| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 46.85 | 46.84 | 46.80 | 46.76 | 46.74 | 46.93 | 46.88 | 47.49 | 47.55 | 47.71 | 47.36 | 47.33 | 47.22 | 47.19 | 32.10 | 32.07 | 31.03 | 30.93 | 30.87 | 30.85 | 30.73 | 30.72 | 30.68 | 30.67 | |

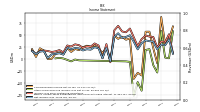

| Earnings Per Share Basic | 0.63 | 0.41 | 0.75 | 0.78 | 0.81 | 0.68 | 0.41 | 0.74 | 1.02 | 0.96 | 0.91 | 1.12 | 0.97 | -0.14 | 0.71 | 0.02 | 0.69 | 0.77 | 0.60 | 0.63 | 0.55 | 0.69 | 0.72 | 0.65 | |

| Earnings Per Share Diluted | 0.63 | 0.41 | 0.75 | 0.78 | 0.81 | 0.68 | 0.41 | 0.74 | 1.02 | 0.94 | 0.90 | 1.10 | 0.95 | -0.14 | 0.70 | 0.02 | 0.68 | 0.76 | 0.59 | 0.62 | 0.54 | 0.68 | 0.70 | 0.63 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

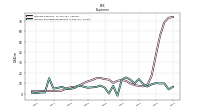

| Interest Expense | 73.75 | 72.99 | 68.64 | 55.82 | 37.10 | 17.10 | 8.04 | 6.95 | 7.46 | 8.19 | 9.77 | 12.21 | 12.99 | 12.30 | 10.27 | 13.43 | 13.95 | 14.94 | 14.70 | 12.92 | 11.70 | 9.86 | 7.53 | 6.42 | |

| Interest Income Expense Net | 101.09 | 100.93 | 101.54 | 103.66 | 110.50 | 111.38 | 102.17 | 88.18 | 89.75 | 88.48 | 86.56 | 82.58 | 85.24 | 68.83 | 55.34 | 56.25 | 57.69 | 58.30 | 57.02 | 53.02 | 51.37 | 52.76 | 51.52 | 48.43 | |

| Interest Paid Net | 75.52 | 69.30 | 63.58 | 52.63 | 32.38 | 15.68 | 7.01 | 8.63 | 6.70 | 9.93 | 9.82 | 14.79 | 12.18 | 13.42 | 12.08 | 11.00 | 13.59 | 17.59 | 13.05 | 10.82 | 10.30 | 8.42 | 7.20 | 6.07 | |

| Income Tax Expense Benefit | 6.54 | 3.98 | 9.84 | 9.70 | 10.04 | 8.93 | 6.72 | 9.31 | 14.01 | 9.72 | 13.44 | 15.59 | 13.34 | -2.04 | 7.46 | 0.08 | 5.72 | 7.72 | 6.31 | 5.97 | 5.64 | 6.70 | 7.79 | 5.48 | |

| Income Taxes Paid Net | 0.06 | 8.54 | 30.24 | -0.90 | 0.10 | 0.08 | 0.65 | 0.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | 29.38 | 19.18 | 35.31 | 36.38 | 38.15 | 31.83 | 19.35 | 35.24 | 48.84 | 45.29 | 43.30 | 52.87 | 45.61 | -5.60 | 22.87 | 0.74 | 21.57 | 23.97 | NA | NA | 17.04 | 21.38 | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | 57.67 | -28.99 | -13.84 | 19.87 | 18.01 | -66.94 | -48.95 | -77.40 | -6.78 | -5.77 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -3.65 | -1.85 | -5.76 | |

| Net Income Loss | 29.37 | 19.18 | 35.30 | 36.38 | 38.14 | 31.83 | 19.34 | 35.24 | 48.83 | 45.29 | 43.29 | 52.87 | 45.60 | -5.60 | 22.87 | 0.74 | 21.57 | 23.97 | 18.69 | 19.59 | 17.04 | 21.38 | 22.07 | 19.75 | |

| Comprehensive Income Net Of Tax | 87.04 | -9.82 | 21.46 | 56.25 | 56.15 | -35.11 | -29.61 | -42.17 | 42.05 | 39.52 | 45.64 | 41.34 | 47.91 | -4.20 | 23.82 | 11.55 | 21.11 | 27.40 | 24.73 | 26.95 | 23.82 | 17.73 | 20.21 | 14.00 | |

| Net Income Loss Available To Common Stockholders Basic | 29.37 | 19.18 | 35.30 | 36.38 | 38.14 | 31.83 | 19.34 | 35.24 | 48.83 | 45.29 | 43.29 | 52.87 | 45.60 | -5.60 | 22.87 | 0.74 | 21.46 | 23.84 | 18.59 | 19.48 | 16.95 | 21.26 | 21.95 | 19.75 | |

| Interest Income Expense After Provision For Loan Loss | 100.78 | 98.11 | 102.62 | 103.17 | 110.95 | 100.02 | 89.85 | 92.43 | 100.52 | 91.01 | 100.40 | 96.43 | 88.16 | 13.43 | 29.42 | 26.68 | 54.74 | 56.47 | 56.14 | 51.62 | 49.17 | 50.94 | 50.45 | 48.11 | |

| Noninterest Expense | 80.20 | 83.00 | 81.29 | 80.44 | 80.23 | 81.85 | 97.00 | 89.27 | 90.90 | 95.01 | 92.96 | 94.70 | 109.86 | 118.09 | 80.58 | 68.56 | 62.69 | 62.94 | 64.12 | 55.10 | 53.74 | 57.21 | 56.36 | 56.15 | |

| Noninterest Income | 15.34 | 8.04 | 23.81 | 23.35 | 17.47 | 22.59 | 33.21 | 41.39 | 53.22 | 59.01 | 49.30 | 66.73 | 80.64 | 97.03 | 81.49 | 42.70 | 35.23 | 38.15 | 32.98 | 29.04 | 27.25 | 34.35 | 35.76 | 33.27 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

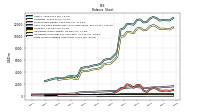

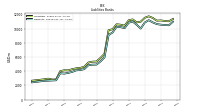

| Assets | 12604.40 | 12489.63 | 12887.40 | 13101.15 | 12847.76 | 12258.08 | 12193.86 | 12674.19 | 12597.69 | 11810.29 | 11918.37 | 11935.83 | 11207.33 | 11010.44 | 7255.54 | 6655.69 | 6124.92 | 6088.90 | 5940.40 | 5335.16 | 5136.76 | 5058.17 | 4923.25 | 4725.42 | |

| Liabilities | 11149.52 | 11116.64 | 11500.35 | 11731.36 | 11522.24 | 10976.83 | 10873.92 | 11294.32 | 11164.99 | 10409.28 | 10546.55 | 10606.63 | 9915.95 | 9765.35 | 6450.32 | 5873.36 | 5362.59 | 5344.06 | 5221.64 | 4640.58 | 4464.91 | 4409.44 | 4292.29 | 4114.34 | |

| Liabilities And Stockholders Equity | 12604.40 | 12489.63 | 12887.40 | 13101.15 | 12847.76 | 12258.08 | 12193.86 | 12674.19 | 12597.69 | 11810.29 | 11918.37 | 11935.83 | 11207.33 | 11010.44 | 7255.54 | 6655.69 | 6124.92 | 6088.90 | 5940.40 | 5335.16 | 5136.76 | 5058.17 | 4923.25 | 4725.42 | |

| Stockholders Equity | 1454.79 | 1372.90 | 1386.95 | 1369.70 | 1325.42 | 1281.16 | 1319.85 | 1379.78 | 1432.60 | 1400.91 | 1371.72 | 1329.10 | 1291.29 | 1245.00 | 805.22 | 782.33 | 762.33 | 744.84 | 718.76 | 694.58 | 671.86 | 648.73 | 630.96 | 611.08 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

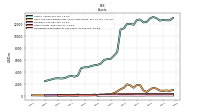

| Cash And Cash Equivalents At Carrying Value | 810.93 | 848.32 | 1160.35 | 1319.95 | 1027.05 | 618.29 | 872.86 | 1743.31 | 1797.74 | 1324.56 | 1717.10 | 1895.13 | 1317.90 | 1062.39 | 717.59 | 425.09 | 232.68 | 243.00 | 164.34 | 195.41 | 125.36 | 181.63 | 104.42 | 73.70 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 810.93 | 848.32 | 1160.35 | 1319.95 | 1027.05 | 618.29 | 872.86 | 1743.31 | 1797.74 | 1324.56 | 1717.10 | 1895.13 | 1317.90 | 1062.39 | 717.59 | 425.09 | 232.68 | 243.00 | 164.34 | 195.41 | 125.36 | 181.63 | 104.42 | 73.70 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

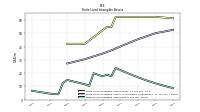

| Amortization Of Intangible Assets | 0.84 | 0.89 | 0.94 | 0.99 | 1.04 | 1.11 | 1.19 | 1.24 | 1.29 | 1.34 | 1.39 | 1.44 | 1.50 | 1.42 | 1.21 | 1.20 | 1.16 | 1.20 | 1.25 | 0.73 | 0.75 | 0.78 | 0.80 | 0.85 | |

| Goodwill | 242.56 | 242.56 | 242.56 | 242.56 | 242.56 | 242.56 | 242.56 | 242.56 | 242.56 | 242.56 | 242.56 | 242.56 | 242.56 | 236.09 | 175.44 | 174.86 | 169.05 | 168.49 | 168.49 | 137.19 | 137.19 | 137.19 | 137.19 | 137.19 | |

| Finite Lived Intangible Assets Net | 8.71 | 9.55 | 10.44 | 11.38 | 12.37 | 13.41 | 14.52 | 15.71 | 16.95 | 18.25 | 19.59 | 20.99 | 22.43 | 23.92 | 17.67 | 18.88 | 17.59 | 18.75 | 19.95 | 10.44 | 11.63 | 12.40 | 13.20 | 14.03 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deposits | 10548.29 | 10639.07 | 10872.25 | 11182.92 | 10855.83 | 10006.08 | 10543.30 | 10996.28 | 10836.90 | 10071.92 | 10203.96 | 10256.89 | 9458.04 | 9093.75 | 5952.80 | 5376.93 | 4934.94 | 4921.76 | 4842.83 | 4303.19 | 4171.72 | 4129.47 | 3909.86 | 3766.15 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 390.96 | NA | NA | NA | 415.68 | NA | NA | NA | 171.78 | NA | NA | NA | 238.32 | 438.84 | NA | NA | 304.68 | NA | NA | NA | NA | NA | 139.38 | 139.59 |

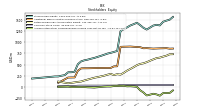

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 1454.79 | 1372.90 | 1386.95 | 1369.70 | 1325.42 | 1281.16 | 1319.85 | 1379.78 | 1432.60 | 1400.91 | 1371.72 | 1329.10 | 1291.29 | 1245.00 | 805.22 | 782.33 | 762.33 | 744.84 | 718.76 | 694.58 | 671.86 | 648.73 | 630.96 | 611.08 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 1454.89 | 1372.99 | 1387.04 | 1369.79 | 1325.52 | 1281.25 | 1319.94 | 1379.87 | 1432.69 | 1401.01 | 1371.81 | 1329.20 | 1291.38 | 1245.09 | 805.22 | 782.33 | 762.33 | 744.84 | 718.76 | NA | 671.86 | NA | NA | NA | |

| Common Stock Value | 46.85 | 46.84 | 46.80 | 46.76 | 46.74 | 46.93 | 46.88 | 47.49 | 47.55 | 47.71 | 47.36 | 47.33 | 47.22 | 47.19 | 32.10 | 32.07 | 31.03 | 30.93 | 30.87 | 30.85 | 30.73 | 30.72 | 30.68 | 30.67 | |

| Additional Paid In Capital Common Stock | 864.26 | 862.34 | 859.52 | 856.63 | 861.59 | 867.14 | 864.61 | 888.17 | 892.53 | 897.43 | 902.78 | 900.52 | 898.85 | 896.16 | 462.93 | 460.94 | 425.63 | 426.82 | 425.64 | 423.65 | 424.15 | 422.30 | 420.38 | 418.81 | |

| Retained Earnings Accumulated Deficit | 678.41 | 656.12 | 644.04 | 615.87 | 586.53 | 554.54 | 528.85 | 515.66 | 486.67 | 443.14 | 403.17 | 365.19 | 317.62 | 276.36 | 286.30 | 266.38 | 293.52 | 274.49 | 253.08 | 236.95 | 221.21 | 206.72 | 187.25 | 167.09 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -134.72 | -192.40 | -163.41 | -149.57 | -169.43 | -187.44 | -120.50 | -71.54 | 5.86 | 12.64 | 18.41 | 16.06 | 27.59 | 25.29 | 23.89 | 22.94 | 12.14 | 12.60 | 9.17 | 3.13 | -4.23 | -11.01 | -7.36 | -5.50 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 2.06 | 2.78 | 3.25 | 2.29 | 1.70 | 2.53 | 3.04 | 2.58 | 2.22 | 2.88 | 2.52 | 2.67 | 2.96 | 3.02 | 2.35 | 1.88 | 1.47 | 1.84 | 2.15 | 1.64 | 1.88 | 1.51 | 1.86 | 1.96 | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 0.01 | 0.00 | 0.01 | NA | 0.01 | 0.00 | 0.01 | NA | 0.01 | 0.00 | 0.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

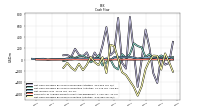

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

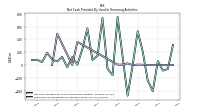

| Net Cash Provided By Used In Operating Activities | 74.36 | 30.10 | 8.23 | 98.38 | 45.67 | 215.28 | 240.24 | 288.15 | 95.92 | 34.06 | 97.08 | -172.18 | -127.24 | 5.69 | -46.04 | -101.70 | 80.08 | -3.02 | -45.58 | 32.43 | 71.46 | 61.94 | 30.96 | 47.84 | |

| Net Cash Provided By Used In Investing Activities | -175.52 | 66.66 | 71.93 | -18.28 | -165.79 | -467.99 | -632.59 | -477.75 | -374.26 | -269.61 | -220.53 | 14.84 | 238.26 | 261.17 | -234.93 | 44.93 | -96.01 | -43.98 | 47.81 | -90.73 | -184.31 | -71.01 | -191.72 | -139.47 | |

| Net Cash Provided By Used In Financing Activities | 63.78 | -408.80 | -239.76 | 212.80 | 528.89 | -1.86 | -478.10 | 135.18 | 751.52 | -156.99 | -54.58 | 734.58 | 144.49 | 77.94 | 573.47 | 249.18 | 5.62 | 125.66 | -33.31 | 128.36 | 56.57 | 86.28 | 191.47 | 45.57 |

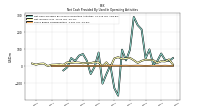

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 74.36 | 30.10 | 8.23 | 98.38 | 45.67 | 215.28 | 240.24 | 288.15 | 95.92 | 34.06 | 97.08 | -172.18 | -127.24 | 5.69 | -46.04 | -101.70 | 80.08 | -3.02 | -45.58 | 32.43 | 71.46 | 61.94 | 30.96 | 47.84 | |

| Net Income Loss | 29.37 | 19.18 | 35.30 | 36.38 | 38.14 | 31.83 | 19.34 | 35.24 | 48.83 | 45.29 | 43.29 | 52.87 | 45.60 | -5.60 | 22.87 | 0.74 | 21.57 | 23.97 | 18.69 | 19.59 | 17.04 | 21.38 | 22.07 | 19.75 | |

| Profit Loss | 29.38 | 19.18 | 35.31 | 36.38 | 38.15 | 31.83 | 19.35 | 35.24 | 48.84 | 45.29 | 43.30 | 52.87 | 45.61 | -5.60 | 22.87 | 0.74 | 21.57 | 23.97 | NA | NA | 17.04 | 21.38 | NA | NA | |

| Depreciation Depletion And Amortization | 3.82 | 2.68 | 2.45 | 2.23 | 1.91 | 2.06 | 2.01 | 2.04 | 2.13 | 2.14 | 2.09 | 2.06 | 2.08 | 1.69 | 1.62 | 1.61 | 1.35 | NA | NA | NA | NA | NA | NA | NA | |

| Deferred Income Tax Expense Benefit | -3.08 | -0.97 | 1.23 | 1.40 | -3.33 | 3.42 | 3.15 | 9.31 | 9.87 | 7.37 | 3.90 | 9.64 | 6.01 | -15.16 | -8.29 | -8.09 | 3.98 | -1.45 | -0.23 | -4.22 | 1.94 | -6.67 | 5.60 | 5.48 | |

| Share Based Compensation | 2.06 | 2.78 | 3.25 | 2.29 | 1.70 | 2.53 | 3.04 | 2.58 | 2.22 | 2.88 | 2.52 | 2.67 | 2.96 | 3.02 | 2.35 | 1.88 | 1.47 | 1.84 | 2.15 | 1.64 | 1.88 | 1.51 | 1.86 | 1.96 |

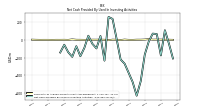

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -175.52 | 66.66 | 71.93 | -18.28 | -165.79 | -467.99 | -632.59 | -477.75 | -374.26 | -269.61 | -220.53 | 14.84 | 238.26 | 261.17 | -234.93 | 44.93 | -96.01 | -43.98 | 47.81 | -90.73 | -184.31 | -71.01 | -191.72 | -139.47 | |

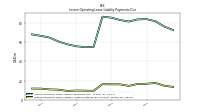

| Payments To Acquire Property Plant And Equipment | 3.67 | 3.99 | 3.13 | 9.45 | 4.57 | 2.84 | 2.62 | 0.60 | 0.91 | 4.03 | -0.88 | 2.05 | 3.28 | -2.17 | 1.81 | 3.01 | 2.76 | 3.04 | 0.10 | 0.91 | 1.54 | 2.01 | 5.89 | 0.70 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 63.78 | -408.80 | -239.76 | 212.80 | 528.89 | -1.86 | -478.10 | 135.18 | 751.52 | -156.99 | -54.58 | 734.58 | 144.49 | 77.94 | 573.47 | 249.18 | 5.62 | 125.66 | -33.31 | 128.36 | 56.57 | 86.28 | 191.47 | 45.57 | |

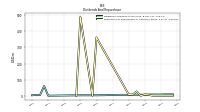

| Payments Of Dividends Common Stock | 7.03 | 7.01 | 7.02 | 6.99 | 6.10 | 6.10 | 6.11 | 6.19 | 5.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 0.00 | 0.00 | 0.00 | 4.94 | 7.24 | 0.00 | 26.54 | 6.20 | 7.16 | NA | NA | NA | NA | NA | NA | NA | 362.43 | 0.00 | NA | NA | 489.75 | 0.79 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Debit Card | 2.62 | 2.64 | 2.63 | 2.40 | 2.55 | 2.61 | 5.35 | 5.09 | 5.31 | 4.87 | 5.38 | 4.34 | 4.26 | 3.91 | 3.61 | 3.13 | 3.31 | 3.19 | 3.00 | 2.66 | 2.66 | 2.41 | 2.58 | 2.36 | |

| Deposit Account | 2.96 | 2.96 | 3.19 | 3.05 | 3.02 | 3.21 | 2.91 | 2.91 | 2.82 | 2.61 | 2.27 | 2.34 | 2.58 | 2.16 | 1.86 | 2.56 | 2.66 | 2.42 | 2.33 | 2.08 | 2.29 | 2.21 | 2.05 | 1.96 | |

| Investment Advisory Management And Administrative Service | 3.09 | 3.07 | 2.78 | 2.38 | 2.23 | 2.23 | 2.27 | 2.13 | 1.04 | 2.51 | 3.00 | 2.01 | 2.19 | 1.83 | 1.37 | 1.70 | 1.33 | 1.34 | 1.29 | 1.29 | 1.38 | 1.41 | 1.18 | 1.21 | |

| Mortgage Banking | 8.38 | 12.00 | 12.23 | 12.09 | 9.11 | 12.38 | 22.56 | 29.53 | 31.35 | 45.38 | 35.50 | 55.33 | 65.73 | 84.69 | 72.17 | 32.74 | 26.18 | 29.19 | 24.53 | 21.02 | 19.00 | 26.65 | 28.54 | 26.47 |