| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Earnings Per Share Basic | 1.46 | 1.99 | 1.86 | 1.91 | 2.07 | 1.82 | 2.85 | 2.19 | 1.62 | 1.96 | 1.81 | 1.93 | 3.25 | 1.52 | 1.26 | -0.07 | 1.36 | 1.28 | 1.17 | 1.19 | |

| Earnings Per Share Diluted | 1.45 | 1.98 | 1.85 | 1.90 | 2.06 | 1.81 | 2.83 | 2.17 | 1.60 | 1.94 | 1.79 | 1.91 | 3.24 | 1.52 | 1.26 | -0.07 | 1.35 | 1.27 | 1.16 | 1.18 | |

| Tier One Risk Based Capital To Risk Weighted Assets | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | |

| Capital To Risk Weighted Assets | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Interest And Fee Income Loans And Leases | 381.04 | 367.49 | 342.99 | 308.44 | 273.65 | 216.97 | 169.92 | 149.47 | 155.32 | 159.24 | 154.54 | 150.17 | 152.49 | 142.44 | 140.00 | 151.03 | 156.50 | 162.24 | 161.84 | 157.26 | |

| Insurance Commissions And Fees | 0.24 | 0.27 | 0.23 | 0.27 | 0.46 | 0.38 | 0.24 | 0.26 | 0.36 | 0.28 | 0.24 | 0.42 | 0.32 | 0.26 | 0.53 | 0.26 | 0.51 | 0.32 | 0.47 | 0.34 | |

| Gain Loss On Investments | 1.01 | 0.27 | 0.90 | -5.32 | -0.41 | -1.34 | 60.72 | -0.52 | 1.45 | -3.51 | 15.46 | -8.34 | 113.01 | -0.47 | 4.58 | 3.52 | NA | NA | NA | NA | |

| Marketing And Advertising Expense | 6.66 | 6.63 | 7.12 | 5.33 | 8.79 | 6.67 | 5.31 | 4.93 | 6.53 | 4.86 | 4.80 | 2.35 | 3.72 | 3.04 | 3.28 | 4.64 | 8.38 | 5.66 | 7.30 | 4.91 | |

| Interest Expense | 266.08 | 249.69 | 235.77 | 167.05 | 121.65 | 66.85 | 23.78 | 11.44 | 11.01 | 11.56 | 11.56 | 11.86 | 12.62 | 12.63 | 14.54 | 37.47 | 43.46 | 50.84 | 50.25 | 47.44 | |

| Interest Income Expense Net | 230.52 | 222.29 | 225.61 | 241.70 | 245.17 | 233.49 | 224.79 | 210.35 | 210.57 | 209.76 | 201.07 | 194.12 | 194.68 | 184.38 | 178.23 | 173.94 | 172.36 | 168.26 | 166.41 | 163.87 | |

| Interest Paid Net | 266.49 | 206.70 | 206.11 | 165.10 | 104.92 | 60.33 | 18.20 | 13.04 | 9.14 | 13.58 | 10.05 | 14.34 | 11.02 | 13.50 | 17.45 | 42.13 | 43.64 | 50.43 | 55.99 | 39.52 | |

| Income Tax Expense Benefit | 9.88 | 22.63 | 19.91 | 19.16 | 23.67 | 20.82 | 36.04 | 19.79 | 19.87 | 19.34 | 19.91 | 16.92 | 34.79 | 10.29 | 8.12 | -0.81 | 10.75 | 10.62 | 10.47 | 10.53 | |

| Income Taxes Paid Net | 11.96 | 17.72 | 48.15 | 1.51 | 21.90 | 25.27 | 53.99 | 0.80 | 22.97 | 21.61 | 47.38 | 0.62 | 0.75 | 15.92 | 18.93 | -1.53 | 0.19 | 1.45 | 0.62 | -0.01 | |

| Other Comprehensive Income Loss Net Of Tax | 235.44 | -106.54 | -59.05 | 75.96 | 56.52 | -194.46 | -221.68 | -469.44 | -37.99 | -58.80 | 53.91 | -149.14 | 19.24 | 14.84 | 64.87 | 136.21 | -12.84 | 33.40 | 80.26 | 78.14 | |

| Net Income Loss | 70.92 | 96.55 | 90.11 | 92.44 | 100.17 | 87.99 | 137.56 | 105.96 | 78.50 | 94.47 | 87.41 | 92.64 | 156.32 | 73.09 | 60.53 | -3.44 | 66.52 | 62.38 | 56.96 | 57.74 | |

| Comprehensive Income Net Of Tax | 306.36 | -9.99 | 31.05 | 168.40 | 156.70 | -106.47 | -84.12 | -363.48 | 40.50 | 35.67 | 141.32 | -56.50 | 175.56 | 87.93 | 125.40 | 132.77 | 53.67 | 95.79 | 137.22 | 135.89 | |

| Interest Income Expense After Provision For Loan Loss | 230.52 | 217.31 | 212.61 | 218.45 | 236.17 | 211.49 | 211.39 | 216.85 | 202.07 | 214.76 | 177.07 | 201.62 | 189.68 | 168.38 | 156.73 | 85.94 | 170.36 | 160.76 | 155.41 | 151.52 | |

| Noninterest Expense | 289.97 | 231.44 | 240.67 | 237.05 | 237.82 | 231.40 | 214.13 | 214.78 | 222.48 | 208.87 | 201.34 | 200.95 | 226.86 | 198.00 | 208.53 | 188.62 | 203.45 | 191.40 | 193.39 | 190.63 | |

| Noninterest Income | 140.25 | 133.32 | 138.08 | 130.20 | 125.50 | 128.72 | 176.34 | 123.68 | 118.78 | 107.91 | 131.59 | 108.90 | 228.29 | 113.00 | 120.46 | 98.42 | 110.36 | 103.64 | 105.40 | 107.38 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 44011.67 | 41464.68 | 41243.04 | 40607.19 | 38512.46 | 37581.06 | 37507.84 | 40605.74 | 42693.48 | 37554.29 | 36619.01 | 34669.39 | 33127.50 | 30250.97 | 29753.61 | 26244.89 | 26561.35 | 24143.09 | 24016.28 | 23556.76 | |

| Liabilities | 40911.25 | 38658.02 | 38411.41 | 37792.53 | 35845.37 | 35057.52 | 34864.95 | 37857.34 | 39548.06 | 34441.44 | 33528.77 | 31711.15 | 30110.56 | 27396.79 | 26976.21 | 23581.44 | 23954.92 | 21579.23 | 21538.49 | 21205.92 | |

| Liabilities And Stockholders Equity | 44011.67 | 41464.68 | 41243.04 | 40607.19 | 38512.46 | 37581.06 | 37507.84 | 40605.74 | 42693.48 | 37554.29 | 36619.01 | 34669.39 | 33127.50 | 30250.97 | 29753.61 | 26244.89 | 26561.35 | 24143.09 | 24016.28 | 23556.76 | |

| Stockholders Equity | 3100.42 | 2806.66 | 2831.63 | 2814.66 | 2667.09 | 2523.55 | 2642.89 | 2748.41 | 3145.42 | 3112.84 | 3090.24 | 2958.24 | 3016.95 | 2854.18 | 2777.39 | 2663.44 | 2606.44 | 2563.87 | 2477.79 | 2350.84 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 5528.26 | 3927.23 | 3739.62 | 3523.30 | 1557.87 | 2010.52 | 2116.49 | 6686.66 | 9214.56 | 6128.12 | 5451.61 | 4193.53 | 3497.57 | 2019.24 | 2148.60 | 1419.25 | 1669.17 | 792.96 | 1275.62 | 1490.16 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 5528.26 | 3927.23 | 3739.62 | 3523.30 | 1557.87 | 2010.52 | 2116.49 | 6686.66 | 9214.56 | 6128.12 | 5451.61 | 4193.53 | 3497.57 | 2019.24 | 2148.60 | 1419.25 | 1669.17 | 792.96 | 1275.62 | 1490.16 | |

| Land | 41.37 | NA | NA | NA | 41.37 | NA | NA | NA | 41.51 | NA | NA | NA | 42.32 | NA | NA | NA | 42.99 | NA | NA | NA | |

