| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 21.44 | 21.44 | 21.44 | 21.44 | 21.44 | 21.44 | 21.44 | 21.42 | 21.13 | 21.11 | 21.10 | 21.10 | 19.40 | 19.40 | 19.40 | 19.40 | 19.38 | 18.47 | 18.47 | 18.47 | 18.47 | 18.47 | 18.46 | 36.93 | 36.85 | 36.78 | 36.72 | 36.67 | |

| dei: Entity Common Stock Shares Outstanding | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

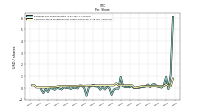

| Earnings Per Share Basic | 0.92 | 0.22 | 0.01 | 0.06 | 0.12 | 0.30 | 0.27 | 0.05 | 0.27 | 0.12 | 0.06 | 0.05 | -0.03 | 0.01 | -0.05 | 0.15 | 0.05 | 0.08 | 0.05 | 0.15 | 0.94 | -0.09 | -0.07 | -0.17 | -0.62 | -0.02 | 0.06 | -0.16 | |

| Earnings Per Share Diluted | 0.92 | 0.22 | 0.01 | 0.06 | 0.11 | 0.30 | 0.27 | 0.05 | 0.27 | 0.12 | 0.06 | 0.05 | -0.03 | 0.01 | -0.05 | 0.15 | 0.05 | 0.08 | 0.05 | 0.15 | 0.93 | -0.09 | -0.07 | -0.17 | -0.62 | -0.02 | 0.06 | -0.16 |

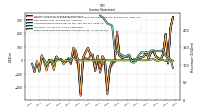

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Excluding Assessed Tax | -415.34 | 144.76 | 138.16 | 138.69 | -403.29 | 138.84 | 140.68 | 134.32 | 9.79 | 12.90 | 8.36 | 7.71 | 8.95 | 9.10 | 8.62 | 14.75 | 125.78 | 11.95 | 14.40 | 16.59 | 136.58 | 14.39 | 6.50 | 7.54 | 217.56 | 6.50 | 7.93 | 8.62 | |

| Revenue From Contract With Customer Including Assessed Tax | 124.67 | 144.76 | 138.16 | 138.69 | 138.51 | 138.84 | 140.68 | 134.32 | 134.82 | 134.44 | 135.47 | 128.14 | 117.90 | 105.55 | 107.57 | 129.31 | 125.78 | 122.53 | 128.66 | 131.02 | 136.58 | 14.39 | 6.50 | 7.54 | 217.56 | 6.50 | 7.93 | 8.62 | |

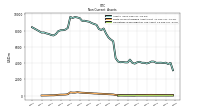

| Revenues | 124.67 | 144.76 | 138.16 | 138.69 | 138.51 | 138.84 | 140.68 | 134.32 | 134.82 | 134.44 | 135.47 | 128.14 | 117.90 | 105.55 | 107.57 | 129.31 | 125.78 | 122.53 | 128.66 | 131.02 | 136.58 | 144.09 | 211.52 | 215.07 | 217.56 | 227.42 | 236.19 | 240.42 | |

| Operating Expenses | 100.08 | 105.61 | 115.48 | 107.88 | 105.37 | 104.72 | 107.81 | 104.73 | 98.06 | 94.12 | 98.60 | 110.11 | 101.28 | 87.13 | 88.24 | 90.51 | 88.80 | 92.25 | 91.53 | 93.92 | 101.61 | 124.19 | 172.56 | 183.51 | 437.54 | 177.58 | 207.02 | 211.25 | |

| Operating Costs And Expenses | 22.33 | 20.99 | 22.48 | 23.17 | 22.75 | 22.31 | 22.28 | 21.94 | 18.52 | 18.56 | 19.42 | 20.22 | 18.03 | 15.78 | 16.52 | 18.48 | 17.03 | 16.74 | 18.74 | 18.84 | 18.76 | 18.39 | 31.15 | 29.76 | 28.22 | 28.95 | 32.15 | 32.99 | |

| General And Administrative Expense | 14.93 | 11.26 | 14.03 | 10.64 | 12.16 | 10.80 | 11.35 | 12.25 | 13.51 | 11.73 | 12.43 | 17.39 | 14.34 | 13.66 | 13.50 | 11.38 | 14.04 | 15.30 | 14.93 | 14.11 | 16.29 | 15.23 | 20.19 | 16.11 | 19.60 | 16.43 | 22.76 | 31.07 | |

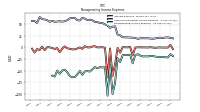

| Interest Expense | 20.01 | 21.15 | 20.92 | 19.92 | 20.39 | 20.14 | 18.91 | 18.26 | 18.68 | 19.17 | 19.14 | 19.39 | 19.12 | 18.09 | 19.81 | 20.59 | 20.75 | 21.16 | 21.09 | 21.73 | 25.39 | 26.96 | 44.91 | 44.04 | 41.62 | 46.30 | 48.91 | 51.83 | |

| Income Loss From Continuing Operations Before Income Taxes Minority Interest And Income Loss From Equity Method Investments | 9.78 | 17.31 | 1.12 | 10.20 | 12.37 | 13.49 | 12.81 | 10.82 | 18.11 | 20.63 | 17.41 | -1.73 | -1.28 | 3.60 | 2.46 | 4.29 | 21.20 | 13.41 | 20.47 | 20.05 | 3.02 | -3.46 | -37.20 | -68.75 | -258.30 | -53.98 | -13.53 | -14.27 | |

| Income Tax Expense Benefit | 1.23 | 0.24 | 0.36 | 0.21 | -0.05 | 0.26 | 0.35 | 0.25 | 0.49 | 0.20 | 0.49 | 0.36 | 0.27 | 0.28 | 0.34 | 0.23 | -0.17 | 0.25 | 0.31 | 0.27 | 0.25 | 0.24 | 0.39 | -0.02 | 2.46 | 9.27 | 0.47 | 0.22 | |

| Profit Loss | 196.42 | 48.64 | 5.35 | 15.30 | 28.21 | 66.21 | 60.41 | 13.96 | 59.09 | 28.16 | 21.99 | 16.18 | -1.04 | 7.40 | -4.40 | 34.63 | 24.29 | 23.90 | 17.54 | 36.09 | 181.33 | -8.69 | -2.63 | -53.90 | -220.21 | 1.23 | 29.88 | -54.03 | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | -5.93 | 3.22 | 5.39 | -2.27 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | -5.93 | 1.93 | 4.29 | -3.20 | -0.74 | 9.78 | NA | NA | 0.00 | 0.00 | 0.00 | 2.68 | 1.05 | -3.92 | 0.29 | 0.39 | 0.27 | 0.01 | 0.31 | 0.30 | -0.33 | 0.42 | -0.20 | -0.28 | 0.33 | 1.34 | 0.90 | 0.81 | |

| Net Income Loss | 196.42 | 48.64 | 5.35 | 15.28 | 28.20 | 66.19 | 60.39 | 13.94 | 58.99 | 28.06 | 21.87 | 16.01 | -1.29 | 7.29 | -4.61 | 34.33 | 24.00 | 23.63 | 17.28 | 35.79 | 180.85 | -8.93 | -3.33 | -54.15 | -218.04 | 0.98 | 29.61 | -54.24 | |

| Comprehensive Income Net Of Tax | 190.49 | 50.57 | 9.64 | 12.08 | 27.45 | 75.98 | 60.39 | 13.94 | 58.99 | 28.06 | 21.87 | 18.69 | -0.24 | 3.37 | -4.32 | 34.72 | 24.27 | 23.64 | 17.59 | 36.09 | 180.56 | -8.57 | -3.48 | -54.36 | -217.67 | 2.14 | 30.41 | -53.48 | |

| Preferred Stock Dividends Income Statement Impact | 2.79 | 2.79 | 2.79 | 2.79 | 2.79 | 2.79 | 2.79 | 2.79 | 2.79 | 2.79 | 2.94 | 5.13 | 5.13 | 5.13 | 5.13 | 5.13 | 7.08 | 8.38 | 8.38 | 8.38 | 8.38 | 8.38 | 8.38 | 8.38 | 8.38 | 8.38 | 6.40 | 5.59 | |

| Net Income Loss Available To Common Stockholders Basic | 193.63 | 45.85 | 2.56 | 12.49 | 25.41 | 63.41 | 57.60 | 11.15 | 56.20 | 25.27 | 13.77 | 10.88 | -6.42 | 2.15 | -9.75 | 29.20 | 9.74 | 15.25 | 8.89 | 27.41 | 172.46 | -17.31 | -11.71 | -62.54 | -226.42 | -7.40 | 23.21 | -59.84 |

