| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | |

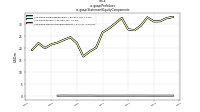

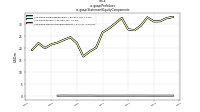

| Earnings Per Share Basic | 1.32 | 1.30 | 1.25 | 1.25 | 1.32 | 1.18 | 1.10 | 1.11 | 1.29 | 1.19 | 1.10 | 1.03 | 0.78 | 0.72 | 0.64 | 0.85 | 0.95 | 0.91 | 0.86 | 0.83 | 0.76 | 0.84 | 0.73 | 0.68 | 0.66 | 0.64 | |

| Earnings Per Share Diluted | 1.32 | 1.30 | 1.25 | 1.25 | 1.32 | 1.18 | 1.10 | 1.11 | 1.29 | 1.19 | 1.10 | 1.03 | 0.78 | 0.72 | 0.64 | 0.85 | 0.95 | 0.91 | 0.86 | 0.83 | 0.76 | 0.84 | 0.73 | 0.68 | 0.66 | 0.64 |

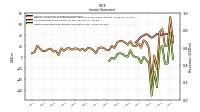

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

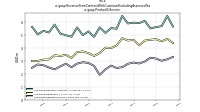

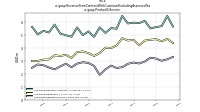

| Interest And Fee Income Loans And Leases | 100.21 | 93.30 | 86.69 | 79.24 | 69.03 | 60.41 | 55.21 | 58.33 | 61.70 | 57.14 | 57.86 | 64.11 | 58.32 | 58.81 | 61.53 | 63.26 | 66.81 | 65.60 | 62.68 | 62.28 | 59.96 | 58.52 | 53.69 | 51.38 | 50.43 | 48.03 | |

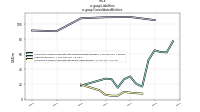

| Insurance Commissions And Fees | 1.71 | 1.64 | 2.03 | 1.53 | 1.70 | 1.57 | 1.91 | 1.55 | 1.86 | 1.68 | 2.15 | 1.62 | 1.82 | 1.70 | 1.88 | 1.47 | 1.60 | 1.52 | 2.17 | 1.48 | 1.58 | 1.49 | 1.96 | 1.38 | 1.43 | 1.31 | |

| Interest Expense | 38.09 | 32.04 | 24.89 | 15.80 | 7.54 | 4.57 | 2.43 | 3.91 | 4.50 | 4.83 | 4.88 | 6.47 | 8.05 | 9.85 | 12.84 | 14.25 | 15.48 | 15.21 | 14.07 | 12.67 | 11.33 | 10.70 | 8.71 | 7.37 | 7.20 | 6.54 | |

| Interest Income Expense Net | 69.24 | 68.52 | 69.56 | 71.45 | 68.93 | 63.46 | 59.62 | 60.07 | 62.22 | 56.94 | 57.41 | 62.11 | 54.87 | 54.00 | 54.84 | 55.30 | 57.20 | 56.43 | 54.95 | 55.84 | 54.36 | 53.17 | 50.53 | 48.81 | 47.23 | 45.86 | |

| Income Tax Expense Benefit | 9.73 | 9.63 | 9.29 | 9.96 | 9.70 | 8.80 | 7.79 | 8.53 | 9.73 | 9.43 | 8.64 | 7.70 | 6.51 | 5.52 | 5.16 | 6.62 | 7.69 | 7.07 | 6.75 | 6.16 | 5.04 | 5.53 | 5.88 | 5.56 | 9.56 | 9.48 | |

| Profit Loss | 32.94 | 32.45 | 31.13 | 31.06 | 32.74 | 29.33 | 27.40 | 27.73 | 32.48 | 30.23 | 28.11 | 26.46 | 20.05 | 18.53 | 16.42 | 21.95 | 24.45 | 23.42 | 22.20 | 21.85 | 19.76 | 21.82 | 18.98 | 17.86 | 17.05 | 16.54 | |

| Other Comprehensive Income Loss Net Of Tax | -11.76 | -12.09 | 20.23 | 14.59 | -55.27 | -26.47 | -70.68 | -12.28 | -5.19 | 0.36 | -11.13 | -1.29 | -0.23 | 2.24 | 12.48 | 0.54 | 2.22 | 5.82 | 7.27 | 5.00 | -3.26 | -1.48 | -6.88 | NA | NA | NA | |

| Comprehensive Income Net Of Tax | 21.18 | 20.35 | 51.35 | 45.66 | -22.53 | 2.84 | -43.29 | 15.45 | 27.30 | 30.58 | 16.98 | 25.18 | 19.83 | 20.74 | 28.89 | 22.48 | 26.66 | 29.21 | 29.46 | 26.45 | 16.63 | 20.48 | 12.23 | 13.21 | 16.20 | 17.78 | |

| Net Income Loss Available To Common Stockholders Basic | 32.94 | 32.44 | 31.12 | 31.07 | 32.74 | 29.31 | 27.39 | 27.72 | 32.48 | 30.22 | 28.11 | 26.46 | 20.06 | 18.50 | 16.41 | 21.94 | 24.44 | 23.39 | 22.20 | 21.45 | 19.89 | 21.96 | 19.12 | 17.99 | 17.18 | 16.67 | |

| Interest Income Expense After Provision For Loan Loss | 68.38 | 68.47 | 66.52 | 66.11 | 65.77 | 60.96 | 57.38 | 61.18 | 64.78 | 59.96 | 55.01 | 57.14 | 45.56 | 43.63 | 43.49 | 52.34 | 53.48 | 52.18 | 50.03 | 51.14 | 48.20 | 48.35 | 46.75 | 45.19 | 45.61 | 43.12 | |

| Noninterest Expense | 50.17 | 49.16 | 49.42 | 48.38 | 45.33 | 45.66 | 45.34 | 48.75 | 48.06 | 45.20 | 44.14 | 48.96 | 47.04 | 44.83 | 46.53 | 49.35 | 47.11 | 47.35 | 45.20 | 47.69 | 47.34 | 45.88 | 45.56 | 47.31 | 44.46 | 41.10 | |

| Noninterest Income | 24.45 | 22.77 | 23.32 | 23.28 | 22.01 | 22.83 | 23.14 | 23.83 | 25.50 | 24.90 | 25.87 | 25.98 | 28.04 | 25.24 | 24.62 | 25.58 | 25.77 | 25.66 | 24.12 | 24.16 | 24.06 | 25.02 | 23.81 | 25.67 | 25.59 | 24.14 |

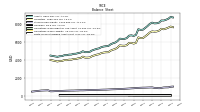

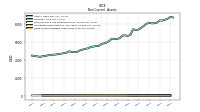

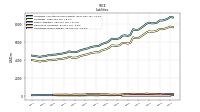

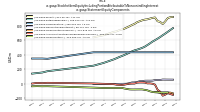

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

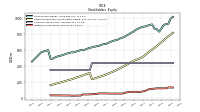

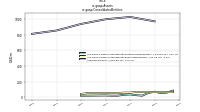

| Assets | 8525.06 | 8414.82 | 8329.80 | 8339.42 | 8097.49 | 8029.36 | 8012.46 | 8096.29 | 7964.09 | 7718.69 | 7511.93 | 7316.41 | 7290.95 | 7365.15 | 6735.12 | 6622.78 | 6691.07 | 6650.10 | 6379.09 | 6293.74 | 6293.17 | 6320.06 | 6051.46 | 5887.28 | 5806.73 | 5687.23 | |

| Liabilities | 7542.06 | 7434.73 | 7361.36 | 7415.65 | 7211.13 | 7118.69 | 7092.99 | 7126.82 | 7007.69 | 6773.24 | 6576.17 | 6385.74 | 6375.93 | 6463.49 | 5857.82 | 5774.14 | 5858.03 | 5845.42 | 5597.98 | 5530.15 | 5542.73 | 5579.78 | 5325.85 | 5168.75 | 5096.24 | 4988.03 | |

| Liabilities And Stockholders Equity | 8525.06 | 8414.82 | 8329.80 | 8339.42 | 8097.49 | 8029.36 | 8012.46 | 8096.29 | 7964.09 | 7718.69 | 7511.93 | 7316.41 | 7290.95 | 7365.15 | 6735.12 | 6622.78 | 6691.07 | 6650.10 | 6379.09 | 6293.74 | 6293.17 | 6320.06 | 6051.46 | 5887.28 | 5806.73 | 5687.23 | |

| Stockholders Equity | 924.25 | 921.02 | 909.16 | 864.07 | 826.06 | 856.25 | 864.85 | 916.25 | 911.33 | 901.23 | 891.29 | 886.85 | 877.75 | 865.00 | 850.90 | 828.28 | 813.17 | 794.66 | 778.42 | 762.08 | 750.44 | 740.28 | 725.61 | 718.54 | 710.50 | 699.20 | |

| Tier One Risk Based Capital | NA | NA | NA | 1048.95 | NA | NA | NA | 956.78 | NA | NA | NA | 889.71 | NA | NA | NA | 807.93 | NA | NA | NA | 751.58 | NA | NA | NA | 699.42 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 111.14 | 112.67 | 94.04 | 122.80 | 117.60 | 281.76 | 416.89 | 525.19 | 637.28 | 469.45 | 335.95 | 243.05 | 154.22 | 180.24 | 122.30 | 83.36 | 127.48 | 96.49 | 67.68 | 99.08 | NA | NA | NA | 78.03 | NA | NA | |

| Available For Sale Securities Debt Securities | 1605.24 | 1661.40 | 1713.48 | 1775.13 | 1801.19 | 1836.39 | 1857.43 | 1863.04 | 1583.24 | 1413.02 | 1291.34 | 1197.47 | 1083.43 | 1055.80 | 1057.17 | 1040.58 | 1032.18 | 1021.79 | 1002.81 | 990.13 | 972.17 | 968.35 | NA | 904.03 | NA | NA |

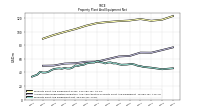

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | NA | NA | NA | 117.76 | NA | NA | NA | 116.17 | NA | NA | NA | 118.67 | NA | NA | NA | 116.56 | NA | NA | NA | 115.70 | NA | NA | NA | 114.37 | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | NA | NA | NA | 72.99 | NA | NA | NA | 69.14 | NA | NA | NA | 69.29 | NA | NA | NA | 64.34 | NA | NA | NA | 63.56 | NA | NA | NA | 59.76 | NA | NA | |

| Property Plant And Equipment Net | NA | NA | NA | 44.77 | NA | NA | NA | 47.04 | NA | NA | 48.29 | 49.37 | 49.93 | 51.49 | 52.43 | 52.22 | 51.68 | 51.57 | 51.36 | 52.14 | 53.48 | 53.36 | 54.84 | 54.61 | 53.32 | 54.78 | |

| Goodwill | NA | NA | NA | 83.87 | NA | NA | NA | 83.87 | NA | NA | NA | 83.87 | NA | NA | NA | 83.87 | NA | NA | NA | 83.87 | NA | NA | NA | 83.68 | NA | NA | |

| Finite Lived Intangible Assets Net | NA | NA | NA | 0.04 | NA | NA | NA | 0.06 | NA | NA | NA | 0.08 | NA | NA | NA | 0.10 | NA | NA | NA | 0.13 | NA | NA | NA | 0.06 | NA | NA | |

| Intangible Assets Net Including Goodwill | 83.92 | 83.90 | 83.90 | 83.91 | 83.91 | 83.92 | 83.92 | 83.93 | 83.93 | 83.94 | 83.94 | 83.95 | 83.95 | 83.96 | 83.96 | 83.97 | 83.98 | 83.98 | 83.99 | 84.00 | 84.10 | 84.10 | 84.12 | 83.74 | 83.80 | 83.85 | |

| Available For Sale Debt Securities Amortized Cost Basis | 1803.87 | 1844.74 | 1881.00 | 1969.17 | 2014.24 | 1977.16 | 1963.51 | 1876.03 | 1580.06 | 1403.01 | 1281.80 | 1173.27 | 1057.53 | 1029.60 | 1033.92 | 1033.77 | 1026.09 | 1018.61 | 1007.30 | 1004.19 | 992.82 | 984.70 | NA | 909.37 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | NA | NA | NA | 796.95 | NA | NA | NA | 653.80 | NA | NA | NA | 834.72 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 6967.49 | 6976.52 | 6801.46 | 6928.27 | 6621.23 | 6744.90 | 6673.09 | 6679.06 | 6522.51 | 6345.41 | 6131.34 | 5946.03 | 5896.85 | 5993.46 | 5275.91 | 5357.33 | 5391.68 | 5403.85 | 5124.09 | 5122.32 | 5061.98 | 5108.44 | 4781.32 | 4752.73 | 4573.71 | 4482.04 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Minority Interest | 58.75 | 59.07 | 59.28 | 59.70 | 60.30 | 54.42 | 54.62 | 53.21 | 45.06 | 44.23 | 44.46 | 43.83 | 37.26 | 36.66 | 26.41 | 20.36 | 19.88 | 10.02 | 2.68 | 1.51 | NA | NA | NA | 0.00 | NA | NA |

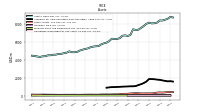

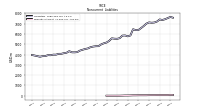

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 924.25 | 921.02 | 909.16 | 864.07 | 826.06 | 856.25 | 864.85 | 916.25 | 911.33 | 901.23 | 891.29 | 886.85 | 877.75 | 865.00 | 850.90 | 828.28 | 813.17 | 794.66 | 778.42 | 762.08 | 750.44 | 740.28 | 725.61 | 718.54 | 710.50 | 699.20 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 983.00 | 980.09 | 968.44 | 923.77 | 886.36 | 910.67 | 919.47 | 969.46 | 956.40 | 945.46 | 935.76 | 930.67 | 915.01 | 901.65 | 877.30 | 848.64 | 833.04 | 804.69 | 781.10 | 763.59 | 750.44 | 740.28 | 725.61 | 718.54 | NA | NA | |

| Common Stock Value | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | 436.54 | |

| Retained Earnings Accumulated Deficit | 769.60 | 744.44 | 719.50 | 694.86 | 671.54 | 646.60 | 624.50 | 603.79 | 583.63 | 558.79 | 535.74 | 514.18 | 497.42 | 484.49 | 472.91 | 463.27 | 448.71 | 431.09 | 414.43 | 398.98 | 383.94 | 370.52 | 354.61 | 339.96 | 327.15 | 314.89 | |

| Treasury Stock Value | 130.58 | 120.41 | 119.41 | 119.64 | 119.74 | 119.88 | 115.65 | 114.21 | 111.25 | 101.71 | 88.22 | 82.24 | 75.86 | 75.92 | 76.20 | 76.70 | 76.72 | 75.38 | 69.14 | 62.76 | 54.37 | 54.37 | 54.60 | 54.63 | 54.64 | 54.66 | |

| Minority Interest | 58.75 | 59.07 | 59.28 | 59.70 | 60.30 | 54.42 | 54.62 | 53.21 | 45.06 | 44.23 | 44.46 | 43.83 | 37.26 | 36.66 | 26.41 | 20.36 | 19.88 | 10.02 | 2.68 | 1.51 | NA | NA | NA | 0.00 | NA | NA | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 0.32 | 0.23 | 0.42 | 0.59 | 0.20 | 0.22 | 0.23 | 0.22 | 0.28 | 0.24 | 0.25 | 0.16 | 0.32 | 0.07 | 0.10 | 0.10 | 0.04 | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

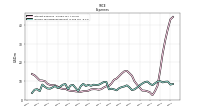

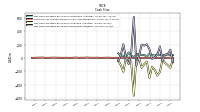

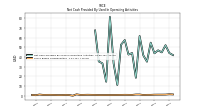

| Net Cash Provided By Used In Operating Activities | 52.16 | 44.77 | 46.85 | 43.79 | 54.79 | 35.15 | 41.80 | 61.69 | 18.52 | 44.07 | 42.49 | 57.48 | 52.66 | 11.05 | 33.30 | 81.37 | 14.43 | 33.41 | 35.40 | 67.41 | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -109.97 | -75.77 | -24.27 | -210.18 | -265.32 | -177.25 | -132.12 | -301.66 | -53.85 | -93.81 | -149.24 | 4.54 | 36.52 | -567.30 | -56.42 | -32.54 | 16.70 | -208.45 | -109.63 | -37.40 | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | 56.27 | 49.63 | -51.34 | 171.58 | 46.38 | 6.97 | -17.98 | 127.88 | 203.17 | 183.24 | 199.66 | 26.81 | -115.19 | 614.19 | 62.05 | -92.95 | -0.13 | 203.84 | 42.83 | -44.81 | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 52.16 | 44.77 | 46.85 | 43.79 | 54.79 | 35.15 | 41.80 | 61.69 | 18.52 | 44.07 | 42.49 | 57.48 | 52.66 | 11.05 | 33.30 | 81.37 | 14.43 | 33.41 | 35.40 | 67.41 | NA | NA | NA | NA | NA | NA | |

| Profit Loss | 32.94 | 32.45 | 31.13 | 31.06 | 32.74 | 29.33 | 27.40 | 27.73 | 32.48 | 30.23 | 28.11 | 26.46 | 20.05 | 18.53 | 16.42 | 21.95 | 24.45 | 23.42 | 22.20 | 21.85 | 19.76 | 21.82 | 18.98 | 17.86 | 17.05 | 16.54 | |

| Increase Decrease In Other Operating Capital Net | 2.30 | 0.25 | 0.37 | 1.38 | 0.74 | 0.55 | 1.33 | -0.06 | 0.01 | -0.33 | 0.09 | 0.11 | -0.29 | -0.27 | -0.49 | -0.39 | -0.24 | -0.51 | -0.60 | -0.48 | -0.21 | -0.35 | 0.01 | -1.05 | -1.80 | -0.52 | |

| Deferred Income Tax Expense Benefit | -1.51 | -3.11 | -0.99 | -4.03 | -2.17 | -3.34 | 0.08 | 2.31 | 4.74 | 5.89 | 2.45 | -13.65 | -2.72 | -4.84 | -2.94 | -1.14 | -2.91 | -2.12 | 0.44 | 0.77 | 2.18 | 4.04 | -7.53 | 7.00 | -3.01 | -0.72 | |

| Share Based Compensation | 1.17 | 1.12 | 1.12 | 1.08 | 0.89 | 0.89 | 0.73 | 1.25 | 1.24 | 0.84 | 0.89 | 0.92 | 0.86 | 0.78 | 0.74 | 0.70 | 0.73 | 0.67 | 0.67 | 0.81 | 0.89 | 0.97 | 0.88 | 0.81 | 1.44 | 0.03 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -109.97 | -75.77 | -24.27 | -210.18 | -265.32 | -177.25 | -132.12 | -301.66 | -53.85 | -93.81 | -149.24 | 4.54 | 36.52 | -567.30 | -56.42 | -32.54 | 16.70 | -208.45 | -109.63 | -37.40 | NA | NA | NA | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 0.98 | 1.22 | 0.41 | 1.11 | 0.72 | 0.44 | 0.11 | 1.50 | 0.44 | 0.67 | 0.28 | 0.86 | -0.14 | 0.47 | 1.66 | 1.94 | 1.56 | 1.71 | 2.82 | 0.12 | 1.61 | -0.23 | 1.57 | 2.64 | 1.78 | 0.99 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

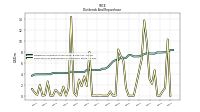

| Net Cash Provided By Used In Financing Activities | 56.27 | 49.63 | -51.34 | 171.58 | 46.38 | 6.97 | -17.98 | 127.88 | 203.17 | 183.24 | 199.66 | 26.81 | -115.19 | 614.19 | 62.05 | -92.95 | -0.13 | 203.84 | 42.83 | -44.81 | NA | NA | NA | NA | NA | NA | |

| Payments Of Dividends Common Stock | 8.17 | 8.18 | 8.14 | 8.14 | 8.13 | 7.91 | 7.92 | 7.93 | 8.00 | 7.81 | 7.60 | 7.39 | 7.39 | 7.38 | 7.61 | 7.61 | 7.10 | 7.14 | 7.17 | 6.67 | 6.69 | 6.42 | 5.91 | 5.38 | 5.11 | 5.11 | |

| Payments For Repurchase Of Common Stock | 10.29 | 1.41 | 0.77 | 0.00 | 0.00 | 4.66 | 2.17 | 3.07 | 9.67 | 13.78 | 6.62 | NA | NA | 0.00 | 0.00 | 0.00 | 1.41 | 6.42 | 7.26 | 8.45 | 0.03 | 0.00 | 0.79 | 0.00 | 0.00 | 0.00 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Debit Card | 4.38 | 4.70 | 4.51 | 4.67 | 4.63 | 4.56 | 4.19 | 4.62 | 4.57 | 4.75 | 4.18 | 3.99 | 4.02 | 3.60 | 3.37 | 3.59 | 3.73 | 3.67 | 3.22 | 3.46 | 3.38 | 3.43 | 3.10 | 3.09 | 2.98 | 2.99 | |

| Deposit Account | 3.30 | 3.12 | 3.00 | 3.17 | 3.24 | 2.94 | 2.79 | 2.87 | 2.77 | 2.51 | 2.45 | 2.63 | 2.34 | 1.91 | 2.60 | 2.83 | 2.89 | 2.79 | 2.50 | 2.78 | 2.57 | 2.34 | 2.48 | 2.66 | 2.72 | 2.46 | |

| Fiduciary And Trust | 5.65 | 6.47 | 5.68 | 5.61 | 5.50 | 6.09 | 5.91 | 5.95 | 5.89 | 6.47 | 5.48 | 5.52 | 5.15 | 5.59 | 4.85 | 5.27 | 4.98 | 5.58 | 4.86 | 4.97 | 5.11 | 5.80 | 5.19 | 5.32 | 5.04 | 5.63 |