| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 90.33 | 90.33 | 90.33 | 90.33 | 90.33 | 90.33 | 90.33 | 90.33 | 90.33 | 90.33 | |

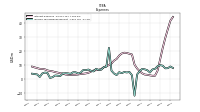

| Earnings Per Share Basic | 0.97 | 0.88 | 0.89 | 1.02 | 1.04 | 0.95 | 0.74 | 0.74 | 0.56 | 0.71 | 0.73 | 0.81 | 0.62 | 0.43 | -0.85 | 0.34 | 0.62 | 0.79 | 0.76 | 0.67 | 0.77 | 0.89 | 0.62 | 0.75 | 0.27 | 0.65 | 0.66 | |

| Earnings Per Share Diluted | 0.96 | 0.87 | 0.89 | 1.02 | 1.03 | 0.95 | 0.74 | 0.74 | 0.57 | 0.70 | 0.72 | 0.81 | 0.62 | 0.43 | -0.85 | 0.34 | 0.62 | 0.79 | 0.76 | 0.66 | 0.77 | 0.88 | 0.61 | 0.75 | 0.27 | 0.65 | 0.65 |

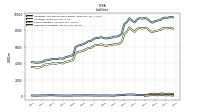

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Interest And Fee Income Loans And Leases | 117.44 | 114.26 | 108.70 | 102.72 | 96.22 | 83.03 | 71.02 | 64.59 | 66.37 | 66.91 | 66.94 | 70.23 | 71.15 | 72.26 | 75.50 | 82.05 | 77.42 | 75.08 | 74.73 | 73.39 | 71.52 | 68.63 | 66.61 | 63.05 | 63.41 | 62.45 | 60.56 | |

| Interest Expense | 41.60 | 35.57 | 29.21 | 22.11 | 14.15 | 6.04 | 2.40 | 2.38 | 2.70 | 3.06 | 3.27 | 4.12 | 5.62 | 7.57 | 10.33 | 17.55 | 18.05 | 18.62 | 18.80 | 18.23 | 16.75 | 14.37 | 13.18 | 11.10 | 10.03 | 9.27 | 8.34 | |

| Interest Expense Debt | 8.68 | 10.66 | 9.11 | 7.21 | 3.08 | 0.84 | 0.61 | 0.52 | 0.51 | 0.62 | 0.62 | 0.64 | 0.82 | 0.95 | 1.10 | 2.21 | 2.26 | 2.41 | 2.74 | 3.25 | 3.77 | 3.49 | 4.01 | 3.25 | 2.80 | 2.52 | 2.37 | |

| Interest Income Expense Net | 85.11 | 87.39 | 88.12 | 88.79 | 89.06 | 83.80 | 75.19 | 67.73 | 68.44 | 68.71 | 68.30 | 70.66 | 69.93 | 69.28 | 70.15 | 70.04 | 64.41 | 61.20 | 60.83 | 60.36 | 59.84 | 59.26 | 58.40 | 56.93 | 57.83 | 57.46 | 56.57 | |

| Interest Paid Net | 36.36 | 33.58 | 23.26 | 18.09 | 22057.85 | 5.12 | 2.52 | 2.51 | 3.04 | 3.09 | 3.75 | 5.37 | 6.92 | 7.72 | 11.93 | 17.80 | 18.23 | 18.43 | 19.59 | 19.02 | 15.20 | 14.26 | 11.76 | 11.82 | 8.91 | NA | NA | |

| Income Tax Expense Benefit | 8.98 | 7.80 | 7.68 | 9.56 | 9.98 | 9.18 | 7.34 | 6.91 | 4.75 | 6.33 | 6.97 | 7.28 | 5.70 | 3.32 | -11.79 | 2.77 | 5.09 | 4.74 | 5.07 | 4.22 | 4.95 | 2.88 | 4.01 | 6.01 | 22.25 | 8.88 | 8.60 | |

| Income Taxes Paid Net | 9.16 | 4.10 | 23.63 | -0.01 | 11.45 | 7.50 | 12.15 | 0.07 | 5.03 | 7.09 | 11.90 | 0.20 | 0.02 | 6.00 | 0.00 | 0.21 | 3.48 | 6.62 | 3.12 | 1.43 | 0.00 | 4.62 | 10.99 | 0.11 | 12.72 | 7.70 | 13.23 | |

| Net Income Loss | 37.05 | 33.47 | 34.47 | 39.80 | 40.27 | 37.25 | 28.86 | 29.14 | 22.48 | 27.60 | 28.37 | 31.90 | 24.18 | 16.70 | -33.07 | 13.23 | 22.27 | 26.94 | 26.10 | 22.93 | 26.85 | 30.88 | 21.44 | 26.16 | 9.29 | 22.72 | 22.77 | |

