| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 5.00 | 3.00 | 4.00 | 4.00 | 4.00 | 4.00 | 4.00 | 4.00 | 4.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 6.00 | 6.00 | 6.00 | 6.00 | NA | NA | NA | |

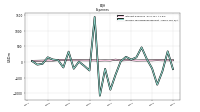

| Earnings Per Share Basic | -2.00 | 3.03 | 2.06 | 0.45 | -2.10 | 0.69 | 4.49 | 1.44 | 0.52 | 1.60 | 0.23 | -3.46 | -2.79 | -1.77 | -8.96 | 11.71 | -1.97 | -0.78 | 0.74 | -1.50 | 3570000.00 | -0.89 | 0.28 | 0.30 | 0.86 | 0.02 | 1.08 | -0.52 | |

| Earnings Per Share Diluted | -1.99 | 3.02 | 2.06 | 0.45 | -2.09 | 0.69 | 4.47 | 1.43 | 0.52 | 1.59 | 0.23 | -3.46 | -2.78 | -1.77 | -8.96 | 11.65 | -1.97 | -0.78 | 0.74 | -1.50 | 3570000.00 | -0.89 | 0.28 | 0.30 | 0.86 | 0.02 | 1.08 | -0.52 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

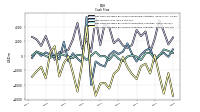

| Revenues | 2170.00 | 3624.00 | 2377.00 | 2357.00 | 1896.00 | 3009.00 | 5168.00 | 3944.00 | 3318.00 | 3615.00 | 2950.00 | 1153.00 | 516.00 | 1840.00 | -2530.00 | 12593.00 | 1689.00 | 3028.00 | 3160.00 | 1714.00 | 5155.00 | 1083.00 | 2962.00 | 2835.00 | 2922.00 | 2806.00 | 3882.00 | 2830.00 | |

| Premiums Earned Net | 281.00 | 267.00 | 280.00 | 276.00 | 250.00 | 259.00 | 238.00 | 247.00 | 231.00 | 230.00 | 241.00 | 258.00 | 243.00 | 221.00 | 244.00 | 289.00 | 300.00 | 284.00 | 280.00 | 283.00 | 271.00 | 269.00 | 275.00 | 279.00 | 299.00 | 267.00 | 277.00 | 281.00 | |

| Insurance Commissions And Fees | 599.00 | 599.00 | 594.00 | 588.00 | 792.00 | 796.00 | 813.00 | 840.00 | 882.00 | 867.00 | 939.00 | 949.00 | 948.00 | 914.00 | 879.00 | 991.00 | 937.00 | 929.00 | 941.00 | 931.00 | 943.00 | 951.00 | 987.00 | 972.00 | 832.00 | 953.00 | 935.00 | 956.00 | |

| Net Investment Income | 1223.00 | 1071.00 | 1036.00 | NA | 958.00 | 842.00 | 711.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Gain Loss On Investments | -84.00 | -346.00 | -42.00 | -21.00 | -7.00 | -65.00 | -223.00 | -336.00 | 102.00 | 165.00 | 414.00 | 182.00 | 585.00 | 21.00 | 201.00 | 65.00 | 30.00 | 199.00 | -12.00 | -11.00 | -131.00 | -35.00 | -22.00 | 102.00 | -159.00 | -12.00 | 4.00 | -24.00 | |

| Other Income | 239.00 | 266.00 | 258.00 | 251.00 | 213.00 | 197.00 | 212.00 | 203.00 | 210.00 | 220.00 | 198.00 | 167.00 | 142.00 | 155.00 | 124.00 | 156.00 | 146.00 | 142.00 | 139.00 | 127.00 | 140.00 | 135.00 | 124.00 | 117.00 | 89.00 | 102.00 | 136.00 | 118.00 | |

| Interest Expense | 57.00 | 55.00 | 55.00 | 61.00 | 53.00 | 51.00 | 50.00 | 47.00 | 60.00 | 59.00 | 51.00 | 74.00 | 48.00 | 52.00 | 48.00 | 52.00 | 54.00 | 54.00 | 57.00 | 56.00 | 60.00 | 65.00 | 60.00 | 46.00 | 45.00 | 42.00 | 38.00 | 35.00 | |

| Income Tax Expense Benefit | -228.00 | 340.00 | -292.00 | -725.00 | -208.00 | 92.00 | 467.00 | 148.00 | 77.00 | 165.00 | 21.00 | -408.00 | -885.00 | -218.00 | -1077.00 | 1440.00 | -271.00 | -124.00 | 11.00 | -215.00 | 330.00 | -175.00 | 59.00 | 79.00 | 149.00 | -59.00 | -84.00 | 30.00 | |

| Profit Loss | -589.00 | 1135.00 | 831.00 | 266.00 | -713.00 | 327.00 | 1773.00 | 639.00 | 388.00 | 765.00 | 223.00 | -1400.00 | -1136.00 | -705.00 | -3942.00 | 5447.00 | -841.00 | -316.00 | 430.00 | -709.00 | 1999.00 | -443.00 | 255.00 | 291.00 | 627.00 | 106.00 | 698.00 | -197.00 | |

| Other Comprehensive Income Loss Net Of Tax | 2037.00 | -2667.00 | -623.00 | 2478.00 | -946.00 | -2340.00 | -3773.00 | -3795.00 | 134.00 | -110.00 | 1244.00 | -3126.00 | -319.00 | 266.00 | 1642.00 | 1441.00 | -625.00 | 587.00 | 1388.00 | 882.00 | 295.00 | -284.00 | -356.00 | -832.00 | 201.00 | -9.00 | 466.00 | 137.00 | |

| Net Income Loss | -698.00 | 1064.00 | 759.00 | 177.00 | -789.00 | 273.00 | 1728.00 | 573.00 | 254.00 | 672.00 | 123.00 | -1488.00 | -1238.00 | -779.00 | -4028.00 | 5410.00 | -937.00 | -384.00 | 363.00 | -775.00 | 1938.00 | -496.00 | 158.00 | 168.00 | 483.00 | 10.00 | 608.00 | -290.00 | |

| Comprehensive Income Net Of Tax | 1327.00 | -1596.00 | 133.00 | 2653.00 | -1747.00 | -2055.00 | -2033.00 | -3218.00 | 382.00 | 565.00 | 1366.00 | -4611.00 | -1563.00 | -519.00 | -2389.00 | 6859.00 | -1565.00 | 208.00 | 1752.00 | 108.00 | 2233.00 | -781.00 | -206.00 | -670.00 | 722.00 | -2.00 | 1066.00 | -160.00 | |

| Net Income Loss Available To Common Stockholders Basic | -724.00 | 1050.00 | 733.00 | 163.00 | -815.00 | 259.00 | 1702.00 | 559.00 | 228.00 | 658.00 | 97.00 | -1501.00 | -1257.00 | -790.00 | -4038.00 | 5397.00 | -946.00 | -374.00 | 363.00 | -775.00 | NA | NA | NA | 168.00 | NA | NA | NA | -290.00 | |

| Net Income Loss Available To Common Stockholders Diluted | -724.00 | 1050.00 | 733.00 | 163.00 | -815.00 | 259.00 | 1702.00 | 559.00 | 228.00 | 658.00 | 97.00 | -1501.00 | -1257.00 | -790.00 | -4029.00 | NA | NA | NA | NA | -775.00 | 1938.00 | -496.00 | 158.00 | 168.00 | 482.00 | 10.00 | 608.00 | -291.00 |

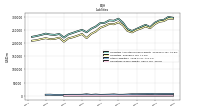

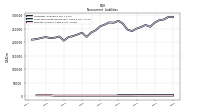

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

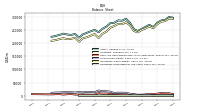

| Assets | 276814.00 | 260252.00 | 269006.00 | 261500.00 | 253468.00 | 245600.00 | 253482.00 | 277658.00 | 292262.00 | 284579.00 | 285982.00 | 276832.00 | 275397.00 | 262496.00 | 254110.00 | 240781.00 | 249870.00 | 244646.00 | 238597.00 | 232819.00 | 220797.00 | 234451.00 | 231012.00 | 232294.00 | 235648.00 | 230940.00 | 226689.00 | 223591.00 | |

| Liabilities | 271656.00 | 256335.00 | 263215.00 | 255416.00 | 249615.00 | 240413.00 | 246135.00 | 267789.00 | 278699.00 | 271264.00 | 272636.00 | 264427.00 | 258077.00 | 243549.00 | 234889.00 | 218884.00 | 234379.00 | 227830.00 | 221952.00 | 217930.00 | 205178.00 | 220437.00 | 216003.00 | 214670.00 | 218440.00 | 215065.00 | 210890.00 | 208799.00 | |

| Liabilities And Stockholders Equity | 276814.00 | 260252.00 | 269006.00 | 261500.00 | 253468.00 | 245600.00 | 253482.00 | 277658.00 | 292262.00 | 284579.00 | 285982.00 | 276832.00 | 275397.00 | 262496.00 | 254110.00 | 240781.00 | 249870.00 | 244646.00 | 238597.00 | 232819.00 | 220797.00 | 234451.00 | 231012.00 | 232294.00 | 235648.00 | 230918.00 | 226712.00 | 223591.00 | |

| Stockholders Equity | 2649.00 | 1642.00 | 3553.00 | 3754.00 | 1658.00 | 3354.00 | 5589.00 | 7954.00 | 11519.00 | 11680.00 | 11732.00 | 10693.00 | 15576.00 | 17300.00 | 17594.00 | 20086.00 | 13535.00 | 14936.00 | 14843.00 | 13143.00 | 13866.00 | 12411.00 | 13376.00 | 13565.00 | 13485.00 | 12425.00 | 12385.00 | 11271.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 8239.00 | 6096.00 | 7693.00 | 5018.00 | 4281.00 | 4139.00 | 5109.00 | 5713.00 | 5188.00 | 5255.00 | 5761.00 | 6795.00 | 6179.00 | 8684.00 | 8364.00 | 10315.00 | 4405.00 | 4471.00 | 4734.00 | 5129.00 | 4469.00 | 4777.00 | 6833.00 | 6091.00 | 4814.00 | 6446.00 | 6187.00 | 5465.00 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 8239.00 | 6096.00 | 7693.00 | 5018.00 | 4281.00 | 4139.00 | 5109.00 | 5713.00 | 5188.00 | 5255.00 | 5761.00 | 6795.00 | 6179.00 | 8684.00 | 8364.00 | 10315.00 | 4405.00 | 4471.00 | 4734.00 | 5129.00 | 4469.00 | NA | NA | NA | 4814.00 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt Noncurrent | 3820.00 | 3820.00 | 3819.00 | 3819.00 | 3322.00 | NA | NA | NA | 3839.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 1739.00 | 1639.00 | 1707.00 | 1717.00 | 1740.00 | 1479.00 | 1410.00 | 1529.00 | 1576.00 | 1492.00 | 1572.00 | 1575.00 | 1601.00 | 1552.00 | 1540.00 | 1554.00 | 1591.00 | 1542.00 | 1545.00 | 1539.00 | 1566.00 | 1460.00 | 1487.00 | 3035.00 | 3097.00 | 3010.00 | 3053.00 | NA |

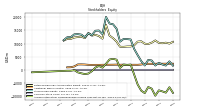

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

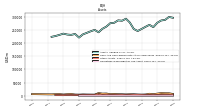

| Stockholders Equity | 2649.00 | 1642.00 | 3553.00 | 3754.00 | 1658.00 | 3354.00 | 5589.00 | 7954.00 | 11519.00 | 11680.00 | 11732.00 | 10693.00 | 15576.00 | 17300.00 | 17594.00 | 20086.00 | 13535.00 | 14936.00 | 14843.00 | 13143.00 | 13866.00 | 12411.00 | 13376.00 | 13565.00 | 13485.00 | 12425.00 | 12385.00 | 11271.00 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 4388.00 | 3281.00 | 5260.00 | 5471.00 | 3398.00 | 4833.00 | 6999.00 | 9483.00 | 13095.00 | 13172.00 | 13304.00 | 12268.00 | 17177.00 | 18852.00 | 19134.00 | 21640.00 | 15126.00 | 16478.00 | 16388.00 | 14682.00 | 15432.00 | 13871.00 | 14863.00 | 16600.00 | 16582.00 | 15435.00 | 15438.00 | 14411.00 | |

| Common Stock Value | 5.00 | 3.00 | 4.00 | 4.00 | 4.00 | 4.00 | 4.00 | 4.00 | 4.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 6.00 | 6.00 | 6.00 | 6.00 | NA | NA | NA | |

| Additional Paid In Capital | 2328.00 | 2308.00 | 2297.00 | 2298.00 | 2299.00 | 2027.00 | 1918.00 | 1933.00 | 1919.00 | 1917.00 | 1980.00 | 1928.00 | 1985.00 | 1953.00 | 1938.00 | 1930.00 | 1920.00 | 1897.00 | 1901.00 | 1881.00 | 1908.00 | 2025.00 | 2067.00 | 2050.00 | 1298.00 | 998.00 | 955.00 | NA | |

| Retained Earnings Accumulated Deficit | 10243.00 | 11163.00 | 10325.00 | 9806.00 | 9924.00 | 10839.00 | 10718.00 | 9312.00 | 8880.00 | 8857.00 | 8739.00 | 8758.00 | 10699.00 | 12032.00 | 12995.00 | 17112.00 | 11827.00 | 12835.00 | 13293.00 | 13004.00 | 13989.00 | 12031.00 | 12613.00 | 12455.00 | 12289.00 | 11751.00 | 11757.00 | 11114.00 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -7777.00 | -9802.00 | -7142.00 | -6516.00 | -8834.00 | -7876.00 | -5548.00 | -1787.00 | 2004.00 | 1876.00 | 1983.00 | 740.00 | 3863.00 | 4188.00 | 3928.00 | 2289.00 | 840.00 | 1468.00 | 876.00 | -513.00 | -1396.00 | -1595.00 | -1310.00 | -946.00 | -108.00 | -330.00 | -333.00 | NA | |

| Minority Interest | 1739.00 | 1639.00 | 1707.00 | 1717.00 | 1740.00 | 1479.00 | 1410.00 | 1529.00 | 1576.00 | 1492.00 | 1572.00 | 1575.00 | 1601.00 | 1552.00 | 1540.00 | 1554.00 | 1591.00 | 1542.00 | 1545.00 | 1539.00 | 1566.00 | 1460.00 | 1487.00 | 3035.00 | 3097.00 | 3010.00 | 3053.00 | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 172.00 | 16.00 | 21.00 | 42.00 | 181.00 | 45.00 | 29.00 | 69.00 | 197.00 | 0.00 | 18.00 | 71.00 | 46.00 | 18.00 | 19.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 82.00 | 78.00 | 85.00 | 89.00 | 83.00 | 79.00 | 100.00 | 139.00 | 97.00 | 101.00 | 87.00 | 108.00 | 75.00 | 68.00 | 69.00 | 93.00 | 70.00 | 62.00 | 56.00 | 68.00 | 62.00 | 68.00 | 81.00 | 135.00 | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

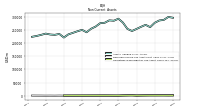

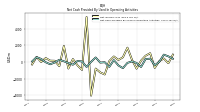

| Net Cash Provided By Used In Operating Activities | -392.00 | 410.00 | 361.00 | -587.00 | -106.00 | 79.00 | -94.00 | -730.00 | -402.00 | 241.00 | -581.00 | -14.00 | -66.00 | 553.00 | 34.00 | -582.00 | 76.00 | 133.00 | -316.00 | -109.00 | 94.00 | 281.00 | -50.00 | -264.00 | -23.00 | 378.00 | 594.00 | 72.00 | |

| Net Cash Provided By Used In Investing Activities | 115.00 | -2449.00 | -1087.00 | -1430.00 | -3215.00 | -2524.00 | -1577.00 | -171.00 | -1914.00 | -2484.00 | -4540.00 | -3751.00 | -3855.00 | -5530.00 | -2585.00 | 4147.00 | -1085.00 | -4969.00 | -2372.00 | -70.00 | -993.00 | -2863.00 | 1348.00 | 459.00 | -3121.00 | -1501.00 | -2168.00 | -2899.00 | |

| Net Cash Provided By Used In Financing Activities | 2387.00 | 470.00 | 3394.00 | 2749.00 | 3588.00 | 1513.00 | 1108.00 | 1437.00 | 2330.00 | 1751.00 | 3994.00 | 4436.00 | 1498.00 | 5285.00 | 557.00 | 2334.00 | 992.00 | 4581.00 | 2294.00 | 838.00 | 594.00 | 529.00 | -542.00 | 1074.00 | 2771.00 | 1376.00 | 2293.00 | 2630.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -392.00 | 410.00 | 361.00 | -587.00 | -106.00 | 79.00 | -94.00 | -730.00 | -402.00 | 241.00 | -581.00 | -14.00 | -66.00 | 553.00 | 34.00 | -582.00 | 76.00 | 133.00 | -316.00 | -109.00 | 94.00 | 281.00 | -50.00 | -264.00 | -23.00 | 378.00 | 594.00 | 72.00 | |

| Net Income Loss | -698.00 | 1064.00 | 759.00 | 177.00 | -789.00 | 273.00 | 1728.00 | 573.00 | 254.00 | 672.00 | 123.00 | -1488.00 | -1238.00 | -779.00 | -4028.00 | 5410.00 | -937.00 | -384.00 | 363.00 | -775.00 | 1938.00 | -496.00 | 158.00 | 168.00 | 483.00 | 10.00 | 608.00 | -290.00 | |

| Profit Loss | -589.00 | 1135.00 | 831.00 | 266.00 | -713.00 | 327.00 | 1773.00 | 639.00 | 388.00 | 765.00 | 223.00 | -1400.00 | -1136.00 | -705.00 | -3942.00 | 5447.00 | -841.00 | -316.00 | 430.00 | -709.00 | 1999.00 | -443.00 | 255.00 | 291.00 | 627.00 | 106.00 | 698.00 | -197.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

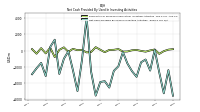

| Net Cash Provided By Used In Investing Activities | 115.00 | -2449.00 | -1087.00 | -1430.00 | -3215.00 | -2524.00 | -1577.00 | -171.00 | -1914.00 | -2484.00 | -4540.00 | -3751.00 | -3855.00 | -5530.00 | -2585.00 | 4147.00 | -1085.00 | -4969.00 | -2372.00 | -70.00 | -993.00 | -2863.00 | 1348.00 | 459.00 | -3121.00 | -1501.00 | -2168.00 | -2899.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

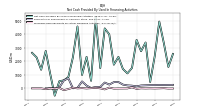

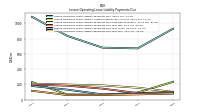

| Net Cash Provided By Used In Financing Activities | 2387.00 | 470.00 | 3394.00 | 2749.00 | 3588.00 | 1513.00 | 1108.00 | 1437.00 | 2330.00 | 1751.00 | 3994.00 | 4436.00 | 1498.00 | 5285.00 | 557.00 | 2334.00 | 992.00 | 4581.00 | 2294.00 | 838.00 | 594.00 | 529.00 | -542.00 | 1074.00 | 2771.00 | 1376.00 | 2293.00 | 2630.00 | |

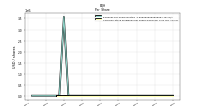

| Payments Of Dividends Common Stock | 74.00 | 77.00 | 78.00 | 72.00 | 74.00 | 75.00 | 75.00 | 70.00 | 72.00 | 74.00 | 76.00 | 74.00 | 75.00 | 76.00 | 77.00 | 69.00 | 785.00 | 74.00 | 73.00 | 68.00 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Dividends | 74.00 | 77.00 | 78.00 | 72.00 | 74.00 | 75.00 | 75.00 | 70.00 | 72.00 | 74.00 | 76.00 | 74.00 | 75.00 | 76.00 | 77.00 | 69.00 | 70.00 | 74.00 | 73.00 | 68.00 | 69.00 | 73.00 | 0.00 | 15.00 | NA | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 241.00 | 238.00 | 226.00 | 214.00 | 150.00 | 200.00 | 220.00 | 279.00 | 468.00 | 460.00 | 279.00 | 430.00 | 100.00 | 100.00 | 25.00 | 205.00 | 513.00 | 37.00 | 6.00 | 744.00 | 591.00 | 57.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 2170.00 | 3624.00 | 2377.00 | 2357.00 | 1896.00 | 3009.00 | 5168.00 | 3944.00 | 3318.00 | 3615.00 | 2950.00 | 1153.00 | 516.00 | 1840.00 | -2530.00 | 12593.00 | 1689.00 | 3028.00 | 3160.00 | 1714.00 | 5155.00 | 1083.00 | 2962.00 | 2835.00 | 2922.00 | 2806.00 | 3882.00 | 2830.00 | |

| Corporate Non | 318.00 | 257.00 | 262.00 | 281.00 | 401.00 | 363.00 | 350.00 | 374.00 | 364.00 | 479.00 | 386.00 | 334.00 | 326.00 | 300.00 | 283.00 | 299.00 | 314.00 | 303.00 | 300.00 | 312.00 | 287.00 | 280.00 | 293.00 | 288.00 | 247.00 | 288.00 | 339.00 | 340.00 | |

| Intersegment Elimination | -213.00 | -199.00 | -218.00 | -180.00 | -181.00 | -184.00 | -196.00 | -199.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Group Retirement | 250.00 | 267.00 | 267.00 | 237.00 | 249.00 | 289.00 | 301.00 | 334.00 | 354.00 | 343.00 | 346.00 | 329.00 | 319.00 | 301.00 | 246.00 | 282.00 | 286.00 | 273.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Individual Retirement | 715.00 | 693.00 | 647.00 | 588.00 | 859.00 | 1017.00 | 1022.00 | 1022.00 | 828.00 | 998.00 | 979.00 | 980.00 | 959.00 | 1079.00 | 800.00 | 1473.00 | 1072.00 | 1181.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Investment Management And Research | 1074.00 | 1034.00 | 1000.00 | 1009.00 | 971.00 | 996.00 | 1003.00 | 1135.00 | 1261.00 | 1093.00 | 1072.00 | 1004.00 | 1053.00 | 899.00 | 844.00 | 907.00 | 979.00 | 872.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Legacy | 194.00 | 198.00 | 203.00 | 206.00 | 201.00 | 204.00 | 199.00 | 215.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Protection Solutions | 807.00 | 822.00 | 784.00 | 767.00 | 824.00 | 791.00 | 836.00 | 851.00 | 862.00 | 838.00 | 832.00 | 826.00 | 800.00 | 751.00 | 728.00 | 865.00 | 842.00 | 855.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Wealth Management | 408.00 | 390.00 | 391.00 | 362.00 | 349.00 | 353.00 | 368.00 | 376.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Intersegment Elimination, Investment Advice | 280.00 | -40.00 | -37.00 | -43.00 | 33.00 | 41.00 | 32.00 | 28.00 | 32.00 | 32.00 | 32.00 | 30.00 | 31.00 | 28.00 | 27.00 | 27.00 | 79.00 | 26.00 | 26.00 | 25.00 | 72.00 | 25.00 | 25.00 | 25.00 | 29.00 | 75.00 | 50.00 | NA |