| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | NA | 0.01 | NA | NA | |

| dei: Entity Common Stock Shares Outstanding | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

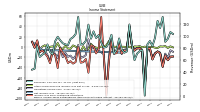

| Earnings Per Share Basic | -0.09 | -0.12 | -0.07 | -0.17 | -0.05 | -0.04 | -0.06 | -0.11 | -0.01 | -0.02 | -0.38 | -0.04 | -0.01 | -0.01 | -0.03 | 0.01 | NA | NA | -0.03 | -0.05 | 0.04 | -0.05 | -0.07 | 0.08 | -0.19 | -0.62 | -0.12 | 0.41 | NA | -0.10 | 0.01 | 0.03 | NA | -0.25 | -0.33 | -0.34 | NA | -0.32 | -0.34 | -0.30 | NA | -0.20 | -0.13 | -0.04 | -0.47 | -0.19 | -0.13 | -0.37 | -0.30 | -0.16 | -0.08 | NA | 0.23 | -0.03 | 0.16 | |

| Earnings Per Share Diluted | -0.09 | -0.12 | -0.07 | -0.17 | -0.05 | -0.04 | -0.06 | -0.11 | -0.01 | -0.02 | -0.38 | -0.04 | -0.01 | -0.01 | -0.03 | 0.01 | NA | NA | -0.03 | -0.05 | 0.04 | -0.05 | -0.07 | 0.08 | -0.19 | -0.62 | -0.12 | 0.40 | NA | -0.10 | 0.01 | 0.03 | NA | -0.25 | -0.33 | -0.34 | NA | -0.32 | -0.34 | -0.30 | NA | -0.20 | -0.13 | -0.04 | -0.47 | -0.19 | -0.13 | -0.37 | -0.30 | -0.16 | -0.08 | NA | 0.23 | -0.03 | 0.14 |

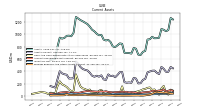

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

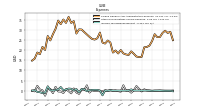

| Revenue From Contract With Customer Excluding Assessed Tax | 106.86 | 95.57 | 90.55 | 132.18 | 113.76 | 125.69 | 97.22 | 83.50 | 91.93 | 86.09 | 0.48 | 77.14 | 74.96 | 70.89 | 59.87 | 86.01 | 119.61 | 74.43 | 72.32 | 77.70 | 96.23 | 77.32 | 70.47 | 102.40 | 89.30 | 81.79 | 81.02 | 89.49 | 101.83 | 97.02 | 108.03 | 95.78 | 119.33 | 92.26 | 86.87 | 85.85 | 132.11 | 103.42 | 98.13 | 95.28 | 85.00 | 86.32 | 88.12 | 93.04 | 99.07 | 91.46 | 69.84 | 73.63 | 86.18 | 72.08 | 69.11 | 65.34 | 83.16 | 45.65 | 44.03 | |

| Revenues | 106.86 | 95.57 | 90.55 | 132.18 | 113.76 | 125.69 | 97.22 | 83.50 | 91.93 | 86.09 | 0.48 | 77.14 | 74.96 | 70.89 | 59.87 | 86.01 | 119.61 | 74.43 | 72.32 | 77.70 | 96.23 | 77.32 | 70.47 | 102.40 | 89.30 | 81.79 | 81.02 | 89.49 | 101.83 | 97.02 | 108.03 | 95.78 | 119.33 | 92.26 | 86.87 | 85.85 | 132.11 | 103.42 | 98.13 | 95.28 | 85.00 | 86.32 | 88.12 | 93.04 | 99.07 | 91.46 | 69.84 | 73.63 | 86.18 | 72.08 | 69.11 | 65.34 | 83.16 | 45.65 | 44.03 | |

| Costs And Expenses | 113.43 | 116.94 | 103.60 | 167.59 | 124.91 | 134.31 | 109.10 | 103.55 | 98.02 | 89.20 | 79.90 | 83.58 | 77.33 | 73.67 | 67.05 | 83.52 | 84.84 | 79.81 | 78.13 | 91.36 | 92.67 | 84.56 | 78.85 | 86.43 | 108.22 | 172.89 | 94.98 | 99.95 | 109.03 | 102.55 | 108.91 | 99.81 | 104.47 | 108.02 | 106.48 | 106.97 | 128.29 | 121.28 | 121.55 | 112.18 | 104.11 | 97.88 | 107.94 | 94.24 | 120.55 | 105.14 | 76.45 | 102.39 | 101.94 | 78.92 | 74.87 | 75.54 | 71.60 | 47.01 | 33.95 | |

| Selling General And Administrative Expense | 24.95 | 29.12 | 28.55 | 29.65 | 28.55 | 26.50 | 26.48 | 27.93 | 24.56 | 22.30 | 21.61 | 21.44 | 16.73 | 16.64 | 16.89 | 18.26 | 19.44 | 17.64 | 17.93 | 18.43 | 20.11 | 18.40 | 19.87 | 18.84 | 23.79 | 24.80 | 23.30 | 23.77 | 28.73 | 25.91 | 25.26 | 25.59 | 26.63 | 27.80 | 28.99 | 30.23 | 30.30 | 28.24 | 34.40 | 33.49 | 36.45 | 33.51 | 35.19 | 32.88 | 34.65 | 30.56 | 27.92 | 24.85 | 27.03 | 20.14 | 21.65 | 18.03 | 18.88 | 15.86 | 14.88 | |

| Operating Income Loss | -6.57 | -21.36 | -13.05 | -35.41 | -11.15 | -8.63 | -11.87 | -20.06 | -6.09 | -3.10 | -79.42 | -6.43 | -2.37 | -2.79 | -7.18 | 2.49 | 34.77 | -5.38 | -5.81 | -13.66 | 3.56 | -7.25 | -8.38 | 15.97 | -18.92 | -91.10 | -13.97 | -10.46 | -7.19 | -5.53 | -0.88 | -4.03 | 14.88 | -15.76 | -19.61 | -21.12 | 3.82 | -17.86 | -23.42 | -16.91 | -19.11 | -11.55 | -19.83 | -1.20 | -21.47 | -13.68 | -6.61 | -28.75 | -15.76 | -6.84 | -5.76 | -10.20 | 11.56 | -1.35 | 10.09 | |

| Interest Paid Net | 4.43 | 3.65 | 4.17 | 4.11 | 0.50 | 0.45 | 0.45 | 0.47 | 0.68 | 0.77 | 1.41 | 1.05 | 0.78 | 0.94 | 1.80 | 2.10 | 1.88 | 2.32 | 0.83 | 1.76 | 7.57 | 2.44 | 3.89 | 2.86 | 2.70 | 5.52 | 5.51 | 3.32 | 8.50 | 3.88 | 10.89 | 6.50 | 13.24 | 6.24 | 12.24 | 5.94 | 8.43 | 12.13 | 6.41 | 12.26 | 9.46 | 2.77 | 5.87 | 4.01 | 4.77 | 3.19 | 3.67 | 2.36 | 4.19 | 1.84 | 0.58 | 0.13 | 1.45 | 0.51 | NA | |

| Income Tax Expense Benefit | -0.26 | -0.05 | -0.06 | -0.06 | -0.00 | 0.11 | 0.07 | 0.05 | -0.08 | 0.06 | 0.06 | 0.08 | 0.07 | 0.08 | 0.08 | 0.08 | 0.66 | 0.07 | 0.07 | 0.06 | 0.07 | 0.09 | 0.09 | 0.09 | 0.27 | -0.04 | 0.12 | -2.26 | 0.11 | 0.42 | 0.43 | 0.38 | 0.26 | -0.24 | 0.74 | 0.85 | -0.84 | 0.81 | 0.15 | 0.96 | 1.06 | 0.56 | 0.29 | 1.80 | 0.60 | 0.28 | 0.17 | 0.25 | 2.17 | -0.96 | -1.18 | -0.73 | -0.60 | 0.29 | 0.08 | |

| Income Taxes Paid Net | 0.02 | 0.00 | 0.03 | 0.03 | 0.02 | 0.00 | NA | NA | 0.00 | 0.00 | NA | NA | -0.04 | -0.02 | 0.04 | 0.03 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | -18.83 | -25.95 | -16.49 | -38.83 | -12.56 | -9.09 | -13.36 | -24.58 | -2.60 | -4.16 | -79.95 | -7.45 | -2.85 | -2.54 | -7.04 | 0.90 | 39.22 | -6.04 | -7.09 | -12.82 | 5.70 | -12.20 | -13.16 | 10.47 | -28.69 | -94.89 | -18.54 | 60.72 | -4.14 | -13.02 | 0.90 | 2.53 | -50.40 | -23.18 | -30.36 | -31.53 | 0.61 | -30.23 | -32.57 | -28.66 | -32.28 | -18.80 | -12.01 | -3.83 | -41.67 | -16.21 | -11.21 | -31.77 | -20.81 | -11.43 | -5.74 | -9.48 | 13.56 | -1.92 | 9.98 | |

| Other Comprehensive Income Loss Net Of Tax | 1.16 | -1.96 | 1.70 | 0.70 | 1.16 | -2.09 | -1.42 | 0.25 | -0.39 | -0.86 | 0.72 | -0.88 | 1.58 | 0.68 | 1.01 | -1.92 | 0.49 | -0.62 | 0.32 | 0.37 | -1.86 | 0.12 | 0.52 | -0.03 | 11.51 | 3.24 | 1.11 | 0.93 | -1.98 | -1.34 | 0.67 | 5.95 | -3.29 | -6.80 | 1.35 | -8.98 | -2.66 | 0.60 | 2.97 | -3.46 | -2.86 | 2.16 | -3.75 | -2.40 | 7.67 | -1.75 | 1.18 | 0.27 | -1.01 | 3.28 | 0.51 | NA | NA | NA | NA | |

| Net Income Loss | -18.69 | -25.81 | -16.30 | -38.70 | -12.33 | -8.97 | -13.23 | -24.19 | -2.38 | -3.93 | -79.67 | -7.17 | -2.56 | -2.27 | -6.74 | 1.70 | 41.08 | -4.33 | -5.38 | -10.95 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -5.62 | NA | NA | NA | 9.89 |

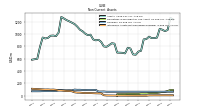

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

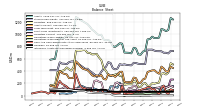

| Assets | 1259.46 | 1064.95 | 1046.38 | 1069.63 | 1082.36 | 941.45 | 934.25 | 932.73 | 957.07 | 917.45 | 912.54 | 727.76 | 715.03 | 663.40 | 669.04 | 764.45 | 777.09 | 685.85 | 694.87 | 697.16 | 699.08 | 843.43 | 850.41 | 818.75 | 791.91 | 798.52 | 872.45 | 906.46 | 897.26 | 911.35 | 989.14 | 980.65 | 1005.79 | 1044.64 | 1070.96 | 1120.99 | 1160.41 | 1183.63 | 1205.48 | 1224.99 | 1250.96 | 1276.58 | 1022.46 | 964.87 | 975.20 | 972.15 | 937.67 | 927.27 | 942.71 | 791.60 | 598.89 | NA | 583.50 | NA | NA | |

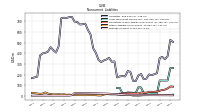

| Liabilities | 525.81 | 373.34 | 343.49 | 365.86 | 354.89 | 212.72 | 204.75 | 194.40 | 201.66 | 162.52 | 157.30 | 206.65 | 192.18 | 139.93 | 141.66 | 225.43 | 234.06 | 183.38 | 186.74 | 183.18 | 174.07 | 324.05 | 320.26 | 357.93 | 342.25 | 332.95 | 317.58 | 338.85 | 403.57 | 446.70 | 575.99 | 619.43 | 676.85 | 671.27 | 669.47 | 693.42 | 695.37 | 739.97 | 737.83 | 730.75 | 732.43 | 728.60 | 463.74 | 406.56 | 428.57 | 457.75 | 415.51 | 403.74 | 398.30 | 379.03 | 181.79 | NA | 167.28 | NA | NA | |

| Liabilities And Stockholders Equity | 1259.46 | 1064.95 | 1046.38 | 1069.63 | 1082.36 | 941.45 | 934.25 | 932.73 | 957.07 | 917.45 | 912.54 | 727.76 | 715.03 | 663.40 | 669.04 | 764.45 | 777.09 | 685.85 | 694.87 | 697.16 | 699.08 | 843.43 | 850.41 | 818.75 | 791.91 | 798.52 | 872.45 | 906.46 | 897.26 | 911.35 | 989.14 | 980.65 | 1005.79 | 1044.64 | 1070.96 | 1120.99 | 1160.41 | 1183.63 | 1205.48 | 1224.99 | 1250.96 | 1276.58 | 1022.46 | 964.87 | 975.20 | 972.15 | 937.67 | 927.27 | 942.71 | 791.60 | 598.89 | NA | 583.50 | NA | NA | |

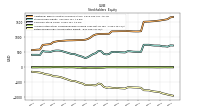

| Stockholders Equity | 726.77 | 684.59 | 695.74 | 696.43 | 719.99 | 721.01 | 721.68 | 730.38 | 747.08 | 746.37 | 746.46 | 512.04 | 513.51 | 513.83 | 517.48 | 528.81 | 533.41 | 490.99 | 494.94 | 499.07 | 508.00 | 500.95 | 510.42 | 439.90 | 426.99 | 442.56 | 531.11 | 543.12 | 468.87 | 439.57 | 387.68 | 335.12 | 302.55 | 346.60 | 374.66 | 400.34 | 437.43 | 435.55 | 464.02 | 490.35 | 514.57 | 544.05 | 554.82 | 554.36 | 542.71 | 510.54 | 518.41 | 519.87 | 540.88 | 409.15 | 413.60 | NA | 413.29 | NA | NA |

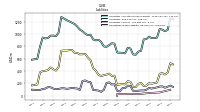

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 470.18 | 393.04 | 392.36 | 441.51 | 471.72 | 355.57 | 378.05 | 412.57 | 409.94 | 397.76 | 383.55 | 277.36 | 263.04 | 208.78 | 205.43 | 284.22 | 293.79 | 215.58 | 221.79 | 216.62 | 225.61 | 388.89 | 385.95 | 341.79 | 304.90 | 331.01 | 322.85 | 351.02 | 261.76 | 269.66 | 336.00 | 313.88 | 329.44 | 312.66 | 330.07 | 378.19 | 413.64 | 424.38 | 437.31 | 468.92 | 521.10 | 558.14 | 289.40 | 284.92 | 284.70 | 345.42 | 353.00 | 367.71 | 401.62 | 268.11 | 138.49 | NA | 162.06 | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 104.94 | 25.08 | 53.15 | 164.81 | 123.95 | 23.12 | 57.49 | 107.97 | 99.45 | 139.91 | 134.04 | 116.70 | 108.98 | 91.59 | 79.16 | 69.51 | 49.21 | 32.07 | 40.89 | 27.98 | 29.84 | 158.14 | 41.53 | NA | 36.08 | 45.31 | 49.96 | 47.12 | 36.12 | 41.55 | 102.32 | 87.24 | 43.72 | 51.84 | 53.30 | 106.86 | 92.38 | 114.69 | 124.70 | 154.33 | 240.03 | 352.14 | 86.02 | 82.57 | 108.52 | 149.07 | 172.72 | 190.67 | 238.12 | 159.00 | 35.28 | 51.95 | 55.19 | 32.18 | 55.70 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 106.96 | 27.10 | 55.16 | 166.81 | 125.95 | 23.12 | 57.49 | 107.97 | 106.46 | 146.91 | 141.04 | 123.70 | 119.98 | 95.61 | 83.17 | 73.53 | 53.22 | 37.70 | 46.51 | 33.61 | 34.62 | 160.02 | 43.41 | 47.10 | 37.21 | 46.77 | 50.21 | 47.38 | 43.12 | NA | NA | NA | 47.96 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Short Term Investments | 158.19 | 149.32 | 138.57 | 55.11 | 139.57 | 110.99 | 130.02 | 120.56 | 129.72 | 120.19 | 120.21 | 29.53 | 29.53 | 0.53 | 16.53 | 29.83 | 56.93 | 66.75 | 66.58 | 66.16 | 65.65 | 95.96 | 211.22 | 128.13 | 141.46 | 151.52 | 151.26 | 50.80 | 73.72 | 77.31 | 79.36 | 75.70 | 102.94 | 114.14 | 128.60 | 113.56 | 122.55 | 133.37 | 152.11 | 164.48 | 138.24 | 54.31 | 62.24 | 37.97 | 38.17 | 29.66 | 37.08 | 37.89 | 33.33 | NA | NA | NA | NA | NA | NA | |

| Accounts Receivable Net Current | 98.43 | 87.55 | 74.75 | 107.90 | 91.43 | 92.16 | 83.36 | 83.02 | 87.43 | 71.18 | 66.50 | 64.17 | 61.78 | 52.90 | 48.14 | 58.69 | 61.76 | 65.35 | 60.57 | 70.34 | 68.86 | 69.82 | 67.82 | 65.69 | 63.96 | 61.00 | 63.87 | 68.12 | 79.43 | 72.95 | 77.68 | 71.90 | 73.64 | 76.17 | 78.54 | 79.06 | 81.97 | 77.08 | 70.25 | 60.14 | 53.47 | 56.26 | 50.53 | 47.36 | 57.59 | 65.99 | 63.56 | 61.16 | 56.45 | 39.71 | 36.63 | NA | 45.65 | NA | NA | |

| Inventory Net | 45.34 | 40.47 | 38.52 | 38.05 | 37.14 | 35.93 | 34.93 | 32.32 | 31.30 | 29.33 | 27.97 | 27.52 | 28.10 | 28.83 | 29.50 | 29.73 | 29.87 | 31.04 | 33.87 | 32.65 | 34.98 | 37.10 | 37.13 | 37.79 | 35.24 | 44.62 | 29.95 | 28.71 | 29.54 | 29.45 | 28.56 | 30.04 | 29.29 | 30.73 | 31.35 | 32.80 | 34.70 | 35.51 | 39.20 | 38.29 | 33.82 | 39.72 | 35.95 | 44.22 | 38.15 | 37.34 | 36.47 | 38.54 | 35.29 | 32.37 | 29.43 | NA | 20.48 | NA | NA | |

| Prepaid Expense And Other Assets Current | 41.49 | 52.08 | 58.28 | 53.57 | 60.60 | 58.26 | 67.50 | 57.25 | 37.58 | 23.75 | 19.97 | 13.38 | 9.40 | 8.49 | 11.86 | 10.95 | 11.11 | 9.54 | 9.04 | 8.77 | 8.44 | 8.10 | 9.55 | 9.43 | 7.79 | 10.84 | 12.24 | 12.66 | 14.02 | 15.19 | 12.60 | 14.19 | 14.93 | 15.79 | 15.17 | 15.85 | 19.81 | 25.19 | 20.92 | 20.48 | 20.84 | 17.40 | 16.04 | 17.87 | 16.00 | 30.75 | 15.13 | 13.97 | 14.03 | 12.35 | 12.89 | 12.64 | 10.96 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Investments In Affiliates Subsidiaries Associates And Joint Ventures | 258.77 | 193.81 | 196.77 | 191.98 | 193.27 | 193.43 | 157.59 | 108.27 | 109.81 | 76.95 | 78.01 | 26.61 | 27.96 | 25.98 | 25.25 | 24.90 | 26.30 | NA | NA | NA | 26.08 | NA | NA | NA | 30.39 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Goodwill | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 64.33 | 68.08 | 67.06 | 66.78 | 93.02 | 93.85 | 94.41 | 94.21 | 91.97 | 93.23 | 95.83 | 95.31 | 98.73 | 86.32 | 88.41 | 86.87 | 88.55 | 90.03 | 89.09 | 74.88 | 75.86 | 73.74 | 73.74 | 73.74 | 73.74 | 72.07 | 71.81 | NA | 71.81 | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 6.37 | 6.37 | 6.37 | 6.37 | 5.92 | 5.92 | 5.92 | 5.50 | 5.50 | 0.02 | 0.17 | 0.32 | 0.46 | 0.63 | 0.80 | 1.00 | 1.23 | 1.46 | 1.70 | 1.95 | 2.21 | 2.48 | 2.84 | 3.22 | 3.59 | 7.49 | 36.76 | 37.50 | 38.70 | 40.30 | 42.29 | 43.58 | 42.64 | 45.23 | 49.31 | 50.06 | 55.36 | 71.45 | 75.93 | 75.64 | 79.77 | 83.71 | 84.44 | 95.28 | 99.28 | 97.87 | 100.75 | 99.73 | 102.10 | 104.77 | 106.82 | NA | 112.17 | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 158.16 | 149.30 | 138.53 | 55.30 | 139.91 | 111.68 | 130.18 | 120.61 | 129.74 | 120.22 | 120.21 | 29.53 | 29.53 | 0.53 | 16.53 | 29.83 | 56.93 | 66.75 | 66.58 | 66.17 | 65.72 | 95.96 | 211.25 | NA | 141.58 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

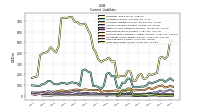

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

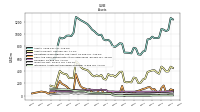

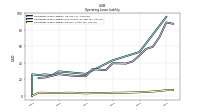

| Liabilities Current | 163.82 | 145.85 | 128.32 | 151.76 | 148.15 | 134.10 | 126.03 | 114.88 | 125.90 | 95.42 | 84.83 | 85.83 | 79.84 | 79.28 | 79.19 | 155.98 | 162.56 | 121.44 | 123.45 | 68.61 | 80.26 | 185.88 | 181.01 | 216.06 | 203.30 | 93.94 | 61.84 | 82.26 | 89.22 | 90.77 | 218.47 | 226.86 | 246.67 | 239.85 | 91.73 | 116.18 | 120.21 | 126.47 | 116.33 | 111.08 | 120.11 | 120.12 | 108.48 | 105.93 | 113.92 | 136.05 | 139.06 | 114.96 | 109.11 | 93.18 | 92.24 | NA | 96.99 | NA | NA | |

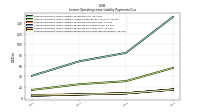

| Long Term Debt Current | 0.04 | 0.04 | 0.04 | 0.04 | 0.09 | 4.17 | 7.32 | 10.03 | 12.85 | 11.05 | 8.69 | 6.76 | 3.59 | 6.13 | 6.04 | 56.03 | 56.01 | 55.40 | 55.56 | 5.34 | 4.71 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accounts Payable Current | 56.99 | 48.79 | 37.94 | 39.14 | 44.44 | 31.04 | 31.75 | 25.60 | 24.35 | 17.40 | 18.03 | 17.46 | 17.31 | 17.08 | 15.76 | 21.35 | 27.38 | 13.97 | 16.46 | 15.41 | 19.02 | 12.85 | 11.59 | 20.27 | 17.90 | 16.21 | 15.42 | 17.22 | 23.64 | 23.11 | 19.77 | 21.72 | 26.91 | 25.68 | 28.86 | 41.58 | 43.92 | 39.09 | 34.26 | 35.39 | 33.54 | 30.86 | 22.93 | 21.99 | 39.22 | 38.13 | 31.73 | 28.10 | 36.67 | 22.95 | 26.57 | NA | 28.64 | NA | NA | |

| Other Accrued Liabilities Current | 12.47 | 13.49 | 15.73 | 18.09 | 16.24 | 14.78 | 14.15 | 12.77 | 12.91 | 11.85 | 10.85 | 10.25 | 8.75 | 10.18 | 11.01 | 12.37 | 13.14 | 11.20 | 11.34 | 11.24 | 14.38 | 13.22 | 14.17 | 11.50 | 13.78 | 12.66 | 6.25 | 17.82 | 8.07 | 7.67 | 7.79 | 23.84 | 20.38 | 7.91 | 9.01 | 15.42 | 19.86 | 8.82 | 10.07 | 12.45 | 15.12 | 13.35 | 9.87 | 11.31 | 4.90 | 2.42 | 5.49 | NA | 7.28 | NA | NA | NA | NA | NA | NA | |

| Taxes Payable Current | 4.50 | 3.90 | 3.52 | 6.65 | 3.78 | 4.08 | 4.03 | 3.69 | 3.37 | 3.33 | 3.38 | 4.88 | 3.09 | 2.95 | 3.62 | 3.12 | 3.73 | 3.98 | 4.61 | 3.00 | 3.40 | 4.25 | 4.01 | 5.64 | 4.58 | 4.16 | 4.55 | 3.81 | 4.57 | 3.85 | 4.84 | 4.04 | 5.34 | 5.36 | 7.20 | 5.45 | 5.18 | 4.94 | 4.43 | 4.09 | 5.45 | 6.01 | 4.79 | 4.52 | 4.48 | 2.57 | 1.64 | NA | 3.04 | NA | NA | NA | NA | NA | NA | |

| Accrued Liabilities Current | 91.53 | 83.14 | 76.61 | 97.54 | 90.08 | 85.20 | 69.34 | 62.35 | 75.16 | 60.85 | 50.35 | 53.16 | 52.64 | 50.20 | 48.15 | 66.53 | 67.70 | 41.40 | 39.76 | 36.75 | 48.47 | 48.32 | 43.60 | 45.39 | 42.27 | 41.99 | 35.74 | 53.69 | 52.60 | 54.27 | 49.98 | 55.83 | 59.08 | 55.48 | 51.33 | 57.15 | 56.76 | 48.28 | 48.35 | 42.58 | 46.74 | 49.96 | 42.31 | 41.19 | 30.79 | 30.57 | 29.15 | 30.08 | 28.25 | 29.23 | 29.42 | NA | 28.14 | NA | NA | |

| Contract With Customer Liability Current | 4.94 | 2.59 | 3.33 | 4.36 | 5.48 | 4.58 | 5.61 | 7.38 | 5.52 | 0.83 | 1.01 | 2.56 | 1.64 | 0.94 | 2.04 | 5.78 | 5.33 | 4.37 | 4.90 | 5.01 | 5.51 | 8.83 | 10.04 | 4.11 | 1.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

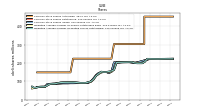

| Long Term Debt | 261.16 | 144.95 | 144.88 | 144.91 | 145.56 | 28.55 | 32.41 | 35.65 | 36.06 | 36.95 | 38.26 | 86.81 | 85.68 | 35.17 | 36.54 | 87.59 | 88.89 | 79.44 | 80.47 | 81.84 | 79.72 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Long Term Debt Noncurrent | 261.12 | 144.91 | 144.84 | 144.88 | 145.47 | 24.39 | 25.09 | 25.61 | 23.21 | 25.90 | 29.57 | 80.04 | 82.09 | 29.05 | 30.50 | 31.56 | 32.87 | 24.04 | 24.91 | 76.50 | 75.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deferred Finance Costs Noncurrent Net | 39.09 | 5.30 | 5.38 | 5.12 | 4.53 | 0.07 | 0.08 | 0.09 | 0.05 | 0.05 | 0.06 | 0.07 | 0.08 | 0.08 | 0.09 | 0.11 | 0.12 | 0.05 | 0.11 | 0.13 | 0.11 | 0.29 | 0.32 | 0.36 | 0.32 | 0.94 | 1.12 | 1.29 | 1.79 | 2.74 | 3.10 | 4.06 | 4.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 6.88 | 7.02 | 7.16 | 7.34 | 7.48 | 7.71 | 7.82 | 7.95 | 8.34 | 8.56 | 8.78 | 9.07 | 9.34 | 9.63 | 9.90 | 10.20 | 9.62 | 11.48 | 13.19 | 14.90 | 17.01 | 18.43 | 19.73 | 20.92 | 22.67 | 23.01 | 23.76 | 24.49 | 24.82 | 25.08 | 25.47 | 26.09 | 26.39 | 26.77 | 26.84 | 27.23 | 27.61 | 8.12 | 3.63 | 3.90 | 3.97 | 3.93 | 3.89 | 3.95 | 3.92 | 3.86 | 3.75 | 3.66 | 3.52 | 3.43 | 3.50 | NA | 2.93 | NA | NA | |

| Other Liabilities Noncurrent | 9.96 | 9.43 | 8.91 | 9.65 | 8.79 | 8.63 | 8.51 | 8.14 | 8.20 | 7.59 | 7.62 | 5.73 | 4.00 | 4.87 | 4.70 | 9.80 | 9.70 | 12.85 | 12.90 | 12.73 | 15.04 | 15.35 | 15.18 | 16.38 | 18.57 | 13.42 | 5.23 | 5.34 | 7.92 | 8.17 | 8.16 | 8.08 | 7.90 | 8.04 | 7.97 | 8.37 | 9.34 | 9.72 | 13.09 | 11.35 | 15.30 | 14.06 | 15.58 | 14.53 | 14.01 | 17.77 | 22.62 | 33.83 | 22.69 | 20.13 | 23.50 | NA | 28.59 | NA | NA | |

| Operating Lease Liability Noncurrent | 89.06 | 71.34 | 59.39 | 56.84 | 48.91 | 41.68 | 39.06 | 39.30 | 39.43 | 31.07 | 31.70 | 32.34 | 23.70 | 24.01 | 24.36 | 25.18 | 26.21 | NA | 22.25 | 21.62 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 726.77 | 684.59 | 695.74 | 696.43 | 719.99 | 721.01 | 721.68 | 730.38 | 747.08 | 746.37 | 746.46 | 512.04 | 513.51 | 513.83 | 517.48 | 528.81 | 533.41 | 490.99 | 494.94 | 499.07 | 508.00 | 500.95 | 510.42 | 439.90 | 426.99 | 442.56 | 531.11 | 543.12 | 468.87 | 439.57 | 387.68 | 335.12 | 302.55 | 346.60 | 374.66 | 400.34 | 437.43 | 435.55 | 464.02 | 490.35 | 514.57 | 544.05 | 554.82 | 554.36 | 542.71 | 510.54 | 518.41 | 519.87 | 540.88 | 409.15 | 413.60 | NA | 413.29 | NA | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 733.65 | 691.61 | 702.90 | 703.77 | 727.47 | 728.72 | 729.51 | 738.33 | 755.41 | 754.93 | 755.24 | 521.11 | 522.85 | 523.47 | 527.38 | 539.02 | 543.03 | 502.47 | 508.13 | 513.98 | 525.01 | 519.38 | 530.15 | 460.82 | 449.66 | 465.57 | 554.87 | 567.61 | 493.69 | 464.65 | 413.15 | 361.21 | 328.94 | 373.38 | 401.49 | 427.57 | 465.04 | 443.67 | 467.64 | 494.25 | 518.54 | 547.98 | 558.71 | 558.31 | 546.63 | 514.40 | 522.16 | 523.53 | 544.41 | 412.58 | 417.10 | NA | 416.22 | NA | NA | |

| Common Stock Value | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | NA | 0.01 | NA | NA | |

| Additional Paid In Capital Common Stock | 1658.34 | 1598.63 | 1582.01 | 1568.09 | 1553.67 | 1543.51 | 1533.12 | 1527.16 | 1519.92 | 1516.45 | 1511.74 | 1198.37 | 1191.79 | 1191.14 | 1193.20 | 1198.80 | 1203.19 | 1202.34 | 1201.34 | 1200.42 | 1198.77 | 1196.72 | 1195.40 | 1113.44 | 1111.43 | 1110.16 | 1107.81 | 1103.12 | 1090.36 | 1055.21 | 989.35 | 938.99 | 915.20 | 905.92 | 904.06 | 901.13 | 898.11 | 894.90 | 893.88 | 890.88 | 883.04 | 877.35 | 871.44 | 855.29 | 837.37 | 771.13 | 760.94 | 752.28 | 741.65 | 587.99 | 584.37 | NA | 569.20 | NA | NA | |

| Retained Earnings Accumulated Deficit | -929.47 | -910.78 | -884.97 | -868.67 | -829.98 | -817.64 | -808.67 | -795.43 | -771.24 | -768.87 | -764.93 | -685.26 | -678.10 | -675.53 | -673.26 | -666.53 | -668.23 | -709.32 | -704.98 | -699.60 | -688.65 | -695.51 | -684.62 | -672.64 | -683.57 | -655.22 | -561.08 | -543.27 | -603.84 | -599.95 | -587.33 | -588.86 | -591.68 | -541.65 | -518.53 | -488.57 | -457.44 | -458.77 | -428.68 | -396.38 | -367.78 | -335.46 | -316.63 | -304.69 | -300.81 | -259.08 | -242.76 | -231.46 | -199.56 | -178.65 | -167.30 | NA | -151.93 | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -2.12 | -3.28 | -1.32 | -3.02 | -3.72 | -4.88 | -2.79 | -1.37 | -1.62 | -1.24 | -0.37 | -1.09 | -0.21 | -1.79 | -2.48 | -3.48 | -1.57 | -2.06 | -1.44 | -1.76 | -2.14 | -0.27 | -0.39 | -0.91 | -0.89 | -12.39 | -15.63 | -16.74 | -17.68 | -15.70 | -14.35 | -15.03 | -20.97 | -17.68 | -10.88 | -12.22 | -3.25 | -0.59 | -1.19 | -4.16 | -0.70 | 2.16 | NA | 3.75 | 6.15 | -1.52 | 0.23 | -0.95 | -1.22 | -0.20 | -3.48 | NA | -4.00 | NA | NA | |

| Minority Interest | 6.88 | 7.02 | 7.16 | 7.34 | 7.48 | 7.71 | 7.82 | 7.95 | 8.34 | 8.56 | 8.78 | 9.07 | 9.34 | 9.63 | 9.90 | 10.20 | 9.62 | 11.48 | 13.19 | 14.90 | 17.01 | 18.43 | 19.73 | 20.92 | 22.67 | 23.01 | 23.76 | 24.49 | 24.82 | 25.08 | 25.47 | 26.09 | 26.39 | 26.77 | 26.84 | 27.23 | 27.61 | 8.12 | 3.63 | 3.90 | 3.97 | 3.93 | 3.89 | 3.95 | 3.92 | 3.86 | 3.75 | 3.66 | 3.52 | 3.43 | 3.50 | NA | 2.93 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

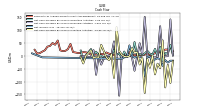

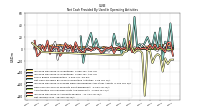

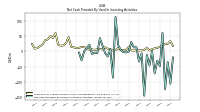

| Net Cash Provided By Used In Operating Activities | 42.99 | 7.75 | 12.04 | -19.00 | 35.00 | -0.51 | 27.40 | 4.84 | 8.46 | 19.93 | 9.66 | 3.26 | 7.92 | 3.36 | 54.02 | -4.26 | 7.68 | -4.18 | 17.01 | -8.23 | 8.98 | 6.08 | 25.27 | -2.35 | 0.53 | 0.44 | -6.69 | 1.40 | 2.04 | 16.63 | 0.84 | 26.77 | NA | 1.85 | -23.71 | 20.86 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -105.28 | -34.71 | -122.54 | 60.52 | -47.83 | -30.32 | -71.76 | 1.36 | -45.86 | -11.43 | -144.25 | -6.13 | -33.10 | 13.71 | 13.12 | 30.44 | -0.98 | -3.48 | -2.10 | 5.06 | 20.10 | 112.36 | -85.38 | 7.28 | -16.55 | -5.22 | 19.30 | 43.16 | -5.84 | -3.84 | -8.46 | 21.84 | NA | 0.59 | -29.25 | -3.94 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | 142.15 | -0.84 | -1.42 | -0.77 | 115.58 | -3.20 | -5.93 | -4.81 | -3.04 | -2.49 | 151.83 | 6.53 | 49.23 | -4.71 | -57.62 | -5.55 | 8.80 | -1.13 | -2.07 | 2.08 | -154.83 | -1.88 | 56.47 | 5.03 | 0.78 | -0.16 | -10.04 | -33.74 | 1.50 | -73.41 | 22.39 | -6.21 | NA | -2.38 | -0.76 | -1.15 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 42.99 | 7.75 | 12.04 | -19.00 | 35.00 | -0.51 | 27.40 | 4.84 | 8.46 | 19.93 | 9.66 | 3.26 | 7.92 | 3.36 | 54.02 | -4.26 | 7.68 | -4.18 | 17.01 | -8.23 | 8.98 | 6.08 | 25.27 | -2.35 | 0.53 | 0.44 | -6.69 | 1.40 | 2.04 | 16.63 | 0.84 | 26.77 | NA | 1.85 | -23.71 | 20.86 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | -18.69 | -25.81 | -16.30 | -38.70 | -12.33 | -8.97 | -13.23 | -24.19 | -2.38 | -3.93 | -79.67 | -7.17 | -2.56 | -2.27 | -6.74 | 1.70 | 41.08 | -4.33 | -5.38 | -10.95 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -5.62 | NA | NA | NA | 9.89 | |

| Profit Loss | -18.83 | -25.95 | -16.49 | -38.83 | -12.56 | -9.09 | -13.36 | -24.58 | -2.60 | -4.16 | -79.95 | -7.45 | -2.85 | -2.54 | -7.04 | 0.90 | 39.22 | -6.04 | -7.09 | -12.82 | 5.70 | -12.20 | -13.16 | 10.47 | -28.69 | -94.89 | -18.54 | 60.72 | -4.14 | -13.02 | 0.90 | 2.53 | -50.40 | -23.18 | -30.36 | -31.53 | 0.61 | -30.23 | -32.57 | -28.66 | -32.28 | -18.80 | -12.01 | -3.83 | -41.67 | -16.21 | -11.21 | -31.77 | -20.81 | -11.43 | -5.74 | -9.48 | 13.56 | -1.92 | 9.98 | |

| Depreciation Depletion And Amortization | 10.71 | 13.39 | 10.89 | 10.68 | 12.19 | 20.54 | 10.56 | 11.39 | 10.98 | 11.09 | 11.38 | 11.73 | 11.96 | 11.74 | 12.05 | 11.92 | 12.29 | 12.25 | 12.61 | 12.48 | 12.35 | 13.36 | 13.33 | 12.80 | 12.86 | 14.10 | 14.34 | 15.32 | 14.58 | 14.80 | 14.92 | 14.96 | 14.93 | 14.00 | 13.40 | 12.89 | 13.61 | 12.32 | 11.61 | 11.52 | 10.46 | 10.92 | 10.78 | 10.16 | 10.16 | 9.05 | 8.91 | 8.14 | 8.01 | 7.55 | 7.63 | 7.21 | 6.92 | 5.51 | 5.07 | |

| Increase Decrease In Inventories | 5.38 | 2.52 | 0.86 | 2.63 | 1.72 | 3.11 | 2.68 | 1.81 | 2.45 | 2.52 | 0.56 | 0.18 | 0.33 | -0.22 | -0.17 | -0.05 | -0.64 | -2.14 | 1.37 | -2.02 | -1.34 | 0.21 | -0.52 | 2.70 | -0.47 | -2.65 | 2.32 | -0.16 | 0.48 | 1.31 | -1.01 | 0.75 | -1.49 | -0.62 | -1.41 | -1.88 | -0.71 | -3.69 | 0.91 | 4.47 | -5.90 | 3.77 | -3.30 | 6.07 | 0.38 | 1.27 | -3.14 | 3.37 | 2.84 | 2.94 | 2.49 | 6.51 | 1.45 | 1.77 | NA | |

| Increase Decrease In Accounts Payable | 10.57 | 10.55 | -5.75 | -0.61 | 3.39 | -0.97 | 6.80 | 0.11 | 6.80 | -1.73 | 1.10 | 0.45 | -0.71 | 1.94 | -4.98 | -5.59 | 12.53 | -3.77 | 1.77 | -1.21 | 3.05 | 1.07 | -7.42 | 3.97 | 0.46 | 1.86 | -3.85 | -7.44 | 0.18 | 1.71 | 0.83 | -3.48 | -0.68 | 0.24 | -8.59 | -2.98 | -0.06 | 10.90 | -7.43 | 5.71 | 0.95 | 9.35 | -5.52 | -11.74 | 2.08 | 2.53 | 3.64 | -8.57 | 13.72 | -3.62 | 5.96 | -8.02 | -12.59 | 13.52 | NA | |

| Deferred Income Tax Expense Benefit | -0.28 | -0.07 | -0.08 | -0.09 | 0.03 | 0.08 | 0.04 | 0.02 | -0.02 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 5.06 | 6.09 | 6.09 | 6.10 | 5.79 | 5.96 | 6.47 | 8.25 | 4.77 | 3.43 | 3.42 | 3.37 | 0.43 | 0.71 | 0.76 | 1.05 | 0.82 | 0.89 | 0.92 | 1.25 | 0.99 | 1.21 | 1.21 | 1.90 | 1.52 | 1.92 | 2.78 | 1.91 | 1.56 | 2.08 | 2.04 | 2.42 | 2.77 | 2.66 | 2.66 | 2.69 | 2.31 | 2.81 | 2.98 | 3.42 | 5.66 | 5.68 | 5.45 | 6.21 | 5.59 | 6.04 | 5.77 | 4.68 | 3.38 | 3.16 | 3.56 | 3.38 | 2.70 | 3.26 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -105.28 | -34.71 | -122.54 | 60.52 | -47.83 | -30.32 | -71.76 | 1.36 | -45.86 | -11.43 | -144.25 | -6.13 | -33.10 | 13.71 | 13.12 | 30.44 | -0.98 | -3.48 | -2.10 | 5.06 | 20.10 | 112.36 | -85.38 | 7.28 | -16.55 | -5.22 | 19.30 | 43.16 | -5.84 | -3.84 | -8.46 | 21.84 | NA | 0.59 | -29.25 | -3.94 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 33.64 | 24.54 | 24.98 | 17.78 | 15.43 | 11.64 | 10.08 | 7.37 | 2.88 | 12.31 | 4.56 | 3.33 | 3.29 | 3.63 | 2.70 | 3.66 | 14.84 | 4.51 | 3.43 | 4.32 | 11.05 | 4.38 | 2.70 | 7.13 | 8.78 | 13.56 | 6.39 | 7.58 | 6.98 | 5.07 | 6.34 | 5.25 | 11.19 | 13.99 | 14.83 | 11.40 | 11.12 | 13.27 | 14.99 | 46.85 | 26.69 | 19.77 | 18.57 | 21.70 | 60.05 | 43.58 | 50.33 | 38.93 | 36.25 | 21.96 | 16.77 | 10.82 | 9.10 | 24.02 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 142.15 | -0.84 | -1.42 | -0.77 | 115.58 | -3.20 | -5.93 | -4.81 | -3.04 | -2.49 | 151.83 | 6.53 | 49.23 | -4.71 | -57.62 | -5.55 | 8.80 | -1.13 | -2.07 | 2.08 | -154.83 | -1.88 | 56.47 | 5.03 | 0.78 | -0.16 | -10.04 | -33.74 | 1.50 | -73.41 | 22.39 | -6.21 | NA | -2.38 | -0.76 | -1.15 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 106.86 | 95.57 | 90.55 | 132.18 | 113.76 | 125.69 | 97.22 | 83.50 | 91.93 | 86.09 | 0.48 | 77.14 | 74.96 | 70.89 | 59.87 | 86.01 | 119.61 | 74.43 | 72.32 | 77.70 | 96.23 | 77.32 | 70.47 | 102.40 | 89.30 | 81.79 | 81.02 | 89.49 | 101.83 | 97.02 | 108.03 | 95.78 | 119.33 | 92.26 | 86.87 | 85.85 | 132.11 | 103.42 | 98.13 | 95.28 | 85.00 | 86.32 | 88.12 | 93.04 | 99.07 | 91.46 | 69.84 | 73.63 | 86.18 | 72.08 | 69.11 | 65.34 | 83.16 | 45.65 | 44.03 | |

| Rng Joint Ventures, Management Fee For Services, Related Party | 0.90 | 1.10 | NA | NA | 0.40 | 0.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| S A F E C E C S.r.l., Related Party | 0.00 | 0.00 | 0.10 | NA | 0.00 | 0.10 | 0.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| T O T L S.a, Related Party | 0.00 | 0.00 | NA | NA | 1.90 | 2.80 | 1.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | 106.86 | 95.57 | 90.55 | 132.18 | 113.76 | 125.69 | 97.22 | 83.50 | 91.93 | 86.09 | 0.48 | 77.14 | 74.96 | 70.89 | 59.87 | 86.01 | 119.61 | 74.43 | 72.32 | 77.70 | 96.23 | 77.32 | 70.47 | 102.40 | 89.30 | 81.79 | 81.02 | 89.49 | 101.83 | 97.02 | 108.03 | 95.78 | 119.33 | 92.26 | 86.87 | 85.85 | 132.11 | 103.42 | 98.13 | 95.28 | 85.00 | 86.32 | 88.12 | 93.04 | 99.07 | 91.46 | 69.84 | 73.63 | 86.18 | 72.08 | 69.11 | 65.34 | 83.16 | 45.65 | 44.03 | |

| Federal Alternative Fuels Tax Credit | 5.88 | 5.42 | 5.06 | 4.50 | 5.48 | 16.06 | -0.01 | 0.23 | 5.69 | 5.29 | 5.24 | 4.48 | 5.03 | 5.02 | 4.37 | 5.42 | 47.12 | 0.00 | 0.00 | 0.00 | -0.13 | 0.00 | 1.38 | 25.48 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Service Revenue Source | 0.61 | 0.65 | 1.01 | 0.41 | 0.31 | 0.34 | 0.34 | 0.28 | 0.45 | 0.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Station Construction Sales | 8.91 | 7.59 | 5.85 | 4.07 | 6.63 | 6.42 | 5.97 | 3.33 | 3.22 | 2.58 | 6.07 | 4.54 | 7.05 | 8.74 | 5.28 | 5.52 | 7.58 | 6.43 | 5.94 | 3.17 | 4.56 | 9.36 | 5.78 | 5.80 | 17.78 | 12.50 | 12.31 | 9.26 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Volume Related Fuel Sales | 66.79 | 60.01 | 53.27 | 106.89 | 76.88 | 78.51 | 67.09 | 58.62 | 58.74 | 52.34 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Volume Related Low Carbon Fuel Standard Credits | 2.27 | 2.85 | 2.47 | 2.30 | 2.52 | 2.60 | 4.08 | 3.43 | 3.83 | 5.74 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Volume Related Operations And Maintenance Service Revenue | 13.06 | 13.65 | 13.91 | 12.04 | 12.17 | 11.98 | 11.04 | 10.71 | 11.43 | 11.68 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Volume Related Product Revenue | 84.27 | 73.69 | 69.78 | 115.66 | 94.64 | 106.94 | 79.89 | 69.18 | 76.83 | 71.78 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Volume Related Renewable Identification Number Credits | 9.20 | 6.78 | 5.38 | 4.50 | 7.64 | 9.27 | 9.79 | 7.93 | 9.82 | 8.13 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Product | 93.19 | 81.28 | 75.63 | 119.73 | 101.28 | 113.36 | 85.85 | 72.51 | 80.05 | 74.35 | -8.96 | 67.69 | 65.52 | 60.31 | 50.43 | 75.70 | 107.52 | 62.81 | 59.69 | 68.45 | 87.03 | 67.44 | 61.12 | 92.25 | 75.55 | 67.67 | 67.85 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Service | 13.67 | 14.29 | 14.92 | 12.46 | 12.48 | 12.33 | 11.37 | 10.99 | 11.88 | 11.74 | 9.45 | 9.45 | 9.44 | 10.58 | 9.45 | 10.30 | 12.09 | 11.63 | 12.63 | 9.25 | 9.20 | 9.88 | 9.35 | 10.15 | 13.76 | 14.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |