| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.64 | 0.09 | 0.09 | 0.08 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.08 | 0.08 | 0.08 | 0.06 | 0.06 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.08 | 0.15 | 0.15 | 0.15 | 0.15 | 0.15 | 0.15 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | NA | 0.14 | NA | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 63.67 | 86.70 | 85.87 | 81.44 | 69.04 | 69.33 | 80.49 | 72.87 | 73.90 | 74.05 | 75.03 | 76.23 | 77.44 | 64.91 | 62.17 | 80.26 | 67.75 | 68.01 | 67.97 | 83.69 | 83.67 | 68.20 | 71.71 | 88.19 | 72.06 | NA | 115.67 | 118.51 | NA | NA | 85.77 | 85.54 | NA | NA | 130.16 | NA | NA | NA | 85.39 | 85.12 | 84.82 | 83.67 | 83.63 | 84.11 | 83.56 | 81.77 | 87.95 | 92.62 | 94.61 | 92.32 | 93.37 | 93.38 | 93.92 | |

| Weighted Average Number Of Shares Outstanding Basic | 63.67 | 86.70 | 85.46 | 81.44 | 69.04 | 69.33 | 71.30 | 72.87 | 73.90 | 74.05 | 75.03 | 76.23 | 77.44 | 64.91 | 62.17 | 64.02 | 67.75 | 68.01 | 67.97 | 67.93 | 67.91 | 68.20 | 71.71 | 72.14 | 72.06 | NA | 71.21 | 73.98 | NA | NA | 85.77 | 85.54 | NA | NA | 85.16 | NA | NA | NA | 85.39 | 85.12 | 84.82 | 83.67 | 83.63 | 84.11 | 83.56 | 81.77 | 87.95 | 92.62 | 92.46 | 92.32 | 93.37 | 93.38 | 93.92 | |

| Earnings Per Share Basic | 0.07 | -1.00 | 0.14 | -1.70 | 8.85 | 0.11 | 1.71 | -0.27 | -0.01 | -0.26 | -0.03 | -0.31 | -0.28 | -0.71 | -0.12 | 5.67 | -0.26 | -1.70 | -0.28 | 0.63 | 0.39 | -0.07 | -0.48 | 2.46 | -0.38 | -0.25 | 0.65 | 0.52 | NA | 0.08 | -0.07 | -0.36 | NA | -0.16 | 0.26 | NA | NA | NA | -0.36 | -0.31 | -0.49 | -1.04 | -0.86 | -0.70 | -0.66 | -0.43 | -0.71 | -0.38 | 0.73 | -0.73 | -0.89 | 2.27 | -0.27 | |

| Earnings Per Share Diluted | 0.07 | -1.00 | 0.14 | -1.70 | 8.85 | 0.11 | 1.51 | -0.27 | -0.01 | -0.26 | -0.03 | -0.31 | -0.28 | -0.71 | -0.12 | 4.55 | -0.26 | -1.70 | -0.28 | 0.54 | 0.35 | -0.07 | -0.48 | 2.04 | -0.38 | -0.11 | 0.44 | 0.37 | NA | 0.08 | -0.07 | -0.36 | NA | -0.16 | 0.21 | NA | NA | NA | -0.36 | -0.31 | -0.49 | -1.04 | -0.86 | -0.70 | -0.66 | -0.43 | -0.71 | -0.38 | 0.71 | -0.73 | -0.89 | 2.27 | -0.27 | |

| Income Loss From Continuing Operations Per Basic Share | NA | -0.00 | 0.00 | -0.00 | -0.00 | -0.00 | 0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | NA | NA | NA | NA | -0.00 | -0.00 | 0.00 | 0.00 | -0.00 | -0.00 | 0.00 | -0.00 | -0.00 | 0.00 | 0.00 | NA | 0.00 | -0.00 | -0.00 | NA | -0.00 | 0.00 | NA | NA | NA | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | 0.00 | NA | NA | -0.00 | NA | |

| Income Loss From Continuing Operations Per Diluted Share | NA | -0.00 | 0.00 | -0.00 | -0.00 | -0.00 | 0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | NA | NA | NA | NA | -0.00 | -0.00 | 0.00 | 0.00 | -0.00 | -0.00 | 0.00 | -0.00 | -0.00 | 0.00 | 0.00 | NA | 0.00 | -0.00 | -0.00 | NA | -0.00 | 0.00 | NA | NA | NA | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | -0.00 | 0.00 | NA | NA | -0.00 | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 78.33 | 30.28 | 47.76 | 48.06 | 31.95 | 50.76 | 195.49 | 105.59 | 113.26 | 92.35 | 115.05 | 96.42 | 173.46 | 128.89 | 145.34 | 98.47 | 106.80 | 140.16 | 122.14 | 171.57 | 364.25 | 103.14 | 119.87 | 347.87 | 113.56 | 106.81 | 128.67 | 126.90 | 114.64 | 172.03 | 120.49 | 109.19 | 112.86 | 109.95 | 113.49 | 129.84 | 108.75 | 101.07 | 95.80 | 100.33 | 94.53 | 93.71 | 86.25 | 96.72 | 94.70 | 96.48 | 97.36 | 129.52 | 110.51 | 136.03 | 133.30 | 135.40 | 166.57 | |

| Other Income | 0.37 | NA | NA | NA | 0.37 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 20.82 | 15.32 | 16.05 | 20.66 | 139.51 | 11.86 | 11.44 | 13.44 | 10.10 | 11.54 | 9.72 | 16.89 | 12.76 | 10.56 | 18.78 | 18.41 | 29.26 | 14.58 | 12.43 | 11.26 | 13.12 | 11.39 | -7.08 | 16.49 | 22.34 | 16.29 | 14.46 | 10.14 | 7.60 | 8.68 | 18.07 | 8.62 | 5.96 | NA | |

| Cost Of Goods And Services Sold | 1.21 | NA | NA | NA | 0.71 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Costs And Expenses | 75.88 | 92.77 | 74.78 | 83.39 | 57.93 | 42.95 | 179.32 | 131.25 | 119.32 | 172.33 | 113.46 | 113.40 | 198.78 | 166.04 | 152.72 | 129.14 | 128.00 | 284.07 | 134.70 | 226.27 | 349.10 | 158.86 | 146.02 | 272.31 | 142.44 | 135.58 | 139.72 | 149.78 | 142.96 | 182.25 | 154.44 | 155.25 | 146.83 | 153.49 | 155.07 | 151.34 | 141.92 | 156.66 | 142.57 | 149.65 | 164.55 | 206.59 | 183.37 | 196.55 | 184.86 | 184.74 | 181.53 | 174.87 | 146.39 | 195.02 | 227.57 | 266.11 | NA | |

| General And Administrative Expense | 15.07 | NA | 14.21 | NA | 1.38 | 62.75 | 17.12 | 30.39 | 21.44 | 27.74 | 19.87 | 19.00 | 34.27 | 26.10 | 24.11 | 27.30 | 21.10 | 18.48 | 21.61 | 23.23 | 28.81 | 25.54 | 20.95 | 27.22 | 25.17 | 21.59 | 19.67 | 19.66 | 23.10 | 18.76 | 21.18 | 20.59 | 20.75 | 19.02 | 23.38 | 26.62 | 19.79 | 25.11 | 24.29 | 20.88 | 21.85 | 19.18 | 19.04 | 19.79 | 22.84 | 27.96 | 26.98 | 25.70 | 24.40 | 32.96 | 24.24 | 25.11 | NA | |

| Operating Income Loss | 2.45 | NA | NA | NA | 22.63 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Expense | 40.87 | 22.00 | 22.66 | 24.15 | 29.24 | -3.05 | 39.47 | 39.42 | 39.56 | 41.83 | 42.41 | 41.95 | 43.39 | 47.07 | 46.52 | 43.75 | 46.58 | 48.18 | 47.22 | 43.17 | 45.18 | 46.00 | 48.73 | 48.81 | 51.19 | 53.23 | 55.10 | 56.05 | 57.02 | 57.30 | 56.88 | 55.82 | 54.63 | 55.07 | 55.42 | 56.53 | 57.46 | 61.71 | 63.79 | 69.16 | 71.57 | 83.50 | 91.78 | 94.47 | 86.14 | 86.61 | 91.78 | 96.77 | 69.34 | 68.05 | 77.29 | 82.31 | NA | |

| Gains Losses On Extinguishment Of Debt | NA | 0.00 | -13.21 | -116.56 | -1.43 | NA | NA | NA | NA | 0.00 | -7.92 | 0.00 | -4.12 | -27.26 | 0.00 | 0.00 | -0.47 | -6.92 | -0.91 | -2.16 | -0.37 | -10.58 | -0.62 | -3.31 | -0.21 | -0.00 | -0.04 | -1.46 | -0.12 | -0.00 | -0.07 | -0.04 | -0.17 | -0.42 | -0.19 | -23.59 | -1.18 | -4.91 | -3.50 | -15.24 | -9.54 | -30.96 | -3.69 | -4.87 | 1.70 | -0.88 | -3.21 | -1.05 | 106.60 | -9.38 | 9.53 | 70.05 | NA | |

| Allocated Share Based Compensation Expense | NA | 3.00 | -0.40 | -17.90 | -12.40 | 46.00 | 3.00 | 14.80 | 5.50 | 12.70 | 5.70 | 4.70 | 16.30 | 9.70 | 6.70 | 9.70 | 4.25 | 1.35 | 3.65 | 3.50 | 9.10 | 6.11 | 2.90 | 3.92 | 5.90 | 3.30 | 1.40 | 1.60 | 4.60 | 1.93 | 2.88 | 3.95 | 3.24 | 4.77 | 3.27 | 3.20 | 2.08 | 4.78 | 4.56 | 4.72 | 5.20 | 3.67 | 3.51 | 3.45 | 4.67 | 14.08 | 7.15 | 4.31 | 4.16 | NA | NA | NA | NA | |

| Income Tax Expense Benefit | NA | 0.00 | 0.56 | 0.00 | 0.00 | -0.11 | -0.01 | 0.67 | -0.67 | 0.07 | 0.08 | 0.03 | 0.06 | 0.12 | 0.08 | 0.21 | 0.03 | 0.43 | 0.14 | 0.13 | 0.12 | -1.92 | -1.28 | 1.64 | 0.61 | -0.31 | -8.26 | -1.19 | -0.41 | 3.84 | -2.89 | 0.81 | 5.88 | 4.53 | 0.10 | -0.21 | -0.51 | -1.28 | -3.88 | 0.43 | 4.08 | 1.91 | 1.79 | 3.48 | 1.27 | -14.45 | 1.35 | -2.67 | 11.05 | 4.47 | 0.72 | 0.79 | NA | |

| Profit Loss | 4.72 | -80.84 | 17.95 | -132.49 | 795.80 | 10.46 | 130.99 | -11.42 | 7.99 | -10.06 | 6.45 | -14.36 | -12.88 | -36.02 | 3.63 | 373.69 | -6.97 | -105.03 | -8.83 | 60.51 | 35.03 | 3.29 | -3.72 | 196.01 | -15.37 | -8.46 | 58.16 | 59.79 | -9.30 | 19.97 | 5.96 | -19.78 | -12.31 | -1.96 | 35.49 | -3.59 | -14.18 | -45.99 | -18.59 | -14.40 | -32.25 | -79.95 | -64.31 | -51.13 | -46.05 | -28.91 | -54.66 | -26.02 | 83.90 | -58.87 | -74.63 | 229.85 | -16.14 | |

| Other Comprehensive Income Loss Net Of Tax | -27.48 | 7.13 | 12.97 | 3.35 | 0.36 | 19.52 | 2.42 | 2.38 | 13.28 | 5.57 | 2.59 | -0.27 | -26.26 | 3.42 | -7.65 | -7.54 | -14.01 | -20.40 | 3.44 | -1.31 | 1.56 | 1.35 | -0.15 | 0.30 | 0.24 | 1.21 | -0.09 | 0.24 | -0.73 | 0.46 | -0.61 | 0.41 | -4.14 | 2.38 | 0.40 | 1.93 | -1.40 | -0.13 | -1.78 | -0.90 | -0.28 | 0.83 | -1.31 | 0.43 | -0.81 | -1.84 | -1.51 | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 4.68 | -80.83 | 18.00 | -132.61 | 616.73 | 12.95 | 127.73 | -13.67 | 5.47 | -13.21 | 3.81 | -17.46 | -15.58 | -38.14 | 0.78 | 370.84 | -9.44 | -107.33 | -10.86 | 51.00 | 34.93 | 3.21 | -3.56 | 190.30 | -14.27 | -6.42 | 59.12 | 50.96 | -8.36 | 20.52 | 6.66 | -19.15 | -10.47 | -0.88 | 35.90 | -3.92 | -14.63 | -47.04 | -18.76 | -14.09 | -32.06 | -79.81 | -63.64 | -50.41 | -46.07 | -25.84 | -53.66 | -26.03 | 83.47 | -67.05 | -75.49 | 229.31 | -25.41 | |

| Comprehensive Income Net Of Tax | -22.80 | -73.71 | 30.98 | -129.26 | 617.09 | 20.07 | 129.20 | -11.80 | 16.29 | -8.78 | 5.74 | -16.98 | -36.39 | -36.32 | -5.60 | 366.30 | -21.77 | -124.99 | -8.24 | 49.69 | 36.49 | 4.56 | -3.71 | 190.59 | -14.03 | -5.21 | 59.03 | 51.20 | -9.08 | 20.98 | 6.06 | -18.74 | -14.61 | 1.50 | 36.30 | -1.99 | -16.03 | -47.17 | -20.54 | -14.99 | -32.34 | -78.98 | -64.95 | -49.98 | -46.88 | -27.68 | -55.17 | -25.00 | 83.85 | NA | NA | NA | NA | |

| Preferred Stock Dividends Income Statement Impact | NA | 5.87 | 5.87 | 5.87 | 5.87 | 5.87 | 5.87 | 5.87 | 5.87 | 5.87 | 5.87 | 5.87 | 5.87 | 8.12 | 8.12 | 8.12 | 8.12 | 8.12 | 8.12 | 8.12 | 8.12 | 26.27 | 12.83 | 12.83 | 12.83 | 12.83 | 12.83 | 12.83 | 12.83 | 12.83 | 12.83 | 12.83 | 12.83 | 12.83 | 12.83 | 12.83 | 12.83 | 12.83 | 12.83 | 12.78 | 10.58 | 10.58 | 10.58 | 10.58 | 10.58 | 10.58 | 10.58 | 10.58 | 10.58 | 10.58 | 10.58 | 10.58 | NA | |

| Net Income Loss Available To Common Stockholders Basic | 4.68 | -86.71 | 12.13 | -138.49 | 610.86 | 7.08 | 121.86 | -19.54 | -0.41 | -19.08 | -2.07 | -23.34 | -21.45 | -46.26 | -7.34 | 362.71 | -17.57 | -115.45 | -18.98 | 42.87 | 26.81 | -4.91 | -34.53 | 177.47 | -27.10 | -19.24 | 46.29 | 38.11 | -21.19 | 7.14 | -6.07 | -30.95 | -22.55 | -13.27 | 22.33 | -16.21 | -26.57 | -57.93 | -30.57 | -26.00 | -41.26 | -87.42 | -71.78 | -59.00 | -54.79 | -35.20 | -62.23 | -35.52 | 67.42 | -67.05 | -83.53 | 212.28 | -25.41 | |

| Net Income Loss Available To Common Stockholders Diluted | 4.68 | -86.71 | 12.13 | -138.49 | 610.86 | 7.08 | 121.86 | -19.54 | -0.41 | -19.09 | -2.07 | -23.34 | -21.45 | -46.26 | -7.34 | 364.96 | -17.57 | -115.45 | -18.98 | 45.12 | 29.06 | -4.91 | -34.53 | 179.72 | -27.10 | -34.74 | 51.45 | 43.29 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 6290.56 | 3253.23 | 3522.13 | 3610.62 | 4084.05 | 4840.53 | 4802.16 | 4767.65 | 4793.59 | 4861.81 | 4888.12 | 4882.60 | 5222.58 | 5085.11 | 5579.96 | 4766.03 | 4671.41 | 5014.28 | 5079.99 | 5358.17 | 4450.06 | 4731.08 | 5795.22 | 4914.76 | 5294.52 | 4825.51 | 5238.01 | 5209.40 | 5492.18 | 5622.89 | 5642.80 | 5673.36 | 5652.58 | 5463.13 | 5480.62 | 5473.48 | 5487.72 | 5642.01 | 5773.34 | 5946.78 | 6077.12 | 6150.79 | 6940.42 | 7186.21 | 7589.90 | 7517.84 | 7753.85 | 8291.42 | NA | 9174.51 | NA | NA | NA | |

| Liabilities | 4092.42 | 1826.33 | 1824.50 | 1979.76 | 2299.10 | 3777.33 | 3735.94 | 3758.94 | 3742.58 | 3797.43 | 3794.68 | 3768.82 | 4062.51 | 3847.15 | 4279.34 | 3444.83 | 3661.94 | 3950.16 | 3875.97 | 4133.78 | 3434.16 | 3816.83 | 4867.82 | 3705.81 | 4256.52 | 3760.80 | 4159.93 | 4170.32 | 4467.80 | 4510.84 | 4483.01 | 4476.71 | 4419.78 | 4203.59 | 4206.99 | 4219.36 | 4214.24 | 4328.96 | 4375.91 | 4515.21 | 4611.86 | 4823.95 | 5525.52 | 5715.43 | 6082.95 | 5944.23 | 6149.15 | 6549.10 | NA | 7479.85 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 6290.56 | 3253.23 | 3522.13 | 3610.62 | 4084.05 | 4840.53 | 4802.16 | 4767.65 | 4793.59 | 4861.81 | 4888.12 | 4882.60 | 5222.58 | 5085.11 | 5579.96 | 4766.03 | 4671.41 | 5014.28 | 5079.99 | 5358.17 | 4450.06 | 4731.08 | 5795.22 | 4914.76 | 5294.52 | 4825.51 | 5238.01 | 5209.40 | 5492.18 | 5622.89 | 5642.80 | 5673.36 | 5652.58 | 5463.13 | 5480.62 | 5473.48 | 5487.72 | 5642.01 | 5773.34 | 5946.78 | 6077.12 | 6150.79 | 6940.42 | 7186.21 | 7589.90 | 7517.84 | 7753.85 | 8291.42 | NA | 9174.51 | NA | NA | NA | |

| Stockholders Equity | 2151.63 | 1408.52 | 1680.32 | 1614.58 | 1454.44 | 851.30 | 867.58 | 811.55 | 853.33 | 870.97 | 900.76 | 921.93 | 968.12 | 1040.42 | 1104.12 | 1123.63 | 810.37 | 862.98 | 1001.62 | 1023.31 | 981.25 | 879.70 | 888.09 | 1169.28 | 991.12 | 1016.56 | 1025.14 | 985.56 | 980.11 | 1059.11 | 1102.40 | 1137.94 | 1169.11 | 1197.09 | 1210.57 | 1186.90 | 1205.57 | 1243.26 | 1322.96 | 1354.90 | 1383.10 | 1238.94 | 1325.65 | 1399.44 | 1462.10 | 1528.36 | 1557.95 | 1693.96 | NA | 1648.13 | NA | NA | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 20.34 | 1442.27 | 1335.72 | 1400.66 | 1500.20 | 339.60 | 298.89 | 154.94 | 193.85 | 98.63 | 88.19 | 80.67 | 371.29 | 307.17 | 917.31 | 330.10 | 315.41 | 931.75 | 757.38 | 1039.59 | 366.72 | 657.69 | 1912.45 | 954.28 | 897.49 | 328.74 | 547.51 | 521.36 | 591.18 | 711.10 | 656.74 | 637.14 | 625.35 | 472.06 | 652.79 | 356.51 | 409.60 | 513.57 | 735.45 | 715.91 | 468.39 | 256.34 | 284.66 | 243.84 | 126.86 | 356.83 | 217.01 | 388.95 | 318.43 | 504.87 | 1119.64 | 531.52 | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 48.29 | 1448.69 | 1341.10 | 1405.84 | 1551.25 | 394.00 | 354.80 | 208.37 | 247.88 | 150.57 | 135.97 | 126.96 | 417.90 | 352.21 | 978.82 | 394.25 | 363.81 | 974.54 | 792.36 | 1066.99 | 387.14 | 677.73 | 1934.14 | 977.66 | 923.78 | 354.63 | NA | NA | NA | 737.76 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Net | 1.31 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Goodwill | 155.80 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 216.12 | 0.32 | 0.33 | 0.35 | 1.16 | 1.21 | 146.59 | 149.62 | 152.55 | 156.04 | 158.98 | 161.91 | 164.85 | 174.97 | 176.56 | 154.57 | 170.70 | 156.28 | 158.18 | 162.01 | 27.41 | 27.12 | 23.80 | 20.45 | 61.72 | 63.10 | 63.59 | 64.34 | 69.65 | 71.45 | 73.59 | 78.31 | 80.43 | 50.09 | 54.34 | 57.06 | 60.01 | 100.65 | 58.70 | 53.90 | 56.90 | 59.90 | NA | NA | NA | 53.60 | NA | NA | NA | 42.80 | NA | NA | NA | |

| Held To Maturity Securities Fair Value | NA | NA | 32.94 | 35.00 | 98.42 | 96.84 | 95.26 | 93.68 | 92.20 | 90.72 | 89.23 | 87.75 | 86.37 | 84.98 | 83.59 | 82.20 | 80.91 | 100.47 | 100.13 | 96.90 | 19.28 | 68.31 | NA | NA | NA | 61.00 | NA | NA | NA | 61.20 | NA | NA | NA | 190.20 | NA | NA | NA | 140.89 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | NA | NA | NA | 23.64 | 23.64 | 23.86 | 23.86 | 23.86 | 20.48 | 20.68 | 20.68 | 20.68 | 20.68 | 21.14 | 21.14 | 21.14 | 21.14 | 21.18 | 21.18 | 21.18 | 21.20 | 21.23 | NA | NA | NA | 21.24 | NA | NA | NA | 1.01 | NA | NA | NA | 1.02 | NA | NA | NA | 1.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After One Through Five Years Fair Value | NA | NA | NA | NA | 98.42 | 96.84 | 95.26 | 93.68 | 92.20 | 90.72 | 89.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Within One Year Fair Value | NA | NA | 32.94 | 35.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 3901.84 | 1682.52 | 1680.71 | 1833.25 | 2084.25 | 2572.17 | 3282.60 | 3289.48 | 3291.34 | 3286.97 | 3307.68 | 3283.06 | 3583.36 | 3387.08 | 3827.36 | 3068.56 | 3070.30 | 3609.09 | 3612.81 | 3869.58 | 3130.93 | 3476.40 | 4278.95 | 3368.11 | 3882.39 | 3389.91 | 3749.87 | 3770.64 | 4110.73 | 4143.68 | 4144.82 | 4151.65 | 4261.53 | 4022.68 | 4047.02 | 4082.51 | 4102.05 | 4158.12 | 4253.16 | 4402.45 | 4494.64 | 4691.49 | 5388.86 | 5603.94 | 5968.44 | 5837.54 | 5995.05 | 6393.22 | NA | 7345.43 | NA | NA | NA | |

| Minority Interest | 27.50 | 18.38 | 17.31 | 16.29 | 330.51 | 211.91 | 198.64 | 197.15 | 197.68 | 193.41 | 192.69 | 191.85 | 191.95 | 197.54 | 196.51 | 197.56 | 199.10 | 201.14 | 190.59 | 189.26 | 34.65 | 34.55 | 35.80 | 36.08 | 43.36 | 43.12 | 46.35 | 45.89 | 35.28 | 42.22 | 45.81 | 46.02 | 50.48 | 51.26 | 51.70 | 55.79 | 56.55 | 58.20 | 62.08 | 64.42 | 69.00 | 74.21 | 75.04 | 71.34 | 44.85 | 45.25 | 46.76 | 48.36 | NA | 46.52 | NA | NA | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 2151.63 | 1408.52 | 1680.32 | 1614.58 | 1454.44 | 851.30 | 867.58 | 811.55 | 853.33 | 870.97 | 900.76 | 921.93 | 968.12 | 1040.42 | 1104.12 | 1123.63 | 810.37 | 862.98 | 1001.62 | 1023.31 | 981.25 | 879.70 | 888.09 | 1169.28 | 991.12 | 1016.56 | 1025.14 | 985.56 | 980.11 | 1059.11 | 1102.40 | 1137.94 | 1169.11 | 1197.09 | 1210.57 | 1186.90 | 1205.57 | 1243.26 | 1322.96 | 1354.90 | 1383.10 | 1238.94 | 1325.65 | 1399.44 | 1462.10 | 1528.36 | 1557.95 | 1693.96 | NA | 1648.13 | NA | NA | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 2179.13 | 1426.90 | 1697.63 | 1630.86 | 1784.95 | 1063.21 | 1066.22 | 1008.71 | 1051.01 | 1064.38 | 1093.45 | 1113.79 | 1160.07 | 1237.96 | 1300.62 | 1321.20 | 1009.47 | 1064.12 | 1192.20 | 1212.57 | 1015.90 | 914.25 | 923.89 | 1205.36 | 1034.48 | 1059.68 | 1071.49 | 1031.45 | 1015.39 | 1101.33 | 1148.21 | 1183.96 | 1219.60 | 1248.35 | 1262.28 | 1242.69 | 1262.12 | 1301.46 | 1385.04 | 1419.32 | 1452.09 | 1313.15 | 1400.69 | 1470.78 | 1506.95 | 1573.60 | 1604.71 | 1742.32 | NA | 1694.66 | NA | NA | NA | |

| Common Stock Value | 0.64 | 0.09 | 0.09 | 0.08 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.08 | 0.08 | 0.08 | 0.06 | 0.06 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.08 | 0.15 | 0.15 | 0.15 | 0.15 | 0.15 | 0.15 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | NA | 0.14 | NA | NA | NA | |

| Additional Paid In Capital | 2031.03 | 3459.46 | 3457.96 | 3406.42 | 3100.66 | 3100.01 | 3127.40 | 3185.75 | 3204.86 | 3240.53 | 3247.45 | 3260.17 | 3275.05 | 3284.88 | 3297.80 | 3297.30 | 3335.72 | 3352.22 | 3351.58 | 3350.75 | 3350.25 | 3352.66 | 3357.49 | 3603.98 | 3603.59 | 3602.17 | 3592.71 | 3599.34 | 3632.25 | 3689.33 | 4023.96 | 4007.94 | 4007.54 | 4007.51 | 4009.66 | 4009.46 | 4013.30 | 4022.14 | 4020.86 | 4019.42 | 4019.85 | 3832.78 | 3829.93 | 3828.19 | 3825.66 | 3834.46 | 3825.79 | 3818.69 | NA | 3809.07 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 144.16 | -2053.27 | -1772.84 | -1774.07 | -1625.09 | -2227.21 | -2225.55 | -2338.45 | -2309.76 | -2316.97 | -2289.67 | -2279.28 | -2247.50 | -2205.84 | -2153.24 | -2139.61 | -2495.84 | -2472.06 | -2350.44 | -2325.29 | -2368.16 | -2470.56 | -2465.65 | -2431.12 | -2608.59 | -2581.49 | -2562.24 | -2608.53 | -2646.66 | -2625.47 | -2633.16 | -2611.75 | -2579.77 | -2556.47 | -2542.76 | -2565.83 | -2549.08 | -2521.62 | -2461.75 | -2430.16 | -2403.29 | -2360.65 | -2270.26 | -2196.04 | -2135.05 | -2078.40 | -2041.97 | -1977.73 | NA | -2014.01 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -24.20 | 2.23 | -4.90 | -17.87 | -21.22 | -21.59 | -34.35 | -35.82 | -41.86 | -52.68 | -57.11 | -59.05 | -59.52 | -38.71 | -40.52 | -34.14 | -29.59 | -17.27 | 0.39 | -2.23 | -0.93 | -2.48 | -3.83 | -3.68 | -3.97 | -4.22 | -5.43 | -5.34 | -5.58 | -4.85 | -5.31 | -4.71 | -5.12 | -0.97 | -3.35 | -3.75 | -5.67 | -4.28 | -4.14 | -2.37 | -1.46 | -1.19 | -2.01 | -0.71 | -1.14 | -0.33 | 1.51 | 3.02 | NA | 1.61 | NA | NA | NA | |

| Minority Interest | 27.50 | 18.38 | 17.31 | 16.29 | 330.51 | 211.91 | 198.64 | 197.15 | 197.68 | 193.41 | 192.69 | 191.85 | 191.95 | 197.54 | 196.51 | 197.56 | 199.10 | 201.14 | 190.59 | 189.26 | 34.65 | 34.55 | 35.80 | 36.08 | 43.36 | 43.12 | 46.35 | 45.89 | 35.28 | 42.22 | 45.81 | 46.02 | 50.48 | 51.26 | 51.70 | 55.79 | 56.55 | 58.20 | 62.08 | 64.42 | 69.00 | 74.21 | 75.04 | 71.34 | 44.85 | 45.25 | 46.76 | 48.36 | NA | 46.52 | NA | NA | NA | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 0.52 | 0.00 | 0.00 | 315.42 | 69.71 | 3.11 | 3.92 | 4.59 | 2.15 | 4.19 | 3.80 | 3.45 | 3.72 | 4.07 | 3.31 | 4.36 | 3.25 | 2.93 | 2.83 | 43.17 | NA | 1.32 | 0.13 | NA | NA | NA | NA | NA | 7.29 | 3.85 | 0.49 | 4.63 | 0.00 | 0.03 | 0.31 | 1.88 | 2.60 | 6.26 | 3.45 | 3.78 | 16.62 | 2.33 | 0.07 | 0.09 | 0.52 | 0.47 | 0.62 | NA | NA | NA | NA | NA | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

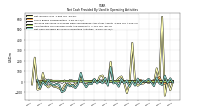

| Net Cash Provided By Used In Operating Activities | -6.81 | 32.29 | -12.01 | 58.01 | -30.62 | -15.59 | 40.22 | -41.17 | -3.79 | 28.06 | 3.61 | 11.21 | -21.00 | 30.17 | -36.29 | 7.03 | -46.53 | 12.49 | -15.48 | 25.43 | -46.57 | -6.59 | -16.11 | 140.41 | -37.49 | 35.77 | -14.71 | 15.75 | -16.80 | 27.02 | -23.19 | -11.42 | -52.35 | -11.91 | 85.05 | -22.80 | -60.68 | -30.17 | -43.76 | -22.84 | -83.69 | -99.40 | -27.38 | -21.43 | -35.77 | -19.35 | 19.52 | -31.33 | -0.62 | -56.25 | 18.50 | NA | NA | |

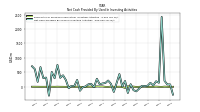

| Net Cash Provided By Used In Investing Activities | -269.93 | 81.18 | 81.51 | 207.25 | 2417.87 | 140.29 | 189.74 | 46.34 | 137.63 | 36.85 | 22.77 | 34.32 | -62.76 | -156.84 | -117.27 | 89.24 | -213.23 | 199.64 | 12.74 | 440.35 | 126.13 | -176.93 | 100.12 | 216.11 | 130.19 | 115.19 | 86.83 | 277.63 | -13.11 | 99.32 | 87.06 | 13.70 | -16.05 | -135.99 | 237.09 | 27.37 | 31.32 | -48.87 | 233.60 | 397.23 | 311.48 | 757.65 | 295.29 | 514.07 | -307.93 | 317.61 | 302.18 | 681.39 | 170.25 | 607.89 | 709.30 | NA | NA | |

| Net Cash Provided By Used In Financing Activities | 276.64 | -5.90 | -134.19 | -410.62 | -1229.99 | -85.52 | -83.52 | -44.69 | -36.41 | -50.60 | -17.39 | -336.47 | 149.48 | -499.97 | 738.14 | -65.83 | -350.97 | -29.94 | -271.89 | 214.06 | -370.17 | -1071.18 | 874.15 | -299.73 | 476.04 | -369.72 | -45.96 | -363.20 | -90.03 | -72.05 | -44.24 | 9.07 | 221.70 | -32.82 | -25.87 | -57.66 | -74.61 | -142.85 | -170.30 | -126.87 | -15.74 | -686.57 | -227.09 | -375.66 | 113.73 | -158.45 | -493.62 | -579.55 | -356.06 | -1166.42 | -139.68 | NA | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -6.81 | 32.29 | -12.01 | 58.01 | -30.62 | -15.59 | 40.22 | -41.17 | -3.79 | 28.06 | 3.61 | 11.21 | -21.00 | 30.17 | -36.29 | 7.03 | -46.53 | 12.49 | -15.48 | 25.43 | -46.57 | -6.59 | -16.11 | 140.41 | -37.49 | 35.77 | -14.71 | 15.75 | -16.80 | 27.02 | -23.19 | -11.42 | -52.35 | -11.91 | 85.05 | -22.80 | -60.68 | -30.17 | -43.76 | -22.84 | -83.69 | -99.40 | -27.38 | -21.43 | -35.77 | -19.35 | 19.52 | -31.33 | -0.62 | -56.25 | 18.50 | NA | NA | |

| Net Income Loss | 4.68 | -80.83 | 18.00 | -132.61 | 616.73 | 12.95 | 127.73 | -13.67 | 5.47 | -13.21 | 3.81 | -17.46 | -15.58 | -38.14 | 0.78 | 370.84 | -9.44 | -107.33 | -10.86 | 51.00 | 34.93 | 3.21 | -3.56 | 190.30 | -14.27 | -6.42 | 59.12 | 50.96 | -8.36 | 20.52 | 6.66 | -19.15 | -10.47 | -0.88 | 35.90 | -3.92 | -14.63 | -47.04 | -18.76 | -14.09 | -32.06 | -79.81 | -63.64 | -50.41 | -46.07 | -25.84 | -53.66 | -26.03 | 83.47 | -67.05 | -75.49 | 229.31 | -25.41 | |

| Profit Loss | 4.72 | -80.84 | 17.95 | -132.49 | 795.80 | 10.46 | 130.99 | -11.42 | 7.99 | -10.06 | 6.45 | -14.36 | -12.88 | -36.02 | 3.63 | 373.69 | -6.97 | -105.03 | -8.83 | 60.51 | 35.03 | 3.29 | -3.72 | 196.01 | -15.37 | -8.46 | 58.16 | 59.79 | -9.30 | 19.97 | 5.96 | -19.78 | -12.31 | -1.96 | 35.49 | -3.59 | -14.18 | -45.99 | -18.59 | -14.40 | -32.25 | -79.95 | -64.31 | -51.13 | -46.05 | -28.91 | -54.66 | -26.02 | 83.90 | -58.87 | -74.63 | 229.85 | -16.14 | |

| Depreciation Depletion And Amortization | NA | 1.49 | 1.29 | 1.34 | 1.36 | 14.32 | 14.86 | 14.66 | 15.46 | 14.69 | 14.62 | 14.30 | 14.49 | 14.67 | 14.20 | 13.72 | 15.67 | 16.84 | 19.98 | 10.77 | 11.11 | 11.74 | 11.85 | 13.29 | 13.07 | 12.14 | 13.00 | 14.47 | 14.71 | 15.44 | 15.79 | 15.52 | 18.50 | 18.41 | 17.72 | 18.82 | 18.61 | 17.66 | 19.12 | 17.40 | 17.35 | 19.58 | 16.79 | 17.18 | 17.24 | 16.79 | 15.08 | 16.13 | 15.93 | 15.73 | 15.91 | NA | NA | |

| Share Based Compensation | 4.68 | 3.06 | -0.37 | -17.92 | -12.43 | 45.96 | 3.00 | 14.79 | 5.51 | 12.68 | 5.66 | 4.74 | 16.27 | 9.74 | 6.74 | 9.71 | 4.25 | 1.32 | 3.65 | 3.50 | 9.09 | 6.08 | 2.93 | 3.92 | 5.88 | 3.25 | 1.43 | 1.63 | 4.58 | 1.95 | 2.88 | 3.95 | 3.24 | 4.77 | 3.27 | 3.20 | 2.08 | 4.78 | 4.56 | 4.72 | 5.20 | 3.67 | 3.51 | 3.45 | 4.67 | 14.08 | 7.15 | 4.31 | 4.16 | 5.76 | 3.88 | NA | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -269.93 | 81.18 | 81.51 | 207.25 | 2417.87 | 140.29 | 189.74 | 46.34 | 137.63 | 36.85 | 22.77 | 34.32 | -62.76 | -156.84 | -117.27 | 89.24 | -213.23 | 199.64 | 12.74 | 440.35 | 126.13 | -176.93 | 100.12 | 216.11 | 130.19 | 115.19 | 86.83 | 277.63 | -13.11 | 99.32 | 87.06 | 13.70 | -16.05 | -135.99 | 237.09 | 27.37 | 31.32 | -48.87 | 233.60 | 397.23 | 311.48 | 757.65 | 295.29 | 514.07 | -307.93 | 317.61 | 302.18 | 681.39 | 170.25 | 607.89 | 709.30 | NA | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

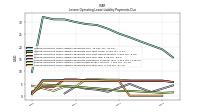

| Net Cash Provided By Used In Financing Activities | 276.64 | -5.90 | -134.19 | -410.62 | -1229.99 | -85.52 | -83.52 | -44.69 | -36.41 | -50.60 | -17.39 | -336.47 | 149.48 | -499.97 | 738.14 | -65.83 | -350.97 | -29.94 | -271.89 | 214.06 | -370.17 | -1071.18 | 874.15 | -299.73 | 476.04 | -369.72 | -45.96 | -363.20 | -90.03 | -72.05 | -44.24 | 9.07 | 221.70 | -32.82 | -25.87 | -57.66 | -74.61 | -142.85 | -170.30 | -126.87 | -15.74 | -686.57 | -227.09 | -375.66 | 113.73 | -158.45 | -493.62 | -579.55 | -356.06 | -1166.42 | -139.68 | NA | NA | |

| Payments Of Dividends | 22.14 | NA | NA | NA | 9.67 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments Of Dividends Common Stock | NA | 0.00 | 10.84 | 10.43 | 8.96 | 8.63 | 8.85 | 9.09 | 8.22 | 8.27 | 8.25 | 8.35 | 7.80 | 6.29 | 6.20 | 6.46 | 6.10 | 6.12 | 6.10 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Dividends | 11.10 | NA | NA | NA | 10.53 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

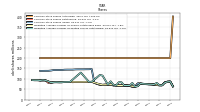

| Revenues | 78.33 | 30.28 | 47.76 | 48.06 | 31.95 | 50.76 | 195.49 | 105.59 | 113.26 | 92.35 | 115.05 | 96.42 | 173.46 | 128.89 | 145.34 | 98.47 | 106.80 | 140.16 | 122.14 | 171.57 | 364.25 | 103.14 | 119.87 | 347.87 | 113.56 | 106.81 | 128.67 | 126.90 | 114.64 | 172.03 | 120.49 | 109.19 | 112.86 | 109.95 | 113.49 | 129.84 | 108.75 | 101.07 | 95.80 | 100.33 | 94.53 | 93.71 | 86.25 | 96.72 | 94.70 | 96.48 | 97.36 | 129.52 | 110.51 | 136.03 | 133.30 | 135.40 | 166.57 | |

| Corporate Non, Other Income Revenue | NA | 6.89 | 3.71 | 1.73 | 0.19 | -0.17 | 14.28 | 0.05 | 5.71 | 0.34 | 14.11 | 0.24 | 11.99 | 1.72 | 2.07 | 1.30 | 3.38 | 4.28 | 3.94 | 2.33 | 1.27 | 1.93 | 3.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Interest Income Revenue, Net Leasing | NA | 0.00 | 0.00 | 0.00 | 0.07 | -1.99 | 1.63 | 1.19 | 0.88 | 0.85 | 0.91 | 0.86 | 0.82 | 0.82 | 0.79 | 0.41 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Interest Income Revenue, Real Estate Lending | NA | 1.15 | 2.09 | 4.22 | 4.87 | 5.64 | 6.32 | 7.79 | 9.77 | 12.35 | 13.36 | 14.58 | 16.39 | 16.42 | 18.91 | 19.93 | 20.38 | 23.05 | 22.91 | 25.21 | 26.70 | 23.40 | 25.44 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Interest Income Sales Type Lease Revenue, Net Leasing | NA | 0.00 | 0.13 | 0.38 | 0.36 | -25.68 | 9.58 | 0.16 | 8.63 | NA | 8.36 | 8.29 | 8.36 | NA | 8.34 | 3.82 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Land Development, Land And Development | NA | 7.36 | 15.09 | 24.40 | 14.90 | 31.17 | 93.37 | 32.32 | 32.25 | 48.45 | 20.50 | 15.58 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Operating Lease Income, Land And Development | NA | 0.09 | 0.08 | 0.10 | 0.14 | 0.10 | 0.10 | 0.09 | 0.09 | 0.09 | 0.09 | 0.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Operating Lease Income, Operating Property | NA | 3.06 | 3.34 | 3.08 | 2.97 | 3.27 | 3.64 | 4.70 | 4.84 | 5.06 | 5.14 | 5.24 | 5.77 | 6.58 | 6.03 | 6.46 | 9.36 | 10.86 | 13.80 | 15.20 | 15.82 | 15.18 | 16.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Other Income Revenue, Land And Development | NA | 1.23 | 2.46 | 1.32 | 1.32 | 1.00 | 3.19 | 1.31 | 1.39 | 13.47 | 3.83 | 1.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Other Income Revenue, Net Leasing | NA | 5.38 | 5.50 | 5.22 | 4.46 | 0.68 | 4.77 | 4.69 | 4.75 | 4.65 | 4.55 | 4.62 | 4.29 | 4.01 | 6.35 | 2.94 | 3.42 | 1.53 | 1.01 | 0.70 | 1.05 | 0.59 | 0.95 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Other Income Revenue, Operating Property | NA | 4.74 | 12.20 | 7.59 | 2.66 | 4.18 | 16.87 | 3.95 | 2.34 | 1.46 | 2.96 | 0.49 | 3.16 | 3.42 | 7.61 | 3.97 | 2.38 | 7.61 | 21.25 | 13.35 | 12.14 | 11.92 | 14.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Other Income Revenue, Real Estate Lending | NA | 0.39 | 3.15 | 0.03 | 0.01 | 0.01 | 1.09 | 0.05 | 0.10 | 7.73 | 0.10 | 3.84 | 0.31 | 2.11 | 0.12 | 0.53 | 2.19 | 0.28 | 0.75 | 3.13 | 0.38 | 0.78 | 1.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Safehold Inc. | NA | NA | 71.70 | 64.88 | 60.36 | NA | 47.28 | 44.21 | 43.51 | NA | 38.00 | 37.35 | 40.16 | NA | 22.31 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Income Revenue | NA | 1.15 | 2.09 | 4.22 | 4.95 | 3.65 | 7.95 | 8.97 | 10.65 | 13.19 | 14.27 | 15.44 | 17.22 | 17.24 | 19.70 | 20.34 | 20.38 | 23.05 | 22.91 | 25.21 | 26.70 | 23.40 | 25.44 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Income Sales Type Lease Revenue | NA | 0.01 | 0.13 | 0.38 | 0.36 | -25.68 | 9.58 | 8.69 | 8.63 | NA | 8.36 | 8.29 | 8.36 | NA | 8.34 | 3.82 | 0.00 | NA | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Land Development | NA | 7.36 | 15.09 | 24.40 | 14.90 | 31.17 | 93.37 | 32.32 | 32.25 | 48.45 | 20.50 | 15.58 | 80.18 | 42.90 | 54.92 | 9.07 | 12.70 | 40.05 | 12.31 | 80.93 | 276.43 | 18.16 | 25.96 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating Lease Income | NA | 3.14 | 3.42 | 3.18 | 3.11 | -120.56 | 44.39 | 45.54 | 47.44 | 48.19 | 46.37 | 46.81 | 47.35 | 48.18 | 44.11 | 55.19 | 58.91 | 58.68 | 59.11 | 44.61 | 45.80 | 45.53 | 47.81 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Income Revenue | NA | 18.61 | 27.02 | 15.88 | 8.64 | 5.71 | 40.20 | 10.06 | 14.29 | 27.64 | 25.55 | 10.29 | 20.37 | 12.23 | 18.27 | 10.05 | 14.81 | 18.39 | 27.81 | 20.82 | 15.32 | 16.05 | 20.66 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |