72 | 64.22 | 69.97 | 62.72 | 64.26 | 65.93 | 67.06 | 67.83 | |

| Operating Costs And Expenses | 6.91 | 7.50 | 7.56 | 7.52 | 6.83 | 7.08 | 7.21 | 7.52 | 6.00 | 5.74 | 6.19 | 6.02 | 5.12 | 4.80 | 5.98 | NA | 6.18 | 5.34 | 6.68 | NA | 6.30 | 6.14 | 6.81 | NA | 6.66 | NA | NA | |

| Costs And Expenses | 46.26 | 43.13 | 44.07 | 47.05 | 45.20 | 48.86 | 46.68 | 63.83 | 42.97 | 40.88 | 42.99 | 44.04 | 39.02 | 38.25 | 43.71 | 47.82 | 44.03 | 43.93 | 44.28 | 60.28 | 47.98 | 55.14 | 44.96 | 48.62 | 49.40 | 48.93 | 54.73 | |

| General And Administrative Expense | 9.67 | 8.98 | 9.31 | 10.30 | 9.37 | 8.67 | 8.35 | 10.03 | 7.33 | 7.60 | 7.37 | 6.82 | 6.06 | 6.70 | 6.22 | NA | 6.25 | 6.53 | 6.07 | 6.46 | 8.13 | 13.38 | 5.89 | 7.38 | 5.95 | 6.37 | 6.45 | |

| Operating Income Loss | 8.63 | 8.52 | 8.47 | 67.20 | 20.68 | 17.97 | 12.95 | 5.66 | 34.40 | 11.35 | 7.11 | 3.69 | 7.47 | 6.38 | 9.16 | 10.28 | 14.89 | 13.43 | 15.43 | 3.44 | 16.24 | 14.83 | 17.75 | 15.65 | 16.53 | 18.13 | 13.09 | |

| Interest Expense | 8.80 | 8.84 | 8.70 | 8.94 | 9.57 | 8.77 | 8.31 | 9.02 | 9.30 | 9.30 | 9.41 | 9.83 | 9.91 | 10.18 | 9.40 | 9.71 | 9.92 | 10.08 | 10.35 | 11.09 | 11.04 | 10.71 | 10.60 | 10.99 | 11.59 | 11.49 | 10.80 | |

| Interest Paid Net | 5.27 | 11.50 | 5.09 | 11.85 | 5.97 | 11.35 | 5.01 | 11.50 | 6.46 | 12.06 | 6.57 | 12.59 | 6.84 | 12.79 | 6.36 | 14.01 | 6.20 | 13.30 | 7.30 | 15.96 | 9.59 | 12.31 | 6.08 | 14.05 | 8.68 | 14.31 | 6.71 | |

| Gains Losses On Extinguishment Of Debt | NA | NA | NA | 0.00 | -0.12 | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | NA | -1.95 | 0.00 | -0.62 | NA | -0.13 | 0.00 | 0.00 | NA | 0.00 | 0.00 | NA | NA | |

| Allocated Share Based Compensation Expense | 2.80 | 2.80 | 2.10 | 2.50 | 2.50 | 2.50 | 2.20 | 1.60 | 1.90 | 2.40 | 2.20 | 1.80 | 1.70 | 1.70 | 1.10 | 2.10 | 1.60 | 1.60 | 1.00 | 1.40 | 1.70 | 2.80 | 0.80 | 2.10 | 0.80 | 1.00 | 0.50 | |

| Income Loss From Continuing Operations | -6.33 | -0.12 | 1.12 | NA | 12.69 | 6.51 | 5.65 | NA | 25.53 | 36.19 | 16.80 | NA | -1.95 | -2.89 | 0.20 | NA | 5.33 | 2.78 | 10.31 | NA | 10.04 | 4.17 | 7.18 | NA | 28.80 | 6.03 | 13.00 | |

| Income Tax Expense Benefit | 0.02 | 0.05 | 0.18 | -0.02 | 0.07 | 0.04 | 0.04 | -0.09 | -0.16 | 0.00 | 0.09 | 0.01 | -0.09 | 0.02 | 0.03 | 0.10 | 0.01 | 0.04 | 0.04 | 0.05 | 0.10 | 0.03 | 0.00 | 0.04 | 0.07 | 0.03 | 0.03 | |

| Profit Loss | -6.30 | 0.03 | 1.29 | 59.61 | 13.23 | 6.93 | 5.89 | -10.57 | 26.30 | 37.23 | 17.31 | -5.87 | -1.99 | -2.96 | 0.34 | 74.46 | 5.57 | 2.96 | 10.69 | -4.19 | 10.36 | 4.40 | 7.46 | 20.92 | 29.63 | 6.25 | 13.41 | |

| Net Income Loss | -6.18 | 0.03 | 1.26 | 58.50 | 12.97 | 6.79 | 5.78 | -10.35 | 25.70 | 36.38 | 16.91 | -5.73 | -1.95 | -2.89 | 0.33 | 72.73 | 5.45 | 2.89 | 10.44 | -4.09 | 10.12 | 4.30 | 7.29 | 20.92 | 28.93 | 6.11 | 13.10 | |

| Comprehensive Income Net Of Tax | -3.65 | 5.74 | -4.33 | 58.72 | 20.34 | 11.12 | 17.94 | -6.58 | 26.88 | 35.57 | 24.27 | -3.61 | -1.03 | -4.96 | -16.58 | 75.49 | 4.46 | 0.42 | 8.94 | -6.68 | 10.59 | 5.20 | 9.67 | 22.68 | 29.12 | 5.48 | 13.80 | |

| Preferred Stock Dividends Income Statement Impact | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 | |

| Net Income Loss Available To Common Stockholders Basic | -7.86 | -1.64 | -0.41 | 56.83 | 11.30 | 5.12 | 4.10 | -12.03 | 24.03 | 34.71 | 15.23 | -7.41 | -3.62 | -4.56 | -1.34 | 71.06 | 3.77 | 1.22 | 8.77 | -5.77 | 8.45 | 2.63 | 5.61 | 19.25 | 27.26 | 4.43 | 11.42 | |

| Net Income Loss Available To Common Stockholders Diluted | -8.01 | -1.79 | -0.56 | NA | 11.01 | 4.84 | 3.98 | NA | 25.53 | 34.52 | 15.13 | NA | -3.62 | -4.56 | -1.48 | NA | 3.65 | 1.10 | 8.64 | NA | 8.37 | 2.50 | 5.50 | NA | 28.80 | 4.35 | 11.33 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

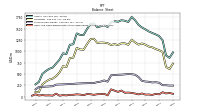

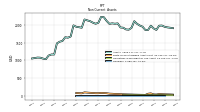

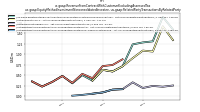

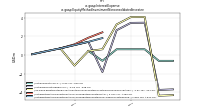

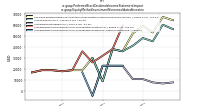

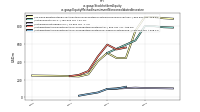

| Assets | 1909.18 | 1920.82 | 1931.31 | 1946.44 | 1983.25 | 1978.56 | 1859.87 | 1902.08 | 1979.69 | 1858.43 | 1857.82 | 1950.04 | 1983.63 | 2032.31 | 2106.67 | 1918.56 | 1865.77 | 1873.89 | 1922.05 | 1928.44 | 2043.50 | 2034.22 | 2045.24 | 2030.39 | 2113.05 | 2218.54 | 2226.16 | |

| Liabilities | 968.92 | 965.48 | 970.46 | 967.79 | 1070.62 | 1075.82 | 957.66 | 1006.62 | 1073.48 | 1008.92 | 1038.88 | 1148.67 | 1178.22 | 1225.87 | 1294.83 | 1070.30 | 1076.27 | 1070.43 | 1100.26 | 1096.90 | 1186.56 | 1168.62 | 1167.34 | 1145.22 | 1232.24 | 1345.65 | 1339.83 | |

