| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 1.44 | 1.44 | 1.44 | 1.46 | 1.46 | 1.45 | 1.45 | 1.46 | 1.47 | 1.47 | 1.49 | 1.49 | 1.50 | 1.50 | 1.50 | 1.49 | 1.50 | 1.50 | 1.52 | 1.53 | 1.53 | 1.53 | 1.53 | 1.53 | 1.53 | 1.52 | 1.52 | 1.52 | |

| Earnings Per Share Basic | 1.05 | -2.35 | 0.59 | 1.35 | 1.37 | 1.49 | 1.45 | 1.61 | 1.34 | 1.46 | 1.55 | 1.73 | 1.62 | 1.63 | 1.44 | 0.53 | 1.41 | 1.34 | 1.27 | 1.37 | 1.24 | 1.37 | 1.44 | 1.34 | 0.16 | 1.14 | 1.11 | 1.04 | |

| Earnings Per Share Diluted | 1.05 | -2.35 | 0.59 | 1.35 | 1.36 | 1.48 | 1.45 | 1.60 | 1.33 | 1.45 | 1.54 | 1.72 | 1.61 | 1.63 | 1.44 | 0.53 | 1.40 | 1.34 | 1.27 | 1.37 | 1.23 | 1.36 | 1.43 | 1.33 | 0.16 | 1.14 | 1.11 | 1.03 | |

| Tier One Risk Based Capital To Risk Weighted Assets | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Capital To Risk Weighted Assets | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Excluding Assessed Tax | 17.16 | 20.67 | 18.40 | 18.80 | 16.91 | 20.14 | 18.05 | 18.87 | 17.69 | 19.43 | 17.49 | 17.99 | 16.72 | 17.36 | 14.94 | 16.73 | 15.90 | 17.74 | 16.70 | 17.22 | 16.52 | 16.82 | 16.39 | 16.23 | 15.62 | 16.14 | 15.95 | 15.39 | |

| Revenues | 17.16 | 20.67 | 18.40 | 18.80 | 16.91 | 20.14 | 18.05 | 18.87 | 17.69 | 19.43 | 17.49 | 17.99 | 16.72 | 17.36 | 14.94 | 16.73 | 15.90 | 17.74 | 16.70 | 17.22 | 16.52 | 16.82 | 16.39 | 16.23 | 15.62 | 16.14 | 15.95 | 15.39 | |

| Insurance Commissions And Fees | 7.77 | 11.40 | 8.67 | 9.51 | 7.63 | 10.82 | 8.43 | 9.32 | 7.78 | 9.83 | 8.05 | 9.17 | 7.29 | 8.92 | 7.25 | 8.04 | 6.78 | 8.52 | 7.75 | 8.04 | 6.68 | 7.90 | 7.39 | 7.39 | 6.89 | 7.68 | 7.09 | 7.12 | |

| Interest Expense | 28.43 | 24.45 | 19.97 | 14.99 | 10.23 | 5.56 | 2.69 | 2.56 | 2.80 | 5.02 | 4.99 | 4.72 | 5.62 | 6.06 | 7.08 | 10.23 | 11.34 | 12.62 | 13.78 | 13.01 | 12.09 | 10.82 | 9.43 | 7.45 | 7.06 | 6.77 | 6.04 | 5.59 | |

| Interest Income Expense Net | 52.36 | 51.01 | 51.90 | 54.25 | 57.29 | 58.11 | 58.26 | 56.61 | 57.81 | 56.10 | 54.85 | 55.04 | 57.75 | 58.25 | 56.37 | 52.97 | 53.24 | 53.16 | 52.32 | 51.91 | 53.24 | 53.16 | 52.71 | 52.69 | 51.97 | 51.00 | 50.30 | 48.03 | |

| Interest Paid Net | 27.45 | 24.31 | 19.57 | 14.93 | 9.84 | 5.62 | 2.80 | 2.77 | 0.98 | 5.65 | 5.30 | 4.98 | 5.71 | 6.48 | 7.45 | 10.69 | 11.34 | 13.07 | 13.57 | 13.57 | 11.99 | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 3.11 | -8.30 | 1.78 | 5.90 | 4.48 | 6.77 | 6.33 | 6.98 | 5.40 | 6.63 | 6.47 | 6.68 | 6.14 | 6.33 | 5.54 | 1.91 | 5.20 | 5.48 | 4.74 | 5.59 | 4.87 | 5.43 | 5.75 | 5.76 | 18.49 | 8.49 | 8.25 | 7.39 | |

| Income Taxes Paid Net | 0.47 | 1.91 | 6.75 | 1.25 | 6.36 | 6.67 | 9.47 | 1.40 | 5.24 | 4.04 | 18.41 | 0.93 | 6.65 | 14.63 | 0.40 | 1.21 | 5.49 | 4.13 | 7.05 | 0.05 | 1.99 | 0.61 | 14.29 | 0.06 | 17.21 | 0.00 | 13.71 | 0.09 | |

| Profit Loss | 15.03 | -33.32 | 8.51 | 19.41 | 19.58 | 21.37 | 20.90 | 23.30 | 19.50 | 21.37 | 22.86 | 25.66 | 24.03 | 24.26 | 21.46 | 7.99 | 21.11 | 20.24 | 19.42 | 21.07 | 18.94 | 20.93 | 22.09 | 20.47 | 2.49 | 17.43 | 16.96 | 15.75 | |

| Other Comprehensive Income Loss Net Of Tax | 51.02 | 19.49 | -7.67 | 20.84 | 34.55 | -64.37 | -43.02 | -79.90 | -0.86 | -7.21 | 9.07 | -24.88 | -8.21 | -2.82 | 0.22 | 22.29 | -6.71 | 3.32 | 10.78 | 12.21 | 11.77 | -5.50 | -3.82 | -14.39 | -8.62 | 0.91 | 2.06 | 1.43 | |

| Net Income Loss | 15.00 | -33.35 | 8.47 | 19.38 | 19.55 | 21.34 | 20.87 | 23.27 | 19.46 | 21.34 | 22.83 | 25.63 | 23.98 | 24.23 | 21.43 | 7.95 | 21.08 | 20.21 | 19.39 | 21.04 | 18.91 | 20.90 | 22.06 | 20.44 | 2.46 | 17.39 | 16.93 | 15.72 | |

| Comprehensive Income Net Of Tax | 66.03 | -13.86 | 0.80 | 40.22 | 54.10 | -43.03 | -22.15 | -56.63 | 18.61 | 14.13 | 31.90 | 0.75 | 15.77 | 21.41 | 21.65 | 30.24 | 14.37 | 23.53 | 30.17 | 33.26 | 30.68 | 15.40 | 18.24 | 6.05 | -6.17 | 18.30 | 18.99 | 17.14 | |

| Net Income Loss Available To Common Stockholders Basic | 14.99 | -33.36 | 8.47 | 19.36 | 19.51 | 21.27 | 20.80 | 23.20 | 19.35 | 21.19 | 22.67 | 25.44 | 23.75 | 23.95 | 21.18 | 7.85 | 20.75 | 19.89 | 19.09 | 20.69 | 18.62 | 20.58 | 21.70 | 20.09 | 2.43 | 17.13 | 16.66 | 15.46 | |

| Net Income Loss Available To Common Stockholders Diluted | 14.99 | -33.36 | 8.47 | 19.36 | 19.51 | 21.27 | 20.80 | 23.20 | 19.35 | 21.19 | 22.67 | 25.44 | 23.75 | 23.95 | 21.18 | 7.85 | 20.75 | 19.89 | 19.09 | 20.69 | 18.62 | 20.58 | 21.70 | 20.09 | 2.43 | 17.13 | 16.66 | 15.46 | |

| Interest Income Expense After Provision For Loan Loss | 50.60 | 49.86 | 49.64 | 55.07 | 55.90 | 57.05 | 57.41 | 57.13 | 53.90 | 57.33 | 57.92 | 57.55 | 57.74 | 58.05 | 56.71 | 36.67 | 54.24 | 51.84 | 51.72 | 51.47 | 51.18 | 52.89 | 51.67 | 52.12 | 49.95 | 50.60 | 49.33 | 47.27 | |

| Noninterest Expense | 51.30 | 49.87 | 51.97 | 50.16 | 50.19 | 49.60 | 49.12 | 46.84 | 48.15 | 50.18 | 47.44 | 45.19 | 46.41 | 46.35 | 46.89 | 45.74 | 45.90 | 45.66 | 46.07 | 44.21 | 47.23 | 45.13 | 44.98 | 43.72 | 46.29 | 41.88 | 41.57 | 41.37 | |

| Noninterest Income | 18.85 | -41.62 | 12.62 | 20.40 | 18.35 | 20.69 | 18.94 | 19.98 | 19.15 | 20.85 | 18.86 | 19.98 | 18.84 | 18.89 | 17.18 | 18.96 | 17.97 | 19.53 | 18.52 | 19.41 | 19.86 | 18.60 | 21.16 | 17.83 | 17.31 | 17.20 | 17.45 | 17.24 |

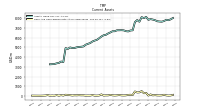

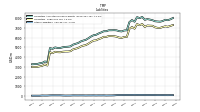

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 7819.75 | 7691.16 | 7626.24 | 7644.37 | 7670.69 | 7779.94 | 7842.46 | 7891.11 | 7819.98 | 8113.11 | 7988.21 | 8095.34 | 7622.17 | 7794.50 | 7582.06 | 6743.11 | 6725.62 | 6627.98 | 6654.39 | 6738.72 | 6758.44 | 6746.96 | 6745.80 | 6648.13 | 6648.29 | 6524.06 | 6415.01 | 6280.05 | |

| Liabilities | 7149.81 | 7078.81 | 6989.80 | 6994.61 | 7053.30 | 7206.98 | 7218.14 | 7233.62 | 7091.04 | 7390.75 | 7259.95 | 7385.41 | 6904.48 | 7080.89 | 6884.03 | 6060.52 | 6062.57 | 5968.12 | 5996.71 | 6091.45 | 6137.56 | 6147.82 | 6155.15 | 6068.72 | 6072.09 | 5934.19 | 5838.10 | 5716.53 | |

| Liabilities And Stockholders Equity | 7819.75 | 7691.16 | 7626.24 | 7644.37 | 7670.69 | 7779.94 | 7842.46 | 7891.11 | 7819.98 | 8113.11 | 7988.21 | 8095.34 | 7622.17 | 7794.50 | 7582.06 | 6743.11 | 6725.62 | 6627.98 | 6654.39 | 6738.72 | 6758.44 | 6746.96 | 6745.80 | 6648.13 | 6648.29 | 6524.06 | 6415.01 | 6280.05 | |

| Stockholders Equity | 668.52 | 610.85 | 634.97 | 648.32 | 615.98 | 571.45 | 622.84 | 656.05 | 727.53 | 720.85 | 726.78 | 708.49 | 716.28 | 712.10 | 696.55 | 681.15 | 661.64 | 658.36 | 656.20 | 645.82 | 619.46 | 597.64 | 589.17 | 577.97 | 574.78 | 588.35 | 575.43 | 562.06 | |

| Tier One Risk Based Capital | 699.52 | NA | NA | NA | 730.33 | NA | NA | NA | 688.42 | NA | NA | NA | 667.36 | NA | NA | NA | 624.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 79.54 | 140.22 | 81.61 | 70.54 | 77.84 | 103.61 | 80.39 | 175.07 | 63.11 | 333.49 | 291.01 | 518.42 | 388.46 | 374.74 | 479.13 | 115.26 | 137.98 | 127.43 | 81.01 | 70.57 | 80.39 | 113.16 | 82.67 | 68.10 | 84.30 | 129.41 | 78.17 | 78.47 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 79.54 | 140.22 | 81.61 | 70.54 | 77.84 | 103.61 | 80.39 | 175.07 | 63.11 | 333.49 | 291.01 | 518.42 | 388.46 | 374.74 | 479.13 | 115.26 | 137.98 | 127.43 | 81.01 | 70.57 | 80.39 | 113.16 | 82.67 | 68.10 | 84.30 | NA | NA | NA | |

| Equity Securities Fv Ni | 0.79 | 0.74 | 0.78 | 0.79 | 0.78 | 0.77 | 0.82 | 0.85 | 0.90 | 0.91 | 0.92 | 0.92 | 0.93 | 0.93 | 0.93 | 0.93 | 0.92 | 0.92 | 0.91 | 0.90 | 0.89 | 0.88 | NA | NA | 0.91 | NA | NA | NA |

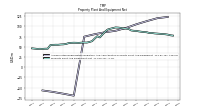

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 122.91 | NA | NA | NA | 119.84 | NA | NA | NA | 112.75 | NA | NA | NA | 105.03 | NA | NA | NA | 95.99 | NA | NA | NA | 89.01 | NA | NA | NA | 85.55 | NA | NA | NA | |

| Amortization Of Intangible Assets | 0.08 | 0.08 | 0.08 | 0.08 | 0.22 | 0.22 | 0.22 | 0.22 | 0.33 | 0.33 | 0.33 | 0.33 | 0.36 | 0.37 | 0.38 | 0.37 | 0.42 | 0.42 | 0.42 | 0.41 | 0.44 | 0.44 | 0.44 | 0.45 | 0.44 | 0.48 | 0.48 | 0.49 | |

| Property Plant And Equipment Net | 79.69 | 80.69 | 81.09 | 81.63 | 82.14 | 82.64 | 83.66 | 83.50 | 85.42 | 85.95 | 86.60 | 87.52 | 88.71 | 89.02 | 89.93 | 93.60 | 94.36 | 94.86 | 96.05 | 96.86 | 97.20 | 95.64 | 93.99 | 92.14 | 87.00 | 79.94 | 72.88 | 75.72 | |

| Goodwill | 92.60 | 92.60 | 92.60 | 92.60 | 92.60 | 92.60 | 92.45 | 92.45 | 92.45 | 92.45 | 92.45 | 92.45 | 92.45 | 92.45 | 92.45 | 92.45 | 92.45 | 92.45 | 92.45 | 92.28 | 92.28 | 92.28 | 92.28 | 92.29 | 92.29 | 92.29 | 92.29 | 92.29 | |

| Intangible Assets Net Excluding Goodwill | 2.33 | 2.42 | 2.51 | 2.60 | 2.71 | 2.93 | 3.12 | 3.38 | 3.64 | 3.99 | 4.27 | 4.60 | 4.91 | 5.21 | 5.50 | 5.85 | 6.22 | 6.65 | 7.09 | 7.27 | 7.63 | 7.99 | 8.34 | 8.79 | 9.26 | 9.75 | 10.25 | 10.77 | |

| Finite Lived Intangible Assets Net | 2.33 | NA | NA | NA | 2.71 | NA | NA | NA | 3.64 | NA | NA | NA | 4.91 | NA | NA | NA | 6.22 | NA | NA | NA | 7.63 | NA | NA | NA | 9.26 | NA | NA | NA | |

| Equity Securities Fv Ni | 0.79 | 0.74 | 0.78 | 0.79 | 0.78 | 0.77 | 0.82 | 0.85 | 0.90 | 0.91 | 0.92 | 0.92 | 0.93 | 0.93 | 0.93 | 0.93 | 0.92 | 0.92 | 0.91 | 0.90 | 0.89 | 0.88 | NA | NA | 0.91 | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 44.95 | 59.41 | 49.92 | 45.26 | 50.65 | 53.57 | 37.66 | 22.61 | 2.39 | 2.10 | 0.00 | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.17 | 1.22 | 3.04 | 2.23 | 1.33 | 0.10 | 0.04 | 0.11 | 0.21 | |

| Held To Maturity Securities Fair Value | 267.45 | 252.98 | 262.44 | 267.10 | 261.69 | 258.75 | 274.66 | 280.92 | 282.29 | 268.28 | 154.30 | NA | 0.00 | NA | NA | NA | 0.00 | 142.58 | 143.55 | 140.42 | 139.38 | 138.23 | 137.22 | 137.84 | 140.31 | 142.01 | 141.65 | 142.44 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.67 | 1.11 | 2.45 | NA | NA | NA | NA | NA | NA | 3.93 | 2.99 | 0.95 | 0.02 | 0.04 | 0.04 | 0.05 | 1.20 | 2.08 | 1.77 | 1.11 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 44.95 | 59.41 | 49.92 | 45.26 | 50.65 | 53.57 | 37.66 | 22.61 | 2.39 | 2.10 | 0.00 | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.17 | 1.22 | 3.04 | 2.23 | 1.33 | 0.10 | 0.04 | 0.11 | 0.21 | |

| Held To Maturity Securities Continuous Unrealized Loss Position Fair Value | 267.45 | 252.98 | 262.44 | NA | 261.69 | NA | 274.66 | 280.92 | 119.87 | 115.26 | NA | NA | NA | NA | NA | NA | NA | NA | 1.29 | 40.02 | 138.24 | 128.37 | 132.46 | 134.47 | 25.60 | 6.08 | 13.63 | 32.56 | |

| Held To Maturity Securities Continuous Unrealized Loss Position Twelve Months Or Longer Fair Value | 267.45 | 252.98 | 254.27 | NA | 237.15 | NA | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 35.13 | 125.13 | 4.78 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Held To Maturity Securities Continuous Unrealized Loss Position Less Than Twelve Months Fair Value | 0.00 | 0.00 | 8.18 | NA | 24.54 | NA | 274.66 | 280.92 | 119.87 | 115.26 | NA | NA | NA | NA | NA | NA | NA | NA | 1.29 | 4.88 | 13.11 | 123.59 | 132.46 | 134.47 | 25.60 | 6.08 | 13.63 | 32.56 | |

| Held To Maturity Securities Debt Maturities After Five Through Ten Years Fair Value | 267.45 | 252.98 | 262.44 | 267.10 | 261.69 | 258.75 | 274.66 | 280.92 | 282.29 | 268.28 | 154.30 | NA | NA | NA | NA | NA | NA | 26.34 | 31.25 | 45.95 | 44.90 | 49.05 | 54.30 | 69.69 | 82.11 | 92.75 | 102.92 | 102.32 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | 891.72 | NA | NA | NA | 443.50 | NA | NA | NA | 507.31 | NA | NA | NA | 565.52 | NA | NA | NA | 466.48 | NA | NA | NA | 477.07 | NA | NA | NA | 572.49 | NA | NA | NA | |

| Deposits | 6399.85 | 6623.44 | 6454.65 | 6509.01 | 6602.30 | 6936.73 | 6769.52 | 7016.74 | 6791.44 | 7090.90 | 6837.00 | 6946.54 | 6437.75 | 6601.24 | 6377.52 | 5409.36 | 5212.92 | 5369.99 | 4988.90 | 4989.93 | 4888.96 | 5025.08 | 4792.23 | 4929.90 | 4837.81 | 4943.94 | 4750.72 | 4850.59 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Minority Interest | 1.41 | 1.50 | 1.47 | 1.44 | 1.41 | 1.51 | 1.48 | 1.44 | 1.41 | 1.51 | 1.47 | 1.44 | 1.41 | 1.51 | 1.48 | 1.44 | 1.41 | 1.51 | 1.48 | 1.44 | 1.41 | 1.51 | 1.48 | 1.44 | 1.42 | 1.52 | 1.49 | 1.45 |