| Comprehensive Income Net Of Tax | 71.78 | 21.88 | 17.08 | 55.27 | 43.11 | -10.55 | 8.73 | -10.81 | 16.42 | 22.96 | 30.91 | 23.99 | 23.71 | 16.93 | -29.51 | 30.57 | 17.91 | 29.14 | 33.51 | 29.10 | 37.00 | 28.57 | 20.44 | 14.64 | 3.47 | 22.98 | 22.50 | |

| Net Income Loss Available To Common Stockholders Basic | 37.03 | 33.44 | 34.43 | 39.75 | 40.11 | 37.15 | 28.78 | 29.03 | 22.39 | 27.47 | 28.23 | 31.76 | 24.11 | 16.65 | -33.07 | 13.20 | 22.27 | 26.86 | 26.03 | 22.87 | 26.85 | 30.79 | 21.37 | 26.08 | 9.29 | 22.65 | 22.68 | |

| Net Income Loss Available To Common Stockholders Diluted | 37.03 | 33.44 | 34.43 | 39.75 | 40.11 | 37.15 | 28.78 | 29.03 | 21.98 | 27.60 | 28.37 | 31.90 | NA | 16.70 | -33.07 | 13.23 | NA | 26.94 | 26.10 | 22.93 | NA | 30.88 | 21.44 | 26.16 | NA | 22.72 | 22.77 | |

| Interest Income Expense After Provision For Loan Loss | 84.17 | 81.89 | 77.59 | 87.87 | 85.88 | 81.30 | 71.99 | 68.25 | 61.31 | 65.32 | 65.74 | 67.52 | 62.80 | 51.79 | -16.61 | 49.99 | 62.31 | 56.28 | 58.62 | 54.71 | 57.13 | 58.80 | 49.06 | 54.46 | 56.85 | 54.61 | 51.70 | |

| Noninterest Expense | 56.20 | 52.80 | 49.63 | 51.70 | 51.27 | 49.63 | 48.42 | 47.41 | 50.19 | 47.24 | 45.83 | 45.58 | 48.53 | 48.25 | 43.48 | 46.39 | 50.18 | 37.67 | 40.35 | 38.92 | 36.41 | 37.09 | 35.86 | 36.08 | 37.95 | 36.55 | 36.60 | |

| Noninterest Income | 18.06 | 12.18 | 14.19 | 13.19 | 15.64 | 14.76 | 12.63 | 15.23 | 16.10 | 15.85 | 15.42 | 17.24 | 15.61 | 16.48 | 15.22 | 12.40 | 15.26 | 13.06 | 12.90 | 11.36 | 11.10 | 12.04 | 12.25 | 13.79 | 13.64 | 13.55 | 16.27 |

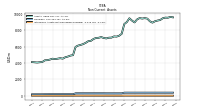

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

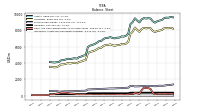

| Assets | 9551.53 | 9466.08 | 9252.92 | 9193.44 | 9110.57 | 8935.97 | 9103.81 | 9432.28 | 9488.53 | 9436.05 | 9495.83 | 9328.98 | 8967.90 | 9190.57 | 9474.30 | 9005.50 | 8764.65 | 7571.99 | 7334.60 | 7229.26 | 7252.22 | 7105.36 | 7097.35 | 7005.33 | 7060.26 | 7170.18 | 7086.17 | |

| Liabilities | 8268.08 | 8242.55 | 8040.07 | 7965.65 | 7925.91 | 7782.79 | 7925.46 | 8247.33 | 8282.08 | 8234.37 | 8307.10 | 8160.70 | 7813.19 | 8048.46 | 8338.52 | 7829.24 | 7572.65 | 6589.54 | 6369.65 | 6286.11 | 6316.46 | 6185.58 | 6190.21 | 6109.92 | 6176.22 | 6282.60 | 6215.10 | |

| Liabilities And Stockholders Equity | 9551.53 | 9466.08 | 9252.92 | 9193.44 | 9110.57 | 8935.97 | 9103.81 | 9432.28 | 9488.53 | 9436.05 | 9495.83 | 9328.98 | 8967.90 | 9190.57 | 9474.30 | 9005.50 | 8764.65 | 7571.99 | 7334.60 | 7229.26 | 7252.22 | 7105.36 | 7097.35 | 7005.33 | 7060.26 | 7170.18 | 7086.17 | |

| Stockholders Equity | 1283.44 | 1223.53 | 1212.85 | 1227.80 | 1184.66 | 1153.18 | 1178.36 | 1184.95 | 1206.45 | 1201.68 | 1188.73 | 1168.28 | 1154.71 | 1142.12 | 1135.78 | 1176.25 | 1192.00 | 982.45 | 964.95 | 943.16 | 935.76 | 919.78 | 907.13 | 895.41 | 884.03 | 887.58 | 871.06 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

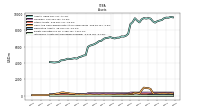

| Cash And Cash Equivalents At Carrying Value | 233.61 | 238.45 | 227.87 | 244.15 | 210.01 | 134.90 | 344.69 | 823.76 | 922.22 | 934.38 | 985.28 | 671.43 | 229.67 | 308.49 | 351.37 | 187.68 | 197.82 | 173.61 | 122.88 | 116.82 | 155.49 | 132.65 | 137.93 | 112.85 | 117.15 | 114.44 | 125.86 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 233.61 | 238.45 | 227.87 | 244.15 | 210.01 | 134.90 | 344.69 | 823.76 | 922.22 | 934.38 | 985.28 | 671.43 | 229.67 | 308.49 | 351.37 | 187.68 | 197.82 | 173.61 | 122.88 | 116.82 | 155.49 | 132.65 | 137.93 | 112.85 | 117.15 | NA | NA | |

| Equity Securities Fv Ni | 1.08 | 0.99 | 0.95 | 1.01 | 0.99 | 1.02 | 1.08 | 1.14 | 1.14 | 1.13 | 1.10 | 3.42 | 3.30 | 3.25 | 2.66 | 3.57 | 5.15 | 4.71 | 4.55 | 4.50 | 4.82 | 5.31 | 5.42 | NA | 5.14 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Goodwill | 373.42 | 373.42 | 373.42 | 373.42 | 373.42 | 373.42 | 373.42 | 373.42 | 373.42 | 373.42 | 373.42 | 373.42 | 373.42 | 373.42 | 373.29 | 374.27 | 371.62 | 287.45 | 287.45 | 287.45 | 287.45 | 287.45 | 287.45 | 287.45 | 291.67 | 291.67 | 291.67 | |

| Intangible Assets Net Excluding Goodwill | 4.06 | 4.38 | 4.71 | 5.04 | 5.38 | 5.74 | 6.12 | 6.50 | 6.89 | 7.33 | 7.77 | 8.21 | 8.68 | 9.27 | 9.74 | 10.29 | 10.92 | 2.09 | 2.25 | 2.42 | 2.60 | 2.73 | 2.91 | 3.13 | 3.68 | 3.96 | 4.19 | |

| Finite Lived Intangible Assets Net | 4.06 | NA | NA | NA | 5378.00 | NA | NA | NA | 6.89 | NA | NA | NA | 8.68 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Equity Securities Fv Ni | 1.08 | 0.99 | 0.95 | 1.01 | 0.99 | 1.02 | 1.08 | 1.14 | 1.14 | 1.13 | 1.10 | 3.42 | 3.30 | 3.25 | 2.66 | 3.57 | 5.15 | 4.71 | 4.55 | 4.50 | 4.82 | 5.31 | 5.42 | NA | 5.14 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | 1320.59 | NA | NA | NA | 733.28 | NA | NA | NA | 961.58 | NA | NA | NA | 1182.94 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 7521.77 | 7222.90 | 7141.21 | 7153.09 | 7219.97 | 7410.60 | 7612.25 | 7960.46 | 7996.52 | 7945.12 | 8015.26 | 7876.03 | 7420.54 | 7633.82 | 7867.92 | 7057.88 | 7036.58 | 5982.69 | 5856.70 | 5833.40 | 5673.92 | 5467.51 | 5393.53 | 5387.09 | 5427.89 | 5443.24 | 5409.86 |

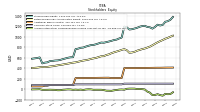

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

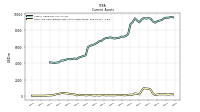

| Stockholders Equity | 1283.44 | 1223.53 | 1212.85 | 1227.80 | 1184.66 | 1153.18 | 1178.36 | 1184.95 | 1206.45 | 1201.68 | 1188.73 | 1168.28 | 1154.71 | 1142.12 | 1135.78 | 1176.25 | 1192.00 | 982.45 | 964.95 | 943.16 | 935.76 | 919.78 | 907.13 | 895.41 | 884.03 | 887.58 | 871.06 | |

| Common Stock Value | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 103.62 | 90.33 | 90.33 | 90.33 | 90.33 | 90.33 | 90.33 | 90.33 | 90.33 | 90.33 | 90.33 | |

| Additional Paid In Capital | 409.03 | 407.98 | 406.97 | 407.11 | 406.28 | 405.51 | 404.84 | 403.84 | 403.10 | 403.03 | 402.05 | 401.35 | 400.67 | 400.79 | 400.42 | 400.39 | 399.94 | 212.04 | 211.32 | 210.95 | 210.34 | 209.69 | 216.88 | 216.62 | 216.11 | 215.45 | 214.94 | |

| Retained Earnings Accumulated Deficit | 959.60 | 935.16 | 913.97 | 890.84 | 863.95 | 835.68 | 809.64 | 791.35 | 773.66 | 762.37 | 746.47 | 731.72 | 710.06 | 698.35 | 692.24 | 740.73 | 761.08 | 748.28 | 730.58 | 716.08 | 701.82 | 684.36 | 662.11 | 649.92 | 628.11 | 626.28 | 610.50 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -90.90 | -125.64 | -114.04 | -96.66 | -112.12 | -114.97 | -67.17 | -47.04 | -7.09 | -1.03 | 3.60 | 1.06 | 8.97 | 9.45 | 9.23 | 5.67 | -11.67 | -7.31 | -9.52 | -16.93 | -23.11 | -33.25 | -30.95 | -29.95 | -18.43 | -12.60 | -12.86 | |

| Treasury Stock Value | 97.92 | 97.59 | 97.67 | 77.12 | 77.07 | 76.67 | 72.58 | 66.82 | 66.83 | 66.31 | 67.02 | 69.48 | 68.61 | 70.10 | 69.73 | 74.16 | 60.98 | 60.89 | 57.76 | 57.27 | 43.62 | 31.34 | 31.25 | 31.51 | 32.08 | 31.88 | 31.85 |

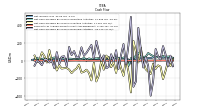

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

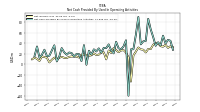

| Net Cash Provided By Used In Operating Activities | 39.68 | 54.37 | 35.80 | 41.90 | 35.20 | 51.94 | 66.70 | 86.60 | 44.37 | 43.70 | 37.90 | 90.14 | 56.45 | 28.57 | 28.39 | -59.96 | 45.63 | 33.90 | 28.44 | 30.46 | 42.83 | 20.69 | 26.70 | 37.79 | 30.80 | 31.31 | 21.81 | |

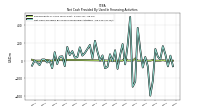

| Net Cash Provided By Used In Investing Activities | -115.39 | -208.00 | -67.43 | -53.39 | -91.98 | -33.43 | -150.24 | -122.94 | -98.15 | -17.20 | 146.99 | -19.65 | 99.82 | 223.36 | -358.64 | -125.64 | 20.28 | -170.83 | -83.71 | 23.70 | -137.81 | -18.45 | -73.85 | 28.16 | 57.45 | -101.94 | -1.42 | |

| Net Cash Provided By Used In Financing Activities | 70.87 | 164.22 | 15.35 | 45.63 | 131.89 | -228.30 | -395.53 | -62.11 | 41.62 | -77.39 | 128.96 | 371.27 | -235.10 | -294.80 | 493.93 | 175.46 | -41.70 | 187.66 | 61.33 | -92.83 | 117.82 | -7.52 | 72.23 | -70.25 | -85.54 | 59.20 | 0.76 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 39.68 | 54.37 | 35.80 | 41.90 | 35.20 | 51.94 | 66.70 | 86.60 | 44.37 | 43.70 | 37.90 | 90.14 | 56.45 | 28.57 | 28.39 | -59.96 | 45.63 | 33.90 | 28.44 | 30.46 | 42.83 | 20.69 | 26.70 | 37.79 | 30.80 | 31.31 | 21.81 | |

| Net Income Loss | 37.05 | 33.47 | 34.47 | 39.80 | 40.27 | 37.25 | 28.86 | 29.14 | 22.48 | 27.60 | 28.37 | 31.90 | 24.18 | 16.70 | -33.07 | 13.23 | 22.27 | 26.94 | 26.10 | 22.93 | 26.85 | 30.88 | 21.44 | 26.16 | 9.29 | 22.72 | 22.77 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -115.39 | -208.00 | -67.43 | -53.39 | -91.98 | -33.43 | -150.24 | -122.94 | -98.15 | -17.20 | 146.99 | -19.65 | 99.82 | 223.36 | -358.64 | -125.64 | 20.28 | -170.83 | -83.71 | 23.70 | -137.81 | -18.45 | -73.85 | 28.16 | 57.45 | -101.94 | -1.42 | |

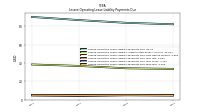

| Payments To Acquire Property Plant And Equipment | 1.30 | 2.23 | 1.25 | 1.44 | 0.99 | 1.32 | 0.90 | 0.66 | 1.50 | 0.18 | 1.11 | 0.81 | 1.06 | 1.49 | 1.43 | 1.43 | 1.10 | 1.50 | 0.80 | 1.76 | 1.58 | 1.78 | 0.49 | 0.31 | 1.05 | 0.63 | 2.27 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 70.87 | 164.22 | 15.35 | 45.63 | 131.89 | -228.30 | -395.53 | -62.11 | 41.62 | -77.39 | 128.96 | 371.27 | -235.10 | -294.80 | 493.93 | 175.46 | -41.70 | 187.66 | 61.33 | -92.83 | 117.82 | -7.52 | 72.23 | -70.25 | -85.54 | 59.20 | 0.76 | |

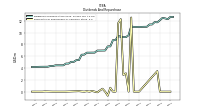

| Payments Of Dividends Common Stock | 12.61 | 12.31 | 12.40 | 12.38 | 12.08 | 11.72 | 11.77 | 11.37 | 11.37 | 10.99 | 10.99 | 10.97 | 10.98 | 10.96 | 10.96 | 11.05 | 9.56 | 9.24 | 9.24 | 9.32 | 9.42 | 8.72 | 8.72 | 7.67 | 7.67 | 6.97 | 6.97 | |

| Payments For Repurchase Of Common Stock | 0.00 | 0.00 | NA | NA | 0.00 | 3.48 | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 12.56 | 0.00 | 3.10 | 2.83 | 12.29 | 11.60 | 0.00 | 0.00 | 0.66 | -0.69 | -0.00 | 0.49 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Wealth Management | 3.05 | 3.00 | 3.19 | 2.95 | 3.02 | 3.21 | 3.25 | 3.24 | 3.31 | 3.46 | 3.17 | 2.94 | 2.49 | 2.52 | 2.59 | 2.36 | 2.41 | 2.10 | 2.06 | 2.05 | 2.30 | 2.48 | 2.62 | 2.68 | 2.52 | 2.41 | 2.43 | |

| Credit And Debit Card | 4.54 | 4.69 | 4.64 | 4.37 | 4.42 | 4.77 | 4.76 | 5.06 | 4.47 | 4.58 | 1.73 | 4.16 | 3.83 | 4.17 | 3.61 | 3.48 | 3.45 | 3.48 | 3.50 | 2.97 | 3.19 | 3.14 | 3.31 | 3.04 | 3.08 | 3.07 | 3.04 | |

| Deposit Account | 4.13 | 4.06 | 3.93 | 4.08 | 4.34 | 4.33 | 4.18 | 3.97 | 4.00 | 3.92 | 3.64 | 3.47 | 2.98 | 2.82 | 2.34 | 3.56 | 3.54 | 3.41 | 3.21 | 3.15 | 3.33 | 3.35 | 3.23 | 3.24 | 3.24 | 3.21 | 3.00 | |

| Wealth Management | 3.05 | 3.00 | 3.19 | 2.95 | 3.02 | 3.21 | 3.25 | 3.24 | 3.31 | 3.46 | 3.17 | 2.94 | 2.49 | 2.52 | 2.59 | 2.36 | 2.41 | 2.10 | 2.06 | 2.05 | 2.30 | 2.48 | 2.62 | 2.68 | 2.52 | 2.41 | 2.43 | |

| Credit And Debit Card | 4.54 | 4.69 | 4.64 | 4.37 | 4.42 | 4.77 | 4.76 | 5.06 | 4.47 | 4.58 | 1.73 | 4.16 | 3.83 | 4.17 | 3.61 | 3.48 | 3.45 | 3.48 | 3.50 | 2.97 | 3.19 | 3.14 | 3.31 | 3.04 | 3.08 | 3.07 | 3.04 | |

| Deposit Account | 4.13 | 4.06 | 3.93 | 4.08 | 4.34 | 4.33 | 4.18 | 3.97 | 4.00 | 3.92 | 3.64 | 3.47 | 2.98 | 2.82 | 2.34 | 3.56 | 3.54 | 3.41 | 3.21 | 3.15 | 3.33 | 3.35 | 3.23 | 3.24 | 3.24 | 3.21 | 3.00 |