| Liabilities And Stockholders Equity | 1909.18 | 1920.82 | 1931.31 | 1946.44 | 1983.25 | 1978.56 | 1859.87 | 1902.08 | 1979.69 | 1858.43 | 1857.82 | 1950.04 | 1983.63 | 2032.31 | 2106.67 | 1918.56 | 1865.77 | 1873.89 | 1922.05 | 1928.44 | 2043.50 | 2034.22 | 2045.24 | 2030.39 | 2113.05 | 2218.54 | 2226.16 | |

| Stockholders Equity | 922.83 | 937.62 | 943.01 | 960.51 | 895.34 | 884.85 | 884.31 | 876.94 | 886.58 | 829.55 | 799.53 | 782.39 | 786.36 | 787.35 | 792.63 | 828.24 | 770.85 | 784.51 | 802.42 | 811.96 | 836.79 | 845.20 | 857.21 | 864.32 | 860.02 | 852.31 | 865.45 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 4.16 | 5.65 | 6.02 | 5.41 | 7.61 | 5.79 | 12.25 | 13.37 | 7.17 | 27.73 | 133.00 | 208.89 | 217.82 | 247.11 | 320.60 | 110.26 | 44.47 | 47.07 | 85.02 | 41.06 | 16.72 | 5.25 | 10.31 | 8.08 | 4.78 | 4.80 | 4.49 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 4.57 | 6.12 | 6.49 | 5.88 | 8.56 | 24.62 | 12.90 | 14.03 | 9.68 | 37.86 | 143.35 | 211.48 | 220.12 | 249.66 | 322.84 | 114.55 | 48.24 | 51.35 | 88.31 | 44.72 | 19.74 | 9.61 | 15.53 | 12.89 | 10.04 | 36.62 | 36.27 | |

| Land | 301.40 | 301.40 | 301.40 | 302.06 | 316.12 | 328.31 | 312.11 | 315.69 | 362.28 | 343.42 | 325.15 | 330.76 | 331.26 | 331.26 | 331.26 | 331.26 | 361.94 | 361.97 | 361.97 | 373.49 | 397.34 | 397.34 | 397.94 | 397.94 | 409.86 | 415.69 | 420.45 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

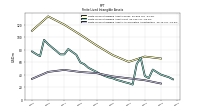

| Construction In Progress Gross | 16.00 | 12.00 | 15.70 | 14.61 | 13.40 | 13.60 | 15.20 | 16.84 | 15.20 | 13.90 | 10.90 | 8.61 | 8.20 | 6.40 | 11.40 | 13.78 | 24.50 | 21.10 | 19.50 | 23.75 | 27.90 | 46.20 | 38.90 | 26.60 | 19.70 | 31.90 | 26.40 | |

| Finite Lived Intangible Assets Net | 32.50 | 35.82 | 37.87 | 40.04 | 43.93 | 48.08 | 34.36 | 37.85 | 66.91 | 56.87 | 24.08 | 26.35 | 27.93 | 29.91 | 31.65 | 34.28 | 35.68 | 38.10 | 40.80 | 44.43 | 47.68 | 51.00 | 56.58 | 59.56 | 71.78 | 76.33 | 80.97 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

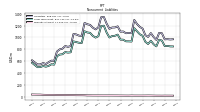

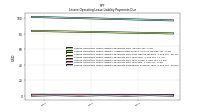

| Long Term Debt | 847.73 | 848.69 | 856.64 | 854.60 | 946.76 | 960.88 | 849.03 | 884.18 | 943.83 | 889.48 | 927.11 | 1027.75 | 1053.38 | 1104.00 | 1155.18 | 930.81 | 933.51 | 934.22 | 962.43 | 963.15 | 1047.11 | 1027.80 | 1023.49 | 999.22 | 1081.51 | 1197.41 | 1192.31 | |

| Minority Interest | 17.43 | 17.72 | 17.84 | 18.14 | 17.29 | 17.89 | 17.89 | 18.51 | 19.63 | 19.95 | 19.40 | 18.98 | 19.06 | 19.09 | 19.20 | 20.02 | 18.64 | 18.96 | 19.37 | 19.58 | 20.16 | 20.40 | 20.70 | 20.85 | 20.79 | 20.58 | 20.88 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

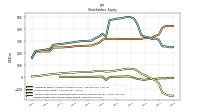

| Stockholders Equity | 922.83 | 937.62 | 943.01 | 960.51 | 895.34 | 884.85 | 884.31 | 876.94 | 886.58 | 829.55 | 799.53 | 782.39 | 786.36 | 787.35 | 792.63 | 828.24 | 770.85 | 784.51 | 802.42 | 811.96 | 836.79 | 845.20 | 857.21 | 864.32 | 860.02 | 852.31 | 865.45 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 940.26 | 955.34 | 960.84 | 978.65 | 912.63 | 902.74 | 902.21 | 895.45 | 906.21 | 849.50 | 818.94 | 801.37 | 805.42 | 806.44 | 811.84 | 848.25 | 789.49 | 803.46 | 821.79 | 831.54 | 856.95 | 865.60 | 877.91 | 885.17 | 880.81 | 872.90 | 886.33 | |

| Common Stock Value | 0.86 | 0.86 | 0.86 | 0.85 | 0.84 | 0.84 | 0.84 | 0.84 | 0.83 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.80 | 0.79 | 0.79 | 0.79 | 0.79 | |

| Additional Paid In Capital | 1261.48 | 1258.67 | 1255.87 | 1255.09 | 1235.63 | 1232.47 | 1230.06 | 1227.79 | 1218.90 | 1177.26 | 1174.96 | 1174.32 | 1173.00 | 1171.29 | 1169.93 | 1169.56 | 1168.30 | 1167.06 | 1166.05 | 1164.85 | 1163.68 | 1163.36 | 1161.25 | 1160.86 | 1160.05 | 1159.20 | 1158.59 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 24.07 | 21.55 | 15.84 | 21.43 | 21.22 | 13.85 | 9.53 | -2.63 | -6.41 | -7.58 | -6.77 | -14.13 | -16.25 | -17.17 | -15.09 | 1.82 | -0.94 | 0.04 | 2.52 | 4.02 | 6.61 | 6.14 | 5.24 | 2.86 | 1.26 | 1.07 | 1.69 | |

| Minority Interest | 17.43 | 17.72 | 17.84 | 18.14 | 17.29 | 17.89 | 17.89 | 18.51 | 19.63 | 19.95 | 19.40 | 18.98 | 19.06 | 19.09 | 19.20 | 20.02 | 18.64 | 18.96 | 19.37 | 19.58 | 20.16 | 20.40 | 20.70 | 20.85 | 20.79 | 20.58 | 20.88 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 2.81 | 2.81 | 0.78 | 2.54 | 2.43 | 2.48 | 0.87 | 2.13 | 2.05 | 2.40 | 0.83 | 1.32 | 1.71 | 1.39 | 0.73 | 1.27 | 1.23 | 1.11 | 1.20 | 1.17 | 0.34 | 2.13 | 0.39 | 0.81 | 0.86 | 0.61 | 0.18 | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 0.22 | 0.22 | 0.23 | 0.21 | 0.21 | 0.22 | 0.22 | 0.21 | 0.22 | 0.14 | 0.14 | 0.00 | 0.00 | 0.00 | 0.42 | 0.42 | 0.42 | 0.42 | 0.42 | 0.42 | 0.42 | 0.42 | 0.42 | 0.42 | 0.42 | 0.42 | 0.42 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

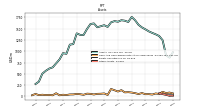

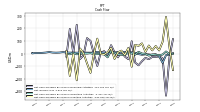

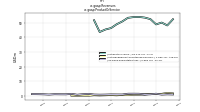

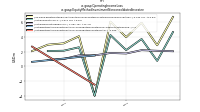

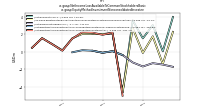

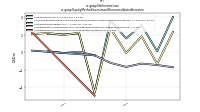

| Net Cash Provided By Used In Operating Activities | 26.02 | 27.08 | 18.80 | 16.35 | 44.49 | 22.92 | 13.92 | 31.94 | 27.06 | 14.98 | 18.89 | 22.02 | 27.66 | 3.05 | 10.32 | 20.95 | 32.33 | 23.43 | 13.88 | 26.50 | 25.84 | 26.43 | 27.55 | 29.07 | 36.74 | 26.63 | 25.49 | |

| Net Cash Provided By Used In Investing Activities | -12.39 | -5.34 | -5.50 | 69.74 | -29.55 | -109.93 | 6.00 | 31.46 | -140.58 | -81.95 | 23.95 | -3.32 | -4.87 | -5.06 | -5.67 | 71.19 | -15.01 | -11.29 | 50.20 | 102.30 | -14.11 | -16.74 | -29.18 | 76.20 | 100.96 | -11.87 | -175.64 | |

| Net Cash Provided By Used In Financing Activities | -15.18 | -22.11 | -12.69 | -88.78 | -31.00 | 98.73 | -21.06 | -59.04 | 85.34 | -38.52 | -110.97 | -27.34 | -52.33 | -71.17 | 203.64 | -25.83 | -20.43 | -49.11 | -20.48 | -103.82 | -1.61 | -15.60 | 4.27 | -101.97 | -137.72 | -14.46 | 151.06 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 26.02 | 27.08 | 18.80 | 16.35 | 44.49 | 22.92 | 13.92 | 31.94 | 27.06 | 14.98 | 18.89 | 22.02 | 27.66 | 3.05 | 10.32 | 20.95 | 32.33 | 23.43 | 13.88 | 26.50 | 25.84 | 26.43 | 27.55 | 29.07 | 36.74 | 26.63 | 25.49 | |

| Net Income Loss | -6.18 | 0.03 | 1.26 | 58.50 | 12.97 | 6.79 | 5.78 | -10.35 | 25.70 | 36.38 | 16.91 | -5.73 | -1.95 | -2.89 | 0.33 | 72.73 | 5.45 | 2.89 | 10.44 | -4.09 | 10.12 | 4.30 | 7.29 | 20.92 | 28.93 | 6.11 | 13.10 | |

| Profit Loss | -6.30 | 0.03 | 1.29 | 59.61 | 13.23 | 6.93 | 5.89 | -10.57 | 26.30 | 37.23 | 17.31 | -5.87 | -1.99 | -2.96 | 0.34 | 74.46 | 5.57 | 2.96 | 10.69 | -4.19 | 10.36 | 4.40 | 7.46 | 20.92 | 29.63 | 6.25 | 13.41 | |

| Depreciation Depletion And Amortization | 19.96 | 17.07 | 17.22 | 21.63 | 18.44 | 19.17 | 20.21 | 18.79 | 18.49 | 16.60 | 18.38 | 20.21 | 18.30 | 17.86 | 20.85 | 18.78 | 20.02 | 20.63 | 19.22 | 21.61 | 21.15 | 23.46 | 21.11 | 22.05 | 23.13 | 23.34 | 22.82 | |

| Share Based Compensation | 1.20 | 1.18 | 0.85 | 1.09 | 1.06 | 1.10 | 0.96 | 1.00 | 0.99 | 1.04 | 1.05 | 0.89 | 1.04 | 1.00 | 0.82 | 0.76 | 0.75 | 1.17 | 0.81 | 0.69 | 1.09 | 2.16 | 0.72 | 0.74 | 0.79 | 0.54 | 0.65 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -12.39 | -5.34 | -5.50 | 69.74 | -29.55 | -109.93 | 6.00 | 31.46 | -140.58 | -81.95 | 23.95 | -3.32 | -4.87 | -5.06 | -5.67 | 71.19 | -15.01 | -11.29 | 50.20 | 102.30 | -14.11 | -16.74 | -29.18 | 76.20 | 100.96 | -11.87 | -175.64 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -15.18 | -22.11 | -12.69 | -88.78 | -31.00 | 98.73 | -21.06 | -59.04 | 85.34 | -38.52 | -110.97 | -27.34 | -52.33 | -71.17 | 203.64 | -25.83 | -20.43 | -49.11 | -20.48 | -103.82 | -1.61 | -15.60 | 4.27 | -101.97 | -137.72 | -14.46 | 151.06 | |

| Payments Of Dividends Common Stock | 12.03 | 12.00 | 11.32 | 11.29 | 10.98 | 10.95 | 10.16 | 9.66 | 6.04 | 0.00 | 6.04 | 0.00 | 0.04 | 17.67 | 17.67 | 17.67 | 17.67 | 17.68 | 17.63 | 17.63 | 17.64 | 17.61 | 17.57 | 17.57 | 17.56 | 17.56 | 17.53 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

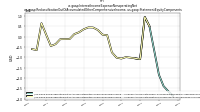

| Revenues | 54.89 | 51.05 | 52.25 | 51.55 | 54.73 | 55.29 | 56.09 | 56.00 | 55.17 | 52.22 | 50.09 | 47.72 | 46.49 | 44.63 | 52.88 | 58.10 | 58.92 | 57.36 | 59.71 | 63.72 | 64.22 | 69.97 | 62.72 | 64.26 | 65.93 | 67.06 | 67.83 | |

| Equity Method Investment Nonconsolidated Investee Or Group Of Investees One | NA | NA | NA | NA | NA | 4.59 | 4.41 | 2.66 | 1.89 | 1.25 | 0.16 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Equity Method Investment Nonconsolidated Investee Total | NA | NA | NA | NA | NA | 19.04 | 18.42 | 15.40 | 11.15 | 7.71 | 5.89 | 6.14 | 6.71 | 5.55 | 6.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| R2 G Venture L L C | 21.07 | 21.69 | 20.88 | 18.41 | 17.27 | 14.45 | 14.01 | 12.74 | 9.26 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| R G M Z Venture R E I T L L C | 5.42 | 6.02 | 5.60 | 5.61 | 5.51 | 4.59 | 4.41 | 2.66 | 1.89 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Equity Method Investment Nonconsolidated Investee Or Group Of Investees | 26.50 | 27.71 | 26.48 | 24.01 | 22.78 | 14.45 | 14.01 | 12.74 | 9.26 | 6.47 | 5.74 | 6.14 | 6.71 | 5.55 | 6.03 | 1.48 | 0.18 | 0.69 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Managementand Other Fee Income | 1.59 | 1.88 | 1.30 | 1.28 | 1.23 | 0.88 | 0.74 | 0.71 | 0.43 | 0.53 | 0.32 | 0.48 | 0.34 | 0.23 | 0.35 | 0.05 | 0.09 | 0.04 | 0.05 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Rental Income | 52.41 | 48.19 | 50.12 | 48.90 | 52.49 | 53.55 | 54.00 | 53.90 | 53.38 | 50.88 | 48.94 | 46.37 | 45.38 | 43.69 | 51.72 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Real Estate Other | 0.89 | 0.98 | 0.82 | 1.38 | 1.01 | 0.86 | 1.35 | 1.38 | 1.36 | 0.81 | 0.84 | 0.88 | 0.77 | 0.71 | 0.80 | 1.27 | 1.02 | 0.68 | 1.30 | 0.98 | 1.00 | 1.05 | 0.81 | 0.99 | 1.08 | 1.13 | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | 54.89 | 51.05 | 52.25 | 51.55 | 54.73 | 55.29 | 56.09 | 56.00 | 55.17 | 52.22 | 50.09 | 47.72 | 46.49 | 44.63 | 52.88 | 58.10 | 58.92 | 57.36 | 59.71 | 63.72 | 64.22 | 69.97 | 62.72 | 64.26 | 65.93 | 67.06 | 67.83 | |

