| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

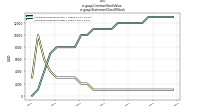

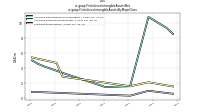

| Weighted Average Number Of Diluted Shares Outstanding | 141.49 | 138.60 | 136.19 | NA | 132.58 | 130.28 | 128.46 | NA | 125.14 | 123.13 | 121.35 | NA | 118.46 | 116.84 | 115.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 141.49 | 138.60 | 136.19 | NA | 132.58 | 130.28 | 128.46 | NA | 125.14 | 123.13 | 121.35 | NA | 118.46 | 116.84 | 115.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

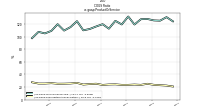

| Earnings Per Share Basic | -0.04 | -0.16 | -0.14 | -0.82 | -0.28 | -0.23 | -0.18 | -0.28 | -0.18 | -0.19 | -0.15 | -0.15 | -0.14 | -0.17 | -0.15 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | -0.04 | -0.16 | -0.14 | -0.82 | -0.28 | -0.23 | -0.18 | -0.28 | -0.18 | -0.19 | -0.15 | -0.15 | -0.14 | -0.17 | -0.15 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

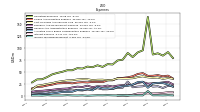

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

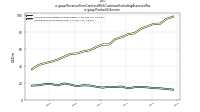

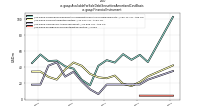

| Revenue From Contract With Customer Excluding Assessed Tax | 109.85 | 108.05 | 103.09 | 103.04 | 101.07 | 98.78 | 93.20 | 90.69 | 89.23 | 86.49 | 80.33 | 79.29 | 77.25 | 74.99 | 73.90 | 70.39 | 71.82 | 69.73 | 64.11 | 63.34 | 61.36 | 57.85 | 52.45 | 53.00 | 46.36 | 39.41 | 32.34 | |

| Revenues | 109.85 | 108.05 | 103.09 | 103.04 | 101.07 | 98.78 | 93.20 | 90.69 | 89.23 | 86.49 | 80.33 | 79.29 | 77.25 | 74.99 | 73.90 | 70.39 | 71.82 | 69.73 | 64.11 | 64.06 | 61.64 | 57.75 | 51.74 | 49.82 | 46.36 | 39.41 | 32.34 | |

| Cost Of Revenue | 35.03 | 37.78 | 37.35 | 38.06 | 40.28 | 38.65 | 36.23 | 35.70 | 35.70 | 35.99 | 32.72 | 32.13 | 33.27 | 33.08 | 32.30 | 34.15 | 34.30 | 33.70 | 32.03 | 31.75 | 30.18 | 28.65 | 26.02 | 24.37 | 22.11 | 20.62 | 12.81 | |

| Cost Of Goods And Services Sold | 35.03 | 37.78 | 37.35 | 38.06 | 40.28 | 38.65 | 36.23 | 35.70 | 35.70 | 35.99 | 32.72 | 32.13 | 33.27 | 33.08 | 32.30 | 34.15 | 34.30 | 33.70 | 32.03 | 31.75 | 30.18 | 28.65 | 26.02 | 24.37 | 22.11 | 20.62 | 12.81 | |

| Gross Profit | 74.82 | 70.27 | 65.75 | 64.98 | 60.79 | 60.13 | 56.96 | 54.99 | 53.53 | 50.49 | 47.61 | 47.16 | 43.98 | 41.91 | 41.60 | 36.25 | 37.52 | 36.03 | 32.08 | 32.31 | 31.46 | 29.11 | 25.73 | 25.45 | 24.25 | 18.79 | 19.53 | |

