| 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 1.25 | 1.25 | 1.22 | 1.22 | 1.22 | 1.22 | 1.22 | 1.22 | 1.17 | 1.17 | 1.17 | 1.16 | 1.16 | 1.16 | 1.16 | |

| Weighted Average Number Of Diluted Shares Outstanding | 103.74 | NA | 102.98 | 104.54 | 105.98 | NA | 110.98 | 111.10 | 108.44 | NA | 111.37 | 111.55 | 111.54 | NA | 111.39 | |

| Weighted Average Number Of Shares Outstanding Basic | 103.15 | NA | 102.98 | 104.54 | 105.98 | NA | 110.98 | 111.10 | 108.44 | NA | 111.37 | 111.55 | 111.54 | NA | 111.39 | |

| Earnings Per Share Basic | 0.20 | 0.22 | 0.20 | 0.26 | 0.20 | 0.18 | 0.14 | 0.14 | 0.06 | 0.12 | 0.13 | 0.11 | 0.13 | 0.13 | 0.10 | |

| Earnings Per Share Diluted | 0.20 | 0.22 | 0.20 | 0.26 | 0.20 | 0.18 | 0.14 | 0.14 | 0.06 | 0.12 | 0.13 | 0.11 | 0.13 | 0.13 | 0.10 |

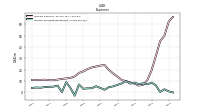

| 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Interest And Fee Income Loans And Leases | 56.96 | 56.94 | 55.45 | 57.68 | 58.77 | 62.73 | 63.26 | 65.23 | 64.02 | 60.21 | 53.59 | 51.71 | 52.26 | 51.58 | 48.59 | |

| Interest Expense | 6.01 | 7.62 | 8.70 | 9.80 | 10.90 | 13.82 | 16.61 | 19.72 | 23.99 | 23.60 | 22.72 | 21.89 | 20.50 | 18.41 | 17.11 | |

| Interest Income Expense Net | 62.73 | 60.96 | 57.35 | 58.08 | 56.74 | 58.68 | 56.32 | 55.87 | 50.70 | 47.43 | 41.72 | 40.84 | 42.38 | 43.38 | 40.58 | |

| Interest Paid Net | 5.90 | 8.36 | 8.65 | 10.01 | 10.89 | 14.79 | 16.97 | 20.60 | 23.20 | 22.48 | 43.40 | 1.22 | 20.27 | 16.68 | 18.36 | |

| Income Tax Expense Benefit | 7.16 | 8.62 | 7.71 | 9.93 | 7.87 | 6.55 | 5.25 | 4.60 | 2.25 | 3.83 | 5.39 | 3.63 | 3.51 | 3.12 | 6.96 | |

| Income Taxes Paid Net | 1.85 | 3.06 | 4.67 | 9.21 | -0.69 | -1.72 | 10.95 | 1.30 | 0.00 | 1.40 | 0.88 | -5.27 | 0.10 | 7.89 | 4.00 | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | 3.16 | 3.84 | 1.47 | 0.95 | 5.68 | 1.93 | 1.78 | -0.75 | -11.35 | 2.27 | -1.28 | -4.68 | -2.78 | NA | NA | |

| Net Income Loss | 20.40 | 23.33 | 20.98 | 26.69 | 21.05 | 20.65 | 15.09 | 15.10 | 6.76 | 13.55 | 14.22 | 12.03 | 14.92 | 14.87 | 10.83 | |

| Comprehensive Income Net Of Tax | -34.03 | 26.27 | 15.39 | 55.93 | 18.16 | 38.96 | -19.64 | 21.55 | 15.84 | 0.79 | 19.57 | 16.53 | 21.54 | 24.74 | 4.79 | |

| Interest Income Expense After Provision For Loan Loss | 61.27 | 68.35 | 56.87 | 59.84 | 58.02 | 58.05 | 53.81 | 50.13 | 41.13 | 44.91 | 40.56 | 40.73 | 41.95 | 42.60 | 39.08 | |

| Noninterest Expense | 40.75 | 43.37 | 37.05 | 37.61 | 37.70 | 40.81 | 41.38 | 37.44 | 38.51 | 36.24 | 31.06 | 31.84 | 29.56 | 31.01 | 26.59 | |

| Noninterest Income | 7.04 | 6.97 | 8.87 | 14.39 | 8.60 | 9.96 | 7.91 | 7.01 | 6.39 | 8.71 | 10.12 | 6.78 | 6.04 | 6.41 | 5.29 |

| 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

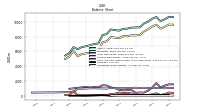

| Assets | 9237.09 | 9224.10 | 9200.12 | 9067.43 | 9039.93 | 8798.54 | 8865.47 | 8963.19 | 8325.05 | 8188.69 | 7070.25 | 6980.74 | 6816.96 | 6691.62 | 6567.85 | |

| Liabilities | 8204.61 | 8145.02 | 8169.24 | 8034.39 | 8040.28 | 7787.25 | 7848.14 | 7922.20 | 7363.93 | 7206.18 | 6078.41 | 5972.83 | 5822.46 | 5719.56 | 5620.81 | |

| Liabilities And Stockholders Equity | 9237.09 | 9224.10 | 9200.12 | 9067.43 | 9039.93 | 8798.54 | 8865.47 | 8963.19 | 8325.05 | 8188.69 | 7070.25 | 6980.74 | 6816.96 | 6691.62 | 6567.85 | |

| Stockholders Equity | 1032.49 | 1079.08 | 1030.88 | 1033.05 | 999.65 | 1011.29 | 1017.33 | 1040.99 | 961.13 | 982.52 | 991.84 | 1007.91 | 994.50 | 972.06 | 947.05 |

| 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

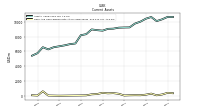

| Cash And Cash Equivalents At Carrying Value | 96.00 | 70.96 | 298.49 | 387.23 | 359.72 | 422.96 | 265.90 | 225.88 | 88.32 | 75.55 | NA | NA | NA | 42.06 | 54.71 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 96.00 | 70.96 | 298.49 | 387.23 | 359.72 | 422.96 | 265.90 | 225.88 | 88.32 | 75.55 | 57.95 | 54.38 | 65.14 | 42.20 | 54.83 | |

| Equity Securities Fv Ni | 2.79 | 2.71 | 2.79 | 4.05 | 4.83 | 5.42 | 4.71 | 4.71 | 2.27 | 2.85 | 1.80 | 1.90 | 1.40 | 1.89 | NA |

| 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | NA | 145.27 | NA | NA | NA | 133.14 | NA | NA | NA | 130.79 | NA | NA | NA | 106.53 | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | NA | 66.56 | NA | NA | NA | 57.17 | NA | NA | NA | 57.83 | NA | NA | NA | 54.48 | NA | |

| Amortization Of Intangible Assets | 0.25 | 0.25 | 0.25 | 0.26 | 0.26 | 0.27 | 0.27 | 0.27 | 0.24 | NA | NA | 0.00 | 0.00 | NA | NA | |

| Property Plant And Equipment Net | 77.78 | 78.71 | 74.43 | 75.45 | 76.79 | 75.97 | 76.85 | 77.59 | 72.39 | 72.97 | 63.72 | 61.27 | 58.29 | 52.05 | 48.67 | |

| Goodwill | NA | 85.32 | NA | NA | NA | 80.28 | NA | 0.00 | NA | 60.76 | NA | NA | NA | 5.72 | NA | |

| Intangible Assets Net Including Goodwill | 91.38 | 91.69 | 85.86 | 86.19 | 86.33 | 87.38 | 92.51 | 92.64 | 68.28 | 68.58 | 6.16 | 6.19 | 6.11 | 6.08 | 5.94 | |

| Equity Securities Fv Ni | 2.79 | 2.71 | 2.79 | 4.05 | 4.83 | 5.42 | 4.71 | 4.71 | 2.27 | 2.85 | 1.80 | 1.90 | 1.40 | 1.89 | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 20.19 | 1.69 | 0.91 | 0.39 | 1.26 | 0.00 | 0.03 | 0.04 | 0.01 | 0.33 | 0.18 | 0.47 | 3.67 | 7.38 | 13.11 | |

| Held To Maturity Securities Fair Value | 399.02 | 434.79 | 417.27 | 415.03 | 398.91 | 277.09 | 288.44 | 289.84 | 286.57 | 289.50 | 296.32 | 303.18 | 284.45 | 254.84 | 251.42 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 0.18 | 6.74 | 10.09 | 13.28 | 8.90 | 14.37 | 15.76 | 15.88 | 13.43 | 4.07 | 7.41 | 4.04 | 0.59 | 0.07 | 0.34 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 20.19 | 1.69 | 0.91 | 0.39 | 1.26 | 0.00 | 0.03 | 0.04 | 0.01 | 0.33 | 0.18 | 0.47 | 3.67 | 7.38 | 13.11 | |

| Held To Maturity Securities Continuous Unrealized Loss Position Fair Value | 383.69 | 123.15 | 63.19 | 31.16 | 111.51 | 2.18 | NA | NA | 1.91 | 38.62 | 16.79 | 52.56 | 220.92 | 232.71 | 240.92 | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | NA | 429.73 | 408.09 | NA | NA | 262.72 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After One Through Five Years Fair Value | 14.11 | 14.75 | 14.86 | NA | NA | 5.00 | 5.00 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Twelve Months Or Longer Fair Value | 24.50 | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.77 | 0.94 | 44.85 | 210.89 | 221.44 | 148.99 | |

| Held To Maturity Securities Continuous Unrealized Loss Position Less Than Twelve Months Fair Value | 359.19 | 123.15 | 63.19 | 31.16 | 111.51 | 2.18 | NA | NA | 1.91 | 37.84 | 15.85 | 7.71 | 10.03 | 11.27 | 91.93 | |

| Held To Maturity Securities Debt Maturities After Five Through Ten Years Fair Value | 18.38 | 19.54 | 19.68 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Ten Years Fair Value | 9.02 | 9.82 | 9.84 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | 1075.14 | 1087.63 | 1193.34 | 1364.24 | 1457.64 | 1494.13 | 1543.09 | 1572.33 | 1358.14 | 1293.61 | 1216.49 | 1126.92 | 1114.28 | 1107.67 | 907.82 | |

| Deposits | 7594.99 | 7570.22 | 7222.36 | 7079.28 | 6996.33 | 6778.62 | 6629.65 | 6581.11 | 5772.42 | 5645.84 | 4783.32 | 4668.65 | 4606.63 | 4413.87 | 4372.35 |

| 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 432.75 | 377.31 | 749.63 | 749.68 | 722.62 | 799.36 | 1015.21 | 1129.98 | 1376.94 | 1407.02 | 1129.12 | 1163.27 | 1098.63 | 1189.18 | NA |

| 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

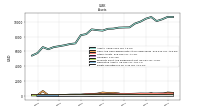

| Stockholders Equity | 1032.49 | 1079.08 | 1030.88 | 1033.05 | 999.65 | 1011.29 | 1017.33 | 1040.99 | 961.13 | 982.52 | 991.84 | 1007.91 | 994.50 | 972.06 | 947.05 | |

| Common Stock Value | 1.25 | 1.25 | 1.22 | 1.22 | 1.22 | 1.22 | 1.22 | 1.22 | 1.17 | 1.17 | 1.17 | 1.16 | 1.16 | 1.16 | 1.16 | |

| Additional Paid In Capital | 670.96 | 667.91 | 617.55 | 614.38 | 611.55 | 609.53 | 607.74 | 605.12 | 534.21 | 531.67 | 529.59 | 527.65 | 527.35 | 527.04 | 526.72 | |

| Retained Earnings Accumulated Deficit | 791.75 | 765.13 | 741.80 | 720.82 | 694.13 | 673.08 | 652.43 | 637.34 | 622.25 | 615.48 | 601.93 | 587.71 | 575.68 | 560.22 | 545.35 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -100.36 | -45.92 | -48.85 | -43.27 | -72.51 | -69.62 | -87.93 | -53.21 | -59.66 | -68.73 | -55.97 | -61.32 | -65.82 | -71.90 | -81.77 | |

| Treasury Stock Value | 294.12 | 271.65 | 242.45 | 221.07 | 195.36 | 163.01 | 115.58 | 108.33 | 95.33 | 54.95 | 42.08 | 3.87 | NA | 0.00 | NA | |

| Stock Issued During Period Value New Issues | NA | NA | NA | NA | NA | 0.00 | 0.00 | 68.53 | NA | NA | 0.01 | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 1.92 | 2.14 | 2.20 | 2.40 | 2.14 | 2.21 | 2.18 | 2.21 | 2.20 | 2.06 | 1.63 | NA | NA | NA | NA |

| 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 32.85 | 31.22 | -4.79 | -100.06 | 172.34 | 39.76 | 4.96 | -39.99 | 43.17 | 93.99 | 30.55 | -18.53 | 17.75 | 9.96 | 16.85 | |

| Net Cash Provided By Used In Investing Activities | -67.46 | 65.67 | -206.00 | 40.22 | -343.49 | 233.92 | 110.66 | 0.83 | -87.77 | -339.10 | -69.42 | -116.68 | -97.75 | 825.34 | -312.98 | |

| Net Cash Provided By Used In Financing Activities | 59.64 | -324.41 | 122.05 | 87.36 | 107.91 | -116.62 | -75.61 | 176.72 | 57.38 | 262.71 | 42.44 | 124.45 | 102.94 | 94.28 | 283.78 |

| 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 32.85 | 31.22 | -4.79 | -100.06 | 172.34 | 39.76 | 4.96 | -39.99 | 43.17 | 93.99 | 30.55 | -18.53 | 17.75 | 9.96 | 16.85 | |

| Net Income Loss | 20.40 | 23.33 | 20.98 | 26.69 | 21.05 | 20.65 | 15.09 | 15.10 | 6.76 | 13.55 | 14.22 | 12.03 | 14.92 | 14.87 | 10.83 | |

| Deferred Income Tax Expense Benefit | 0.95 | 7.19 | 9.78 | 0.00 | 0.74 | 13.60 | -11.08 | -0.31 | 7.53 | 14.69 | 0.00 | -7.31 | 0.15 | -12.25 | -0.05 | |

| Share Based Compensation | 1.92 | 2.14 | 2.20 | 2.40 | 2.14 | 2.21 | 2.18 | 2.21 | 2.20 | 2.06 | 1.63 | 0.00 | 0.00 | 0.00 | NA |

| 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -67.46 | 65.67 | -206.00 | 40.22 | -343.49 | 233.92 | 110.66 | 0.83 | -87.77 | -339.10 | -69.42 | -116.68 | -97.75 | 825.34 | -312.98 | |

| Payments To Acquire Property Plant And Equipment | 0.86 | 1.27 | 0.63 | 1.10 | 2.48 | 0.87 | 0.90 | 1.15 | 1.70 | 4.30 | 3.65 | 4.09 | 7.30 | 4.47 | 2.96 |

| 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 59.64 | -324.41 | 122.05 | 87.36 | 107.91 | -116.62 | -75.61 | 176.72 | 57.38 | 262.71 | 42.44 | 124.45 | 102.94 | 94.28 | 283.78 | |

| Payments For Repurchase Of Common Stock | 21.68 | 28.68 | 20.54 | 25.71 | 32.84 | 47.88 | 6.92 | 13.00 | 40.36 | 13.22 | 38.22 | 3.87 | 0.00 | 0.00 | 0.00 |

| 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deposit Account Title Insurance And Other Non Interest Income | 4.16 | 4.62 | 4.35 | 4.32 | 4.20 | 4.30 | 3.75 | 3.14 | 3.95 | 4.23 | 3.65 | 3.36 | 3.06 | 3.41 | 3.33 | |

| Deposit Account Title Insurance Insurance Agency And Other Non Interest Income | 4.16 | NA | 4.35 | 4.32 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Insurance Agency Income | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Non Interest Income | 2.03 | 1.97 | 1.93 | 1.96 | 1.74 | 1.78 | 1.75 | 1.53 | 1.42 | 1.38 | 1.19 | 1.21 | 1.06 | 1.26 | 1.14 | |

| Title Insurance | 0.96 | 1.53 | 1.43 | 1.50 | 1.62 | 1.59 | 1.22 | 1.00 | 1.23 | 1.49 | 1.35 | 1.10 | 1.04 | 1.08 | 1.19 | |

| Deposit Account | 1.17 | 1.12 | 0.99 | 0.86 | 0.84 | 0.93 | 0.79 | 0.62 | 1.30 | 1.36 | 1.11 | 1.05 | 0.96 | 1.07 | 1.00 | |

| Deposit Account Title Insurance And Other Non Interest Income | 4.16 | 4.62 | 4.35 | 4.32 | 4.20 | 4.30 | 3.75 | 3.14 | 3.95 | 4.23 | 3.65 | 3.36 | 3.06 | 3.41 | 3.33 | |

| Deposit Account Title Insurance Insurance Agency And Other Non Interest Income | 4.16 | NA | 4.35 | 4.32 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Insurance Agency Income | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Non Interest Income | 2.03 | 1.97 | 1.93 | 1.96 | 1.74 | 1.78 | 1.75 | 1.53 | 1.42 | 1.38 | 1.19 | 1.21 | 1.06 | 1.26 | 1.14 | |

| Title Insurance | 0.96 | 1.53 | 1.43 | 1.50 | 1.62 | 1.59 | 1.22 | 1.00 | 1.23 | 1.49 | 1.35 | 1.10 | 1.04 | 1.08 | 1.19 | |

| Deposit Account | 1.17 | 1.12 | 0.99 | 0.86 | 0.84 | 0.93 | 0.79 | 0.62 | 1.30 | 1.36 | 1.11 | 1.05 | 0.96 | 1.07 | 1.00 |