| Machinery And Equipment Gross | 194.17 | NA | NA | NA | 187.21 | NA | NA | NA | 181.22 | NA | NA | NA | 176.02 | NA | NA | NA | 164.03 | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 7068.61 | 6330.70 | 6668.61 | 6907.90 | 7006.35 | 7128.28 | 7739.22 | 8550.09 | 11976.51 | 11162.69 | 10347.53 | 9753.39 | 9299.69 | 8719.25 | 8483.62 | 7639.45 | 7447.36 | 7411.91 | 7176.35 | 6891.87 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 893.78 | NA | NA | NA | 875.75 | NA | NA | NA | 849.03 | NA | NA | NA | 834.55 | NA | NA | NA | 803.62 | NA | NA | NA | |

| Amortization Of Intangible Assets | 2.05 | 2.12 | 2.12 | 2.30 | 1.65 | 1.09 | 1.23 | 1.07 | 1.11 | 1.11 | 1.16 | 1.38 | 1.60 | 1.52 | 1.66 | 1.73 | 1.59 | 1.33 | 1.25 | 1.33 | |

| Property Plant And Equipment Net | 241.70 | 249.04 | 255.13 | 260.62 | 263.65 | 260.69 | 257.73 | 264.52 | 270.93 | 273.38 | 281.01 | 286.07 | 293.10 | 295.09 | 300.17 | 297.67 | 300.33 | 290.27 | 278.73 | 279.00 | |

| Goodwill | 207.38 | 207.38 | 207.38 | 207.38 | 207.38 | 182.22 | 182.22 | 182.22 | 174.52 | 174.52 | 174.52 | 174.52 | 180.87 | 180.87 | 180.87 | 180.87 | 180.87 | 180.87 | 180.87 | 180.87 | |

| Finite Lived Intangible Assets Net | 71.01 | 73.06 | 75.18 | 76.43 | 78.72 | 13.37 | 14.46 | 15.69 | 14.42 | 15.53 | 16.64 | 17.79 | 21.06 | 22.66 | 24.18 | 25.84 | 27.60 | 17.19 | 12.43 | 13.68 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 529.54 | 882.95 | 606.72 | 522.40 | 598.57 | 758.18 | 464.90 | 209.15 | 41.38 | 32.55 | 29.52 | 38.10 | 14.89 | 10.72 | 9.80 | 3.82 | 35.02 | 15.34 | 33.33 | 56.29 | |

| Held To Maturity Securities Fair Value | 5183.37 | 4856.47 | 5234.24 | 5371.86 | 5280.66 | 5079.81 | 5245.45 | 4393.45 | 1442.39 | 1064.82 | 1065.12 | 1012.13 | 1029.44 | 1099.29 | 1153.83 | 1146.91 | 1082.35 | 1089.48 | 1094.43 | 1122.66 | |

| Held To Maturity Securities | 5691.87 | 5732.58 | 5810.59 | 5861.66 | 5861.60 | 5837.71 | 5709.54 | 4602.23 | 1480.42 | 1089.42 | 1084.01 | 1042.67 | 1014.61 | 1070.31 | 1114.93 | 1114.16 | 1116.10 | 1102.01 | 1112.77 | 1147.95 | |

| Available For Sale Debt Securities Amortized Cost Basis | 7692.86 | 7248.52 | 7434.48 | 7585.60 | 7777.95 | 7992.60 | 8317.50 | 8898.85 | 11822.58 | 10956.85 | 10062.58 | 9552.40 | 8887.73 | 8331.43 | 8116.47 | 7353.18 | 7323.98 | 7273.56 | 7089.13 | 6913.53 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 21.04 | 6.83 | 30.36 | 32.60 | 17.63 | 0.28 | 0.81 | 0.38 | 3.36 | 7.94 | 10.62 | 7.56 | 29.72 | 39.70 | 48.70 | 36.57 | 1.26 | 2.82 | 14.99 | 31.00 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 529.54 | 882.95 | 606.72 | 522.40 | 598.57 | 758.18 | 464.90 | 209.15 | 41.38 | 32.55 | 29.52 | 38.10 | 14.89 | 10.72 | 9.80 | 3.82 | 35.02 | 15.34 | 33.33 | 56.29 | |

| Held To Maturity Securities Continuous Unrealized Loss Position Fair Value | 4683.31 | 4612.83 | 4725.34 | 4795.17 | 4850.76 | 4935.46 | 4999.14 | 4361.69 | 1120.62 | 537.12 | 434.88 | 581.71 | 241.98 | 208.66 | 181.89 | 134.29 | 1018.12 | 738.74 | 972.69 | NA | |

| Held To Maturity Securities Debt Maturities After One Through Five Years Fair Value | 319.38 | 317.45 | 305.89 | 316.81 | 338.15 | 331.53 | 333.27 | 144.82 | 156.93 | 156.12 | 131.84 | 122.78 | 126.90 | 128.33 | 129.45 | 96.18 | 100.30 | 84.00 | 84.89 | 115.80 | |

| Held To Maturity Securities Debt Maturities Within One Year Fair Value | 103.90 | 83.96 | 93.37 | 91.66 | 81.89 | 68.68 | 55.40 | 13.78 | 17.80 | 8.72 | 7.09 | 1.39 | 4.94 | 1.35 | 0.68 | 14.17 | 15.27 | 27.44 | 26.18 | 2.71 | |

| Held To Maturity Securities Continuous Unrealized Loss Position Twelve Months Or Longer Fair Value | 4110.89 | 4077.64 | 4225.28 | 3551.26 | 845.88 | 414.72 | 357.95 | 332.12 | 217.58 | 197.95 | 161.96 | 104.72 | 109.71 | 104.41 | 106.51 | 113.94 | 546.57 | 629.95 | 907.46 | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Less Than Twelve Months Fair Value | 572.42 | 535.19 | 500.06 | 1243.91 | 4004.87 | 4520.74 | 4641.19 | 4029.57 | 903.04 | 339.17 | 272.92 | 476.99 | 132.27 | 104.25 | 75.38 | 20.36 | 471.54 | 108.79 | 65.23 | NA | |

| Held To Maturity Securities Debt Maturities After Five Through Ten Years Fair Value | 817.13 | 757.54 | 805.38 | 800.82 | 704.13 | 618.05 | 654.86 | 579.54 | 481.79 | 498.15 | 490.23 | 413.60 | 435.04 | 476.15 | 454.52 | 425.00 | 386.58 | 372.72 | 380.45 | 376.27 | |

| Held To Maturity Securities Debt Maturities After Ten Years Fair Value | 1561.35 | 1419.84 | 1572.17 | 1593.18 | 1583.42 | 1425.29 | 1325.91 | 1231.11 | 392.17 | 401.82 | 435.96 | 474.36 | 462.57 | 493.46 | 569.18 | 611.56 | 580.20 | 605.33 | 602.90 | 627.88 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deposits | 35792.86 | 33431.75 | 33520.46 | 31931.90 | 32639.13 | 31806.39 | 31486.02 | 34362.57 | 35599.93 | 31235.81 | 30048.47 | 28280.79 | 27051.25 | 24737.91 | 24459.40 | 21175.52 | 21603.24 | 19309.35 | 19400.23 | 19365.22 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 383.25 | 382.77 | 382.28 | 381.80 | 381.31 | 381.54 | 272.50 | 272.04 | 271.54 | 271.05 | 270.56 | 270.07 | 269.60 | 269.04 | 71.00 | 121.58 | 97.49 | 86.95 | 88.57 | 81.61 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 3100.42 | 2806.66 | 2831.63 | 2814.66 | 2667.09 | 2523.55 | 2642.89 | 2748.41 | 3145.42 | 3112.84 | 3090.24 | 2958.24 | 3016.95 | 2854.18 | 2777.39 | 2663.44 | 2606.44 | 2563.87 | 2477.79 | 2350.84 | |

| Additional Paid In Capital Common Stock | 1134.36 | 1128.24 | 1124.98 | 1120.88 | 1125.95 | 1120.49 | 1115.50 | 1109.59 | 1110.52 | 1102.82 | 1098.14 | 1093.67 | 1090.45 | 1085.38 | 1081.71 | 1073.09 | 1073.76 | 1069.51 | 1065.30 | 1060.63 | |

| Retained Earnings Accumulated Deficit | 2810.82 | 2759.41 | 2681.45 | 2609.93 | 2536.09 | 2454.42 | 2384.45 | 2265.13 | 2177.00 | 2116.57 | 2040.13 | 1968.32 | 1891.25 | 1750.39 | 1692.29 | 1646.75 | 1672.44 | 1621.20 | 1573.59 | 1531.40 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -556.93 | -792.37 | -685.83 | -626.78 | -702.74 | -759.26 | -564.80 | -343.13 | 126.31 | 164.31 | 223.11 | 169.20 | 318.34 | 299.10 | 284.26 | 219.39 | 83.18 | 96.02 | 62.62 | -17.64 | |

| Treasury Stock Value | 342.89 | 343.68 | 344.02 | 344.43 | 347.26 | 347.16 | 347.32 | 338.24 | 323.46 | 325.91 | 326.19 | 328.00 | 338.14 | 335.74 | 335.93 | 330.85 | 278.00 | 277.92 | 278.77 | 278.60 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 5.99 | 3.53 | 3.94 | 4.52 | 4.75 | 4.84 | 5.74 | 5.49 | 7.11 | 4.79 | 4.15 | 4.46 | 4.68 | 3.73 | 3.29 | 2.82 | 3.32 | 3.91 | 3.72 | 3.29 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

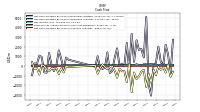

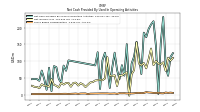

| Net Cash Provided By Used In Operating Activities | 84.98 | 232.22 | 153.71 | 1.70 | 144.44 | 219.30 | 209.76 | 196.05 | 171.72 | 185.10 | 61.32 | 115.94 | 157.97 | 113.95 | 92.33 | 9.36 | 150.91 | 56.55 | 87.76 | 46.20 | |

| Net Cash Provided By Used In Investing Activities | -689.09 | -144.55 | -397.86 | -41.78 | -936.96 | -388.92 | -1705.08 | -814.43 | -2172.59 | -395.17 | -581.14 | -1086.59 | -1347.19 | -670.01 | -2705.01 | 231.12 | -1670.01 | -514.97 | -544.92 | -270.53 | |

| Net Cash Provided By Used In Financing Activities | 2205.14 | 99.94 | 460.46 | 2005.51 | 339.87 | 63.65 | -3074.85 | -1909.52 | 5087.31 | 886.58 | 1777.90 | 1666.62 | 2667.55 | 426.70 | 3342.02 | -490.40 | 2395.31 | -24.24 | 242.62 | 40.36 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 84.98 | 232.22 | 153.71 | 1.70 | 144.44 | 219.30 | 209.76 | 196.05 | 171.72 | 185.10 | 61.32 | 115.94 | 157.97 | 113.95 | 92.33 | 9.36 | 150.91 | 56.55 | 87.76 | 46.20 | |

| Net Income Loss | 70.92 | 96.55 | 90.11 | 92.44 | 100.17 | 87.99 | 137.56 | 105.96 | 78.50 | 94.47 | 87.41 | 92.64 | 156.32 | 73.09 | 60.53 | -3.44 | 66.52 | 62.38 | 56.96 | 57.74 | |

| Increase Decrease In Other Operating Capital Net | 69.71 | -53.93 | -4.40 | 121.54 | -17.50 | -70.31 | -94.40 | -119.01 | -20.62 | -82.90 | 82.06 | -78.10 | 0.92 | 17.33 | 30.83 | 79.01 | -7.37 | 56.47 | 26.75 | 36.45 | |

| Deferred Income Tax Expense Benefit | -9.00 | -0.79 | -6.79 | -3.85 | 0.02 | -6.92 | 1.61 | -1.02 | -9.32 | -4.23 | -9.42 | 10.25 | 11.16 | 0.99 | -5.86 | -11.13 | NA | NA | NA | NA | |

| Share Based Compensation | 5.99 | 3.53 | 3.94 | 5.24 | 4.75 | 4.84 | 5.74 | 6.16 | 7.11 | 4.79 | 4.15 | 5.15 | 4.68 | 3.74 | 3.29 | 3.41 | 3.32 | 3.92 | 3.72 | 3.89 | |

| Amortization Of Financing Costs | 0.22 | 0.22 | 0.22 | 0.22 | 0.22 | 0.11 | 0.11 | 0.11 | 0.11 | 0.11 | 0.11 | 0.11 | 0.11 | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

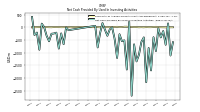

| Net Cash Provided By Used In Investing Activities | -689.09 | -144.55 | -397.86 | -41.78 | -936.96 | -388.92 | -1705.08 | -814.43 | -2172.59 | -395.17 | -581.14 | -1086.59 | -1347.19 | -670.01 | -2705.01 | 231.12 | -1670.01 | -514.97 | -544.92 | -270.53 | |

| Payments To Acquire Property Plant And Equipment | 3.78 | 6.04 | 7.66 | 9.43 | 17.37 | 17.46 | 8.25 | 8.64 | 12.98 | 5.31 | 9.43 | 5.96 | 13.45 | 11.40 | 17.71 | 17.65 | 24.58 | 24.90 | 12.76 | 10.07 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

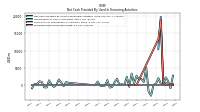

| Net Cash Provided By Used In Financing Activities | 2205.14 | 99.94 | 460.46 | 2005.51 | 339.87 | 63.65 | -3074.85 | -1909.52 | 5087.31 | 886.58 | 1777.90 | 1666.62 | 2667.55 | 426.70 | 3342.02 | -490.40 | 2395.31 | -24.24 | 242.62 | 40.36 | |

| Payments Of Dividends | 18.93 | 18.44 | 18.44 | 18.43 | 18.36 | 17.88 | 17.87 | 17.92 | 17.93 | 17.88 | 15.48 | 15.46 | 15.36 | 14.88 | 14.89 | 15.15 | 15.22 | 14.72 | 14.72 | 14.78 | |

| Dividends | 19.51 | 18.59 | 18.59 | 18.59 | 18.51 | 18.02 | 18.23 | 17.83 | 18.07 | 18.03 | 15.60 | 15.57 | 15.46 | 14.99 | 14.99 | 15.21 | 15.28 | 14.77 | 14.77 | 14.77 | |

| Payments For Repurchase Of Common Stock | 0.27 | 0.19 | 0.00 | 7.90 | 0.19 | 0.00 | 9.32 | 22.49 | 1.24 | 0.18 | 0.06 | 4.03 | 4.20 | 0.11 | 0.07 | 59.39 | 0.16 | 0.22 | 0.03 | 4.09 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Brokerage Fees, Commercial Banking | 0.18 | 0.07 | 0.07 | 0.06 | 0.06 | 0.07 | 0.07 | 0.03 | 0.02 | 0.02 | 0.01 | 0.06 | 0.06 | 0.07 | 0.06 | 0.06 | 0.06 | 0.05 | 0.06 | 0.05 | |

| Brokerage Fees, Institutional Banking | 11.56 | 11.35 | 11.69 | 11.79 | 11.40 | 11.90 | 10.35 | 1.48 | 1.23 | 0.85 | 0.67 | 1.32 | 1.89 | 2.77 | 3.82 | 7.59 | 6.73 | 6.05 | 5.03 | 5.42 | |

| Brokerage Fees, Personal Banking | 1.70 | 1.98 | 1.85 | 1.82 | 1.87 | 1.87 | 1.97 | 1.94 | 2.10 | 2.03 | 1.91 | 1.95 | 1.97 | 1.98 | 1.87 | 2.21 | 2.05 | 2.00 | 2.00 | 1.77 | |

| Insurance Fees And Commissions, Personal Banking | 0.24 | 0.27 | 0.23 | 0.27 | 0.46 | 0.38 | 0.24 | 0.26 | 0.36 | 0.28 | 0.24 | 0.42 | 0.32 | 0.26 | 0.53 | 0.26 | 0.51 | 0.32 | 0.47 | 0.34 | |

| Other Financial Services, Commercial Banking | 0.15 | 0.22 | 0.17 | 0.23 | 0.21 | 0.20 | 0.23 | 0.16 | 0.18 | 0.21 | 0.20 | 0.23 | 0.24 | 0.24 | 0.16 | 0.40 | 0.28 | 0.29 | 0.29 | 0.34 | |

| Other Financial Services, Institutional Banking | 1.02 | 0.84 | 0.52 | 0.46 | 0.43 | 0.48 | 0.48 | 0.42 | 0.41 | 0.40 | 0.41 | 0.40 | 0.39 | 0.36 | 0.37 | 0.44 | 0.37 | 0.38 | 0.38 | 0.34 | |

| Other Financial Services, Personal Banking | 0.61 | 0.65 | 0.61 | 0.70 | 0.57 | 0.69 | 0.69 | 0.69 | 0.71 | 0.67 | 0.65 | 0.67 | 0.63 | 0.65 | 0.61 | 0.71 | 0.72 | 0.75 | 0.84 | 0.87 | |

| Trading And Investment Banking, Institutional Banking | -0.13 | 0.12 | 0.15 | 0.16 | 0.14 | -0.04 | 0.06 | 0.15 | 0.04 | 0.13 | 0.32 | 0.30 | 0.00 | 0.07 | 0.02 | 0.66 | 0.08 | 0.40 | 0.13 | 0.13 | |

| Credit Card, Commercial Banking | 16.04 | 16.76 | 16.87 | 15.63 | 15.55 | 16.66 | 15.76 | 13.97 | 14.42 | 15.13 | 14.33 | 12.37 | 12.90 | 12.95 | 10.91 | 14.99 | 15.12 | 15.55 | 15.21 | 14.49 | |

| Credit Card, Institutional Banking | 6.48 | 6.34 | 6.66 | 6.68 | 5.76 | 5.35 | 5.55 | 5.33 | 4.81 | 4.73 | 4.77 | 4.81 | 4.77 | 4.71 | 3.54 | 4.72 | 5.27 | 5.32 | 5.27 | 5.53 | |

| Credit Card, Personal Banking | 5.47 | 5.48 | 5.70 | 5.59 | 5.97 | 5.95 | 5.91 | 5.22 | 5.87 | 5.70 | 5.78 | 5.11 | 5.24 | 5.21 | 4.68 | 4.99 | 5.53 | 5.62 | 5.65 | 5.12 | |

| Deposit Account, Commercial Banking | 10.21 | 9.85 | 9.78 | 8.53 | 8.40 | 8.36 | 8.70 | 8.95 | 8.38 | 7.92 | 8.23 | 7.53 | 7.53 | 7.43 | 6.89 | 6.89 | 7.32 | 7.54 | 7.39 | 7.46 | |

| Deposit Account, Institutional Banking | 9.76 | 9.92 | 10.16 | 10.74 | 9.35 | 9.56 | 10.25 | 13.89 | 11.06 | 9.87 | 12.43 | 12.58 | 10.36 | 10.18 | 10.46 | 15.61 | 10.00 | 10.22 | 10.63 | 11.08 | |

| Deposit Account, Personal Banking | 1.33 | 1.29 | 1.42 | 1.88 | 1.99 | 1.98 | 1.84 | 1.74 | 2.09 | 2.01 | 1.85 | 1.80 | 2.12 | 1.99 | 1.67 | 2.54 | 2.74 | 2.83 | 2.69 | 2.71 | |

| Fiduciary And Trust, Institutional Banking | 53.36 | 52.94 | 48.41 | 49.18 | 46.50 | 46.38 | 45.35 | 45.48 | 44.18 | 42.70 | 40.12 | 37.48 | 34.44 | 34.19 | 31.36 | 31.26 | 30.56 | 28.81 | 27.25 | 26.69 | |

| Fiduciary And Trust, Personal Banking | 13.23 | 13.73 | 13.18 | 13.18 | 12.71 | 13.20 | 13.53 | 14.04 | 14.34 | 14.22 | 13.74 | 17.35 | 16.33 | 16.36 | 14.97 | 15.74 | 16.27 | 16.41 | 15.65 | 15.27 | |

| Commercial Banking | 26.57 | 26.90 | 26.88 | 24.45 | 24.22 | 25.28 | 24.76 | 23.12 | 22.99 | 23.27 | 22.76 | 20.19 | 20.72 | 20.69 | 18.02 | 22.34 | 22.78 | 23.43 | 22.95 | 22.34 | |

| Institutional Banking | 82.04 | 81.50 | 77.60 | 79.01 | 73.59 | 73.64 | 72.05 | 66.77 | 61.73 | 58.67 | 58.73 | 56.90 | 51.86 | 52.29 | 49.57 | 60.28 | 53.01 | 51.18 | 48.70 | 49.18 | |

| Personal Banking | 22.58 | 23.41 | 22.98 | 23.45 | 23.56 | 24.07 | 24.19 | 23.88 | 25.47 | 24.91 | 24.17 | 27.30 | 26.61 | 26.45 | 24.34 | 26.45 | 27.83 | 27.92 | 27.29 | 26.07 |