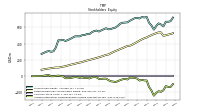

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 668.52 | 610.85 | 634.97 | 648.32 | 615.98 | 571.45 | 622.84 | 656.05 | 727.53 | 720.85 | 726.78 | 708.49 | 716.28 | 712.10 | 696.55 | 681.15 | 661.64 | 658.36 | 656.20 | 645.82 | 619.46 | 597.64 | 589.17 | 577.97 | 574.78 | 588.35 | 575.43 | 562.06 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 669.93 | 612.36 | 636.44 | 649.76 | 617.39 | 572.96 | 624.32 | 657.49 | 728.94 | 722.36 | 728.25 | 709.94 | 717.69 | 713.61 | 698.03 | 682.60 | 663.05 | 659.87 | 657.68 | 647.27 | 620.87 | 599.14 | 590.65 | 579.41 | 576.20 | 589.87 | 576.91 | 563.52 | |

| Common Stock Value | 1.44 | 1.44 | 1.44 | 1.46 | 1.46 | 1.45 | 1.45 | 1.46 | 1.47 | 1.47 | 1.49 | 1.49 | 1.50 | 1.50 | 1.50 | 1.49 | 1.50 | 1.50 | 1.52 | 1.53 | 1.53 | 1.53 | 1.53 | 1.53 | 1.53 | 1.52 | 1.52 | 1.52 | |

| Additional Paid In Capital Common Stock | 297.18 | 296.72 | 298.13 | 303.36 | 302.76 | 303.43 | 303.33 | 305.88 | 312.54 | 315.96 | 327.88 | 333.25 | 333.98 | 337.33 | 335.27 | 333.66 | 338.51 | 341.65 | 355.28 | 367.25 | 366.60 | 367.67 | 367.12 | 366.67 | 364.03 | 364.15 | 362.56 | 361.20 | |

| Retained Earnings Accumulated Deficit | 501.51 | 495.12 | 537.10 | 537.33 | 526.73 | 515.87 | 502.77 | 490.20 | 475.26 | 464.15 | 450.77 | 435.99 | 418.41 | 402.50 | 386.02 | 372.34 | 370.48 | 357.17 | 344.51 | 332.78 | 319.40 | 308.12 | 294.55 | 279.83 | 265.01 | 259.74 | 249.18 | 239.08 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -125.00 | -176.03 | -195.52 | -187.85 | -208.69 | -243.24 | -178.87 | -135.85 | -55.95 | -55.09 | -47.88 | -56.95 | -32.07 | -23.86 | -21.05 | -21.27 | -43.56 | -36.85 | -40.17 | -50.95 | -63.16 | -74.94 | -69.44 | -65.62 | -51.30 | -32.72 | -33.62 | -35.68 | |

| Minority Interest | 1.41 | 1.50 | 1.47 | 1.44 | 1.41 | 1.51 | 1.48 | 1.44 | 1.41 | 1.51 | 1.47 | 1.44 | 1.41 | 1.51 | 1.48 | 1.44 | 1.41 | 1.51 | 1.48 | 1.44 | 1.41 | 1.51 | 1.48 | 1.44 | 1.42 | 1.52 | 1.49 | 1.45 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 1.16 | 0.79 | 1.11 | 1.04 | 1.28 | 1.09 | 1.03 | 0.94 | 1.30 | 1.41 | 1.26 | 1.18 | 1.36 | 1.08 | 1.11 | 1.18 | 1.23 | 1.00 | 1.03 | 0.98 | 0.97 | 0.81 | 0.84 | 0.85 | 0.84 | 0.71 | 0.70 | 0.71 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 18.93 | 25.32 | 21.99 | 22.76 | 21.02 | 30.81 | 27.60 | 23.92 | 29.82 | 40.86 | 20.24 | 30.26 | 40.07 | 18.23 | 18.94 | 24.14 | 27.41 | 28.20 | 29.57 | 16.44 | 39.67 | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -146.93 | -39.89 | 11.44 | 29.08 | 107.10 | 24.02 | -91.67 | -47.89 | 4.07 | -103.36 | -102.84 | -381.17 | 171.83 | -312.20 | -464.91 | -38.44 | -86.57 | 68.22 | 104.38 | 47.95 | -43.17 | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | 67.33 | 73.17 | -22.36 | -59.14 | -153.89 | -31.60 | -30.61 | 135.94 | -304.28 | 104.97 | -144.81 | 480.88 | -198.17 | 189.58 | 809.83 | -8.42 | 69.72 | -50.01 | -123.52 | -74.20 | -29.28 | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 18.93 | 25.32 | 21.99 | 22.76 | 21.02 | 30.81 | 27.60 | 23.92 | 29.82 | 40.86 | 20.24 | 30.26 | 40.07 | 18.23 | 18.94 | 24.14 | 27.41 | 28.20 | 29.57 | 16.44 | 39.67 | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 15.00 | -33.35 | 8.47 | 19.38 | 19.55 | 21.34 | 20.87 | 23.27 | 19.46 | 21.34 | 22.83 | 25.63 | 23.98 | 24.23 | 21.43 | 7.95 | 21.08 | 20.21 | 19.39 | 21.04 | 18.91 | 20.90 | 22.06 | 20.44 | 2.46 | 17.39 | 16.93 | 15.72 | |

| Profit Loss | 15.03 | -33.32 | 8.51 | 19.41 | 19.58 | 21.37 | 20.90 | 23.30 | 19.50 | 21.37 | 22.86 | 25.66 | 24.03 | 24.26 | 21.46 | 7.99 | 21.11 | 20.24 | 19.42 | 21.07 | 18.94 | 20.93 | 22.09 | 20.47 | 2.49 | 17.43 | 16.96 | 15.75 | |

| Increase Decrease In Other Operating Capital Net | 1.66 | 7.83 | -0.32 | 0.99 | 3.63 | -1.62 | -2.16 | 4.29 | 2.07 | -3.65 | 9.05 | 3.76 | -9.54 | 9.04 | -12.52 | 5.74 | 3.98 | -1.73 | -3.06 | 8.92 | -8.30 | -5.41 | 4.38 | 5.86 | -5.07 | 5.14 | -3.70 | 4.69 | |

| Share Based Compensation | 1.16 | 0.79 | 1.11 | 1.04 | 1.28 | 1.09 | 1.03 | 0.94 | 1.30 | 1.41 | 1.26 | 1.18 | 1.36 | 1.08 | 1.11 | 1.18 | 1.23 | 1.00 | 1.03 | 0.98 | 0.97 | 0.81 | 0.84 | 0.85 | 0.84 | 0.71 | 0.70 | 0.71 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -146.93 | -39.89 | 11.44 | 29.08 | 107.10 | 24.02 | -91.67 | -47.89 | 4.07 | -103.36 | -102.84 | -381.17 | 171.83 | -312.20 | -464.91 | -38.44 | -86.57 | 68.22 | 104.38 | 47.95 | -43.17 | NA | NA | NA | NA | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 1.45 | 1.96 | 1.94 | 1.41 | 1.98 | 1.41 | 4.75 | 0.03 | 1.43 | 1.36 | 1.14 | 0.81 | 1.66 | 1.03 | 0.95 | 0.91 | 1.97 | 1.32 | 1.08 | 1.64 | 3.70 | 3.47 | 3.78 | 7.13 | 12.08 | 8.07 | 7.74 | 7.40 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 67.33 | 73.17 | -22.36 | -59.14 | -153.89 | -31.60 | -30.61 | 135.94 | -304.28 | 104.97 | -144.81 | 480.88 | -198.17 | 189.58 | 809.83 | -8.42 | 69.72 | -50.01 | -123.52 | -74.20 | -29.28 | NA | NA | NA | NA | NA | NA | NA | |

| Payments Of Dividends Common Stock | 8.47 | 8.62 | 8.71 | 8.71 | 8.69 | 8.24 | 8.30 | 8.34 | 8.36 | 7.96 | 8.05 | 8.05 | 8.06 | 7.76 | 7.75 | 7.79 | 7.77 | 7.55 | 7.66 | 7.66 | 7.64 | 7.33 | 7.34 | 7.33 | 7.15 | 6.84 | 6.83 | 6.82 | |

| Payments For Repurchase Of Common Stock | 0.02 | 2.33 | 6.38 | 0.00 | 0.00 | 1.30 | 3.76 | 10.37 | 2.60 | 13.19 | 6.47 | 1.51 | 3.79 | 0.00 | 0.00 | 5.62 | 2.88 | 14.71 | 12.28 | 0.00 | 1.24 | 0.00 | 0.00 | 1.21 | 0.00 | 0.00 | 0.00 | 0.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 17.16 | 20.67 | 18.40 | 18.80 | 16.91 | 20.14 | 18.05 | 18.87 | 17.69 | 19.43 | 17.49 | 17.99 | 16.72 | 17.36 | 14.94 | 16.73 | 15.90 | 17.74 | 16.70 | 17.22 | 16.52 | 16.82 | 16.39 | 16.23 | 15.62 | 16.14 | 15.95 | 15.39 | |

| Card Services Income | 2.86 | 2.86 | 3.09 | 2.68 | 2.79 | 2.73 | 2.96 | 2.54 | 2.77 | 2.72 | 2.95 | 2.38 | 2.38 | 2.42 | 2.28 | 2.18 | 2.44 | 2.55 | 2.75 | 2.79 | 2.48 | 2.44 | 2.62 | 2.15 | 2.23 | 2.19 | 2.68 | 2.01 | |

| Other Non Interest Income | 0.34 | 0.31 | 0.33 | 0.35 | 0.33 | 0.33 | 0.31 | 0.32 | 0.32 | 0.29 | 0.30 | 0.30 | 0.31 | 0.28 | 0.24 | 0.31 | 0.30 | 0.31 | 0.27 | 0.31 | 0.29 | 0.29 | 0.28 | 0.31 | 0.28 | 0.28 | 0.24 | 0.30 | |

| Service Charges On Deposit Accounts | 1.77 | 1.75 | 1.64 | 1.75 | 1.91 | 1.92 | 1.76 | 1.78 | 1.77 | 1.64 | 1.47 | 1.47 | 1.64 | 1.44 | 1.25 | 1.98 | 2.11 | 2.19 | 2.02 | 2.00 | 2.13 | 2.09 | 2.08 | 2.13 | 2.10 | 2.12 | 2.04 | 2.17 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 17.16 | 20.67 | 18.40 | 18.80 | 16.91 | 20.14 | 18.05 | 18.87 | 17.69 | 19.43 | 17.49 | 17.99 | 16.72 | 17.36 | 14.94 | 16.73 | 15.90 | 17.74 | 16.70 | 17.22 | 16.52 | 16.82 | 16.39 | 16.23 | 15.62 | 16.14 | 15.95 | 15.39 | |

| Card Services Income | 2.86 | 2.86 | 3.09 | 2.68 | 2.79 | 2.73 | 2.96 | 2.54 | 2.77 | 2.72 | 2.95 | 2.38 | 2.38 | 2.42 | 2.28 | 2.18 | 2.44 | 2.55 | 2.75 | 2.79 | 2.48 | 2.44 | 2.62 | 2.15 | 2.23 | 2.19 | 2.68 | 2.01 | |

| Other Non Interest Income | 0.34 | 0.31 | 0.33 | 0.35 | 0.33 | 0.33 | 0.31 | 0.32 | 0.32 | 0.29 | 0.30 | 0.30 | 0.31 | 0.28 | 0.24 | 0.31 | 0.30 | 0.31 | 0.27 | 0.31 | 0.29 | 0.29 | 0.28 | 0.31 | 0.28 | 0.28 | 0.24 | 0.30 | |

| Service Charges On Deposit Accounts | 1.77 | 1.75 | 1.64 | 1.75 | 1.91 | 1.92 | 1.76 | 1.78 | 1.77 | 1.64 | 1.47 | 1.47 | 1.64 | 1.44 | 1.25 | 1.98 | 2.11 | 2.19 | 2.02 | 2.00 | 2.13 | 2.09 | 2.08 | 2.13 | 2.10 | 2.12 | 2.04 | 2.17 |