| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-31 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | 2010-06-18 | 2010-03-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 2.10 | 2.10 | 2.10 | 2.10 | 2.09 | 2.11 | 2.11 | 2.11 | 2.11 | 2.11 | 2.10 | 2.10 | 2.10 | 2.00 | 2.00 | 1.99 | 2.00 | 2.00 | 2.00 | 2.02 | 2.04 | 2.08 | 2.08 | 2.01 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.01 | 2.01 | 2.01 | 2.01 | 2.01 | 2.01 | 2.01 | 2.00 | 1.96 | 1.96 | 1.96 | 1.96 | 1.96 | 1.96 | 1.95 | 1.95 | 1.95 | 1.68 | 1.68 | 1.68 | 1.68 | 1.67 | 1.67 | 1.55 | NA | NA | NA | |

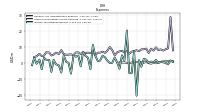

| Earnings Per Share Basic | 0.04 | 0.12 | 0.17 | 0.03 | 0.08 | 0.12 | 0.24 | 0.04 | -0.02 | -0.02 | -0.10 | -0.82 | -1.04 | -0.40 | -0.36 | -0.17 | 0.67 | 0.06 | 0.14 | 0.04 | 0.12 | 0.15 | 0.14 | 0.02 | 0.12 | 0.11 | 0.18 | 0.04 | 0.12 | 0.15 | 0.22 | 0.08 | 0.14 | 0.12 | 0.12 | 0.05 | 0.32 | 0.22 | 0.27 | 0.02 | 0.15 | 0.04 | 0.08 | -0.02 | 0.10 | -0.24 | 0.05 | 0.02 | 0.03 | -0.01 | -0.00 | -0.07 | NA | -0.02 | 0.01 | NA | |

| Earnings Per Share Diluted | 0.04 | 0.12 | 0.17 | 0.03 | 0.08 | 0.12 | 0.23 | 0.04 | -0.02 | -0.02 | -0.10 | -0.82 | -1.04 | -0.40 | -0.36 | -0.17 | 0.66 | 0.06 | 0.14 | 0.04 | 0.12 | 0.15 | 0.14 | 0.02 | 0.12 | 0.11 | 0.18 | 0.04 | 0.12 | 0.15 | 0.22 | 0.08 | 0.14 | 0.12 | 0.12 | 0.05 | 0.32 | 0.22 | 0.26 | 0.02 | 0.15 | 0.04 | 0.08 | -0.02 | 0.10 | -0.24 | 0.05 | 0.02 | 0.03 | -0.01 | -0.00 | -0.07 | NA | -0.02 | 0.01 | NA |

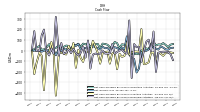

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-31 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | 2010-06-18 | 2010-03-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

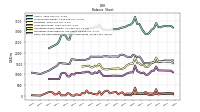

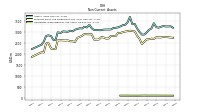

| Revenue From Contract With Customer Excluding Assessed Tax | 263.55 | 276.52 | 291.25 | 243.55 | 255.06 | 268.21 | 281.41 | 196.83 | 189.93 | 179.47 | 124.79 | 72.94 | 59.05 | 50.07 | 20.38 | 170.00 | 237.52 | 240.28 | 257.92 | 202.38 | 223.41 | 220.82 | 237.95 | 181.53 | 207.04 | 223.49 | 243.27 | 196.21 | 206.62 | 220.24 | 256.66 | 213.03 | 233.80 | 238.50 | 249.80 | 208.89 | 223.63 | 229.22 | 229.93 | 190.08 | 201.47 | 210.64 | 224.18 | 181.30 | 266.40 | 183.87 | 185.55 | 121.42 | 223.32 | 179.00 | 169.50 | 122.27 | 180.86 | 151.11 | 151.12 | 112.83 | |

| Revenues | 263.55 | 276.52 | 291.25 | 243.55 | 255.06 | 268.21 | 281.41 | 196.83 | 189.93 | 179.47 | 124.79 | 72.94 | 59.05 | 50.07 | 20.38 | 170.00 | 237.52 | 240.28 | 257.92 | 202.38 | 223.41 | 220.82 | 237.95 | 181.53 | 207.04 | 223.49 | 243.27 | 196.21 | 206.62 | 220.24 | 256.66 | 213.03 | 233.80 | 238.50 | 249.80 | 208.89 | 223.63 | 229.22 | 229.93 | 190.08 | 201.47 | 210.64 | 224.18 | 181.30 | 266.40 | 183.87 | 185.55 | 121.42 | 223.32 | 179.00 | 169.50 | 122.27 | 180.86 | 151.11 | 151.12 | 112.83 | |

