| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.01 | 0.01 | NA | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 | NA | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | NA | 186.49 | 178.51 | 177.19 | NA | 174.27 | 172.75 | 170.75 | NA | 138.96 | 125.93 | NA | NA | NA | NA | NA | NA | 81.32 | 10.54 | NA | NA | 10.30 | 10.21 | NA | |

| Weighted Average Number Of Shares Outstanding Basic | NA | 186.49 | 178.51 | 177.19 | NA | 174.27 | 172.75 | 170.75 | NA | 138.96 | 125.93 | NA | NA | NA | NA | NA | NA | 81.32 | 10.54 | NA | NA | 10.30 | 10.21 | NA | |

| Earnings Per Share Basic | -0.21 | -0.31 | -0.67 | -0.44 | -0.19 | -0.30 | -0.31 | -0.15 | -0.13 | -0.09 | -0.34 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | -0.21 | -0.31 | -0.67 | -0.44 | -0.19 | -0.30 | -0.31 | -0.15 | -0.13 | -0.09 | -0.34 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

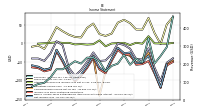

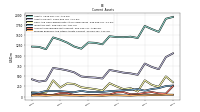

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Excluding Assessed Tax | 446.60 | 276.15 | 227.57 | 185.02 | 326.32 | 190.78 | 212.16 | 177.60 | 232.76 | 183.82 | 172.24 | 141.32 | 213.54 | 208.67 | 185.29 | 130.03 | 213.61 | 190.19 | 168.88 | 169.36 | 123.25 | 93.77 | 86.78 | 72.20 | |

| Revenues | 462.58 | 292.27 | 243.24 | 201.04 | 342.47 | 207.23 | 228.47 | 194.01 | 249.39 | 200.31 | 187.86 | 156.70 | 213.54 | 233.47 | 233.78 | 200.71 | 213.61 | 190.19 | 168.88 | 169.36 | 123.25 | 93.77 | 86.78 | 72.20 | |

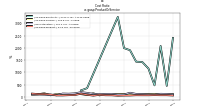

| Cost Of Revenue | 391.20 | 241.33 | 245.21 | 173.10 | 273.77 | 170.34 | 191.13 | 139.36 | 185.76 | 144.32 | 161.61 | 136.77 | 188.59 | 180.01 | 192.11 | 184.95 | 196.36 | 166.81 | 136.11 | 125.69 | 111.20 | 108.86 | 92.59 | 81.39 | |

| Cost Of Goods And Services Sold | -647.54 | 241.33 | 245.21 | 173.10 | -491.33 | 170.34 | 191.13 | 139.36 | 185.76 | 144.32 | 161.61 | 136.77 | 188.59 | 180.01 | 192.11 | 184.95 | 196.36 | 166.81 | 136.11 | 125.69 | 111.20 | 108.86 | 92.59 | 81.39 | |

| Gross Profit | 71.38 | 50.94 | -1.97 | 27.94 | 68.70 | 36.88 | 37.34 | 54.65 | 63.63 | 55.99 | 26.25 | 19.93 | 24.95 | 53.47 | 41.67 | 15.76 | 17.25 | 23.39 | 32.77 | 43.67 | 12.05 | -15.09 | -5.81 | -9.20 | |

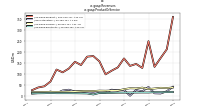

| Operating Expenses | 111.94 | 103.54 | 100.20 | 93.60 | 82.21 | 80.77 | 80.06 | 69.05 | 68.14 | 56.36 | 55.75 | 66.33 | 72.82 | 78.11 | 91.79 | 88.40 | 105.42 | 89.50 | 38.03 | 37.98 | 39.34 | 32.59 | 35.36 | 31.95 | |

| Research And Development Expense | 38.32 | 36.15 | 41.61 | 34.53 | 26.79 | 27.63 | 25.67 | 23.30 | 21.69 | 19.23 | 19.38 | 23.28 | 22.15 | 23.39 | 29.77 | 28.86 | 32.97 | 27.02 | 14.41 | 14.73 | 15.18 | 12.37 | 12.37 | 11.22 | |

| General And Administrative Expense | 47.77 | 44.12 | 38.11 | 37.74 | 31.72 | 33.01 | 31.66 | 25.80 | 27.61 | 25.43 | 24.95 | 29.10 | 33.31 | 36.60 | 43.66 | 39.07 | 47.47 | 41.00 | 15.36 | 14.99 | 14.82 | 13.65 | 14.32 | 12.88 | |

| Selling And Marketing Expense | 25.85 | 23.27 | 20.48 | 21.33 | 23.70 | 20.12 | 22.73 | 19.95 | 18.84 | 11.70 | 11.43 | 13.95 | 17.36 | 18.12 | 18.36 | 20.46 | 24.98 | 21.48 | 8.25 | 8.26 | 9.35 | 6.56 | 8.66 | 7.84 | |

| Operating Income Loss | -40.57 | -52.59 | -102.17 | -65.66 | -13.51 | -43.89 | -42.71 | -14.40 | -4.52 | -0.37 | -29.50 | -46.40 | -47.87 | -24.65 | -50.12 | -72.64 | -88.18 | -66.11 | -5.25 | 5.68 | -27.30 | -47.68 | -41.16 | -41.15 | |

| Interest Expense | 12.50 | 13.10 | 13.80 | 14.10 | 25.20 | 14.50 | 14.60 | 14.70 | 21.30 | 20.30 | 15.20 | 22.10 | 41.40 | 16.90 | 18.30 | 17.60 | 17.80 | 18.80 | 25.20 | 24.00 | 29.80 | 28.90 | NA | NA | |

| Interest Expense Debt | 12.49 | 13.10 | 13.81 | 14.09 | 25.23 | 14.51 | 14.55 | 14.73 | 21.25 | 19.90 | 14.37 | 20.75 | 21.64 | 15.28 | 16.73 | 15.96 | 16.18 | 17.38 | 26.17 | 11.39 | 27.85 | 26.95 | 25.55 | 16.85 | |

| Interest Paid Net | 9.32 | 13.73 | 11.53 | 14.40 | 26.14 | 15.38 | 12.26 | 14.96 | 15.04 | 22.12 | 16.70 | 17.79 | 33.96 | 12.03 | 9.32 | 14.54 | 8.86 | 14.06 | 5.32 | 11.22 | 5.07 | 5.56 | NA | NA | |

| Gains Losses On Extinguishment Of Debt | -4.72 | 0.00 | -4.23 | NA | NA | NA | NA | NA | 0.00 | 1.22 | 0.00 | -14.10 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 0.21 | 0.34 | -0.01 | 0.56 | 0.45 | 0.16 | 0.31 | 0.12 | -0.02 | 0.01 | 0.14 | 0.12 | 0.03 | 0.14 | 0.26 | 0.21 | 1.08 | -0.00 | 0.13 | 0.33 | -0.12 | 0.31 | 0.23 | 0.21 | |

| Income Taxes Paid | 0.14 | 0.31 | 0.60 | 0.38 | 0.20 | 0.19 | 0.11 | 0.07 | 0.02 | 0.13 | 0.20 | 0.03 | 0.14 | 0.22 | 0.28 | 0.22 | 0.70 | 0.43 | 0.22 | 0.40 | 0.25 | 0.25 | NA | NA | |

| Profit Loss | -50.78 | -60.39 | -121.17 | -82.75 | -48.51 | -56.66 | -58.42 | -29.78 | -31.59 | -17.88 | -47.98 | -81.64 | -71.01 | -39.93 | -67.23 | -88.27 | -104.44 | -82.51 | -50.19 | -22.35 | -71.92 | -76.36 | -67.60 | -65.39 | |

| Other Comprehensive Income Loss Net Of Tax | 0.98 | -1.03 | -0.59 | -0.15 | 19.20 | -1.06 | 1.39 | -4.88 | 1.25 | 0.57 | -0.53 | -8.21 | 7.84 | -2.46 | -3.49 | -2.17 | -3.06 | 1.24 | 1.09 | 2.86 | 1.11 | 0.07 | -0.92 | NA | |

| Net Income Loss | NA | -57.08 | -118.80 | -78.36 | -33.32 | -52.37 | -53.86 | -24.89 | -27.14 | -11.95 | -42.51 | -75.95 | -65.83 | -34.90 | -62.22 | -84.44 | -99.78 | -78.58 | -45.68 | -17.72 | -67.76 | -71.83 | -63.48 | -59.53 | |

| Comprehensive Income Net Of Tax | -46.89 | -57.61 | -119.30 | -78.51 | -25.33 | -54.05 | -51.09 | -34.31 | -27.14 | -11.95 | -42.54 | -75.95 | -141.91 | -34.90 | -62.37 | -88.66 | -99.92 | -78.52 | -45.58 | -17.44 | -67.53 | -71.76 | -63.52 | NA | |

| Net Income Loss Available To Common Stockholders Basic | NA | NA | NA | -78.36 | -33.32 | -52.37 | -53.86 | -24.89 | -27.14 | -11.95 | -42.51 | -75.95 | -68.29 | -51.75 | -81.91 | -104.92 | -115.45 | -78.58 | -45.68 | -21.59 | -67.76 | -71.83 | -63.48 | NA |

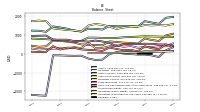

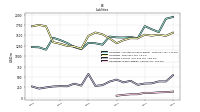

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 1946.63 | 1902.07 | 1580.83 | 1649.97 | 1725.57 | 1431.73 | 1464.03 | 1451.26 | 1454.39 | 1474.36 | 1277.54 | 1312.61 | 1322.59 | 1169.93 | 1222.58 | 1318.85 | 1389.67 | 1445.14 | 1157.74 | 1214.22 | 1220.99 | NA | NA | NA | |

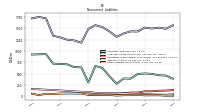

| Liabilities | 1567.81 | 1491.14 | 1517.20 | 1496.18 | 1518.55 | 1431.35 | 1434.08 | 1386.86 | 1312.99 | 1431.68 | 1528.07 | 1571.77 | 1490.45 | 1181.01 | 1233.79 | 1250.82 | 1298.96 | 1338.83 | 1722.54 | 1753.87 | 1721.62 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 1946.63 | 1902.07 | 1580.83 | 1649.97 | 1725.57 | 1431.73 | 1464.03 | 1451.26 | 1454.39 | 1474.36 | 1277.54 | 1312.61 | 1322.59 | 1169.93 | 1222.58 | 1318.85 | 1389.67 | 1445.14 | 1157.74 | 1214.22 | 1220.99 | NA | NA | NA | |

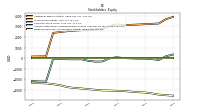

| Stockholders Equity | 340.78 | 172.89 | -176.96 | -90.79 | -44.33 | -46.91 | -21.57 | 6.06 | 78.82 | -22.42 | -316.95 | -333.10 | -259.59 | -106.85 | -115.78 | -105.44 | -91.66 | -84.97 | -2227.02 | -2213.43 | -2180.00 | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 1055.96 | 964.37 | 669.25 | 723.61 | 806.42 | 530.94 | 565.90 | 584.47 | 618.60 | 650.05 | 440.79 | 462.89 | 472.71 | 490.36 | 592.28 | 639.84 | 672.58 | 698.53 | 390.27 | 365.05 | 419.98 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 348.50 | 492.12 | 235.64 | 286.01 | 396.04 | 121.86 | 203.96 | 180.72 | 246.95 | 325.24 | 144.07 | 180.31 | 202.82 | 226.50 | 308.01 | 320.41 | 220.73 | 395.52 | 91.60 | 88.23 | 103.83 | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 518.37 | 669.32 | 414.18 | 493.90 | 615.11 | 319.90 | 400.53 | 365.66 | 416.71 | 504.37 | 324.13 | 353.92 | 377.39 | 357.88 | 371.07 | 369.93 | 280.49 | 444.23 | 149.87 | 143.59 | 180.61 | 191.94 | 213.23 | NA | |

| Accounts Receivable Net Current | 251.00 | 71.18 | 77.97 | 110.84 | 87.79 | 62.07 | 54.47 | 108.33 | 99.51 | 50.48 | 49.61 | 35.69 | 37.83 | 26.74 | 38.30 | 84.07 | 84.89 | 41.48 | 36.80 | 62.00 | 30.32 | NA | NA | NA | |

| Inventory Net | 268.39 | 254.90 | 206.71 | 183.07 | 143.37 | 182.56 | 163.32 | 153.17 | 142.06 | 131.91 | 112.48 | 107.20 | 109.61 | 140.37 | 104.93 | 116.54 | 132.48 | 134.72 | 136.43 | 94.03 | 90.26 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 43.64 | 46.49 | 35.16 | 37.00 | 30.66 | 31.95 | 23.06 | 26.81 | 30.72 | 30.24 | 20.75 | 24.99 | 28.07 | 25.64 | 25.09 | 28.36 | 33.74 | 32.88 | 23.00 | 28.94 | 26.68 | NA | NA | NA |

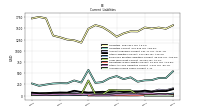

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Noncurrent | 890.66 | NA | NA | NA | 919.15 | NA | NA | 866.79 | 835.78 | 824.31 | 836.75 | 849.71 | 849.88 | 679.57 | 630.29 | 679.01 | 717.09 | 746.61 | 767.46 | NA | 801.01 | NA | NA | NA | |

| Goodwill | NA | NA | NA | 1.96 | 1.96 | 1.72 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Noncurrent | 40.20 | 38.32 | 38.91 | 38.41 | 39.12 | 38.59 | 35.92 | 35.20 | 34.51 | 40.63 | 40.99 | 44.60 | 41.65 | 58.40 | 60.98 | 34.39 | 34.79 | 37.01 | 38.39 | 43.18 | 37.46 | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

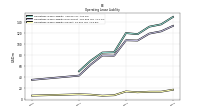

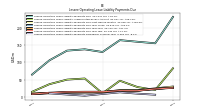

| Liabilities Current | 541.95 | 392.73 | 393.69 | 346.96 | 342.48 | 311.87 | 409.05 | 369.31 | 436.38 | 389.52 | 303.73 | 285.74 | 573.96 | 293.73 | 339.09 | 276.19 | 279.67 | 271.85 | 248.15 | 220.97 | 271.28 | NA | NA | NA | |

| Long Term Debt Current | 26.02 | 28.73 | 27.17 | 30.29 | 25.83 | 13.82 | 119.71 | 118.47 | 120.85 | 129.70 | 26.10 | 26.23 | 338.00 | 27.16 | 26.22 | 37.51 | 29.85 | 21.92 | 30.01 | NA | 20.14 | NA | NA | NA | |

| Accounts Payable Current | 161.77 | 120.44 | 134.02 | 89.01 | 72.97 | 101.91 | 87.13 | 72.96 | 58.33 | 64.28 | 64.90 | 60.40 | 55.58 | 81.06 | 61.43 | 64.42 | 66.89 | 59.82 | 53.80 | 47.76 | 48.58 | NA | NA | NA | |

| Other Accrued Liabilities Current | 1.54 | 34.04 | 28.75 | 51.91 | 46.20 | 31.96 | 31.66 | 27.70 | 28.64 | 10.54 | 11.04 | 10.81 | 29.79 | 24.58 | 30.52 | 29.42 | 31.24 | 27.77 | 18.90 | NA | 30.97 | NA | NA | NA | |

| Accrued Income Taxes Current | 1.14 | NA | NA | NA | 0.48 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Liabilities Current | 144.18 | 102.01 | 101.20 | 92.17 | 114.14 | 85.88 | 96.05 | 82.13 | 112.00 | 77.88 | 88.05 | 77.81 | 70.28 | 82.15 | 109.72 | 67.97 | 69.53 | 66.87 | 54.83 | 53.65 | 67.65 | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 411.58 | 483.43 | 489.26 | 522.81 | 526.73 | 504.20 | 506.45 | 508.50 | 390.90 | 570.35 | 645.72 | 696.00 | 636.81 | 663.97 | 668.21 | 741.08 | 741.28 | 740.81 | 960.13 | NA | 941.34 | NA | NA | NA | |

| Long Term Debt Noncurrent | 385.56 | 454.70 | 462.09 | 492.52 | 500.90 | 490.38 | 386.74 | 390.03 | 270.05 | 440.69 | 619.65 | 669.77 | 299.23 | 636.81 | 641.98 | 703.57 | 711.43 | 718.89 | 930.12 | NA | 921.21 | NA | NA | NA | |

| Minority Interest | 38.04 | 29.48 | 32.03 | 36.03 | 42.50 | 46.95 | 51.19 | 57.99 | 62.20 | 64.91 | 66.30 | 73.87 | 91.29 | 95.21 | 104.07 | 114.66 | 125.11 | 134.85 | 141.43 | 149.76 | 155.37 | NA | NA | NA | |

| Other Liabilities Noncurrent | 9.49 | 8.92 | 18.65 | 18.36 | 16.77 | 26.75 | 20.90 | 19.87 | 12.28 | 26.62 | 27.28 | 28.54 | 28.01 | 56.12 | 58.42 | 58.03 | 55.94 | 48.16 | 52.15 | 21.75 | 52.91 | NA | NA | NA | |

| Operating Lease Liability Noncurrent | 132.36 | 122.41 | 118.29 | 105.66 | 106.19 | 78.15 | 78.44 | 61.71 | 41.85 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 340.78 | 172.89 | -176.96 | -90.79 | -44.33 | -46.91 | -21.57 | 6.06 | 78.82 | -22.42 | -316.95 | -333.10 | -259.59 | -106.85 | -115.78 | -105.44 | -91.66 | -84.97 | -2227.02 | -2213.43 | -2180.00 | NA | NA | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 378.82 | 202.37 | -144.92 | -54.76 | -1.83 | 0.04 | 29.61 | 64.05 | 141.02 | NA | NA | NA | -168.30 | NA | NA | NA | NA | 106.32 | -2030.65 | NA | -1966.48 | -1900.65 | -1839.39 | NA | |

| Common Stock Value | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.01 | 0.01 | NA | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 | NA | NA | NA | |

| Additional Paid In Capital | 3906.49 | 3691.72 | 3284.26 | 3251.13 | 3219.08 | 3183.10 | 3155.92 | 3129.69 | 3182.75 | 3054.38 | 2747.89 | NA | 2686.76 | 2647.87 | 2604.03 | 2552.01 | 2480.60 | 2387.36 | 166.81 | 158.60 | 150.80 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -3564.48 | -3517.31 | -3460.23 | -3341.43 | -3263.07 | -3229.75 | -3177.38 | -3123.52 | -3103.94 | -3076.80 | -3064.84 | NA | -2946.38 | -2880.55 | -2828.80 | -2746.89 | -2572.40 | -2472.62 | -2394.04 | -2372.16 | -2330.65 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -1.25 | -1.53 | -1.00 | -0.50 | -0.35 | -0.28 | -0.12 | -0.13 | -0.01 | -0.01 | -0.01 | NA | 0.02 | -0.15 | -0.15 | 0.01 | 0.13 | 0.27 | 0.22 | 0.12 | -0.16 | NA | NA | NA | |

| Minority Interest | 38.04 | 29.48 | 32.03 | 36.03 | 42.50 | 46.95 | 51.19 | 57.99 | 62.20 | 64.91 | 66.30 | 73.87 | 91.29 | 95.21 | 104.07 | 114.66 | 125.11 | 134.85 | 141.43 | 149.76 | 155.37 | NA | NA | NA | |

| Stock Issued During Period Value New Issues | 0.00 | 371.53 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 2.50 | NA | NA | NA | 0.17 | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 30.45 | 23.89 | 32.80 | NA | 18.30 | 20.74 | 18.52 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 69.33 | NA | NA | NA | 7.49 | NA | NA | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 0.88 | 1.56 | 1.54 | NA | 0.50 | 0.54 | 0.88 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 2.33 | NA | NA | NA | 2.72 | NA | NA |

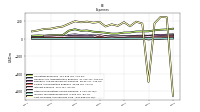

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

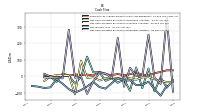

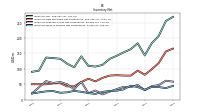

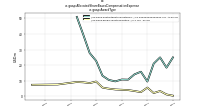

| Net Cash Provided By Used In Operating Activities | -23.27 | -69.94 | -6.07 | -92.44 | 47.23 | -72.61 | 53.73 | -89.03 | -18.81 | -39.76 | -12.29 | -27.95 | 24.59 | 23.98 | 119.38 | -4.17 | -44.77 | 4.94 | 15.90 | -34.49 | -2.08 | 14.48 | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -35.92 | -36.18 | -26.22 | -18.51 | -5.18 | -7.05 | -21.53 | -12.93 | -4.85 | -13.51 | -7.20 | -12.36 | -26.10 | -5.10 | -10.46 | 95.11 | -110.25 | 5.75 | 3.14 | 6.54 | -0.81 | -28.86 | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -93.85 | 362.16 | -46.83 | -10.11 | 253.25 | -0.67 | 2.65 | 51.15 | -64.01 | 233.50 | -10.30 | 16.84 | 21.03 | -32.07 | -107.78 | -1.49 | -8.72 | 283.67 | -12.76 | -9.07 | -8.44 | -6.91 | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

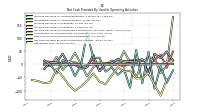

| Net Cash Provided By Used In Operating Activities | -23.27 | -69.94 | -6.07 | -92.44 | 47.23 | -72.61 | 53.73 | -89.03 | -18.81 | -39.76 | -12.29 | -27.95 | 24.59 | 23.98 | 119.38 | -4.17 | -44.77 | 4.94 | 15.90 | -34.49 | -2.08 | 14.48 | NA | NA | |

| Net Income Loss | NA | -57.08 | -118.80 | -78.36 | -33.32 | -52.37 | -53.86 | -24.89 | -27.14 | -11.95 | -42.51 | -75.95 | -65.83 | -34.90 | -62.22 | -84.44 | -99.78 | -78.58 | -45.68 | -17.72 | -67.76 | -71.83 | -63.48 | -59.53 | |

| Profit Loss | -50.78 | -60.39 | -121.17 | -82.75 | -48.51 | -56.66 | -58.42 | -29.78 | -31.59 | -17.88 | -47.98 | -81.64 | -71.01 | -39.93 | -67.23 | -88.27 | -104.44 | -82.51 | -50.19 | -22.35 | -71.92 | -76.36 | -67.60 | -65.39 | |

| Increase Decrease In Accounts Receivable | 178.62 | -5.94 | -32.87 | 23.05 | 25.72 | 7.43 | -50.53 | 8.81 | 49.03 | 0.87 | 13.92 | -2.14 | 6.20 | -11.56 | -45.77 | -0.82 | 43.40 | 4.68 | -21.72 | 28.20 | -6.94 | -3.18 | NA | NA | |

| Increase Decrease In Inventories | 14.08 | 47.97 | 23.28 | 39.54 | -39.07 | 18.93 | 10.21 | 10.82 | 10.23 | 19.24 | 5.62 | -2.08 | -26.32 | 35.44 | -11.61 | -15.93 | -2.25 | -1.71 | 39.35 | 6.82 | 7.14 | -17.64 | NA | NA | |

| Increase Decrease In Accounts Payable | 47.86 | -13.34 | 35.87 | 16.12 | -24.84 | 8.52 | 15.30 | 14.14 | -9.32 | -0.13 | 4.01 | 4.82 | -25.48 | 19.63 | -3.00 | -2.46 | 7.07 | 6.02 | 6.04 | -0.83 | 9.39 | 11.02 | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -35.92 | -36.18 | -26.22 | -18.51 | -5.18 | -7.05 | -21.53 | -12.93 | -4.85 | -13.51 | -7.20 | -12.36 | -26.10 | -5.10 | -10.46 | 95.11 | -110.25 | 5.75 | 3.14 | 6.54 | -0.81 | -28.86 | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 35.92 | 36.18 | 26.22 | 18.51 | 5.18 | 10.16 | 21.53 | 12.93 | 4.85 | 13.51 | 7.20 | 12.36 | 27.58 | 4.59 | 10.34 | 8.54 | 10.33 | 2.74 | 1.37 | 0.22 | 1.08 | 1.80 | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -93.85 | 362.16 | -46.83 | -10.11 | 253.25 | -0.67 | 2.65 | 51.15 | -64.01 | 233.50 | -10.30 | 16.84 | 21.03 | -32.07 | -107.78 | -1.49 | -8.72 | 283.67 | -12.76 | -9.07 | -8.44 | -6.91 | NA | NA |

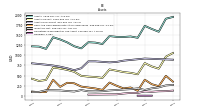

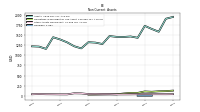

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

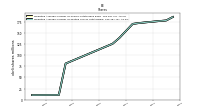

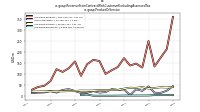

| Revenues | 462.58 | 292.27 | 243.24 | 201.04 | 342.47 | 207.23 | 228.47 | 194.01 | 249.39 | 200.31 | 187.86 | 156.70 | 213.54 | 233.47 | 233.78 | 200.71 | 213.61 | 190.19 | 168.88 | 169.36 | 123.25 | 93.77 | 86.78 | 72.20 | |

| Variable Interest Entity Primary Beneficiary, Installation, P P A3 A Upgrade, Power Purchase Agreement Company3a | 2.90 | 0.90 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Variable Interest Entity Primary Beneficiary, Net Installation, P P A3 A Upgrade, Power Purchase Agreement Company3a | NA | 2.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Variable Interest Entity Primary Beneficiary, Net Product, P P A3 A Upgrade, Power Purchase Agreement Company3a | NA | 12.70 | NA | NA | NA | 49.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Variable Interest Entity Primary Beneficiary, Net Product And Installation, P P A3 A Upgrade, Power Purchase Agreement Company3a | NA | NA | 36.90 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Installation | 43.16 | 22.68 | 12.73 | 13.55 | 42.35 | 22.17 | 28.88 | 2.66 | 28.83 | 26.60 | 29.84 | 16.62 | 14.43 | 19.01 | 17.29 | 22.26 | 21.36 | 29.69 | 26.25 | 14.12 | 21.60 | 14.98 | 14.35 | 12.29 | |

| Electricity | 19.23 | 19.00 | 18.46 | 18.70 | 17.15 | 17.25 | 17.02 | 17.00 | 16.62 | 16.48 | 15.61 | 15.38 | 15.06 | 8.25 | 12.94 | 13.43 | 13.82 | 14.06 | 14.01 | 14.03 | 14.81 | 14.02 | 13.62 | 13.65 | |

| Product | 360.25 | 213.24 | 173.62 | 133.55 | 250.16 | 128.55 | 146.87 | 137.93 | 171.80 | 131.08 | 116.20 | 99.56 | 158.43 | 182.62 | 179.90 | 141.73 | 156.67 | 125.69 | 108.65 | 121.31 | 66.91 | 45.26 | 39.94 | 27.66 | |

| Service | 39.94 | 37.35 | 38.43 | 35.24 | 32.81 | 39.25 | 35.71 | 36.42 | 32.14 | 26.14 | 26.21 | 25.15 | 25.63 | 23.60 | 23.66 | 23.29 | 21.75 | 20.75 | 19.98 | 19.91 | 19.93 | 19.51 | 18.88 | 18.59 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 446.60 | 276.15 | 227.57 | 185.02 | 326.32 | 190.78 | 212.16 | 177.60 | 232.76 | 183.82 | 172.24 | 141.32 | 213.54 | 208.67 | 185.29 | 130.03 | 213.61 | 190.19 | 168.88 | 169.36 | 123.25 | 93.77 | 86.78 | 72.20 | |

| Installation | 43.16 | 22.68 | 12.73 | 13.55 | 42.35 | 22.17 | 28.88 | 2.66 | 28.83 | 26.60 | 29.84 | 16.62 | 14.43 | 21.10 | 13.08 | 12.22 | 21.36 | 29.69 | 26.25 | 14.12 | 21.60 | 14.98 | 14.35 | 12.29 | |

| Electricity | 3.26 | 2.88 | 2.79 | 2.68 | 1.00 | 0.80 | 0.71 | 0.59 | 0.58 | 0.34 | 0.00 | 0.00 | 0.00 | 0.00 | 5.11 | 3.42 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Product | 360.25 | 213.24 | 173.62 | 133.55 | 250.16 | 128.55 | 146.87 | 137.93 | 171.80 | 131.08 | 116.20 | 99.56 | 158.43 | 163.90 | 144.08 | 90.93 | 156.67 | 125.69 | 108.65 | 121.31 | 66.91 | 45.26 | 39.94 | 27.66 | |

| Service | 39.94 | 37.35 | 38.43 | 35.24 | 32.81 | 39.25 | 35.71 | 36.42 | 32.14 | 26.14 | 26.21 | 25.15 | 25.63 | 23.66 | 23.03 | 23.47 | 21.75 | 20.75 | 19.98 | 19.91 | 19.93 | 19.51 | 18.88 | 18.59 |