| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

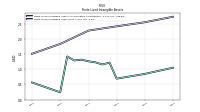

| Weighted Average Number Of Diluted Shares Outstanding | 73.72 | 74.08 | 74.38 | NA | 74.35 | 74.64 | 74.80 | NA | 74.88 | 74.42 | 74.03 | NA | 72.28 | 71.66 | 71.90 | NA | 72.66 | 49.02 | 44.82 | NA | 44.80 | 44.39 | |

| Weighted Average Number Of Shares Outstanding Basic | 73.26 | 73.44 | 73.37 | NA | 73.33 | 73.31 | 73.26 | NA | 72.81 | 72.39 | 71.78 | NA | 69.87 | 69.42 | 69.32 | NA | 68.87 | 49.02 | 41.94 | NA | 41.94 | 41.94 | |

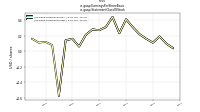

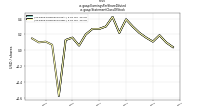

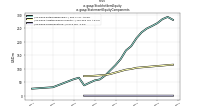

| Earnings Per Share Basic | 0.04 | 0.10 | 0.19 | 0.11 | 0.16 | 0.22 | 0.31 | 0.41 | 0.23 | 0.44 | 0.31 | 0.27 | 0.28 | 0.21 | 0.06 | 0.16 | 0.14 | -0.57 | 0.08 | 0.12 | 0.11 | 0.16 | |

| Earnings Per Share Diluted | 0.04 | 0.10 | 0.19 | 0.11 | 0.16 | 0.22 | 0.30 | 0.39 | 0.22 | 0.42 | 0.30 | 0.27 | 0.27 | 0.20 | 0.06 | 0.16 | 0.13 | -0.57 | 0.07 | 0.11 | 0.10 | 0.15 |

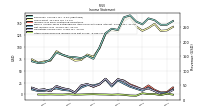

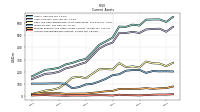

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

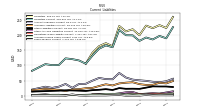

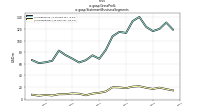

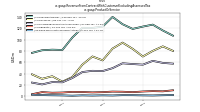

| Revenue From Contract With Customer Excluding Assessed Tax | 257.60 | 273.73 | 279.61 | 259.15 | 268.71 | 290.05 | 283.50 | 239.81 | 244.06 | 228.61 | 178.91 | 140.75 | 151.04 | 142.78 | 146.07 | 147.56 | 154.20 | 161.90 | 137.34 | 127.72 | 125.91 | 131.80 | |

| Revenues | 257.60 | 273.73 | 279.61 | 259.15 | 268.71 | 290.05 | 283.50 | 239.81 | 244.06 | 228.61 | 178.91 | 140.75 | 151.04 | 142.78 | 146.07 | 147.56 | 154.20 | 161.90 | 137.34 | 127.72 | 125.91 | 131.80 | |

| Cost Of Goods And Services Sold | 124.37 | 126.03 | 140.39 | 125.86 | 126.33 | 127.81 | 129.09 | 108.34 | 109.59 | 101.40 | 82.24 | 61.96 | 67.57 | 70.71 | 75.12 | 69.45 | 71.52 | 71.48 | 66.59 | 58.57 | 59.52 | 58.47 | |

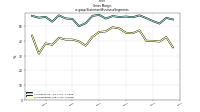

| Gross Profit | 133.23 | 147.70 | 139.22 | 133.29 | 142.38 | 162.24 | 154.41 | 131.46 | 134.48 | 127.22 | 96.67 | 78.79 | 83.47 | 72.07 | 70.95 | 78.10 | 82.68 | 90.42 | 70.75 | 69.16 | 66.39 | 73.33 | |

| Operating Expenses | 132.91 | 140.34 | 126.96 | 122.63 | 127.63 | 142.96 | 125.96 | 99.53 | 115.27 | 94.29 | 75.45 | 62.18 | 61.67 | 53.27 | 67.10 | 67.47 | 69.84 | 72.69 | 63.85 | 58.47 | 56.87 | 59.24 | |

