| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 1.27 | 1.27 | 1.27 | 1.27 | 0.83 | 0.83 | 0.82 | 0.82 | 0.82 | 0.82 | 0.82 | 0.82 | 0.81 | 0.73 | 0.68 | 0.65 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | NA | 0.31 | NA | NA | NA | |

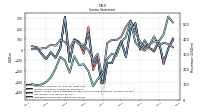

| Earnings Per Share Basic | 0.70 | -0.02 | 0.11 | 0.85 | 0.03 | 3.03 | 2.36 | -0.81 | 0.99 | -0.20 | -1.54 | -1.49 | -5.73 | -0.73 | -2.14 | 2.71 | 0.01 | 1.35 | 1.75 | -2.02 | 5.66 | 0.24 | -1.69 | -0.73 | -2.74 | -1.16 | 0.79 | 1.10 | |

| Earnings Per Share Diluted | 0.70 | -0.02 | 0.11 | 0.84 | 0.02 | 2.99 | 2.33 | -0.81 | 0.99 | -0.20 | -1.54 | -1.49 | -5.73 | -0.73 | -2.14 | 2.69 | 0.01 | 1.35 | 1.74 | -2.02 | 5.66 | 0.24 | -1.69 | -0.73 | -2.74 | -1.16 | 0.79 | 1.10 |

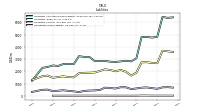

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

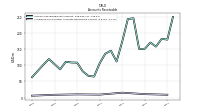

| Revenues | 384.96 | 383.13 | 367.21 | 322.58 | 342.20 | 377.13 | 519.09 | 413.57 | 381.95 | 290.91 | 303.77 | 267.91 | 175.71 | 135.14 | 88.87 | 187.76 | 233.24 | 228.86 | 286.81 | 178.71 | 258.66 | 282.87 | 203.91 | 145.85 | 115.62 | 99.96 | 95.43 | 101.82 | |

| Costs And Expenses | 350.22 | 256.36 | 326.79 | 314.73 | 263.58 | 213.14 | 243.10 | 196.05 | 257.65 | 198.57 | 210.42 | 203.28 | 461.15 | 172.20 | 183.48 | 191.98 | 186.27 | 175.97 | 191.94 | 160.34 | 184.69 | 191.51 | 164.69 | 97.27 | 97.25 | 86.63 | 89.11 | NA | |

| General And Administrative Expense | 37.24 | 24.89 | 33.18 | 63.19 | 29.01 | 25.29 | 22.93 | 22.53 | 19.68 | 20.43 | 19.38 | 19.19 | 16.69 | 17.82 | 17.19 | 27.47 | 23.41 | 17.32 | 18.86 | 17.61 | 24.70 | 21.66 | 30.88 | 8.58 | 9.79 | 9.66 | 7.47 | NA | |

| Operating Income Loss | 34.74 | 126.77 | 40.42 | 7.85 | 78.62 | 163.99 | 275.99 | 217.52 | 124.31 | 92.34 | 93.34 | 64.63 | -285.44 | -37.06 | -94.60 | -4.21 | 46.97 | 52.88 | 94.87 | 18.37 | 73.97 | 91.36 | 39.21 | 48.58 | 18.37 | 13.33 | 6.31 | 7.29 | |

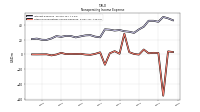

| Interest Expense | 44.30 | 45.64 | 45.63 | 37.58 | 33.97 | 29.27 | 30.78 | 31.49 | 33.10 | 32.39 | 33.57 | 34.08 | 23.25 | 24.12 | 26.19 | 25.85 | 24.57 | 23.12 | 24.93 | 25.22 | 23.86 | 24.84 | 21.68 | 19.74 | 19.89 | 21.46 | 20.80 | NA | |

| Interest Paid Net | 21.38 | 45.44 | 22.50 | 40.99 | 2.62 | 41.62 | 4.22 | 43.35 | 4.29 | 45.60 | 5.29 | 13.71 | 26.25 | 7.03 | 29.26 | 4.91 | 26.56 | 4.60 | 26.80 | 4.61 | 26.17 | 3.67 | 13.20 | 10.44 | 13.77 | 8.82 | NA | NA | |

| Allocated Share Based Compensation Expense | 3.87 | 0.39 | 4.75 | 3.94 | 4.28 | 4.31 | 4.05 | 3.32 | 2.70 | 2.61 | 3.02 | 2.66 | 2.35 | 2.35 | 2.35 | 1.63 | 1.80 | 1.94 | 2.00 | 1.30 | 0.39 | 1.00 | 1.50 | 0.30 | 0.07 | 0.30 | NA | NA | |

| Income Tax Expense Benefit | -5.08 | -15.87 | 6.89 | -46.54 | 0.28 | 0.12 | 2.61 | -0.47 | -2.35 | -0.36 | 0.50 | 0.58 | 57.97 | -28.25 | -49.39 | 55.26 | -36.57 | 0.79 | 6.00 | -6.36 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | 85.90 | -2.10 | 13.68 | 89.86 | 2.75 | 250.47 | 195.14 | -66.44 | 81.01 | -16.69 | -125.78 | -121.49 | -430.74 | -52.00 | -140.61 | 157.75 | 0.30 | 73.30 | 94.76 | -109.64 | 306.29 | 13.11 | -74.91 | -22.94 | NA | NA | NA | NA | |

| Net Income Loss | 85.90 | -2.10 | 13.68 | 89.86 | 2.75 | 250.47 | 195.14 | -66.44 | 81.01 | -16.69 | -125.78 | -121.49 | -430.74 | -52.00 | -140.61 | 157.75 | 0.30 | 73.30 | 94.76 | -109.64 | 306.29 | 13.11 | -74.91 | -22.94 | -85.76 | -36.18 | 24.61 | 34.46 |

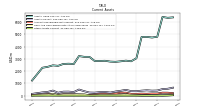

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

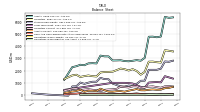

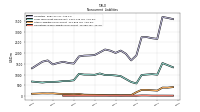

| Assets | 4816.31 | 4753.10 | 4805.41 | 4795.76 | 3058.63 | 2813.37 | 2863.10 | 2810.49 | 2766.82 | 2786.16 | 2852.16 | 2839.69 | 2834.55 | 3172.28 | 3174.65 | 3238.19 | 2589.48 | 2611.89 | 2592.03 | 2439.94 | 2479.99 | 2357.15 | 2284.07 | NA | 1239.29 | NA | NA | NA | |

| Liabilities | 2661.16 | 2691.04 | 2743.53 | 2734.91 | 1893.05 | 1658.02 | 1965.59 | 2115.37 | 2006.16 | 2111.54 | 2165.74 | 2032.54 | 1907.94 | 1890.01 | 1880.10 | 1843.29 | 1511.20 | 1537.06 | 1593.99 | 1539.95 | 1472.49 | 1657.38 | 1598.22 | NA | 1293.38 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 4816.31 | 4753.10 | 4805.41 | 4795.76 | 3058.63 | 2813.37 | 2863.10 | 2810.49 | 2766.82 | 2786.16 | 2852.16 | 2839.69 | 2834.55 | 3172.28 | 3174.65 | 3238.19 | 2589.48 | 2611.89 | 2592.03 | 2439.94 | 2479.99 | 2357.15 | 2284.07 | NA | 1239.29 | NA | NA | NA | |

| Stockholders Equity | 2155.15 | 2062.06 | 2061.89 | 2060.84 | 1165.58 | 1155.34 | 897.51 | 695.12 | 760.65 | 674.62 | 686.42 | 807.15 | 926.60 | 1282.28 | 1294.55 | 1394.90 | 1078.28 | 1074.82 | 998.04 | 899.99 | 1007.50 | 699.76 | 685.85 | -77.13 | -54.09 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

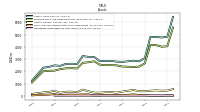

| Assets Current | 422.18 | 411.59 | 440.17 | 411.10 | 367.83 | 371.98 | 475.49 | 401.81 | 340.00 | 253.73 | 304.22 | 292.00 | 247.39 | 256.44 | 369.71 | 502.30 | 293.98 | 332.75 | 328.27 | 238.65 | 416.85 | 306.54 | 268.73 | NA | 144.88 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 33.64 | 13.63 | 17.52 | 16.17 | 44.15 | 64.49 | 108.48 | 78.35 | 69.85 | 59.43 | 65.35 | 64.98 | 34.23 | 32.38 | 107.86 | 106.95 | 87.02 | 90.68 | 89.11 | 45.73 | 139.91 | 89.92 | 78.86 | NA | 32.19 | NA | NA | NA | |

| Accounts Receivable Net Current | 178.98 | 181.38 | 157.33 | 169.85 | 150.60 | 150.10 | 244.88 | 242.30 | 173.24 | 111.47 | 144.76 | 135.41 | 106.22 | 64.95 | 67.04 | 81.03 | 107.84 | 108.35 | 110.50 | 87.19 | 103.03 | 119.02 | 100.82 | NA | 62.87 | NA | NA | NA | |

| Other Assets Current | 10.39 | 14.46 | 17.25 | 11.90 | 1.92 | 1.89 | 4.24 | 1.81 | 1.67 | 1.72 | 1.74 | 1.76 | 1.86 | 1.80 | 1.98 | 2.05 | 1.84 | 1.95 | 2.08 | 3.11 | 7.64 | 8.34 | 3.91 | NA | 2.15 | NA | NA | NA |

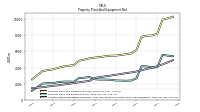

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 8208.64 | 7992.92 | 7960.42 | 7811.07 | 6149.81 | 5767.35 | 5646.76 | 5561.33 | 5480.62 | 5469.63 | 5395.07 | 5296.21 | 5233.40 | 5141.72 | 4981.48 | 4847.12 | 4290.64 | 4218.96 | 4118.40 | 3956.48 | 3770.83 | 3673.77 | 3545.59 | NA | 2521.67 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 4168.33 | 3985.61 | 3822.92 | 3653.56 | 3506.54 | 3387.12 | 3294.80 | 3190.38 | 3092.04 | 2986.14 | 2897.55 | 2798.89 | 2697.23 | 2327.56 | 2247.01 | 2158.57 | 2065.02 | 1967.61 | 1879.49 | 1784.20 | 1719.61 | 1635.46 | 1547.66 | NA | 1430.89 | NA | NA | NA | |

| Property Plant And Equipment Net | 4040.31 | 4007.31 | 4137.51 | 4157.51 | 2643.28 | 2380.23 | 2351.96 | 2370.95 | 2388.58 | 2483.49 | 2497.52 | 2497.32 | 2536.17 | 2814.16 | 2734.47 | 2688.55 | 2225.61 | 2251.35 | 2238.91 | 2172.28 | 2051.22 | 2038.31 | 1997.94 | NA | 1090.78 | NA | NA | NA | |

| Other Assets Noncurrent | 5.96 | 13.45 | 17.51 | 18.14 | 6.48 | 6.94 | 8.30 | 11.78 | 12.30 | 21.99 | 22.50 | 21.46 | 24.26 | 75.68 | 47.25 | 21.77 | 54.38 | 2.62 | 2.70 | 7.87 | 2.69 | 2.06 | 8.14 | NA | 0.71 | NA | NA | NA |

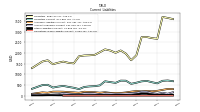

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

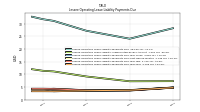

| Liabilities Current | 578.62 | 629.80 | 691.88 | 671.19 | 607.06 | 556.33 | 701.34 | 705.59 | 600.53 | 635.83 | 674.74 | 482.24 | 447.53 | 434.42 | 407.88 | 308.75 | 370.45 | 411.36 | 458.15 | 424.58 | 380.42 | 510.71 | 495.63 | NA | 323.47 | NA | NA | NA | |

| Long Term Debt Current | 33.06 | 33.11 | 33.16 | 33.20 | NA | NA | NA | 6.06 | 6.06 | 6.06 | 6.06 | NA | NA | NA | NA | NA | NA | NA | NA | 0.45 | 0.44 | 0.44 | 0.43 | NA | 24.98 | NA | NA | NA | |

| Accounts Payable Current | 84.19 | 125.56 | 184.18 | 184.47 | 128.17 | 109.96 | 102.39 | 91.16 | 85.81 | 106.10 | 111.13 | 72.77 | 104.86 | 110.89 | 104.15 | 58.75 | 71.36 | 95.74 | 115.09 | 62.55 | 51.02 | 37.81 | 38.73 | NA | 72.68 | NA | NA | NA | |

| Accrued Liabilities Current | 227.69 | 205.09 | 220.42 | 201.36 | 219.77 | 189.74 | 152.40 | 126.84 | 130.46 | 133.26 | 160.60 | 140.55 | 163.38 | 172.74 | 184.99 | 138.27 | 154.82 | 169.15 | 186.35 | 192.32 | 188.65 | 138.46 | 155.90 | NA | 87.97 | NA | NA | NA | |

| Other Liabilities Current | 48.77 | 54.22 | 91.60 | 92.04 | 60.36 | 26.93 | 32.80 | 33.97 | 33.06 | 30.70 | 29.28 | 25.19 | 24.16 | 23.10 | 22.07 | 20.92 | 20.18 | 18.99 | 18.14 | 17.29 | 22.07 | 21.35 | 15.54 | NA | 15.19 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

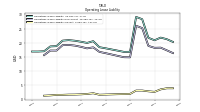

| Long Term Debt | 1025.67 | 1051.88 | 1033.27 | 1010.21 | 585.34 | 652.11 | 788.47 | 931.14 | 962.73 | 984.84 | NA | NA | 985.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 402.06 | NA | NA | NA | |

| Long Term Debt Noncurrent | 992.61 | 1018.77 | 1000.11 | 977.01 | 585.34 | 652.11 | 788.47 | 925.08 | 956.67 | 978.78 | 976.57 | 1049.37 | 985.51 | 994.75 | 997.04 | 1033.16 | 732.98 | 697.19 | 697.13 | 665.93 | 654.86 | 654.32 | 627.97 | NA | 672.58 | NA | NA | NA | |

| Other Liabilities Noncurrent | 251.28 | 267.04 | 283.44 | 284.38 | 176.15 | 39.91 | 41.10 | 35.58 | 45.01 | 37.82 | 42.55 | 48.62 | 54.37 | 56.47 | 61.85 | 92.47 | 81.59 | 88.71 | 93.03 | 103.74 | 123.36 | 118.92 | 122.82 | NA | 103.56 | NA | NA | NA | |

| Operating Lease Liability Noncurrent | 18.21 | 18.89 | 25.17 | 25.98 | 14.86 | 14.89 | 15.37 | 15.85 | 16.33 | 16.78 | 18.38 | 18.02 | 18.55 | 19.00 | 19.23 | 19.14 | 17.24 | 17.25 | 15.64 | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

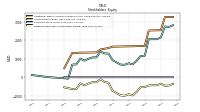

| Stockholders Equity | 2155.15 | 2062.06 | 2061.89 | 2060.84 | 1165.58 | 1155.34 | 897.51 | 695.12 | 760.65 | 674.62 | 686.42 | 807.15 | 926.60 | 1282.28 | 1294.55 | 1394.90 | 1078.28 | 1074.82 | 998.04 | 899.99 | 1007.50 | 699.76 | 685.85 | -77.13 | -54.09 | NA | NA | NA | |

| Common Stock Value | 1.27 | 1.27 | 1.27 | 1.27 | 0.83 | 0.83 | 0.82 | 0.82 | 0.82 | 0.82 | 0.82 | 0.82 | 0.81 | 0.73 | 0.68 | 0.65 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | NA | 0.31 | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 2549.10 | 2541.91 | 2539.63 | 2531.40 | 1699.80 | 1692.32 | 1684.95 | 1677.70 | 1676.80 | 1671.78 | 1666.89 | 1661.84 | 1659.80 | 1584.82 | 1545.14 | 1504.90 | 1346.14 | 1342.99 | 1339.51 | 1336.22 | 1334.09 | 1324.27 | 1323.60 | NA | 489.87 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -347.72 | -433.62 | -431.51 | -445.19 | -535.05 | -537.80 | -788.26 | -983.40 | -916.96 | -997.98 | -981.28 | -855.50 | -734.01 | -303.27 | -251.27 | -110.66 | -268.41 | -268.71 | -342.01 | -436.77 | -327.14 | -625.05 | -638.30 | NA | -544.27 | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 7.20 | 2.35 | 8.23 | 7.23 | 7.48 | 7.50 | 7.24 | 5.39 | 5.02 | 4.94 | 6.02 | 4.19 | 4.33 | 4.37 | 4.39 | 3.38 | 3.16 | 3.53 | 3.57 | 2.13 | 1.45 | 0.81 | 3.92 | 0.23 | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

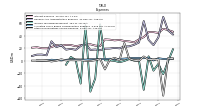

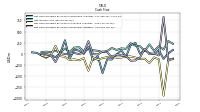

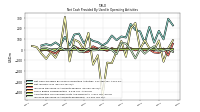

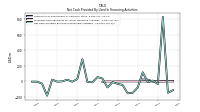

| Net Cash Provided By Used In Operating Activities | 176.26 | 65.73 | 214.23 | 62.86 | 170.81 | 184.56 | 240.75 | 113.61 | 123.74 | 88.55 | 132.14 | 66.96 | 39.86 | 70.45 | 81.38 | 110.23 | 61.32 | 149.79 | 141.50 | 41.12 | 119.76 | 36.58 | 67.47 | 39.65 | 51.62 | 39.17 | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -120.75 | -79.29 | -205.61 | -106.98 | -113.33 | -81.42 | -57.85 | -59.38 | -81.59 | -85.52 | -53.90 | -72.74 | -93.75 | -133.56 | -74.91 | -376.68 | -95.49 | -143.32 | -121.84 | -135.31 | -66.56 | -47.97 | 182.04 | -30.01 | -63.44 | -29.42 | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -34.90 | 10.45 | -7.26 | 117.12 | -77.83 | -147.14 | -152.77 | -45.73 | -31.72 | -8.96 | -77.87 | 36.53 | 55.75 | -12.38 | -5.57 | 286.38 | 30.51 | -4.90 | 22.46 | 0.01 | -3.20 | 22.46 | -183.95 | -28.52 | -3.36 | -3.18 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 176.26 | 65.73 | 214.23 | 62.86 | 170.81 | 184.56 | 240.75 | 113.61 | 123.74 | 88.55 | 132.14 | 66.96 | 39.86 | 70.45 | 81.38 | 110.23 | 61.32 | 149.79 | 141.50 | 41.12 | 119.76 | 36.58 | 67.47 | 39.65 | 51.62 | 39.17 | NA | NA | |

| Net Income Loss | 85.90 | -2.10 | 13.68 | 89.86 | 2.75 | 250.47 | 195.14 | -66.44 | 81.01 | -16.69 | -125.78 | -121.49 | -430.74 | -52.00 | -140.61 | 157.75 | 0.30 | 73.30 | 94.76 | -109.64 | 306.29 | 13.11 | -74.91 | -22.94 | -85.76 | -36.18 | 24.61 | 34.46 | |

| Profit Loss | 85.90 | -2.10 | 13.68 | 89.86 | 2.75 | 250.47 | 195.14 | -66.44 | 81.01 | -16.69 | -125.78 | -121.49 | -430.74 | -52.00 | -140.61 | 157.75 | 0.30 | 73.30 | 94.76 | -109.64 | 306.29 | 13.11 | -74.91 | -22.94 | NA | NA | NA | NA | |

| Depreciation Depletion And Amortization | 183.06 | 163.36 | 169.79 | 147.32 | 119.46 | 92.32 | 104.51 | 98.34 | 105.90 | 88.60 | 99.84 | 101.66 | 101.81 | 80.55 | 88.44 | 93.54 | 97.41 | 88.12 | 95.81 | 64.59 | 84.14 | 87.81 | 67.73 | 49.04 | 43.52 | 37.75 | 36.16 | NA | |

| Increase Decrease In Accounts Receivable | -16.53 | 31.31 | 1.69 | -36.82 | 8.86 | -81.18 | 0.58 | 56.82 | 64.47 | -41.71 | -4.47 | 17.11 | 32.92 | -3.44 | -6.41 | 11.58 | -20.52 | -17.39 | 34.42 | -2.31 | -3.67 | 23.92 | -17.10 | -2.36 | 17.35 | 19.60 | NA | NA | |

| Increase Decrease In Accounts Payable | -30.34 | -26.17 | 1.00 | -4.89 | 7.58 | -6.68 | 13.98 | 9.38 | -4.67 | -5.37 | 14.75 | -10.98 | 3.60 | 10.86 | 31.19 | -18.55 | -25.02 | 8.89 | 31.93 | -8.28 | 5.20 | -0.90 | -36.19 | -16.93 | -0.71 | -7.76 | NA | NA | |

| Share Based Compensation | 3.87 | 0.39 | 4.75 | 3.94 | 4.28 | 4.31 | 4.05 | 3.32 | 2.70 | 2.61 | 3.02 | 2.66 | 2.35 | 2.35 | 2.35 | 1.63 | 1.80 | 1.94 | 1.96 | 1.26 | 0.76 | 0.57 | 1.46 | 0.10 | 0.10 | 0.28 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -120.75 | -79.29 | -205.61 | -106.98 | -113.33 | -81.42 | -57.85 | -59.38 | -81.59 | -85.52 | -53.90 | -72.74 | -93.75 | -133.56 | -74.91 | -376.68 | -95.49 | -143.32 | -121.84 | -135.31 | -66.56 | -47.97 | 182.04 | -30.01 | -63.44 | -29.42 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -34.90 | 10.45 | -7.26 | 117.12 | -77.83 | -147.14 | -152.77 | -45.73 | -31.72 | -8.96 | -77.87 | 36.53 | 55.75 | -12.38 | -5.57 | 286.38 | 30.51 | -4.90 | 22.46 | 0.01 | -3.20 | 22.46 | -183.95 | -28.52 | -3.36 | -3.18 | NA | NA | |

| Payments For Repurchase Of Common Stock | 0.00 | 0.00 | 22.33 | 25.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 384.96 | 383.13 | 367.21 | 322.58 | 342.20 | 377.13 | 519.09 | 413.57 | 381.95 | 290.91 | 303.77 | 267.91 | 175.71 | 135.14 | 88.87 | 187.76 | 233.24 | 228.86 | 286.81 | 178.71 | 258.66 | 282.87 | 203.91 | 145.85 | 115.62 | 99.96 | 95.43 | 101.82 | |

| Operating | 384.96 | 383.13 | 367.21 | NA | 342.20 | 377.13 | 519.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Upstream | 384.96 | 383.13 | 367.21 | 322.58 | 342.20 | 377.13 | 519.09 | 413.57 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| 7.66 | 6.86 | 7.90 | 9.71 | 10.29 | 13.18 | 19.35 | 16.70 | 18.02 | 12.98 | 9.65 | 9.11 | 5.76 | 3.41 | 1.96 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| Natural Gas Production | 14.65 | 16.87 | 16.33 | 20.18 | 45.56 | 68.36 | 70.41 | 42.98 | 44.53 | 31.72 | 26.13 | 28.23 | 18.34 | 12.34 | 11.14 | 11.90 | 13.54 | 12.54 | 14.75 | 14.45 | 24.25 | 20.19 | 16.45 | 12.72 | 11.65 | 11.18 | 12.89 | NA | |

| Oil And Condensate | 362.65 | 359.40 | 342.98 | 292.69 | 286.35 | 295.58 | 429.33 | 353.89 | 320.40 | 246.21 | 267.99 | 229.56 | 148.50 | 117.19 | 74.47 | 166.62 | 208.63 | 211.90 | 256.91 | 155.68 | 225.86 | 248.10 | 180.16 | 127.69 | 98.26 | 84.03 | 78.72 | NA |