| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | NA | NA | NA | |

| Earnings Per Share Basic | -2.74 | -0.63 | -0.67 | 0.41 | -11.32 | 0.19 | -3.75 | 0.98 | -0.32 | -1.35 | NA | -0.85 | -0.24 | -0.56 | NA | NA | NA | NA | NA | NA | NA | NA | -0.64 | NA | NA | NA | -1.69 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

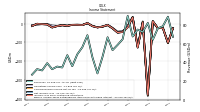

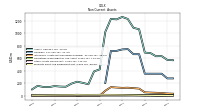

| Revenue From Contract With Customer Excluding Assessed Tax | 82.61 | 73.06 | 70.73 | 59.03 | 76.65 | 67.28 | 69.27 | 63.98 | 86.69 | 62.08 | 56.76 | 53.23 | 67.08 | 46.08 | 28.22 | 45.51 | 69.29 | 56.42 | 48.73 | 35.99 | 47.82 | 34.58 | 35.57 | 32.71 | 39.27 | 31.41 | 32.81 | 26.88 | |

| Revenues | 89.17 | 79.00 | 76.70 | 64.33 | 82.50 | 72.71 | 75.41 | 67.93 | 90.05 | 64.98 | 58.85 | 53.23 | 67.08 | 46.08 | 28.22 | 45.51 | 69.29 | 56.42 | 48.73 | 35.99 | 47.82 | 34.58 | 35.57 | 32.71 | 39.27 | 31.41 | 32.81 | 26.88 | |

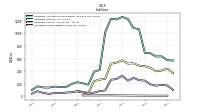

| Costs And Expenses | 192.09 | 99.66 | 101.02 | 52.10 | 465.14 | 61.19 | 197.72 | 32.27 | 106.46 | 104.78 | 101.60 | 75.40 | 73.20 | 62.22 | 47.96 | 57.44 | 68.04 | 63.02 | 54.21 | 42.49 | 58.63 | 43.24 | 47.20 | 42.53 | 41.46 | 33.95 | 38.13 | 33.93 | |

| Research And Development Expense | 12.51 | 12.43 | 14.85 | 11.56 | 14.80 | 13.76 | 13.58 | 12.29 | 11.81 | 11.14 | 8.93 | 6.22 | 5.09 | 4.63 | 3.97 | 3.85 | 2.96 | 3.02 | 2.78 | 2.94 | 3.77 | 4.10 | 4.89 | 3.46 | 2.62 | 3.42 | 3.09 | 3.01 | |

| General And Administrative Expense | 13.90 | 15.56 | 16.28 | 13.07 | 20.07 | 19.97 | 20.98 | 20.43 | 17.09 | 20.07 | 16.89 | 12.18 | 11.30 | 12.76 | 11.73 | 10.74 | 9.16 | 12.22 | 8.34 | 7.00 | 10.74 | 7.92 | 8.98 | 6.58 | 5.36 | 5.28 | 4.77 | 4.69 | |

| Selling And Marketing Expense | 14.11 | 14.16 | 15.21 | 13.95 | 16.82 | 18.29 | 21.98 | 17.65 | 19.00 | 16.73 | 17.06 | 13.20 | 12.50 | 11.43 | 10.40 | 10.97 | 12.37 | 11.07 | 11.05 | 9.34 | 13.96 | 9.45 | 10.25 | 8.22 | 8.47 | 8.30 | 7.92 | 7.23 | |

| Operating Income Loss | -102.92 | -20.65 | -24.32 | 12.23 | -382.63 | 11.52 | -122.32 | 35.66 | -16.41 | -39.79 | -42.75 | -22.17 | -6.12 | -16.14 | -19.74 | -11.93 | 1.26 | -6.60 | -5.48 | -6.50 | -10.81 | -8.66 | -11.63 | -9.82 | -2.19 | -2.54 | -5.32 | -7.05 | |

