| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 355.64 | 355.60 | 355.60 | 355.60 | 355.03 | 354.75 | 354.62 | 354.46 | 353.40 | 335.42 | 335.41 | 335.34 | 334.52 | 334.31 | 334.29 | 264.21 | 263.74 | 263.66 | 263.53 | 263.50 | 263.10 | 263.07 | 263.02 | 262.95 | 262.68 | 262.53 | 262.44 | |

| Weighted Average Number Of Diluted Shares Outstanding | 134.99 | 134.89 | 134.85 | 134.84 | 134.80 | 134.55 | 134.86 | 136.44 | 131.30 | 128.96 | 129.03 | 128.89 | 129.48 | 129.45 | 119.89 | 101.40 | 101.54 | 101.71 | 102.05 | 102.16 | 103.16 | 103.93 | 104.95 | 105.16 | 105.12 | 105.07 | 99.62 | |

| Weighted Average Number Of Shares Outstanding Basic | 134.69 | 134.69 | 134.68 | 134.41 | 134.27 | 134.18 | 134.62 | 136.06 | 130.94 | 128.76 | 128.75 | 128.64 | 129.37 | 129.37 | 119.82 | 101.30 | 101.25 | 101.43 | 101.77 | 101.89 | 102.93 | 103.62 | 104.68 | 104.86 | 104.81 | 104.76 | 99.20 | |

| Earnings Per Share Basic | 0.59 | 0.71 | 0.68 | 0.73 | 0.74 | 0.76 | 0.71 | 0.60 | 0.56 | 0.71 | 0.73 | 0.83 | 0.71 | 0.80 | 0.44 | 0.40 | 0.62 | 0.65 | 0.66 | 0.62 | 0.62 | 0.62 | 0.63 | 0.59 | 0.17 | 0.54 | 0.37 | |

| Earnings Per Share Diluted | 0.59 | 0.71 | 0.68 | 0.73 | 0.74 | 0.76 | 0.71 | 0.60 | 0.56 | 0.71 | 0.73 | 0.83 | 0.71 | 0.80 | 0.44 | 0.40 | 0.62 | 0.65 | 0.66 | 0.62 | 0.62 | 0.62 | 0.63 | 0.59 | 0.17 | 0.54 | 0.37 |

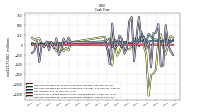

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Interest And Fee Income Loans And Leases | 320.73 | 308.20 | 294.36 | 279.90 | 262.08 | 225.50 | 196.16 | 180.84 | 176.38 | 176.69 | 182.74 | 188.67 | 191.40 | 192.27 | 179.31 | 158.85 | 161.80 | 165.15 | 175.13 | 164.87 | 164.27 | 164.23 | 159.29 | 148.93 | 159.88 | 155.82 | 140.90 | |

| Interest Expense | 139.49 | 128.46 | 118.47 | 94.98 | 58.34 | 23.06 | 12.87 | 11.29 | 11.52 | 12.50 | 13.67 | 14.70 | 16.93 | 24.61 | 28.11 | 38.96 | 42.59 | 48.43 | 48.69 | 44.93 | 40.80 | 36.26 | 28.88 | 23.14 | 21.66 | 21.31 | 18.70 | |

| Interest Expense Long Term Debt | 15.36 | 17.86 | 25.41 | 25.23 | 13.20 | 4.91 | 2.88 | 2.55 | 2.53 | 2.53 | 2.48 | 2.53 | 2.60 | 6.71 | 8.67 | 11.03 | 10.89 | 11.53 | 12.63 | 11.60 | 9.65 | 9.27 | 9.34 | 7.06 | 6.79 | 6.65 | 5.70 | |