| Equity Method Investment Nonconsolidated Investee Or Group Of Investees One, Unconsolidated Joint Ventures | NA | NA | NA | NA | NA | 0.17 | 0.15 | 0.09 | 0.06 | 0.03 | 0.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Equity Method Investment Nonconsolidated Investee Total, Unconsolidated Joint Ventures | NA | NA | NA | NA | NA | 0.88 | 0.74 | 0.71 | 0.43 | 0.53 | 0.32 | 0.48 | 0.34 | 0.23 | 0.35 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| R2 G Venture L L C, Unconsolidated Joint Ventures | 1.33 | 1.66 | 1.06 | 1.08 | 0.90 | 0.71 | 0.59 | 0.63 | 0.37 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| R G M Z Venture R E I T L L C, Unconsolidated Joint Ventures | 0.25 | 0.22 | 0.24 | 0.19 | 0.33 | 0.17 | 0.15 | 0.09 | 0.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Equity Method Investment Nonconsolidated Investee Or Group Of Investees, Unconsolidated Joint Ventures | 1.59 | 1.88 | 1.30 | 1.28 | 1.23 | 0.71 | 0.59 | 0.63 | 0.37 | 0.50 | 0.30 | 0.48 | 0.34 | 0.23 | 0.35 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Leasing Fee, Equity Method Investment Nonconsolidated Investee Or Group Of Investees One, Unconsolidated Joint Ventures | NA | NA | NA | NA | NA | 0.00 | 0.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Leasing Fee, Equity Method Investment Nonconsolidated Investee Total, Unconsolidated Joint Ventures | NA | NA | NA | NA | NA | 0.20 | 0.11 | 0.07 | 0.01 | 0.26 | 0.08 | 0.23 | 0.12 | 0.02 | 0.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Leasing Fee, R2 G Venture L L C, Unconsolidated Joint Ventures | 0.48 | 0.67 | 0.22 | 0.17 | 0.13 | 0.20 | 0.10 | 0.07 | 0.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Leasing Fee, R G M Z Venture R E I T L L C, Unconsolidated Joint Ventures | 0.05 | 0.02 | 0.04 | 0.01 | 0.14 | 0.00 | 0.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Leasing Fee, Equity Method Investment Nonconsolidated Investee Or Group Of Investees, Unconsolidated Joint Ventures | 0.53 | 0.69 | 0.26 | 0.18 | 0.27 | 0.20 | 0.10 | 0.07 | 0.01 | 0.26 | 0.08 | 0.23 | 0.12 | 0.02 | 0.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Management Fee, Equity Method Investment Nonconsolidated Investee Or Group Of Investees One, Unconsolidated Joint Ventures | NA | NA | NA | NA | NA | 0.17 | 0.14 | 0.09 | 0.06 | 0.03 | 0.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Management Fee, Equity Method Investment Nonconsolidated Investee Total, Unconsolidated Joint Ventures | NA | NA | NA | NA | NA | 0.67 | 0.64 | 0.64 | 0.41 | 0.28 | 0.24 | 0.24 | 0.21 | 0.21 | 0.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Management Fee, R2 G Venture L L C, Unconsolidated Joint Ventures | 0.84 | 0.84 | 0.72 | 0.81 | 0.64 | 0.51 | 0.49 | 0.55 | 0.35 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Management Fee, R G M Z Venture R E I T L L C, Unconsolidated Joint Ventures | 0.21 | 0.21 | 0.20 | 0.19 | 0.18 | 0.17 | 0.14 | 0.09 | 0.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Management Fee, Equity Method Investment Nonconsolidated Investee Or Group Of Investees, Unconsolidated Joint Ventures | 1.05 | 1.05 | 0.92 | 0.99 | 0.83 | 0.51 | 0.49 | 0.55 | 0.35 | 0.24 | 0.23 | 0.25 | 0.21 | 0.21 | 0.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Management Service, R2 G Venture L L C, Unconsolidated Joint Ventures | 0.01 | 0.14 | 0.12 | 0.11 | 0.13 | NA | NA | 0.00 | 0.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Management Service, Equity Method Investment Nonconsolidated Investee Or Group Of Investees, Unconsolidated Joint Ventures | 0.01 | 0.14 | 0.12 | 0.11 | 0.13 | NA | NA | 0.00 | 0.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |