| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2013-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.60 | 0.56 | 0.56 | 0.56 | 0.56 | 0.56 | 0.56 | 0.56 | 0.55 | 0.55 | 0.52 | 0.54 | 0.55 | 0.24 | 0.24 | 0.24 | 0.24 | 0.24 | 0.23 | 0.15 | 0.15 | 0.15 | 0.11 | 0.11 | 0.11 | 0.11 | 0.11 | 0.10 | 0.10 | 0.10 | 0.06 | 0.06 | |

| Earnings Per Share Basic | 0.07 | 0.60 | 0.62 | 0.71 | 0.74 | 0.80 | 0.55 | 0.66 | 0.85 | 0.75 | 0.60 | 0.64 | 0.46 | 0.46 | 0.48 | 0.08 | 0.56 | 0.52 | 0.50 | 0.14 | 0.41 | 0.37 | 0.42 | 0.43 | 0.14 | 0.26 | 0.24 | 0.20 | 0.28 | 0.32 | 0.30 | 0.26 | 0.24 | 0.24 | 0.19 | 0.19 | 0.18 | 0.21 | 0.17 | |

| Earnings Per Share Diluted | 0.06 | 0.60 | 0.62 | 0.70 | 0.73 | 0.79 | 0.54 | 0.65 | 0.82 | 0.73 | 0.59 | 0.64 | 0.46 | 0.46 | 0.48 | 0.08 | 0.56 | 0.51 | 0.49 | 0.13 | 0.40 | 0.36 | 0.42 | 0.42 | 0.14 | 0.25 | 0.23 | 0.20 | 0.27 | 0.31 | 0.29 | 0.26 | 0.23 | 0.23 | 0.19 | 0.19 | 0.18 | 0.21 | 0.16 | |

| Tier One Risk Based Capital To Risk Weighted Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Capital To Risk Weighted Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2013-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Interest And Fee Income Loans And Leases | 165.44 | 167.37 | 163.73 | 151.71 | 136.85 | 109.20 | 82.19 | 71.44 | 74.17 | 71.14 | 67.81 | 67.40 | 69.60 | 68.69 | 70.44 | 77.86 | 82.47 | 85.81 | 86.79 | 85.75 | 35.03 | 35.07 | 32.29 | 32.07 | 28.18 | 20.71 | 13.02 | 11.88 | 11.69 | 11.59 | 11.05 | 10.36 | 9.65 | 9.23 | 7.45 | 7.35 | 7.33 | 7.18 | 6.07 | |

| Interest Expense | 92.07 | 87.75 | 81.69 | 66.25 | 46.12 | 22.18 | 9.11 | 7.34 | 8.15 | 8.50 | 9.05 | 9.99 | 11.33 | 11.56 | 13.59 | 19.57 | 21.88 | 24.77 | 24.73 | 22.31 | 9.49 | 8.64 | 6.93 | 4.99 | 4.15 | 3.15 | 1.93 | 1.82 | 1.76 | 1.54 | 1.25 | 1.09 | 0.99 | 0.92 | 0.79 | 0.76 | 0.78 | 0.73 | 0.64 | |

| Interest Income Expense Net | 95.53 | 99.36 | 100.83 | 103.39 | 106.10 | 101.04 | 84.48 | 73.04 | 76.74 | 71.28 | 67.13 | 65.64 | 66.77 | 65.87 | 65.76 | 67.41 | 69.86 | 70.87 | 71.44 | 72.92 | 28.70 | 29.18 | 27.62 | 29.10 | 25.75 | 19.13 | 12.38 | 11.25 | 10.52 | 10.52 | 10.23 | 9.69 | 9.01 | 8.62 | 6.97 | 6.86 | 6.83 | 6.70 | 5.65 | |