| Costs And Expenses | 237.15 | 233.76 | 236.65 | 217.84 | 219.16 | 220.42 | 217.73 | 182.42 | 183.74 | 168.81 | 136.07 | 234.56 | 278.08 | 111.87 | 88.90 | 189.51 | 75.21 | 211.03 | 211.96 | 185.88 | 189.03 | 176.59 | 200.01 | 168.01 | 171.52 | 189.17 | 192.62 | 176.91 | 172.87 | 178.94 | 198.56 | 188.72 | 195.51 | 197.09 | 205.64 | 187.48 | 189.43 | 191.04 | 174.90 | 180.02 | 179.97 | 188.68 | 191.71 | 179.27 | 234.25 | 202.81 | 162.40 | 125.90 | 201.73 | 164.63 | 154.90 | 126.56 | 167.49 | 144.35 | 136.39 | 114.76 | |

| General And Administrative Expense | 8.37 | 7.53 | 8.28 | 7.87 | 9.52 | 7.52 | 8.73 | 6.03 | 8.76 | 8.34 | 8.29 | 7.16 | 7.75 | 7.27 | 6.83 | 5.56 | 7.45 | 6.32 | 7.40 | 7.06 | 6.42 | 4.52 | 7.83 | 9.79 | 7.51 | 6.11 | 6.83 | 6.26 | 6.21 | 4.68 | 6.74 | 6.00 | 6.27 | 6.05 | 6.33 | 5.41 | 6.39 | 6.37 | 4.69 | 5.19 | 5.02 | 4.93 | 5.29 | 7.84 | 5.38 | 6.23 | 5.00 | 4.48 | 6.35 | 6.45 | 4.37 | 4.07 | 5.53 | 3.95 | 3.56 | NA | |

| Interest Expense | 16.36 | 15.97 | 15.57 | 17.17 | 15.42 | 9.07 | 9.68 | 4.12 | 7.80 | 10.05 | 10.71 | 8.48 | 10.33 | 10.82 | 11.63 | 21.22 | 8.32 | 14.18 | 12.42 | 11.66 | 10.59 | 10.23 | 10.27 | 9.88 | 9.69 | 9.69 | 9.59 | 9.51 | 9.49 | 9.50 | 11.07 | 11.66 | 13.72 | 12.91 | 12.84 | 13.22 | 14.46 | 14.69 | 14.60 | 14.53 | 14.77 | 14.47 | 14.46 | 13.58 | 17.06 | 12.73 | 12.51 | 11.47 | 8.32 | 13.61 | 12.34 | 11.14 | 15.07 | 11.24 | 11.09 | 8.13 | |

| Interest Paid Net | 15.66 | 15.39 | 14.95 | 14.37 | 13.33 | 9.82 | 13.84 | 10.55 | 10.28 | 10.60 | 11.14 | 10.48 | 10.72 | 11.17 | 11.81 | 10.04 | 11.14 | 11.20 | 11.29 | 10.12 | 10.09 | 9.49 | 9.81 | 9.16 | 9.11 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | -0.10 | 0.22 | 0.42 | -0.23 | 1.66 | 0.31 | 0.69 | -0.05 | 1.83 | 2.37 | -2.55 | 1.61 | -20.60 | 7.21 | -6.62 | -6.44 | 20.09 | 1.22 | 4.57 | -3.85 | 0.16 | 3.17 | -0.05 | -0.18 | 1.19 | 3.38 | 4.39 | 1.25 | 1.04 | 4.39 | 11.04 | -4.08 | 3.00 | 4.17 | 6.73 | -2.33 | 4.43 | 3.73 | 4.32 | -6.85 | -0.17 | 0.59 | 4.61 | -6.14 | -1.80 | -0.92 | 1.85 | -5.77 | 1.73 | 1.80 | 3.09 | -4.09 | 1.84 | -0.66 | 3.09 | -1.63 | |

| Income Taxes Paid Net | 0.02 | 0.81 | 1.82 | 0.01 | 2.03 | 1.34 | 3.26 | 0.00 | 0.46 | 0.56 | 0.94 | -0.33 | -0.04 | 0.25 | 0.09 | -0.31 | 0.16 | 0.15 | 1.14 | 0.02 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

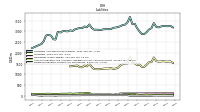

| Profit Loss | 10.98 | 27.33 | 39.13 | 9.19 | 18.39 | 28.55 | 52.70 | 10.06 | -2.95 | -1.77 | -19.12 | -171.57 | -208.31 | -79.64 | -73.39 | -34.69 | 134.58 | 11.57 | 29.07 | 8.98 | 24.01 | 31.44 | 28.01 | 4.34 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 10.95 | 27.27 | 38.97 | 9.16 | 18.33 | 28.46 | 52.52 | 10.03 | -2.94 | -1.76 | -19.03 | -170.85 | -207.44 | -79.59 | -72.78 | -34.56 | 134.05 | 11.53 | 28.96 | 8.95 | 24.01 | 31.44 | 28.01 | 4.34 | 24.77 | 21.62 | 36.59 | 8.89 | 23.91 | 29.94 | 44.17 | 16.78 | 25.70 | 24.46 | 24.82 | 10.64 | 63.62 | 43.81 | 51.92 | 4.04 | 29.55 | 8.56 | 15.07 | -4.13 | 16.63 | -44.78 | 8.94 | 2.62 | 4.94 | -1.01 | -0.56 | -11.04 | 1.87 | -3.53 | 0.84 | -8.35 | |

| Comprehensive Income Net Of Tax | 5.12 | 27.21 | 42.66 | 9.31 | 18.33 | 28.46 | 52.52 | 10.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Preferred Stock Dividends Income Statement Impact | 2.46 | 2.45 | 2.45 | 2.45 | 2.46 | 2.45 | 2.45 | 2.45 | 2.46 | 2.45 | 2.45 | 2.45 | 2.46 | 0.84 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 8.49 | 24.82 | 36.51 | 6.70 | 15.87 | 26.00 | 50.06 | 7.57 | -5.39 | -4.22 | -21.49 | -173.30 | -209.90 | -80.44 | -72.78 | -34.56 | 134.05 | 11.50 | 28.93 | 8.91 | 23.99 | 31.44 | 28.01 | 4.34 | 24.77 | 21.62 | 36.59 | 8.89 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-31 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | 2010-06-18 | 2010-03-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

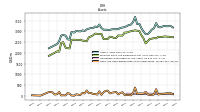

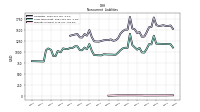

| Assets | 3238.69 | 3256.32 | 3224.74 | 3183.52 | 3207.54 | 3386.21 | 3144.81 | 3089.23 | 2965.31 | 2871.65 | 2869.07 | 2994.05 | 3146.77 | 3354.12 | 3338.27 | 3671.04 | 3425.77 | 3315.20 | 3295.46 | 3240.88 | 3197.58 | 3178.33 | 3162.44 | 3101.75 | 3100.86 | 3099.93 | 3097.01 | 3068.75 | 3069.46 | 3078.45 | 3077.00 | 3155.53 | 3320.46 | 3190.35 | 3227.27 | 3146.66 | 3158.35 | 3125.68 | 3091.72 | 3016.84 | 3047.77 | 2997.23 | 3004.86 | 3016.16 | 2944.04 | 2973.24 | 2616.18 | 2630.45 | 2798.64 | 2837.61 | 2802.11 | 2548.79 | 2414.61 | NA | NA | NA | |

| Liabilities | 1589.70 | 1605.72 | 1594.68 | 1588.24 | 1611.36 | 1782.75 | 1562.89 | 1560.31 | 1444.34 | 1347.38 | 1342.66 | 1448.85 | 1427.85 | 1511.93 | 1531.70 | 1794.44 | 1504.70 | 1504.84 | 1469.65 | 1410.94 | 1306.99 | 1262.11 | 1251.14 | 1284.00 | 1267.21 | 1267.31 | 1262.27 | 1247.45 | 1232.68 | 1234.07 | 1239.23 | 1338.69 | 1495.85 | 1367.59 | 1405.20 | 1325.98 | 1329.36 | 1403.48 | 1394.60 | NA | 1367.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Liabilities And Stockholders Equity | 3238.69 | 3256.32 | 3224.74 | 3183.52 | 3207.54 | 3386.21 | 3144.81 | 3089.23 | 2965.31 | 2871.65 | 2869.07 | 2994.05 | 3146.77 | 3354.12 | 3338.27 | 3671.04 | 3425.77 | 3315.20 | 3295.46 | 3240.88 | 3197.58 | 3178.33 | 3162.44 | 3101.75 | 3100.86 | 3099.93 | 3097.01 | 3068.75 | 3069.46 | 3078.45 | 3077.00 | 3155.53 | 3320.46 | 3190.35 | 3227.27 | 3146.66 | 3158.35 | 3125.68 | 3091.72 | 3016.84 | 3047.77 | 2997.23 | 3004.86 | 3016.16 | 2944.04 | 2973.24 | 2616.18 | 2630.45 | 2798.64 | 2837.61 | 2802.11 | 2548.79 | 2414.61 | NA | NA | NA | |

| Stockholders Equity | 1642.08 | 1643.91 | 1623.26 | 1588.84 | 1589.88 | 1597.28 | 1575.73 | 1522.93 | 1515.21 | 1518.80 | 1518.90 | 1537.83 | 1711.11 | 1833.78 | 1798.40 | 1868.11 | 1912.49 | 1802.36 | 1817.90 | 1822.26 | 1882.90 | 1916.21 | 1911.30 | 1817.75 | 1833.64 | 1832.62 | 1834.74 | 1821.30 | 1836.79 | 1844.38 | 1837.76 | 1816.84 | 1824.61 | 1822.75 | 1822.07 | 1820.69 | 1828.99 | 1722.20 | 1697.12 | 1663.72 | 1680.69 | 1666.76 | 1673.94 | 1674.54 | 1695.11 | 1701.40 | 1486.10 | 1489.30 | 1502.16 | 1509.56 | 1523.74 | 1536.56 | 1413.52 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-31 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | 2010-06-18 | 2010-03-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

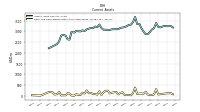

| Cash And Cash Equivalents At Carrying Value | 121.59 | 102.74 | 98.56 | 76.50 | 67.56 | 313.87 | 71.71 | 41.58 | 38.62 | 66.50 | 192.94 | 99.83 | 111.80 | 110.56 | 87.84 | 387.82 | 122.52 | 26.72 | 41.90 | 36.52 | 43.86 | 169.65 | 134.55 | 69.09 | 183.57 | 166.62 | 149.65 | 112.43 | 243.09 | 235.97 | 166.55 | 48.90 | 213.58 | 61.98 | 84.12 | 87.16 | 144.37 | 119.07 | 253.90 | 111.48 | 144.58 | 43.45 | 54.25 | 77.38 | 9.62 | 21.60 | 104.82 | 128.57 | 26.29 | 28.78 | 20.92 | 186.42 | 84.20 | 61.28 | 155.42 | 181.40 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 167.17 | 145.24 | 136.09 | 122.54 | 107.18 | 359.86 | 114.07 | 80.46 | 75.51 | 97.83 | 219.63 | 123.95 | 134.85 | 142.03 | 124.20 | 434.90 | 179.79 | 76.30 | 89.47 | 83.38 | 91.60 | 212.28 | 176.12 | 107.49 | 223.77 | 208.94 | 191.13 | 161.18 | 289.16 | NA | NA | NA | 272.92 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-31 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | 2010-06-18 | 2010-03-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

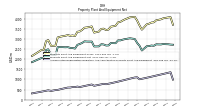

| Property Plant And Equipment Gross | 4059.99 | 4042.35 | 3989.63 | 3964.18 | 3942.83 | 3841.20 | 3829.02 | 3772.20 | 3737.81 | 3605.04 | 3474.50 | 3687.35 | 3927.69 | 4113.34 | 4100.68 | 4088.94 | 4038.55 | 3989.43 | 3931.36 | 3864.84 | 3838.05 | 3669.05 | 3646.25 | 3624.61 | 3480.98 | 3453.43 | 3524.38 | 3513.10 | 3381.88 | 3353.51 | 3329.15 | 3636.95 | 3608.64 | 3586.67 | 3572.51 | 3466.13 | 3388.76 | 3371.65 | 3159.17 | 3188.75 | 3168.09 | 3207.38 | 3173.96 | 3153.04 | 3131.18 | 3089.49 | 2681.51 | 2673.08 | 2667.68 | 2962.71 | 2901.03 | 2474.57 | 2468.29 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 1304.79 | 1276.71 | 1249.24 | 1221.61 | 1194.36 | 1166.82 | 1139.96 | 1113.08 | 1086.36 | 1060.55 | 1034.94 | 1010.19 | 1110.34 | 1099.35 | 1070.78 | 1041.93 | 1011.78 | 981.41 | 951.88 | 922.49 | 893.44 | 866.16 | 839.74 | 813.65 | 788.70 | 765.21 | 785.18 | 759.58 | 735.20 | 711.47 | 687.85 | 751.61 | 726.47 | 701.48 | 676.13 | 650.12 | 624.37 | 648.66 | 623.34 | 625.69 | 600.55 | 599.34 | 573.33 | 546.39 | 519.72 | 482.64 | 474.30 | 453.88 | 433.18 | 462.99 | 439.32 | 417.98 | 396.69 | NA | NA | NA | |

| Property Plant And Equipment Net | 2755.20 | 2765.65 | 2740.39 | 2742.57 | 2748.48 | 2674.38 | 2689.06 | 2659.12 | 2651.44 | 2544.49 | 2439.55 | 2677.16 | 2817.36 | 3013.99 | 3029.91 | 3047.01 | 3026.77 | 3008.02 | 2979.49 | 2942.35 | 2944.62 | 2802.89 | 2806.51 | 2810.97 | 2692.29 | 2688.21 | 2739.19 | 2753.52 | 2646.68 | 2642.03 | 2641.30 | 2885.34 | 2882.18 | 2885.19 | 2896.38 | 2816.01 | 2764.39 | 2722.99 | 2535.83 | 2563.06 | 2567.53 | 2608.03 | 2600.63 | 2606.65 | 2611.45 | 2606.85 | 2207.20 | 2219.20 | 2234.50 | 2499.72 | 2461.70 | 2056.59 | 2071.60 | NA | NA | NA |

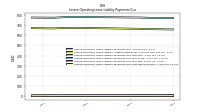

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-31 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | 2010-06-18 | 2010-03-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 1177.01 | 1179.25 | 1181.43 | 1183.58 | 1185.79 | 1366.44 | 1170.01 | 1173.58 | 1067.22 | 982.79 | 986.25 | 1089.67 | 1048.70 | 1100.14 | 1152.29 | 1411.91 | 1090.10 | 1093.65 | 1076.76 | 1034.91 | 977.97 | 931.64 | 934.52 | 937.60 | 937.79 | 940.80 | 943.72 | 918.01 | 920.54 | 922.96 | 925.29 | 1025.53 | 1177.70 | 1056.20 | 1097.33 | 1034.66 | 1038.33 | 1125.31 | 1125.73 | 1088.26 | 1091.86 | 1060.30 | 1064.07 | 1077.66 | 988.73 | 1018.47 | 900.62 | 903.33 | 1042.93 | 1075.89 | 1036.09 | 779.14 | 780.88 | NA | NA | NA | |

| Minority Interest | 6.91 | 6.68 | 6.80 | 6.44 | 6.30 | 6.19 | 6.19 | 5.99 | 5.75 | 5.48 | 7.51 | 7.38 | 7.82 | 8.40 | 8.17 | 8.49 | 8.57 | 8.00 | 7.91 | 7.68 | 7.70 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

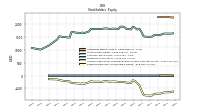

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-31 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | 2010-06-18 | 2010-03-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 1642.08 | 1643.91 | 1623.26 | 1588.84 | 1589.88 | 1597.28 | 1575.73 | 1522.93 | 1515.21 | 1518.80 | 1518.90 | 1537.83 | 1711.11 | 1833.78 | 1798.40 | 1868.11 | 1912.49 | 1802.36 | 1817.90 | 1822.26 | 1882.90 | 1916.21 | 1911.30 | 1817.75 | 1833.64 | 1832.62 | 1834.74 | 1821.30 | 1836.79 | 1844.38 | 1837.76 | 1816.84 | 1824.61 | 1822.75 | 1822.07 | 1820.69 | 1828.99 | 1722.20 | 1697.12 | 1663.72 | 1680.69 | 1666.76 | 1673.94 | 1674.54 | 1695.11 | 1701.40 | 1486.10 | 1489.30 | 1502.16 | 1509.56 | 1523.74 | 1536.56 | 1413.52 | NA | NA | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 1648.98 | 1650.60 | 1630.06 | 1595.27 | 1596.18 | 1603.46 | 1581.92 | 1528.92 | 1520.96 | 1524.27 | 1526.41 | 1545.20 | 1718.92 | 1842.19 | 1806.57 | 1876.60 | 1921.06 | 1810.35 | 1825.81 | 1829.94 | 1890.59 | 1916.21 | 1911.30 | 1817.75 | 1833.64 | NA | NA | NA | 1836.79 | NA | NA | NA | 1824.61 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Common Stock Value | 2.10 | 2.10 | 2.10 | 2.10 | 2.09 | 2.11 | 2.11 | 2.11 | 2.11 | 2.11 | 2.10 | 2.10 | 2.10 | 2.00 | 2.00 | 1.99 | 2.00 | 2.00 | 2.00 | 2.02 | 2.04 | 2.08 | 2.08 | 2.01 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.01 | 2.01 | 2.01 | 2.01 | 2.01 | 2.01 | 2.01 | 2.00 | 1.96 | 1.96 | 1.96 | 1.96 | 1.96 | 1.96 | 1.95 | 1.95 | 1.95 | 1.68 | 1.68 | 1.68 | 1.68 | 1.67 | 1.67 | 1.55 | NA | NA | NA | |

| Additional Paid In Capital | 2291.30 | 2289.50 | NA | NA | 2288.43 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -649.33 | -651.53 | -670.06 | -700.29 | -700.69 | -703.75 | -723.29 | -773.36 | -780.93 | -775.54 | -771.32 | -749.83 | -576.53 | -366.63 | -286.20 | -213.42 | -178.86 | -287.58 | -273.85 | -277.44 | -245.62 | -243.83 | -249.12 | -250.84 | -229.81 | -229.30 | -225.64 | -236.96 | -220.58 | -217.27 | -224.00 | -242.84 | -234.28 | -234.72 | -233.87 | -233.41 | -218.77 | -261.74 | -285.34 | -317.04 | -300.88 | -313.70 | -305.54 | -303.89 | -283.04 | -283.95 | -223.46 | -218.87 | -207.94 | -199.36 | -184.82 | -170.74 | -146.08 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -2.04 | 3.80 | 3.83 | 0.15 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 6.91 | 6.68 | 6.80 | 6.44 | 6.30 | 6.19 | 6.19 | 5.99 | 5.75 | 5.48 | 7.51 | 7.38 | 7.82 | 8.40 | 8.17 | 8.49 | 8.57 | 8.00 | 7.91 | 7.68 | 7.70 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

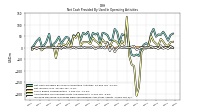

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-31 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | 2010-06-18 | 2010-03-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 52.88 | 70.26 | 56.35 | 58.07 | 48.21 | 82.54 | 62.33 | 13.15 | 20.03 | 14.09 | -1.48 | -34.94 | -28.98 | -34.56 | -30.40 | 10.26 | 57.58 | 54.81 | 59.04 | 21.86 | 69.35 | 81.84 | 34.51 | 33.60 | 55.08 | 62.09 | 65.45 | 21.91 | 63.04 | 57.94 | 64.93 | 29.68 | 69.74 | 57.88 | 65.54 | 34.40 | 64.19 | 49.88 | 54.92 | 10.84 | 43.55 | 47.17 | 34.80 | 18.21 | 48.47 | 25.83 | 17.10 | 1.74 | 60.96 | 24.93 | 10.68 | 7.66 | 42.56 | 28.75 | 13.18 | 0.58 | |

| Net Cash Provided By Used In Investing Activities | -19.67 | -49.92 | -29.61 | -21.64 | -98.83 | -16.56 | -22.35 | -110.87 | -124.00 | -129.63 | 203.38 | -11.96 | -9.82 | -8.71 | -20.75 | -39.70 | 75.07 | -51.52 | -59.00 | -30.29 | -176.76 | -16.38 | -27.52 | -123.65 | -9.71 | -16.80 | -28.25 | -123.85 | -22.27 | 40.18 | 91.44 | -23.70 | -12.83 | -13.62 | -107.17 | -70.02 | 7.09 | -162.97 | 72.04 | -21.73 | 44.66 | -37.64 | -27.42 | -21.60 | -12.62 | -426.77 | -11.28 | 81.56 | -17.24 | -15.08 | -374.58 | -49.24 | -17.71 | -118.64 | -222.80 | -11.37 | |

| Net Cash Provided By Used In Financing Activities | -11.28 | -11.19 | -13.19 | -21.06 | -202.07 | 179.81 | -6.38 | 102.67 | 81.64 | -6.25 | -106.22 | 36.00 | 31.62 | 61.11 | -259.55 | 284.54 | -29.16 | -16.45 | 6.05 | 0.21 | -13.27 | -29.30 | 61.64 | -26.24 | -28.42 | -28.32 | 0.02 | -28.72 | -33.63 | -28.70 | -38.72 | -170.66 | 94.70 | -66.41 | 38.59 | -21.59 | -45.98 | -21.74 | 15.46 | -22.22 | 12.93 | -20.33 | -30.50 | 71.14 | -47.83 | 317.72 | -29.57 | 18.97 | -46.21 | -1.99 | 198.40 | 143.81 | -1.92 | -4.26 | 183.64 | 14.80 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-31 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | 2010-06-18 | 2010-03-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 52.88 | 70.26 | 56.35 | 58.07 | 48.21 | 82.54 | 62.33 | 13.15 | 20.03 | 14.09 | -1.48 | -34.94 | -28.98 | -34.56 | -30.40 | 10.26 | 57.58 | 54.81 | 59.04 | 21.86 | 69.35 | 81.84 | 34.51 | 33.60 | 55.08 | 62.09 | 65.45 | 21.91 | 63.04 | 57.94 | 64.93 | 29.68 | 69.74 | 57.88 | 65.54 | 34.40 | 64.19 | 49.88 | 54.92 | 10.84 | 43.55 | 47.17 | 34.80 | 18.21 | 48.47 | 25.83 | 17.10 | 1.74 | 60.96 | 24.93 | 10.68 | 7.66 | 42.56 | 28.75 | 13.18 | 0.58 | |

| Net Income Loss | 10.95 | 27.27 | 38.97 | 9.16 | 18.33 | 28.46 | 52.52 | 10.03 | -2.94 | -1.76 | -19.03 | -170.85 | -207.44 | -79.59 | -72.78 | -34.56 | 134.05 | 11.53 | 28.96 | 8.95 | 24.01 | 31.44 | 28.01 | 4.34 | 24.77 | 21.62 | 36.59 | 8.89 | 23.91 | 29.94 | 44.17 | 16.78 | 25.70 | 24.46 | 24.82 | 10.64 | 63.62 | 43.81 | 51.92 | 4.04 | 29.55 | 8.56 | 15.07 | -4.13 | 16.63 | -44.78 | 8.94 | 2.62 | 4.94 | -1.01 | -0.56 | -11.04 | 1.87 | -3.53 | 0.84 | -8.35 | |

| Profit Loss | 10.98 | 27.33 | 39.13 | 9.19 | 18.39 | 28.55 | 52.70 | 10.06 | -2.95 | -1.77 | -19.12 | -171.57 | -208.31 | -79.64 | -73.39 | -34.69 | 134.58 | 11.57 | 29.07 | 8.98 | 24.01 | 31.44 | 28.01 | 4.34 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 2.03 | 2.01 | 2.76 | 1.97 | 1.94 | 1.93 | 2.77 | 1.16 | 2.09 | 2.08 | 2.78 | 1.78 | 1.69 | 1.64 | 2.34 | 1.56 | 1.50 | 1.22 | 2.21 | 1.45 | 1.47 | -0.31 | 1.96 | 2.46 | 1.43 | 1.43 | 2.02 | 1.32 | 1.31 | 0.65 | 1.99 | 1.37 | 1.32 | 1.40 | 1.81 | 1.19 | 1.21 | 1.42 | 1.64 | 1.05 | 0.99 | 0.98 | 1.38 | 1.86 | 1.30 | 0.97 | 1.32 | 0.94 | 1.16 | 1.04 | 1.36 | 0.94 | 1.17 | 0.88 | 1.13 | 0.79 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-31 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | 2010-06-18 | 2010-03-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -19.67 | -49.92 | -29.61 | -21.64 | -98.83 | -16.56 | -22.35 | -110.87 | -124.00 | -129.63 | 203.38 | -11.96 | -9.82 | -8.71 | -20.75 | -39.70 | 75.07 | -51.52 | -59.00 | -30.29 | -176.76 | -16.38 | -27.52 | -123.65 | -9.71 | -16.80 | -28.25 | -123.85 | -22.27 | 40.18 | 91.44 | -23.70 | -12.83 | -13.62 | -107.17 | -70.02 | 7.09 | -162.97 | 72.04 | -21.73 | 44.66 | -37.64 | -27.42 | -21.60 | -12.62 | -426.77 | -11.28 | 81.56 | -17.24 | -15.08 | -374.58 | -49.24 | -17.71 | -118.64 | -222.80 | -11.37 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-31 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | 2010-06-18 | 2010-03-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -11.28 | -11.19 | -13.19 | -21.06 | -202.07 | 179.81 | -6.38 | 102.67 | 81.64 | -6.25 | -106.22 | 36.00 | 31.62 | 61.11 | -259.55 | 284.54 | -29.16 | -16.45 | 6.05 | 0.21 | -13.27 | -29.30 | 61.64 | -26.24 | -28.42 | -28.32 | 0.02 | -28.72 | -33.63 | -28.70 | -38.72 | -170.66 | 94.70 | -66.41 | 38.59 | -21.59 | -45.98 | -21.74 | 15.46 | -22.22 | 12.93 | -20.33 | -30.50 | 71.14 | -47.83 | 317.72 | -29.57 | 18.97 | -46.21 | -1.99 | 198.40 | 143.81 | -1.92 | -4.26 | 183.64 | 14.80 | |

| Payments Of Dividends Common Stock | 6.38 | 6.38 | 6.38 | 12.77 | 6.41 | 0.00 | 0.00 | 0.01 | 0.00 | 0.00 | 0.00 | 0.12 | 0.00 | 0.00 | 0.00 | 25.56 | 25.30 | 25.19 | 25.45 | 26.11 | 26.19 | 25.95 | 25.21 | 25.36 | 25.09 | 25.09 | 25.09 | 25.27 | 25.14 | 25.15 | 25.14 | 25.35 | 25.10 | 25.16 | 25.12 | 20.73 | 20.11 | 20.09 | 20.09 | 16.81 | 16.64 | 16.64 | 16.67 | 15.74 | 15.64 | 0.00 | 26.92 | 13.46 | 13.43 | 13.44 | 13.43 | 0.08 | 0.00 | 0.00 | 0.00 | 4.32 | |

| Payments For Repurchase Of Common Stock | 0.00 | 0.00 | 2.01 | 0.41 | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 10.00 | 0.00 | 2.80 | 10.00 | 30.00 | 32.96 | 0.00 | -0.03 | 0.18 | 0.01 | 0.00 | 0.00 | 0.53 | 5.68 | 0.83 | 0.00 | 0.69 | 0.00 | 0.00 | 0.00 | 2.73 | 0.52 | 0.00 | 0.00 | 1.90 | 0.00 | 0.00 | 0.33 | 1.62 | 0.02 | 0.00 | 0.00 | 2.95 | 0.00 | 0.75 | 0.00 | 3.10 | 0.00 | 0.00 | 1.94 | 2.02 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-07 | 2012-06-15 | 2012-03-23 | 2011-12-31 | 2011-09-09 | 2011-06-17 | 2011-03-25 | 2010-12-31 | 2010-09-10 | 2010-06-18 | 2010-03-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 263.55 | 276.52 | 291.25 | 243.55 | 255.06 | 268.21 | 281.41 | 196.83 | 189.93 | 179.47 | 124.79 | 72.94 | 59.05 | 50.07 | 20.38 | 170.00 | 237.52 | 240.28 | 257.92 | 202.38 | 223.41 | 220.82 | 237.95 | 181.53 | 207.04 | 223.49 | 243.27 | 196.21 | 206.62 | 220.24 | 256.66 | 213.03 | 233.80 | 238.50 | 249.80 | 208.89 | 223.63 | 229.22 | 229.93 | 190.08 | 201.47 | 210.64 | 224.18 | 181.30 | 266.40 | 183.87 | 185.55 | 121.42 | 223.32 | 179.00 | 169.50 | 122.27 | 180.86 | 151.11 | 151.12 | 112.83 | |

| Food And Beverage | 66.89 | 64.72 | 68.37 | 59.78 | 61.94 | 61.94 | 68.61 | 45.75 | 41.69 | 36.51 | 25.61 | 13.93 | 12.04 | 9.59 | 3.04 | 43.91 | 53.46 | 50.62 | 60.71 | 50.47 | 48.81 | 42.92 | 51.57 | 40.79 | 42.86 | 42.65 | 52.76 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Hotel Owned | 23.54 | 25.46 | 25.56 | 23.10 | 22.04 | 21.27 | 19.78 | 18.91 | 15.24 | 14.22 | 12.28 | 8.60 | 8.34 | 7.32 | 4.24 | 14.29 | 15.30 | 15.54 | 15.57 | 15.26 | 13.33 | 12.15 | 11.32 | 11.76 | 11.55 | 12.85 | 13.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Occupancy | 173.12 | 186.33 | 197.32 | 160.67 | 171.08 | 184.99 | 193.03 | 132.17 | 133.00 | 128.74 | 86.90 | 50.41 | 38.67 | 33.17 | 13.10 | 111.80 | 168.76 | 174.11 | 181.63 | 136.65 | 161.26 | 165.75 | 175.06 | 128.98 | 152.63 | 167.99 | 177.48 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | 263.55 | 276.52 | 291.25 | 243.55 | 255.06 | 268.21 | 281.41 | 196.83 | 189.93 | 179.47 | 124.79 | 72.94 | 59.05 | 50.07 | 20.38 | 170.00 | 237.52 | 240.28 | 257.92 | 202.38 | 223.41 | 220.82 | 237.95 | 181.53 | 207.04 | 223.49 | 243.27 | 196.21 | 206.62 | 220.24 | 256.66 | 213.03 | 233.80 | 238.50 | 249.80 | 208.89 | 223.63 | 229.22 | 229.93 | 190.08 | 201.47 | 210.64 | 224.18 | 181.30 | 266.40 | 183.87 | 185.55 | 121.42 | 223.32 | 179.00 | 169.50 | 122.27 | 180.86 | 151.11 | 151.12 | 112.83 | |

| Food And Beverage | 66.89 | 64.72 | 68.37 | 59.78 | 61.94 | 61.94 | 68.61 | 45.75 | 41.69 | 36.51 | 25.61 | 13.93 | 12.04 | 9.59 | 3.04 | 43.91 | 53.46 | 50.62 | 60.71 | 50.47 | 48.81 | 42.92 | 51.57 | 40.79 | 42.86 | 42.65 | 52.76 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Hotel Owned | 23.54 | 25.46 | 25.56 | 23.10 | 22.04 | 21.27 | 19.78 | 18.91 | 15.24 | 14.22 | 12.28 | 8.60 | 8.34 | 7.32 | 4.24 | 14.29 | 15.30 | 15.54 | 15.57 | 15.26 | 13.33 | 12.15 | 11.32 | 11.76 | 11.55 | 12.85 | 13.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Occupancy | 173.12 | 186.33 | 197.32 | 160.67 | 171.08 | 184.99 | 193.03 | 132.17 | 133.00 | 128.74 | 86.90 | 50.41 | 38.67 | 33.17 | 13.10 | 111.80 | 168.76 | 174.11 | 181.63 | 136.65 | 161.26 | 165.75 | 175.06 | 128.98 | 152.63 | 167.99 | 177.48 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |