| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

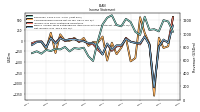

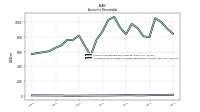

| Earnings Per Share Basic | -0.29 | -2.22 | -0.20 | 0.21 | -0.11 | -0.10 | -0.04 | 0.10 | -0.22 | -0.21 | -0.43 | -0.12 | -0.71 | -0.29 | -0.13 | -0.12 | -0.03 | 0.03 | 0.10 | 0.09 | 0.04 | 0.20 | -0.21 | 0.25 | NA | NA | NA | NA | |

| Earnings Per Share Diluted | -0.29 | -2.22 | -0.20 | 0.21 | -0.11 | -0.10 | -0.04 | 0.10 | -0.22 | -0.21 | -0.43 | -0.12 | -0.71 | -0.29 | -0.13 | -0.12 | -0.03 | 0.03 | 0.10 | 0.09 | 0.04 | 0.20 | -0.21 | 0.25 | NA | NA | NA | NA |

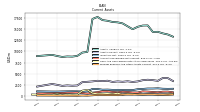

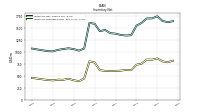

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

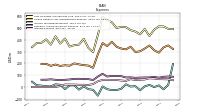

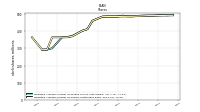

| Revenue From Contract With Customer Excluding Assessed Tax | 1035.00 | 1068.00 | 1057.00 | 1257.00 | 981.00 | 1028.00 | 1177.00 | 1225.00 | 1112.00 | 1131.00 | 1279.00 | 1242.00 | 1139.70 | 889.60 | 586.30 | 657.70 | 787.00 | 771.30 | 781.60 | 731.10 | 799.30 | 761.10 | 770.20 | 736.20 | 754.30 | 697.10 | 732.80 | 704.80 | |

| Revenue From Contract With Customer Including Assessed Tax | 1035.00 | 1068.00 | 1057.00 | 1257.00 | 981.00 | 1026.00 | 1175.00 | 1226.00 | 1112.00 | 1131.00 | 1278.00 | 1243.00 | 1139.70 | 889.60 | 586.30 | 657.70 | 787.00 | 771.30 | 781.60 | 731.10 | 799.30 | 761.10 | 770.20 | 736.20 | 754.30 | 697.10 | 732.80 | 704.80 | |

| Revenues | 1035.00 | 1068.00 | 1057.00 | 1257.00 | 981.00 | 1028.00 | 1177.00 | 1225.00 | 1112.00 | 1131.00 | 1279.00 | 1242.00 | 1139.70 | 889.60 | 586.30 | 657.70 | 787.00 | 771.30 | 781.60 | 731.10 | 799.30 | 761.10 | 770.20 | 736.20 | 754.30 | 697.10 | 732.80 | 704.80 | |

| Cost Of Goods And Services Sold | 516.00 | 487.00 | 434.00 | 494.00 | 448.00 | 472.00 | 484.00 | 509.00 | 512.00 | 502.00 | 551.00 | 569.00 | 596.20 | 441.80 | 295.90 | 332.70 | 410.10 | 360.40 | 356.00 | 343.80 | 412.50 | 369.80 | 431.50 | 360.00 | 405.00 | 376.20 | 374.00 | 338.60 | |

| Costs And Expenses | 1162.00 | 2165.00 | 1136.00 | 1149.00 | 1064.00 | 1070.00 | 1195.00 | 1154.00 | 1234.00 | 1261.00 | 1515.00 | 1322.00 | 1457.80 | 1098.60 | 663.40 | 725.50 | 791.30 | 783.80 | 731.40 | 686.30 | 801.50 | 682.30 | 810.20 | 658.70 | 909.70 | 706.20 | NA | NA | |

