| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | |

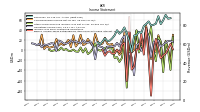

| Earnings Per Share Basic | -0.01 | -0.02 | 0.09 | 0.14 | 0.04 | -0.59 | 0.00 | 0.18 | 0.03 | 0.13 | NA | NA | NA | NA | NA | NA | 0.24 | 0.12 | 0.11 | 0.15 | 0.09 | 0.11 | 0.09 | 0.09 | 0.25 | 0.15 | 0.14 | 0.18 | |

| Earnings Per Share Diluted | -0.01 | -0.02 | 0.09 | 0.14 | 0.03 | -0.61 | 0.00 | 0.18 | 0.03 | 0.13 | NA | NA | NA | NA | NA | NA | 0.24 | 0.12 | 0.11 | 0.15 | 0.09 | 0.11 | 0.09 | 0.09 | 0.25 | 0.15 | 0.14 | 0.18 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

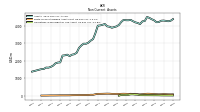

| Revenues | 85.51 | 81.39 | 89.95 | 81.84 | 80.58 | 79.95 | 84.26 | 81.51 | 79.36 | 71.90 | 73.06 | 69.39 | 69.01 | 51.28 | 63.77 | 71.42 | 77.79 | 73.33 | 71.06 | 74.80 | 69.44 | 66.08 | 63.57 | 63.12 | 66.08 | 62.68 | 59.50 | 62.00 | |

| Gain Loss On Investments | 0.18 | 1.66 | 1.81 | 26.76 | -16.58 | -7.86 | -26.28 | 15.73 | -7.39 | 47.29 | 2.71 | 6.51 | 34.59 | -7.95 | 87.81 | -0.53 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Income | 0.18 | 1.66 | 1.81 | 26.76 | -16.58 | -7.86 | -26.28 | 15.73 | -7.39 | 47.29 | 2.71 | 6.51 | 34.59 | -7.95 | 87.81 | -0.53 | 0.00 | 5.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Costs And Expenses | 74.89 | 74.70 | 70.29 | 69.73 | 71.33 | 102.78 | 70.83 | 70.28 | 64.84 | 74.79 | 67.41 | 65.33 | 118.44 | 65.33 | 70.02 | 117.76 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| General And Administrative Expense | 10.57 | 10.31 | 10.64 | 9.95 | 11.30 | 10.17 | 10.66 | 11.94 | 10.48 | 9.98 | 10.67 | 9.00 | 9.64 | 8.62 | 8.72 | 9.07 | 9.84 | 8.22 | 9.03 | 8.32 | 9.98 | 7.98 | 7.91 | 8.47 | 8.47 | 7.95 | 8.86 | 8.47 | |

| Operating Income Loss | 10.62 | 6.69 | 19.66 | 12.11 | 16.49 | -13.95 | 25.65 | 40.04 | 10.16 | -1.34 | 13.16 | 8.68 | -49.25 | -14.03 | -5.76 | -46.34 | 28.04 | 21.27 | 7.09 | 14.19 | 7.59 | 6.95 | 6.30 | 6.70 | -5.06 | 5.74 | 6.74 | 9.90 | |

| Interest And Debt Expense | 24.69 | 24.89 | 22.09 | 21.59 | 21.90 | 21.16 | 19.22 | 17.93 | 15.97 | 17.33 | 17.61 | 17.14 | 17.69 | 17.75 | 18.32 | 18.30 | 17.07 | 19.10 | 19.76 | 17.86 | 19.10 | 18.08 | 16.91 | 15.89 | 19.31 | 15.43 | 12.75 | 11.49 | |

| Interest Paid Net | 32.77 | 31.43 | 32.24 | 23.11 | 23.19 | 19.73 | 10.31 | 11.88 | 12.86 | 11.14 | 8.84 | 11.82 | 31.92 | 13.91 | 12.40 | 14.16 | 0.00 | 18.20 | 18.49 | 16.90 | 16.58 | 16.03 | 17.31 | 11.91 | 10.32 | 16.28 | 13.71 | 9.63 | |

| Allocated Share Based Compensation Expense | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.10 | 0.10 | -0.10 | 0.00 | 0.20 | 0.10 | |

| Income Loss From Continuing Operations | -1.34 | -1.43 | 9.28 | 13.36 | 3.98 | -55.89 | -0.37 | 16.84 | 2.40 | 12.07 | 3.92 | 5.16 | -10.72 | -9.03 | 19.41 | -8.41 | 21.31 | 10.46 | 9.08 | 12.20 | 7.13 | 9.22 | 7.67 | 7.42 | 20.91 | 12.87 | 12.06 | 15.63 | |

| Income Tax Expense Benefit | 0.05 | -0.04 | 0.17 | 0.12 | 0.01 | -0.02 | 0.21 | -0.18 | -0.31 | 0.06 | 0.19 | 0.15 | 1.01 | 0.07 | 0.14 | -0.95 | -0.15 | 1.40 | 0.27 | -0.05 | 0.08 | 0.46 | -0.01 | 0.39 | -0.01 | 0.47 | 0.43 | 0.12 | |

| Income Taxes Paid Net | 0.05 | 0.12 | 0.00 | 0.12 | 0.01 | -0.18 | 0.37 | -0.18 | -0.11 | -0.09 | 0.24 | 0.10 | -0.61 | 0.06 | 0.00 | 0.22 | 0.00 | 0.47 | 0.14 | 0.11 | 0.00 | 1.23 | -0.67 | 0.67 | 0.10 | 0.64 | -0.08 | 0.22 | |

| Profit Loss | -10.23 | -16.27 | 2.75 | 22.00 | -3.98 | -89.55 | -15.82 | 44.10 | -8.62 | 31.56 | 1.23 | 1.86 | -32.62 | -38.29 | 64.91 | -60.04 | 14.66 | 8.84 | -5.24 | 2.94 | -6.67 | -2.60 | -2.27 | -4.16 | 24.94 | 13.29 | 6.11 | 19.97 | |

| Other Comprehensive Income Loss Net Of Tax | -43.42 | 17.29 | 25.25 | -21.80 | -2.59 | 45.63 | 21.26 | 40.78 | 11.21 | 6.57 | -4.75 | 38.87 | 13.81 | 6.46 | -5.51 | -73.80 | 16.18 | -15.68 | -23.19 | -13.86 | -15.58 | 3.92 | 3.06 | 6.02 | 3.97 | 0.09 | -1.19 | 1.08 | |

| Comprehensive Income Net Of Tax | -34.45 | 14.28 | 29.13 | -3.45 | 1.11 | -17.45 | 16.59 | 47.33 | 9.35 | 16.81 | -2.03 | 38.09 | 0.26 | -4.69 | 14.92 | -62.95 | 34.27 | -4.11 | -9.47 | 0.66 | -5.62 | 12.35 | 10.43 | 12.18 | 24.08 | 12.83 | 11.12 | 16.87 | |

| Net Income Loss Available To Common Stockholders Basic | -1.34 | -1.43 | 9.28 | 13.36 | 3.98 | -55.89 | -0.37 | 16.84 | 2.40 | 12.07 | 3.92 | 5.16 | -10.72 | -9.03 | 19.41 | -8.41 | 21.31 | 10.46 | 9.08 | 12.20 | 7.13 | 9.22 | 7.67 | 7.42 | 20.91 | 12.87 | 12.06 | 15.63 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

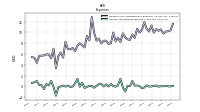

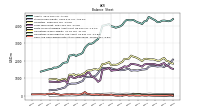

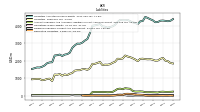

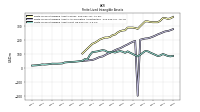

| Assets | 4291.15 | 4280.78 | 4204.16 | 4194.21 | 4302.58 | 4363.50 | 4438.88 | 4496.18 | 4261.75 | 4244.65 | 4089.61 | 4153.68 | 4186.88 | 4251.41 | 4328.75 | 4305.14 | 4309.11 | 4329.55 | 4209.92 | 4038.88 | 3958.78 | 3918.72 | 3880.77 | 3938.98 | 3960.25 | 4092.96 | 4048.84 | 4014.90 | |

| Liabilities | 2157.60 | 2101.26 | 2006.22 | 2000.68 | 2053.72 | 2082.30 | 2075.67 | 2087.97 | 2111.81 | 2103.13 | 1973.26 | 2069.31 | 2138.33 | 2199.31 | 2235.42 | 2293.58 | 2122.15 | 2100.02 | 2109.82 | 1932.52 | 1876.83 | 1794.91 | 1768.22 | 1774.31 | 1744.61 | 1923.16 | 1868.45 | 1818.41 | |

| Liabilities And Stockholders Equity | 4291.15 | 4280.78 | 4204.16 | 4194.21 | 4302.58 | 4363.50 | 4438.88 | 4496.18 | 4261.75 | 4244.65 | 4089.61 | 4153.68 | 4186.88 | 4251.41 | 4328.75 | 4305.14 | 4309.11 | 4329.55 | 4209.92 | 4038.88 | 3958.78 | 3918.72 | 3880.77 | 3938.98 | 3960.25 | 4092.96 | 4048.84 | 4014.90 | |

| Stockholders Equity | 1636.92 | 1685.23 | 1685.67 | 1671.08 | 1691.83 | 1702.55 | 1692.61 | 1661.61 | 1521.61 | 1504.99 | 1498.69 | 1466.85 | 1441.31 | 1453.23 | 1455.59 | 1434.46 | 1542.31 | 1519.58 | 1481.20 | 1465.93 | 1459.51 | 1485.76 | 1492.67 | 1524.67 | 1567.20 | 1563.54 | 1570.19 | 1578.53 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 17.48 | 19.31 | 17.19 | 17.12 | 17.16 | 18.07 | 23.92 | 36.15 | 17.75 | 17.36 | 34.65 | 15.42 | 19.23 | 16.11 | 34.27 | 23.40 | 15.85 | 48.14 | 33.75 | 27.77 | 21.27 | 9.53 | 17.33 | 39.34 | 74.82 | 48.26 | 43.44 | 47.71 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 25.29 | 27.18 | 29.52 | 31.38 | 32.22 | 30.70 | 34.94 | 48.03 | 27.56 | 32.19 | 49.74 | 31.15 | 33.92 | 29.78 | 48.35 | 37.62 | 30.01 | 61.01 | 46.17 | 40.29 | 34.85 | 22.03 | 31.09 | 51.86 | 85.67 | 67.73 | 67.75 | 71.73 | |

| Land | 872.23 | 880.88 | 881.72 | 881.72 | 817.80 | 829.31 | 845.02 | 821.84 | 739.64 | 777.99 | 761.03 | 767.63 | 776.27 | 771.51 | 771.80 | 756.83 | 756.30 | 733.68 | 732.42 | 705.40 | 710.47 | 674.76 | 667.76 | 667.85 | 658.84 | 659.55 | 647.09 | 649.53 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Construction In Progress Gross | 23.25 | 19.89 | 16.84 | 13.30 | 21.03 | 13.12 | 12.49 | NA | 11.13 | 12.34 | 9.43 | 6.45 | 5.75 | 7.61 | 6.50 | 6.66 | 13.62 | 38.46 | 36.72 | 30.41 | 44.09 | 34.92 | 27.44 | 21.06 | 18.64 | 22.05 | 23.91 | 21.64 | |

| Investments In Affiliates Subsidiaries Associates And Joint Ventures | 197.24 | 184.03 | 191.93 | 191.55 | 291.16 | 317.42 | 333.53 | 413.14 | 322.33 | 305.67 | 258.06 | 256.33 | 249.81 | 240.41 | 250.82 | 294.19 | 305.10 | 372.48 | 320.48 | 309.35 | 262.41 | 301.72 | 306.62 | 311.54 | 302.07 | 270.25 | 272.74 | 260.50 | |

| Finite Lived Intangible Assets Net | 100.59 | 90.04 | 86.12 | 94.60 | 102.37 | 110.62 | 119.78 | 121.45 | 108.92 | 95.52 | 83.72 | 91.37 | 100.73 | 109.49 | 119.25 | 108.72 | 116.82 | 121.17 | 117.07 | 110.63 | 115.94 | 112.25 | 114.98 | 125.05 | 127.57 | 123.59 | 119.00 | 116.37 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 1870.14 | 1820.09 | 1763.02 | 1746.61 | 1793.06 | 1817.83 | 1814.23 | 1819.65 | 1812.24 | 1787.90 | 1664.11 | 1715.06 | 1763.84 | 1789.59 | 1811.48 | 1825.98 | 1708.20 | 1655.36 | 1685.08 | 1599.18 | 1550.55 | 1481.73 | 1461.25 | 1455.28 | 1424.41 | 1602.85 | 1543.75 | 1501.90 | |

| Minority Interest | 446.30 | 439.01 | 452.44 | 459.18 | 489.36 | 506.30 | 670.61 | 746.59 | 628.32 | 636.52 | 617.66 | 617.52 | 607.24 | 598.87 | 637.74 | 577.10 | 644.66 | 709.94 | 618.91 | 640.42 | 622.44 | 638.04 | 619.87 | 640.00 | 648.44 | 606.26 | 610.20 | 617.96 |

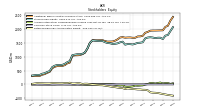

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

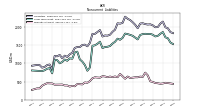

| Stockholders Equity | 1636.92 | 1685.23 | 1685.67 | 1671.08 | 1691.83 | 1702.55 | 1692.61 | 1661.61 | 1521.61 | 1504.99 | 1498.69 | 1466.85 | 1441.31 | 1453.23 | 1455.59 | 1434.46 | 1542.31 | 1519.58 | 1481.20 | 1465.93 | 1459.51 | 1485.76 | 1492.67 | 1524.67 | 1567.20 | 1563.54 | 1570.19 | 1578.53 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 2083.22 | 2124.24 | 2138.11 | 2130.26 | 2181.20 | 2208.85 | 2363.22 | 2408.21 | 2149.93 | 2141.51 | 2116.35 | 2084.37 | 2048.55 | 2052.10 | 2093.33 | 2011.56 | 2186.97 | 2229.52 | 2100.11 | 2106.35 | 2081.95 | 2123.80 | 2112.55 | 2164.67 | 2215.64 | 2169.79 | 2180.40 | 2196.49 | |

| Common Stock Value | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | |

| Additional Paid In Capital Common Stock | 1953.52 | 1950.21 | 1947.78 | 1945.16 | 1945.32 | 1940.03 | 1895.56 | 1864.06 | 1754.38 | 1733.45 | 1730.69 | 1683.55 | 1683.16 | 1695.34 | 1693.01 | 1686.79 | 1706.36 | 1692.66 | 1625.91 | 1577.50 | 1548.60 | 1546.40 | 1543.65 | 1564.07 | 1596.51 | 1594.33 | 1592.07 | 1589.77 | |

| Retained Earnings Accumulated Deficit | -349.14 | -330.64 | -312.06 | -304.17 | -300.40 | -287.26 | -214.28 | -196.82 | -196.65 | -185.37 | -184.17 | -174.83 | -167.05 | -156.32 | -147.29 | -166.70 | -132.96 | -129.03 | -115.22 | -100.63 | -89.70 | -73.99 | -61.20 | -46.86 | -32.01 | -30.32 | -21.44 | -11.75 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 32.44 | 65.56 | 49.85 | 30.00 | 46.82 | 49.68 | 11.24 | -5.72 | -36.21 | -43.17 | -47.91 | -41.96 | -74.89 | -85.87 | -90.21 | -85.72 | -31.18 | -44.14 | -29.57 | -11.02 | 0.52 | 13.27 | 10.14 | 7.38 | 2.61 | -0.55 | -0.52 | 0.44 | |

| Minority Interest | 446.30 | 439.01 | 452.44 | 459.18 | 489.36 | 506.30 | 670.61 | 746.59 | 628.32 | 636.52 | 617.66 | 617.52 | 607.24 | 598.87 | 637.74 | 577.10 | 644.66 | 709.94 | 618.91 | 640.42 | 622.44 | 638.04 | 619.87 | 640.00 | 648.44 | 606.26 | 610.20 | 617.96 | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 2.07 | 1.75 | 5.49 | 70.87 | 7.65 | 24.63 | 24.78 | 22.78 | 5.49 | 10.53 | 4.36 | 6.68 | 2.92 | 20.12 | 1.42 | 3.12 | 59.69 | 29.71 | 1.65 | 3.24 | 0.14 | 9.01 | 14.95 | 0.69 | 25.53 | 2.77 | 0.69 | 3.82 |

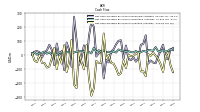

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

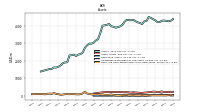

| Net Cash Provided By Used In Operating Activities | 40.59 | 25.67 | 30.06 | 59.43 | 32.73 | 35.72 | 38.22 | 26.54 | 32.59 | 21.36 | 20.10 | 30.93 | 21.48 | 22.58 | 30.77 | 27.73 | 31.99 | 32.96 | 42.44 | 19.79 | 28.89 | 18.15 | 26.10 | 22.94 | 35.42 | 24.26 | 36.67 | 23.48 | |

| Net Cash Provided By Used In Investing Activities | -118.47 | -63.42 | -23.04 | -3.61 | 20.78 | -3.06 | 8.17 | -150.06 | -114.91 | -114.57 | 19.45 | 11.49 | -3.34 | -6.18 | 3.80 | -90.48 | -37.43 | -126.11 | -140.50 | -93.01 | -60.30 | -53.78 | 3.74 | -26.28 | 156.39 | -50.62 | -56.38 | -39.30 | |

| Net Cash Provided By Used In Financing Activities | 75.99 | 35.41 | -8.89 | -56.66 | -51.99 | -36.90 | -59.47 | 143.98 | 81.82 | 75.66 | -20.96 | -45.20 | -14.00 | -34.96 | -23.84 | 70.36 | -25.55 | 107.99 | 103.94 | 78.67 | 44.22 | 26.58 | -50.61 | -30.47 | -165.24 | 31.18 | 15.45 | -8.27 |

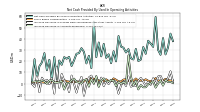

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 40.59 | 25.67 | 30.06 | 59.43 | 32.73 | 35.72 | 38.22 | 26.54 | 32.59 | 21.36 | 20.10 | 30.93 | 21.48 | 22.58 | 30.77 | 27.73 | 31.99 | 32.96 | 42.44 | 19.79 | 28.89 | 18.15 | 26.10 | 22.94 | 35.42 | 24.26 | 36.67 | 23.48 | |

| Profit Loss | -10.23 | -16.27 | 2.75 | 22.00 | -3.98 | -89.55 | -15.82 | 44.10 | -8.62 | 31.56 | 1.23 | 1.86 | -32.62 | -38.29 | 64.91 | -60.04 | 14.66 | 8.84 | -5.24 | 2.94 | -6.67 | -2.60 | -2.27 | -4.16 | 24.94 | 13.29 | 6.11 | 19.97 | |

| Depreciation Depletion And Amortization | 35.03 | 33.73 | 34.06 | 33.17 | 33.49 | 33.74 | 34.97 | 33.71 | 29.84 | 30.87 | 31.34 | 31.39 | 48.17 | 34.46 | 33.79 | 33.38 | 32.64 | 32.17 | 30.30 | 30.33 | 30.79 | 28.68 | 29.50 | 28.58 | 27.69 | 26.65 | 26.06 | 24.54 | |

| Increase Decrease In Accounts Receivable | -1.79 | 2.80 | 0.01 | -3.56 | 1.94 | 0.34 | -0.58 | -3.28 | -3.28 | -1.30 | -5.21 | 2.41 | -1.70 | 6.33 | 25.20 | -0.02 | 1.32 | -0.13 | 1.54 | -2.28 | 2.59 | 3.20 | 1.89 | 2.36 | 4.63 | 2.81 | -2.89 | 6.72 | |

| Share Based Compensation | 2.56 | 2.56 | 2.75 | 4.88 | 2.58 | 2.18 | 2.54 | 3.82 | 2.65 | 2.65 | 2.62 | 4.51 | 2.36 | 2.42 | 2.32 | 3.82 | 3.60 | 1.92 | 1.99 | 3.45 | 4.62 | 2.22 | 2.30 | 3.81 | 2.03 | 2.13 | 2.77 | 4.24 | |

| Amortization Of Financing Costs | 1.82 | 1.57 | 1.45 | 1.65 | 1.54 | 1.60 | 1.11 | 1.39 | 0.49 | 1.35 | 1.28 | 1.27 | 1.13 | 1.12 | 1.16 | 1.76 | 1.81 | 1.87 | 2.16 | 1.74 | 1.66 | 1.61 | 1.37 | 1.38 | 1.99 | 1.49 | 1.33 | 1.17 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -118.47 | -63.42 | -23.04 | -3.61 | 20.78 | -3.06 | 8.17 | -150.06 | -114.91 | -114.57 | 19.45 | 11.49 | -3.34 | -6.18 | 3.80 | -90.48 | -37.43 | -126.11 | -140.50 | -93.01 | -60.30 | -53.78 | 3.74 | -26.28 | 156.39 | -50.62 | -56.38 | -39.30 |

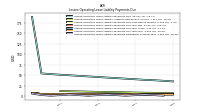

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 75.99 | 35.41 | -8.89 | -56.66 | -51.99 | -36.90 | -59.47 | 143.98 | 81.82 | 75.66 | -20.96 | -45.20 | -14.00 | -34.96 | -23.84 | 70.36 | -25.55 | 107.99 | 103.94 | 78.67 | 44.22 | 26.58 | -50.61 | -30.47 | -165.24 | 31.18 | 15.45 | -8.27 | |

| Payments Of Dividends Common Stock | 17.16 | 17.16 | 17.13 | 17.12 | 17.09 | 17.09 | 17.01 | 13.40 | 13.27 | 13.26 | NA | NA | 0.00 | 0.00 | 24.94 | 25.25 | 24.26 | 23.65 | 23.16 | 22.84 | 22.02 | 22.01 | 22.26 | 22.60 | 21.76 | 21.75 | 21.74 | 34.27 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 85.51 | 81.39 | 89.95 | 81.84 | 80.58 | 79.95 | 84.26 | 81.51 | 79.36 | 71.90 | 73.06 | 69.39 | 69.01 | 51.28 | 63.77 | 71.42 | 77.79 | 73.33 | 71.06 | 74.80 | 69.44 | 66.08 | 63.57 | 63.12 | 66.08 | 62.68 | 59.50 | 62.00 | |

| Operating, Core Portfolio | 50.04 | 47.33 | 56.38 | 49.80 | 50.90 | 50.08 | 53.23 | 48.35 | 47.04 | 45.94 | 46.00 | 42.35 | 42.88 | 38.85 | 38.60 | 39.93 | 41.82 | 42.14 | 43.21 | 46.69 | 43.44 | 42.29 | 40.54 | 41.63 | 42.84 | 41.20 | 41.49 | NA | |

| Operating, Opportunity Funds | 35.47 | 34.06 | 33.57 | 32.04 | 29.68 | 29.87 | 31.03 | 33.16 | 32.32 | 25.95 | 27.06 | 27.05 | 26.13 | 12.43 | 25.17 | 31.49 | 35.96 | 31.18 | 27.85 | 28.11 | 26.01 | 23.79 | 23.03 | 21.50 | 23.24 | 21.48 | 18.02 | NA | |

| Unconsolidated Affiliates | 27.05 | 24.49 | 28.67 | 28.22 | 23.91 | 25.10 | 23.95 | 23.12 | 26.09 | 17.91 | 19.54 | 17.28 | 8.96 | 21.35 | 19.06 | 24.11 | 23.56 | 22.31 | 22.74 | 19.97 | 20.45 | 19.97 | 19.60 | 20.16 | 19.76 | 20.88 | 20.97 | NA | |

| Equity Method Investee | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.30 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | -0.40 | 0.20 | 0.30 | 0.20 | 0.30 | 0.30 | 0.30 | 0.30 | 0.30 | 0.40 | 0.30 | 0.40 |