| General And Administrative Expense | 35.22 | 28.55 | 28.09 | 28.82 | 28.50 | 31.16 | 26.84 | 23.28 | 24.18 | 21.97 | 19.88 | 18.48 | 17.74 | 15.78 | 18.87 | 20.47 | 19.02 | 18.84 | 19.27 | 17.84 | 16.28 | 16.14 | |

| Operating Income Loss | 0.32 | 7.36 | 12.26 | 10.66 | 14.75 | 19.28 | 28.45 | 31.94 | 19.21 | 32.93 | 21.21 | 16.61 | 21.80 | 18.80 | 3.85 | 10.64 | 12.83 | 17.73 | 6.90 | 10.68 | 9.52 | 14.09 | |

| Income Tax Expense Benefit | 1.13 | 2.43 | 4.67 | 2.50 | 4.20 | 4.82 | 6.40 | 2.33 | 2.70 | 1.13 | -1.27 | -3.04 | 2.10 | 4.39 | -0.17 | 1.95 | 3.28 | 4.54 | 1.72 | 2.83 | 2.22 | 3.50 | |

| Income Taxes Paid Net | 2.36 | 8.97 | 0.26 | 7.12 | 1.30 | 13.89 | 0.71 | 1.50 | 0.90 | 0.25 | 0.36 | 3.45 | 8.40 | 0.00 | 0.10 | 0.94 | 3.71 | NA | NA | 2.31 | 7.01 | NA | |

| Profit Loss | 3.18 | 7.30 | 14.17 | 7.87 | 11.99 | 16.27 | 22.57 | 29.38 | 16.67 | 31.54 | 22.25 | 18.96 | 19.44 | 14.24 | 4.16 | 8.40 | 9.56 | 12.74 | 4.96 | 7.70 | 7.14 | 10.47 | |

| Other Comprehensive Income Loss Net Of Tax | -1.41 | 0.83 | 0.76 | 2.56 | -2.56 | -2.19 | -0.70 | 0.06 | -0.55 | -0.06 | 0.10 | 0.61 | 0.34 | -0.12 | -0.34 | 0.43 | -0.18 | -0.13 | 0.14 | -0.13 | -0.04 | NA | |

| Net Income Loss | 3.18 | 7.30 | 14.17 | 7.87 | 11.99 | 16.27 | 22.57 | 29.38 | 16.67 | 31.54 | 22.25 | 18.96 | 19.44 | 14.24 | 4.16 | 8.40 | 9.56 | 12.74 | NA | 7.70 | 7.14 | 10.47 |

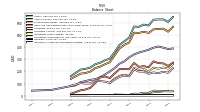

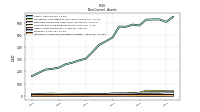

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

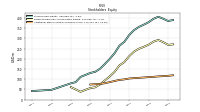

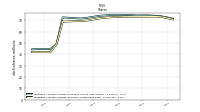

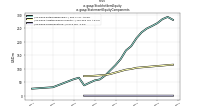

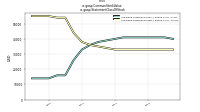

| Assets | 629.50 | 629.20 | 627.40 | 579.32 | 586.72 | 568.52 | 570.78 | 480.41 | 449.31 | 419.67 | 359.82 | 305.75 | 291.33 | 272.23 | 259.49 | 232.29 | 221.73 | 215.56 | NA | 162.07 | NA | NA | |

| Liabilities | 232.97 | 223.16 | 231.46 | 199.75 | 219.42 | 212.31 | 230.28 | 163.40 | 173.45 | 163.55 | 141.53 | 105.69 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Liabilities And Stockholders Equity | 629.50 | 629.20 | 627.40 | 579.32 | 586.72 | 568.52 | 570.78 | 480.41 | 449.31 | 419.67 | 359.82 | 305.75 | 291.33 | 272.23 | 259.49 | 232.29 | 221.73 | 215.56 | NA | 162.07 | NA | NA | |

| Stockholders Equity | 396.53 | 406.04 | 395.94 | 379.57 | 367.30 | 356.21 | 340.50 | 317.01 | 283.13 | 264.45 | 227.71 | 200.06 | 174.91 | 151.44 | 136.12 | 130.76 | 120.79 | 111.26 | 85.72 | 79.82 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 553.52 | 551.32 | 547.33 | 518.22 | 527.33 | 518.01 | 519.83 | 439.84 | 419.85 | 389.62 | 331.48 | 276.93 | 259.37 | 239.72 | 227.21 | 199.34 | 186.72 | 182.27 | NA | 139.15 | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 266.90 | 269.33 | 283.32 | 234.72 | 244.05 | 237.86 | 270.61 | 218.46 | 221.60 | 219.58 | 182.91 | 146.01 | 158.70 | 150.77 | 103.58 | 65.42 | 51.15 | 44.84 | NA | 16.37 | NA | NA | |

| Accounts Receivable Net Current | 12.61 | 11.20 | 8.08 | 5.42 | 6.72 | 7.81 | 11.39 | 4.64 | 6.71 | 7.36 | 6.58 | 4.62 | 4.71 | 4.85 | 3.02 | 4.75 | 5.60 | 8.37 | NA | 5.34 | NA | NA | |

| Inventory Net | 202.88 | 205.31 | 190.15 | 215.22 | 213.33 | 208.50 | 179.25 | 171.26 | 141.77 | 118.83 | 100.45 | 95.27 | 73.59 | 64.51 | 101.37 | 104.26 | 103.74 | 102.53 | NA | 102.22 | NA | NA | |

| Prepaid Expense And Other Assets Current | 63.58 | 59.38 | 64.80 | 59.87 | 59.10 | 57.02 | 58.13 | 42.11 | 39.31 | 31.64 | 26.14 | 20.33 | 19.91 | 19.59 | 18.28 | 24.16 | 26.21 | 25.37 | NA | 15.23 | NA | NA |

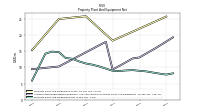

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | NA | NA | NA | 22.02 | NA | NA | NA | 18.29 | NA | NA | NA | 25.86 | NA | NA | NA | 25.00 | NA | NA | NA | 15.35 | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 16.70 | 15.46 | 14.26 | 13.08 | 12.77 | 11.59 | 10.42 | 9.35 | 17.93 | 16.83 | 15.73 | 14.65 | NA | NA | NA | 10.27 | NA | NA | NA | 9.44 | NA | NA | |

| Property Plant And Equipment Net | 8.06 | 8.40 | 8.77 | 8.93 | 9.16 | 9.05 | 8.87 | 8.95 | 9.63 | 10.30 | 10.83 | 11.21 | 11.86 | 12.67 | 12.91 | 14.73 | 14.89 | 14.24 | NA | 5.91 | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 1.83 | 1.79 | 1.70 | 1.60 | 1.39 | 1.32 | 1.26 | 1.21 | NA | NA | NA | 1.26 | NA | NA | NA | 1.46 | 0.32 | 0.40 | NA | 0.56 | NA | NA | |

| Finite Lived Intangible Assets Net | NA | NA | NA | 0.85 | NA | NA | NA | 0.69 | 1.22 | 1.16 | 1.23 | 1.26 | 1.31 | 1.29 | 1.42 | 0.24 | NA | NA | NA | 0.56 | NA | NA | |

| Other Assets Noncurrent | 1.24 | 1.24 | 1.25 | 0.81 | 3.10 | 3.26 | 3.11 | 2.75 | 2.76 | 2.74 | 2.85 | 0.50 | 0.61 | 0.59 | 0.61 | 0.64 | 0.67 | 0.69 | NA | 0.73 | NA | NA |

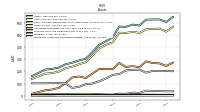

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

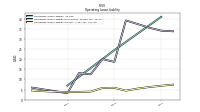

| Liabilities Current | 197.40 | 185.73 | 192.26 | 181.09 | 199.34 | 199.79 | 217.17 | 160.22 | 166.18 | 155.22 | 132.10 | 105.69 | 116.43 | 120.80 | 123.37 | 101.53 | 100.94 | 104.30 | NA | 82.26 | NA | NA | |

| Accounts Payable Current | 44.48 | 46.01 | 49.10 | 50.79 | 53.19 | 60.09 | 75.13 | 54.34 | 54.91 | 58.63 | 49.69 | 39.34 | 38.78 | 25.89 | 38.81 | 29.81 | 25.81 | 29.69 | NA | 20.22 | NA | NA | |

| Other Accrued Liabilities Current | 7.13 | 8.53 | 6.80 | 5.29 | 12.40 | 11.26 | 7.82 | 5.17 | 4.11 | 4.88 | 2.79 | 2.98 | 2.60 | 2.66 | 1.92 | 2.61 | 2.13 | 4.45 | NA | 1.86 | NA | NA | |

| Taxes Payable Current | 1.44 | 1.14 | 2.60 | 0.23 | 0.44 | 0.10 | 2.76 | NA | 0.99 | 0.95 | 0.83 | 0.20 | 0.82 | 4.45 | 0.40 | 0.47 | 0.51 | 0.88 | NA | 0.92 | NA | NA | |

| Accrued Income Taxes Current | 3.75 | 1.96 | 4.89 | 3.93 | 5.43 | 3.52 | 5.80 | 5.59 | 5.86 | 3.86 | 3.85 | 2.75 | 2.51 | 2.25 | 1.28 | 3.02 | 2.98 | 2.26 | NA | 1.97 | NA | NA | |

| Accrued Liabilities Current | 42.64 | 35.98 | 35.52 | 38.27 | 44.49 | 43.02 | 40.62 | 33.90 | 37.74 | 31.97 | 25.75 | 24.73 | 21.70 | 20.72 | 15.45 | 19.40 | 21.11 | 22.14 | NA | 18.40 | NA | NA | |

| Other Liabilities Current | 30.46 | 30.80 | 26.69 | 22.58 | 23.14 | 22.83 | 25.21 | 18.92 | 21.69 | 19.63 | 18.37 | 15.82 | 16.77 | 17.40 | 17.74 | 16.74 | 16.05 | 15.24 | NA | 13.54 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

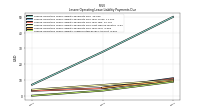

| Operating Lease Liability Noncurrent | 35.57 | 37.43 | 39.20 | 18.66 | 20.08 | 12.52 | 13.11 | 3.18 | 4.11 | 5.03 | 5.94 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

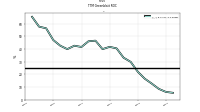

| Stockholders Equity | 396.53 | 406.04 | 395.94 | 379.57 | 367.30 | 356.21 | 340.50 | 317.01 | 283.13 | 264.45 | 227.71 | 200.06 | 174.91 | 151.44 | 136.12 | 130.76 | 120.79 | 111.26 | 85.72 | 79.82 | NA | NA | |

| Additional Paid In Capital Common Stock | 115.05 | 113.75 | 111.78 | 110.34 | 108.50 | 106.84 | 105.21 | 103.59 | 99.15 | 96.58 | 91.33 | 86.04 | 80.45 | 76.77 | 75.56 | 74.02 | NA | NA | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 281.40 | 292.22 | 284.09 | 269.16 | 258.73 | 249.30 | 235.22 | 213.35 | 183.91 | 167.79 | 136.31 | 113.95 | 94.38 | 74.60 | 60.49 | 56.68 | 47.84 | 38.46 | NA | 61.27 | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 1.23 | 1.72 | 1.28 | 1.45 | 1.52 | 1.40 | 1.49 | 1.12 | 1.34 | 1.35 | 0.98 | 0.95 | 0.98 | 0.87 | 0.56 | 0.52 | 0.51 | 0.52 | 0.51 | 0.54 | 0.35 | 0.40 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

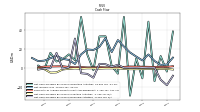

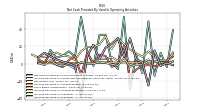

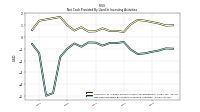

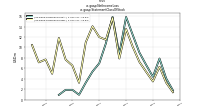

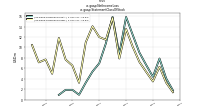

| Net Cash Provided By Used In Operating Activities | 12.49 | -14.10 | 48.83 | -11.02 | 10.01 | -29.35 | 53.80 | -6.10 | 1.85 | 33.35 | 33.21 | -2.45 | 14.34 | 53.81 | 8.08 | 14.22 | 9.15 | 6.76 | 15.92 | -1.38 | 2.41 | NA | |

| Net Cash Provided By Used In Investing Activities | -0.99 | -0.97 | -1.15 | -1.26 | -1.39 | -1.45 | -1.07 | -0.43 | -0.52 | -0.52 | -0.74 | -0.48 | -0.46 | -0.83 | -0.55 | -1.00 | -1.70 | -4.77 | -4.99 | -1.38 | -0.59 | NA | |

| Net Cash Provided By Used In Financing Activities | -12.51 | 0.25 | 0.16 | 0.39 | 0.13 | 0.24 | 0.13 | 3.32 | 1.23 | 3.90 | 4.32 | -10.36 | -6.29 | -5.66 | 30.98 | 0.61 | -0.97 | 15.78 | -0.25 | -0.74 | -1.78 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 12.49 | -14.10 | 48.83 | -11.02 | 10.01 | -29.35 | 53.80 | -6.10 | 1.85 | 33.35 | 33.21 | -2.45 | 14.34 | 53.81 | 8.08 | 14.22 | 9.15 | 6.76 | 15.92 | -1.38 | 2.41 | NA | |

| Net Income Loss | 3.18 | 7.30 | 14.17 | 7.87 | 11.99 | 16.27 | 22.57 | 29.38 | 16.67 | 31.54 | 22.25 | 18.96 | 19.44 | 14.24 | 4.16 | 8.40 | 9.56 | 12.74 | NA | 7.70 | 7.14 | 10.47 | |

| Profit Loss | 3.18 | 7.30 | 14.17 | 7.87 | 11.99 | 16.27 | 22.57 | 29.38 | 16.67 | 31.54 | 22.25 | 18.96 | 19.44 | 14.24 | 4.16 | 8.40 | 9.56 | 12.74 | 4.96 | 7.70 | 7.14 | 10.47 | |

| Increase Decrease In Accounts Receivable | 1.42 | 3.12 | 2.66 | -1.30 | -1.09 | -3.57 | 6.75 | -2.08 | -0.65 | 0.78 | 1.96 | -0.09 | -0.14 | 1.83 | -1.73 | -0.85 | -2.77 | -1.11 | 4.15 | -1.56 | 0.92 | NA | |

| Increase Decrease In Inventories | -2.44 | 15.16 | -25.07 | 1.90 | 4.83 | 29.26 | 7.99 | 29.49 | 22.94 | 18.37 | 5.18 | 21.68 | 9.08 | -36.86 | -2.89 | 0.08 | 2.36 | 4.80 | 8.38 | 12.45 | 7.54 | NA | |

| Increase Decrease In Accounts Payable | -1.53 | -3.09 | -1.69 | -2.40 | -6.90 | -15.04 | 20.78 | -0.57 | -3.72 | 8.95 | 10.35 | 0.56 | 12.89 | -12.91 | 8.99 | 4.00 | -3.88 | -1.40 | 10.87 | 1.56 | 4.78 | NA | |

| Share Based Compensation | 1.23 | 1.72 | 1.28 | 1.45 | 1.52 | 1.40 | 1.49 | 1.12 | 1.34 | 1.35 | 0.98 | 0.95 | 0.98 | 0.87 | 0.56 | 0.52 | 0.51 | 0.52 | 0.51 | 0.54 | 0.35 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -0.99 | -0.97 | -1.15 | -1.26 | -1.39 | -1.45 | -1.07 | -0.43 | -0.52 | -0.52 | -0.74 | -0.48 | -0.46 | -0.83 | -0.55 | -1.00 | -1.70 | -4.77 | -4.99 | -1.38 | -0.59 | NA | |

| Payments To Acquire Property Plant And Equipment | 0.99 | 0.97 | 1.15 | 1.26 | 1.39 | 1.45 | 1.07 | 0.43 | 0.52 | 0.52 | 0.74 | 0.48 | 0.46 | 0.83 | 0.55 | 1.00 | 1.70 | NA | NA | 1.38 | 0.59 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -12.51 | 0.25 | 0.16 | 0.39 | 0.13 | 0.24 | 0.13 | 3.32 | 1.23 | 3.90 | 4.32 | -10.36 | -6.29 | -5.66 | 30.98 | 0.61 | -0.97 | 15.78 | -0.25 | -0.74 | -1.78 | NA |

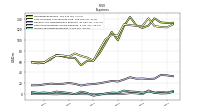

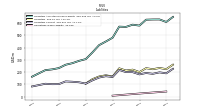

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

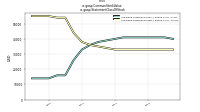

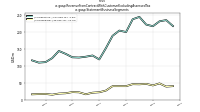

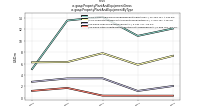

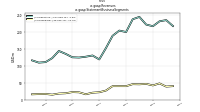

| Revenues | 257.60 | 273.73 | 279.61 | 259.15 | 268.71 | 290.05 | 283.50 | 239.81 | 244.06 | 228.61 | 178.91 | 140.75 | 151.04 | 142.78 | 146.07 | 147.56 | 154.20 | 161.90 | 137.34 | 127.72 | 125.91 | 131.80 | |

| Beauty | 10.70 | 8.86 | 9.29 | 8.59 | 7.42 | 8.17 | 8.44 | 7.44 | 6.98 | 7.68 | 7.95 | 6.76 | 6.40 | 7.49 | 3.74 | NA | NA | NA | NA | NA | NA | NA | |

| Dresses | 80.06 | 87.99 | 80.01 | 70.16 | 83.57 | 94.56 | 84.08 | 63.32 | 70.21 | 55.72 | 33.95 | 25.86 | 35.41 | 30.87 | 38.70 | NA | NA | NA | NA | NA | NA | NA | |

| Fashion Apparel | 106.83 | 115.94 | 126.24 | 122.82 | 118.72 | 126.97 | 139.78 | 122.70 | 120.43 | 120.62 | 103.50 | 81.65 | 82.15 | 81.15 | 76.50 | NA | NA | NA | NA | NA | NA | NA | |

| Handbags Shoes And Accessories | 57.60 | 58.92 | 62.49 | 55.81 | 56.91 | 58.21 | 49.63 | 44.50 | 44.98 | 42.79 | 32.30 | 24.78 | 25.14 | 21.02 | 24.27 | NA | NA | NA | NA | NA | NA | NA | |

| Manufactured Product Other | 2.40 | 2.02 | 1.58 | 1.78 | 2.10 | 2.15 | 1.58 | 1.84 | 1.47 | 1.80 | 1.21 | 1.71 | 1.94 | 2.26 | 2.87 | NA | NA | NA | NA | NA | NA | NA | |

| Breakage On Store Credit And Gift Cards, Accounting Standards Update201409 | 0.80 | 0.60 | 0.50 | 0.50 | 0.30 | 0.40 | 0.50 | 0.40 | 0.30 | 0.30 | 0.20 | 0.10 | 0.20 | 0.20 | 0.80 | 0.30 | 1.80 | 0.20 | 0.20 | NA | NA | NA | |

| Forward | 39.91 | 38.58 | 47.96 | 42.02 | 46.64 | 45.33 | 45.76 | 39.83 | 39.86 | 39.83 | 26.75 | 21.82 | 20.46 | 15.86 | 21.60 | 22.33 | 18.77 | 17.95 | 14.69 | 16.76 | 16.44 | 15.70 | |

| Revolve | 217.70 | 235.15 | 231.65 | 217.14 | 222.07 | 244.73 | 237.74 | 199.97 | 204.21 | 188.79 | 152.16 | 118.93 | 130.57 | 126.92 | 124.47 | 125.23 | 135.43 | 143.94 | 122.65 | 110.96 | 109.47 | 116.10 | |

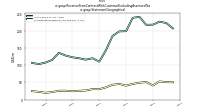

| US | 207.17 | 222.86 | 226.72 | 217.99 | 217.59 | 240.91 | 237.88 | 199.12 | 198.51 | 185.38 | 143.28 | 110.46 | 120.46 | 116.27 | 120.33 | 123.19 | 128.23 | 136.06 | 115.41 | 107.81 | 103.28 | 107.02 | |

| Rest Of The World | 50.43 | 50.87 | 52.89 | 41.16 | 51.12 | 49.15 | 45.62 | 40.68 | 45.56 | 43.23 | 35.62 | 30.30 | 30.58 | 26.51 | 25.75 | 24.37 | 25.96 | 25.84 | 21.94 | 19.91 | 22.63 | 24.78 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 257.60 | 273.73 | 279.61 | 259.15 | 268.71 | 290.05 | 283.50 | 239.81 | 244.06 | 228.61 | 178.91 | 140.75 | 151.04 | 142.78 | 146.07 | 147.56 | 154.20 | 161.90 | 137.34 | 127.72 | 125.91 | 131.80 | |

| Beauty | 10.70 | 8.86 | 9.29 | 8.59 | 7.42 | 8.17 | 8.44 | 7.44 | 6.98 | 7.68 | 7.95 | 6.76 | 6.40 | 7.49 | 3.74 | NA | NA | NA | NA | NA | NA | NA | |

| Dresses | 80.06 | 87.99 | 80.01 | 70.16 | 83.57 | 94.56 | 84.08 | 63.32 | 70.21 | 55.72 | 33.95 | 25.86 | 35.41 | 30.87 | 38.70 | NA | NA | NA | NA | NA | NA | NA | |

| Fashion Apparel | 106.83 | 115.94 | 126.24 | 122.82 | 118.72 | 126.97 | 139.78 | 122.70 | 120.43 | 120.62 | 103.50 | 81.65 | 82.15 | 81.15 | 76.50 | NA | NA | NA | NA | NA | NA | NA | |

| Handbags Shoes And Accessories | 57.60 | 58.92 | 62.49 | 55.81 | 56.91 | 58.21 | 49.63 | 44.50 | 44.98 | 42.79 | 32.30 | 24.78 | 25.14 | 21.02 | 24.27 | NA | NA | NA | NA | NA | NA | NA | |

| Manufactured Product Other | 2.40 | 2.02 | 1.58 | 1.78 | 2.10 | 2.15 | 1.58 | 1.84 | 1.47 | 1.80 | 1.21 | 1.71 | 1.94 | 2.26 | 2.87 | NA | NA | NA | NA | NA | NA | NA | |

| Breakage On Store Credit And Gift Cards, Accounting Standards Update201409 | 0.80 | 0.60 | 0.50 | 0.50 | 0.30 | 0.40 | 0.50 | 0.40 | 0.30 | 0.30 | 0.20 | 0.10 | 0.20 | 0.20 | 0.80 | 0.30 | 1.80 | 0.20 | 0.20 | NA | NA | NA | |

| Forward | 39.91 | 38.58 | 47.96 | 42.02 | 46.64 | 45.33 | 45.76 | 39.83 | 39.86 | 39.83 | 26.75 | 21.82 | 20.46 | 15.86 | 21.60 | 22.33 | 18.77 | 17.95 | 14.69 | 16.76 | 16.44 | 15.70 | |

| Revolve | 217.70 | 235.15 | 231.65 | 217.14 | 222.07 | 244.73 | 237.74 | 199.97 | 204.21 | 188.79 | 152.16 | 118.93 | 130.57 | 126.92 | 124.47 | 125.23 | 135.43 | 143.94 | 122.65 | 110.96 | 109.47 | 116.10 | |

| US | 207.17 | 222.86 | 226.72 | 217.99 | 217.59 | 240.91 | 237.88 | 199.12 | 198.51 | 185.38 | 143.28 | 110.46 | 120.46 | 116.27 | 120.33 | 123.19 | 128.23 | 136.06 | 115.41 | 107.81 | 103.28 | 107.02 | |

| Rest Of The World | 50.43 | 50.87 | 52.89 | 41.16 | 51.12 | 49.15 | 45.62 | 40.68 | 45.56 | 43.23 | 35.62 | 30.30 | 30.58 | 26.51 | 25.75 | 24.37 | 25.96 | 25.84 | 21.94 | 19.91 | 22.63 | 24.78 |