| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Weighted Average Number Of Diluted Shares Outstanding | 578.80 | 579.00 | 584.20 | NA | 584.30 | 584.80 | 586.50 | NA | 239.50 | 231.10 | 230.00 | |

| Weighted Average Number Of Shares Outstanding Basic | 578.80 | 579.00 | 584.10 | NA | 584.30 | 584.80 | 586.50 | NA | 239.50 | 231.10 | 230.00 | |

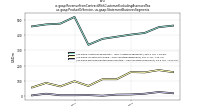

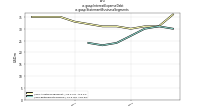

| Earnings Per Share Basic | 1.10 | 1.00 | 1.67 | 0.98 | -1.52 | -3.53 | -1.50 | 0.85 | 1.01 | 2.70 | 2.81 | |

| Earnings Per Share Diluted | 1.10 | 1.00 | 1.66 | 0.98 | -1.52 | -3.53 | -1.50 | 0.85 | 1.01 | 2.70 | 2.81 |

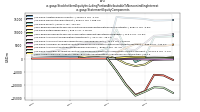

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

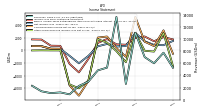

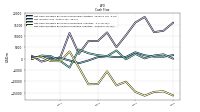

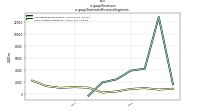

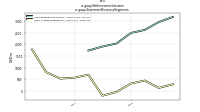

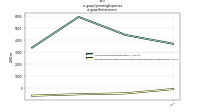

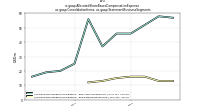

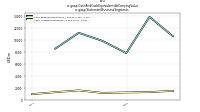

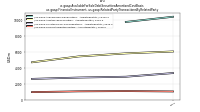

| Revenues | 2595.00 | 13702.00 | 5301.00 | 4842.00 | 2979.00 | 2272.00 | 875.00 | 1195.00 | 1078.00 | 1383.00 | 2295.00 | |

| Realized Investment Gains Losses | -2624.00 | 366.00 | 1065.00 | 106.00 | -2847.00 | -5759.00 | -4217.00 | NA | NA | NA | NA | |

| Premiums Earned Net | 26.00 | 9041.00 | 96.00 | 869.00 | 3045.00 | 5614.00 | 2110.00 | NA | NA | NA | NA | |

| Operating Expenses | 1751.00 | 12831.00 | 3574.00 | 3713.00 | 4435.00 | 5941.00 | 3391.00 | 1696.00 | 648.00 | 747.00 | 1022.00 | |

| Interest Expense Debt | 66.00 | 62.00 | 61.00 | 57.00 | 55.00 | 54.00 | 56.00 | 33.00 | 35.00 | 35.00 | 35.00 | |

| Interest Paid Net | 188.00 | 176.00 | 169.00 | 134.00 | 118.00 | 111.00 | 203.00 | 139.00 | 217.00 | 105.00 | 95.00 | |

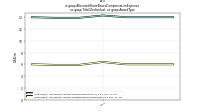

| Allocated Share Based Compensation Expense | 142.00 | 139.00 | 140.00 | 127.10 | 118.80 | 126.00 | 168.00 | 1034.30 | 56.20 | 53.00 | 56.00 | |

| Income Tax Expense Benefit | 243.00 | 201.00 | 253.00 | 211.00 | -185.00 | -487.00 | -608.00 | 96.00 | 101.00 | 194.00 | 203.00 | |

| Income Taxes Paid | 28.00 | 99.00 | 35.00 | 245.00 | 435.00 | 302.00 | 25.00 | 42.00 | 41.00 | 31.00 | 7.00 | |

| Profit Loss | 640.00 | 750.00 | 1538.00 | 960.00 | -1174.00 | -3002.00 | -1530.00 | 612.00 | 631.00 | 1505.00 | 1519.00 | |

| Other Comprehensive Income Loss Net Of Tax | -1863.00 | -124.00 | 1222.00 | 1749.00 | -4777.00 | -6000.00 | -5390.00 | -12.00 | -9.00 | 4.00 | -15.00 | |

| Net Income Loss | 682.00 | NA | NA | 584.00 | -876.00 | -2051.00 | -870.00 | 244.00 | 258.00 | 658.00 | 679.00 | |

| Comprehensive Income Net Of Tax | -1024.00 | 369.00 | 2183.00 | 2016.00 | -4844.00 | -7165.00 | -5541.00 | 242.00 | 258.00 | 658.00 | 678.00 | |

| Preferred Stock Dividends Income Statement Impact | 22.00 | NA | NA | NA | NA | NA | NA | 10.00 | 9.00 | 9.00 | 9.00 | |

| Net Income Loss Available To Common Stockholders Basic | 660.00 | 599.00 | 1010.00 | 584.00 | -876.00 | -2051.00 | -870.00 | 234.00 | 249.00 | 649.00 | 670.00 | |

| Net Income Loss Available To Common Stockholders Diluted | 660.00 | 599.00 | 1010.00 | 584.00 | -876.00 | -2051.00 | -870.00 | 234.00 | 249.00 | 649.00 | 670.00 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

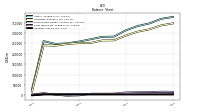

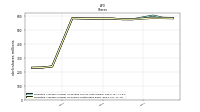

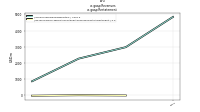

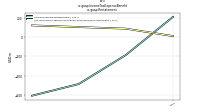

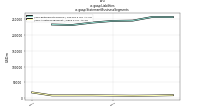

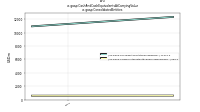

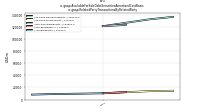

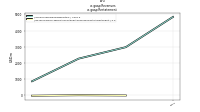

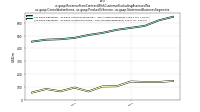

| Assets | 283235.00 | 281984.00 | 270324.00 | 259333.00 | 250340.00 | 247850.00 | 261555.00 | 30502.00 | NA | NA | NA | |

| Liabilities | 265273.00 | 264657.00 | 252590.00 | 252104.00 | 247454.00 | 239689.00 | 241277.00 | 18538.00 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 283235.00 | 281984.00 | 270324.00 | 259333.00 | 250340.00 | 247850.00 | 261555.00 | 30502.00 | NA | NA | NA | |

| Stockholders Equity | 8442.00 | 8229.00 | 8074.00 | 397.00 | -1339.00 | 3679.00 | 10993.00 | 3789.00 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | NA | 12070.00 | 15099.00 | 8980.00 | 10942.00 | 12718.00 | 9769.00 | 917.00 | 2090.00 | 1825.00 | 1718.00 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 14427.00 | 14784.00 | 18085.00 | 11128.00 | 13236.00 | 14510.00 | 12434.00 | 2088.00 | 3816.00 | 4155.00 | 3434.00 | |

| Available For Sale Securities Debt Securities | 129700.00 | 128559.00 | 118579.00 | 112225.00 | 102648.00 | 100809.00 | 105060.00 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Goodwill | NA | NA | NA | 4322.00 | 4322.00 | 4417.00 | 4300.00 | 117.00 | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 150894.00 | 146211.00 | 135597.00 | 131422.00 | 124631.00 | 116471.00 | 112487.00 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 7026.00 | 6454.00 | 6464.00 | 6472.00 | 6081.00 | 6092.00 | 6102.00 | 3134.00 | NA | NA | NA | |

| Minority Interest | 9233.00 | 8813.00 | 8618.00 | 5800.00 | 3201.00 | 3479.00 | 7495.00 | 6405.00 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

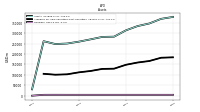

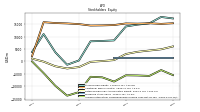

| Stockholders Equity | 8442.00 | 8229.00 | 8074.00 | 397.00 | -1339.00 | 3679.00 | 10993.00 | 3789.00 | NA | NA | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 17675.00 | 17042.00 | 16692.00 | 6197.00 | 1862.00 | 7158.00 | 18488.00 | 10194.00 | 8474.00 | 8212.00 | 7498.00 | |

| Additional Paid In Capital | 14605.00 | 14468.00 | 14408.00 | 14982.00 | 15256.00 | 15412.00 | 15762.00 | 2096.00 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 535.00 | 153.00 | -172.00 | -2259.00 | -2837.00 | -1943.00 | -93.00 | 1144.00 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -8095.00 | -6392.00 | -6162.00 | -12326.00 | -13758.00 | -9790.00 | -4676.00 | -5.00 | NA | NA | NA | |

| Minority Interest | 9233.00 | 8813.00 | 8618.00 | 5800.00 | 3201.00 | 3479.00 | 7495.00 | 6405.00 | NA | NA | NA | |

| Stock Issued During Period Value New Issues | 1397.00 | NA | NA | 0.00 | 0.00 | 231.00 | 21.00 | 0.00 | 22.00 | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 119.00 | 123.00 | 122.00 | 104.00 | 100.00 | 117.00 | 141.00 | 1020.00 | 46.00 | 41.00 | 45.00 | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 608.00 | 358.00 | NA | NA | 368.00 | 551.00 | NA | NA | NA | NA | NA |

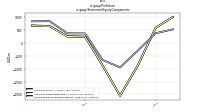

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

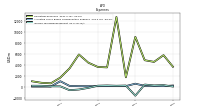

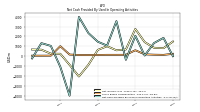

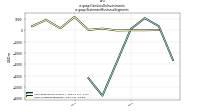

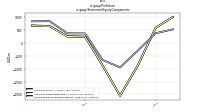

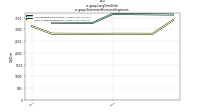

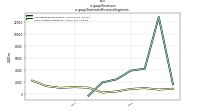

| Net Cash Provided By Used In Operating Activities | -364.00 | 3551.00 | 1071.00 | 1465.00 | 2344.00 | 3973.00 | -3993.00 | -1073.00 | 1044.00 | 1322.00 | -229.00 | |

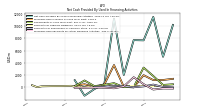

| Net Cash Provided By Used In Investing Activities | -10211.00 | -11868.00 | -5640.00 | -11273.00 | -11353.00 | -3921.00 | 3103.00 | -1208.00 | -1116.00 | 753.00 | 19.00 | |

| Net Cash Provided By Used In Financing Activities | 10221.00 | 5014.00 | 11523.00 | 7697.00 | 7733.00 | 2040.00 | 11240.00 | 553.00 | -267.00 | -1354.00 | 1177.00 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -364.00 | 3551.00 | 1071.00 | 1465.00 | 2344.00 | 3973.00 | -3993.00 | -1073.00 | 1044.00 | 1322.00 | -229.00 | |

| Net Income Loss | 682.00 | NA | NA | 584.00 | -876.00 | -2051.00 | -870.00 | 244.00 | 258.00 | 658.00 | 679.00 | |

| Profit Loss | 640.00 | 750.00 | 1538.00 | 960.00 | -1174.00 | -3002.00 | -1530.00 | 612.00 | 631.00 | 1505.00 | 1519.00 | |

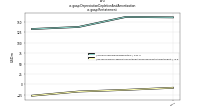

| Depreciation Depletion And Amortization | 241.00 | 180.00 | 165.00 | 161.00 | 162.00 | 138.00 | 133.00 | 7.00 | 7.00 | 7.00 | 6.00 | |

| Increase Decrease In Other Operating Capital Net | 202.00 | 34.00 | 852.00 | 1860.00 | -1544.00 | -2244.00 | -1121.00 | -422.00 | -1466.00 | 165.00 | -1327.00 | |

| Share Based Compensation | 142.00 | 140.00 | 140.00 | 130.00 | 117.00 | 125.00 | 168.00 | 1015.00 | 57.00 | 53.00 | 56.00 |

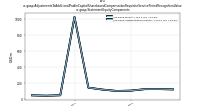

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -10211.00 | -11868.00 | -5640.00 | -11273.00 | -11353.00 | -3921.00 | 3103.00 | -1208.00 | -1116.00 | 753.00 | 19.00 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

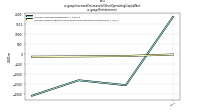

| Net Cash Provided By Used In Financing Activities | 10221.00 | 5014.00 | 11523.00 | 7697.00 | 7733.00 | 2040.00 | 11240.00 | 553.00 | -267.00 | -1354.00 | 1177.00 | |

| Payments Of Dividends Common Stock | 256.00 | 256.00 | 241.00 | 240.00 | 264.00 | 229.00 | 229.00 | 111.00 | 126.00 | 120.00 | 144.00 | |

| Dividends | NA | NA | 424.00 | 249.00 | 368.00 | 551.00 | 841.00 | 460.00 | 530.00 | 754.00 | 314.00 | |

| Payments For Repurchase Of Common Stock | 0.00 | 77.00 | 458.00 | 172.00 | 26.00 | 211.00 | 226.00 | 98.00 | 78.00 | NA | NA |

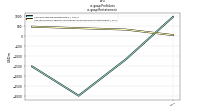

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

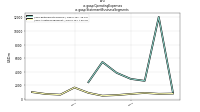

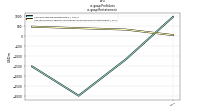

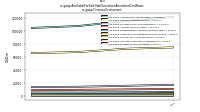

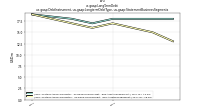

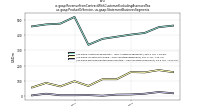

| Revenues | 2595.00 | 13702.00 | 5301.00 | 4842.00 | 2979.00 | 2272.00 | 875.00 | 1195.00 | 1078.00 | 1383.00 | 2295.00 | |

| Variable Interest Entity Primary Beneficiary, Retirement Services | 318.00 | 347.00 | 281.00 | 292.00 | 114.00 | 55.00 | -21.00 | NA | NA | NA | NA | |

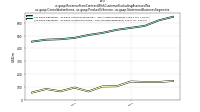

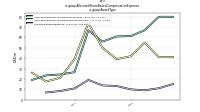

| Operating, Asset Management | 834.00 | 793.00 | 742.00 | 729.00 | 671.00 | 636.00 | 584.00 | 598.00 | 558.00 | 559.00 | 518.00 | |

| NA | NA | NA | NA | 0.00 | 14.00 | -13.00 | NA | NA | NA | NA | ||

| NA | NA | NA | 4842.00 | 2979.00 | 2272.00 | 875.00 | NA | NA | NA | NA | ||

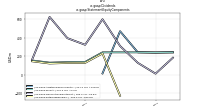

| Asset Management | 929.00 | 786.00 | 1036.00 | 891.00 | 477.00 | 292.00 | 1109.00 | 1195.00 | 1078.00 | 1383.00 | 2295.00 | |

| Retirement Services | 1666.00 | 12916.00 | 4265.00 | 3951.00 | 2502.00 | 1980.00 | -234.00 | NA | NA | NA | NA | |

| Material Reconciling Items, Asset Management1 | 247.00 | 232.00 | 216.00 | 209.00 | 192.00 | 181.00 | 182.00 | NA | NA | NA | 0.00 | |

| Intersegment Elimination, Asset Management1, Asset Management | NA | NA | NA | NA | NA | NA | 182.00 | NA | NA | NA | NA | |

| Operating, Asset Management1, Asset Management | 648.00 | 620.00 | 577.00 | 561.30 | 545.90 | 521.90 | 505.40 | 483.00 | 472.50 | 468.80 | 453.90 | |

| Operating, Investment Advice, Asset Management | 146.00 | 138.00 | 138.00 | 141.70 | 104.60 | 103.10 | 64.10 | 94.30 | 65.20 | 83.20 | 55.40 | |

| Asset Management1, Asset Management | 462.00 | 452.00 | 414.00 | 403.00 | 389.00 | 375.00 | 336.00 | 519.00 | 475.00 | 470.00 | 457.00 | |

| Investment Advice, Asset Management | 157.00 | 170.00 | 155.00 | 157.00 | 110.00 | 110.00 | 66.00 | 97.00 | 63.00 | 86.00 | 56.00 | |

| Management Service Incentive, Asset Management | 18.00 | 26.00 | 15.00 | 10.00 | 9.00 | 2.00 | 6.00 | 5.00 | 5.00 | 15.00 | 4.00 |