| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

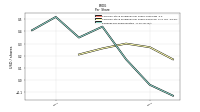

| Weighted Average Number Of Diluted Shares Outstanding | 123.88 | NA | 24.16 | 24.03 | 23.14 | NA | 22.28 | NA | NA | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 25.07 | NA | 24.16 | 24.03 | 23.14 | NA | 22.28 | NA | NA | NA | NA | |

| Weighted Average Number Of Share Outstanding Basic And Diluted | NA | NA | NA | NA | 23.14 | NA | 22.28 | NA | NA | NA | NA | |

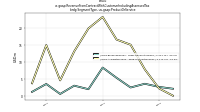

| Earnings Per Share Basic | 0.03 | -0.04 | 0.17 | 0.44 | 0.35 | 0.52 | 0.41 | NA | NA | NA | NA | |

| Earnings Per Share Diluted | -0.13 | -0.04 | 0.17 | 0.44 | 0.35 | 0.52 | 0.41 | NA | NA | NA | NA | |

| Earnings Per Share Basic And Diluted | NA | NA | NA | NA | 0.35 | 0.52 | 0.41 | NA | NA | NA | NA |

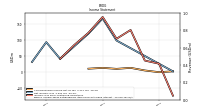

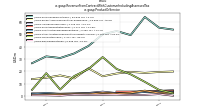

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

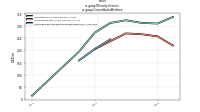

| Revenue From Contract With Customer Including Assessed Tax | 91.45 | 95.47 | 110.42 | 99.02 | 104.13 | 107.32 | 92.17 | 71.97 | 58.55 | 71.75 | 51.35 | |

| Operating Expenses | 61.66 | 70.67 | 79.80 | 75.69 | 75.94 | 83.15 | 56.71 | 66.47 | 43.42 | 55.98 | 37.49 | |

| General And Administrative Expense | 13.89 | 11.11 | 10.69 | 9.77 | 9.51 | 8.62 | 6.70 | 5.39 | 4.10 | 4.04 | 4.45 | |

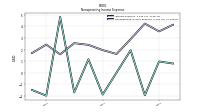

| Interest Expense | 4.14 | 3.57 | 4.25 | 2.90 | 1.62 | 1.96 | 2.41 | 2.55 | 1.59 | 2.43 | 1.70 | |

| Interest Expense Debt | 3.40 | 3.40 | 3.20 | 1.50 | 1.50 | 1.60 | 1.50 | 3.00 | NA | NA | NA | |

| Interest Paid Net | 6.81 | 0.06 | 3.02 | 0.08 | 3.04 | -0.10 | 5.05 | 0.00 | 3.02 | 3.09 | NA | |

| Income Tax Expense Benefit | -5.84 | 7.61 | 3.20 | 5.84 | -5.54 | -4.82 | -2.61 | 0.42 | -0.41 | -0.43 | -0.40 | |

| Income Taxes Paid Net | 0.13 | 4.25 | 2.97 | 1.45 | 0.62 | 0.47 | 2.66 | 0.42 | 0.41 | 0.23 | NA | |

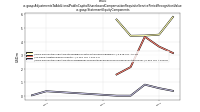

| Profit Loss | -67.43 | 18.24 | 32.24 | 124.38 | 97.50 | 165.79 | 118.88 | 83.24 | NA | NA | NA | |

| Net Income Loss | 2.03 | NA | NA | NA | 97.50 | 165.79 | 118.88 | NA | 40.72 | 92.54 | 31.26 | |

| Comprehensive Income Net Of Tax | 2.12 | -0.47 | 4.84 | 12.93 | 9.78 | 12.90 | 10.29 | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 0.73 | -0.86 | 4.13 | NA | NA | 11.92 | 9.07 | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Diluted | -16.55 | -0.86 | 4.13 | NA | NA | 11.92 | 9.07 | NA | NA | NA | NA |

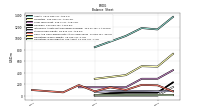

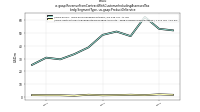

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

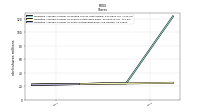

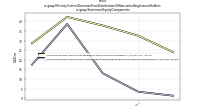

| Assets | 1371.94 | 1154.84 | 1179.42 | 1042.07 | NA | 846.29 | NA | NA | NA | NA | NA | |

| Liabilities | 730.34 | 508.52 | 516.41 | 361.07 | NA | 296.56 | NA | NA | NA | NA | NA | |

| Liabilities And Stockholders Equity | 1371.94 | 1154.84 | 1179.42 | 1042.07 | NA | 846.29 | NA | NA | NA | NA | NA | |

| Stockholders Equity | 84.87 | 79.10 | 84.71 | 88.45 | NA | 71.79 | NA | NA | NA | NA | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

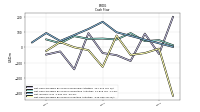

| Cash And Cash Equivalents At Carrying Value | 77.51 | 183.58 | 191.49 | 102.78 | 149.12 | 78.42 | 188.34 | 61.55 | NA | 101.83 | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 87.46 | 193.26 | 200.46 | 110.18 | 158.28 | 83.87 | 193.79 | 67.16 | 139.60 | 107.35 | 128.88 |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Goodwill | 234.60 | 55.98 | 55.98 | 55.98 | 46.15 | 9.80 | NA | NA | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 153.41 | 4.89 | 5.38 | 5.86 | NA | 3.44 | NA | NA | NA | NA | NA | |

| Finite Lived Intangible Assets Net | NA | 4.89 | NA | NA | NA | 3.44 | NA | NA | NA | NA | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 446.40 | 297.30 | 297.20 | 150.00 | 150.00 | 150.00 | 150.00 | NA | NA | NA | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

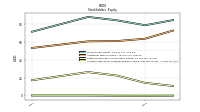

| Stockholders Equity | 84.87 | 79.10 | 84.71 | 88.45 | NA | 71.79 | NA | NA | NA | NA | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 641.60 | 646.32 | 663.01 | 681.00 | 638.42 | 549.74 | 418.07 | 169.64 | 215.36 | 201.47 | 145.40 | |

| Additional Paid In Capital | 73.10 | 63.94 | 61.24 | 60.96 | NA | 53.53 | NA | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 10.72 | 14.23 | 22.50 | 26.36 | NA | 17.18 | NA | NA | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -0.13 | -0.22 | -0.19 | -0.03 | NA | -0.02 | NA | NA | NA | NA | NA | |

| Stock Issued During Period Value New Issues | NA | 0.00 | 0.00 | 0.00 | 14.93 | NA | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 9.36 | 8.70 | 9.62 | 6.55 | 7.24 | NA | NA | NA | NA | 5.00 | 0.39 | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 25.43 | 35.97 | 50.84 | 80.77 | 46.08 | NA | NA | NA | NA | NA | NA |

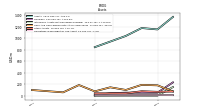

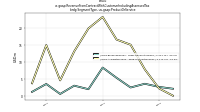

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

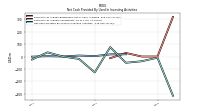

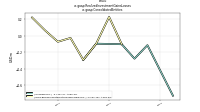

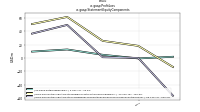

| Net Cash Provided By Used In Operating Activities | 12.81 | 45.91 | 40.06 | 91.99 | 50.39 | 56.36 | 54.38 | 72.17 | 26.30 | 50.76 | NA | |

| Net Cash Provided By Used In Investing Activities | -316.00 | -9.30 | -38.19 | -50.35 | 75.95 | -128.36 | -19.09 | -0.48 | 33.67 | -24.23 | NA | |

| Net Cash Provided By Used In Financing Activities | 197.37 | -43.81 | 88.41 | -89.75 | -51.93 | -37.92 | 91.34 | -144.14 | -27.73 | -48.05 | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

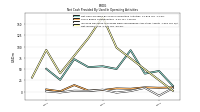

| Net Cash Provided By Used In Operating Activities | 12.81 | 45.91 | 40.06 | 91.99 | 50.39 | 56.36 | 54.38 | 72.17 | 26.30 | 50.76 | NA | |

| Net Income Loss | 2.03 | NA | NA | NA | 97.50 | 165.79 | 118.88 | NA | 40.72 | 92.54 | 31.26 | |

| Profit Loss | -67.43 | 18.24 | 32.24 | 124.38 | 97.50 | 165.79 | 118.88 | 83.24 | NA | NA | NA | |

| Share Based Compensation | 9.36 | 8.70 | 9.62 | 6.55 | 7.27 | 3.59 | 2.45 | 14.62 | 0.84 | 5.00 | NA | |

| Amortization Of Financing Costs | NA | 0.13 | 0.13 | 0.11 | 0.11 | NA | NA | NA | NA | NA | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -316.00 | -9.30 | -38.19 | -50.35 | 75.95 | -128.36 | -19.09 | -0.48 | 33.67 | -24.23 | NA | |

| Payments To Acquire Investments | NA | NA | NA | 18.11 | 17.27 | 3.43 | 7.95 | 0.13 | 2.58 | -1.05 | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

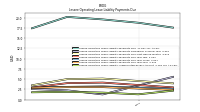

| Net Cash Provided By Used In Financing Activities | 197.37 | -43.81 | 88.41 | -89.75 | -51.93 | -37.92 | 91.34 | -144.14 | -27.73 | -48.05 | NA | |

| Payments Of Dividends Common Stock | 5.54 | 7.83 | 8.86 | 7.61 | 5.92 | 0.00 | NA | NA | NA | 39.94 | NA | |

| Dividends | 5.54 | NA | NA | NA | 5.92 | NA | NA | NA | NA | 41.08 | 59.56 |

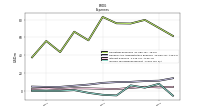

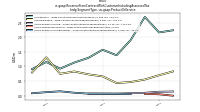

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

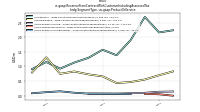

| Revenue From Contract With Customer Including Assessed Tax | 91.45 | 95.47 | 110.42 | 99.02 | 104.13 | 107.32 | 92.17 | 71.97 | 58.55 | 71.75 | 51.35 | |

| , Construction Management Fees | 2.24 | 2.16 | 2.69 | 1.90 | 1.38 | 1.57 | 1.29 | 1.13 | 0.93 | 1.15 | 0.91 | |

| , Property Management And Leasing Fees | 6.74 | 6.84 | 6.56 | 5.96 | 5.31 | 5.00 | 4.54 | 4.32 | 4.09 | 4.12 | 3.84 | |

| , Construction Management Fees | 0.83 | 0.70 | 0.56 | 0.47 | 0.43 | 0.66 | 0.73 | 0.83 | 0.75 | 1.31 | 0.80 | |

| , Property Management And Leasing Fees | 3.90 | 3.69 | 2.98 | 4.08 | 4.26 | 5.09 | 11.54 | 3.42 | 6.10 | 4.16 | 3.42 | |

| Acquisition Fees, Transaction Fees | 0.17 | 2.29 | 7.87 | 15.07 | 16.60 | 23.21 | 19.84 | 13.14 | 4.65 | 14.97 | 3.79 | |

| Brokerage Fees, Transaction Fees | 2.20 | 2.74 | 3.66 | 2.57 | 5.40 | 8.39 | 2.07 | 3.10 | 0.68 | 3.60 | 1.29 | |

| Funds, Fund Management Fees | 52.13 | 53.35 | 62.64 | 47.62 | 51.21 | 48.61 | 38.83 | 33.51 | 29.47 | 30.78 | 25.15 | |

| Joint Ventures And Separately Managed Accounts, Fund Management Fees | 1.71 | 2.06 | 1.45 | 1.76 | 1.49 | 1.35 | 1.75 | 1.03 | 1.38 | 1.39 | 1.47 | |

| Logistics, Construction Management Fees | 0.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Seniors Housing, Construction Management Fees | 0.14 | 0.14 | 0.10 | NA | 0.07 | 0.07 | 0.07 | NA | NA | NA | NA | |

| Seniors Housing, Property Management And Leasing Fees | 6.87 | 6.77 | 6.87 | 7.06 | 7.11 | 5.97 | 6.43 | 6.60 | 6.56 | 6.59 | 6.49 | |

| Seniors Housing Member, Construction Management Fees | NA | NA | NA | 0.06 | 0.07 | 0.07 | 0.07 | 0.10 | 0.15 | 0.12 | 0.09 | |

| Single Family Rental, Construction Management Fees | 0.00 | 0.05 | 0.07 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Single Family Rental, Property Management And Leasing Fees | 2.40 | 2.23 | 2.38 | 2.51 | 1.60 | NA | NA | NA | NA | NA | NA | |

| Construction Management Fees | 3.29 | 3.25 | 3.41 | 2.43 | 1.89 | 2.30 | 2.10 | 2.06 | 1.83 | 2.59 | 1.79 | |

| Development Fees | 0.34 | 1.65 | 0.99 | 0.79 | 1.26 | 1.14 | 1.02 | 1.16 | 0.39 | 0.65 | 0.74 | |

| Fund Administration Fees | 4.18 | 3.93 | 3.81 | 3.66 | 3.64 | NA | NA | NA | NA | NA | NA | |

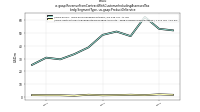

| Fund Management Fees | 53.85 | 55.41 | 64.10 | 49.38 | 52.70 | 49.97 | 40.58 | 34.54 | 30.85 | 32.17 | 26.62 | |

| Insurance Premiums | 4.73 | 4.21 | 3.39 | 2.85 | 2.42 | 3.60 | 2.53 | 2.02 | 1.89 | 1.57 | 2.22 | |

| Other Asset Management And Property Income | 2.80 | 2.48 | 4.41 | 2.66 | 1.96 | 2.65 | 1.53 | 1.61 | 1.52 | 1.33 | 1.15 | |

| Property Management And Leasing Fees | 19.90 | 19.53 | 18.79 | 19.62 | 18.28 | 16.06 | 22.51 | 14.34 | 16.75 | 14.87 | 13.75 | |

| Transaction Fees | 2.38 | 5.03 | 11.53 | 17.64 | 22.00 | 31.60 | 21.91 | 16.24 | 5.33 | 18.57 | 5.08 |