| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Weighted Average Number Of Diluted Shares Outstanding | NA | 59.55 | 59.45 | 59.60 | NA | 58.52 | 55.15 | 53.08 | NA | 52.15 | 51.80 | 51.94 | NA | 51.86 | 52.34 | 53.11 | NA | 53.92 | 53.78 | 53.69 | |

| Weighted Average Number Of Shares Outstanding Basic | NA | 59.10 | 58.94 | 58.80 | NA | 57.72 | 54.35 | 52.18 | NA | 51.77 | 51.58 | 51.56 | NA | 51.55 | 51.95 | 52.59 | NA | 53.23 | 53.06 | 52.88 | |

| Earnings Per Share Basic | 4.64 | 7.26 | 5.65 | 8.03 | 6.20 | 6.33 | 9.23 | 10.20 | 7.49 | 8.53 | 4.44 | 2.56 | 5.10 | 5.19 | 6.12 | 5.49 | 5.01 | 5.16 | 4.48 | 3.69 | |

| Earnings Per Share Diluted | 4.62 | 7.21 | 5.60 | 7.92 | 6.09 | 6.24 | 9.09 | 10.03 | 7.40 | 8.47 | 4.42 | 2.55 | 5.06 | 5.15 | 6.08 | 5.44 | 4.96 | 5.10 | 4.42 | 3.63 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

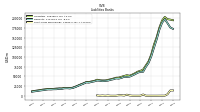

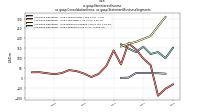

| Revenue From Contract With Customer Excluding Assessed Tax | 433.00 | 350.00 | 368.00 | 352.00 | 366.00 | 315.00 | 306.00 | 328.14 | 300.00 | 247.04 | 285.38 | 222.44 | 236.42 | 205.91 | 221.37 | 217.26 | 147.40 | 130.44 | 122.46 | 111.36 | |

| Revenues | 433.00 | 350.00 | 368.00 | 352.00 | 366.00 | 315.00 | 306.00 | 328.14 | 300.00 | 247.04 | 285.38 | 222.44 | 236.42 | 205.91 | 221.37 | 217.26 | 147.40 | 130.44 | 122.46 | 111.36 | |

| Interest And Fee Income Loans And Leases | 1119.00 | 865.00 | 654.00 | 570.00 | 544.00 | 519.00 | 472.00 | 430.42 | 403.36 | 368.98 | 365.11 | 382.57 | 396.70 | 394.25 | 414.08 | 394.14 | 378.76 | 352.35 | 330.30 | 297.07 | |

| Gain Loss On Investments | -86.00 | -127.00 | -157.00 | 85.00 | 100.00 | 189.00 | 305.00 | 167.08 | 149.99 | 189.84 | 34.87 | 46.05 | 28.09 | 29.85 | 47.70 | 29.03 | 10.73 | 32.19 | 36.11 | 9.06 | |

| Interest Expense | 718.00 | 323.00 | 107.00 | 40.00 | 36.00 | 32.00 | 23.00 | 19.17 | 16.08 | 15.39 | 10.60 | 43.27 | 55.07 | 63.25 | 56.36 | 38.13 | 28.44 | 20.09 | 14.86 | 12.54 | |

| Interest Income Expense Net | 1038.00 | 1198.00 | 1167.00 | 1082.00 | 939.00 | 852.00 | 728.00 | 659.58 | 591.48 | 527.74 | 512.93 | 524.14 | 533.67 | 520.64 | 529.40 | 512.89 | 514.46 | 493.22 | 466.44 | 419.86 | |

| Interest Paid Net | 569.00 | 274.00 | 95.00 | 43.00 | 36.00 | 26.00 | 14.28 | 16.72 | 16.73 | -0.48 | 21.35 | 46.15 | 53.46 | 69.65 | 48.30 | 46.55 | 20.92 | NA | NA | NA | |

| Income Tax Expense Benefit | 74.00 | 175.00 | 132.00 | 182.00 | 142.00 | 149.00 | 173.00 | 187.31 | 148.10 | 162.26 | 87.87 | 49.36 | 94.06 | 105.08 | 119.11 | 107.44 | 105.00 | 95.31 | 77.29 | 73.97 | |

| Income Taxes Paid | -153.00 | -3.00 | 221.00 | 31.00 | 192.00 | 177.00 | 341.16 | 28.84 | 12.08 | 229.56 | 25.55 | 31.99 | 42.77 | 68.97 | 293.03 | 17.57 | 99.04 | 83.71 | 184.30 | 9.38 | |

| Profit Loss | 305.00 | 418.00 | 353.00 | 533.00 | 408.00 | 475.00 | 628.00 | 561.76 | 438.80 | 474.06 | 247.79 | 133.65 | 274.82 | 281.72 | 336.57 | 291.61 | 274.93 | 281.37 | 247.03 | 208.03 | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | -9.00 | -10.00 | -10.00 | 72.00 | -12.00 | -12.00 | -11.00 | 118.00 | -11.70 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | 174.00 | -887.00 | -438.00 | -751.00 | -74.00 | -77.00 | 121.00 | -601.56 | 2.12 | 5.66 | 22.20 | 508.09 | -51.71 | 54.92 | 96.61 | 38.75 | 54.29 | -21.55 | -15.18 | -70.21 | |