| Research And Development Expense | 79.00 | 86.00 | 81.00 | 81.00 | 80.00 | 78.00 | 82.00 | 81.00 | 92.00 | 94.00 | 94.00 | 89.00 | 112.70 | 88.10 | 59.40 | 66.80 | 67.30 | 69.90 | 68.80 | 64.10 | 61.10 | 58.90 | 61.40 | 65.20 | 62.00 | 61.90 | NA | NA | |

| Selling General And Administrative Expense | 292.00 | 313.00 | 353.00 | 327.00 | 304.00 | 298.00 | 343.00 | 320.00 | 327.00 | 342.00 | 385.00 | 348.00 | 374.10 | 277.70 | 162.80 | 182.00 | 185.90 | 192.30 | 200.90 | 181.10 | 185.10 | 179.00 | 191.10 | 180.00 | 196.80 | 194.70 | NA | NA | |

| Interest Expense | 67.00 | 72.00 | 74.00 | 64.00 | 62.00 | 60.00 | 67.00 | 52.00 | 55.00 | 60.00 | 60.00 | 61.00 | 60.40 | 48.10 | 24.80 | 16.50 | 18.70 | 18.70 | 20.70 | 20.80 | 21.00 | 8.60 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Income Tax Expense Benefit | 14.00 | -1.00 | 18.00 | 5.00 | -28.00 | 7.00 | 4.00 | 23.00 | -15.00 | -26.00 | -26.00 | -19.00 | 4.70 | -74.00 | -23.90 | -18.70 | 5.20 | -22.50 | 14.30 | 13.30 | -18.60 | 18.60 | 22.80 | 4.80 | 6.10 | 11.60 | 15.00 | 45.40 | |

| Net Income Loss | -141.00 | -1096.00 | -97.00 | 103.00 | -55.00 | -49.00 | -22.00 | 48.00 | -105.00 | -104.00 | -210.00 | -61.00 | -322.80 | -135.00 | -53.20 | -49.10 | -9.50 | 10.00 | 35.90 | 31.50 | 16.40 | 60.20 | -62.80 | 72.70 | -161.50 | -20.70 | -30.20 | -98.30 | |

| Comprehensive Income Net Of Tax | 75.00 | -1297.00 | -68.00 | 185.00 | 560.00 | -407.00 | -485.00 | 71.00 | -160.00 | -315.00 | -43.00 | -466.00 | 102.00 | -42.00 | -25.40 | -118.00 | 69.30 | -27.70 | 71.50 | 3.30 | 4.50 | 154.70 | -285.70 | 191.30 | -193.00 | -24.70 | NA | NA |

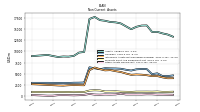

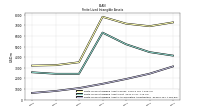

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

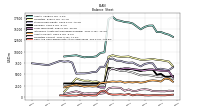

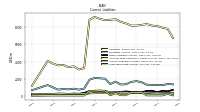

| Assets | 14362.00 | 14344.00 | 15796.00 | 15769.00 | 15491.00 | 14948.00 | 15601.00 | 16251.00 | 16483.00 | 16565.00 | 16833.00 | 16988.00 | 17692.70 | 17237.00 | 9876.00 | 9727.20 | 8985.80 | 8823.70 | 8856.90 | 8747.40 | 8956.70 | 9211.50 | NA | NA | 8940.30 | NA | NA | NA | |

| Liabilities | 8139.00 | 8210.00 | 8376.00 | 8289.00 | 8202.00 | 8203.00 | 8461.00 | 8639.00 | 8945.00 | 8883.00 | 8853.00 | 8981.00 | 9216.80 | 8892.80 | 3224.10 | 3065.70 | 3438.90 | 3336.00 | 3591.40 | 3551.20 | 3759.20 | 4074.40 | NA | NA | 1160.00 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 14362.00 | 14344.00 | 15796.00 | 15769.00 | 15491.00 | 14948.00 | 15601.00 | 16251.00 | 16483.00 | 16565.00 | 16833.00 | 16988.00 | 17692.70 | 17237.00 | 9876.00 | 9727.20 | 8985.80 | 8823.70 | 8856.90 | 8747.40 | 8956.70 | 9211.50 | NA | NA | 8940.30 | NA | NA | NA | |

| Stockholders Equity | 6223.00 | 6134.00 | 7420.00 | 7480.00 | 7289.00 | 6745.00 | 7140.00 | 7612.00 | 7538.00 | 7682.00 | 7980.00 | 8007.00 | 8475.90 | 8344.20 | 6651.90 | 6661.50 | 5546.90 | 5487.70 | 5265.50 | 5196.20 | 5197.50 | 5137.10 | 7576.10 | 7902.10 | 7780.30 | 7962.70 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 3407.00 | 3565.00 | 3652.00 | 3548.00 | 3279.00 | 3154.00 | 3307.00 | 3194.00 | 3276.00 | 3160.00 | 3431.00 | 3344.00 | 3416.50 | 3281.40 | 3191.30 | 3120.60 | 2373.10 | 2310.40 | 2383.50 | 2278.30 | 2504.90 | 2703.70 | NA | NA | 2123.70 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 352.00 | 369.00 | 367.00 | 318.00 | 345.00 | 460.00 | 507.00 | 342.00 | 638.00 | 453.00 | 580.00 | 515.00 | 494.70 | 659.90 | 1391.10 | 1206.40 | 334.00 | 309.20 | 385.10 | 272.10 | 474.80 | 300.00 | 321.00 | 263.40 | 323.40 | 343.60 | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 352.00 | 369.00 | 367.00 | 318.00 | 345.00 | 460.00 | 507.00 | 342.00 | 638.00 | 453.00 | 580.00 | 515.00 | 505.40 | 670.60 | 1401.80 | 1217.10 | 345.10 | 320.30 | 396.60 | 300.60 | 677.50 | 934.90 | 321.00 | 263.40 | 323.40 | 343.60 | NA | NA | |

| Accounts Receivable Net Current | 842.00 | 911.00 | 1000.00 | 1051.00 | 797.00 | 804.00 | 916.00 | 973.00 | 833.00 | 924.00 | 1067.00 | 1028.00 | 871.60 | 762.30 | 543.90 | 676.80 | 816.90 | 758.30 | 757.20 | 684.10 | 651.80 | 606.10 | NA | NA | 567.40 | NA | NA | NA | |

| Inventory Net | 1735.00 | 1690.00 | 1690.00 | 1596.00 | 1538.00 | 1340.00 | 1334.00 | 1345.00 | 1373.00 | 1383.00 | 1450.00 | 1424.00 | 1578.10 | 1597.10 | 1065.30 | 1019.00 | 1050.70 | 1068.70 | 1053.10 | 1035.50 | 1004.10 | 1008.70 | NA | NA | 1062.30 | NA | NA | NA | |

| Inventory Finished Goods | 857.00 | 831.00 | 834.00 | 749.00 | 725.00 | 612.00 | 618.00 | 603.00 | 598.00 | 595.00 | 599.00 | 613.00 | 771.40 | 797.10 | 439.50 | 384.20 | 402.90 | 435.10 | 412.40 | 415.50 | 400.70 | 408.10 | NA | NA | 452.00 | NA | NA | NA | |

| Inventory L I F O Reserve | 64.00 | 58.00 | 58.00 | 57.00 | 58.00 | 54.00 | 51.00 | 49.00 | 46.00 | 43.00 | 38.00 | 30.00 | 28.70 | 31.10 | 33.70 | 38.00 | 39.30 | 39.10 | 42.20 | 44.20 | 47.40 | 43.10 | NA | NA | 40.10 | NA | NA | NA | |

| Inventory Raw Materials And Supplies | 128.00 | 145.00 | 141.00 | 299.00 | 266.00 | 240.00 | 222.00 | 219.00 | 256.00 | 255.00 | 227.00 | 211.00 | 210.20 | 167.00 | 84.10 | 80.70 | 83.90 | 84.60 | 72.70 | 83.70 | 80.40 | 71.40 | NA | NA | 70.40 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 310.00 | 371.00 | 370.00 | 370.00 | 394.00 | 326.00 | 338.00 | 315.00 | 237.00 | 242.00 | 227.00 | 273.00 | 256.30 | 180.60 | 107.40 | 132.10 | 87.40 | 98.00 | 102.30 | 114.80 | 113.90 | 123.20 | NA | NA | 136.10 | NA | NA | NA |

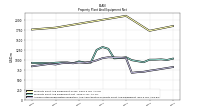

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 1841.00 | NA | NA | NA | 1722.00 | NA | NA | NA | 2096.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 1801.00 | NA | NA | NA | 1754.40 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 815.00 | NA | NA | 744.00 | 723.00 | 696.00 | 688.00 | 670.00 | 1041.00 | 1050.00 | 1054.00 | 1060.00 | 1038.00 | 982.70 | 942.10 | 919.70 | 930.50 | 909.30 | 921.20 | 909.30 | 878.60 | 894.50 | NA | NA | 834.10 | NA | NA | NA | |

| Amortization Of Intangible Assets | 138.00 | 140.00 | 136.00 | 134.00 | 130.00 | 128.00 | 133.00 | 137.00 | 139.00 | 141.00 | 129.00 | 147.00 | 163.70 | 95.60 | 49.00 | 51.60 | 51.40 | 50.70 | 49.30 | 49.00 | 50.10 | 48.70 | 49.40 | 49.20 | 60.20 | 51.60 | NA | NA | |

| Property Plant And Equipment Net | 1026.00 | 992.00 | 1007.00 | 1000.00 | 999.00 | 936.00 | 961.00 | 987.00 | 1061.00 | 1041.00 | 1033.00 | 1271.00 | 1316.30 | 1242.50 | 924.10 | 930.10 | 955.30 | 911.70 | 931.10 | 930.20 | 922.40 | 909.30 | NA | NA | 920.30 | NA | NA | NA | |

| Goodwill | 5094.00 | 4902.00 | 6040.00 | 6061.00 | 5993.00 | 5716.00 | 5898.00 | 6116.00 | 6172.00 | 6191.00 | 6239.00 | 6016.00 | 6224.80 | 6434.70 | 3044.00 | 3004.00 | 2989.60 | 2946.40 | 2959.60 | 2933.10 | 2958.00 | 2968.80 | NA | NA | 2969.20 | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 4494.00 | 4475.00 | 4678.00 | 4791.00 | 4842.00 | 4766.00 | 5059.00 | 5395.00 | 5587.00 | 5816.00 | 5755.00 | 6032.00 | 6387.30 | 5785.60 | 2432.70 | 2455.50 | 2482.80 | 2435.00 | 2352.80 | 2386.50 | 2453.00 | 2514.80 | NA | NA | 2672.80 | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 4147.00 | NA | NA | NA | 4477.00 | NA | NA | NA | 5218.00 | NA | NA | NA | 6312.30 | NA | NA | NA | 2433.40 | NA | NA | NA | 2433.40 | NA | NA | NA | 2575.60 | NA | NA | NA | |

| Other Assets Noncurrent | 341.00 | 410.00 | 419.00 | 369.00 | 378.00 | 376.00 | 376.00 | 559.00 | 387.00 | 357.00 | 375.00 | 325.00 | 347.80 | 492.80 | 283.90 | 217.00 | 185.00 | 220.20 | 229.90 | 219.30 | 103.10 | 100.00 | NA | NA | 242.00 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

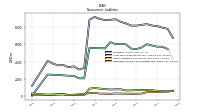

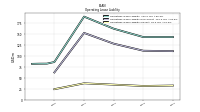

| Liabilities Current | 1241.00 | 1265.00 | 1284.00 | 1578.00 | 1702.00 | 1613.00 | 1338.00 | 1307.00 | 1643.00 | 1362.00 | 1990.00 | 2034.00 | 2076.30 | 1871.20 | 835.40 | 707.50 | 818.50 | 741.50 | 777.50 | 708.20 | 970.70 | 1245.40 | NA | NA | 643.10 | NA | NA | NA | |

| Long Term Debt Current | 38.00 | 39.00 | 39.00 | 381.00 | 388.00 | 394.00 | 56.00 | 61.00 | 294.00 | 61.00 | 555.00 | 605.00 | 554.50 | 553.60 | 25.90 | 26.00 | 24.50 | 24.50 | 27.10 | 29.00 | 29.00 | NA | NA | NA | 0.00 | NA | NA | NA | |

| Accounts Payable Current | 270.00 | 296.00 | 354.00 | 381.00 | 390.00 | 350.00 | 386.00 | 402.00 | 418.00 | 436.00 | 506.00 | 411.00 | 501.00 | 355.90 | 242.50 | 215.00 | 222.60 | 206.10 | 242.90 | 252.10 | 205.20 | 202.70 | NA | NA | 203.80 | NA | NA | NA | |

| Other Liabilities Current | 409.00 | 574.00 | 559.00 | 377.00 | 454.00 | 435.00 | 499.00 | 438.00 | 430.00 | 390.00 | 502.00 | 573.00 | 576.90 | 531.90 | 321.70 | 217.60 | 244.40 | 181.50 | 205.40 | 191.20 | 199.00 | 178.60 | NA | NA | 184.50 | NA | NA | NA | |

| Contract With Customer Liability Current | 367.00 | 356.00 | 332.00 | 329.00 | 324.00 | 298.00 | 284.00 | 295.00 | 316.00 | 316.00 | 303.00 | 331.00 | 295.30 | 278.60 | 164.00 | 192.70 | 211.00 | 182.20 | 176.00 | 171.70 | 169.90 | 147.90 | NA | NA | 165.50 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

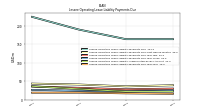

| Long Term Debt | 5774.00 | 5909.00 | 6062.00 | 6020.00 | 5836.00 | 5901.00 | 6063.00 | 6134.00 | 6319.00 | 6334.00 | 6097.00 | 6161.00 | 6126.90 | 6140.10 | 2056.30 | 2061.60 | 2355.00 | 2360.10 | 2409.10 | 2465.60 | 2472.30 | NA | NA | NA | NA | NA | NA | NA | |

| Long Term Debt Noncurrent | 5736.00 | 5870.00 | 6023.00 | 5639.00 | 5448.00 | 5507.00 | 6007.00 | 6073.00 | 6025.00 | 6273.00 | 5542.00 | 5556.00 | 5572.40 | 5586.50 | 2030.40 | 2035.60 | 2330.50 | 2335.60 | 2382.00 | 2436.60 | 2443.30 | 2478.50 | NA | NA | 0.00 | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 567.00 | 643.00 | 658.00 | 663.00 | 662.00 | 618.00 | 620.00 | 747.00 | 745.00 | 726.00 | 767.00 | 828.00 | 900.30 | 823.10 | 65.50 | 90.20 | 100.80 | 81.10 | 147.80 | 131.80 | 114.60 | 125.00 | NA | NA | 251.90 | NA | NA | NA | |

| Pension And Other Postretirement Defined Benefit Plans Liabilities Noncurrent | 184.00 | NA | NA | 164.00 | 161.00 | 240.00 | 254.00 | 270.00 | 271.00 | 302.00 | 317.00 | 316.00 | 345.70 | 299.10 | 83.90 | 82.10 | 82.50 | 81.40 | 108.40 | 106.20 | 109.10 | 136.00 | NA | NA | 139.00 | NA | NA | NA | |

| Other Liabilities Noncurrent | 411.00 | 432.00 | 411.00 | 245.00 | 229.00 | 225.00 | 242.00 | 242.00 | 261.00 | 220.00 | 237.00 | 247.00 | 322.10 | 312.90 | 208.90 | 150.30 | 106.60 | 96.40 | 175.70 | 168.40 | 121.50 | 89.50 | NA | NA | 126.00 | NA | NA | NA | |

| Operating Lease Liability Noncurrent | 110.00 | NA | NA | NA | 111.00 | NA | NA | NA | 127.00 | NA | NA | NA | 151.40 | NA | NA | NA | 61.70 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

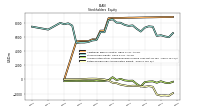

| Stockholders Equity | 6223.00 | 6134.00 | 7420.00 | 7480.00 | 7289.00 | 6745.00 | 7140.00 | 7612.00 | 7538.00 | 7682.00 | 7980.00 | 8007.00 | 8475.90 | 8344.20 | 6651.90 | 6661.50 | 5546.90 | 5487.70 | 5265.50 | 5196.20 | 5197.50 | 5137.10 | 7576.10 | 7902.10 | 7780.30 | 7962.70 | NA | NA | |

| Additional Paid In Capital | 8777.00 | 8763.00 | 8752.00 | 8744.00 | 8738.00 | 8724.00 | 8712.00 | 8699.00 | 8696.00 | 8680.00 | 8663.00 | 8647.00 | 8650.10 | 8620.40 | 6886.10 | 6870.30 | 5636.30 | 5646.40 | 5396.50 | 5398.70 | 5403.30 | 5347.40 | NA | NA | 0.00 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -2288.00 | -2147.00 | -1051.00 | -954.00 | -1057.00 | -972.00 | -923.00 | -901.00 | -949.00 | -852.00 | -748.00 | -538.00 | -477.20 | -154.40 | -19.40 | 33.80 | 84.30 | 93.80 | 83.80 | 47.90 | 16.40 | NA | NA | NA | 0.00 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -266.00 | -482.00 | -281.00 | -310.00 | -392.00 | -1007.00 | -649.00 | -186.00 | -209.00 | -146.00 | 65.00 | -102.00 | 303.00 | -121.80 | -214.80 | -242.60 | -173.70 | -252.50 | -214.80 | -250.40 | -222.20 | -210.30 | NA | NA | -256.60 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

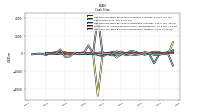

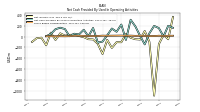

| Net Cash Provided By Used In Operating Activities | 157.00 | 198.00 | 61.00 | -145.00 | 13.00 | 189.00 | 312.00 | -62.00 | 223.00 | 89.00 | 149.00 | 22.00 | -92.90 | -111.70 | 159.30 | 4.30 | 126.30 | 39.60 | 52.60 | 5.60 | 139.50 | 163.90 | 136.90 | 47.00 | 6.70 | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -35.00 | -36.00 | -43.00 | -55.00 | -76.00 | -37.00 | -37.00 | -29.00 | -74.00 | -441.00 | -25.00 | 10.00 | -73.30 | -4696.90 | 10.60 | -19.60 | -74.30 | -83.00 | -49.00 | -28.50 | -48.10 | -21.40 | -23.10 | -34.40 | -35.50 | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -139.00 | -157.00 | 39.00 | 174.00 | -84.00 | -169.00 | -96.00 | -200.00 | 44.00 | 231.00 | -67.00 | 2.00 | -18.30 | 4068.30 | 7.30 | 896.60 | -6.20 | -48.80 | 89.70 | -339.50 | -362.40 | 450.90 | -47.20 | -76.50 | 4.00 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 157.00 | 198.00 | 61.00 | -145.00 | 13.00 | 189.00 | 312.00 | -62.00 | 223.00 | 89.00 | 149.00 | 22.00 | -92.90 | -111.70 | 159.30 | 4.30 | 126.30 | 39.60 | 52.60 | 5.60 | 139.50 | 163.90 | 136.90 | 47.00 | 6.70 | NA | NA | NA | |

| Net Income Loss | -141.00 | -1096.00 | -97.00 | 103.00 | -55.00 | -49.00 | -22.00 | 48.00 | -105.00 | -104.00 | -210.00 | -61.00 | -322.80 | -135.00 | -53.20 | -49.10 | -9.50 | 10.00 | 35.90 | 31.50 | 16.40 | 60.20 | -62.80 | 72.70 | -161.50 | -20.70 | -30.20 | -98.30 | |

| Depreciation Depletion And Amortization | 171.00 | 173.00 | 177.00 | 173.00 | 168.00 | 167.00 | 171.00 | 176.00 | 174.00 | 170.00 | 170.00 | 202.00 | 222.20 | 132.30 | 80.90 | 81.50 | 83.40 | 78.70 | 69.30 | 83.10 | 73.70 | 72.70 | 75.30 | 74.30 | 87.10 | NA | NA | NA | |

| Share Based Compensation | 15.00 | 10.00 | 9.00 | 12.00 | 15.00 | 13.00 | 17.00 | 14.00 | 18.00 | 17.00 | 16.00 | 15.00 | 16.60 | 11.70 | 8.30 | 11.10 | 12.70 | 14.80 | 14.20 | 7.70 | 5.80 | 6.90 | 6.40 | 6.90 | 6.30 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -35.00 | -36.00 | -43.00 | -55.00 | -76.00 | -37.00 | -37.00 | -29.00 | -74.00 | -441.00 | -25.00 | 10.00 | -73.30 | -4696.90 | 10.60 | -19.60 | -74.30 | -83.00 | -49.00 | -28.50 | -48.10 | -21.40 | -23.10 | -34.40 | -35.50 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -139.00 | -157.00 | 39.00 | 174.00 | -84.00 | -169.00 | -96.00 | -200.00 | 44.00 | 231.00 | -67.00 | 2.00 | -18.30 | 4068.30 | 7.30 | 896.60 | -6.20 | -48.80 | 89.70 | -339.50 | -362.40 | 450.90 | -47.20 | -76.50 | 4.00 | NA | NA | NA |

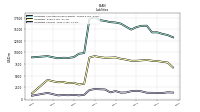

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

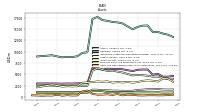

| Revenues | 1035.00 | 1068.00 | 1057.00 | 1257.00 | 981.00 | 1028.00 | 1177.00 | 1225.00 | 1112.00 | 1131.00 | 1279.00 | 1242.00 | 1139.70 | 889.60 | 586.30 | 657.70 | 787.00 | 771.30 | 781.60 | 731.10 | 799.30 | 761.10 | 770.20 | 736.20 | 754.30 | 697.10 | 732.80 | 704.80 | |

| Nutri Quest L L C, Nutri Quest L L C | 3.00 | 7.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Aqua | 43.00 | 42.00 | 50.00 | 40.00 | 43.00 | 47.00 | 42.00 | 43.00 | 33.00 | 44.00 | 44.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Cattle | 249.00 | 242.00 | 210.00 | 248.00 | 222.00 | 227.00 | 248.00 | 247.00 | 245.00 | 250.00 | 224.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Contract Manufacturing | 9.00 | 12.00 | 12.00 | 9.00 | 13.00 | 12.00 | 12.00 | 17.00 | 15.00 | 21.00 | 27.00 | 19.00 | 29.20 | 16.10 | 16.00 | 19.00 | 11.30 | 18.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Farm Animal | 610.00 | 561.00 | 527.00 | 573.00 | 552.00 | 545.00 | 553.00 | 569.00 | 604.00 | 583.00 | 567.00 | 578.00 | 613.00 | 473.00 | 316.00 | 433.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Pet Health | 416.00 | 495.00 | 518.00 | 675.00 | 416.00 | 471.00 | 612.00 | 639.00 | 494.00 | 527.00 | 685.00 | 645.00 | 497.00 | 401.00 | 254.00 | 206.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Poultry | 220.00 | 184.00 | 178.00 | 183.00 | 187.00 | 176.00 | 174.00 | 180.00 | 208.00 | 179.00 | 186.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Swine | 98.00 | 93.00 | 89.00 | 102.00 | 100.00 | 95.00 | 89.00 | 99.00 | 118.00 | 110.00 | 113.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| US | 461.00 | 479.00 | 500.00 | 543.00 | 428.00 | 475.00 | 539.00 | 522.00 | 503.00 | 507.00 | 581.00 | 533.00 | 506.10 | 421.50 | 248.10 | 299.90 | 357.60 | 388.20 | 395.00 | 383.90 | 374.60 | 382.20 | 366.40 | 360.00 | 318.40 | 321.40 | NA | NA | |

| Non Us | 574.00 | 589.00 | 557.00 | 714.00 | 553.00 | 553.00 | 638.00 | 703.00 | 609.00 | 624.00 | 698.00 | 709.00 | 633.60 | 468.10 | 338.20 | 357.80 | 429.40 | 383.10 | 386.60 | 347.20 | 424.70 | 378.90 | 403.80 | 376.20 | 435.90 | 375.70 | NA | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | 1035.00 | 1068.00 | 1057.00 | 1257.00 | 981.00 | 1028.00 | 1177.00 | 1225.00 | 1112.00 | 1131.00 | 1279.00 | 1242.00 | 1139.70 | 889.60 | 586.30 | 657.70 | 787.00 | 771.30 | 781.60 | 731.10 | 799.30 | 761.10 | 770.20 | 736.20 | 754.30 | 697.10 | 732.80 | 704.80 | |

| Nutri Quest L L C, Nutri Quest L L C | 3.00 | 7.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Aqua | 43.00 | 42.00 | 50.00 | 40.00 | 43.00 | 47.00 | 42.00 | 43.00 | 33.00 | 44.00 | 44.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Cattle | 249.00 | 242.00 | 210.00 | 248.00 | 222.00 | 227.00 | 248.00 | 247.00 | 245.00 | 250.00 | 224.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Contract Manufacturing | 9.00 | 12.00 | 12.00 | 9.00 | 13.00 | 12.00 | 12.00 | 17.00 | 15.00 | 21.00 | 27.00 | 19.00 | 29.20 | 16.10 | 16.00 | 19.00 | 11.30 | 18.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Farm Animal | 610.00 | 561.00 | 527.00 | 573.00 | 552.00 | 545.00 | 553.00 | 569.00 | 604.00 | 583.00 | 567.00 | 578.00 | 613.00 | 473.00 | 316.00 | 433.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Pet Health | 416.00 | 495.00 | 518.00 | 675.00 | 416.00 | 471.00 | 612.00 | 639.00 | 494.00 | 527.00 | 685.00 | 645.00 | 497.00 | 401.00 | 254.00 | 206.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Poultry | 220.00 | 184.00 | 178.00 | 183.00 | 187.00 | 176.00 | 174.00 | 180.00 | 208.00 | 179.00 | 186.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Swine | 98.00 | 93.00 | 89.00 | 102.00 | 100.00 | 95.00 | 89.00 | 99.00 | 118.00 | 110.00 | 113.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| US | 461.00 | 479.00 | 500.00 | 543.00 | 428.00 | 475.00 | 539.00 | 522.00 | 503.00 | 507.00 | 581.00 | 533.00 | 506.10 | 421.50 | 248.10 | 299.90 | 357.60 | 388.20 | 395.00 | 383.90 | 374.60 | 382.20 | 366.40 | 360.00 | 318.40 | 321.40 | NA | NA | |

| Non Us | 574.00 | 589.00 | 557.00 | 714.00 | 553.00 | 553.00 | 638.00 | 703.00 | 609.00 | 624.00 | 698.00 | 709.00 | 633.60 | 468.10 | 338.20 | 357.80 | 429.40 | 383.10 | 386.60 | 347.20 | 424.70 | 378.90 | 403.80 | 376.20 | 435.90 | 375.70 | NA | NA | |

| Revenue From Contract With Customer Including Assessed Tax | 1035.00 | 1068.00 | 1057.00 | 1257.00 | 981.00 | 1026.00 | 1175.00 | 1226.00 | 1112.00 | 1131.00 | 1278.00 | 1243.00 | 1139.70 | 889.60 | 586.30 | 657.70 | 787.00 | 771.30 | 781.60 | 731.10 | 799.30 | 761.10 | 770.20 | 736.20 | 754.30 | 697.10 | 732.80 | 704.80 |