| Interest Expense Debt | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 0.94 | 3.24 | 3.19 | 3.15 | 3.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Income Expense Net | -0.84 | -0.92 | -0.57 | -0.01 | -0.15 | -0.58 | -0.88 | -0.95 | -3.25 | -3.19 | -3.08 | -3.04 | -3.04 | -0.28 | -0.01 | 0.28 | 0.31 | -0.22 | -0.34 | -0.30 | -0.27 | -0.25 | -0.99 | -1.75 | -1.81 | -1.76 | -2.02 | -2.64 | |

| Interest Paid Net | 1.28 | 1.03 | 0.66 | 1.27 | 0.02 | 1.17 | 0.02 | 1.17 | 0.02 | 1.17 | 0.04 | 1.10 | 0.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 11.02 | 10.25 | 11.74 | 7.97 | 12.49 | 5.77 | 12.84 | 13.59 | 12.85 | 16.83 | 13.34 | 7.25 | 7.58 | 11.58 | 9.11 | 4.12 | 3.58 | 7.49 | 3.07 | 1.71 | 9.82 | 5.72 | 8.35 | 0.98 | 1.44 | 1.48 | 1.24 | 2.90 | |

| Net Income Loss | -100.84 | -23.97 | -23.51 | 13.61 | -378.28 | 6.27 | -126.29 | 33.04 | -11.84 | -44.53 | -47.31 | -24.89 | -6.78 | -15.36 | -19.76 | -13.53 | 3.43 | -7.75 | -6.51 | -6.31 | -11.57 | -8.37 | -13.05 | -20.05 | -4.06 | -2.47 | -0.65 | -12.46 | |

| Comprehensive Income Net Of Tax | -103.67 | -21.70 | -24.79 | 12.33 | -382.26 | 10.27 | -122.56 | 34.41 | -11.96 | -43.26 | -47.47 | -25.19 | -8.73 | -16.31 | -19.65 | -12.23 | 2.10 | -7.18 | -6.06 | -6.69 | -11.21 | -8.17 | -12.17 | -20.56 | -4.15 | -2.85 | -1.10 | -12.58 | |

| Net Income Loss Available To Common Stockholders Basic | -100.84 | -23.97 | -23.51 | 13.61 | -378.28 | 6.27 | -126.29 | 33.04 | -11.84 | -44.53 | -47.31 | -24.89 | -6.78 | -15.36 | -19.76 | -13.53 | 3.43 | -7.75 | -6.51 | -6.31 | -11.57 | -8.37 | -13.05 | -20.21 | -4.42 | -2.82 | -5.44 | -12.71 |

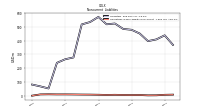

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

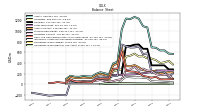

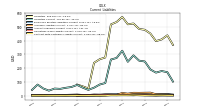

| Assets | 574.14 | 634.92 | 633.32 | 684.60 | 691.24 | 1066.31 | 1089.51 | 1231.18 | 1263.80 | 1224.58 | 1232.87 | 1023.03 | 422.54 | 389.42 | 183.04 | 206.08 | 224.31 | 193.25 | 143.56 | 146.47 | 153.76 | 138.07 | 140.25 | 157.81 | 100.76 | NA | NA | NA | |

| Liabilities | 439.35 | 409.58 | 397.21 | 452.28 | 479.63 | 485.80 | 525.35 | 519.51 | 573.10 | 535.96 | 518.48 | 278.14 | 265.35 | 239.06 | 52.57 | 67.72 | 81.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Liabilities And Stockholders Equity | 574.14 | 634.92 | 633.32 | 684.60 | 691.24 | 1066.31 | 1089.51 | 1231.18 | 1263.80 | 1224.58 | 1232.87 | 1023.03 | 422.54 | 389.42 | 183.04 | 206.08 | 224.31 | 193.25 | 143.56 | 146.47 | 153.76 | 138.07 | 140.25 | 157.81 | 100.76 | NA | NA | NA | |

| Stockholders Equity | 134.80 | 225.34 | 236.11 | 232.32 | 211.60 | 580.51 | 564.16 | 711.67 | 690.70 | 688.62 | 714.39 | 744.89 | 157.19 | 150.36 | 130.47 | 138.36 | 143.27 | 127.32 | 46.54 | 47.18 | 51.98 | 51.23 | 36.77 | 40.56 | -208.69 | -205.25 | -203.57 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

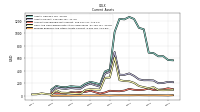

| Assets Current | 223.93 | 205.59 | 201.71 | 246.39 | 250.04 | 249.13 | 263.94 | 319.44 | 358.73 | 335.53 | 338.46 | 702.57 | 385.59 | 353.94 | 146.40 | 170.04 | 195.73 | 166.07 | 115.30 | 117.30 | 124.37 | 111.85 | 117.46 | 136.10 | 74.63 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 91.83 | 90.07 | 92.07 | 139.19 | 121.91 | 138.51 | 157.04 | 208.29 | 233.47 | 237.37 | 250.60 | 613.55 | 293.24 | 287.64 | 98.37 | 102.17 | 104.46 | 95.18 | 32.49 | 36.43 | 39.62 | 47.81 | 50.47 | 89.78 | 21.26 | 28.19 | 40.34 | 24.35 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 91.83 | 90.14 | 92.14 | 139.28 | 121.98 | 138.59 | 157.12 | 208.38 | 233.56 | 237.48 | 250.71 | 613.66 | 293.35 | 287.75 | 98.47 | 102.30 | 104.59 | 95.43 | 42.75 | 56.69 | 59.87 | 67.81 | 70.47 | 89.78 | 21.26 | 28.19 | 40.34 | 24.35 | |

| Accounts Receivable Net Current | 120.62 | 103.32 | 97.28 | 93.71 | 115.61 | 97.17 | 92.21 | 96.53 | 111.08 | 83.84 | 73.47 | 75.33 | 81.25 | 53.39 | 36.57 | 57.67 | 81.45 | 61.69 | 63.77 | 53.24 | 58.12 | 36.82 | 40.49 | 39.91 | 48.35 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 6.10 | 7.26 | 7.82 | 8.26 | 7.98 | 8.70 | 9.66 | 8.81 | 7.98 | 7.76 | 8.13 | 7.67 | 5.69 | 7.12 | 6.36 | 6.01 | 5.78 | 5.32 | 5.61 | 5.04 | 3.96 | 3.69 | 3.43 | 3.66 | 2.12 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

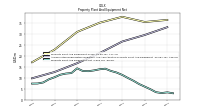

| Property Plant And Equipment Gross | 36.39 | NA | NA | NA | 35.44 | NA | NA | NA | 37.80 | NA | NA | NA | 35.11 | NA | NA | NA | 30.91 | NA | NA | NA | 22.84 | NA | NA | NA | 17.05 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 33.07 | NA | NA | NA | 29.52 | NA | NA | NA | 26.52 | NA | NA | NA | 21.25 | NA | NA | NA | 16.62 | NA | NA | NA | 12.61 | NA | NA | NA | 9.73 | NA | NA | NA | |

| Property Plant And Equipment Net | 3.32 | 3.00 | 3.40 | 4.75 | 5.92 | 7.10 | 8.62 | 9.91 | 11.27 | 12.37 | 13.10 | 14.12 | 13.87 | 13.34 | 12.98 | 13.09 | 14.29 | 12.12 | 11.89 | 11.35 | 10.23 | 9.27 | 7.83 | 7.36 | 7.32 | NA | NA | NA | |

| Goodwill | 277.20 | 352.72 | 352.72 | 352.72 | 352.72 | 665.81 | 665.81 | 747.58 | 742.52 | 718.95 | 718.49 | 203.18 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 35.00 | 43.12 | 46.56 | 50.01 | 53.48 | 113.88 | 121.05 | 128.25 | 125.55 | 130.69 | 137.19 | 78.98 | 0.45 | 0.42 | 0.41 | 0.40 | 0.39 | 0.38 | 0.37 | 0.37 | 0.37 | 0.36 | 0.37 | 0.36 | 0.53 | NA | NA | NA | |

| Other Assets Noncurrent | 2.73 | 1.94 | 2.49 | 2.62 | 2.59 | 2.74 | 3.11 | 2.64 | 2.41 | 2.56 | 2.62 | 2.68 | 1.79 | 1.72 | 1.70 | 1.96 | 1.71 | 1.34 | 1.28 | 1.37 | 1.29 | 1.10 | 1.10 | 0.99 | 4.22 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

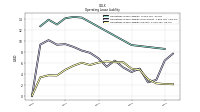

| Liabilities Current | 171.15 | 179.48 | 167.92 | 190.84 | 248.94 | 254.91 | 293.53 | 246.78 | 327.35 | 274.46 | 262.97 | 92.04 | 81.27 | 58.26 | 42.46 | 58.41 | 78.40 | 63.13 | 57.42 | 49.55 | 51.92 | 36.75 | 52.55 | 80.80 | 42.14 | NA | NA | NA | |

| Accounts Payable Current | 4.42 | 3.48 | 1.70 | 2.07 | 3.77 | 4.77 | 2.81 | 3.84 | 4.62 | 3.81 | 5.22 | 3.25 | 1.36 | 1.74 | 1.18 | 1.15 | 1.23 | 1.95 | 1.21 | 1.90 | 2.10 | 2.44 | 0.92 | 1.78 | 1.55 | NA | NA | NA | |

| Accrued Liabilities Current | 9.59 | 9.67 | 10.47 | 21.99 | 21.34 | 20.56 | 20.96 | 14.63 | 19.62 | 6.05 | 8.21 | 8.71 | 5.50 | 3.20 | 3.27 | 3.00 | 6.02 | 3.91 | 4.01 | 3.74 | 4.39 | 3.54 | 4.51 | 3.92 | 4.62 | NA | NA | NA | |

| Contract With Customer Liability Current | 2.40 | 3.32 | 3.02 | 2.77 | 1.75 | 3.00 | 4.65 | 3.12 | 3.28 | 2.63 | 2.78 | 0.26 | 0.35 | 0.54 | 0.97 | 0.60 | 1.13 | 0.74 | 0.40 | 0.57 | 0.35 | 0.25 | 0.17 | NA | 0.13 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Debt And Capital Lease Obligations | 257.50 | NA | NA | NA | 226.05 | NA | NA | NA | NA | NA | NA | NA | 174.02 | NA | NA | NA | 0.04 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

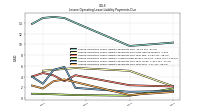

| Operating Lease Liability Noncurrent | 6.39 | 2.88 | 2.43 | 4.93 | 4.31 | 5.13 | 6.38 | 5.27 | 6.80 | 7.80 | 8.22 | 8.89 | 9.38 | 9.28 | 10.11 | 9.30 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 134.80 | 225.34 | 236.11 | 232.32 | 211.60 | 580.51 | 564.16 | 711.67 | 690.70 | 688.62 | 714.39 | 744.89 | 157.19 | 150.36 | 130.47 | 138.36 | 143.27 | 127.32 | 46.54 | 47.18 | 51.98 | 51.23 | 36.77 | 40.56 | -208.69 | -205.25 | -203.57 | NA | |

| Common Stock Value | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 1243.59 | 1230.46 | 1219.53 | 1190.95 | 1182.57 | 1169.21 | 1163.13 | 1188.08 | 1212.82 | 1198.78 | 1181.29 | 1164.32 | 551.43 | 535.86 | 499.66 | 487.90 | 480.58 | 466.74 | 378.77 | 373.35 | 371.46 | 359.50 | 336.87 | 328.49 | 58.69 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -1111.27 | -1010.44 | -986.47 | -962.96 | -976.57 | -598.29 | -604.56 | -478.27 | -522.62 | -510.78 | -466.25 | -418.95 | -394.05 | -387.28 | -371.92 | -352.16 | -338.63 | -342.06 | -334.31 | -327.80 | -321.49 | -309.92 | -301.55 | -288.50 | -268.44 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 2.47 | 5.30 | 3.04 | 4.32 | 5.60 | 9.58 | 5.58 | 1.85 | 0.49 | 0.61 | -0.65 | -0.49 | -0.19 | 1.76 | 2.71 | 2.61 | 1.31 | 2.63 | 2.07 | 1.62 | 1.99 | 1.64 | 1.44 | 0.56 | 1.07 | NA | NA | NA | |

| Stock Issued During Period Value New Issues | 0.00 | 0.00 | 15.17 | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.01 | 484.04 | NA | NA | NA | NA | 0.00 | 61.31 | NA | 66.10 | 0.00 | 5.72 | 8.35 | 66.10 | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 11.90 | 10.88 | 12.29 | 8.38 | 12.86 | 6.09 | 13.32 | 14.54 | 12.27 | 17.02 | 13.54 | 7.39 | 10.24 | 10.29 | 8.17 | 4.18 | 3.60 | 7.50 | 3.08 | 1.72 | 9.85 | 5.72 | 8.35 | 2.91 | 1.44 | 1.48 | NA | NA |

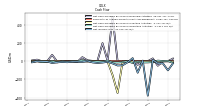

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

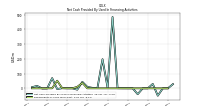

| Net Cash Provided By Used In Operating Activities | 2.93 | 1.19 | 5.75 | -10.06 | -13.10 | -14.43 | -6.68 | -19.69 | -0.56 | -10.46 | -14.98 | -12.53 | 5.62 | -5.57 | -4.24 | -3.41 | 4.10 | 10.33 | -1.49 | -1.48 | -4.70 | -1.51 | -12.70 | -0.09 | -5.53 | -10.45 | -0.29 | -5.82 | |

| Net Cash Provided By Used In Investing Activities | -1.37 | -3.15 | -2.75 | -2.80 | -3.15 | -3.30 | -4.27 | -5.03 | -3.41 | -2.87 | -348.45 | -151.96 | -3.86 | -2.87 | -1.95 | -1.44 | -4.61 | -1.25 | -3.18 | -1.98 | -3.16 | -2.02 | -1.37 | -0.79 | -0.55 | -0.59 | -0.11 | -0.40 | |

| Net Cash Provided By Used In Financing Activities | 0.05 | 0.02 | -50.08 | 29.98 | -0.18 | -0.01 | -39.98 | 0.18 | 0.23 | 0.37 | 0.74 | 484.67 | 3.42 | 197.60 | 2.27 | 3.14 | 9.13 | 43.94 | -9.05 | 0.16 | 0.05 | 0.94 | -5.03 | 69.23 | -0.87 | -1.19 | 16.25 | 7.57 |

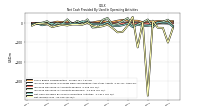

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 2.93 | 1.19 | 5.75 | -10.06 | -13.10 | -14.43 | -6.68 | -19.69 | -0.56 | -10.46 | -14.98 | -12.53 | 5.62 | -5.57 | -4.24 | -3.41 | 4.10 | 10.33 | -1.49 | -1.48 | -4.70 | -1.51 | -12.70 | -0.09 | -5.53 | -10.45 | -0.29 | -5.82 | |

| Net Income Loss | -100.84 | -23.97 | -23.51 | 13.61 | -378.28 | 6.27 | -126.29 | 33.04 | -11.84 | -44.53 | -47.31 | -24.89 | -6.78 | -15.36 | -19.76 | -13.53 | 3.43 | -7.75 | -6.51 | -6.31 | -11.57 | -8.37 | -13.05 | -20.05 | -4.06 | -2.47 | -0.65 | -12.46 | |

| Depreciation Depletion And Amortization | 6.70 | 5.99 | 7.20 | 6.58 | 6.85 | 10.47 | 10.36 | 9.87 | 9.60 | 8.38 | 8.83 | 3.06 | 2.02 | 1.93 | 1.54 | 2.33 | 1.35 | 1.17 | 1.05 | 0.96 | 0.81 | 0.78 | 0.78 | 0.91 | 0.72 | 0.77 | 0.77 | 0.77 | |

| Increase Decrease In Accounts Receivable | 18.72 | 7.08 | 3.34 | -21.41 | 19.63 | 4.58 | -4.38 | -15.28 | 27.18 | 10.97 | -2.34 | -7.87 | 27.41 | 17.45 | -20.31 | -22.15 | 20.23 | -1.24 | 11.76 | -4.74 | 20.31 | -3.18 | 0.92 | -8.62 | 10.76 | 2.84 | 0.57 | -6.67 | |

| Increase Decrease In Accounts Payable | 0.50 | 1.78 | -0.35 | -1.69 | -1.00 | 1.93 | -0.97 | -0.85 | 1.22 | -1.98 | 1.53 | 0.49 | -0.10 | 0.28 | -0.41 | 0.25 | -0.20 | -0.10 | 0.39 | -0.69 | 0.69 | 1.06 | -0.43 | -0.41 | -0.92 | -0.81 | -0.81 | 0.63 | |

| Share Based Compensation | 11.02 | 10.25 | 11.74 | 7.97 | 12.49 | 5.77 | 12.84 | 13.59 | 12.85 | 16.83 | 13.34 | 7.25 | 7.58 | 11.58 | 9.11 | 4.12 | 3.58 | 7.49 | 3.07 | 1.71 | 9.82 | 5.72 | 8.35 | 2.90 | 1.44 | 1.48 | 1.24 | 0.98 | |

| Amortization Of Financing Costs | 0.36 | 0.36 | 0.36 | 0.36 | 0.37 | 0.36 | 0.36 | 0.36 | 0.23 | 0.22 | 0.21 | 0.21 | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.10 | 0.09 | 0.14 | 1.46 | 5.15 | 0.13 | 0.15 |

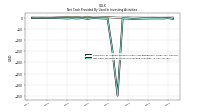

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -1.37 | -3.15 | -2.75 | -2.80 | -3.15 | -3.30 | -4.27 | -5.03 | -3.41 | -2.87 | -348.45 | -151.96 | -3.86 | -2.87 | -1.95 | -1.44 | -4.61 | -1.25 | -3.18 | -1.98 | -3.16 | -2.02 | -1.37 | -0.79 | -0.55 | -0.59 | -0.11 | -0.40 | |

| Payments To Acquire Property Plant And Equipment | 0.27 | 0.05 | -0.02 | 0.36 | 0.08 | 0.20 | 0.49 | 0.40 | 0.96 | 0.35 | 0.41 | 1.38 | 2.72 | 1.47 | 0.73 | 0.49 | 3.72 | 0.54 | 2.53 | 1.49 | 2.73 | 1.70 | 1.07 | 0.42 | 0.24 | 0.48 | 0.10 | 0.39 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 0.05 | 0.02 | -50.08 | 29.98 | -0.18 | -0.01 | -39.98 | 0.18 | 0.23 | 0.37 | 0.74 | 484.67 | 3.42 | 197.60 | 2.27 | 3.14 | 9.13 | 43.94 | -9.05 | 0.16 | 0.05 | 0.94 | -5.03 | 69.23 | -0.87 | -1.19 | 16.25 | 7.57 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

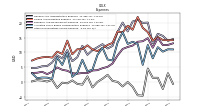

| Revenues | 89.17 | 79.00 | 76.70 | 64.33 | 82.50 | 72.71 | 75.41 | 67.93 | 90.05 | 64.98 | 58.85 | 53.23 | 67.08 | 46.08 | 28.22 | 45.51 | 69.29 | 56.42 | 48.73 | 35.99 | 47.82 | 34.58 | 35.57 | 32.71 | 39.27 | 31.41 | 32.81 | 26.88 | |

| Bridg Acquisition | 6.56 | 5.94 | 5.97 | 5.30 | 5.86 | 5.42 | 6.13 | 3.94 | 3.36 | 2.91 | 2.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Cardlytic Direct | 82.61 | 73.06 | 70.73 | 59.03 | 76.65 | 67.28 | 69.27 | 63.98 | 86.69 | 62.08 | 56.76 | 53.23 | 67.08 | 46.08 | 28.22 | 45.51 | 69.29 | 56.42 | 48.73 | 35.99 | 47.68 | 34.42 | 35.10 | 32.12 | 38.78 | 30.21 | 28.95 | 24.45 | |

| 6.27 | 4.21 | 4.06 | 3.25 | 6.03 | 4.76 | 6.23 | 6.28 | 7.16 | 4.82 | 4.71 | 4.11 | 4.51 | 2.62 | 1.47 | 5.48 | 7.90 | 5.42 | 5.61 | 4.64 | 6.86 | 3.70 | 4.83 | 3.73 | 6.36 | 4.57 | 3.73 | 2.20 | ||

| US | 82.90 | 74.80 | 72.64 | 61.08 | 76.47 | 67.95 | 69.18 | 61.65 | 82.89 | 60.17 | 54.15 | 49.12 | 62.57 | 43.46 | 26.75 | 40.03 | 61.40 | 51.00 | 43.12 | 31.35 | 40.96 | 30.88 | 30.73 | 28.99 | 32.90 | 26.84 | 29.08 | 24.68 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 82.61 | 73.06 | 70.73 | 59.03 | 76.65 | 67.28 | 69.27 | 63.98 | 86.69 | 62.08 | 56.76 | 53.23 | 67.08 | 46.08 | 28.22 | 45.51 | 69.29 | 56.42 | 48.73 | 35.99 | 47.82 | 34.58 | 35.57 | 32.71 | 39.27 | 31.41 | 32.81 | 26.88 | |

| Bridg Subscription Revenue | 6.56 | 5.94 | 5.97 | 5.30 | 5.72 | 5.42 | 6.13 | 3.92 | 3.36 | 2.85 | 2.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Bridg Total Revenue | 6.56 | 5.94 | 5.97 | 5.30 | 5.86 | 5.42 | 6.13 | 3.94 | 3.36 | 2.91 | 2.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Cost Other | 1.78 | 2.27 | 1.76 | 1.82 | 1.85 | 2.25 | 2.14 | 2.25 | 0.29 | 0.36 | 0.41 | 0.35 | 0.43 | 0.46 | 0.53 | 0.59 | 0.65 | 0.81 | 0.91 | 1.01 | 0.56 | 1.03 | 2.10 | 2.51 | NA | NA | NA | NA | |

| Costper Redemption | 28.22 | 20.84 | 19.53 | 17.93 | 22.66 | 21.60 | 20.71 | 23.02 | 27.93 | 20.22 | 18.45 | 15.31 | 20.43 | 12.00 | 7.34 | 14.07 | 19.44 | 15.61 | 14.28 | 13.96 | 13.94 | 8.24 | 9.46 | 11.76 | NA | NA | NA | NA | |

| Costper Served Sales | 52.60 | 49.96 | 49.44 | 39.27 | 52.13 | 43.44 | 46.42 | 38.72 | 58.47 | 41.49 | 37.90 | 37.57 | 46.23 | 33.62 | 20.35 | 30.85 | 49.20 | 40.00 | 33.55 | 21.01 | 33.31 | 25.32 | 24.01 | 18.45 | NA | NA | NA | NA |