| Operating Expenses | 83.64 | 88.51 | 85.93 | 164.66 | 94.71 | 90.32 | 80.62 | 89.18 | 75.11 | 73.50 | 65.02 | 65.80 | 59.99 | 63.42 | 59.30 | 60.70 | 56.53 | 57.36 | 52.96 | 53.03 | 49.76 | 47.31 | 44.31 | 38.83 | 34.16 | 33.80 | 27.51 | |

| Research And Development Expense | 27.50 | 26.26 | 25.67 | 24.93 | 28.41 | 26.35 | 22.87 | 21.65 | 21.74 | 20.86 | 18.97 | 20.92 | 18.91 | 19.43 | 17.54 | 20.74 | 17.90 | 18.74 | 17.02 | 14.75 | 14.28 | 13.32 | 12.06 | 11.02 | 9.98 | 9.77 | 7.88 | |

| General And Administrative Expense | 15.89 | 19.45 | 18.82 | 23.45 | 19.33 | 18.82 | 17.29 | 29.29 | 16.37 | 16.38 | 14.19 | 13.13 | 13.02 | 15.38 | 13.27 | 12.51 | 10.60 | 11.32 | 10.45 | 11.68 | 9.58 | 8.56 | 9.41 | 6.78 | 5.56 | 5.55 | 4.68 | |

| Selling And Marketing Expense | 40.24 | 42.80 | 41.44 | 41.30 | 46.97 | 45.15 | 40.46 | 38.24 | 37.00 | 36.26 | 31.86 | 31.75 | 28.06 | 28.61 | 28.50 | 27.45 | 28.03 | 27.29 | 25.50 | 26.60 | 25.90 | 25.43 | 22.84 | 21.03 | 18.62 | 18.48 | 14.95 | |

| Operating Income Loss | -8.82 | -18.24 | -20.18 | -99.69 | -33.92 | -30.19 | -23.66 | -34.19 | -21.58 | -23.00 | -17.41 | -18.65 | -16.01 | -21.50 | -17.70 | -24.45 | -19.01 | -21.33 | -20.88 | -20.72 | -18.30 | -18.21 | -18.58 | -13.38 | -9.91 | -15.01 | -7.98 | |

| Interest Expense | 5.61 | 4.61 | 4.39 | 4.49 | 4.44 | 4.42 | 1.78 | 0.04 | 0.04 | 0.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 26.10 | 26.65 | 25.22 | 16.36 | 29.01 | 28.21 | 22.82 | 20.29 | 19.91 | 18.07 | 13.80 | 15.35 | 14.77 | 18.28 | 10.88 | 13.63 | 11.84 | 11.62 | 7.96 | 7.63 | 7.46 | 5.66 | 4.60 | 3.00 | 3.04 | 1.80 | 1.15 | |

| Income Tax Expense Benefit | 0.34 | 0.59 | 0.47 | 9.44 | 0.31 | 0.53 | 0.31 | 0.21 | 0.61 | 0.24 | 0.37 | 0.74 | 0.41 | 0.55 | 0.16 | -0.28 | 0.42 | 0.06 | 0.24 | 0.75 | 0.20 | 0.20 | 0.19 | 0.73 | 0.00 | 0.20 | 0.13 | |

| Other Comprehensive Income Loss Net Of Tax | -0.71 | -0.23 | 0.06 | 1.85 | -1.31 | -0.59 | -0.76 | -0.46 | -0.15 | -0.17 | -0.12 | 0.70 | -0.09 | 0.26 | -0.27 | 0.00 | -0.07 | -0.18 | -0.05 | 0.38 | -0.71 | 0.42 | -0.08 | NA | NA | NA | NA | |

| Net Income Loss | -5.50 | -22.56 | -19.30 | -107.86 | -37.03 | -29.91 | -23.17 | -35.18 | -22.89 | -23.69 | -17.66 | -18.79 | -16.77 | -20.12 | -17.49 | -23.75 | -18.24 | -20.81 | -20.59 | -20.67 | -17.89 | -19.59 | -19.45 | -13.82 | -10.37 | -14.84 | -8.13 | |

| Comprehensive Income Net Of Tax | -6.22 | -22.79 | -19.24 | -106.01 | -38.34 | -30.50 | -23.93 | -35.64 | -23.04 | -23.87 | -17.78 | -18.09 | -16.86 | -19.86 | -17.76 | -23.75 | -18.30 | -20.99 | -20.64 | -20.28 | -18.60 | -19.17 | -19.52 | -13.26 | -10.29 | -14.69 | -7.96 |

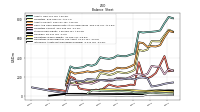

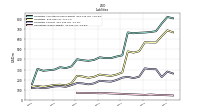

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

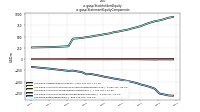

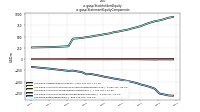

| Assets | 758.13 | 681.85 | 673.16 | 668.60 | 666.19 | 660.93 | 669.32 | 441.25 | 429.22 | 413.62 | 414.13 | 421.51 | 395.33 | 386.57 | 392.17 | 402.23 | 331.29 | 313.66 | 323.23 | 299.42 | 293.24 | 287.24 | 306.81 | 155.37 | NA | NA | NA | |

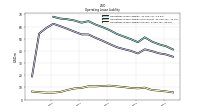

| Liabilities | 632.56 | 569.12 | 569.48 | 571.44 | 482.29 | 468.27 | 480.46 | 270.64 | 249.50 | 236.28 | 242.62 | 249.59 | 227.04 | 217.10 | 230.34 | 237.57 | 163.55 | 141.44 | 149.01 | 146.43 | 136.65 | 127.99 | 134.54 | 128.70 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 758.13 | 681.85 | 673.16 | 668.60 | 666.19 | 660.93 | 669.32 | 441.25 | 429.22 | 413.62 | 414.13 | 421.51 | 395.33 | 386.57 | 392.17 | 402.23 | 331.29 | 313.66 | 323.23 | 299.42 | 293.24 | 287.24 | 306.81 | 155.37 | NA | NA | NA | |

| Stockholders Equity | 125.58 | 112.73 | 103.68 | 97.16 | 183.90 | 192.66 | 188.86 | 170.61 | 179.72 | 177.34 | 171.51 | 171.91 | 168.29 | 169.47 | 161.83 | 164.66 | 167.74 | 172.22 | 174.22 | 152.99 | 156.59 | 159.25 | 172.26 | 26.67 | NA | NA | NA |

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 610.89 | 528.91 | 515.15 | 518.55 | 511.71 | 551.02 | 558.37 | 328.33 | 305.37 | 289.07 | 286.63 | 293.74 | 266.49 | 254.73 | 257.59 | 266.78 | 255.61 | 245.56 | 256.18 | 244.92 | 239.84 | 231.81 | 256.90 | 107.27 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 414.83 | 323.28 | 238.39 | 203.24 | 182.26 | 206.94 | 350.63 | 113.51 | 116.56 | 104.59 | 101.12 | 94.11 | 104.05 | 118.60 | 84.69 | 54.27 | 64.62 | 56.55 | 62.61 | 67.94 | 77.88 | 179.19 | 202.51 | 48.21 | 57.46 | 63.18 | 68.59 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 414.83 | 323.28 | 238.39 | 203.24 | 182.26 | 206.94 | 350.63 | 113.51 | 116.56 | 104.59 | 101.12 | 94.11 | 104.05 | 118.60 | 84.69 | 54.27 | 64.62 | 56.55 | 62.61 | 70.02 | 84.32 | 185.85 | 207.67 | 53.36 | 62.62 | 68.34 | 73.75 | |

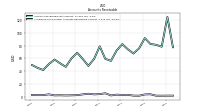

| Accounts Receivable Net Current | 78.30 | 81.22 | 82.58 | 91.74 | 75.83 | 67.69 | 74.31 | 82.26 | 72.36 | 56.24 | 59.48 | 78.86 | 59.27 | 48.43 | 59.37 | 68.88 | 60.07 | 46.91 | 52.46 | 58.26 | 51.38 | 42.05 | 45.39 | 49.76 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 23.55 | 26.12 | 22.88 | 24.29 | 19.54 | 18.85 | 16.26 | 15.60 | 15.98 | 18.84 | 16.59 | 15.57 | 16.89 | 16.32 | 15.55 | 16.39 | 16.16 | 15.33 | 15.73 | 10.41 | 9.20 | 8.79 | 8.78 | 9.30 | NA | NA | NA | |

| Available For Sale Securities Debt Securities | NA | NA | NA | 183.01 | NA | NA | 101.93 | 101.88 | 86.77 | 96.32 | 96.28 | 92.48 | 74.71 | 60.62 | 87.90 | 117.66 | 105.78 | 118.06 | 116.70 | 107.91 | 97.03 | 0.00 | 0.00 | 0.00 | NA | NA | NA |

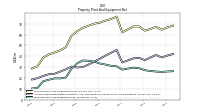

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 64.50 | 67.08 | 65.20 | 63.60 | 67.46 | 67.56 | 64.81 | 61.94 | 76.60 | 74.34 | 72.83 | 71.03 | 70.04 | 68.11 | 66.10 | 63.13 | 58.80 | 48.31 | 45.44 | 43.49 | 41.82 | 38.73 | 30.75 | 28.75 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 38.93 | 41.17 | 38.78 | 36.45 | 38.48 | 38.07 | 36.18 | 34.27 | 45.85 | 43.15 | 40.43 | 37.66 | 34.98 | 32.25 | 30.03 | 29.64 | 30.41 | 27.93 | 25.86 | 23.87 | 23.43 | 21.80 | 19.82 | 18.55 | NA | NA | NA | |

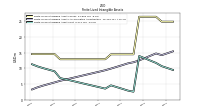

| Amortization Of Intangible Assets | 0.61 | 0.74 | 0.74 | 0.74 | 0.59 | 0.37 | 0.55 | 0.55 | 0.55 | 0.52 | 0.42 | 0.43 | 0.42 | 0.42 | 0.40 | 0.40 | 0.40 | 0.40 | 0.50 | 0.60 | 0.50 | 0.60 | 0.70 | 0.70 | 0.70 | 0.50 | NA | |

| Property Plant And Equipment Net | 25.57 | 25.91 | 26.41 | 27.16 | 28.98 | 29.50 | 28.63 | 27.68 | 30.74 | 31.20 | 32.39 | 33.37 | 35.07 | 35.86 | 36.07 | 33.49 | 28.39 | 20.38 | 19.57 | 19.62 | 18.39 | 16.92 | 10.92 | 10.20 | NA | NA | NA | |

| Goodwill | 55.00 | 57.15 | 56.27 | 53.99 | 52.62 | 17.63 | 17.63 | 17.63 | 17.63 | 17.63 | 17.63 | 17.63 | 17.63 | 17.63 | 17.63 | 17.63 | 17.63 | 17.63 | 17.63 | 20.86 | 20.86 | 20.86 | 20.61 | 20.61 | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 10.69 | 11.72 | 12.46 | 13.20 | 13.93 | 2.53 | 2.90 | 3.45 | 4.01 | 4.56 | 3.50 | 3.93 | 4.35 | 4.77 | 5.20 | 5.62 | 6.04 | 6.46 | 6.89 | 9.04 | 9.54 | 10.05 | 10.61 | 11.29 | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 10.69 | 11.72 | 12.46 | 13.20 | 13.93 | 2.53 | 2.90 | 3.45 | 4.01 | 4.56 | 3.50 | 3.93 | 4.35 | 4.77 | 5.20 | 5.62 | 6.04 | 6.46 | 6.89 | 9.04 | 9.54 | 10.05 | 10.61 | 11.29 | NA | NA | NA | |

| Other Assets Noncurrent | 4.04 | 4.51 | 4.43 | 4.68 | 4.50 | 4.64 | 4.45 | 4.79 | 3.68 | 3.41 | 3.62 | 3.85 | 3.59 | 3.93 | 4.08 | 4.83 | 5.57 | 5.92 | 4.73 | 3.29 | 2.52 | 2.71 | 2.82 | 0.83 | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | NA | NA | NA | 183.58 | NA | NA | 102.55 | 102.11 | 86.80 | 96.32 | 96.28 | 92.45 | 74.61 | 60.38 | 87.57 | 117.54 | 105.65 | 118.01 | 116.67 | 107.90 | 97.07 | NA | NA | NA | NA | NA | NA |

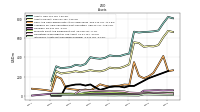

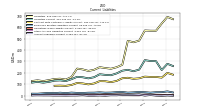

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

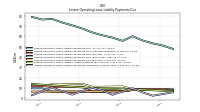

| Liabilities Current | 225.07 | 302.60 | 304.07 | 311.62 | 228.40 | 214.51 | 226.82 | 219.30 | 195.22 | 179.54 | 182.44 | 188.00 | 161.97 | 152.06 | 161.66 | 165.62 | 144.56 | 127.89 | 134.21 | 131.85 | 121.13 | 114.24 | 121.41 | 114.81 | NA | NA | NA | |

| Long Term Debt Current | NA | NA | NA | NA | NA | NA | 0.57 | 1.66 | 2.75 | 3.88 | 4.40 | 4.40 | 4.43 | 4.43 | 4.43 | 4.43 | 4.45 | 4.44 | 4.07 | 2.96 | 1.85 | 5.00 | NA | 2.92 | NA | NA | NA | |

| Accounts Payable Current | 0.47 | 1.02 | 5.99 | 1.07 | 10.61 | 7.65 | 7.16 | 6.79 | 3.48 | 3.72 | 0.84 | 2.25 | 0.23 | 0.28 | 5.34 | 2.10 | 1.72 | 0.96 | 1.62 | 1.51 | 2.68 | 2.84 | 3.47 | 2.57 | NA | NA | NA | |

| Other Accrued Liabilities Current | 2.71 | 4.35 | 7.73 | 8.61 | 3.79 | 3.80 | 4.37 | 4.23 | 5.71 | 5.31 | 3.62 | 4.70 | 5.64 | 4.71 | 3.79 | 4.73 | 6.73 | 5.27 | 5.54 | 6.76 | 4.97 | 4.76 | 6.43 | 4.29 | NA | NA | NA | |

| Contract With Customer Liability Current | 158.41 | 164.56 | 164.33 | 167.15 | 152.32 | 148.16 | 157.13 | 152.74 | 129.33 | 118.92 | 126.88 | 127.70 | 107.31 | 99.19 | 107.73 | 111.41 | 94.01 | 86.09 | 88.30 | 86.78 | NA | NA | NA | NA | NA | NA | NA |

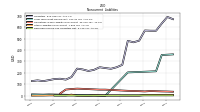

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

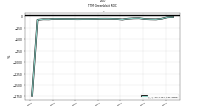

| Long Term Debt Noncurrent | 356.64 | 214.40 | 212.31 | 210.40 | 208.39 | 206.43 | 204.50 | NA | NA | NA | 0.57 | 1.67 | 2.79 | 3.89 | 4.99 | 6.09 | 7.19 | 8.29 | 9.39 | 10.49 | 11.53 | 9.62 | 10.80 | 12.05 | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 3.72 | 3.72 | 3.72 | 3.72 | 3.25 | 3.24 | 3.24 | 3.24 | 1.93 | 1.93 | 1.92 | 1.93 | 1.56 | 1.55 | 1.59 | 1.57 | 1.88 | 1.88 | 1.88 | 1.88 | NA | NA | NA | NA | NA | NA | NA | |

| Other Liabilities Noncurrent | 7.34 | 7.36 | 7.32 | 7.33 | 1.50 | 1.61 | 1.65 | 1.70 | 2.95 | 2.92 | 2.90 | 2.88 | 4.17 | 0.97 | 0.95 | 0.97 | 9.71 | 3.30 | 3.45 | 3.68 | 3.19 | 1.86 | 1.72 | 1.17 | NA | NA | NA | |

| Operating Lease Liability Noncurrent | 38.06 | 39.87 | 41.33 | 37.92 | 40.10 | 41.53 | 43.15 | 45.63 | 48.33 | 50.79 | 53.54 | 53.59 | 55.84 | 58.15 | 60.36 | 62.31 | 58.84 | 54.31 | 19.08 | NA | NA | NA | NA | NA | NA | NA | NA |

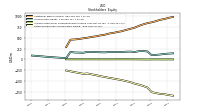

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

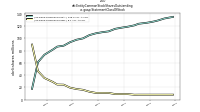

| Stockholders Equity | 125.58 | 112.73 | 103.68 | 97.16 | 183.90 | 192.66 | 188.86 | 170.61 | 179.72 | 177.34 | 171.51 | 171.91 | 168.29 | 169.47 | 161.83 | 164.66 | 167.74 | 172.22 | 174.22 | 152.99 | 156.59 | 159.25 | 172.26 | 26.67 | NA | NA | NA | |

| Additional Paid In Capital | 936.15 | 917.08 | 885.24 | 859.48 | 840.22 | 810.64 | 776.32 | 734.15 | 707.63 | 682.20 | 652.50 | 635.13 | 613.41 | 597.74 | 570.24 | 555.31 | 534.64 | 520.81 | 501.82 | 488.78 | 472.09 | 461.80 | 455.61 | 286.15 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -808.78 | -803.27 | -780.71 | -761.42 | -653.56 | -616.52 | -586.62 | -563.45 | -528.26 | -505.38 | -481.68 | -464.02 | -445.23 | -428.46 | -408.34 | -390.85 | -367.10 | -348.86 | -328.05 | -336.27 | -315.61 | -297.72 | -278.13 | -258.69 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -1.81 | -1.09 | -0.86 | -0.92 | -2.77 | -1.46 | -0.86 | -0.11 | 0.35 | 0.50 | 0.68 | 0.80 | 0.10 | 0.18 | -0.08 | 0.19 | 0.19 | 0.25 | 0.43 | 0.48 | 0.10 | 0.81 | 0.39 | 0.47 | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 26.10 | 26.65 | 25.22 | 16.36 | 29.01 | 28.21 | 22.82 | 20.29 | 19.91 | 18.07 | 13.80 | 15.35 | 14.77 | 18.28 | 10.88 | 13.63 | 11.84 | 11.62 | 7.96 | 7.63 | 7.46 | 5.66 | 4.60 | NA | NA | NA | NA |

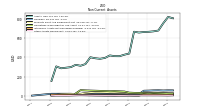

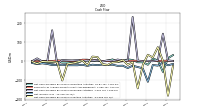

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

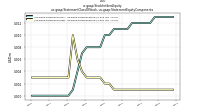

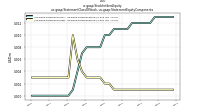

| Net Cash Provided By Used In Operating Activities | -55.66 | 5.39 | 14.59 | -17.96 | -4.86 | -4.80 | 6.98 | 10.37 | 0.69 | -2.62 | 10.25 | 3.13 | 1.36 | 3.84 | 2.95 | 4.01 | 3.51 | -8.95 | -2.16 | -6.99 | -6.37 | -2.40 | -7.83 | -6.90 | -4.86 | -8.66 | -4.36 | |

| Net Cash Provided By Used In Investing Activities | 2.00 | 74.72 | 20.30 | 34.85 | -19.42 | -142.62 | -3.89 | -18.26 | 7.02 | -3.24 | -5.62 | -19.07 | -15.69 | 22.65 | 24.99 | -20.24 | 3.90 | -3.43 | -9.98 | -13.14 | -101.05 | -5.17 | -1.76 | -2.22 | -0.82 | -12.37 | -0.71 | |

| Net Cash Provided By Used In Financing Activities | 145.90 | 5.19 | 0.54 | 2.91 | 0.57 | 4.05 | 234.38 | 5.12 | 4.39 | 9.51 | 2.46 | 5.24 | -0.24 | 7.08 | 2.90 | 5.85 | 0.80 | 6.52 | 4.81 | 5.49 | 6.57 | -14.67 | 163.97 | -0.70 | -0.11 | 15.46 | 0.77 |

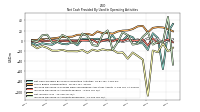

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -55.66 | 5.39 | 14.59 | -17.96 | -4.86 | -4.80 | 6.98 | 10.37 | 0.69 | -2.62 | 10.25 | 3.13 | 1.36 | 3.84 | 2.95 | 4.01 | 3.51 | -8.95 | -2.16 | -6.99 | -6.37 | -2.40 | -7.83 | -6.90 | -4.86 | -8.66 | -4.36 | |

| Net Income Loss | -5.50 | -22.56 | -19.30 | -107.86 | -37.03 | -29.91 | -23.17 | -35.18 | -22.89 | -23.69 | -17.66 | -18.79 | -16.77 | -20.12 | -17.49 | -23.75 | -18.24 | -20.81 | -20.59 | -20.67 | -17.89 | -19.59 | -19.45 | -13.82 | -10.37 | -14.84 | -8.13 | |

| Increase Decrease In Accounts Receivable | -2.75 | -2.19 | -7.53 | 16.75 | 7.77 | -5.98 | -7.46 | 10.97 | 16.61 | -3.03 | -18.22 | 20.24 | 12.14 | -10.19 | -8.52 | 9.46 | 14.14 | -4.65 | -4.45 | 6.31 | 11.33 | -2.02 | -3.18 | 11.79 | 10.62 | -1.78 | 0.36 | |

| Increase Decrease In Accounts Payable | -0.57 | -4.77 | 4.70 | -9.50 | 2.72 | 0.59 | 0.10 | 3.26 | -0.32 | 2.85 | -1.34 | 1.98 | 0.02 | -3.98 | 2.10 | 0.65 | 0.44 | -0.67 | 0.00 | -1.13 | -0.13 | -0.87 | 1.03 | -0.70 | 0.04 | -2.00 | -1.10 | |

| Share Based Compensation | 26.10 | 26.65 | 25.22 | 16.36 | 29.01 | 28.21 | 22.82 | 20.29 | 19.91 | 18.07 | 13.80 | 15.35 | 14.77 | 18.28 | 10.88 | 13.63 | 11.84 | 11.62 | 7.96 | 7.63 | 7.46 | 5.66 | 4.60 | 3.00 | 3.04 | 1.80 | 1.15 | |

| Amortization Of Financing Costs | NA | NA | NA | 2.00 | 2.00 | 1.90 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 2.00 | 74.72 | 20.30 | 34.85 | -19.42 | -142.62 | -3.89 | -18.26 | 7.02 | -3.24 | -5.62 | -19.07 | -15.69 | 22.65 | 24.99 | -20.24 | 3.90 | -3.43 | -9.98 | -13.14 | -101.05 | -5.17 | -1.76 | -2.22 | -0.82 | -12.37 | -0.71 | |

| Payments To Acquire Property Plant And Equipment | 3.08 | 2.18 | 1.66 | 2.16 | 2.39 | 2.82 | 3.26 | 2.73 | 2.35 | 1.73 | 1.97 | 1.07 | 2.12 | 4.83 | 5.12 | 8.55 | 8.64 | 2.57 | 1.68 | 2.79 | 3.93 | 4.93 | 1.76 | 2.22 | 0.82 | 0.95 | 0.71 |

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 145.90 | 5.19 | 0.54 | 2.91 | 0.57 | 4.05 | 234.38 | 5.12 | 4.39 | 9.51 | 2.46 | 5.24 | -0.24 | 7.08 | 2.90 | 5.85 | 0.80 | 6.52 | 4.81 | 5.49 | 6.57 | -14.67 | 163.97 | -0.70 | -0.11 | 15.46 | 0.77 |

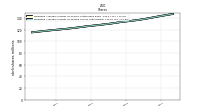

| 2023-10-31 | 2023-07-31 | 2023-04-30 | 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | 2020-04-30 | 2020-01-31 | 2019-10-31 | 2019-07-31 | 2019-04-30 | 2019-01-31 | 2018-10-31 | 2018-07-31 | 2018-04-30 | 2018-01-31 | 2017-10-31 | 2017-07-31 | 2017-04-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 109.85 | 108.05 | 103.09 | 103.04 | 101.07 | 98.78 | 93.20 | 90.69 | 89.23 | 86.49 | 80.33 | 79.29 | 77.25 | 74.99 | 73.90 | 70.39 | 71.82 | 69.73 | 64.11 | 64.06 | 61.64 | 57.75 | 51.74 | 49.82 | 46.36 | 39.41 | 32.34 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 109.85 | 108.05 | 103.09 | 103.04 | 101.07 | 98.78 | 93.20 | 90.69 | 89.23 | 86.49 | 80.33 | 79.29 | 77.25 | 74.99 | 73.90 | 70.39 | 71.82 | 69.73 | 64.11 | 63.34 | 61.36 | 57.85 | 52.45 | 53.00 | 46.36 | 39.41 | 32.34 | |

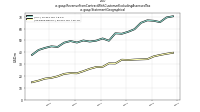

| Subscription And Circulation | 98.05 | 95.47 | 89.71 | 89.51 | 86.57 | 83.81 | 78.50 | 77.33 | 73.78 | 71.50 | 65.14 | 65.11 | 62.02 | 58.31 | 56.90 | 54.56 | 54.04 | 50.65 | 47.31 | 44.96 | 43.08 | 40.88 | 35.89 | NA | NA | NA | NA | |

| Technology Service | 11.80 | 12.57 | 13.38 | 13.53 | 14.51 | 14.96 | 14.70 | 13.36 | 15.46 | 14.99 | 15.19 | 14.18 | 15.23 | 16.68 | 17.00 | 15.83 | 17.78 | 19.09 | 16.80 | 18.38 | 18.27 | 16.97 | 16.56 | NA | NA | NA | NA | |

| US | 70.31 | 69.35 | 65.41 | 66.52 | 66.90 | 64.81 | 59.42 | 57.25 | 55.58 | 55.97 | 49.71 | 51.61 | 49.75 | 49.01 | 49.90 | 48.17 | 49.44 | 48.03 | 44.45 | 44.95 | 43.63 | 41.85 | 37.78 | NA | NA | NA | NA | |

| Non Us | 39.54 | 38.70 | 37.69 | 36.52 | 34.17 | 33.97 | 33.78 | 33.44 | 33.65 | 30.52 | 30.62 | 27.68 | 27.49 | 25.98 | 24.00 | 22.22 | 22.39 | 21.70 | 19.66 | 18.38 | 17.73 | 15.99 | 14.66 | NA | NA | NA | NA |