| Interest Paid Net | 85.87 | 81.49 | 72.98 | 54.19 | 42.65 | 18.07 | 11.20 | 5.37 | 11.36 | 5.76 | 12.42 | 7.60 | 12.52 | 10.60 | 16.63 | 18.49 | 22.28 | 25.61 | 25.31 | 14.97 | 9.24 | 7.98 | 7.03 | 4.93 | 3.97 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 6.00 | 9.28 | 9.72 | 11.01 | 11.89 | 12.25 | 8.08 | 8.10 | 10.70 | 9.20 | 7.84 | 8.99 | 4.70 | 6.20 | 3.99 | -0.68 | 8.17 | 7.59 | 7.37 | 1.99 | 3.59 | 1.45 | 2.35 | 3.51 | 7.23 | 2.65 | 1.80 | 1.35 | 1.63 | 1.77 | 1.64 | 1.43 | 1.30 | 1.28 | 0.93 | 0.61 | 0.79 | 0.72 | 0.51 | |

| Net Income Loss | 3.50 | 32.62 | 33.73 | 38.41 | 39.90 | 43.32 | 29.63 | 33.47 | 41.51 | 36.84 | 29.46 | 31.79 | 22.80 | 22.92 | 24.03 | 4.13 | 29.05 | 27.41 | 26.88 | 7.41 | 9.82 | 8.94 | 10.19 | 10.39 | 3.26 | 5.18 | 3.62 | 3.10 | 3.19 | 3.38 | 3.17 | 2.81 | 2.57 | 2.54 | 1.86 | 1.82 | 1.69 | 1.36 | 1.00 | |

| Comprehensive Income Net Of Tax | 47.87 | 7.97 | 5.05 | 53.31 | 44.98 | -9.75 | -10.77 | -11.62 | 35.91 | 29.31 | 44.23 | 37.98 | 31.87 | 28.06 | 20.74 | 30.38 | 24.27 | 33.50 | 37.60 | 17.35 | 12.01 | 7.89 | 9.74 | 8.06 | 2.27 | 5.29 | 4.49 | 3.30 | 1.66 | 3.37 | 3.37 | 3.04 | 2.34 | 2.61 | 1.70 | 1.83 | 1.74 | 1.28 | 0.94 | |

| Interest Income Expense After Provision For Loan Loss | 87.53 | 91.64 | 86.96 | 92.51 | 94.82 | 93.54 | 75.48 | 73.05 | 81.13 | 71.72 | 66.55 | 66.20 | 65.86 | 55.73 | 46.79 | 31.75 | 66.37 | 61.20 | 68.11 | 67.91 | 26.92 | 26.12 | 26.12 | 28.42 | 23.22 | 18.38 | 11.43 | 10.36 | 10.08 | 10.28 | 9.70 | 8.85 | 8.40 | 8.62 | 6.82 | 6.75 | 6.51 | 6.28 | 5.15 | |

| Noninterest Expense | 60.24 | 59.41 | 57.20 | 56.62 | 57.36 | 50.99 | 48.15 | 46.57 | 45.08 | 41.32 | 41.72 | 39.60 | 47.37 | 36.41 | 40.06 | 35.55 | 36.28 | 34.63 | 39.90 | 66.99 | 17.54 | 18.25 | 16.17 | 17.31 | 15.04 | 12.52 | 7.78 | 7.45 | 7.08 | 7.03 | 6.30 | 5.97 | 5.73 | 5.84 | 4.73 | 5.08 | 4.68 | 4.83 | 4.21 | |

| Noninterest Income | -17.79 | 9.67 | 13.69 | 13.53 | 14.33 | 13.02 | 10.38 | 15.10 | 16.15 | 15.63 | 12.46 | 14.17 | 9.01 | 9.79 | 21.29 | 7.25 | 7.13 | 8.43 | 6.03 | 8.48 | 3.62 | 2.51 | 2.59 | 2.78 | 2.30 | 1.98 | 1.77 | 1.53 | 1.82 | 1.89 | 1.41 | 1.37 | 1.21 | 1.04 | 0.69 | 0.77 | 0.66 | 0.63 | 0.56 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2013-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

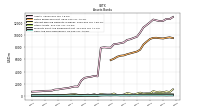

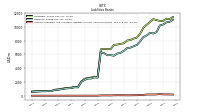

| Assets | 12394.34 | 12346.33 | 12470.37 | 12609.49 | 12154.36 | 11714.45 | 11304.81 | 10453.68 | 9757.25 | 9572.30 | 9349.52 | 9237.51 | 8820.87 | 8702.38 | 8587.86 | 8531.62 | 7954.94 | 7962.88 | 8010.11 | 7931.75 | 3208.55 | 3275.85 | 3133.63 | 3063.32 | 2945.58 | 2494.86 | 1508.59 | 1522.02 | 1408.51 | 1269.24 | 1215.50 | 1130.48 | 1039.60 | 1009.54 | 827.14 | 808.91 | 802.29 | 745.34 | 664.97 | |

| Liabilities | 10863.01 | 10855.17 | 10979.09 | 11115.75 | 10704.59 | 10302.56 | 9875.37 | 9005.68 | 8442.17 | 8288.14 | 8076.62 | 8003.70 | 7617.49 | 7517.04 | 7424.11 | 7382.35 | 6764.14 | 6757.35 | 6804.81 | 6738.04 | 2677.91 | 2758.63 | 2625.19 | 2565.89 | 2456.65 | 2048.93 | 1260.99 | 1279.29 | 1169.42 | 1126.82 | 1076.65 | 995.24 | 907.55 | 872.03 | 710.05 | 693.77 | 688.97 | 669.74 | 598.73 | |

| Liabilities And Stockholders Equity | 12394.34 | 12346.33 | 12470.37 | 12609.49 | 12154.36 | 11714.45 | 11304.81 | 10453.68 | 9757.25 | 9572.30 | 9349.52 | 9237.51 | 8820.87 | 8702.38 | 8587.86 | 8531.62 | 7954.94 | 7962.88 | 8010.11 | 7931.75 | 3208.55 | 3275.85 | 3133.63 | 3063.32 | 2945.58 | 2494.86 | 1508.59 | 1522.02 | 1408.51 | 1269.24 | 1215.50 | 1130.48 | 1039.60 | 1009.54 | 827.14 | 808.91 | 802.29 | 745.34 | 664.97 | |

| Stockholders Equity | 1531.32 | 1491.17 | 1491.28 | 1493.74 | 1449.77 | 1411.90 | 1429.44 | 1448.00 | 1315.08 | 1284.16 | 1272.91 | 1233.81 | 1203.38 | 1185.34 | 1163.75 | 1149.27 | 1190.80 | 1205.53 | 1205.29 | 1193.70 | 530.64 | 517.21 | 508.44 | 497.43 | 488.93 | 445.93 | 247.60 | 242.72 | 239.09 | 142.42 | 138.85 | 135.24 | 132.05 | 137.51 | 117.08 | 115.13 | 113.31 | 75.60 | 66.24 | |

| Tier One Risk Based Capital | 1202.25 | 1204.45 | 1175.47 | 1146.36 | 1121.02 | 1084.44 | 1044.95 | 1016.92 | 843.59 | 854.39 | 833.96 | 808.34 | 782.49 | 776.11 | 755.14 | 730.46 | 771.68 | 780.70 | 784.88 | 783.01 | 370.18 | 359.05 | 348.37 | 332.69 | 324.73 | 313.44 | 222.27 | 218.27 | 215.06 | 117.02 | 113.43 | 109.98 | 107.45 | 113.50 | 100.57 | 98.43 | 96.24 | 58.53 | 49.10 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2013-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 629.06 | 713.41 | 663.92 | 808.39 | 436.08 | 433.90 | 410.72 | 551.57 | 379.78 | 229.71 | 390.03 | 468.03 | 230.82 | 128.77 | 160.31 | 430.84 | 251.55 | 252.59 | 265.82 | 339.47 | 84.45 | 261.79 | 146.74 | 195.19 | 149.04 | 151.38 | 173.15 | 285.74 | 234.79 | 178.59 | 127.24 | 92.38 | 71.55 | 123.51 | 63.27 | 85.54 | 93.25 | 67.73 | 76.65 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 629.06 | 713.41 | 663.92 | 808.39 | 436.08 | 433.90 | 410.72 | 551.57 | 379.78 | 229.71 | 390.03 | 468.03 | 230.82 | 128.77 | 160.31 | 430.84 | 251.55 | 252.59 | 265.82 | 339.47 | 84.45 | 261.79 | 146.74 | 195.19 | 149.04 | NA | NA | NA | 234.79 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Equity Securities Fv Ni | 9.90 | 9.46 | 9.76 | 9.92 | 9.79 | 9.74 | 10.17 | 10.53 | 11.04 | 11.14 | 11.23 | 11.16 | 11.36 | 11.61 | 15.84 | 15.37 | 11.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2013-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 137.12 | NA | NA | NA | 135.40 | NA | NA | NA | 130.83 | NA | NA | NA | 133.50 | NA | NA | NA | 132.44 | NA | NA | NA | 88.40 | NA | NA | NA | 82.30 | NA | NA | NA | 22.93 | NA | NA | NA | 21.87 | NA | NA | NA | 14.53 | NA | 12.28 | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 31.39 | NA | NA | NA | 26.58 | NA | NA | NA | 21.56 | NA | NA | NA | 18.44 | NA | NA | NA | 13.90 | NA | NA | NA | 9.99 | NA | NA | NA | 7.05 | NA | NA | NA | 5.52 | NA | NA | NA | 4.42 | NA | NA | NA | 3.38 | NA | 2.33 | |

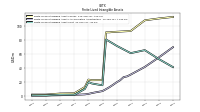

| Amortization Of Intangible Assets | 2.44 | 2.44 | 2.47 | 2.50 | 2.50 | 2.49 | 2.50 | 2.50 | 2.49 | 2.51 | 2.52 | 2.54 | 2.56 | 2.84 | 2.70 | 2.70 | 2.70 | 2.71 | 2.72 | 2.76 | 0.83 | 0.80 | 0.86 | 0.98 | 0.55 | 0.22 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.07 | 0.07 | 0.30 | NA | 0.30 | |

| Property Plant And Equipment Net | 105.73 | 106.12 | 105.99 | 107.54 | 108.82 | 108.72 | 108.77 | 109.14 | 109.27 | 116.06 | 123.50 | 114.58 | 115.06 | 115.79 | 115.56 | 116.06 | 118.54 | 118.45 | 115.37 | 119.35 | 78.41 | 77.35 | 76.35 | 76.05 | 75.25 | 40.13 | 17.98 | 17.52 | 17.41 | 17.50 | 17.24 | 17.25 | 17.45 | 17.59 | 12.11 | 11.53 | 11.15 | 11.23 | 9.95 | |

| Goodwill | 404.45 | 404.45 | 404.45 | 404.45 | 404.45 | 404.45 | 404.45 | 404.45 | 403.77 | 370.84 | 370.84 | 370.84 | 370.84 | 370.84 | 370.84 | 370.84 | 370.84 | 370.46 | 370.22 | 368.27 | 161.45 | 161.45 | 161.45 | 161.69 | 159.45 | 135.83 | 26.86 | 26.86 | 26.86 | 26.86 | 26.86 | 26.86 | 26.86 | 26.02 | 19.15 | 19.15 | 19.15 | 19.15 | 19.15 | |

| Intangible Assets Net Excluding Goodwill | 41.75 | 44.29 | 48.29 | 51.09 | 53.21 | 56.24 | 59.01 | 63.99 | 66.02 | 54.68 | 57.14 | 59.24 | 61.73 | 64.72 | 66.70 | 69.44 | 72.26 | 75.36 | 78.35 | 81.25 | 15.90 | 16.60 | 17.48 | 18.37 | 20.44 | 10.53 | 2.17 | 2.16 | 2.18 | 2.26 | 2.26 | 2.35 | 2.41 | 2.46 | 1.11 | 1.19 | 1.26 | 1.34 | 1.57 | |

| Finite Lived Intangible Assets Net | 41.75 | NA | NA | NA | 53.21 | NA | NA | NA | 66.02 | NA | NA | NA | 61.73 | NA | NA | NA | 72.26 | 75.36 | 78.35 | 81.25 | 15.90 | 16.60 | 17.48 | 18.37 | 20.44 | 10.53 | NA | NA | 2.18 | NA | NA | NA | 2.41 | NA | NA | NA | 1.26 | NA | 1.57 | |

| Equity Securities Fv Ni | 9.90 | 9.46 | 9.76 | 9.92 | 9.79 | 9.74 | 10.17 | 10.53 | 11.04 | 11.14 | 11.23 | 11.16 | 11.36 | 11.61 | 15.84 | 15.37 | 11.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 20.47 | 33.71 | 24.21 | 23.16 | 27.39 | 32.57 | 22.19 | 12.25 | 0.61 | 0.43 | 0.12 | 0.10 | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 160.02 | 147.84 | 158.77 | 161.78 | 158.78 | 155.55 | 162.30 | 169.82 | 61.45 | 57.47 | 51.49 | 36.53 | 34.28 | 34.22 | 35.21 | 35.51 | 34.81 | 35.18 | 34.55 | 26.98 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 0.09 | NA | NA | 0.10 | 0.01 | NA | 0.08 | 0.81 | 2.62 | 2.65 | 2.98 | 2.72 | 3.41 | 3.24 | 3.22 | 2.67 | 1.84 | 2.06 | 1.33 | 0.64 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 20.47 | 33.71 | 24.21 | 23.16 | 27.39 | 32.57 | 22.19 | 12.25 | 0.61 | 0.43 | 0.12 | 0.10 | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Fair Value | 145.15 | 147.84 | 158.77 | 149.17 | 154.70 | 155.55 | 156.51 | 144.12 | 28.80 | 26.54 | 17.06 | NA | NA | NA | NA | NA | NA | NA | 1.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | 160.02 | 147.84 | 158.77 | 161.78 | 158.78 | 155.55 | 162.30 | 169.82 | 61.45 | 57.47 | 51.49 | NA | 34.28 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After One Through Five Years Fair Value | 4.45 | 4.41 | 0.44 | 0.45 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Twelve Months Or Longer Fair Value | 137.31 | 129.89 | 133.94 | 133.17 | 42.94 | 36.91 | 25.23 | 18.15 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Less Than Twelve Months Fair Value | 7.84 | 17.95 | 24.83 | 16.00 | 111.76 | 118.64 | 131.28 | 125.97 | 28.80 | 26.54 | 17.06 | NA | NA | NA | NA | NA | NA | NA | 1.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Five Through Ten Years Fair Value | 12.63 | 12.12 | 12.74 | 12.95 | 8.13 | 7.91 | 6.35 | 4.33 | 4.12 | 4.14 | 4.18 | 4.18 | 3.59 | 3.60 | 3.03 | 2.97 | 1.22 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Ten Years Fair Value | 85.35 | 76.56 | 87.10 | 87.82 | 90.78 | 86.57 | 89.55 | 94.27 | 25.98 | 25.97 | 24.12 | 19.38 | 21.14 | 21.00 | 21.58 | 21.23 | 22.67 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2013-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Taxes Payable Current | 0.03 | NA | NA | NA | 0.57 | NA | NA | NA | 0.81 | NA | NA | NA | 0.27 | NA | NA | NA | 0.78 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Time Deposit Maturities Year One | 2854.48 | NA | NA | NA | 1954.85 | NA | NA | NA | 1017.16 | NA | NA | NA | 1194.78 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 10338.19 | 10196.52 | 9233.91 | 9034.74 | 9123.23 | 8748.44 | 8517.71 | 7889.60 | 7363.61 | 7178.75 | 6978.90 | 6904.57 | 6512.85 | 6222.56 | 6125.55 | 5799.94 | 5894.35 | 5877.85 | 6165.09 | 6297.72 | 2622.43 | 2656.25 | 2490.42 | 2493.79 | 2278.63 | 1985.66 | 1211.11 | 1221.70 | 1119.63 | 1077.22 | 1027.73 | 946.06 | 868.41 | 842.61 | 673.11 | 668.25 | 638.74 | 644.54 | 573.94 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2013-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 1531.32 | 1491.17 | 1491.28 | 1493.74 | 1449.77 | 1411.90 | 1429.44 | 1448.00 | 1315.08 | 1284.16 | 1272.91 | 1233.81 | 1203.38 | 1185.34 | 1163.75 | 1149.27 | 1190.80 | 1205.53 | 1205.29 | 1193.70 | 530.64 | 517.21 | 508.44 | 497.43 | 488.93 | 445.93 | 247.60 | 242.72 | 239.09 | 142.42 | 138.85 | 135.24 | 132.05 | 137.51 | 117.08 | 115.13 | 113.31 | 75.60 | 66.24 | |

| Common Stock Value | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.60 | 0.56 | 0.56 | 0.56 | 0.56 | 0.56 | 0.56 | 0.56 | 0.55 | 0.55 | 0.52 | 0.54 | 0.55 | 0.24 | 0.24 | 0.24 | 0.24 | 0.24 | 0.23 | 0.15 | 0.15 | 0.15 | 0.11 | 0.11 | 0.11 | 0.11 | 0.11 | 0.10 | 0.10 | 0.10 | 0.06 | 0.06 | |

| Additional Paid In Capital | 1317.52 | 1314.46 | 1311.69 | 1308.35 | 1306.85 | 1303.17 | 1300.17 | 1297.16 | 1142.76 | 1137.89 | 1134.60 | 1131.32 | 1126.44 | 1124.15 | 1122.06 | 1119.76 | 1117.88 | 1114.66 | 1112.24 | 1109.39 | 449.43 | 448.12 | 447.23 | 445.96 | 445.52 | 404.90 | 211.90 | 211.51 | 211.17 | 116.31 | 116.11 | 115.88 | 115.72 | 115.58 | 97.76 | 97.48 | 97.47 | 61.51 | 55.30 | |

| Retained Earnings Accumulated Deficit | 444.24 | 451.51 | 429.75 | 406.87 | 379.30 | 350.19 | 317.66 | 298.83 | 275.27 | 243.63 | 216.70 | 195.66 | 172.23 | 157.64 | 143.28 | 127.81 | 147.91 | 125.34 | 104.65 | 84.56 | 83.97 | 74.14 | 65.21 | 55.02 | 44.63 | 41.14 | 36.00 | 32.39 | 29.29 | 26.10 | 22.73 | 19.55 | 16.74 | 14.20 | 11.69 | 9.85 | 8.05 | 6.38 | 2.92 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -63.46 | -107.83 | -83.19 | -54.51 | -69.40 | -74.49 | -21.42 | 18.98 | 64.07 | 69.66 | 77.19 | 62.41 | 56.23 | 47.16 | 42.01 | 45.31 | 19.06 | 23.84 | 17.74 | 7.02 | -2.93 | -5.11 | -4.07 | -3.61 | -1.28 | -0.06 | -0.17 | -1.05 | -1.25 | 0.28 | 0.29 | 0.09 | -0.14 | 0.09 | 0.02 | 0.18 | 0.17 | 0.12 | 0.03 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 3.04 | 2.96 | 3.17 | 2.89 | 2.85 | 3.12 | 2.64 | 3.32 | 2.74 | 2.67 | 2.69 | 2.48 | 2.10 | 2.08 | 1.84 | 1.96 | 1.73 | 1.43 | 0.93 | 17.56 | 0.97 | 0.94 | 1.36 | 0.77 | 0.74 | 0.41 | 0.40 | 0.40 | 0.28 | 0.24 | 0.24 | 0.22 | 0.19 | 0.17 | 0.17 | 0.11 | 0.20 | 0.09 | 0.08 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2013-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

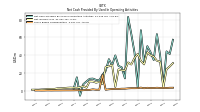

| Net Cash Provided By Used In Operating Activities | 6.02 | 39.75 | 63.78 | 34.54 | 43.34 | 50.15 | 31.02 | 68.22 | 3.44 | 42.86 | 63.97 | 83.22 | 13.76 | 26.29 | 27.87 | 39.73 | 28.46 | 35.47 | 22.16 | 17.88 | 11.55 | 12.05 | 13.53 | 13.27 | 10.32 | 7.17 | -5.79 | 14.96 | 2.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -122.40 | 183.17 | -41.76 | -66.51 | -428.61 | -397.28 | -1008.71 | -564.78 | 2.35 | -382.96 | -207.47 | -228.31 | -4.34 | -141.61 | -325.48 | -403.13 | -5.53 | 32.09 | -185.66 | 112.77 | -109.57 | -27.74 | -118.47 | -144.22 | -17.05 | 54.35 | -96.16 | -65.99 | -83.13 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | 32.04 | -173.43 | -166.49 | 404.29 | 387.45 | 370.31 | 836.83 | 668.36 | 144.28 | 179.78 | 65.50 | 382.29 | 92.63 | 83.78 | 27.07 | 542.69 | -23.97 | -80.79 | 89.86 | 124.38 | -79.32 | 130.74 | 56.49 | 177.11 | 4.40 | -83.30 | -10.63 | 101.97 | 137.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2013-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 6.02 | 39.75 | 63.78 | 34.54 | 43.34 | 50.15 | 31.02 | 68.22 | 3.44 | 42.86 | 63.97 | 83.22 | 13.76 | 26.29 | 27.87 | 39.73 | 28.46 | 35.47 | 22.16 | 17.88 | 11.55 | 12.05 | 13.53 | 13.27 | 10.32 | 7.17 | -5.79 | 14.96 | 2.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 3.50 | 32.62 | 33.73 | 38.41 | 39.90 | 43.32 | 29.63 | 33.47 | 41.51 | 36.84 | 29.46 | 31.79 | 22.80 | 22.92 | 24.03 | 4.13 | 29.05 | 27.41 | 26.88 | 7.41 | 9.82 | 8.94 | 10.19 | 10.39 | 3.26 | 5.18 | 3.62 | 3.10 | 3.19 | 3.38 | 3.17 | 2.81 | 2.57 | 2.54 | 1.86 | 1.82 | 1.69 | 1.36 | 1.00 | |

| Depreciation Depletion And Amortization | 4.59 | 4.86 | 5.28 | 4.76 | 4.67 | 4.62 | 5.00 | 4.38 | 3.75 | 4.56 | 3.65 | 3.77 | 3.92 | 4.05 | 3.77 | 4.09 | 3.56 | 4.43 | 3.94 | 4.01 | 1.73 | 1.63 | 1.73 | 1.99 | 1.25 | 0.71 | 0.43 | 0.45 | 0.30 | 0.46 | 0.38 | 0.37 | 0.35 | 0.39 | 0.32 | 0.33 | 0.33 | 0.35 | NA | |

| Share Based Compensation | 3.04 | 2.96 | 3.17 | 2.89 | 2.85 | 3.12 | 2.64 | 3.32 | 2.74 | 2.67 | 2.69 | 2.48 | 2.10 | 2.08 | 1.84 | 1.96 | 1.73 | 1.43 | 0.93 | 17.56 | 0.97 | 0.94 | 1.36 | 0.77 | 0.74 | 0.41 | 0.40 | 0.40 | 0.28 | 0.24 | 0.24 | 0.22 | 0.19 | 0.17 | 0.17 | 0.11 | 0.20 | 0.09 | 0.08 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2013-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -122.40 | 183.17 | -41.76 | -66.51 | -428.61 | -397.28 | -1008.71 | -564.78 | 2.35 | -382.96 | -207.47 | -228.31 | -4.34 | -141.61 | -325.48 | -403.13 | -5.53 | 32.09 | -185.66 | 112.77 | -109.57 | -27.74 | -118.47 | -144.22 | -17.05 | 54.35 | -96.16 | -65.99 | -83.13 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2013-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 32.04 | -173.43 | -166.49 | 404.29 | 387.45 | 370.31 | 836.83 | 668.36 | 144.28 | 179.78 | 65.50 | 382.29 | 92.63 | 83.78 | 27.07 | 542.69 | -23.97 | -80.79 | 89.86 | 124.38 | -79.32 | 130.74 | 56.49 | 177.11 | 4.40 | -83.30 | -10.63 | 101.97 | 137.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

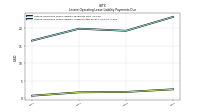

| Payments Of Dividends Common Stock | 10.77 | 10.86 | 10.85 | 10.84 | 10.79 | 10.79 | 10.79 | 9.91 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Dividends | 10.77 | 10.86 | 10.85 | 10.84 | 10.79 | 10.79 | 10.79 | 9.91 | 9.87 | 9.91 | 8.41 | 8.36 | 8.21 | 8.56 | 8.56 | 8.73 | 6.48 | 6.71 | 6.78 | 6.82 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |