| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | NA | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | |

| dei: Entity Common Stock Shares Outstanding | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Basic | 1.06 | 1.29 | 1.32 | 1.24 | 1.40 | 1.31 | 1.00 | -0.14 | 1.20 | 1.03 | 1.02 | 1.18 | 0.64 | 0.75 | 0.57 | 0.40 | 0.96 | 1.00 | 1.05 | 1.06 | 1.05 | 1.06 | 0.87 | 0.85 | 0.74 | 0.68 | 0.65 | 0.62 | |

| Earnings Per Share Diluted | 1.06 | 1.28 | 1.32 | 1.24 | 1.40 | 1.31 | 1.00 | -0.14 | 1.20 | 1.03 | 1.01 | 1.17 | 0.64 | 0.75 | 0.57 | 0.39 | 0.96 | 1.00 | 1.05 | 1.06 | 1.05 | 1.06 | 0.86 | 0.85 | 0.73 | 0.67 | 0.64 | 0.62 | |

| Tier One Risk Based Capital To Risk Weighted Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Capital To Risk Weighted Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Excluding Assessed Tax | 53.81 | 58.39 | 61.49 | 59.72 | 62.85 | 70.10 | 70.59 | 65.13 | 53.08 | 52.74 | 54.18 | 52.41 | 48.90 | 51.63 | 45.04 | 53.17 | 50.84 | 51.82 | 53.41 | 52.23 | 49.94 | 50.23 | 50.83 | 49.67 | 46.71 | 47.00 | 46.95 | 45.29 | |

| Revenues | 53.81 | 58.39 | 61.49 | 59.72 | 62.85 | 70.10 | 70.59 | 65.13 | 53.08 | 52.74 | 54.18 | 52.41 | 48.90 | 51.63 | 45.04 | 53.17 | 50.84 | 51.82 | 53.41 | 52.23 | 49.94 | 50.23 | 50.83 | 49.67 | 46.71 | 47.00 | 46.95 | 45.29 | |

| Operating Income Loss | 257.62 | 314.94 | 329.11 | 333.58 | 356.16 | 334.57 | 249.37 | 138.50 | 127.07 | 133.23 | 106.53 | 112.54 | 74.16 | 110.32 | 107.90 | 125.34 | 122.44 | 130.58 | 137.00 | 134.48 | 135.53 | 123.87 | NA | NA | NA | NA | NA | NA | |

| Interest Expense | 362.13 | 343.65 | 349.57 | 235.65 | 141.22 | 66.57 | 27.09 | 15.58 | 9.24 | 10.00 | 10.71 | 11.81 | 19.14 | 19.98 | 27.87 | 43.67 | 50.75 | 53.60 | 50.47 | 44.64 | 43.26 | 37.99 | 35.48 | 31.75 | 31.18 | 30.12 | 29.00 | 27.02 | |

| Interest Income Expense Net | 571.02 | 587.14 | 583.83 | 595.28 | 602.38 | 551.00 | 486.66 | 394.25 | 226.78 | 229.69 | 220.85 | 223.76 | 216.93 | 219.26 | 224.41 | 230.80 | 231.25 | 240.54 | 241.79 | 241.55 | 237.13 | 230.37 | 225.01 | 214.17 | 204.93 | 200.90 | 197.79 | 192.66 | |

| Interest Paid Net | 370.94 | 332.97 | 323.52 | 221.18 | 126.31 | 65.00 | 34.09 | 15.46 | -0.42 | 19.45 | 6.47 | 16.64 | 14.57 | 25.79 | 27.43 | 50.33 | 45.34 | 64.73 | 43.76 | 43.37 | 39.87 | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 36.22 | 51.97 | 62.65 | 65.83 | 68.41 | 64.07 | 54.81 | -33.60 | 31.03 | 29.77 | 33.99 | 30.21 | 15.12 | 18.29 | 14.80 | 11.14 | 25.97 | 25.41 | 26.45 | 26.14 | 26.70 | 13.70 | 20.74 | 20.07 | 17.03 | 30.28 | 29.09 | 21.95 | |

| Income Taxes Paid | 54.80 | 73.10 | 134.36 | 6.33 | 63.62 | 63.86 | 58.95 | 7.11 | 4.78 | 26.94 | 77.52 | 3.35 | 16.70 | 66.02 | 6.42 | 4.93 | 19.48 | 20.82 | 65.48 | 4.27 | 9.69 | 3.46 | 44.47 | 3.31 | 30.23 | 25.50 | 47.95 | 5.39 | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | 54.87 | -22.71 | -47.52 | 21.37 | 6.91 | -13.70 | -0.31 | -7.84 | -6.09 | -1.73 | -1.65 | -4.37 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | 365.21 | -196.96 | -130.80 | 96.94 | 51.94 | -255.57 | -205.61 | -253.14 | -24.09 | -4.38 | -2.38 | -33.98 | -9.78 | 10.59 | 66.25 | 11.27 | 1.16 | 28.96 | 35.65 | 28.81 | 0.91 | -9.63 | -6.46 | -23.95 | -6.79 | 2.98 | 4.95 | -0.03 | |

| Net Income Loss | 185.39 | 226.47 | 234.97 | 221.00 | 244.75 | 233.97 | 182.31 | -16.75 | 111.04 | 95.71 | 94.03 | 108.08 | 60.04 | 69.28 | 53.10 | 38.20 | 90.47 | 93.86 | 98.65 | 99.74 | 98.84 | 99.67 | 81.68 | 80.22 | 69.89 | 64.50 | 61.58 | 59.47 | |

| Comprehensive Income Net Of Tax | 550.60 | 29.52 | 104.17 | 317.94 | 296.69 | -21.60 | -23.30 | -269.89 | 86.95 | 91.33 | 91.65 | 74.10 | 50.26 | 79.87 | 119.34 | 49.47 | 91.64 | 122.82 | 134.30 | 128.55 | 99.75 | 90.05 | 75.22 | 56.28 | 63.11 | 67.48 | 66.52 | 59.44 | |

| Net Income Loss Available To Common Stockholders Basic | 179.52 | 220.17 | 228.57 | 215.00 | 238.48 | 227.68 | 176.43 | -20.18 | 108.43 | 93.17 | 91.56 | 105.53 | 57.72 | 66.89 | 50.73 | 36.02 | 88.07 | 91.44 | 96.19 | 97.55 | 96.67 | 97.46 | 79.49 | 78.08 | 67.71 | 62.43 | 59.48 | 57.34 | |

| Net Income Loss Available To Common Stockholders Diluted | 179.52 | 220.17 | 228.57 | 215.00 | 238.48 | 227.68 | 176.43 | -20.18 | 108.43 | 93.17 | 91.56 | 105.53 | 57.72 | 66.89 | 50.73 | 36.02 | 88.07 | 91.44 | 96.19 | 97.55 | 96.66 | 97.46 | 79.49 | 78.08 | 67.57 | 62.43 | 59.48 | 57.34 | |

| Interest Income Expense After Provision For Loan Loss | 535.02 | 550.64 | 552.33 | 548.53 | 559.38 | 514.47 | 474.42 | 205.40 | 241.78 | 221.94 | 242.35 | 249.51 | 217.93 | 196.51 | 184.41 | 154.80 | 225.25 | 229.24 | 229.89 | 232.95 | 227.13 | 219.87 | 214.51 | 203.17 | 191.93 | 190.75 | 190.54 | 182.16 | |

| Noninterest Expense | 377.22 | 362.58 | 344.09 | 332.47 | 348.39 | 330.07 | 358.23 | 359.79 | 189.85 | 180.24 | 187.03 | 187.98 | 219.53 | 184.00 | 176.58 | 178.84 | 179.73 | 179.89 | 180.64 | 175.69 | 174.76 | 178.78 | 180.46 | 171.62 | 171.05 | 161.82 | 164.42 | 163.78 | |

| Noninterest Income | 63.81 | 90.38 | 89.37 | 70.77 | 102.18 | 113.64 | 120.93 | 104.03 | 90.14 | 83.78 | 72.70 | 76.76 | 76.76 | 75.06 | 60.08 | 73.38 | 70.92 | 69.93 | 75.85 | 68.61 | 73.16 | 72.28 | 68.37 | 68.75 | 66.04 | 65.85 | 64.55 | 63.04 |

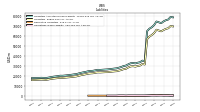

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

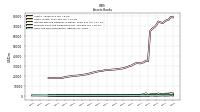

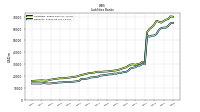

| Assets | 74945.25 | 73130.85 | 74038.24 | 74844.40 | 71277.52 | 69052.57 | 67595.02 | 65131.48 | 34915.60 | 35374.26 | 33753.75 | 33259.04 | 32590.69 | 32994.44 | 32708.62 | 31654.87 | 30389.34 | 29895.10 | 28942.04 | 28238.13 | 27610.31 | 27346.32 | 27036.74 | 26752.15 | 26487.65 | 26350.18 | 26174.93 | 26002.92 | |

| Liabilities | 66255.25 | 64931.65 | 65758.52 | 66550.10 | 63221.33 | 61226.16 | 59597.23 | 56954.35 | 31477.27 | 31988.07 | 30424.05 | 29986.11 | 29356.06 | 29774.75 | 29533.84 | 28564.63 | 27181.57 | 26742.71 | 25876.83 | 25271.87 | 24723.80 | 24530.12 | 24275.01 | 24036.01 | 23785.69 | 23711.40 | 23569.80 | 23442.56 | |

| Liabilities And Stockholders Equity | 74945.25 | 73130.85 | 74038.24 | 74844.40 | 71277.52 | 69052.57 | 67595.02 | 65131.48 | 34915.60 | 35374.26 | 33753.75 | 33259.04 | 32590.69 | 32994.44 | 32708.62 | 31654.87 | 30389.34 | 29895.10 | 28942.04 | 28238.13 | 27610.31 | 27346.32 | 27036.74 | 26752.15 | 26487.65 | 26350.18 | 26174.93 | 26002.92 | |

| Tier One Risk Based Capital | 6472.41 | 6332.45 | 6207.24 | 6080.56 | 6106.35 | 5921.70 | 5827.19 | 5793.09 | 2949.33 | 2874.83 | 2809.92 | 2754.14 | 2688.17 | 2664.63 | 2630.34 | 2604.36 | 2661.40 | 2606.07 | 2547.00 | 2482.20 | 2430.01 | 2360.49 | 2293.82 | 2239.64 | 2238.17 | 2154.66 | 2123.13 | 2082.43 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 1715.80 | 2172.73 | 1360.76 | 2434.07 | 839.94 | 613.12 | 901.80 | 793.21 | 461.57 | 2604.16 | 1579.89 | 1371.66 | 263.10 | 241.80 | 303.12 | 267.94 | 257.89 | 302.83 | 217.48 | 220.66 | 260.42 | 222.23 | 228.63 | 164.93 | 231.16 | 215.24 | 231.81 | 184.04 | |

| Land | 73.92 | NA | NA | NA | 73.92 | NA | NA | NA | 9.44 | NA | NA | NA | 9.44 | NA | NA | NA | 11.00 | NA | NA | NA | 11.00 | NA | NA | NA | 11.30 | NA | NA | NA |

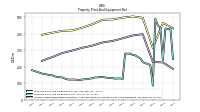

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 432.49 | NA | NA | NA | 464.27 | NA | NA | NA | 312.95 | NA | NA | NA | 495.47 | NA | NA | NA | 503.63 | NA | NA | NA | 496.23 | NA | NA | NA | 485.35 | NA | NA | NA | |

| Leasehold Improvements Gross | 88.06 | NA | NA | NA | 84.48 | NA | NA | NA | 65.61 | NA | NA | NA | 71.33 | NA | NA | NA | 77.35 | NA | NA | NA | 77.67 | NA | NA | NA | 82.07 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 186.37 | NA | NA | NA | 225.15 | NA | NA | NA | 228.32 | NA | NA | NA | 396.21 | NA | NA | NA | 388.56 | NA | NA | NA | 371.38 | NA | NA | NA | 355.35 | NA | NA | NA | |

| Amortization Of Intangible Assets | 8.62 | 8.90 | 9.19 | 9.50 | 8.24 | 8.51 | 8.80 | 6.39 | 1.12 | 1.12 | 1.13 | 1.14 | 1.15 | 1.09 | 0.96 | 0.96 | 0.96 | 0.96 | 0.96 | 0.96 | 0.96 | 0.96 | 0.96 | 0.96 | 0.98 | 1.00 | 1.03 | 1.05 | |

| Property Plant And Equipment Net | 246.12 | 431.70 | 426.31 | 431.43 | 239.12 | 434.72 | 449.58 | 490.00 | 84.63 | 209.57 | 215.72 | 220.98 | 226.74 | 250.53 | 258.39 | 268.42 | 270.41 | 278.64 | 278.23 | 279.58 | 124.85 | 128.51 | 127.97 | 127.20 | 130.00 | 130.36 | 131.83 | 134.55 | |

| Goodwill | 2631.47 | 2631.47 | 2631.47 | 2631.47 | 2514.10 | 2513.77 | 2513.77 | 2513.77 | 538.37 | 538.37 | 538.37 | 538.37 | 538.37 | 538.37 | 538.37 | 538.37 | 538.37 | 538.37 | 538.37 | 538.37 | 538.37 | 538.37 | 538.37 | 538.37 | 538.37 | 538.37 | 538.37 | 538.37 | |

| Finite Lived Intangible Assets Net | 203.13 | 211.75 | 220.65 | 229.84 | 199.34 | 207.27 | 215.78 | 224.58 | 17.87 | 18.99 | 20.11 | 21.24 | 22.38 | 23.53 | 19.99 | 20.95 | 21.92 | 22.88 | 23.84 | 24.80 | 25.76 | 26.73 | 27.69 | 28.65 | 29.61 | 30.59 | 31.59 | 32.62 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 832.34 | NA | NA | NA | 806.20 | NA | NA | NA | 55.66 | NA | NA | NA | 2.54 | NA | NA | NA | 16.42 | 13.55 | 26.39 | 76.07 | 128.20 | 177.68 | 143.17 | 127.56 | 59.45 | 49.94 | 55.87 | 74.33 | |

| Held To Maturity Securities Fair Value | 6264.62 | 5675.67 | 6066.68 | 6320.68 | 5761.45 | 5650.12 | 6008.85 | 6091.62 | 6280.94 | 6139.44 | 5794.15 | 5730.73 | 5835.36 | 6006.42 | 5745.56 | 5642.53 | 5380.65 | 5285.70 | 4674.51 | 4433.38 | 4209.12 | 4164.36 | 4225.98 | 4297.04 | 4456.35 | 4481.68 | 4197.38 | 4170.40 | |

| Held To Maturity Securities | 7074.80 | NA | NA | NA | 6564.88 | NA | NA | NA | 6198.34 | NA | NA | 5568.09 | 5568.19 | 5723.43 | 5477.13 | 5486.21 | 5293.92 | 5193.52 | 4636.71 | 4480.16 | 4325.42 | 4332.46 | 4356.22 | 4408.32 | 4487.39 | 4497.31 | 4219.20 | 4212.05 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 22.17 | 0.04 | 1.32 | 8.21 | 2.77 | 0.88 | 5.96 | 20.80 | 138.25 | 180.44 | 190.82 | 190.43 | 269.72 | 283.95 | 268.73 | 158.06 | 103.16 | 105.73 | 64.20 | 29.29 | 11.90 | 9.58 | 12.93 | 16.28 | 28.41 | 34.30 | 34.05 | 32.69 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 832.34 | NA | NA | NA | 806.20 | NA | NA | NA | 55.66 | NA | NA | NA | 2.54 | NA | NA | NA | 16.42 | 13.55 | 26.39 | 76.07 | 128.20 | 177.68 | 143.17 | 127.56 | 59.45 | 49.94 | 55.87 | 74.33 | |

| Held To Maturity Securities Debt Maturities After One Through Five Years Fair Value | 60.43 | 56.36 | 56.14 | 53.72 | 54.27 | 52.31 | 54.32 | 54.86 | 7.71 | 6.22 | 5.16 | 4.38 | 4.71 | 5.61 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Within One Year Fair Value | 8.14 | 8.31 | 4.34 | 6.12 | 2.19 | 2.15 | 4.43 | 2.45 | 0.18 | 0.38 | 0.38 | 0.38 | 0.69 | 1.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Five Through Ten Years Fair Value | 349.08 | 333.25 | 326.28 | 324.86 | 312.74 | 312.35 | 316.82 | 306.14 | 304.19 | 307.84 | 298.45 | 297.86 | 294.53 | 295.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Ten Years Fair Value | 5846.97 | 5277.75 | 5679.93 | 5935.98 | 5392.24 | 5283.30 | 5633.29 | 5728.17 | 5968.85 | 5825.00 | 5490.16 | 5428.10 | 5535.44 | 5704.61 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | 8217.68 | 3790.11 | 2859.06 | 1132.50 | 3754.39 | 1353.41 | 600.94 | 399.08 | 1566.26 | 1022.75 | 566.95 | 335.67 | 2173.67 | 1468.97 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 60784.28 | 60331.77 | 58747.53 | 55297.48 | 54054.34 | 54008.89 | 53077.16 | 54356.28 | 29847.03 | 30026.33 | 28846.97 | 28481.83 | 27335.44 | 26920.55 | 26356.00 | 24513.84 | 23324.75 | 23280.67 | 22598.78 | 22750.93 | 21858.85 | 21997.62 | 21343.36 | 21385.04 | 20993.73 | 20855.24 | 20458.10 | 20241.66 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 1048.82 | 1050.54 | 1052.26 | 1071.41 | 1073.13 | 1074.84 | 1076.56 | 1078.27 | 562.93 | 564.11 | 565.30 | 566.48 | 567.66 | 568.85 | 570.03 | 571.21 | 540.36 | 549.16 | 538.38 | 524.30 | 226.02 | 225.96 | 225.89 | 225.83 | 225.77 | 225.70 | 225.64 | 225.58 |

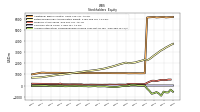

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 8690.00 | 8199.20 | 8279.73 | 8294.29 | 8056.19 | 7826.41 | 7997.79 | 8177.14 | 3438.32 | 3386.19 | 3329.70 | 3272.93 | 3234.62 | 3219.69 | 3174.78 | 3090.24 | 3207.77 | 3152.39 | 3065.22 | 2966.26 | 2886.51 | 2816.20 | 2761.72 | 2716.14 | 2701.96 | 2638.79 | 2605.13 | 2560.36 | |

| Common Stock Value | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | NA | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | |

| Additional Paid In Capital | 6179.75 | 6164.85 | 6150.71 | 6137.74 | 6173.24 | 6161.30 | 6148.85 | 6129.44 | 1108.59 | 1104.88 | 1101.13 | 1105.14 | 1109.53 | 1106.47 | 1103.76 | 1101.32 | 1113.25 | 1115.20 | 1113.89 | 1113.11 | 1114.39 | 1114.85 | 1115.41 | 1120.52 | 1122.16 | 1123.68 | 1124.66 | 1124.90 | |

| Retained Earnings Accumulated Deficit | 3282.53 | 3170.33 | 3017.45 | 2856.74 | 2713.86 | 2543.01 | 2383.64 | 2276.88 | 2333.29 | 2260.56 | 2203.16 | 2147.44 | 2077.52 | 2055.62 | 2024.49 | 2009.54 | 2061.35 | 2010.93 | 1955.93 | 1895.87 | 1828.30 | 1761.04 | 1699.77 | 1649.52 | 1595.76 | 1535.59 | 1496.30 | 1460.03 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -550.57 | -915.78 | -718.82 | -588.02 | -684.96 | -736.90 | -481.33 | -275.72 | -22.58 | 1.51 | 5.89 | 8.27 | 42.26 | 52.04 | 41.45 | -24.80 | -36.07 | -37.23 | -66.19 | -101.84 | -130.65 | -131.56 | -121.94 | -115.48 | -91.53 | -69.10 | -72.08 | -77.03 | |

| Treasury Stock Value | 507.52 | 506.00 | 455.42 | 397.98 | 431.76 | 426.81 | 339.18 | 239.26 | 126.95 | 126.74 | 126.44 | 133.89 | 140.66 | 140.41 | 140.88 | 141.80 | 76.73 | 82.48 | 84.39 | 86.86 | 71.50 | 74.10 | 77.50 | 84.40 | 70.43 | 75.03 | 67.40 | 71.19 |

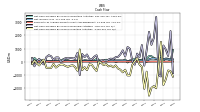

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 87.81 | 427.17 | 249.37 | 214.29 | 275.29 | 421.86 | 423.55 | 215.26 | 224.42 | 150.94 | 84.41 | 228.82 | 219.05 | 120.62 | 102.47 | -61.59 | 171.79 | 34.10 | 54.63 | 43.33 | -26.98 | 239.86 | 124.26 | 132.27 | 144.69 | 118.27 | 37.91 | 144.09 | |

| Net Cash Provided By Used In Investing Activities | -1775.25 | 1510.88 | -308.18 | -2023.20 | -1853.11 | -1990.21 | -2586.37 | -756.65 | -2066.59 | -391.35 | -211.78 | 264.63 | 31.09 | -226.91 | -1046.75 | -1046.04 | -606.54 | -812.91 | -610.80 | -519.50 | -281.27 | -426.95 | -294.52 | -358.64 | -173.76 | -266.58 | -92.31 | 5.44 | |

| Net Cash Provided By Used In Financing Activities | 1230.50 | -1126.08 | -1014.50 | 3403.03 | 1804.64 | 1279.67 | 2271.41 | 873.04 | -300.42 | 1264.68 | 335.60 | 615.11 | -228.84 | 44.97 | 979.47 | 1117.67 | 389.81 | 864.16 | 553.00 | 367.33 | 346.43 | 180.70 | 233.96 | 160.14 | 44.99 | 131.75 | 102.16 | -156.15 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 87.81 | 427.17 | 249.37 | 214.29 | 275.29 | 421.86 | 423.55 | 215.26 | 224.42 | 150.94 | 84.41 | 228.82 | 219.05 | 120.62 | 102.47 | -61.59 | 171.79 | 34.10 | 54.63 | 43.33 | -26.98 | 239.86 | 124.26 | 132.27 | 144.69 | 118.27 | 37.91 | 144.09 | |

| Net Income Loss | 185.39 | 226.47 | 234.97 | 221.00 | 244.75 | 233.97 | 182.31 | -16.75 | 111.04 | 95.71 | 94.03 | 108.08 | 60.04 | 69.28 | 53.10 | 38.20 | 90.47 | 93.86 | 98.65 | 99.74 | 98.84 | 99.67 | 81.68 | 80.22 | 69.89 | 64.50 | 61.58 | 59.47 | |

| Deferred Income Tax Expense Benefit | -25.65 | -28.42 | -13.48 | 13.91 | -20.43 | -4.95 | -15.75 | -28.54 | -4.31 | -16.70 | 2.82 | 13.19 | -1.26 | -2.96 | -20.50 | -6.52 | -2.72 | 3.13 | -9.43 | 9.94 | -3.67 | 17.39 | -5.53 | 1.29 | -5.83 | -3.73 | -7.06 | 7.55 | |

| Share Based Compensation | 13.89 | 14.38 | 14.17 | 11.65 | 10.87 | 12.76 | 21.47 | 9.00 | 3.59 | 3.64 | 3.47 | 2.96 | 2.82 | 3.34 | 3.40 | 2.61 | 2.94 | 3.27 | 3.44 | 2.98 | 3.01 | 2.72 | 2.54 | 3.33 | 3.23 | 3.01 | 2.73 | 3.32 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -1775.25 | 1510.88 | -308.18 | -2023.20 | -1853.11 | -1990.21 | -2586.37 | -756.65 | -2066.59 | -391.35 | -211.78 | 264.63 | 31.09 | -226.91 | -1046.75 | -1046.04 | -606.54 | -812.91 | -610.80 | -519.50 | -281.27 | -426.95 | -294.52 | -358.64 | -173.76 | -266.58 | -92.31 | 5.44 | |

| Payments To Acquire Property Plant And Equipment | 6.32 | 14.32 | 9.37 | 10.29 | 10.24 | 8.63 | 5.25 | 4.64 | 5.36 | 3.82 | 3.73 | 3.68 | 7.26 | 6.20 | 4.27 | 3.55 | 6.95 | 6.07 | 6.74 | 5.96 | 7.48 | 9.42 | 10.28 | 5.78 | 8.51 | 6.64 | 6.16 | 7.23 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 1230.50 | -1126.08 | -1014.50 | 3403.03 | 1804.64 | 1279.67 | 2271.41 | 873.04 | -300.42 | 1264.68 | 335.60 | 615.11 | -228.84 | 44.97 | 979.47 | 1117.67 | 389.81 | 864.16 | 553.00 | 367.33 | 346.43 | 180.70 | 233.96 | 160.14 | 44.99 | 131.75 | 102.16 | -156.15 | |

| Payments Of Dividends Common Stock | 68.82 | 69.29 | 69.90 | 70.14 | 69.61 | 70.69 | 71.23 | 36.23 | 36.22 | 36.24 | 36.24 | 36.11 | 36.08 | 36.08 | 36.08 | 36.73 | 36.81 | 36.81 | 36.80 | 30.37 | 29.96 | 31.03 | 30.07 | 23.90 | 23.90 | 23.87 | 23.92 | 22.94 | |

| Payments For Repurchase Of Common Stock | 0.00 | 49.98 | NA | NA | 2.84 | 97.14 | 99.92 | 122.20 | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 76.56 | 0.00 | 0.00 | 0.00 | 13.00 | 0.00 | 0.00 | 0.00 | 12.16 | 0.00 | 11.59 | 0.00 | 0.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 53.81 | 58.39 | 61.49 | 59.72 | 62.85 | 70.10 | 70.59 | 65.13 | 53.08 | 52.74 | 54.18 | 52.41 | 48.90 | 51.63 | 45.04 | 53.17 | 50.84 | 51.82 | 53.41 | 52.23 | 49.94 | 50.23 | 50.83 | 49.67 | 46.71 | 47.00 | 46.95 | 45.29 | |

| Corporate Non | 1.06 | 2.22 | 0.78 | 0.85 | 0.83 | 0.49 | 0.43 | 0.05 | 0.10 | 0.08 | 0.11 | 0.04 | 0.09 | 0.04 | -0.13 | 0.07 | -0.04 | 0.10 | 0.03 | 0.09 | -0.04 | -0.02 | 0.00 | 0.10 | -0.00 | 0.10 | 0.05 | 0.11 | |

| Corporate Non, Investment Advisory Management And Administrative Service | -0.01 | 0.00 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | 0.02 | -0.04 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | NA | |

| Corporate Non, Deposit Service Fees | 0.02 | 1.12 | -0.33 | -0.07 | 0.84 | 0.50 | 0.44 | 0.05 | 0.12 | 0.09 | 0.12 | 0.05 | 0.10 | 0.02 | -0.09 | 0.08 | -0.03 | 0.11 | 0.04 | 0.10 | -0.03 | -0.01 | 0.01 | 0.11 | 0.01 | 0.11 | 0.06 | 0.11 | |

| Corporate Non, Other Non Interest Income | 1.05 | 1.09 | 1.12 | 0.93 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Operating, Investment Advisory Management And Administrative Service, Commercial Banking | 3.04 | 2.86 | 2.87 | 2.77 | 2.77 | 2.67 | 2.77 | 3.13 | 10.12 | 9.99 | 10.10 | 9.41 | 25.17 | 2.67 | 2.59 | 2.53 | 25.29 | 2.65 | 2.54 | 2.48 | 2.44 | 2.58 | 2.59 | 2.54 | 2.53 | 2.47 | 2.44 | NA | |

| Operating, Investment Advisory Management And Administrative Service, Community Banking | 4.73 | 4.39 | 4.53 | 3.83 | 4.25 | 8.76 | 8.48 | 7.47 | 7.00 | 6.93 | 7.05 | 6.49 | 5.97 | 5.57 | 4.55 | 6.22 | NA | 5.86 | 5.78 | 5.17 | 5.67 | 5.84 | 5.88 | 5.34 | 5.64 | 5.29 | 5.44 | NA | |

| Operating, Deposit Service Fees, Commercial Banking | 4.50 | 5.06 | 5.58 | 5.39 | 5.76 | 7.57 | 7.65 | 6.68 | 4.53 | 4.21 | 4.10 | 4.10 | 6.10 | 2.88 | 2.70 | 3.06 | 6.59 | 2.99 | 3.08 | 3.04 | 3.16 | 3.21 | 3.18 | 3.22 | 3.19 | 3.12 | 3.02 | 2.88 | |

| Operating, Deposit Service Fees, Community Banking | 14.54 | 15.25 | 19.18 | 18.02 | 18.30 | 18.73 | 18.35 | 15.95 | 13.43 | 13.08 | 12.73 | 11.30 | 9.71 | 12.70 | 11.49 | 14.59 | 12.31 | 16.05 | 16.29 | 15.37 | 16.44 | 16.11 | 15.66 | 15.31 | 16.15 | 16.43 | 16.08 | 15.53 | |

| Operating, Deposit Service Fees, H S A Bank | 18.40 | 19.57 | 20.99 | 22.09 | 23.56 | 24.01 | 24.95 | 25.13 | 22.46 | 22.89 | 24.48 | 25.02 | 22.44 | 23.67 | 21.74 | 24.84 | 21.60 | 22.26 | 23.70 | 24.53 | 20.70 | 21.29 | 22.01 | 21.81 | 18.27 | 18.66 | 19.03 | 18.48 | |

| Operating, Loans And Lease Related Fees, Commercial Banking | 4.61 | 4.27 | 4.32 | 4.43 | 5.30 | 5.62 | 6.08 | 4.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Other Non Interest Income, Community Banking | 1.10 | 3.54 | 1.20 | 0.36 | 0.41 | 0.41 | 0.28 | 0.39 | 0.09 | 0.27 | 0.30 | 0.25 | -1.10 | 0.53 | 0.74 | 0.32 | -0.61 | 0.65 | 0.70 | 0.50 | 0.65 | 0.35 | 0.64 | 0.49 | 0.22 | 0.22 | 0.16 | 0.22 | |

| Operating, Other Non Interest Income, H S A Bank | 1.82 | 1.23 | 2.04 | 1.98 | 1.67 | 1.83 | 1.60 | 1.82 | 2.04 | 1.87 | 2.08 | 1.99 | 1.66 | 3.57 | 1.36 | 1.54 | 1.36 | 1.26 | 1.27 | 1.05 | 0.92 | 0.86 | 0.88 | 0.86 | 0.71 | 0.71 | 0.72 | 0.79 | |

| Operating, Commercial Banking | 12.15 | 12.19 | 12.78 | 12.58 | 13.83 | 15.87 | 16.49 | 14.32 | 14.95 | 14.56 | 14.48 | 13.81 | 32.44 | 5.55 | 5.29 | 5.59 | 33.03 | 5.64 | 5.63 | 5.52 | 5.60 | 5.79 | 5.77 | 5.76 | 5.72 | 5.59 | 5.46 | 5.25 | |

| Operating, Community Banking | 20.38 | 23.18 | 24.90 | 22.21 | 22.96 | 27.90 | 27.12 | 23.81 | 13.52 | 13.34 | 13.04 | 11.55 | -7.73 | 18.80 | 16.78 | 21.13 | -5.11 | 22.55 | 22.77 | 21.04 | 22.76 | 22.30 | 22.18 | 21.14 | 22.00 | 21.94 | 21.68 | 20.66 | |

| Operating, H S A Bank | 20.22 | 20.80 | 23.02 | 24.07 | 25.23 | 25.84 | 26.55 | 26.96 | 24.50 | 24.76 | 26.55 | 27.00 | 24.11 | 27.23 | 23.10 | 26.38 | 22.96 | 23.53 | 24.98 | 25.58 | 21.61 | 22.16 | 22.88 | 22.67 | 18.99 | 19.37 | 19.75 | 19.27 | |

| Investment Advisory Management And Administrative Service | 7.77 | 7.25 | 7.39 | 6.59 | 7.02 | 11.42 | 11.24 | 10.60 | 10.11 | 9.98 | 10.09 | 9.40 | 8.82 | 8.26 | 7.10 | 8.74 | 8.48 | 8.50 | 8.31 | 7.65 | 8.11 | 8.41 | 8.46 | 7.87 | 8.15 | 7.75 | 7.88 | NA | |

| Deposit Service Fees | 37.46 | 41.01 | 45.42 | 45.44 | 48.45 | 50.81 | 51.38 | 47.83 | 40.54 | 40.26 | 41.44 | 40.47 | 38.34 | 39.28 | 35.84 | 42.57 | 40.47 | 41.41 | 43.12 | 43.02 | 40.27 | 40.60 | 40.86 | 40.45 | 37.62 | 38.32 | 38.19 | 37.01 | |

| Loans And Lease Related Fees | 4.61 | 4.27 | 4.32 | 4.43 | 5.30 | 5.62 | 6.08 | 4.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Non Interest Income | 3.97 | 5.86 | 4.36 | 3.27 | 2.08 | 2.25 | 1.89 | 2.21 | 2.42 | 2.50 | 2.65 | 2.54 | 1.74 | 4.09 | 2.10 | 1.86 | 1.90 | 1.91 | 1.98 | 1.55 | 1.56 | 1.22 | 1.52 | 1.35 | 0.93 | 0.93 | 0.88 | 1.01 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 53.81 | 58.39 | 61.49 | 59.72 | 62.85 | 70.10 | 70.59 | 65.13 | 53.08 | 52.74 | 54.18 | 52.41 | 48.90 | 51.63 | 45.04 | 53.17 | 50.84 | 51.82 | 53.41 | 52.23 | 49.94 | 50.23 | 50.83 | 49.67 | 46.71 | 47.00 | 46.95 | 45.29 | |

| Corporate Non | 1.06 | 2.22 | 0.78 | 0.85 | 0.83 | 0.49 | 0.43 | 0.05 | 0.10 | 0.08 | 0.11 | 0.04 | 0.09 | 0.04 | -0.13 | 0.07 | -0.04 | 0.10 | 0.03 | 0.09 | -0.04 | -0.02 | 0.00 | 0.10 | -0.00 | 0.10 | 0.05 | 0.11 | |

| Corporate Non, Investment Advisory Management And Administrative Service | -0.01 | 0.00 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | 0.02 | -0.04 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | NA | |

| Corporate Non, Deposit Service Fees | 0.02 | 1.12 | -0.33 | -0.07 | 0.84 | 0.50 | 0.44 | 0.05 | 0.12 | 0.09 | 0.12 | 0.05 | 0.10 | 0.02 | -0.09 | 0.08 | -0.03 | 0.11 | 0.04 | 0.10 | -0.03 | -0.01 | 0.01 | 0.11 | 0.01 | 0.11 | 0.06 | 0.11 | |

| Corporate Non, Other Non Interest Income | 1.05 | 1.09 | 1.12 | 0.93 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Operating, Investment Advisory Management And Administrative Service, Commercial Banking | 3.04 | 2.86 | 2.87 | 2.77 | 2.77 | 2.67 | 2.77 | 3.13 | 10.12 | 9.99 | 10.10 | 9.41 | 25.17 | 2.67 | 2.59 | 2.53 | 25.29 | 2.65 | 2.54 | 2.48 | 2.44 | 2.58 | 2.59 | 2.54 | 2.53 | 2.47 | 2.44 | NA | |

| Operating, Investment Advisory Management And Administrative Service, Community Banking | 4.73 | 4.39 | 4.53 | 3.83 | 4.25 | 8.76 | 8.48 | 7.47 | 7.00 | 6.93 | 7.05 | 6.49 | 5.97 | 5.57 | 4.55 | 6.22 | NA | 5.86 | 5.78 | 5.17 | 5.67 | 5.84 | 5.88 | 5.34 | 5.64 | 5.29 | 5.44 | NA | |

| Operating, Deposit Service Fees, Commercial Banking | 4.50 | 5.06 | 5.58 | 5.39 | 5.76 | 7.57 | 7.65 | 6.68 | 4.53 | 4.21 | 4.10 | 4.10 | 6.10 | 2.88 | 2.70 | 3.06 | 6.59 | 2.99 | 3.08 | 3.04 | 3.16 | 3.21 | 3.18 | 3.22 | 3.19 | 3.12 | 3.02 | 2.88 | |

| Operating, Deposit Service Fees, Community Banking | 14.54 | 15.25 | 19.18 | 18.02 | 18.30 | 18.73 | 18.35 | 15.95 | 13.43 | 13.08 | 12.73 | 11.30 | 9.71 | 12.70 | 11.49 | 14.59 | 12.31 | 16.05 | 16.29 | 15.37 | 16.44 | 16.11 | 15.66 | 15.31 | 16.15 | 16.43 | 16.08 | 15.53 | |

| Operating, Deposit Service Fees, H S A Bank | 18.40 | 19.57 | 20.99 | 22.09 | 23.56 | 24.01 | 24.95 | 25.13 | 22.46 | 22.89 | 24.48 | 25.02 | 22.44 | 23.67 | 21.74 | 24.84 | 21.60 | 22.26 | 23.70 | 24.53 | 20.70 | 21.29 | 22.01 | 21.81 | 18.27 | 18.66 | 19.03 | 18.48 | |

| Operating, Loans And Lease Related Fees, Commercial Banking | 4.61 | 4.27 | 4.32 | 4.43 | 5.30 | 5.62 | 6.08 | 4.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Other Non Interest Income, Community Banking | 1.10 | 3.54 | 1.20 | 0.36 | 0.41 | 0.41 | 0.28 | 0.39 | 0.09 | 0.27 | 0.30 | 0.25 | -1.10 | 0.53 | 0.74 | 0.32 | -0.61 | 0.65 | 0.70 | 0.50 | 0.65 | 0.35 | 0.64 | 0.49 | 0.22 | 0.22 | 0.16 | 0.22 | |

| Operating, Other Non Interest Income, H S A Bank | 1.82 | 1.23 | 2.04 | 1.98 | 1.67 | 1.83 | 1.60 | 1.82 | 2.04 | 1.87 | 2.08 | 1.99 | 1.66 | 3.57 | 1.36 | 1.54 | 1.36 | 1.26 | 1.27 | 1.05 | 0.92 | 0.86 | 0.88 | 0.86 | 0.71 | 0.71 | 0.72 | 0.79 | |

| Operating, Commercial Banking | 12.15 | 12.19 | 12.78 | 12.58 | 13.83 | 15.87 | 16.49 | 14.32 | 14.95 | 14.56 | 14.48 | 13.81 | 32.44 | 5.55 | 5.29 | 5.59 | 33.03 | 5.64 | 5.63 | 5.52 | 5.60 | 5.79 | 5.77 | 5.76 | 5.72 | 5.59 | 5.46 | 5.25 | |

| Operating, Community Banking | 20.38 | 23.18 | 24.90 | 22.21 | 22.96 | 27.90 | 27.12 | 23.81 | 13.52 | 13.34 | 13.04 | 11.55 | -7.73 | 18.80 | 16.78 | 21.13 | -5.11 | 22.55 | 22.77 | 21.04 | 22.76 | 22.30 | 22.18 | 21.14 | 22.00 | 21.94 | 21.68 | 20.66 | |

| Operating, H S A Bank | 20.22 | 20.80 | 23.02 | 24.07 | 25.23 | 25.84 | 26.55 | 26.96 | 24.50 | 24.76 | 26.55 | 27.00 | 24.11 | 27.23 | 23.10 | 26.38 | 22.96 | 23.53 | 24.98 | 25.58 | 21.61 | 22.16 | 22.88 | 22.67 | 18.99 | 19.37 | 19.75 | 19.27 | |

| Investment Advisory Management And Administrative Service | 7.77 | 7.25 | 7.39 | 6.59 | 7.02 | 11.42 | 11.24 | 10.60 | 10.11 | 9.98 | 10.09 | 9.40 | 8.82 | 8.26 | 7.10 | 8.74 | 8.48 | 8.50 | 8.31 | 7.65 | 8.11 | 8.41 | 8.46 | 7.87 | 8.15 | 7.75 | 7.88 | NA | |

| Deposit Service Fees | 37.46 | 41.01 | 45.42 | 45.44 | 48.45 | 50.81 | 51.38 | 47.83 | 40.54 | 40.26 | 41.44 | 40.47 | 38.34 | 39.28 | 35.84 | 42.57 | 40.47 | 41.41 | 43.12 | 43.02 | 40.27 | 40.60 | 40.86 | 40.45 | 37.62 | 38.32 | 38.19 | 37.01 | |

| Loans And Lease Related Fees | 4.61 | 4.27 | 4.32 | 4.43 | 5.30 | 5.62 | 6.08 | 4.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Non Interest Income | 3.97 | 5.86 | 4.36 | 3.27 | 2.08 | 2.25 | 1.89 | 2.21 | 2.42 | 2.50 | 2.65 | 2.54 | 1.74 | 4.09 | 2.10 | 1.86 | 1.90 | 1.91 | 1.98 | 1.55 | 1.56 | 1.22 | 1.52 | 1.35 | 0.93 | 0.93 | 0.88 | 1.01 |