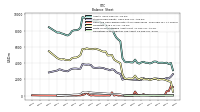

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

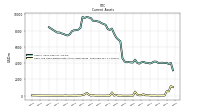

| Assets | 4061.35 | 4025.12 | 4061.00 | 4053.18 | 4045.02 | 4196.97 | 4203.42 | 4051.48 | 3967.05 | 4052.29 | 4053.46 | 4175.38 | 4108.28 | 3944.86 | 4048.53 | 4445.08 | 4093.62 | 4099.86 | 4142.74 | 4116.02 | 4206.33 | 4620.09 | 6704.39 | 6910.45 | 7170.07 | 7640.70 | 8270.04 | 8092.97 | |

| Liabilities | 1885.81 | 1978.40 | 2036.30 | 2008.17 | 1952.39 | 2079.54 | 2112.74 | 1995.36 | 1924.40 | 2033.83 | 2036.43 | 2003.78 | 2163.46 | 1985.15 | 2088.73 | 2477.60 | 2112.14 | 2092.36 | 2115.49 | 2063.06 | 2133.33 | 2645.10 | 4012.05 | 4138.12 | 4272.64 | 4451.68 | 5011.82 | 4965.72 | |

| Liabilities And Stockholders Equity | 4061.35 | 4025.12 | 4061.00 | 4053.18 | 4045.02 | 4196.97 | 4203.42 | 4051.48 | 3967.05 | 4052.29 | 4053.46 | 4175.38 | 4108.28 | 3944.86 | 4048.53 | 4445.08 | 4093.62 | 4099.86 | 4142.74 | 4116.02 | 4206.33 | 4620.09 | 6704.39 | 6910.45 | 7170.07 | 7640.70 | 8270.04 | 8092.97 | |

| Stockholders Equity | 2175.54 | 2046.72 | 2024.70 | 2039.22 | 2086.83 | 2111.64 | 2084.88 | 2050.32 | 2036.86 | 2014.82 | 2013.46 | 2168.13 | 1941.51 | 1956.47 | 1956.51 | 1964.40 | 1978.41 | 2004.43 | 2024.14 | 2049.95 | 2070.07 | 1970.01 | 2687.43 | 2767.42 | 2890.93 | 3180.09 | 3249.51 | 3118.70 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 551.97 | 26.56 | 28.04 | 25.03 | 20.25 | 20.88 | 38.53 | 17.19 | 41.81 | 61.92 | 57.95 | 190.83 | 69.74 | 57.22 | 128.49 | 514.26 | 16.08 | 23.73 | 9.42 | 9.61 | 11.09 | 11.45 | 32.07 | 16.56 | 92.61 | 18.27 | 414.07 | 19.71 | |

| Land | 930.54 | 1082.33 | 1094.24 | 1073.73 | 1066.85 | 1095.66 | 1089.40 | 1051.20 | 1011.40 | 962.87 | 961.55 | 947.41 | 953.56 | 881.54 | 881.58 | 881.36 | 881.40 | 857.78 | 861.44 | 861.73 | 873.55 | 970.01 | 1667.26 | 1700.50 | 1738.79 | 1903.81 | 1938.59 | 1987.85 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Investments In Affiliates Subsidiaries Associates And Joint Ventures | 39.37 | 40.83 | 40.56 | 45.58 | 44.61 | 46.00 | 53.02 | 57.05 | 64.63 | 72.68 | 75.10 | 75.98 | 77.30 | 175.25 | 173.31 | 178.98 | 294.50 | 330.88 | 340.88 | 302.72 | 329.62 | 287.87 | 321.10 | 333.66 | 383.81 | 434.95 | 435.49 | 395.36 | |

| Finite Lived Intangible Assets Net | 68.99 | 74.46 | 81.35 | 83.54 | 87.75 | 98.55 | 104.11 | 101.77 | 94.06 | 78.00 | 81.45 | 84.08 | 90.42 | 46.74 | 50.15 | 54.02 | 58.02 | 55.99 | 62.13 | 66.76 | 77.42 | 88.75 | 149.90 | 167.83 | 182.41 | 199.49 | 216.60 | 236.37 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Senior Notes | 1303.24 | 1368.28 | 1367.78 | 1454.46 | 1453.92 | 1453.38 | 1452.85 | 1452.31 | 1451.77 | 1451.23 | 1450.69 | 1450.15 | 1449.61 | 1449.08 | 1448.54 | 1448.00 | 1647.96 | 1647.47 | 1646.98 | 1646.50 | 1646.01 | 1896.46 | 1918.26 | 1917.83 | 2810.10 | 2809.40 | 3060.34 | 2914.19 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

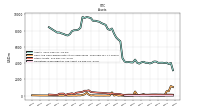

| Stockholders Equity | 2175.54 | 2046.72 | 2024.70 | 2039.22 | 2086.83 | 2111.64 | 2084.88 | 2050.32 | 2036.86 | 2014.82 | 2013.46 | 2168.13 | 1941.51 | 1956.47 | 1956.51 | 1964.40 | 1978.41 | 2004.43 | 2024.14 | 2049.95 | 2070.07 | 1970.01 | 2687.43 | 2767.42 | 2890.93 | 3180.09 | 3249.51 | 3118.70 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 2175.54 | 2046.72 | 2024.70 | 2045.01 | 2092.62 | 2117.43 | 2090.68 | 2056.12 | 2042.65 | 2018.47 | 2017.03 | 2171.60 | 1944.82 | 1959.71 | 1959.80 | 1967.48 | 1981.48 | 2007.51 | 2027.25 | 2052.97 | 2073.00 | 1974.99 | 2692.34 | 2772.32 | 2897.44 | 3189.02 | 3258.22 | 3127.25 | |

| Common Stock Value | 21.44 | 21.44 | 21.44 | 21.44 | 21.44 | 21.44 | 21.44 | 21.42 | 21.13 | 21.11 | 21.10 | 21.10 | 19.40 | 19.40 | 19.40 | 19.40 | 19.38 | 18.47 | 18.47 | 18.47 | 18.47 | 18.47 | 18.46 | 36.93 | 36.85 | 36.78 | 36.72 | 36.67 | |

| Additional Paid In Capital | 5974.90 | 5972.90 | 5971.92 | 5966.09 | 5974.22 | 5974.00 | 5973.44 | 5968.72 | 5934.17 | 5942.47 | 5940.53 | 5933.69 | 5705.16 | 5706.23 | 5704.72 | 5703.52 | 5700.40 | 5547.53 | 5546.41 | 5545.30 | 5544.22 | 5542.95 | 5543.01 | 5522.87 | 5513.20 | 5505.85 | 5499.10 | 5497.66 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 6.12 | 12.05 | 10.12 | 5.84 | 9.04 | 9.78 | NA | NA | NA | NA | NA | NA | -2.68 | -3.73 | 0.19 | -0.10 | -0.49 | -0.76 | -0.77 | -1.08 | -1.38 | -1.09 | -1.46 | -1.31 | -1.11 | -1.47 | -2.63 | -3.43 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

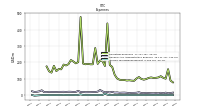

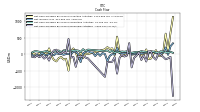

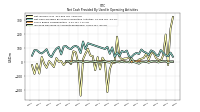

| Net Cash Provided By Used In Operating Activities | 46.48 | 65.25 | 84.63 | 42.17 | 51.78 | 73.38 | 82.09 | 50.02 | 65.15 | 72.61 | 88.65 | 56.11 | 64.24 | 54.07 | 36.02 | 35.85 | 80.73 | 69.21 | 77.95 | 42.26 | 67.34 | 35.71 | 103.99 | 57.76 | 108.17 | 92.50 | NA | NA | |

| Net Cash Provided By Used In Investing Activities | 617.41 | 55.44 | -62.13 | -50.83 | 115.28 | 6.11 | -134.45 | -154.50 | 139.18 | -33.17 | -42.10 | 10.54 | 0.11 | -9.55 | -17.22 | 129.14 | -40.03 | 21.20 | -68.03 | 76.46 | 525.98 | -34.10 | 171.53 | 153.53 | 208.55 | 141.87 | NA | NA | |

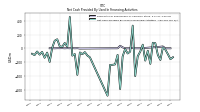

| Net Cash Provided By Used In Financing Activities | -158.12 | -86.03 | -19.37 | 12.90 | -169.85 | -96.67 | 74.33 | 80.44 | -226.42 | -35.25 | -179.10 | 52.64 | -47.42 | -115.70 | -404.47 | 330.23 | -47.60 | -75.55 | -10.43 | -120.70 | -592.94 | -95.14 | -234.54 | -240.20 | -242.09 | -689.80 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 46.48 | 65.25 | 84.63 | 42.17 | 51.78 | 73.38 | 82.09 | 50.02 | 65.15 | 72.61 | 88.65 | 56.11 | 64.24 | 54.07 | 36.02 | 35.85 | 80.73 | 69.21 | 77.95 | 42.26 | 67.34 | 35.71 | 103.99 | 57.76 | 108.17 | 92.50 | NA | NA | |

| Net Income Loss | 196.42 | 48.64 | 5.35 | 15.28 | 28.20 | 66.19 | 60.39 | 13.94 | 58.99 | 28.06 | 21.87 | 16.01 | -1.29 | 7.29 | -4.61 | 34.33 | 24.00 | 23.63 | 17.28 | 35.79 | 180.85 | -8.93 | -3.33 | -54.15 | -218.04 | 0.98 | 29.61 | -54.24 | |

| Profit Loss | 196.42 | 48.64 | 5.35 | 15.30 | 28.21 | 66.21 | 60.41 | 13.96 | 59.09 | 28.16 | 21.99 | 16.18 | -1.04 | 7.40 | -4.40 | 34.63 | 24.29 | 23.90 | 17.54 | 36.09 | 181.33 | -8.69 | -2.63 | -53.90 | -220.21 | 1.23 | 29.88 | -54.03 | |

| Increase Decrease In Other Operating Capital Net | -6.41 | 12.07 | -8.93 | 13.32 | 0.57 | -2.45 | -3.31 | 7.32 | -4.66 | 4.20 | -5.03 | 4.72 | 0.33 | -3.81 | -1.91 | 13.95 | -8.36 | -0.87 | -3.11 | 12.08 | -5.38 | 7.19 | -14.44 | 19.84 | -5.36 | 12.39 | 3.63 | 6.11 | |

| Increase Decrease In Accounts Receivable | 6.29 | 4.43 | 1.57 | -4.82 | 5.62 | 5.01 | 1.71 | -6.82 | 2.52 | -2.12 | -2.63 | -13.64 | -6.85 | -2.06 | 24.74 | -4.18 | -0.13 | -3.40 | 3.19 | -4.02 | -0.61 | 1.16 | 6.93 | -5.18 | -2.66 | 3.71 | -0.82 | -2.69 | |

| Share Based Compensation | 2.10 | 1.90 | 1.88 | 1.76 | 1.79 | 1.80 | 1.80 | 1.82 | 1.83 | 2.07 | 1.93 | 7.69 | 3.13 | 2.90 | 2.75 | 0.02 | 0.31 | 3.79 | 2.88 | 2.92 | 2.12 | 0.62 | 2.99 | 1.73 | 1.96 | 1.56 | 2.73 | 5.24 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 617.41 | 55.44 | -62.13 | -50.83 | 115.28 | 6.11 | -134.45 | -154.50 | 139.18 | -33.17 | -42.10 | 10.54 | 0.11 | -9.55 | -17.22 | 129.14 | -40.03 | 21.20 | -68.03 | 76.46 | 525.98 | -34.10 | 171.53 | 153.53 | 208.55 | 141.87 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -158.12 | -86.03 | -19.37 | 12.90 | -169.85 | -96.67 | 74.33 | 80.44 | -226.42 | -35.25 | -179.10 | 52.64 | -47.42 | -115.70 | -404.47 | 330.23 | -47.60 | -75.55 | -10.43 | -120.70 | -592.94 | -95.14 | -234.54 | -240.20 | -242.09 | -689.80 | NA | NA | |

| Payments Of Dividends | 30.07 | 30.05 | 30.05 | 30.35 | 30.49 | 30.66 | 30.66 | 28.21 | 28.22 | 28.22 | 28.26 | 14.84 | 5.13 | 5.13 | 44.05 | 44.04 | 46.16 | 44.64 | 44.64 | 45.26 | 45.41 | 78.69 | 78.69 | 78.55 | 78.42 | 76.74 | 75.40 | 75.25 | |

| Payments For Repurchase Of Common Stock | 0.00 | 0.00 | 0.00 | 26.61 | 22.26 | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 7.50 | 0.00 | 0.00 | 0.00 | 14.07 | 36.34 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 124.67 | 144.76 | 138.16 | 138.69 | 138.51 | 138.84 | 140.68 | 134.32 | 134.82 | 134.44 | 135.47 | 128.14 | 117.90 | 105.55 | 107.57 | 129.31 | 125.78 | 122.53 | 128.66 | 131.02 | 136.58 | 144.09 | 211.52 | 215.07 | 217.56 | 227.42 | 236.19 | 240.42 | |

| Unconsolidated Joint Ventures | 22.04 | 21.68 | 24.07 | 24.69 | 26.83 | 25.86 | 38.16 | 41.65 | 44.94 | 48.67 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | -415.34 | 144.76 | 138.16 | 138.69 | -403.29 | 138.84 | 140.68 | 134.32 | 9.79 | 12.90 | 8.36 | 7.71 | 8.95 | 9.10 | 8.62 | 14.75 | 125.78 | 11.95 | 14.40 | 16.59 | 136.58 | 14.39 | 6.50 | 7.54 | 217.56 | 6.50 | 7.93 | 8.62 | |

| Asset And Property Management Fees, Unconsolidated Joint Ventures | 1.30 | 1.40 | 1.50 | 1.50 | 1.50 | 1.70 | 2.20 | 2.30 | 2.60 | 2.80 | 2.60 | 2.60 | 2.70 | 3.00 | 2.70 | 4.50 | 4.90 | 4.70 | 4.80 | 5.20 | 4.30 | 4.00 | 4.90 | 5.60 | 4.50 | 4.70 | NA | NA | |

| Development Fees Leasing Commissions And Other Earned From Unconsolidated Joint Ventures, Unconsolidated Joint Ventures | 0.00 | 0.10 | 0.10 | 0.10 | 0.30 | 0.60 | 0.60 | 0.40 | 0.70 | 0.60 | 0.50 | 0.40 | 0.60 | 0.60 | 0.40 | 2.60 | 1.50 | 1.20 | 1.10 | 1.40 | 1.80 | 1.50 | 1.60 | 1.90 | NA | NA | NA | NA | |

| Unconsolidated Joint Ventures | 1.30 | 1.50 | 1.60 | 1.60 | 1.80 | 2.30 | 2.80 | 2.70 | 3.30 | 3.40 | 3.10 | 3.00 | 3.30 | 3.60 | 3.10 | 7.10 | 6.40 | 5.90 | 5.90 | 6.60 | 6.10 | 5.50 | 6.50 | 7.50 | 7.40 | 6.50 | NA | NA | |

| Revenue From Contract With Customer Including Assessed Tax | 124.67 | 144.76 | 138.16 | 138.69 | 138.51 | 138.84 | 140.68 | 134.32 | 134.82 | 134.44 | 135.47 | 128.14 | 117.90 | 105.55 | 107.57 | 129.31 | 125.78 | 122.53 | 128.66 | 131.02 | 136.58 | 14.39 | 6.50 | 7.54 | 217.56 | 6.50 | 7.93 | 8.62 |