| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.81 | 0.80 | 0.79 | 0.79 | 0.68 | 0.67 | 0.67 | 0.59 | 0.58 | 0.58 | 0.58 | 0.58 | 0.58 | 0.57 | 0.56 | 0.56 | 0.52 | 0.51 | 0.38 | 0.38 | 0.38 | 0.38 | 0.38 | 0.33 | 0.33 | 0.00 | NA | NA | NA | NA | NA | NA | |

| dei: Entity Common Stock Shares Outstanding | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 51.04 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

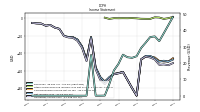

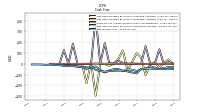

| Earnings Per Share Basic | -0.54 | -0.58 | -0.57 | -0.60 | -0.55 | -0.55 | -0.60 | -0.80 | -1.51 | -1.37 | -1.21 | -1.06 | -1.10 | -1.13 | -1.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | -0.54 | -0.58 | -0.57 | -0.60 | -0.55 | -0.55 | -0.60 | -0.80 | -1.51 | -1.37 | -1.21 | -1.06 | -1.10 | -1.13 | -1.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

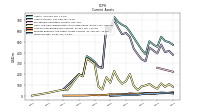

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

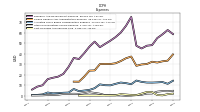

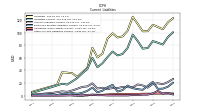

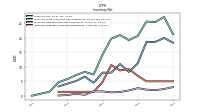

| Revenue From Contract With Customer Excluding Assessed Tax | 48.29 | 43.31 | 38.30 | 33.45 | 36.34 | 35.97 | 32.49 | 29.22 | 24.20 | 23.22 | 23.57 | 25.16 | 19.49 | 15.45 | 7.09 | 0.06 | 0.00 | 0.00 | 25.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Revenue From Contract With Customer Including Assessed Tax | 48.29 | 43.31 | 38.30 | 33.45 | 36.34 | 35.97 | 32.49 | 29.22 | 24.20 | 23.22 | 23.57 | 25.16 | 19.49 | 15.45 | 7.09 | 0.06 | 0.00 | 0.00 | 25.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Revenues | 48.29 | 43.31 | 38.30 | 33.45 | 36.34 | 35.97 | 32.49 | 29.22 | 24.20 | 23.22 | 23.57 | 25.16 | 19.49 | 15.45 | 7.09 | 0.06 | 0.00 | 0.00 | 25.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Cost Of Goods And Services Sold | 1.78 | 1.29 | 0.17 | 0.49 | 3.25 | 3.34 | 1.80 | 0.38 | 0.52 | 0.92 | 1.27 | 0.22 | 0.13 | 0.09 | 0.01 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Costs And Expenses | 99.53 | 97.00 | 91.08 | 86.70 | 83.51 | 80.86 | 76.28 | 76.11 | 112.60 | 102.89 | 94.09 | 86.65 | 82.48 | 79.45 | 76.02 | 75.32 | 70.37 | 58.35 | 47.98 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Research And Development Expense | 58.60 | 62.46 | 58.30 | 54.77 | 48.07 | 47.48 | 44.86 | 47.41 | 74.93 | 66.44 | 59.98 | 55.68 | 52.29 | 49.21 | 46.08 | 51.39 | 46.64 | 40.37 | 34.81 | 35.79 | 27.36 | 20.63 | 17.98 | 16.93 | 15.66 | 9.75 | 8.45 | 5.66 | NA | NA | NA | NA | |

| Selling General And Administrative Expense | 39.15 | 33.25 | 32.61 | 31.45 | 32.20 | 30.03 | 29.62 | 28.32 | 37.15 | 35.53 | 32.83 | 30.75 | 30.07 | 30.14 | 29.93 | 23.94 | 23.74 | 17.98 | 13.16 | 13.24 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating Income Loss | -51.24 | -53.69 | -52.77 | -53.26 | -47.16 | -44.88 | -43.79 | -46.89 | -88.40 | -79.67 | -70.51 | -61.49 | -63.00 | -64.00 | -68.93 | -75.26 | -70.37 | -58.35 | -22.98 | -49.02 | -33.83 | -25.89 | -22.43 | -21.95 | -20.34 | -12.18 | -10.69 | -7.72 | -8.53 | -6.07 | -5.91 | -5.32 | |

| Allocated Share Based Compensation Expense | 14.07 | 11.16 | 12.86 | 12.51 | 12.31 | 12.37 | 12.99 | 14.27 | 10.79 | 11.79 | 12.37 | 11.12 | 9.71 | 9.83 | 10.61 | 6.99 | 5.34 | 4.73 | 4.11 | 6.23 | 2.81 | 2.61 | 2.23 | 2.04 | 2.84 | 1.01 | 0.59 | 0.42 | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | 1.47 | 0.07 | -0.79 | 0.80 | 1.06 | -0.77 | -0.70 | -0.61 | -0.11 | 0.14 | -0.02 | 0.03 | -0.03 | 0.05 | -0.77 | 0.65 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | -47.19 | -49.58 | -48.56 | -49.61 | -45.94 | -43.04 | -43.06 | -46.89 | -88.39 | -79.84 | -70.43 | -61.30 | -62.74 | -63.70 | -67.24 | -72.81 | -67.22 | -56.20 | -21.46 | -47.38 | -32.30 | -24.43 | -21.69 | -21.43 | -19.91 | -12.04 | -10.63 | -7.71 | -8.56 | -6.10 | -5.93 | -5.35 | |

| Comprehensive Income Net Of Tax | -45.72 | -49.51 | -49.35 | -48.81 | -44.88 | -43.82 | -43.77 | -47.51 | -88.51 | -79.70 | -70.45 | -61.27 | -62.77 | -63.65 | -68.01 | -72.16 | -67.17 | -56.31 | -21.31 | -47.36 | -32.30 | -24.43 | -21.69 | -21.43 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

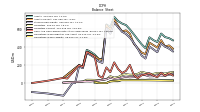

| Assets | 473.57 | 497.84 | 509.62 | 549.02 | 454.04 | 475.95 | 507.04 | 385.46 | 429.48 | 483.42 | 540.57 | 595.25 | 642.43 | 659.67 | 686.30 | 732.93 | 622.41 | 649.60 | 260.01 | 269.69 | 315.56 | 345.92 | 368.16 | 182.14 | 199.09 | NA | NA | NA | 58.95 | NA | NA | NA | |

| Liabilities | 122.65 | 116.17 | 105.19 | 108.94 | 112.35 | 102.18 | 102.03 | 113.90 | 124.76 | 102.96 | 93.91 | 92.23 | 98.76 | 90.58 | 66.62 | 60.67 | 75.94 | 44.05 | 37.13 | 29.69 | 35.58 | 36.55 | 37.06 | 17.55 | 15.12 | NA | NA | NA | 6.04 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 473.57 | 497.84 | 509.62 | 549.02 | 454.04 | 475.95 | 507.04 | 385.46 | 429.48 | 483.42 | 540.57 | 595.25 | 642.43 | 659.67 | 686.30 | 732.93 | 622.41 | 649.60 | 260.01 | 269.69 | 315.56 | 345.92 | 368.16 | 182.14 | 199.09 | NA | NA | NA | 58.95 | NA | NA | NA | |

| Stockholders Equity | 350.92 | 381.67 | 404.43 | 440.08 | 341.69 | 373.78 | 405.01 | 271.56 | 304.72 | 380.46 | 446.66 | 503.01 | 543.68 | 569.09 | 619.68 | 672.26 | 546.47 | 605.55 | 222.88 | 240.00 | 279.98 | 309.37 | 331.10 | 164.59 | 183.97 | 0.00 | NA | NA | -139.76 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 381.10 | 417.58 | 405.05 | 476.16 | 392.96 | 420.88 | 448.53 | 319.83 | 339.01 | 385.29 | 437.14 | 546.63 | 584.03 | 571.46 | 633.09 | 703.48 | 593.41 | 642.29 | 256.43 | 266.44 | 301.04 | 325.61 | 348.75 | 181.11 | 198.18 | NA | NA | NA | 58.25 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 83.51 | 108.09 | 81.39 | 114.64 | 64.74 | 82.54 | 109.70 | 95.33 | 87.06 | 53.19 | 90.95 | 201.65 | 135.90 | 111.15 | 155.45 | 229.65 | 120.32 | 173.71 | 57.24 | 82.23 | 293.76 | 320.88 | 346.53 | 179.87 | 196.75 | NA | NA | 49.96 | 57.46 | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 83.51 | 108.09 | 81.39 | 114.64 | 64.74 | 82.54 | 109.70 | 95.33 | 87.06 | 53.19 | 90.95 | 201.65 | 135.90 | 111.15 | 155.45 | 229.65 | 120.32 | 173.71 | 57.24 | 82.23 | 293.76 | 320.88 | 346.53 | NA | 196.75 | 82.15 | 93.99 | NA | 57.46 | NA | NA | NA | |

| Marketable Securities Current | 222.71 | NA | NA | NA | 259.75 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accounts Receivable Net Current | 31.95 | 27.55 | 23.20 | 22.44 | 22.43 | 23.28 | 25.85 | 23.15 | 20.59 | 18.05 | 18.61 | 21.82 | 13.90 | 11.81 | 7.38 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Inventory Net | 21.21 | 27.11 | 25.34 | 25.53 | 20.56 | 19.13 | 20.89 | 19.63 | 14.12 | 7.25 | 8.21 | 7.09 | 5.72 | 4.60 | 1.39 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 21.72 | 23.85 | 27.77 | 29.56 | 25.48 | 13.89 | 17.94 | 20.50 | 18.66 | 17.72 | 14.98 | 15.55 | 12.49 | 9.72 | 13.98 | 11.98 | 13.83 | 7.70 | 6.01 | 4.10 | 7.27 | 4.73 | 2.22 | 1.24 | 1.43 | NA | NA | NA | 0.79 | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 269.41 | NA | NA | NA | 274.30 | NA | NA | NA | 240.52 | NA | NA | 300.53 | 425.41 | 473.16 | 476.32 | 461.85 | 459.26 | 460.88 | 168.18 | 180.11 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

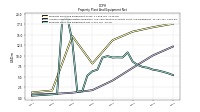

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 17.62 | NA | NA | NA | 16.79 | NA | NA | NA | 15.75 | NA | NA | NA | 13.71 | NA | NA | NA | 8.16 | NA | NA | NA | 14.67 | NA | NA | NA | 1.75 | NA | NA | NA | 1.28 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 12.20 | NA | NA | NA | 10.08 | NA | NA | NA | 7.14 | NA | NA | NA | 4.12 | NA | NA | NA | 1.83 | NA | NA | NA | 1.22 | NA | NA | NA | 0.92 | NA | NA | NA | 0.77 | NA | NA | NA | |

| Property Plant And Equipment Net | 5.42 | 5.86 | 6.21 | 6.51 | 6.71 | 7.15 | 7.35 | 7.82 | 8.61 | 10.82 | 9.59 | 9.63 | 9.58 | 9.93 | 9.57 | 6.69 | 6.33 | 5.27 | 1.59 | 1.50 | 13.45 | 19.24 | 18.26 | 0.95 | 0.84 | NA | NA | NA | 0.51 | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 269.62 | NA | NA | NA | 275.55 | NA | NA | NA | 240.79 | NA | NA | 300.49 | 425.39 | 473.12 | 476.33 | 461.08 | 459.14 | 460.82 | 168.00 | 180.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

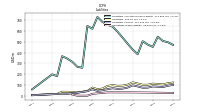

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Liabilities Current | 100.28 | 92.89 | 81.03 | 83.91 | 86.47 | 75.47 | 74.55 | 86.67 | 96.77 | 75.79 | 66.05 | 63.79 | 69.99 | 61.19 | 51.34 | 45.07 | 60.04 | 42.26 | 35.34 | 27.89 | 22.74 | 17.64 | 18.91 | 16.30 | 13.81 | NA | NA | NA | 4.56 | NA | NA | NA | |

| Accounts Payable Current | 26.48 | 21.45 | 18.21 | 19.67 | 18.61 | 12.80 | 16.23 | 17.80 | 13.13 | 13.50 | 14.02 | 11.90 | 12.31 | 10.24 | 12.58 | 11.34 | 19.57 | 14.77 | 13.90 | 10.94 | 8.31 | 6.05 | 6.94 | 5.56 | 4.39 | NA | NA | NA | 1.41 | NA | NA | NA | |

| Other Accrued Liabilities Current | 1.95 | 4.55 | 3.40 | 7.66 | 3.72 | 1.65 | 1.65 | 0.91 | 1.07 | 0.37 | 0.41 | 0.41 | 0.39 | 0.36 | 0.82 | 0.77 | 1.54 | 1.42 | 0.09 | 0.18 | 0.60 | 0.35 | 0.15 | 0.02 | 0.02 | NA | NA | NA | 0.02 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Operating Lease Liability Noncurrent | 22.38 | 23.27 | 24.15 | 25.02 | 25.88 | 26.71 | 27.48 | 27.23 | 27.99 | 27.17 | 27.86 | 28.44 | 28.76 | 29.39 | 15.28 | 15.60 | 15.90 | 0.11 | 0.16 | 0.24 | 11.35 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 350.92 | 381.67 | 404.43 | 440.08 | 341.69 | 373.78 | 405.01 | 271.56 | 304.72 | 380.46 | 446.66 | 503.01 | 543.68 | 569.09 | 619.68 | 672.26 | 546.47 | 605.55 | 222.88 | 240.00 | 279.98 | 309.37 | 331.10 | 164.59 | 183.97 | 0.00 | NA | NA | -139.76 | NA | NA | NA | |

| Common Stock Value | 0.81 | 0.80 | 0.79 | 0.79 | 0.68 | 0.67 | 0.67 | 0.59 | 0.58 | 0.58 | 0.58 | 0.58 | 0.58 | 0.57 | 0.56 | 0.56 | 0.52 | 0.51 | 0.38 | 0.38 | 0.38 | 0.38 | 0.38 | 0.33 | 0.33 | 0.00 | NA | NA | NA | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 1777.84 | 1762.88 | 1736.14 | 1722.45 | 1575.36 | 1562.57 | 1550.00 | 1372.87 | 1358.52 | 1345.75 | 1332.25 | 1318.16 | 1297.56 | 1260.21 | 1247.16 | 1231.73 | 1033.82 | 1025.74 | 586.89 | 582.70 | 575.33 | 572.41 | NA | NA | 379.52 | NA | NA | NA | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -1428.31 | -1381.12 | -1331.53 | -1282.97 | -1233.36 | -1187.43 | -1144.38 | -1101.32 | -1054.43 | -966.04 | -886.20 | -815.77 | -754.47 | -691.73 | -628.03 | -560.79 | -487.98 | -420.76 | -364.57 | -343.11 | -295.72 | -263.42 | -238.99 | -217.30 | -195.87 | NA | NA | NA | -145.59 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 0.58 | -0.90 | -0.97 | -0.18 | -0.98 | -2.04 | -1.27 | -0.56 | 0.05 | 0.17 | 0.03 | 0.04 | 0.01 | 0.04 | -0.01 | 0.76 | 0.11 | 0.06 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Stock Issued During Period Value New Issues | 0.00 | 14.62 | 0.00 | 134.49 | 0.00 | 0.00 | 163.35 | NA | 0.00 | 0.00 | 0.00 | 8.55 | 17.89 | 0.00 | 0.00 | 188.38 | 0.00 | 431.78 | NA | NA | 0.00 | NA | 185.26 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 14.07 | 11.16 | 12.86 | 12.51 | 12.31 | 12.37 | 12.99 | 14.27 | 10.79 | 11.79 | 12.37 | 11.12 | 9.71 | 9.83 | 10.61 | 6.99 | 5.34 | 4.73 | 4.11 | 6.23 | 2.81 | 2.61 | 2.23 | 2.04 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

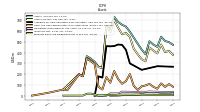

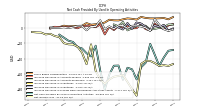

| Net Cash Provided By Used In Operating Activities | -28.81 | -29.81 | -38.63 | -49.45 | -35.16 | -20.83 | -45.52 | -51.35 | -67.18 | -54.00 | -51.97 | -67.68 | -49.13 | -49.34 | -60.84 | -80.37 | -55.83 | -23.19 | -37.27 | -33.01 | -26.87 | -24.93 | -18.29 | -16.69 | -12.75 | -8.87 | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | 2.20 | 41.40 | 4.36 | -35.41 | 16.30 | -6.07 | -104.19 | 59.65 | 98.95 | 14.44 | -60.45 | 123.91 | 46.08 | 1.82 | -17.75 | -1.69 | 1.68 | -294.81 | 12.26 | -179.65 | -0.30 | -0.22 | -1.52 | -0.15 | -0.13 | -0.20 | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | 0.89 | 15.59 | 0.84 | 134.69 | 0.48 | 0.21 | 164.22 | 0.08 | 1.98 | 1.71 | 1.68 | 9.52 | 27.79 | 3.23 | 4.39 | 191.39 | 0.76 | 434.48 | 0.02 | 1.12 | 0.06 | -0.50 | 186.47 | -0.04 | 127.49 | -2.77 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -28.81 | -29.81 | -38.63 | -49.45 | -35.16 | -20.83 | -45.52 | -51.35 | -67.18 | -54.00 | -51.97 | -67.68 | -49.13 | -49.34 | -60.84 | -80.37 | -55.83 | -23.19 | -37.27 | -33.01 | -26.87 | -24.93 | -18.29 | -16.69 | -12.75 | -8.87 | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | -47.19 | -49.58 | -48.56 | -49.61 | -45.94 | -43.04 | -43.06 | -46.89 | -88.39 | -79.84 | -70.43 | -61.30 | -62.74 | -63.70 | -67.24 | -72.81 | -67.22 | -56.20 | -21.46 | -47.38 | -32.30 | -24.43 | -21.69 | -21.43 | -19.91 | -12.04 | -10.63 | -7.71 | -8.56 | -6.10 | -5.93 | -5.35 | |

| Depreciation Depletion And Amortization | 0.46 | 0.47 | 0.57 | 0.61 | 0.60 | 0.74 | 0.82 | 0.78 | 0.78 | 0.76 | 0.74 | 0.73 | 0.69 | 0.67 | 0.48 | 0.46 | 0.45 | 0.17 | 0.11 | 0.10 | 0.10 | 0.09 | 0.07 | 0.06 | 0.05 | 0.04 | 0.03 | 0.03 | NA | NA | NA | NA | |

| Increase Decrease In Accounts Receivable | 4.17 | 4.49 | 0.77 | -0.08 | -1.23 | -2.38 | 2.84 | 2.56 | 2.55 | -0.56 | -3.21 | 7.92 | 2.08 | 4.43 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Increase Decrease In Inventories | -0.97 | -3.53 | 3.63 | 1.26 | 3.36 | -3.17 | 1.44 | 5.47 | 6.88 | -0.88 | 6.13 | -1.97 | 0.79 | 1.66 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Increase Decrease In Accounts Payable | 4.93 | 3.27 | -1.42 | 0.99 | 5.57 | -3.39 | -1.55 | 4.68 | -0.34 | -0.53 | 2.14 | -0.43 | 2.38 | -2.85 | 1.46 | -8.51 | 4.40 | 0.87 | 2.96 | 2.63 | 2.26 | -0.49 | 1.08 | 1.14 | 1.47 | 0.99 | 1.44 | -1.00 | NA | NA | NA | NA | |

| Share Based Compensation | 14.07 | 11.16 | 12.86 | 12.51 | 12.31 | 12.37 | 12.99 | 14.27 | 10.79 | 11.79 | 12.37 | 11.12 | 9.71 | 9.83 | 10.61 | 6.99 | 5.34 | 4.73 | 4.11 | 6.23 | 2.81 | 2.61 | 2.23 | 2.04 | 2.84 | 1.01 | 0.59 | 0.42 | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

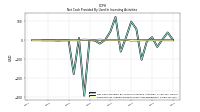

| Net Cash Provided By Used In Investing Activities | 2.20 | 41.40 | 4.36 | -35.41 | 16.30 | -6.07 | -104.19 | 59.65 | 98.95 | 14.44 | -60.45 | 123.91 | 46.08 | 1.82 | -17.75 | -1.69 | 1.68 | -294.81 | 12.26 | -179.65 | -0.30 | -0.22 | -1.52 | -0.15 | -0.13 | -0.20 | NA | NA | NA | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 0.06 | 0.06 | 0.29 | 0.36 | -0.02 | 0.57 | NA | NA | -1.11 | 2.01 | 0.43 | 0.64 | 0.43 | 1.23 | 2.98 | 0.67 | 1.73 | 2.97 | 0.20 | 0.04 | 0.30 | 0.22 | 0.46 | 0.15 | 0.13 | 0.20 | 0.04 | 0.03 | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 0.89 | 15.59 | 0.84 | 134.69 | 0.48 | 0.21 | 164.22 | 0.08 | 1.98 | 1.71 | 1.68 | 9.52 | 27.79 | 3.23 | 4.39 | 191.39 | 0.76 | 434.48 | 0.02 | 1.12 | 0.06 | -0.50 | 186.47 | -0.04 | 127.49 | -2.77 | NA | NA | NA | NA | NA | NA |

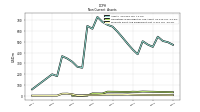

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 48.29 | 43.31 | 38.30 | 33.45 | 36.34 | 35.97 | 32.49 | 29.22 | 24.20 | 23.22 | 23.57 | 25.16 | 19.49 | 15.45 | 7.09 | 0.06 | 0.00 | 0.00 | 25.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 48.29 | 43.31 | 38.30 | 33.45 | 36.34 | 35.97 | 32.49 | 29.22 | 24.20 | 23.22 | 23.57 | 25.16 | 19.49 | 15.45 | 7.09 | 0.06 | 0.00 | 0.00 | 25.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Collaboration Arrangement | 1.58 | 1.49 | 0.98 | 0.22 | 3.46 | 3.66 | 1.00 | 0.41 | 0.50 | 1.54 | 1.52 | 5.19 | 0.01 | 0.28 | 2.27 | 0.06 | 0.00 | 0.00 | 25.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Product | 46.71 | 41.82 | 37.32 | 33.22 | 32.88 | 32.32 | 31.50 | 28.81 | 23.70 | 21.68 | 22.05 | 19.96 | 19.47 | 15.16 | 4.83 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Product,US | 35.35 | 32.66 | 28.92 | 24.62 | 25.59 | 24.48 | 23.73 | 23.41 | 21.48 | 19.98 | 20.73 | 19.29 | 18.50 | 14.70 | 4.83 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Product, Non Us | -6.59 | 9.16 | 8.40 | 8.60 | 7.29 | 7.84 | 7.76 | 5.40 | 2.21 | 1.71 | 1.32 | 0.68 | 1.00 | 0.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Revenue From Contract With Customer Including Assessed Tax | 48.29 | 43.31 | 38.30 | 33.45 | 36.34 | 35.97 | 32.49 | 29.22 | 24.20 | 23.22 | 23.57 | 25.16 | 19.49 | 15.45 | 7.09 | 0.06 | 0.00 | 0.00 | 25.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |