| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.90 | 0.90 | 0.90 | 0.90 | 0.90 | 0.90 | 0.90 | 0.90 | 0.90 | 0.90 | 0.89 | 0.89 | 0.89 | 0.88 | 0.88 | |

| Tier One Risk Based Capital To Risk Weighted Assets | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | |

| Capital To Risk Weighted Assets | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

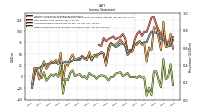

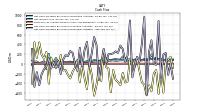

| Revenue From Contract With Customer Including Assessed Tax | 11.59 | 11.79 | 10.57 | 9.96 | 9.81 | 11.03 | 10.51 | 10.83 | 10.51 | 9.44 | 9.97 | 9.16 | 8.28 | 8.32 | 7.07 | 8.56 | 8.69 | 7.59 | 8.09 | 7.11 | 7.17 | 6.93 | 7.01 | 6.87 | 6.49 | 6.50 | 6.00 | 6.66 | |

| Interest And Fee Income Loans And Leases | 302.48 | 293.11 | 273.48 | 261.18 | 243.32 | 211.54 | 181.02 | 166.09 | 164.06 | 163.95 | 161.49 | 159.72 | 163.62 | 167.56 | 168.15 | 177.87 | 181.22 | 187.83 | 182.29 | 178.28 | 174.35 | 168.18 | 158.66 | 151.29 | 148.16 | 146.38 | 129.84 | 124.91 | |

| Interest Expense | 151.12 | 137.83 | 118.57 | 92.95 | 61.97 | 28.48 | 14.37 | 12.76 | 13.74 | 16.14 | 17.37 | 21.50 | 27.78 | 34.73 | 39.53 | 46.42 | 50.02 | 50.83 | 49.07 | 44.45 | 38.43 | 31.78 | 27.49 | 24.36 | 22.59 | 20.88 | 18.28 | 18.69 | |

| Interest Income Expense Net | 182.14 | 185.64 | 181.53 | 192.44 | 201.81 | 197.53 | 175.16 | 159.19 | 155.45 | 152.48 | 148.00 | 141.82 | 139.82 | 137.50 | 134.47 | 140.31 | 141.21 | 147.00 | 143.38 | 143.32 | 145.44 | 145.08 | 140.03 | 135.34 | 133.05 | 133.20 | 117.35 | 112.11 | |

| Interest Paid Net | 148.14 | 133.11 | 116.83 | 86.78 | 53.37 | 25.48 | 13.77 | 12.90 | 13.91 | 16.91 | 18.80 | 25.87 | 29.28 | 38.90 | 43.00 | 51.25 | 45.10 | 49.79 | 45.88 | 41.75 | 36.65 | 30.27 | 27.10 | 22.51 | 22.65 | 19.16 | 18.76 | 20.50 | |

| Income Tax Expense Benefit | 10.49 | 10.13 | 9.45 | 19.39 | 33.68 | 30.98 | 24.18 | 23.05 | 23.23 | 17.04 | 22.68 | 20.59 | 10.33 | 2.19 | 3.49 | 9.09 | 16.29 | 20.97 | 14.38 | 18.59 | 17.19 | 18.70 | 11.05 | 18.87 | 51.17 | 35.16 | 15.43 | 20.50 | |

| Income Taxes Paid | 10.00 | 11.62 | NA | NA | 36.90 | 19.80 | 38.90 | 1.28 | 27.40 | 28.50 | 33.90 | 2.89 | 9.88 | 3.39 | 29.46 | 2.64 | 18.04 | 9.70 | 31.31 | 2.50 | 17.79 | 16.48 | 27.93 | 3.66 | 14.41 | 32.20 | 14.20 | 15.90 | |

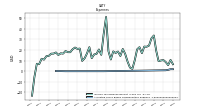

| Other Comprehensive Income Loss Net Of Tax | 38.12 | -24.48 | -7.97 | 11.22 | 10.58 | -41.55 | -25.35 | -42.91 | -2.70 | -2.74 | 0.69 | -3.62 | -1.08 | -1.96 | -1.52 | 7.58 | 3.13 | 0.53 | 9.07 | 7.58 | 5.77 | -0.86 | -2.02 | -9.32 | -2.29 | 1.20 | 2.22 | 0.07 | |

| Net Income Loss | 82.53 | 82.37 | 93.22 | 96.01 | 97.60 | 99.03 | 88.98 | 75.03 | 75.32 | 72.40 | 77.20 | 73.38 | 70.89 | 56.79 | 54.32 | 46.85 | 67.38 | 72.83 | 72.24 | 66.68 | 64.65 | 69.76 | 73.66 | 63.82 | 25.94 | 49.75 | 51.41 | 48.94 | |

| Comprehensive Income Net Of Tax | 120.64 | 57.89 | 85.25 | 107.22 | 108.18 | 57.49 | 63.63 | 32.12 | 72.63 | 69.66 | 77.89 | 69.76 | 69.81 | 54.83 | 52.80 | 54.43 | 70.51 | 73.36 | 81.32 | 74.25 | 70.42 | 68.89 | 71.65 | 54.49 | 23.65 | 50.95 | 53.64 | 49.01 | |

| Interest Income Expense After Provision For Loan Loss | 180.41 | 178.64 | 172.38 | 184.34 | 200.41 | 195.53 | 172.66 | 150.55 | 151.95 | 149.43 | 157.00 | 155.38 | 144.82 | 125.00 | 109.47 | 115.31 | 146.21 | 149.00 | 143.38 | 143.32 | 145.44 | 146.58 | 140.03 | 138.34 | 133.05 | 133.20 | 117.35 | 114.61 | |

| Noninterest Expense | 110.50 | 93.97 | 92.82 | 83.19 | 81.22 | 75.39 | 74.12 | 72.70 | 73.20 | 72.22 | 69.71 | 71.40 | 75.05 | 76.00 | 67.27 | 65.15 | 71.19 | 65.58 | 69.55 | 70.97 | 74.39 | 65.96 | 63.09 | 60.97 | 66.41 | 61.25 | 56.66 | 51.89 | |

| Noninterest Income | 23.10 | 7.84 | 23.11 | 14.24 | 12.09 | 9.88 | 14.62 | 20.23 | 19.80 | 12.22 | 12.58 | 10.00 | 11.45 | 9.98 | 15.61 | 5.79 | 8.65 | 10.39 | 12.79 | 12.92 | 10.79 | 7.83 | 7.77 | 5.31 | 10.47 | 12.96 | 6.15 | 6.72 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

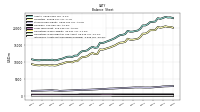

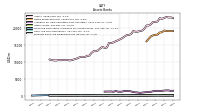

| Assets | 23081.53 | 22844.53 | 23028.44 | 22031.60 | 21947.98 | 21890.13 | 21235.55 | 20866.57 | 20886.72 | 19860.44 | 19348.36 | 19230.19 | 19043.13 | 19018.24 | 19267.04 | 18296.46 | 18094.14 | 18004.97 | 17606.01 | 17119.09 | 16784.74 | 16461.72 | 16197.75 | 15882.34 | 15640.19 | 15728.42 | 14336.78 | 14223.96 | |

| Liabilities | 20344.96 | 20205.79 | 20425.77 | 19489.26 | 19473.94 | 19470.57 | 18804.02 | 18444.34 | 18440.47 | 17397.15 | 16896.01 | 16766.90 | 16624.99 | 16643.51 | 16924.59 | 15983.42 | 15799.86 | 15759.07 | 15406.71 | 14955.76 | 14662.87 | 14344.95 | 14132.91 | 13872.55 | 13666.88 | 13759.72 | 12439.02 | 12366.06 | |

| Liabilities And Stockholders Equity | 23081.53 | 22844.53 | 23028.44 | 22031.60 | 21947.98 | 21890.13 | 21235.55 | 20866.57 | 20886.72 | 19860.44 | 19348.36 | 19230.19 | 19043.13 | 19018.24 | 19267.04 | 18296.46 | 18094.14 | 18004.97 | 17606.01 | 17119.09 | 16784.74 | 16461.72 | 16197.75 | 15882.34 | 15640.19 | 15728.42 | 14336.78 | 14223.96 | |

| Stockholders Equity | 2736.57 | 2638.74 | 2602.67 | 2542.34 | 2474.04 | 2419.56 | 2431.53 | 2422.23 | 2446.25 | 2463.29 | 2452.36 | 2463.29 | 2418.14 | 2374.72 | 2342.45 | 2313.04 | 2294.28 | 2245.89 | 2199.30 | 2163.33 | 2121.87 | 2116.78 | 2064.83 | 2009.79 | 1973.30 | 1968.70 | 1897.77 | 1857.90 | |

| Tier One Risk Based Capital | 2501.44 | NA | NA | NA | 2276.83 | NA | NA | NA | 2137.93 | NA | NA | NA | 2059.06 | NA | NA | NA | 1959.83 | NA | NA | NA | 1736.85 | NA | NA | NA | 1572.03 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Equity Securities Fv Ni | 40.41 | 31.46 | 37.67 | 27.01 | 22.16 | 23.12 | 26.79 | 27.74 | 22.32 | 20.12 | 20.11 | 20.99 | 23.74 | 22.96 | 24.57 | 18.79 | 28.00 | 32.86 | 32.50 | 29.26 | 25.10 | 23.52 | 23.13 | 24.15 | 28.10 | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 1604.57 | 1508.80 | 1487.32 | 1541.25 | 1473.35 | 1414.41 | 1234.57 | 1219.54 | 1127.31 | 1079.22 | 1002.51 | 908.84 | 1036.55 | 1080.54 | 1146.10 | 1355.17 | 1451.84 | 1427.44 | 1471.58 | 1309.85 | 1242.51 | 1283.06 | 1475.95 | 1241.11 | 1333.63 | NA | NA | 1300.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 211.73 | NA | NA | NA | 208.44 | NA | NA | NA | 206.22 | NA | NA | NA | 205.14 | NA | NA | NA | 201.46 | NA | NA | NA | 196.59 | NA | NA | NA | 191.01 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 120.63 | NA | NA | NA | 113.66 | NA | NA | NA | 106.82 | NA | NA | NA | 102.15 | NA | NA | NA | 97.22 | NA | NA | NA | 93.40 | NA | NA | NA | 87.95 | NA | NA | NA | |

| Amortization Of Intangible Assets | 0.25 | 0.25 | 0.56 | 0.25 | 1.17 | 0.25 | 0.25 | 0.22 | 0.17 | 0.17 | 0.17 | 0.17 | 0.17 | 0.17 | 0.17 | 0.17 | 0.17 | 0.17 | 0.17 | 0.17 | 0.17 | 0.19 | 0.28 | 0.23 | 0.30 | 0.28 | 0.17 | 0.17 | |

| Property Plant And Equipment Net | 91.10 | 91.03 | 92.09 | 93.20 | 94.78 | 96.42 | 97.56 | 98.80 | 99.40 | 100.34 | 100.92 | 101.86 | 103.00 | 103.44 | 104.17 | 103.48 | 104.24 | 103.82 | 102.92 | 103.24 | 103.19 | 102.56 | 102.42 | 101.93 | 103.06 | 107.95 | 104.13 | 105.03 | |

| Goodwill | 375.70 | 375.70 | 375.70 | 375.70 | 375.70 | 375.70 | 375.70 | 375.71 | 372.19 | 372.19 | 372.19 | 372.19 | 372.19 | 372.19 | 372.19 | 372.19 | 372.19 | 372.19 | 372.19 | 372.19 | 372.19 | 372.19 | 372.19 | 372.19 | 372.19 | 372.19 | 372.19 | 372.19 | |

| Intangible Assets Net Excluding Goodwill | 4.46 | 4.72 | 4.99 | 5.56 | 5.76 | 6.95 | 7.23 | 7.51 | 4.63 | 4.83 | 5.04 | 5.25 | 5.43 | 5.63 | 6.03 | 6.19 | 6.30 | 6.82 | 6.78 | 6.87 | 7.19 | 7.39 | 7.46 | 7.80 | 8.06 | 9.41 | 2.54 | 2.75 | |

| Finite Lived Intangible Assets Net | 4.04 | 4.29 | 4.54 | 5.10 | 5.35 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Equity Securities Fv Ni | 40.41 | 31.46 | 37.67 | 27.01 | 22.16 | 23.12 | 26.79 | 27.74 | 22.32 | 20.12 | 20.11 | 20.99 | 23.74 | 22.96 | 24.57 | 18.79 | 28.00 | 32.86 | 32.50 | 29.26 | 25.10 | 23.52 | 23.13 | 24.15 | 28.10 | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 1726.08 | 1684.95 | 1629.36 | 1672.44 | 1622.17 | 1577.31 | 1336.29 | 1284.86 | 1126.87 | 1073.07 | 991.72 | 898.46 | 1019.23 | 1060.97 | 1122.99 | 1330.23 | 1443.73 | 1422.43 | 1468.45 | 1322.58 | 1267.73 | 1320.84 | 1510.14 | 1271.29 | 1336.35 | 1364.95 | 1366.62 | 1230.79 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

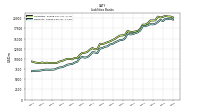

| Time Deposit Maturities Year One | 9312.88 | NA | NA | NA | 6926.12 | NA | NA | NA | 5318.81 | NA | NA | NA | 6507.62 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 19325.45 | 19635.59 | 19097.00 | 18648.87 | 18505.28 | 18575.75 | 18287.33 | 18060.26 | 18058.84 | 17006.87 | 16537.51 | 16353.63 | 16109.40 | 16034.25 | 16281.90 | 15090.15 | 14692.31 | 14658.27 | 14362.92 | 14086.36 | 13702.34 | 13581.08 | 13104.55 | 13012.25 | 12689.89 | 12561.69 | 11463.32 | 11587.27 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 119.14 | 119.14 | 119.14 | 119.14 | 119.14 | 119.14 | 119.14 | 119.14 | 119.14 | 119.14 | 119.14 | 119.14 | 119.14 | 119.14 | 119.14 | 119.14 | 119.14 | 160.39 | 169.76 | 174.45 | 189.45 | 194.14 | 194.14 | 194.14 | 194.14 | 119.14 | 119.14 | 119.14 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

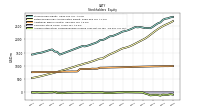

| Stockholders Equity | 2736.57 | 2638.74 | 2602.67 | 2542.34 | 2474.04 | 2419.56 | 2431.53 | 2422.23 | 2446.25 | 2463.29 | 2452.36 | 2463.29 | 2418.14 | 2374.72 | 2342.45 | 2313.04 | 2294.28 | 2245.89 | 2199.30 | 2163.33 | 2121.87 | 2116.78 | 2064.83 | 2009.79 | 1973.30 | 1968.70 | 1897.77 | 1857.90 | |

| Common Stock Value | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.91 | 0.90 | 0.90 | 0.90 | 0.90 | 0.90 | 0.90 | 0.90 | 0.90 | 0.90 | 0.90 | 0.89 | 0.89 | 0.89 | 0.88 | 0.88 | |

| Additional Paid In Capital | 987.95 | 986.07 | 983.23 | 983.53 | 981.12 | 978.43 | 976.55 | 974.75 | 972.47 | 969.72 | 967.17 | 965.57 | 964.73 | 955.74 | 953.62 | 952.33 | 950.47 | 947.88 | 945.25 | 942.84 | 942.06 | 939.80 | 937.22 | 934.34 | 932.87 | 932.52 | 895.58 | 892.58 | |

| Retained Earnings Accumulated Deficit | 2500.34 | 2442.52 | 2384.82 | 2316.26 | 2244.86 | 2172.10 | 2098.12 | 2034.68 | 1985.17 | 1935.83 | 1887.57 | 1837.26 | 1789.33 | 1743.11 | 1710.99 | 1681.35 | 1659.15 | 1616.48 | 1568.35 | 1520.86 | 1479.15 | 1439.45 | 1389.22 | 1335.06 | 1281.64 | 1275.09 | 1242.32 | 1207.67 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -85.42 | -123.53 | -99.05 | -91.08 | -102.30 | -112.87 | -71.33 | -45.98 | -3.06 | -0.37 | 2.37 | 1.69 | 5.31 | 6.39 | 8.35 | 9.88 | 2.30 | -0.83 | -1.36 | -10.43 | -18.01 | -23.78 | -22.92 | -20.91 | -2.51 | -0.22 | -1.42 | -3.64 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 2.04 | 1.99 | 1.45 | 1.51 | 1.80 | 1.82 | 1.75 | 1.61 | 1.81 | 1.70 | 1.21 | 1.24 | 1.80 | 1.26 | 1.00 | 1.54 | 1.75 | 1.79 | 1.52 | 1.53 | 2.00 | 1.92 | 1.91 | 1.50 | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

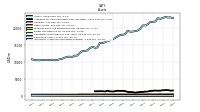

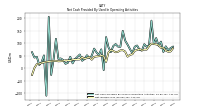

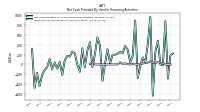

| Net Cash Provided By Used In Operating Activities | 65.81 | 107.08 | 90.68 | 121.17 | 97.42 | 190.87 | 92.65 | 86.46 | 96.77 | 71.17 | 74.81 | 91.57 | 86.83 | 60.89 | 77.20 | 95.03 | 111.23 | 150.22 | 86.33 | 87.20 | 97.21 | 89.18 | 65.20 | 84.95 | 125.28 | -6.63 | 76.17 | 54.07 | |

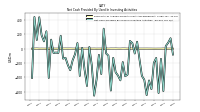

| Net Cash Provided By Used In Investing Activities | -589.87 | -141.19 | -617.59 | -128.43 | -197.37 | -563.54 | -441.92 | -646.61 | -431.76 | -378.60 | -146.94 | 97.38 | -66.92 | 78.45 | 107.79 | -361.52 | -382.01 | -185.63 | -440.37 | -373.67 | -328.18 | -126.50 | -582.65 | -97.00 | -65.57 | 279.05 | -352.74 | -85.40 | |

| Net Cash Provided By Used In Financing Activities | 189.93 | -285.23 | 875.84 | -21.80 | -0.99 | 482.05 | 245.15 | -631.47 | 960.54 | 409.00 | 40.43 | 144.27 | -32.90 | -278.97 | 888.69 | 172.73 | 39.42 | 302.82 | 373.39 | 224.56 | 254.25 | 215.19 | 197.87 | 195.98 | 19.46 | 308.13 | 10.41 | -333.17 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 65.81 | 107.08 | 90.68 | 121.17 | 97.42 | 190.87 | 92.65 | 86.46 | 96.77 | 71.17 | 74.81 | 91.57 | 86.83 | 60.89 | 77.20 | 95.03 | 111.23 | 150.22 | 86.33 | 87.20 | 97.21 | 89.18 | 65.20 | 84.95 | 125.28 | -6.63 | 76.17 | 54.07 | |

| Net Income Loss | 82.53 | 82.37 | 93.22 | 96.01 | 97.60 | 99.03 | 88.98 | 75.03 | 75.32 | 72.40 | 77.20 | 73.38 | 70.89 | 56.79 | 54.32 | 46.85 | 67.38 | 72.83 | 72.24 | 66.68 | 64.65 | 69.76 | 73.66 | 63.82 | 25.94 | 49.75 | 51.41 | 48.94 | |

| Depreciation Depletion And Amortization | 1.97 | 2.00 | 2.35 | 2.05 | 3.11 | 2.27 | 2.46 | 2.11 | 2.01 | 1.79 | 2.11 | 2.04 | 2.02 | 1.96 | 1.89 | 1.80 | 1.75 | 1.70 | 1.68 | 1.63 | 1.72 | 1.73 | 1.86 | 2.01 | 1.85 | 1.91 | 1.74 | 1.77 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -589.87 | -141.19 | -617.59 | -128.43 | -197.37 | -563.54 | -441.92 | -646.61 | -431.76 | -378.60 | -146.94 | 97.38 | -66.92 | 78.45 | 107.79 | -361.52 | -382.01 | -185.63 | -440.37 | -373.67 | -328.18 | -126.50 | -582.65 | -97.00 | -65.57 | 279.05 | -352.74 | -85.40 | |

| Payments To Acquire Property Plant And Equipment | 1.77 | 0.67 | 0.67 | 0.29 | 0.30 | 0.86 | 0.95 | 1.28 | 0.90 | 1.04 | 1.03 | 0.76 | 1.41 | 1.06 | 2.45 | 0.87 | 2.01 | 2.43 | 1.19 | 1.50 | 2.17 | 1.79 | 2.07 | 0.64 | 2.21 | -0.74 | 0.70 | 1.02 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 189.93 | -285.23 | 875.84 | -21.80 | -0.99 | 482.05 | 245.15 | -631.47 | 960.54 | 409.00 | 40.43 | 144.27 | -32.90 | -278.97 | 888.69 | 172.73 | 39.42 | 302.82 | 373.39 | 224.56 | 254.25 | 215.19 | 197.87 | 195.98 | 19.46 | 308.13 | 10.41 | -333.17 | |

| Payments Of Dividends | 24.70 | 24.67 | 24.66 | 24.61 | 24.84 | 25.06 | 25.54 | 25.52 | 25.99 | 24.14 | 24.55 | 24.65 | 24.67 | 24.68 | 24.67 | 24.66 | 24.71 | 24.70 | 24.75 | 24.97 | 24.93 | 19.53 | 19.50 | 19.47 | 19.40 | 16.97 | 16.77 | 16.76 | |

| Payments For Repurchase Of Common Stock | -0.02 | -0.01 | -0.04 | 16.74 | 31.54 | 46.29 | 30.59 | 32.90 | 66.44 | 37.14 | NA | NA | 10.71 | 0.00 | 0.00 | 12.88 | 0.00 | 4.69 | 23.01 | 8.60 | 42.65 | 0.00 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

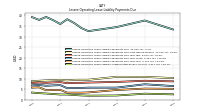

| Asset Management1 | 4.82 | 5.15 | 3.64 | 3.90 | 3.94 | 4.18 | 3.96 | 4.35 | 3.98 | 3.58 | 3.94 | 3.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposit Account | 1.42 | 1.54 | 1.64 | 1.83 | 1.53 | 1.69 | 1.63 | 1.67 | 1.48 | 1.40 | 1.34 | 1.36 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Asset Management1 | 4.82 | 5.15 | 3.64 | 3.90 | 3.94 | 4.18 | 3.96 | 4.35 | 3.98 | 3.58 | 3.94 | 3.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposit Account | 1.42 | 1.54 | 1.64 | 1.83 | 1.53 | 1.69 | 1.63 | 1.67 | 1.48 | 1.40 | 1.34 | 1.36 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Revenue From Contract With Customer Including Assessed Tax | 11.59 | 11.79 | 10.57 | 9.96 | 9.81 | 11.03 | 10.51 | 10.83 | 10.51 | 9.44 | 9.97 | 9.16 | 8.28 | 8.32 | 7.07 | 8.56 | 8.69 | 7.59 | 8.09 | 7.11 | 7.17 | 6.93 | 7.01 | 6.87 | 6.49 | 6.50 | 6.00 | 6.66 | |

| Fees And Services Charges On Deposit Account | 2.13 | 2.22 | 2.34 | 2.52 | 2.24 | 2.40 | 2.35 | 2.41 | 2.23 | 2.13 | 2.14 | 2.11 | 2.02 | 2.02 | 1.87 | 2.05 | 1.91 | 1.89 | 2.02 | 2.03 | 1.97 | 2.03 | 2.08 | 2.32 | 2.13 | 2.29 | 2.25 | 2.51 | |

| Other Service Fees | 4.64 | 4.42 | 4.59 | 3.54 | 3.63 | 4.45 | 4.20 | 4.07 | 4.29 | 3.73 | 3.88 | 3.49 | 3.70 | 3.68 | 2.99 | 3.37 | 3.80 | 3.65 | 3.56 | 3.39 | 3.55 | 3.38 | 3.52 | 3.25 | 3.20 | 3.86 | 3.18 | 3.17 | |

| Wealth Management Fees | 4.82 | 5.15 | 3.64 | 3.90 | 3.94 | 4.18 | 3.96 | 4.35 | 3.98 | 3.58 | 3.94 | 3.56 | 2.56 | 2.63 | 2.21 | 3.14 | 2.98 | 2.05 | 2.51 | 1.70 | 1.65 | 1.53 | 1.42 | 1.30 | 1.16 | 0.35 | 0.57 | 0.98 |