| 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | |

| Weighted Average Number Of Diluted Shares Outstanding | 56.19 | 56.83 | 55.73 | 55.04 | NA | 54.74 | 54.70 | 54.91 | |

| Weighted Average Number Of Shares Outstanding Basic | 55.43 | 56.23 | 55.05 | 54.47 | NA | 54.59 | 54.49 | 54.66 | |

| Earnings Per Share Basic | 0.51 | 0.46 | 0.54 | 0.69 | 0.52 | 0.56 | 0.47 | 0.28 | |

| Earnings Per Share Diluted | 0.51 | 0.46 | 0.53 | 0.69 | 0.52 | 0.56 | 0.47 | 0.28 | |

| Tier One Risk Based Capital To Risk Weighted Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Capital To Risk Weighted Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

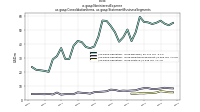

| 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|

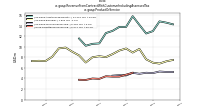

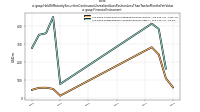

| Interest And Fee Income Loans And Leases | 60.88 | 65.16 | 61.40 | 62.56 | 71.53 | 69.81 | 71.09 | 72.54 | |

| Interest Expense | 6.04 | 7.11 | 7.15 | 7.44 | 8.37 | 9.88 | 10.42 | 15.00 | |

| Interest Income Expense Net | 70.06 | 70.75 | 64.54 | 64.89 | 72.94 | 69.75 | 70.81 | 69.43 | |

| Interest Paid Net | 3.65 | 4.69 | 9.80 | 1.77 | 11.61 | 16.23 | 11.37 | 14.39 | |

| Allocated Share Based Compensation Expense | 1.91 | 1.84 | 2.44 | 1.40 | 2.69 | 2.21 | 1.07 | 1.10 | |

| Income Tax Expense Benefit | 7.27 | 6.46 | 6.86 | 10.82 | 7.88 | 9.12 | 7.01 | 3.86 | |

| Income Taxes Paid | NA | 0.43 | NA | NA | 2.80 | 14.88 | 4.01 | 0.50 | |

| Profit Loss | 28.44 | 25.94 | 29.77 | 37.82 | 28.34 | 30.83 | 25.81 | 15.36 | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | -5.20 | 0.20 | 0.14 | 0.61 | 0.21 | 0.21 | -0.15 | -2.25 | |

| Net Income Loss | 28.44 | 25.94 | 29.77 | 37.82 | 28.34 | 30.83 | 25.81 | 15.36 | |

| Comprehensive Income Net Of Tax | -85.41 | 13.85 | 36.67 | 8.33 | 26.13 | 29.32 | 29.74 | 33.51 | |

| Net Income Loss Available To Common Stockholders Basic | 28.44 | 25.94 | 29.77 | 37.82 | 28.34 | 30.83 | 25.81 | 15.36 | |

| Interest Income Expense After Provision For Loan Loss | 70.31 | 72.62 | 66.24 | 71.69 | 69.80 | 64.20 | 57.92 | 52.22 | |

| Noninterest Expense | 70.38 | 73.49 | 62.62 | 54.50 | 64.07 | 56.54 | 53.07 | 60.51 |

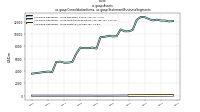

| 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|

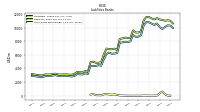

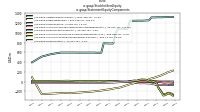

| Assets | 12567.51 | 12899.33 | 12415.45 | 10759.56 | 10544.05 | 10539.63 | 10835.97 | 9721.41 | |

| Liabilities | 11349.48 | 11566.25 | 11069.76 | 9493.74 | 9273.98 | 9283.92 | 9599.88 | 8503.82 | |

| Liabilities And Stockholders Equity | 12567.51 | 12899.33 | 12415.45 | 10759.56 | 10544.05 | 10539.63 | 10835.97 | 9721.41 | |

| Stockholders Equity | 1218.03 | 1333.08 | 1345.69 | 1265.82 | 1270.07 | 1255.70 | 1236.08 | 1217.59 | |

| Tier One Risk Based Capital | 1085.86 | 1060.76 | 1062.18 | 1007.99 | 983.03 | 964.40 | 941.24 | 921.83 |

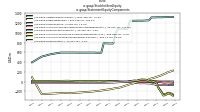

| 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | NA | NA | NA | NA | NA | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 479.23 | 883.85 | 920.81 | 404.80 | 688.54 | 479.72 | 1050.07 | 342.85 | |

| Equity Securities Fv Ni | 19.52 | 13.01 | 13.95 | 7.15 | 5.53 | 17.81 | 5.13 | 4.94 | |

| Available For Sale Securities Debt Securities | 2946.05 | 3997.24 | 3464.52 | 2796.95 | 2261.19 | 2080.85 | 1696.87 | 1765.94 |

| 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | NA | NA | NA | NA | 775.50 | NA | NA | NA | |

| Deposits | 10591.84 | 10817.87 | 10337.12 | 8873.85 | 8677.85 | 8642.70 | 8909.67 | 7973.23 |

| 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|

| Senior Notes | 39.98 | 39.91 | 39.88 | 39.84 | 39.81 | 39.77 | 39.74 | 39.71 |

| 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|

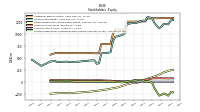

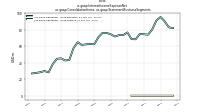

| Stockholders Equity | 1218.03 | 1333.08 | 1345.69 | 1265.82 | 1270.07 | 1255.70 | 1236.08 | 1217.59 | |

| Common Stock Value | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | |

| Additional Paid In Capital | 1318.70 | 1315.04 | 1316.72 | 1255.04 | 1253.36 | 1250.39 | 1248.05 | 1249.30 | |

| Retained Earnings Accumulated Deficit | 107.89 | 75.64 | 62.93 | 45.90 | 20.83 | 4.72 | -13.95 | -27.60 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -137.60 | -1.37 | 10.72 | 3.82 | 33.31 | 35.52 | 37.04 | 33.10 | |

| Treasury Stock Value | 71.02 | 56.30 | 44.73 | 39.00 | 37.49 | 34.98 | 35.10 | 37.27 |

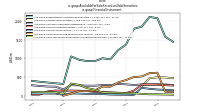

| 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|

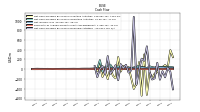

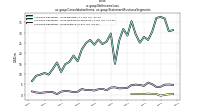

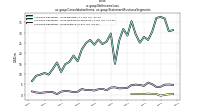

| Net Cash Provided By Used In Operating Activities | 42.51 | 20.23 | 36.73 | 45.54 | 67.89 | 46.68 | 35.92 | 18.81 | |

| Net Cash Provided By Used In Investing Activities | -186.99 | -528.33 | 304.63 | -545.85 | 146.30 | -295.26 | -405.47 | -181.23 | |

| Net Cash Provided By Used In Financing Activities | -212.38 | 471.14 | 174.65 | 216.58 | -5.37 | -321.77 | 1076.78 | -24.02 |

| 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|

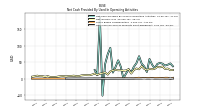

| Net Cash Provided By Used In Operating Activities | 42.51 | 20.23 | 36.73 | 45.54 | 67.89 | 46.68 | 35.92 | 18.81 | |

| Net Income Loss | 28.44 | 25.94 | 29.77 | 37.82 | 28.34 | 30.83 | 25.81 | 15.36 | |

| Profit Loss | 28.44 | 25.94 | 29.77 | 37.82 | 28.34 | 30.83 | 25.81 | 15.36 | |

| Depreciation Depletion And Amortization | 2.76 | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 1.91 | 1.84 | 2.44 | 1.45 | 2.72 | 2.21 | 1.07 | 1.14 |

| 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|

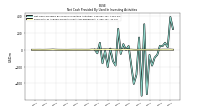

| Net Cash Provided By Used In Investing Activities | -186.99 | -528.33 | 304.63 | -545.85 | 146.30 | -295.26 | -405.47 | -181.23 | |

| Payments To Acquire Property Plant And Equipment | 0.73 | 0.95 | 1.18 | 1.91 | 1.04 | 0.13 | 0.71 | 2.31 |

| 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -212.38 | 471.14 | 174.65 | 216.58 | -5.37 | -321.77 | 1076.78 | -24.02 | |

| Payments Of Dividends | 12.74 | 12.96 | 12.48 | 12.51 | 11.99 | 11.99 | 11.97 | 12.05 | |

| Payments For Repurchase Of Common Stock | 5.22 | 14.79 | 5.74 | 1.51 | 2.60 | 0.00 | -0.00 | 9.67 |

| 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|

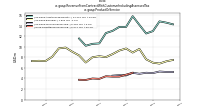

| Remittance Processing | 5.08 | 4.36 | 4.35 | 4.42 | 3.93 | 4.00 | 3.72 | 3.75 | |

| Asset Management1 | 15.78 | 13.75 | 13.00 | 12.58 | 10.63 | 10.55 | 10.19 | 11.55 | |

| Banking | 8.91 | 9.29 | 8.61 | 8.04 | 8.20 | 8.01 | 7.03 | 8.36 | |

| Technology Service | 5.08 | 4.62 | 4.53 | NA | NA | NA | NA | NA |