| Interest Income Expense Net | 229.69 | 228.45 | 227.46 | 234.32 | 249.40 | 240.62 | 214.90 | 191.50 | 183.68 | 181.58 | 186.52 | 190.96 | 191.99 | 185.66 | 170.60 | 141.52 | 141.28 | 141.92 | 150.55 | 144.17 | 146.71 | 148.78 | 149.12 | 144.04 | 154.86 | 150.28 | 136.25 | |

| Allocated Share Based Compensation Expense | 3.31 | 3.15 | 3.29 | 2.71 | 2.81 | 2.46 | 2.54 | 2.06 | 2.53 | 1.91 | 1.89 | 1.69 | 1.99 | 1.37 | 1.37 | 1.25 | 1.41 | 1.19 | 1.20 | 1.11 | 1.06 | 1.02 | 1.99 | 0.97 | 0.97 | 0.91 | 1.00 | |

| Income Tax Expense Benefit | 24.81 | 24.78 | 23.45 | 24.45 | 26.61 | 25.92 | 23.53 | 20.10 | 19.49 | 23.60 | 24.45 | 27.57 | 20.83 | 28.97 | 11.02 | 9.89 | 12.47 | 17.01 | 17.53 | 17.33 | 15.76 | 17.93 | 19.24 | 17.90 | 66.89 | 27.84 | 19.30 | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | -11.99 | 2.65 | 3.44 | -7.16 | -1.70 | 12.29 | 8.40 | 17.67 | 2.68 | 1.38 | -6.04 | 14.99 | 3.95 | 0.68 | -1.27 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 79.39 | 96.16 | 92.46 | 98.31 | 99.77 | 102.58 | 95.61 | 81.66 | 73.85 | 92.15 | 94.84 | 106.90 | 92.37 | 103.78 | 52.69 | 40.18 | 63.28 | 65.97 | 67.21 | 63.64 | 63.95 | 64.41 | 66.27 | 61.71 | 17.98 | 56.74 | 37.06 | |

| Comprehensive Income Net Of Tax | 169.16 | 57.38 | 75.91 | 136.91 | 119.34 | -2.36 | -10.05 | -55.14 | 70.20 | 80.39 | 103.50 | 86.39 | 93.39 | 113.63 | 80.36 | 58.88 | 44.20 | 70.55 | 86.11 | 81.34 | 83.59 | 57.75 | 60.83 | 45.67 | 10.11 | 59.42 | 40.86 | |

| Net Income Loss Available To Common Stockholders Basic | 79.21 | 95.93 | 92.24 | 98.06 | 99.50 | 102.31 | 95.36 | 81.45 | 73.65 | 91.89 | 94.56 | 106.60 | 92.14 | 103.52 | 52.56 | 40.06 | 63.14 | 65.81 | 67.05 | 63.50 | 63.83 | 64.29 | 66.15 | 61.60 | 17.95 | 56.65 | 37.00 | |

| Interest Income Expense After Provision For Loan Loss | 222.81 | 222.50 | 216.02 | 227.43 | 233.04 | 232.95 | 216.71 | 194.91 | 191.08 | 189.41 | 195.40 | 190.82 | 175.24 | 168.88 | 124.69 | 114.40 | 135.42 | 136.88 | 145.14 | 139.17 | 140.88 | 143.97 | 142.92 | 138.87 | 147.88 | 143.00 | 127.99 | |

| Noninterest Expense | 152.29 | 135.23 | 135.29 | 137.42 | 137.54 | 137.20 | 141.17 | 139.17 | 151.79 | 142.28 | 138.95 | 148.93 | 156.12 | 171.59 | 149.37 | 101.13 | 96.90 | 96.13 | 100.19 | 89.42 | 91.00 | 93.31 | 93.41 | 90.45 | 95.78 | 96.65 | 112.14 | |

| Noninterest Income | 33.67 | 33.66 | 35.18 | 32.74 | 30.88 | 32.75 | 43.61 | 46.02 | 54.05 | 68.62 | 62.85 | 92.57 | 94.08 | 135.47 | 88.39 | 36.81 | 37.24 | 42.22 | 39.80 | 31.22 | 20.18 | 31.69 | 36.01 | 31.19 | 17.02 | 38.23 | 40.51 |

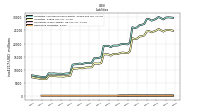

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 29926.48 | 29224.79 | 29694.65 | 30182.24 | 29489.38 | 29048.47 | 28777.90 | 29365.51 | 29328.90 | 27507.52 | 27190.93 | 27030.76 | 26184.25 | 25931.31 | 26234.97 | 20370.65 | 19662.32 | 19751.46 | 19882.54 | 19645.13 | 19250.50 | 19187.64 | 19207.60 | 18619.70 | 19058.96 | 19129.98 | 19035.60 | |

| Liabilities | 25155.24 | 24575.92 | 25057.61 | 25575.70 | 24973.19 | 24608.39 | 24290.85 | 24770.37 | 24610.27 | 23076.75 | 22797.21 | 22698.06 | 21886.63 | 21663.87 | 22037.12 | 17026.95 | 16298.49 | 16397.12 | 16548.68 | 16358.24 | 15998.87 | 15936.51 | 15965.04 | 15368.39 | 15818.43 | 15866.14 | 15798.18 | |

| Liabilities And Stockholders Equity | 29926.48 | 29224.79 | 29694.65 | 30182.24 | 29489.38 | 29048.47 | 28777.90 | 29365.51 | 29328.90 | 27507.52 | 27190.93 | 27030.76 | 26184.25 | 25931.31 | 26234.97 | 20370.65 | 19662.32 | 19751.46 | 19882.54 | 19645.13 | 19250.50 | 19187.64 | 19207.60 | 18619.70 | 19058.96 | 19129.98 | 19035.60 | |

| Stockholders Equity | 4771.24 | 4648.88 | 4637.04 | 4606.54 | 4516.19 | 4440.09 | 4487.05 | 4595.14 | 4718.63 | 4430.77 | 4393.71 | 4332.70 | 4297.62 | 4267.44 | 4197.85 | 3343.70 | 3363.83 | 3354.34 | 3333.86 | 3286.89 | 3251.62 | 3251.13 | 3242.57 | 3251.31 | 3240.53 | 3263.84 | 3237.42 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 1598.94 | 1184.05 | 1692.36 | 1918.69 | 1176.65 | 1356.35 | 1658.49 | 2803.09 | 3758.17 | 4033.56 | 3677.40 | 2963.14 | 2209.07 | NA | NA | NA | 837.49 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

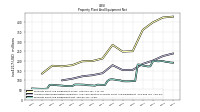

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 428.61 | NA | NA | NA | 424.06 | NA | NA | NA | 398.73 | NA | NA | NA | 360.27 | NA | NA | NA | 250.01 | NA | NA | NA | 247.74 | NA | NA | NA | 282.80 | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 238.09 | NA | NA | NA | 224.90 | NA | NA | NA | 201.51 | NA | NA | NA | 184.45 | NA | NA | NA | 153.37 | NA | NA | NA | 152.49 | NA | NA | NA | 177.91 | NA | NA | |

| Property Plant And Equipment Net | 190.52 | 191.66 | 194.30 | 195.57 | 199.16 | 198.75 | 197.63 | 200.17 | 197.22 | 171.94 | 171.36 | 173.74 | 175.82 | 180.46 | 181.24 | 96.17 | 96.64 | 94.80 | 94.55 | 94.55 | 95.25 | 99.75 | 100.26 | 103.01 | 104.89 | 104.31 | 96.33 | |

| Goodwill | 1888.89 | 1888.89 | 1888.89 | 1888.89 | 1888.89 | 1888.89 | 1888.89 | 1889.24 | 1886.49 | 1810.04 | 1810.04 | 1804.04 | 1796.85 | 1794.89 | 1794.78 | 1478.01 | 1478.01 | 1478.01 | 1478.01 | 1478.01 | 1478.01 | 1478.01 | 1478.01 | 1478.58 | 1478.38 | 1487.61 | 1485.11 | |

| Held To Maturity Securities Fair Value | 1.02 | 1.02 | 1.02 | 1.02 | 1.02 | 0.02 | 0.02 | 0.02 | 1.02 | 1.02 | 1.02 | 1.02 | 1.21 | 1.21 | 1.22 | 1.22 | 1.45 | 1.47 | 6.48 | 8.55 | 18.66 | 19.62 | 19.71 | 20.01 | 20.02 | 19.91 | 20.01 | |

| Held To Maturity Securities | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 0.99 | 0.99 | 1.00 | 1.21 | 1.21 | 1.22 | 1.23 | 1.45 | 1.47 | 6.46 | 8.49 | 20.00 | 20.35 | 20.38 | 20.41 | 20.43 | 20.34 | 20.40 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deposits | 22819.32 | 22676.85 | 22369.75 | 22284.59 | 22303.17 | 22863.38 | 23026.65 | 23474.30 | 23350.26 | 21822.61 | 21567.39 | 21396.47 | 20585.16 | 20251.54 | 19893.84 | 14014.17 | 13852.42 | 14095.41 | 14404.08 | 14159.40 | 13994.75 | 14091.17 | 13830.77 | 13646.17 | 13830.59 | 13875.30 | 13971.22 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 1789.10 | 1110.56 | 1910.63 | 2510.70 | 2197.66 | 1010.85 | 510.92 | 531.62 | 817.39 | 532.78 | 533.37 | 533.95 | 864.37 | 645.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

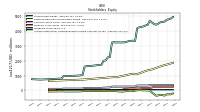

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 4771.24 | 4648.88 | 4637.04 | 4606.54 | 4516.19 | 4440.09 | 4487.05 | 4595.14 | 4718.63 | 4430.77 | 4393.71 | 4332.70 | 4297.62 | 4267.44 | 4197.85 | 3343.70 | 3363.83 | 3354.34 | 3333.86 | 3286.89 | 3251.62 | 3251.13 | 3242.57 | 3251.31 | 3240.53 | 3263.84 | 3237.42 | |

| Common Stock Value | 355.64 | 355.60 | 355.60 | 355.60 | 355.03 | 354.75 | 354.62 | 354.46 | 353.40 | 335.42 | 335.41 | 335.34 | 334.52 | 334.31 | 334.29 | 264.21 | 263.74 | 263.66 | 263.53 | 263.50 | 263.10 | 263.07 | 263.02 | 262.95 | 262.68 | 262.53 | 262.44 | |

| Additional Paid In Capital Common Stock | 3181.76 | 3178.53 | 3175.28 | 3171.89 | 3168.87 | 3163.78 | 3159.93 | 3156.10 | 3149.95 | 2903.58 | 2901.59 | 2898.81 | 2894.47 | 2891.75 | 2890.39 | 2141.27 | 2140.18 | 2138.24 | 2137.46 | 2135.82 | 2134.46 | 2133.16 | 2131.70 | 2130.09 | 2129.08 | 2126.91 | 2125.36 | |

| Retained Earnings Accumulated Deficit | 1745.62 | 1716.30 | 1668.84 | 1625.01 | 1575.43 | 1524.27 | 1470.24 | 1423.17 | 1390.78 | 1363.49 | 1316.61 | 1267.04 | 1205.39 | 1158.47 | 1100.10 | 1092.83 | 1132.58 | 1104.84 | 1073.39 | 1040.87 | 1013.04 | 984.06 | 954.95 | 924.26 | 891.82 | 909.56 | 887.46 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -259.68 | -349.46 | -310.68 | -294.13 | -332.73 | -352.30 | -247.36 | -141.69 | -4.89 | -1.24 | 10.52 | 1.86 | 22.37 | 21.35 | 11.50 | -16.17 | -34.87 | -15.78 | -20.37 | -39.27 | -57.02 | -76.66 | -70.00 | -64.55 | -42.02 | -34.16 | -36.85 | |

| Treasury Stock Value | 252.11 | 252.10 | 252.01 | 251.84 | 250.40 | 250.40 | 250.38 | 196.90 | 170.62 | 170.48 | 170.42 | 170.35 | 159.14 | 138.43 | 138.43 | 138.43 | 137.79 | 136.61 | 120.16 | 114.03 | 101.95 | 52.50 | 37.11 | 1.44 | 1.01 | 0.99 | 0.99 |

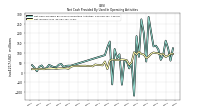

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 162.58 | 89.57 | 64.94 | 118.15 | 137.05 | 133.75 | 206.41 | 283.61 | 56.34 | 201.24 | 271.38 | 80.58 | 185.78 | -117.44 | 50.62 | 21.48 | 56.74 | 59.17 | -61.46 | 93.25 | 73.76 | 120.27 | -59.99 | 158.48 | 128.78 | 89.23 | NA | |

| Net Cash Provided By Used In Investing Activities | -249.63 | -68.03 | 265.21 | 91.43 | -629.01 | -740.40 | -774.65 | -1303.60 | -233.71 | -44.39 | 332.74 | -38.98 | 162.22 | 132.67 | -34.95 | -122.36 | -92.20 | -109.49 | -1.43 | -175.92 | -279.28 | 126.27 | -531.51 | -186.99 | -117.77 | 205.15 | NA | |

| Net Cash Provided By Used In Financing Activities | 501.94 | -529.85 | -556.49 | 532.45 | 312.27 | 304.50 | -576.37 | 64.91 | -98.02 | 199.32 | 110.14 | 712.47 | 204.53 | -421.51 | 710.31 | 600.22 | -103.20 | -227.10 | 143.81 | 234.94 | -28.78 | -84.78 | 545.25 | -498.49 | -91.87 | 41.65 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 162.58 | 89.57 | 64.94 | 118.15 | 137.05 | 133.75 | 206.41 | 283.61 | 56.34 | 201.24 | 271.38 | 80.58 | 185.78 | -117.44 | 50.62 | 21.48 | 56.74 | 59.17 | -61.46 | 93.25 | 73.76 | 120.27 | -59.99 | 158.48 | 128.78 | 89.23 | NA | |

| Net Income Loss | 79.39 | 96.16 | 92.46 | 98.31 | 99.77 | 102.58 | 95.61 | 81.66 | 73.85 | 92.15 | 94.84 | 106.90 | 92.37 | 103.78 | 52.69 | 40.18 | 63.28 | 65.97 | 67.21 | 63.64 | 63.95 | 64.41 | 66.27 | 61.71 | 17.98 | 56.74 | 37.06 |

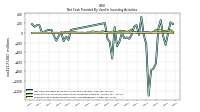

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -249.63 | -68.03 | 265.21 | 91.43 | -629.01 | -740.40 | -774.65 | -1303.60 | -233.71 | -44.39 | 332.74 | -38.98 | 162.22 | 132.67 | -34.95 | -122.36 | -92.20 | -109.49 | -1.43 | -175.92 | -279.28 | 126.27 | -531.51 | -186.99 | -117.77 | 205.15 | NA | |

| Payments To Acquire Property Plant And Equipment | 3.21 | 1.75 | 3.28 | 3.45 | 5.01 | 5.73 | 2.62 | 3.51 | 4.02 | 4.83 | 3.80 | 2.73 | 4.68 | 7.52 | 4.82 | 2.01 | 4.28 | 2.69 | 2.36 | 1.75 | 1.34 | 2.28 | 1.40 | 0.76 | 3.24 | 8.32 | 1.12 |

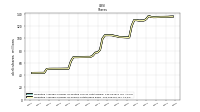

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 501.94 | -529.85 | -556.49 | 532.45 | 312.27 | 304.50 | -576.37 | 64.91 | -98.02 | 199.32 | 110.14 | 712.47 | 204.53 | -421.51 | 710.31 | 600.22 | -103.20 | -227.10 | 143.81 | 234.94 | -28.78 | -84.78 | 545.25 | -498.49 | -91.87 | 41.65 | NA | |

| Payments Of Dividends | 48.72 | 48.74 | 48.62 | 48.65 | 48.56 | 48.54 | 49.29 | 46.66 | 45.29 | 45.27 | 45.27 | 45.45 | 45.42 | 45.43 | 35.62 | 36.25 | 34.52 | 34.69 | 34.76 | 34.97 | 35.30 | 35.59 | 35.75 | 35.71 | 34.65 | 34.62 | 26.78 | |

| Payments For Repurchase Of Common Stock | 0.00 | 0.01 | 0.00 | 1.37 | 0.00 | 0.01 | 53.39 | 26.06 | 0.00 | 0.00 | 0.00 | 11.21 | 20.71 | 0.00 | 0.00 | 0.61 | 1.17 | 16.39 | 6.03 | 12.07 | 49.40 | 15.34 | 35.58 | 0.40 | 0.00 | 0.00 | 0.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Credit Card | 1.92 | 1.68 | 1.71 | 1.71 | 1.67 | 1.86 | 1.67 | 1.38 | 1.58 | 1.47 | 1.37 | 1.06 | 1.13 | 1.23 | 0.72 | 0.99 | 1.15 | 1.26 | 1.10 | 1.16 | 0.78 | 1.55 | 1.48 | 1.36 | 1.36 | 1.33 | 1.22 | |

| Deposit Account | 9.11 | 9.28 | 9.32 | 9.36 | 9.51 | 10.07 | 10.83 | 10.15 | 10.51 | 9.89 | 9.40 | 8.90 | 9.50 | 9.32 | 8.05 | 7.96 | 8.55 | 8.70 | 8.46 | 8.05 | 8.65 | 8.67 | 8.42 | 8.23 | 8.64 | 8.74 | 8.53 | |

| Fiduciary And Trust | 4.36 | 4.43 | 3.92 | 4.20 | 3.73 | 4.02 | 4.12 | 4.55 | 3.70 | 3.88 | 3.65 | 4.32 | 3.12 | 3.07 | 2.65 | 2.92 | 2.47 | 2.38 | 2.77 | 2.52 | -0.20 | 3.35 | 3.10 | 2.22 | -1.14 | 2.97 | 2.86 | |

| Financial Service Other | 0.92 | 0.85 | 0.95 | 1.14 | 0.81 | 0.92 | 0.79 | 0.76 | 0.75 | 0.70 | 0.78 | 0.76 | 0.75 | 0.71 | 0.61 | 0.52 | 0.58 | 0.57 | 0.58 | 0.52 | 0.59 | 0.53 | 0.60 | 0.51 | 0.52 | 0.54 | 0.52 | |

| Mortgage Banking | 4.75 | 7.56 | 7.91 | 6.38 | 4.62 | 6.42 | 12.45 | 19.20 | 27.34 | 42.01 | 36.94 | 65.39 | 70.79 | 109.46 | 68.21 | 17.63 | 17.55 | 24.02 | 21.70 | 13.68 | 11.57 | 13.28 | 18.69 | 14.57 | 15.31 | 20.39 | 22.54 | |

| Service Other | 4.51 | 4.51 | 4.52 | 4.78 | 4.41 | 4.38 | 4.29 | 4.13 | 4.33 | 4.27 | 4.19 | 3.76 | 3.58 | 3.57 | 3.26 | 3.48 | 3.60 | 3.57 | 3.44 | 3.26 | 3.38 | 3.35 | 3.10 | 3.09 | NA | NA | NA |