| Comprehensive Income Net Of Tax | 489.00 | -418.00 | -65.00 | -236.00 | 320.00 | 310.00 | 636.00 | -64.74 | 395.03 | 451.97 | 255.73 | 643.71 | 211.15 | 322.20 | 414.59 | 327.48 | 320.55 | 253.27 | 222.62 | 124.75 | |

| Preferred Stock Dividends Income Statement Impact | 40.00 | 40.00 | 40.00 | 43.00 | 23.00 | 22.00 | 13.00 | 4.59 | 4.59 | 4.59 | 4.59 | 3.37 | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 275.00 | 429.00 | 333.00 | 472.00 | 371.00 | 365.00 | 502.00 | 532.22 | 388.32 | 441.71 | 228.94 | 132.25 | 262.86 | 267.28 | 317.99 | 288.73 | 266.26 | 274.82 | 237.80 | 194.96 | |

| Interest Income Expense After Provision For Loan Loss | 897.00 | 1126.00 | 971.00 | 1071.00 | 891.00 | 831.00 | 693.00 | 640.90 | 629.91 | 579.76 | 446.45 | 280.66 | 516.28 | 484.11 | 505.46 | 484.33 | 500.82 | 476.05 | 437.36 | 391.89 | |

| Noninterest Expense | 1008.00 | 892.00 | 848.00 | 873.00 | 902.00 | 879.00 | 653.00 | 636.00 | 664.80 | 491.02 | 479.64 | 399.58 | 460.75 | 391.32 | 383.52 | 365.66 | 307.59 | 309.44 | 305.74 | 265.42 | |

| Noninterest Income | 490.00 | 359.00 | 362.00 | 517.00 | 561.00 | 672.00 | 761.00 | 744.18 | 621.78 | 547.58 | 368.85 | 301.93 | 313.34 | 294.01 | 333.75 | 280.38 | 186.71 | 210.07 | 192.69 | 155.52 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

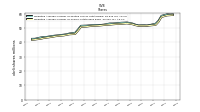

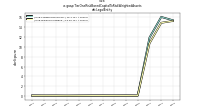

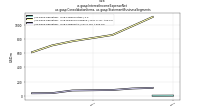

| Assets | 211793.00 | 212867.00 | 214389.00 | 220355.00 | 211478.00 | 190996.00 | 163399.00 | 142346.62 | 115511.01 | 96916.77 | 85730.99 | 75009.64 | 71004.90 | 68231.23 | 63773.74 | 60160.29 | 56927.98 | 58139.73 | 55867.75 | 53500.79 | |

| Liabilities | 195498.00 | 197057.00 | 198113.00 | 203995.00 | 194869.00 | 176327.00 | 151432.00 | 132225.84 | 107077.52 | 88949.39 | 78262.67 | 67826.42 | 64383.82 | 62182.76 | 58067.56 | 54676.46 | 51663.14 | 53069.69 | 51062.90 | 48941.06 | |

| Liabilities And Stockholders Equity | 211793.00 | 212867.00 | 214389.00 | 220355.00 | 211478.00 | 190996.00 | 163399.00 | 142346.62 | 115511.01 | 96916.77 | 85730.99 | 75009.64 | 71004.90 | 68231.23 | 63773.74 | 60160.29 | 56927.98 | 58139.73 | 55867.75 | 53500.79 | |

| Stockholders Equity | 16004.00 | 15509.00 | 15918.00 | 15980.00 | 16236.00 | 14300.00 | 11667.00 | 9894.89 | 8219.70 | 7792.94 | 7319.37 | 7034.75 | 6470.31 | 5890.68 | 5554.04 | 5342.77 | 5116.21 | 4924.37 | 4657.65 | 4415.45 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 13803.00 | 13968.00 | 15398.00 | 20606.00 | 14619.00 | 18940.00 | 23959.00 | 21254.86 | 17674.76 | 15687.78 | 14202.11 | 9561.45 | 6781.78 | 6946.20 | 9020.92 | 7066.88 | 3571.54 | 3819.14 | 2712.10 | 2619.38 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 13803.00 | 13968.00 | 15398.00 | 20606.00 | 14619.00 | 18940.00 | 23959.00 | 21254.86 | 17674.76 | 15687.78 | 14202.11 | 9561.45 | 6781.78 | 6946.20 | 9020.92 | 7066.88 | 3571.54 | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 26069.00 | 26711.00 | 26223.00 | 25991.00 | 27221.00 | 22984.00 | 23876.00 | 25986.47 | 30913.00 | 25904.32 | 18451.91 | 12648.06 | NA | 12866.86 | 7940.32 | 6755.09 | NA | 9087.61 | 9593.37 | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 923.00 | NA | NA | NA | 715.00 | NA | NA | NA | 562.29 | NA | NA | NA | 512.49 | NA | NA | NA | 427.82 | NA | NA | NA | |

| Furniture And Fixtures Gross | 59.00 | NA | NA | NA | 53.00 | NA | NA | NA | 50.04 | NA | NA | NA | 46.30 | NA | NA | NA | 42.32 | NA | NA | NA | |

| Leasehold Improvements Gross | 164.00 | NA | NA | NA | 149.00 | NA | NA | NA | 124.06 | NA | NA | NA | 121.91 | NA | NA | NA | 98.24 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 529.00 | NA | NA | NA | 445.00 | NA | NA | NA | 386.47 | NA | NA | NA | 350.62 | NA | NA | NA | 298.61 | NA | NA | NA | |

| Amortization Of Intangible Assets | 6.00 | 6.00 | 6.00 | 6.00 | 6.00 | 5.00 | 1.90 | 2.10 | NA | 4.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Property Plant And Equipment Net | 394.00 | 346.00 | 294.00 | 283.00 | 270.00 | 247.00 | 196.00 | 179.67 | 175.82 | 173.48 | 169.31 | 154.78 | 161.88 | 146.71 | 141.89 | 139.00 | 129.21 | 121.89 | 117.60 | 127.05 | |

| Goodwill | 375.00 | 375.00 | 375.00 | 375.00 | 375.00 | 344.00 | 143.00 | 142.69 | 142.69 | 137.82 | 137.82 | 137.82 | 137.82 | 137.82 | 137.82 | 135.19 | 0.00 | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 136.00 | 142.00 | 148.00 | 154.00 | 160.00 | 156.00 | 57.00 | 59.33 | 61.44 | 45.38 | 46.73 | 48.07 | 49.42 | 52.29 | 55.16 | 58.03 | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 15160.00 | 15922.00 | 11244.00 | 7094.00 | 1343.00 | 788.00 | 402.00 | 431.83 | 3.01 | 8.62 | 0.27 | 4.05 | 17.44 | 18.69 | 35.02 | 149.96 | 316.25 | 528.40 | 407.84 | 328.00 | |

| Held To Maturity Securities Fair Value | 76169.00 | 77370.00 | 84579.00 | 91667.00 | 97227.00 | 81995.00 | 60107.00 | 41186.74 | 17216.87 | 13612.46 | 13541.46 | 14131.15 | 14115.27 | 14698.80 | 15064.96 | 14996.51 | 15188.24 | 15372.24 | 15494.00 | 14229.44 | |

| Held To Maturity Securities | 91327.00 | 93292.00 | 95820.00 | 98713.00 | 98202.00 | 82371.00 | 59997.00 | 41165.73 | 16592.54 | 12982.51 | 12859.05 | 13574.52 | 13842.95 | 14407.08 | 14868.76 | 15055.25 | 15487.44 | 15899.73 | 15898.26 | 14548.86 | |

| Held To Maturity Securities Debt Maturities After Ten Years Fair Value | 71426.00 | 72702.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 12973.55 | 13249.37 | NA | |

| Held To Maturity Securities Debt Maturities After One Through Five Years Fair Value | 689.00 | 666.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 350.49 | 363.34 | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 28602.00 | 29502.00 | 28141.00 | 27287.00 | 27370.00 | 22919.00 | NA | NA | 30245.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 2.00 | NA | 3.00 | 48.00 | 368.00 | 412.00 | 512.00 | 452.84 | 627.34 | 638.57 | 682.68 | 560.68 | 289.76 | 310.42 | 231.22 | 91.21 | 17.04 | 0.92 | 3.57 | 8.58 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 15160.00 | 15922.00 | 11244.00 | 7094.00 | 1343.00 | 788.00 | 402.00 | 431.83 | 3.01 | 8.62 | 0.27 | 4.05 | 17.44 | 18.69 | 35.02 | 149.96 | 316.25 | 528.40 | 407.84 | 328.00 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 5370.00 | 3368.00 | 3367.00 | 2571.00 | 2570.00 | 1925.00 | 1834.00 | 1338.18 | 843.63 | 843.43 | 843.22 | 348.08 | 347.99 | 697.23 | 696.97 | 696.72 | 696.47 | 696.22 | 695.97 | 695.73 | |

| Minority Interest | 291.00 | 301.00 | 358.00 | 380.00 | 373.00 | 369.00 | 300.00 | 225.89 | 213.79 | 174.44 | 148.94 | 148.47 | 150.77 | 157.79 | 152.13 | 141.05 | 148.63 | 145.68 | 147.19 | 144.28 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

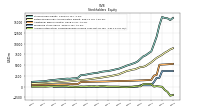

| Stockholders Equity | 16004.00 | 15509.00 | 15918.00 | 15980.00 | 16236.00 | 14300.00 | 11667.00 | 9894.89 | 8219.70 | 7792.94 | 7319.37 | 7034.75 | 6470.31 | 5890.68 | 5554.04 | 5342.77 | 5116.21 | 4924.37 | 4657.65 | 4415.45 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 16295.00 | 15810.00 | 16276.00 | 16360.00 | 16609.00 | 14669.00 | 11967.00 | 10120.78 | 8433.49 | 7967.38 | 7468.31 | 7183.22 | 6621.08 | 6048.47 | 5706.18 | 5483.82 | 5264.84 | 5070.05 | 4804.84 | 4559.72 | |

| Additional Paid In Capital | 5318.00 | 5272.00 | 5223.00 | 5180.00 | 5157.00 | 5100.00 | 2755.00 | 2590.58 | 1585.24 | 1548.92 | 1522.73 | 1489.24 | 1470.07 | 1441.73 | 1421.57 | 1394.13 | 1378.44 | 1360.03 | 1346.59 | 1327.00 | |

| Retained Earnings Accumulated Deficit | 8951.00 | 8676.00 | 8247.00 | 7914.00 | 7442.00 | 7071.00 | 6706.00 | 6203.97 | 5671.75 | 5283.43 | 4841.72 | 4612.78 | 4575.60 | 4312.74 | 4051.19 | 3963.97 | 3791.84 | 3672.70 | 3397.88 | 3160.08 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -1911.00 | -2085.00 | -1198.00 | -760.00 | -9.00 | 65.00 | 142.00 | 20.96 | 622.52 | 620.39 | 614.74 | 592.53 | 84.44 | 136.15 | 81.23 | -15.37 | -54.12 | -108.41 | -86.86 | -71.69 | |

| Minority Interest | 291.00 | 301.00 | 358.00 | 380.00 | 373.00 | 369.00 | 300.00 | 225.89 | 213.79 | 174.44 | 148.94 | 148.47 | 150.77 | 157.79 | 152.13 | 141.05 | 148.63 | 145.68 | 147.19 | 144.28 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 37.00 | 51.00 | 45.00 | 50.00 | 45.00 | 38.00 | 28.00 | 26.69 | 23.25 | 21.41 | 20.15 | 19.17 | 16.27 | 18.78 | 16.65 | 15.12 | 11.71 | 11.50 | 11.94 | 10.52 | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 0.00 | 6.00 | 2.00 | 11.00 | 10.00 | 19.00 | 39.00 | 12.85 | 6.54 | 2.24 | 13.79 | 0.33 | 18.98 | 8.78 | 7.50 | 15.72 | 5.71 | 8.06 | 6.32 | 8.41 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

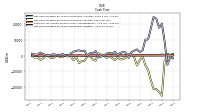

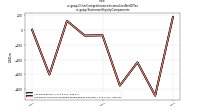

| Net Cash Provided By Used In Operating Activities | 1020.00 | 433.00 | 1052.00 | 359.00 | 683.00 | 434.00 | 481.08 | 213.92 | 392.20 | 307.81 | 577.35 | 168.12 | 454.38 | 259.17 | 109.82 | 340.75 | 229.66 | 356.52 | -1.02 | 348.40 | |

| Net Cash Provided By Used In Investing Activities | 546.00 | -556.00 | -428.00 | -3200.00 | -25256.00 | -23039.00 | -21031.06 | -21009.94 | -15617.35 | -9055.50 | -5933.83 | -599.04 | -2807.11 | -6247.76 | -1221.45 | 904.43 | 935.92 | -1166.19 | -2173.45 | -2396.65 | |

| Net Cash Provided By Used In Financing Activities | -1731.00 | -1274.00 | -5832.00 | 8828.00 | 20252.00 | 17586.00 | 23253.89 | 24376.11 | 17212.14 | 10233.36 | 9997.13 | 3210.58 | 2188.31 | 3913.85 | 3065.67 | 2250.17 | -1413.18 | 1916.70 | 2267.20 | 1744.56 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

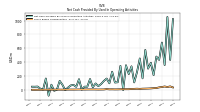

| Net Cash Provided By Used In Operating Activities | 1020.00 | 433.00 | 1052.00 | 359.00 | 683.00 | 434.00 | 481.08 | 213.92 | 392.20 | 307.81 | 577.35 | 168.12 | 454.38 | 259.17 | 109.82 | 340.75 | 229.66 | 356.52 | -1.02 | 348.40 | |

| Profit Loss | 305.00 | 418.00 | 353.00 | 533.00 | 408.00 | 475.00 | 628.00 | 561.76 | 438.80 | 474.06 | 247.79 | 133.65 | 274.82 | 281.72 | 336.57 | 291.61 | 274.93 | 281.37 | 247.03 | 208.03 | |

| Increase Decrease In Other Operating Capital Net | -4.00 | 844.00 | -384.00 | 27.00 | -162.00 | 133.00 | 113.09 | 195.91 | 75.73 | 113.54 | 29.62 | 69.01 | -4.28 | 41.30 | 56.89 | -19.67 | 7.17 | 20.81 | 93.94 | -67.89 | |

| Deferred Income Tax Expense Benefit | 764.00 | -120.00 | -100.00 | 47.00 | -81.00 | 40.00 | -24.51 | 57.51 | 11.04 | 68.63 | -12.63 | -60.13 | -1.35 | 2.13 | 4.98 | -8.83 | -4.53 | 2.06 | -9.76 | -8.83 | |

| Share Based Compensation | 37.00 | 52.00 | 43.00 | 51.00 | 43.00 | 38.00 | 28.31 | 26.69 | 23.25 | 21.41 | 20.15 | 19.17 | 16.27 | 18.78 | 16.65 | 15.12 | 11.71 | 11.50 | 11.94 | 10.52 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 546.00 | -556.00 | -428.00 | -3200.00 | -25256.00 | -23039.00 | -21031.06 | -21009.94 | -15617.35 | -9055.50 | -5933.83 | -599.04 | -2807.11 | -6247.76 | -1221.45 | 904.43 | 935.92 | -1166.19 | -2173.45 | -2396.65 | |

| Payments To Acquire Property Plant And Equipment | 74.00 | 76.00 | 33.00 | 32.00 | 36.00 | 36.00 | 27.15 | 13.85 | 21.40 | 14.79 | 26.13 | 25.09 | 31.61 | 15.24 | 13.13 | 5.50 | 17.15 | 13.87 | 7.13 | 7.72 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -1731.00 | -1274.00 | -5832.00 | 8828.00 | 20252.00 | 17586.00 | 23253.89 | 24376.11 | 17212.14 | 10233.36 | 9997.13 | 3210.58 | 2188.31 | 3913.85 | 3065.67 | 2250.17 | -1413.18 | 1916.70 | 2267.20 | 1744.56 | |

| Payments Of Dividends | 40.00 | 40.00 | 40.00 | 43.00 | 23.00 | 23.00 | 12.41 | 4.59 | 4.59 | 4.59 | 4.59 | 3.37 | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

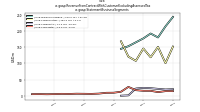

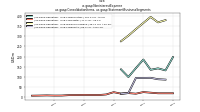

| Revenues | 433.00 | 350.00 | 368.00 | 352.00 | 366.00 | 315.00 | 306.00 | 328.14 | 300.00 | 247.04 | 285.38 | 222.44 | 236.42 | 205.91 | 221.37 | 217.26 | 147.40 | 130.44 | 122.46 | 111.36 | |

| Material Reconciling Items | 2.00 | 0.00 | 3.00 | 1.00 | 2.00 | 1.00 | 2.00 | 1.02 | 1.82 | 0.00 | 0.01 | 0.99 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Material Reconciling Items, Credit Cards Interchange Gross | 1.00 | 0.00 | 1.00 | 1.00 | 1.00 | 0.00 | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Material Reconciling Items, Deposit Account | 0.00 | 0.00 | 1.00 | NA | 0.00 | 1.00 | 1.00 | 0.58 | NA | NA | NA | 0.32 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Material Reconciling Items, Investment Advisory Management And Administrative Service | 1.00 | 0.00 | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Commissions | 25.00 | 24.00 | 24.00 | 25.00 | 21.00 | 17.00 | 17.00 | 24.44 | 17.44 | 16.26 | 16.92 | 16.02 | 15.53 | 12.28 | 14.43 | 14.11 | NA | NA | NA | NA | |

| Correspondent Bank Rebates | NA | NA | NA | 2.00 | 2.00 | 2.00 | 1.00 | 1.29 | 1.58 | 1.38 | 1.37 | 1.40 | 1.70 | 1.63 | 1.61 | 1.47 | 1.56 | 1.37 | 1.47 | 1.40 | |

| Credit Cards Interchange Gross | 54.00 | 55.00 | 61.00 | 57.00 | 59.00 | 52.00 | 49.00 | 41.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Credit Cards Merchant | 8.00 | 7.00 | 6.00 | 5.00 | 6.00 | 4.00 | 4.00 | 3.77 | 4.00 | 3.67 | 5.03 | 5.03 | 5.59 | 3.94 | 4.29 | 4.53 | 4.41 | 3.68 | 3.42 | 2.91 | |

| Fund Management | 16.00 | 16.00 | 14.00 | 13.00 | 16.00 | 15.00 | 21.00 | 14.56 | 12.54 | 9.67 | 8.85 | 7.91 | 8.23 | 8.49 | 7.76 | 8.04 | 5.87 | 5.48 | 5.93 | 5.74 | |

| Investment Banking Revenue | 127.00 | 75.00 | 125.00 | 93.00 | 124.00 | 90.00 | 103.00 | 142.30 | 133.43 | 92.18 | 141.50 | 46.87 | 58.17 | 38.52 | 48.69 | 49.80 | NA | NA | NA | NA | |

| Other Revenue From Contracts For Customers | 2.00 | 3.00 | 1.00 | NA | 68.00 | 66.00 | 69.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Performance Fees | NA | NA | NA | 4.00 | 1.00 | 4.00 | 8.00 | 0.07 | 0.00 | 1.61 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Repurchase Agreement Fees | 62.00 | 39.00 | 12.00 | 1.00 | -1.00 | 1.00 | 0.42 | 0.58 | 1.59 | 1.59 | 0.88 | 11.21 | 12.84 | 13.22 | 11.84 | 11.27 | 10.28 | 8.80 | 6.54 | 5.20 | |

| Spot Contracts | NA | 74.00 | 69.00 | 66.00 | 65.00 | 60.00 | 60.00 | 54.93 | 45.03 | 38.79 | 33.09 | 40.93 | 39.35 | 36.84 | 34.70 | 35.03 | 34.67 | 30.04 | 31.55 | 31.20 | |

| Sweep Money Market | 71.00 | 64.00 | 56.00 | 24.00 | 12.00 | 12.00 | 7.00 | 10.46 | 13.56 | 18.16 | 19.41 | 23.05 | 24.54 | 26.20 | 26.95 | 26.54 | 25.05 | 21.11 | 17.18 | 12.32 | |

| Wealth Management And Trust Fees | 20.00 | 19.00 | 22.00 | 22.00 | 22.00 | 22.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Asset Management1 | 16.00 | 16.00 | 15.00 | 10.00 | 9.00 | 7.00 | 8.00 | 9.02 | 9.86 | 12.17 | 11.60 | 9.14 | 7.78 | 7.26 | 6.96 | 6.67 | 6.43 | 6.36 | 5.73 | 5.36 | |

| Credit Card Merchant Discount | 8.00 | 6.00 | 6.00 | 5.00 | 6.00 | 4.00 | 4.00 | 3.77 | 4.00 | 3.67 | 5.03 | 5.03 | 5.59 | 3.94 | 4.29 | 4.53 | 4.41 | 3.68 | 3.42 | 2.91 | |

| Deposit Account | 32.00 | 32.00 | 32.00 | 30.00 | 30.00 | 29.00 | 28.00 | 25.15 | 23.22 | 22.02 | 20.51 | 24.59 | 23.70 | 22.48 | 22.07 | 20.94 | 20.02 | 19.59 | 18.79 | 17.70 | |

| Investment Advisory Management And Administrative Service | 149.00 | 119.00 | 83.00 | 35.00 | 20.00 | 20.00 | 15.00 | 20.07 | 25.01 | 31.91 | 31.89 | 43.39 | 45.16 | 46.68 | 45.74 | 44.48 | 41.77 | 36.27 | 29.45 | 22.88 | |

| Commissions, S V B Securities | 25.00 | 24.00 | 24.00 | 25.00 | 21.00 | 17.00 | 17.00 | 24.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Correspondent Bank Rebates, Silicon Valley Bank | NA | NA | NA | 2.00 | NA | NA | NA | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Credit Cards Interchange Gross, S V B Private | 0.00 | 1.00 | NA | NA | 0.00 | 0.00 | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Credit Cards Interchange Gross, Silicon Valley Bank | 53.00 | 54.00 | 60.00 | 56.00 | 58.00 | 52.00 | 47.00 | 41.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Credit Cards Merchant, Silicon Valley Bank | 7.00 | 7.00 | 6.00 | 5.00 | 5.00 | 4.00 | 4.00 | 4.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Fund Management, S V B Capital | 15.00 | 13.00 | 12.00 | 12.00 | 15.00 | 14.00 | 20.00 | 13.12 | 10.10 | 8.24 | 7.42 | 6.48 | 6.80 | 7.06 | 6.33 | 6.66 | 5.87 | 5.48 | 5.93 | 5.74 | |

| Fund Management, S V B Securities | 0.00 | 2.00 | 2.00 | 1.00 | 1.00 | 1.00 | 1.00 | 2.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Investment Banking Revenue, S V B Securities | 127.00 | 75.00 | 125.00 | 93.00 | 124.00 | 90.00 | 103.00 | 142.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Revenue From Contracts For Customers, S V B Capital | 0.00 | 2.00 | NA | NA | 1.00 | 4.00 | 8.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Revenue From Contracts For Customers, S V B Private | 0.00 | 0.00 | NA | NA | 1.00 | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Revenue From Contracts For Customers, Silicon Valley Bank | 2.00 | 1.00 | 1.00 | NA | 65.00 | 61.00 | 61.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Performance Fees, S V B Capital | NA | NA | NA | 4.00 | 1.00 | 4.00 | 8.00 | 0.07 | 0.00 | 1.61 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Spot Contracts, S V B Private | NA | NA | NA | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Spot Contracts, Silicon Valley Bank | NA | NA | NA | 65.00 | NA | NA | NA | 55.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Wealth Management And Trust Fees, S V B Private | 20.00 | 19.00 | 22.00 | 22.00 | 22.00 | 22.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposit Account, S V B Private | 0.00 | 0.00 | 0.00 | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposit Account, Silicon Valley Bank | 32.00 | 32.00 | 31.00 | 29.00 | 29.00 | 28.00 | 27.00 | 25.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Investment Advisory Management And Administrative Service, Silicon Valley Bank | 148.00 | 119.00 | 82.00 | 35.00 | 20.00 | 20.00 | 14.00 | 19.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| S V B Capital | 15.00 | 15.00 | 12.00 | 16.00 | 16.00 | 18.00 | 28.00 | 13.19 | 10.10 | 9.85 | 7.42 | 6.48 | 6.80 | 7.06 | 6.33 | 6.66 | 5.87 | 5.48 | 5.93 | 5.74 | |

| S V B Private | 21.00 | 20.00 | 22.00 | 24.00 | 25.00 | 23.00 | 2.00 | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| S V B Securities | 152.00 | 101.00 | 151.00 | 119.00 | 146.00 | 108.00 | 121.00 | 168.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Silicon Valley Bank | 243.00 | 214.00 | 180.00 | 192.00 | 177.00 | 165.00 | 153.00 | 145.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | 433.00 | 350.00 | 368.00 | 352.00 | 366.00 | 315.00 | 306.00 | 328.14 | 300.00 | 247.04 | 285.38 | 222.44 | 236.42 | 205.91 | 221.37 | 217.26 | 147.40 | 130.44 | 122.46 | 111.36 | |

| Material Reconciling Items | 2.00 | 0.00 | 3.00 | 1.00 | 2.00 | 1.00 | 2.00 | 1.02 | 1.82 | 0.00 | 0.01 | 0.99 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Material Reconciling Items, Credit Cards Interchange Gross | 1.00 | 0.00 | 1.00 | 1.00 | 1.00 | 0.00 | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Material Reconciling Items, Deposit Account | 0.00 | 0.00 | 1.00 | NA | 0.00 | 1.00 | 1.00 | 0.58 | NA | NA | NA | 0.32 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Material Reconciling Items, Investment Advisory Management And Administrative Service | 1.00 | 0.00 | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Commissions | 25.00 | 24.00 | 24.00 | 25.00 | 21.00 | 17.00 | 17.00 | 24.44 | 17.44 | 16.26 | 16.92 | 16.02 | 15.53 | 12.28 | 14.43 | 14.11 | NA | NA | NA | NA | |

| Correspondent Bank Rebates | NA | NA | NA | 2.00 | 2.00 | 2.00 | 1.00 | 1.29 | 1.58 | 1.38 | 1.37 | 1.40 | 1.70 | 1.63 | 1.61 | 1.47 | 1.56 | 1.37 | 1.47 | 1.40 | |

| Credit Cards Interchange Gross | 54.00 | 55.00 | 61.00 | 57.00 | 59.00 | 52.00 | 49.00 | 41.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Credit Cards Merchant | 8.00 | 7.00 | 6.00 | 5.00 | 6.00 | 4.00 | 4.00 | 3.77 | 4.00 | 3.67 | 5.03 | 5.03 | 5.59 | 3.94 | 4.29 | 4.53 | 4.41 | 3.68 | 3.42 | 2.91 | |

| Fund Management | 16.00 | 16.00 | 14.00 | 13.00 | 16.00 | 15.00 | 21.00 | 14.56 | 12.54 | 9.67 | 8.85 | 7.91 | 8.23 | 8.49 | 7.76 | 8.04 | 5.87 | 5.48 | 5.93 | 5.74 | |

| Investment Banking Revenue | 127.00 | 75.00 | 125.00 | 93.00 | 124.00 | 90.00 | 103.00 | 142.30 | 133.43 | 92.18 | 141.50 | 46.87 | 58.17 | 38.52 | 48.69 | 49.80 | NA | NA | NA | NA | |

| Other Revenue From Contracts For Customers | 2.00 | 3.00 | 1.00 | NA | 68.00 | 66.00 | 69.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Performance Fees | NA | NA | NA | 4.00 | 1.00 | 4.00 | 8.00 | 0.07 | 0.00 | 1.61 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Repurchase Agreement Fees | 62.00 | 39.00 | 12.00 | 1.00 | -1.00 | 1.00 | 0.42 | 0.58 | 1.59 | 1.59 | 0.88 | 11.21 | 12.84 | 13.22 | 11.84 | 11.27 | 10.28 | 8.80 | 6.54 | 5.20 | |

| Spot Contracts | NA | 74.00 | 69.00 | 66.00 | 65.00 | 60.00 | 60.00 | 54.93 | 45.03 | 38.79 | 33.09 | 40.93 | 39.35 | 36.84 | 34.70 | 35.03 | 34.67 | 30.04 | 31.55 | 31.20 | |

| Sweep Money Market | 71.00 | 64.00 | 56.00 | 24.00 | 12.00 | 12.00 | 7.00 | 10.46 | 13.56 | 18.16 | 19.41 | 23.05 | 24.54 | 26.20 | 26.95 | 26.54 | 25.05 | 21.11 | 17.18 | 12.32 | |

| Wealth Management And Trust Fees | 20.00 | 19.00 | 22.00 | 22.00 | 22.00 | 22.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Asset Management1 | 16.00 | 16.00 | 15.00 | 10.00 | 9.00 | 7.00 | 8.00 | 9.02 | 9.86 | 12.17 | 11.60 | 9.14 | 7.78 | 7.26 | 6.96 | 6.67 | 6.43 | 6.36 | 5.73 | 5.36 | |

| Credit Card Merchant Discount | 8.00 | 6.00 | 6.00 | 5.00 | 6.00 | 4.00 | 4.00 | 3.77 | 4.00 | 3.67 | 5.03 | 5.03 | 5.59 | 3.94 | 4.29 | 4.53 | 4.41 | 3.68 | 3.42 | 2.91 | |

| Deposit Account | 32.00 | 32.00 | 32.00 | 30.00 | 30.00 | 29.00 | 28.00 | 25.15 | 23.22 | 22.02 | 20.51 | 24.59 | 23.70 | 22.48 | 22.07 | 20.94 | 20.02 | 19.59 | 18.79 | 17.70 | |

| Investment Advisory Management And Administrative Service | 149.00 | 119.00 | 83.00 | 35.00 | 20.00 | 20.00 | 15.00 | 20.07 | 25.01 | 31.91 | 31.89 | 43.39 | 45.16 | 46.68 | 45.74 | 44.48 | 41.77 | 36.27 | 29.45 | 22.88 | |

| Commissions, S V B Securities | 25.00 | 24.00 | 24.00 | 25.00 | 21.00 | 17.00 | 17.00 | 24.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Correspondent Bank Rebates, Silicon Valley Bank | NA | NA | NA | 2.00 | NA | NA | NA | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Credit Cards Interchange Gross, S V B Private | 0.00 | 1.00 | NA | NA | 0.00 | 0.00 | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Credit Cards Interchange Gross, Silicon Valley Bank | 53.00 | 54.00 | 60.00 | 56.00 | 58.00 | 52.00 | 47.00 | 41.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Credit Cards Merchant, Silicon Valley Bank | 7.00 | 7.00 | 6.00 | 5.00 | 5.00 | 4.00 | 4.00 | 4.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Fund Management, S V B Capital | 15.00 | 13.00 | 12.00 | 12.00 | 15.00 | 14.00 | 20.00 | 13.12 | 10.10 | 8.24 | 7.42 | 6.48 | 6.80 | 7.06 | 6.33 | 6.66 | 5.87 | 5.48 | 5.93 | 5.74 | |

| Fund Management, S V B Securities | 0.00 | 2.00 | 2.00 | 1.00 | 1.00 | 1.00 | 1.00 | 2.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Investment Banking Revenue, S V B Securities | 127.00 | 75.00 | 125.00 | 93.00 | 124.00 | 90.00 | 103.00 | 142.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Revenue From Contracts For Customers, S V B Capital | 0.00 | 2.00 | NA | NA | 1.00 | 4.00 | 8.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Revenue From Contracts For Customers, S V B Private | 0.00 | 0.00 | NA | NA | 1.00 | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Revenue From Contracts For Customers, Silicon Valley Bank | 2.00 | 1.00 | 1.00 | NA | 65.00 | 61.00 | 61.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Performance Fees, S V B Capital | NA | NA | NA | 4.00 | 1.00 | 4.00 | 8.00 | 0.07 | 0.00 | 1.61 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Spot Contracts, S V B Private | NA | NA | NA | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Spot Contracts, Silicon Valley Bank | NA | NA | NA | 65.00 | NA | NA | NA | 55.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Wealth Management And Trust Fees, S V B Private | 20.00 | 19.00 | 22.00 | 22.00 | 22.00 | 22.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposit Account, S V B Private | 0.00 | 0.00 | 0.00 | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposit Account, Silicon Valley Bank | 32.00 | 32.00 | 31.00 | 29.00 | 29.00 | 28.00 | 27.00 | 25.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Investment Advisory Management And Administrative Service, Silicon Valley Bank | 148.00 | 119.00 | 82.00 | 35.00 | 20.00 | 20.00 | 14.00 | 19.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| S V B Capital | 15.00 | 15.00 | 12.00 | 16.00 | 16.00 | 18.00 | 28.00 | 13.19 | 10.10 | 9.85 | 7.42 | 6.48 | 6.80 | 7.06 | 6.33 | 6.66 | 5.87 | 5.48 | 5.93 | 5.74 | |

| S V B Private | 21.00 | 20.00 | 22.00 | 24.00 | 25.00 | 23.00 | 2.00 | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| S V B Securities | 152.00 | 101.00 | 151.00 | 119.00 | 146.00 | 108.00 | 121.00 | 168.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Silicon Valley Bank | 243.00 | 214.00 | 180.00 | 192.00 | 177.00 | 165.00 | 153.00 | 145.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |