| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 72.52 | 72.51 | 72.52 | 72.48 | 72.26 | 72.25 | 72.25 | 72.21 | 72.02 | 72.02 | 72.01 | 71.95 | 71.75 | 71.70 | 71.67 | 71.65 | 71.50 | 71.45 | 49.10 | 49.13 | 49.02 | 49.01 | 49.01 | 39.82 | 38.73 | 38.71 | 38.70 | 38.60 | 36.38 | 36.35 | 36.30 | 36.27 | 33.62 | 33.61 | 33.61 | 33.59 | 28.16 | 28.16 | 28.16 | 26.54 | 26.46 | 25.27 | 25.26 | 25.24 | 25.16 | 25.16 | 25.16 | 25.15 | 25.09 | 25.08 | 25.10 | 25.10 | 24.98 | 24.96 | 24.96 | |

| Earnings Per Share Basic | 0.96 | 1.16 | 0.91 | 0.87 | 1.19 | 1.34 | 1.30 | 1.18 | 1.18 | 1.18 | 1.27 | 1.80 | 1.36 | 1.68 | 0.47 | 0.28 | 0.88 | 0.31 | 0.82 | 0.84 | 0.92 | 0.87 | 0.24 | 0.70 | 0.25 | 0.54 | 0.62 | 0.59 | 0.52 | 0.62 | 0.58 | 0.38 | 0.44 | 0.49 | 0.04 | 0.32 | 0.40 | 0.44 | 0.32 | 0.32 | 0.04 | 0.26 | 0.26 | 0.20 | 0.15 | 0.05 | NA | NA | 0.01 | 0.67 | NA | NA | 0.07 | -0.07 | NA | |

| Earnings Per Share Diluted | 0.95 | 1.16 | 0.91 | 0.87 | 1.18 | 1.34 | 1.30 | 1.17 | 1.17 | 1.17 | 1.27 | 1.79 | 1.36 | 1.67 | 0.47 | 0.28 | 0.88 | 0.31 | 0.82 | 0.84 | 0.91 | 0.87 | 0.24 | 0.70 | 0.24 | 0.54 | 0.62 | 0.59 | 0.52 | 0.61 | 0.57 | 0.37 | 0.43 | 0.48 | 0.04 | 0.32 | 0.39 | 0.43 | 0.32 | 0.32 | 0.04 | 0.26 | 0.26 | 0.20 | 0.16 | 0.04 | NA | NA | 0.02 | 0.66 | NA | NA | 0.07 | -0.07 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Interest And Fee Income Loans And Leases | 303.49 | 304.70 | 292.01 | 271.96 | 250.26 | 216.40 | 190.74 | 177.57 | 170.81 | 166.36 | 167.76 | 171.16 | 171.97 | 172.35 | 175.34 | 171.24 | 182.39 | 175.05 | 117.01 | 112.40 | 111.75 | 110.47 | 82.72 | 73.27 | 73.44 | 70.46 | 65.46 | 61.52 | 57.98 | 57.32 | 54.16 | 49.19 | 47.34 | 45.77 | 39.84 | 38.62 | 41.23 | 39.61 | 35.30 | 34.47 | 29.29 | 29.63 | 29.86 | 28.72 | 30.33 | 29.16 | 30.33 | 29.48 | 35.36 | 31.63 | 32.88 | 28.97 | 27.68 | 26.46 | 28.19 | |

| Gain Loss On Investments | -0.29 | -0.02 | -0.01 | 0.01 | 0.00 | -0.02 | 0.25 | -0.03 | -0.00 | 0.53 | 0.00 | -0.01 | 0.00 | 0.00 | 0.01 | -0.01 | -0.00 | 0.00 | 0.07 | 0.07 | 0.00 | 0.05 | -0.12 | 0.04 | 0.00 | 0.00 | 0.04 | 0.00 | 0.00 | 0.00 | 0.00 | 0.09 | 0.00 | 0.12 | 0.01 | 0.01 | 0.00 | 0.13 | 0.00 | 0.01 | 0.00 | 0.00 | -0.00 | 0.17 | NA | NA | NA | NA | 0.00 | 0.00 | NA | NA | 0.00 | 0.00 | NA | |

| Marketing And Advertising Expense | 2.97 | 2.72 | 2.63 | 3.53 | 3.82 | 3.55 | 3.12 | 1.99 | 2.38 | 2.68 | 1.95 | 1.43 | 3.27 | 0.97 | 1.46 | 2.36 | 2.25 | 1.95 | 1.99 | 1.74 | 1.63 | 1.45 | 1.26 | 1.23 | 1.52 | 1.25 | 1.26 | 1.11 | 1.27 | 1.25 | 0.85 | 0.81 | 1.17 | 0.67 | 0.83 | 0.64 | 0.85 | 0.59 | 0.72 | 0.71 | 0.60 | 0.43 | 0.33 | 0.26 | 0.49 | 0.42 | 0.36 | 0.35 | 0.22 | 0.19 | 0.15 | 0.16 | 0.10 | 0.17 | 0.14 | |

| Interest Expense | 126.11 | 122.80 | 112.41 | 84.06 | 49.51 | 21.32 | 11.20 | 10.83 | 11.53 | 11.38 | 11.90 | 12.97 | 15.33 | 17.40 | 21.20 | 34.82 | 38.73 | 39.59 | 27.38 | 25.53 | 23.20 | 22.08 | 13.95 | 10.71 | 10.04 | 9.47 | 8.25 | 6.46 | 5.68 | 5.14 | 4.75 | 4.12 | 3.98 | 3.80 | 3.54 | 3.54 | 3.89 | 4.05 | 3.34 | 3.39 | 2.70 | 2.43 | 2.48 | 2.54 | 2.98 | 3.41 | 4.13 | 4.55 | 5.46 | 6.99 | 7.18 | 7.93 | 7.80 | 7.17 | 7.24 | |

| Interest Income Expense Net | 206.10 | 207.75 | 209.54 | 211.65 | 224.14 | 212.98 | 191.36 | 172.54 | 166.84 | 161.66 | 161.85 | 164.98 | 163.46 | 162.54 | 163.81 | 147.94 | 155.35 | 148.77 | 101.65 | 99.39 | 99.55 | 99.04 | 76.00 | 68.80 | 69.52 | 66.86 | 63.16 | 60.59 | 57.28 | 57.07 | 54.59 | 50.44 | 48.62 | 47.40 | 40.69 | 38.83 | 41.01 | 39.13 | 35.26 | 34.48 | 29.05 | 29.32 | 29.48 | 28.34 | 29.56 | 28.24 | 28.88 | 27.73 | 32.77 | 27.80 | 28.75 | 24.21 | 23.01 | 22.00 | 23.86 | |

| Interest Paid Net | 127.47 | 108.89 | 105.49 | 76.59 | 44.60 | 18.57 | 14.45 | 9.02 | 13.57 | 9.40 | 14.65 | 11.34 | 16.08 | 17.98 | 25.49 | 35.23 | 38.31 | 35.82 | 25.51 | 25.74 | 21.99 | 22.32 | 11.61 | 11.60 | 9.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 24.45 | 24.91 | 20.34 | 18.13 | 22.31 | 28.52 | 28.02 | 27.71 | 25.53 | 29.02 | 26.86 | 37.78 | 31.71 | 34.04 | 8.61 | 3.90 | 20.96 | 5.69 | 12.06 | 11.43 | 7.02 | 13.32 | 2.42 | 7.71 | 22.06 | 8.14 | 10.31 | 10.21 | 6.99 | 10.36 | 9.67 | 6.12 | 3.30 | 7.37 | 0.49 | 4.75 | 4.17 | 5.12 | 4.27 | 3.92 | 0.09 | 3.26 | 3.33 | 2.61 | -12.01 | 0.82 | 1.41 | 2.50 | -20.52 | 8.25 | 0.90 | NA | NA | NA | NA | |

| Income Taxes Paid Net | 12.97 | 26.17 | 62.19 | -0.00 | 51.34 | 30.70 | 51.65 | 0.20 | 16.16 | 24.73 | 30.93 | -0.00 | 42.24 | 48.44 | 8.01 | -0.08 | 3.77 | 10.72 | 21.33 | 0.05 | 9.77 | 6.23 | 4.02 | 0.00 | 10.73 | 12.18 | 16.01 | 0.02 | 9.61 | 13.57 | 16.59 | 0.80 | 3.09 | 0.08 | 2.44 | 0.21 | 4.27 | 9.43 | NA | NA | 5.62 | 2.95 | NA | NA | 2.51 | 0.00 | NA | NA | -1.09 | 1.30 | NA | NA | NA | NA | NA | |

| Net Income Loss | 65.93 | 80.11 | 62.63 | 60.42 | 82.22 | 92.56 | 90.07 | 81.70 | 81.94 | 81.68 | 88.33 | 124.96 | 94.28 | 116.14 | 32.24 | 19.32 | 61.25 | 21.38 | 38.90 | 39.91 | 43.54 | 41.44 | 9.39 | 26.66 | 9.15 | 20.16 | 23.09 | 21.15 | 18.18 | 21.56 | 20.05 | 12.32 | 14.15 | 15.63 | 1.31 | 9.76 | 10.58 | 11.66 | 8.13 | 8.35 | 1.38 | 6.68 | 6.68 | 5.29 | 4.67 | 1.90 | 2.50 | 5.37 | 1.14 | 16.46 | 2.11 | 1.38 | 1.86 | -0.90 | -3.42 | |

| Comprehensive Income Net Of Tax | 90.81 | 69.92 | 47.60 | 71.35 | 86.45 | 54.46 | 79.27 | 64.27 | 75.65 | 78.54 | 87.26 | 117.55 | 90.54 | 113.78 | 32.30 | 40.88 | 63.76 | 20.40 | 56.54 | 43.55 | 55.29 | 37.44 | 7.64 | 17.51 | 4.63 | 21.98 | 25.72 | 21.00 | 6.67 | 19.05 | 26.60 | 15.38 | 18.79 | 16.75 | -1.97 | 10.02 | 12.70 | 11.52 | 9.88 | 11.02 | 2.94 | 2.12 | 3.98 | 4.51 | 6.40 | 0.61 | 2.97 | 3.77 | 2.17 | 16.92 | 2.98 | 0.12 | 2.10 | -1.17 | -4.06 | |

| Interest Income Expense After Provision For Loan Loss | 183.15 | 183.29 | 164.02 | 161.92 | 191.25 | 195.33 | 176.44 | 166.31 | 164.08 | 171.34 | 161.71 | 193.57 | 164.97 | 144.86 | 75.65 | 106.90 | 149.66 | 142.78 | 96.98 | 95.99 | 95.89 | 96.94 | 66.89 | 67.00 | 66.99 | 65.07 | 60.95 | 58.75 | 55.57 | 56.26 | 53.70 | 49.76 | 48.06 | 46.41 | 38.03 | 37.76 | 40.12 | 37.46 | 33.90 | 32.76 | 27.57 | 26.40 | 25.31 | 25.41 | 25.12 | 21.70 | 21.66 | 14.85 | 23.75 | 20.25 | 19.63 | 17.16 | 11.60 | 12.26 | 5.25 | |

| Noninterest Expense | 149.01 | 141.45 | 148.40 | 139.42 | 135.06 | 139.58 | 142.20 | 143.82 | 138.37 | 137.20 | 135.76 | 148.80 | 151.12 | 153.69 | 155.77 | 138.05 | 122.56 | 192.70 | 81.25 | 75.42 | 74.81 | 72.35 | 86.39 | 59.10 | 58.92 | 63.77 | 55.74 | 53.09 | 54.66 | 53.20 | 52.36 | 55.60 | 51.22 | 48.40 | 51.15 | 40.83 | 41.67 | 38.58 | 37.32 | 33.24 | 33.27 | 28.75 | 26.69 | 28.88 | 29.79 | 28.81 | 26.62 | 34.25 | 28.94 | 29.26 | 22.60 | 21.16 | 21.91 | 18.93 | 23.38 | |

| Noninterest Income | 56.25 | 63.18 | 67.35 | 56.05 | 48.35 | 65.32 | 83.84 | 86.91 | 81.77 | 76.56 | 89.24 | 117.97 | 112.14 | 159.02 | 120.96 | 54.38 | 55.11 | 76.99 | 35.24 | 30.77 | 30.47 | 30.17 | 31.31 | 26.46 | 23.56 | 27.00 | 28.19 | 25.71 | 24.27 | 28.86 | 28.38 | 24.29 | 22.41 | 24.98 | 20.63 | 17.57 | 16.36 | 17.90 | 15.82 | 12.75 | 11.52 | 12.29 | 11.38 | 11.36 | 11.90 | 9.83 | 8.88 | 27.26 | 6.92 | 33.72 | 5.97 | 6.19 | 12.27 | 5.01 | 13.05 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

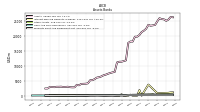

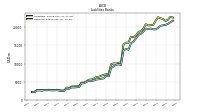

| Assets | 25203.70 | 25697.83 | 25800.62 | 26088.38 | 25053.29 | 23813.66 | 23687.47 | 23560.29 | 23858.32 | 22533.14 | 21886.93 | 21427.13 | 20438.64 | 19873.85 | 19872.63 | 18224.55 | 18242.58 | 17764.28 | 11889.34 | 11656.27 | 11443.51 | 11428.99 | 11190.70 | 8022.83 | 7856.20 | 7649.82 | 7397.86 | 7094.86 | 6892.03 | 6493.49 | 6221.29 | 6097.77 | 5588.94 | 5216.30 | 5205.73 | 4152.90 | 4037.08 | 3999.41 | 3973.14 | 3487.98 | 3667.65 | 2818.50 | 2808.68 | 2861.65 | 3019.05 | 2949.38 | 2920.31 | 3043.23 | 2994.31 | 3010.38 | 2857.24 | 2918.42 | 2972.17 | 2434.70 | 2421.91 | |

| Liabilities | 21776.95 | 22350.76 | 22515.99 | 22835.19 | 21855.89 | 20694.59 | 20614.09 | 20553.13 | 20891.87 | 19632.37 | 19049.93 | 18669.53 | 17791.55 | 17309.17 | 17412.50 | 15787.40 | 15773.00 | 15343.55 | 10352.22 | 10160.69 | 9987.17 | 10024.02 | 9818.80 | 7153.88 | 7051.72 | 6847.90 | 6615.18 | 6336.64 | 6245.59 | 5850.91 | 5595.38 | 5496.94 | 5074.18 | 4714.00 | 4718.96 | 3663.12 | 3671.05 | 3645.58 | 3629.74 | 3187.95 | 3350.95 | 2528.15 | 2520.90 | 2577.93 | 2740.03 | 2650.18 | 2619.37 | 2745.54 | 2700.54 | 2715.96 | 2580.08 | 2644.57 | 2698.76 | 2160.74 | 2147.04 | |

| Liabilities And Stockholders Equity | 25203.70 | 25697.83 | 25800.62 | 26088.38 | 25053.29 | 23813.66 | 23687.47 | 23560.29 | 23858.32 | 22533.14 | 21886.93 | 21427.13 | 20438.64 | 19873.85 | 19872.63 | 18224.55 | 18242.58 | 17764.28 | 11889.34 | 11656.27 | 11443.51 | 11428.99 | 11190.70 | 8022.83 | 7856.20 | 7649.82 | 7397.86 | 7094.86 | 6892.03 | 6493.49 | 6221.29 | 6097.77 | 5588.94 | 5216.30 | 5205.73 | 4152.90 | 4037.08 | 3999.41 | 3973.14 | 3487.98 | 3667.65 | 2818.50 | 2808.68 | 2861.65 | 3019.05 | 2949.38 | 2920.31 | 3043.23 | 2994.31 | 3010.38 | 2857.24 | 2918.42 | 2972.17 | 2434.70 | 2421.91 | |

| Stockholders Equity | 3426.75 | 3347.07 | 3284.63 | 3253.20 | 3197.40 | 3119.07 | 3073.38 | 3007.16 | 2966.45 | 2900.77 | 2837.00 | 2757.60 | 2647.09 | 2564.68 | 2460.13 | 2437.15 | 2469.58 | 2420.72 | 1537.12 | 1495.58 | 1456.35 | 1404.98 | 1371.90 | 868.94 | 804.48 | 801.92 | 782.68 | 758.22 | 646.44 | 642.58 | 625.91 | 600.83 | 514.76 | 502.30 | 486.77 | 489.78 | 366.03 | 353.83 | 343.40 | 300.03 | 316.70 | 290.36 | 287.78 | 283.72 | 279.02 | 299.21 | 300.94 | 297.70 | 293.77 | 294.42 | 277.16 | 273.86 | 273.41 | 273.97 | 274.87 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 1167.30 | 1545.77 | 1319.13 | 2020.85 | 1118.13 | 1331.17 | 2306.84 | 3798.46 | 4064.66 | 3752.44 | 3304.52 | 2759.13 | 2117.31 | 751.79 | 721.46 | 652.16 | 621.85 | 479.69 | 338.15 | 857.00 | 679.53 | 629.26 | 424.71 | 334.88 | 330.66 | NA | NA | NA | 198.38 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

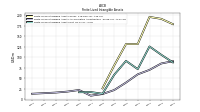

| Property Plant And Equipment Gross | 337.79 | NA | NA | NA | 333.10 | NA | NA | NA | 325.76 | NA | NA | NA | 312.78 | NA | NA | NA | 314.10 | NA | NA | NA | 216.88 | NA | NA | NA | 184.64 | NA | NA | NA | 180.57 | NA | NA | NA | NA | NA | NA | NA | 153.84 | NA | NA | NA | 141.06 | NA | NA | NA | 112.67 | NA | NA | NA | 110.51 | NA | NA | NA | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 121.36 | NA | NA | NA | 112.82 | NA | NA | NA | 100.36 | NA | NA | NA | 89.89 | NA | NA | NA | 80.99 | NA | NA | NA | 71.47 | NA | NA | NA | 66.90 | NA | NA | NA | 59.36 | NA | NA | NA | 61.01 | NA | NA | NA | 56.59 | NA | NA | NA | 37.87 | NA | NA | NA | 36.69 | NA | NA | NA | 37.38 | NA | NA | NA | NA | NA | NA | |

| Amortization Of Intangible Assets | 4.42 | 4.42 | 4.69 | 4.71 | 4.71 | 4.71 | 5.14 | 5.18 | 3.39 | 3.39 | 4.07 | 4.13 | 4.19 | 4.19 | 5.60 | 5.63 | 5.74 | 5.72 | 3.12 | 3.13 | 3.65 | 2.68 | 2.25 | 0.93 | 0.94 | 0.94 | 1.01 | 1.04 | 1.04 | 0.99 | 1.32 | 1.02 | 1.16 | 1.32 | 0.63 | 0.63 | 0.66 | 0.70 | 0.44 | 0.53 | 0.35 | 0.35 | 0.36 | 0.36 | 0.36 | 0.36 | 0.41 | 0.22 | 0.23 | 0.28 | 0.24 | 0.26 | 0.27 | 0.25 | 0.19 | |

| Property Plant And Equipment Net | 216.44 | 217.56 | 218.66 | 218.88 | 220.28 | 222.69 | 224.25 | 224.29 | 225.40 | 226.43 | 229.99 | 231.55 | 222.89 | 231.28 | 230.12 | 231.35 | 233.10 | 239.43 | 141.38 | 141.70 | 145.41 | 145.88 | 144.48 | 116.38 | 117.74 | 119.46 | 121.11 | 121.61 | 121.22 | 122.19 | 123.98 | 124.75 | 121.64 | 124.76 | 124.92 | 98.29 | 97.25 | 98.75 | 99.50 | 87.43 | 103.19 | 65.66 | 70.17 | 72.34 | 75.98 | 75.61 | 75.19 | 72.75 | 73.12 | 71.85 | 65.92 | 66.36 | 66.59 | 66.06 | 66.71 | |

| Goodwill | 1015.65 | 1015.65 | 1015.65 | 1015.65 | 1015.65 | 1023.07 | 1023.06 | 1022.35 | 1012.62 | 928.00 | 928.00 | 928.00 | 928.00 | 928.00 | 928.00 | 931.95 | 931.64 | 911.49 | 501.14 | 501.31 | 503.43 | 505.60 | 504.76 | 208.51 | 125.53 | 125.53 | 125.53 | 125.53 | 125.53 | 122.55 | 121.42 | 121.51 | 90.08 | 87.70 | 87.37 | 63.55 | 63.55 | 58.88 | 58.90 | 35.05 | 35.05 | 0.96 | 0.96 | 0.96 | 0.96 | 0.96 | 0.96 | 0.96 | 0.96 | 0.96 | 0.96 | 0.96 | 0.96 | NA | NA | |

| Finite Lived Intangible Assets Net | 87.90 | NA | NA | NA | 106.20 | NA | NA | NA | 125.90 | NA | NA | NA | 72.00 | NA | NA | NA | 91.60 | NA | NA | NA | 58.70 | NA | NA | NA | 13.50 | NA | NA | NA | 17.43 | NA | NA | NA | 17.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 18.78 | 26.17 | 20.62 | 18.08 | 20.33 | 22.40 | 14.51 | 8.96 | 1.65 | 1.15 | 0.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 122.73 | 115.69 | 121.89 | 116.09 | 114.54 | 107.81 | 97.14 | 82.49 | 78.21 | 63.30 | 29.01 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 18.78 | 26.17 | 20.62 | 18.08 | 20.33 | 22.40 | 14.51 | 8.96 | 1.65 | 1.15 | 0.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Fair Value | 122.73 | 115.69 | 121.89 | 116.09 | 114.54 | 107.81 | 97.14 | 75.45 | 73.20 | 63.30 | 9.58 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | 141.51 | 141.86 | 142.51 | 134.18 | 134.86 | 130.21 | NA | NA | 79.85 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Twelve Months Or Longer Fair Value | 109.12 | 102.89 | 82.88 | 75.60 | 65.56 | 47.45 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Less Than Twelve Months Fair Value | 13.61 | 12.79 | 39.01 | 40.50 | 48.98 | 60.36 | 97.14 | 75.45 | 73.20 | 63.30 | 9.58 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Ten Years Fair Value | 26.85 | 24.55 | 26.61 | 27.33 | 26.52 | 25.07 | 27.63 | 11.68 | 8.71 | 3.78 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | 3333.07 | NA | NA | NA | 1233.02 | NA | NA | NA | 1466.73 | NA | NA | NA | 1691.53 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 20708.51 | 20590.35 | 20443.12 | 19897.46 | 19462.74 | 19466.92 | 19684.98 | 19588.44 | 19665.55 | 18833.49 | 18258.00 | 17875.87 | 16957.82 | 16063.81 | 15589.82 | 13844.62 | 14027.07 | 13659.59 | 9582.37 | 9800.88 | 9649.31 | 9181.36 | 8761.59 | 6446.16 | 6625.85 | 5895.50 | 5793.40 | 5642.37 | 5575.16 | 5306.10 | 5179.53 | 5230.79 | 4879.29 | 4530.52 | 4511.55 | 3480.23 | 3431.15 | 3373.12 | 3389.03 | 3010.65 | 2999.23 | 2443.42 | 2443.10 | 2489.97 | 2624.66 | 2580.12 | 2544.67 | 2665.36 | 2591.57 | 2628.89 | 2511.36 | 2572.69 | 2535.43 | 2099.00 | 2080.03 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 3426.75 | 3347.07 | 3284.63 | 3253.20 | 3197.40 | 3119.07 | 3073.38 | 3007.16 | 2966.45 | 2900.77 | 2837.00 | 2757.60 | 2647.09 | 2564.68 | 2460.13 | 2437.15 | 2469.58 | 2420.72 | 1537.12 | 1495.58 | 1456.35 | 1404.98 | 1371.90 | 868.94 | 804.48 | 801.92 | 782.68 | 758.22 | 646.44 | 642.58 | 625.91 | 600.83 | 514.76 | 502.30 | 486.77 | 489.78 | 366.03 | 353.83 | 343.40 | 300.03 | 316.70 | 290.36 | 287.78 | 283.72 | 279.02 | 299.21 | 300.94 | 297.70 | 293.77 | 294.42 | 277.16 | 273.86 | 273.41 | 273.97 | 274.87 | |

| Common Stock Value | 72.52 | 72.51 | 72.52 | 72.48 | 72.26 | 72.25 | 72.25 | 72.21 | 72.02 | 72.02 | 72.01 | 71.95 | 71.75 | 71.70 | 71.67 | 71.65 | 71.50 | 71.45 | 49.10 | 49.13 | 49.02 | 49.01 | 49.01 | 39.82 | 38.73 | 38.71 | 38.70 | 38.60 | 36.38 | 36.35 | 36.30 | 36.27 | 33.62 | 33.61 | 33.61 | 33.59 | 28.16 | 28.16 | 28.16 | 26.54 | 26.46 | 25.27 | 25.26 | 25.24 | 25.16 | 25.16 | 25.16 | 25.15 | 25.09 | 25.08 | 25.10 | 25.10 | 24.98 | 24.96 | 24.96 | |

| Additional Paid In Capital Common Stock | 1945.38 | 1942.85 | 1939.87 | 1937.66 | 1935.21 | 1932.91 | 1931.09 | 1928.70 | 1924.81 | 1922.96 | 1920.57 | 1917.99 | 1913.29 | 1911.03 | 1909.84 | 1908.72 | 1907.11 | 1904.79 | 1053.50 | 1053.19 | 1051.58 | 1050.75 | 1049.28 | 559.04 | 508.40 | 506.78 | 505.80 | 503.54 | 410.28 | 409.63 | 408.55 | 407.73 | 337.35 | 336.60 | 336.21 | 335.58 | 225.01 | 224.14 | 223.89 | 190.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 1539.96 | 1484.42 | 1414.74 | 1362.51 | 1311.26 | 1239.48 | 1157.36 | 1077.72 | 1006.44 | 934.98 | 863.83 | 785.98 | 671.51 | 587.66 | 481.95 | 460.15 | 507.95 | 457.13 | 446.18 | 412.00 | 377.13 | 338.35 | 301.66 | 296.37 | 273.12 | 267.69 | 251.26 | 231.89 | 214.45 | 199.77 | 181.70 | 163.40 | 152.82 | 140.28 | 126.27 | 126.57 | 118.41 | 109.17 | 98.85 | 92.06 | 83.99 | 83.03 | 76.79 | 70.55 | 65.71 | 62.16 | 61.08 | 59.40 | 54.85 | 54.53 | 38.89 | 37.58 | 37.00 | 35.95 | 37.66 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -35.94 | -60.82 | -50.62 | -35.58 | -46.51 | -50.73 | -12.63 | -1.84 | 15.59 | 21.89 | 25.02 | 26.09 | 33.51 | 37.25 | 39.61 | 39.55 | 18.00 | 15.48 | 16.46 | -1.18 | -4.83 | -16.58 | -12.57 | -10.82 | -1.28 | 3.24 | 1.42 | -1.21 | -1.06 | 10.45 | 12.96 | 6.41 | 3.35 | 4.20 | 3.07 | 6.35 | 6.10 | 3.97 | 4.12 | 2.37 | -0.29 | -0.53 | 3.58 | 6.27 | 6.61 | 7.34 | 7.80 | 6.51 | 7.30 | 8.69 | 7.41 | 5.74 | 6.20 | 8.37 | 7.83 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 2.53 | 3.02 | 2.23 | 2.20 | 1.86 | 1.86 | 1.64 | 1.30 | 1.82 | 2.15 | 1.44 | 1.30 | 1.07 | 0.94 | 1.31 | 0.77 | 0.85 | 0.81 | 0.81 | 0.75 | 0.77 | 1.47 | 2.29 | 0.90 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

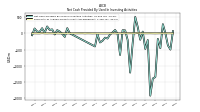

| Net Cash Provided By Used In Operating Activities | 212.89 | 131.90 | 92.46 | 131.70 | -0.32 | 348.92 | 353.44 | 360.42 | 266.69 | -165.33 | 372.38 | -464.61 | 419.03 | 405.61 | -327.24 | 300.99 | -352.91 | -616.18 | -30.80 | 59.68 | -15.27 | -38.07 | -103.96 | 48.50 | 33.12 | -27.36 | -81.58 | 13.25 | -7.52 | NA | NA | NA | NA | NA | NA | NA | NA | NA | -16.34 | 32.24 | 0.14 | 9.81 | -7.23 | 30.92 | 3.30 | 3.92 | 17.30 | 7.72 | 10.53 | 25.78 | 0.60 | 9.25 | -8.96 | 32.38 | NA | |

| Net Cash Provided By Used In Investing Activities | 4.12 | 285.27 | -458.09 | -169.50 | -1348.59 | -1395.01 | -1925.89 | -205.03 | -480.22 | 55.66 | -196.05 | 199.62 | 509.28 | -292.20 | -1212.97 | -204.83 | 92.94 | 98.00 | -666.42 | -11.61 | 106.08 | 31.32 | -32.40 | -158.31 | -132.18 | -229.19 | -281.10 | -24.43 | -403.48 | NA | NA | NA | NA | NA | NA | NA | NA | NA | 3.57 | 161.83 | -106.46 | -12.88 | 57.86 | 101.64 | -32.69 | 124.04 | 108.19 | 215.01 | 13.72 | 160.51 | 44.67 | 59.60 | 150.99 | -56.89 | NA | |

| Net Cash Provided By Used In Financing Activities | -595.48 | -190.53 | -336.09 | 940.51 | 1135.87 | 70.42 | 80.83 | -421.59 | 525.74 | 557.58 | 369.06 | 906.81 | 437.20 | -83.08 | 1609.52 | -65.85 | 402.12 | 659.71 | 178.38 | 129.40 | -40.54 | 211.30 | 226.20 | 114.03 | 185.81 | 223.15 | 280.78 | 172.00 | 395.31 | NA | NA | NA | NA | NA | NA | NA | NA | NA | 22.36 | -185.65 | 115.77 | 6.25 | -50.78 | -162.34 | 52.37 | -130.79 | -130.33 | -223.30 | -14.48 | -199.08 | -65.11 | -54.80 | -111.51 | 13.88 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 212.89 | 131.90 | 92.46 | 131.70 | -0.32 | 348.92 | 353.44 | 360.42 | 266.69 | -165.33 | 372.38 | -464.61 | 419.03 | 405.61 | -327.24 | 300.99 | -352.91 | -616.18 | -30.80 | 59.68 | -15.27 | -38.07 | -103.96 | 48.50 | 33.12 | -27.36 | -81.58 | 13.25 | -7.52 | NA | NA | NA | NA | NA | NA | NA | NA | NA | -16.34 | 32.24 | 0.14 | 9.81 | -7.23 | 30.92 | 3.30 | 3.92 | 17.30 | 7.72 | 10.53 | 25.78 | 0.60 | 9.25 | -8.96 | 32.38 | NA | |

| Net Income Loss | 65.93 | 80.11 | 62.63 | 60.42 | 82.22 | 92.56 | 90.07 | 81.70 | 81.94 | 81.68 | 88.33 | 124.96 | 94.28 | 116.14 | 32.24 | 19.32 | 61.25 | 21.38 | 38.90 | 39.91 | 43.54 | 41.44 | 9.39 | 26.66 | 9.15 | 20.16 | 23.09 | 21.15 | 18.18 | 21.56 | 20.05 | 12.32 | 14.15 | 15.63 | 1.31 | 9.76 | 10.58 | 11.66 | 8.13 | 8.35 | 1.38 | 6.68 | 6.68 | 5.29 | 4.67 | 1.90 | 2.50 | 5.37 | 1.14 | 16.46 | 2.11 | 1.38 | 1.86 | -0.90 | -3.42 | |

| Deferred Income Tax Expense Benefit | -7.09 | -2.88 | -7.70 | -2.81 | -13.98 | -32.20 | 4.07 | 6.43 | 6.34 | 5.59 | 13.57 | 12.92 | 20.72 | 3.89 | -25.21 | -7.33 | 10.74 | 8.12 | 1.00 | 2.96 | 0.35 | 2.47 | -3.88 | 2.43 | 13.39 | 0.82 | -1.20 | -0.58 | 7.22 | -2.98 | -1.73 | -1.67 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.17 | NA | NA | NA | -6.62 | NA | NA | |

| Share Based Compensation | 2.54 | 2.99 | 2.23 | 2.20 | 1.85 | 1.81 | 1.55 | 1.50 | 2.06 | 2.43 | 1.70 | 1.75 | 1.10 | 1.01 | 1.14 | 0.56 | 0.97 | 0.94 | 0.36 | 1.15 | 0.81 | 1.28 | 2.71 | 1.44 | 0.90 | 0.92 | 0.82 | 0.67 | 0.68 | 0.58 | 0.52 | 0.49 | 0.34 | 0.38 | 0.38 | 0.38 | 0.83 | 0.22 | 0.22 | 0.80 | 0.45 | 0.20 | 0.20 | 0.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 4.12 | 285.27 | -458.09 | -169.50 | -1348.59 | -1395.01 | -1925.89 | -205.03 | -480.22 | 55.66 | -196.05 | 199.62 | 509.28 | -292.20 | -1212.97 | -204.83 | 92.94 | 98.00 | -666.42 | -11.61 | 106.08 | 31.32 | -32.40 | -158.31 | -132.18 | -229.19 | -281.10 | -24.43 | -403.48 | NA | NA | NA | NA | NA | NA | NA | NA | NA | 3.57 | 161.83 | -106.46 | -12.88 | 57.86 | 101.64 | -32.69 | 124.04 | 108.19 | 215.01 | 13.72 | 160.51 | 44.67 | 59.60 | 150.99 | -56.89 | NA | |

| Payments To Acquire Property Plant And Equipment | 5.85 | 3.80 | 4.62 | 3.26 | 2.26 | 3.12 | 4.64 | 3.55 | 3.46 | 4.79 | 3.39 | 13.81 | 3.95 | 4.90 | 5.70 | 3.57 | 5.66 | 1.31 | 3.06 | 1.55 | 2.67 | 4.27 | 1.93 | 1.13 | 0.74 | 0.64 | 1.15 | 1.22 | 2.73 | 1.37 | 3.18 | 3.69 | 1.52 | 4.46 | 3.60 | 3.00 | 1.93 | 1.56 | 1.76 | 0.46 | 1.50 | 2.02 | 0.65 | 1.47 | 2.42 | 1.90 | 3.67 | 1.07 | 2.45 | 7.11 | 0.92 | 1.54 | 2.67 | 0.39 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

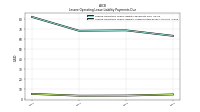

| Net Cash Provided By Used In Financing Activities | -595.48 | -190.53 | -336.09 | 940.51 | 1135.87 | 70.42 | 80.83 | -421.59 | 525.74 | 557.58 | 369.06 | 906.81 | 437.20 | -83.08 | 1609.52 | -65.85 | 402.12 | 659.71 | 178.38 | 129.40 | -40.54 | 211.30 | 226.20 | 114.03 | 185.81 | 223.15 | 280.78 | 172.00 | 395.31 | NA | NA | NA | NA | NA | NA | NA | NA | NA | 22.36 | -185.65 | 115.77 | 6.25 | -50.78 | -162.34 | 52.37 | -130.79 | -130.33 | -223.30 | -14.48 | -199.08 | -65.11 | -54.80 | -111.51 | 13.88 | NA | |

| Payments Of Dividends Common Stock | 10.34 | 10.34 | 10.39 | 10.58 | 10.38 | 10.38 | 10.40 | 10.45 | 10.44 | 10.47 | 10.46 | 10.43 | 10.42 | 10.42 | 10.41 | 10.43 | 10.44 | 4.73 | 4.76 | 4.75 | 4.75 | 4.10 | 3.83 | 3.73 | 3.72 | 3.72 | 3.71 | 3.49 | 3.49 | 1.61 | 1.74 | 1.74 | 1.61 | 1.61 | 1.61 | 1.61 | 1.34 | 1.34 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |