| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 123.60 | 123.60 | 123.60 | 123.60 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.52 | |

| dei: Entity Common Stock Shares Outstanding | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Basic | 0.44 | 0.38 | 0.42 | 0.30 | 0.38 | 0.36 | 0.33 | 0.29 | 0.37 | 0.36 | 0.31 | 0.41 | 0.26 | 0.20 | 0.24 | 0.05 | 0.27 | 0.28 | 0.25 | 0.28 | 0.25 | 0.32 | 0.24 | 0.04 | 0.22 | 0.14 | 0.18 | 0.20 | 0.19 | 0.14 | 0.14 | 0.11 | 0.14 | 0.15 | 0.16 | 0.09 | 0.13 | 0.13 | 0.13 | 0.10 | 0.16 | 0.06 | 0.11 | 0.08 | 0.09 | 0.12 | 0.11 | -0.05 | 0.08 | 0.07 | 0.13 | |

| Earnings Per Share Diluted | 0.44 | 0.38 | 0.42 | 0.30 | 0.39 | 0.36 | 0.33 | 0.29 | 0.36 | 0.36 | 0.31 | 0.41 | 0.26 | 0.20 | 0.24 | 0.05 | 0.27 | 0.28 | 0.25 | 0.27 | 0.25 | 0.32 | 0.24 | 0.04 | 0.22 | 0.14 | 0.18 | 0.20 | 0.19 | 0.14 | 0.14 | 0.11 | 0.14 | 0.15 | 0.16 | 0.09 | 0.13 | 0.13 | 0.13 | 0.10 | 0.16 | 0.06 | 0.11 | 0.08 | 0.09 | 0.12 | 0.11 | -0.05 | 0.08 | 0.07 | 0.13 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Interest And Fee Income Loans And Leases | 132.97 | 129.37 | 120.69 | 107.67 | 89.58 | 78.72 | 69.52 | 64.39 | 66.66 | 67.26 | 65.37 | 68.31 | 67.90 | 67.47 | 68.08 | 71.74 | 73.36 | 73.39 | 70.42 | 68.79 | 66.11 | 63.94 | 58.48 | 57.98 | 57.34 | 54.91 | 48.30 | 47.95 | 46.66 | 45.70 | 45.03 | 44.48 | 43.08 | 42.65 | 42.60 | 42.71 | 43.20 | 42.19 | 43.10 | 43.95 | 43.94 | 43.63 | 44.61 | 46.47 | 46.34 | 46.41 | 48.04 | 48.09 | 49.11 | 49.38 | 54.24 | |

| Insurance Commissions And Fees | 2.46 | 2.31 | 2.31 | 2.55 | 2.05 | 2.05 | 2.49 | 2.27 | 2.13 | 2.22 | 1.98 | 2.17 | 1.87 | 2.16 | 1.83 | 2.00 | 1.70 | 2.01 | 1.96 | 1.87 | 1.87 | 1.82 | 1.87 | 2.15 | 2.13 | 2.44 | 2.08 | 1.92 | 2.10 | 1.99 | 1.96 | 1.99 | 2.16 | 2.18 | 2.19 | 1.78 | 1.71 | 1.60 | 1.40 | 1.38 | 1.82 | 1.38 | 1.42 | 1.33 | 1.84 | 1.67 | 1.42 | 1.50 | 1.70 | 1.62 | 1.04 | |

| Marketing And Advertising Expense | 1.06 | 1.66 | 1.33 | 1.66 | 1.09 | 1.28 | 1.43 | 1.23 | 1.15 | 1.15 | 1.35 | 1.32 | 0.88 | 1.11 | 1.53 | 1.15 | 0.64 | 1.23 | 1.24 | 0.77 | 1.20 | 1.18 | 0.81 | 1.05 | 0.94 | 0.99 | 0.81 | 0.66 | 0.75 | 0.66 | 0.53 | 0.69 | 0.79 | NA | NA | 0.61 | 0.86 | 0.79 | 0.70 | 0.76 | 0.81 | 0.78 | 0.78 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Expense | 48.52 | 42.13 | 33.44 | 20.23 | 8.25 | 3.34 | 3.07 | 3.07 | 3.28 | 3.55 | 3.85 | 4.62 | 5.81 | 7.22 | 8.29 | 11.61 | 12.23 | 14.93 | 14.11 | 12.90 | 11.06 | 9.27 | 6.81 | 6.27 | 5.85 | 5.30 | 4.35 | 4.41 | 4.86 | 4.76 | 4.55 | 4.09 | 3.82 | 3.78 | 3.91 | 4.27 | 4.54 | 4.78 | 4.92 | 5.00 | 5.08 | 5.28 | 6.34 | 6.68 | 7.23 | 7.79 | 8.45 | 8.85 | 10.12 | 11.10 | 13.39 | |

| Interest Income Expense Net | 95.74 | 97.76 | 97.82 | 94.36 | 88.03 | 82.36 | 73.66 | 68.17 | 70.25 | 70.64 | 68.20 | 69.44 | 67.49 | 66.37 | 66.69 | 67.72 | 68.81 | 67.13 | 65.49 | 65.05 | 63.81 | 63.67 | 59.69 | 59.57 | 59.56 | 57.82 | 51.83 | 51.52 | 49.62 | 49.09 | 48.81 | 48.25 | 46.69 | 46.37 | 47.17 | 46.15 | 46.55 | 45.38 | 45.59 | 46.31 | 47.23 | 45.70 | 45.42 | 47.19 | 46.65 | 46.92 | 48.17 | 47.63 | 47.48 | 46.88 | 49.97 | |

| Interest Paid Net | 47.50 | 40.34 | 33.79 | 18.25 | 8.71 | 1.74 | 4.19 | 1.75 | 4.58 | 2.24 | 5.32 | 3.48 | 7.28 | 6.19 | 9.94 | 10.55 | 13.81 | 16.23 | 12.66 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 11.89 | 10.05 | 10.83 | 7.71 | 9.15 | 8.48 | 7.64 | 6.73 | 8.85 | 8.44 | 7.71 | 9.56 | 6.20 | 4.49 | 5.03 | 1.03 | 6.51 | 6.69 | 5.94 | 7.06 | 5.93 | 7.61 | 4.68 | 26.13 | 9.49 | 6.05 | 6.88 | 8.09 | 7.31 | 4.86 | 5.38 | 4.21 | 4.90 | 5.60 | 6.13 | 2.38 | 5.47 | 4.74 | 5.09 | 3.77 | 5.70 | 2.02 | 3.80 | 3.01 | 3.14 | 4.55 | 3.96 | -5.66 | 1.86 | 1.72 | 0.90 | |

| Income Taxes Paid Net | 10.65 | 9.95 | 16.91 | 0.02 | 10.71 | 7.00 | 7.60 | 9.02 | 0.00 | 6.17 | 16.18 | 0.03 | 9.71 | 16.08 | 0.05 | 0.08 | 4.79 | 10.18 | 0.06 | 5.08 | 7.75 | 10.97 | 0.03 | 10.51 | 6.00 | 10.36 | 1.04 | 4.20 | 5.25 | 9.50 | 1.00 | 4.33 | 0.00 | 2.50 | 1.50 | 3.00 | 4.00 | 3.70 | 0.00 | 0.00 | 0.88 | NA | NA | 2.74 | 3.20 | NA | NA | 1.50 | 0.50 | NA | NA | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | 7.30 | 1.67 | -2.83 | 4.59 | 1.72 | -8.76 | -3.75 | -14.16 | -3.26 | -0.42 | -0.42 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | 42.30 | -15.50 | -13.98 | 13.12 | 4.60 | -45.26 | -28.86 | -59.39 | -12.28 | -3.60 | 0.92 | -11.04 | -1.88 | -2.41 | 4.17 | 11.77 | -0.50 | 7.79 | 7.24 | 9.32 | -4.10 | -3.55 | -5.49 | -2.20 | 1.02 | 1.09 | 0.94 | -13.79 | -1.19 | 2.67 | 7.66 | -7.35 | 5.10 | -2.84 | 7.20 | 5.18 | -3.65 | 6.47 | 8.10 | -1.12 | -2.75 | -16.41 | -1.57 | -3.71 | 2.13 | -0.21 | 1.04 | -1.91 | 1.40 | 5.18 | NA | |

| Net Income Loss | 44.83 | 39.23 | 42.78 | 30.22 | 35.73 | 33.97 | 30.75 | 27.73 | 34.78 | 34.09 | 29.62 | 39.77 | 25.68 | 19.19 | 23.85 | 4.73 | 26.82 | 27.28 | 24.59 | 27.00 | 25.15 | 32.08 | 23.27 | 3.98 | 21.28 | 14.01 | 15.89 | 17.91 | 17.20 | 12.01 | 12.47 | 10.06 | 12.41 | 13.45 | 14.22 | 7.73 | 12.50 | 11.93 | 12.30 | 9.26 | 15.85 | 5.82 | 10.55 | 8.73 | 9.85 | 12.32 | 11.05 | -5.72 | 8.33 | 7.42 | 11.95 | |

| Comprehensive Income Net Of Tax | 87.12 | 23.73 | 28.80 | 43.35 | 40.33 | -11.30 | 1.89 | -31.67 | 22.49 | 30.49 | 30.54 | 28.73 | 23.80 | 16.77 | 28.02 | 16.50 | 26.32 | 35.08 | 31.83 | 36.31 | 21.05 | 28.53 | 17.78 | 1.78 | 22.30 | 15.11 | 16.83 | 4.12 | 16.01 | 14.68 | 20.14 | 2.71 | 17.52 | 10.61 | 21.42 | 12.91 | 8.84 | 18.40 | 20.40 | 8.14 | 13.11 | -10.59 | 8.98 | 5.03 | 11.98 | 12.12 | 12.09 | -7.63 | 9.73 | 12.60 | 8.48 | |

| Interest Income Expense After Provision For Loan Loss | 97.60 | 91.87 | 95.03 | 86.36 | 78.91 | 76.44 | 69.56 | 66.21 | 72.98 | 70.31 | 62.79 | 73.83 | 59.81 | 55.16 | 59.83 | 36.76 | 63.91 | 64.29 | 61.39 | 63.55 | 60.85 | 62.51 | 52.78 | 57.32 | 58.35 | 59.43 | 48.60 | 53.34 | 46.21 | 38.72 | 42.28 | 42.12 | 42.06 | 43.33 | 46.01 | 43.58 | 44.48 | 42.07 | 42.36 | 45.09 | 44.52 | 34.90 | 40.92 | 41.48 | 39.90 | 42.62 | 44.38 | 21.72 | 40.51 | 37.77 | 41.97 | |

| Noninterest Expense | 65.18 | 67.41 | 65.94 | 71.38 | 58.33 | 59.90 | 55.68 | 55.72 | 55.43 | 55.03 | 51.54 | 51.86 | 54.55 | 58.25 | 52.76 | 50.27 | 53.11 | 52.23 | 49.73 | 50.02 | 49.53 | 49.13 | 46.87 | 51.91 | 47.36 | 58.26 | 42.77 | 45.67 | 38.70 | 37.41 | 38.14 | 43.13 | 40.26 | 40.63 | 39.85 | 47.36 | 41.57 | 42.40 | 39.89 | 45.33 | 40.05 | 42.00 | 41.45 | 43.84 | 44.77 | 41.85 | 46.75 | 48.58 | 41.12 | 45.70 | 43.38 | |

| Noninterest Income | 24.30 | 24.83 | 24.52 | 22.96 | 24.31 | 25.91 | 24.51 | 23.98 | 26.07 | 27.25 | 26.09 | 27.36 | 26.62 | 26.77 | 21.81 | 19.27 | 22.53 | 21.91 | 18.87 | 20.53 | 19.76 | 26.31 | 22.04 | 24.70 | 19.79 | 18.90 | 16.93 | 18.33 | 16.99 | 15.56 | 13.71 | 15.28 | 15.51 | 16.35 | 14.19 | 13.89 | 15.05 | 17.00 | 14.92 | 13.26 | 17.08 | 14.93 | 14.88 | 14.10 | 17.86 | 16.10 | 17.38 | 15.48 | 10.80 | 17.06 | 14.26 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

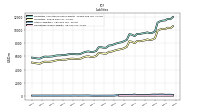

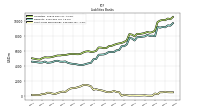

| Assets | 11459.49 | 11421.99 | 11318.60 | 11113.75 | 9805.67 | 9578.63 | 9526.43 | 9642.12 | 9545.09 | 9477.85 | 9402.40 | 9416.99 | 9068.10 | 9289.37 | 9364.66 | 8515.10 | 8308.77 | 8070.85 | 7972.67 | 7828.26 | 7686.35 | 7648.76 | 7320.77 | 7308.54 | 7384.34 | 7383.39 | 6808.98 | 6684.02 | 6666.48 | 6749.82 | 6699.15 | 6566.89 | 6384.75 | 6316.73 | 6331.84 | 6360.28 | 6356.10 | 6300.22 | 6209.40 | 6214.86 | 6150.96 | 6153.02 | 6099.04 | 5995.39 | 5963.64 | 5946.82 | 5968.64 | 5841.12 | 5658.06 | 5691.30 | 5812.84 | |

| Liabilities | 10145.21 | 10181.46 | 10086.18 | 9888.74 | 8753.59 | 8556.06 | 8477.27 | 8574.50 | 8435.72 | 8365.00 | 8295.98 | 8329.51 | 7999.49 | 8216.53 | 8288.95 | 7457.18 | 7253.11 | 7049.02 | 6974.65 | 6852.87 | 6713.41 | 6687.97 | 6421.42 | 6420.41 | 6490.04 | 6503.92 | 6047.98 | 5934.09 | 5914.70 | 6008.03 | 5965.84 | 5847.34 | 5661.98 | 5605.52 | 5618.98 | 5644.14 | 5646.61 | 5575.72 | 5492.61 | 5503.16 | 5439.61 | 5442.34 | 5351.31 | 5249.38 | 5189.75 | 5174.33 | 5201.29 | 5082.58 | 4889.07 | 4929.23 | 5063.06 | |

| Liabilities And Stockholders Equity | 11459.49 | 11421.99 | 11318.60 | 11113.75 | 9805.67 | 9578.63 | 9526.43 | 9642.12 | 9545.09 | 9477.85 | 9402.40 | 9416.99 | 9068.10 | 9289.37 | 9364.66 | 8515.10 | 8308.77 | 8070.85 | 7972.67 | 7828.26 | 7686.35 | 7648.76 | 7320.77 | 7308.54 | 7384.34 | 7383.39 | 6808.98 | 6684.02 | 6666.48 | 6749.82 | 6699.15 | 6566.89 | 6384.75 | 6316.73 | 6331.84 | 6360.28 | 6356.10 | 6300.22 | 6209.40 | 6214.86 | 6150.96 | 6153.02 | 6099.04 | 5995.39 | 5963.64 | 5946.82 | 5968.64 | 5841.12 | 5658.06 | 5691.30 | 5812.84 | |

| Stockholders Equity | 1314.27 | 1240.53 | 1232.42 | 1225.01 | 1052.07 | 1022.58 | 1049.16 | 1067.62 | 1109.37 | 1112.86 | 1106.42 | 1087.48 | 1068.62 | 1072.83 | 1075.70 | 1057.92 | 1055.66 | 1021.83 | 998.02 | 975.39 | 972.93 | 960.78 | 899.35 | 888.13 | 894.30 | 879.47 | 761.00 | 749.93 | 751.79 | 741.79 | 733.31 | 719.55 | 722.77 | 711.21 | 712.86 | 716.14 | 709.48 | 724.50 | 716.78 | 711.70 | 711.36 | 710.67 | 747.73 | 746.01 | 773.89 | 772.49 | 767.36 | 758.54 | 768.99 | 762.08 | 749.78 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 146.99 | 337.07 | 448.87 | 395.80 | 154.24 | 180.77 | 299.80 | 524.80 | 395.37 | 334.67 | 284.45 | NA | 356.58 | NA | NA | NA | 121.86 | NA | NA | 98.95 | NA | NA | NA | 107.29 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Equity Securities Fv Ni | 6.20 | NA | NA | NA | 1.20 | NA | NA | NA | 1.20 | NA | NA | NA | 1.70 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 1020.99 | 817.60 | 738.11 | 750.61 | 762.66 | 787.41 | 863.62 | NA | 1041.38 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

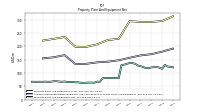

| Property Plant And Equipment Gross | 312.33 | NA | NA | NA | 294.92 | NA | NA | NA | 291.10 | NA | NA | NA | 291.26 | NA | NA | NA | 294.19 | NA | NA | 228.11 | NA | NA | NA | 223.63 | NA | NA | NA | 207.31 | NA | NA | NA | 197.72 | NA | NA | NA | 198.24 | NA | NA | NA | 234.88 | NA | NA | NA | 227.83 | NA | NA | NA | 221.32 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 191.31 | NA | NA | NA | 179.81 | NA | NA | NA | 170.33 | NA | NA | NA | 165.75 | NA | NA | NA | 156.92 | NA | NA | 147.64 | NA | NA | NA | 142.29 | NA | NA | NA | 139.78 | NA | NA | NA | 134.27 | NA | NA | NA | 133.25 | NA | NA | NA | 166.94 | NA | NA | NA | 158.86 | NA | NA | NA | 154.57 | NA | NA | NA | |

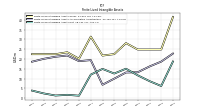

| Amortization Of Intangible Assets | 1.21 | 1.34 | 1.28 | 1.15 | 0.73 | 0.75 | 0.86 | 0.86 | 0.90 | 0.87 | 0.86 | 0.87 | 0.90 | 0.94 | 0.92 | 0.93 | 0.98 | 0.74 | 0.75 | 0.79 | 0.82 | 0.83 | 0.78 | 0.82 | 0.84 | 0.85 | 0.57 | 0.23 | 0.07 | 0.11 | 0.14 | 0.14 | 0.16 | 0.16 | 0.16 | 0.10 | 0.17 | 0.18 | 0.18 | 0.22 | 0.19 | 0.30 | 0.36 | 0.36 | 0.37 | 0.37 | 0.37 | 0.37 | 0.38 | 0.39 | 0.39 | |

| Property Plant And Equipment Net | 121.02 | 123.14 | 124.25 | 130.21 | 115.11 | 120.23 | 121.87 | 121.47 | 120.78 | 117.88 | 118.41 | 122.33 | 125.52 | 128.04 | 134.78 | 136.90 | 137.27 | 131.04 | 129.11 | 80.47 | 80.43 | 81.60 | 80.87 | 81.34 | 81.58 | 79.67 | 66.33 | 67.53 | 63.36 | 63.92 | 63.86 | 63.45 | 62.81 | 63.40 | 64.82 | 64.99 | 66.28 | 66.06 | 66.11 | 67.94 | 67.05 | 67.75 | 69.01 | 68.97 | 67.23 | 66.74 | 67.48 | 66.75 | 67.03 | 66.78 | 66.98 | |

| Goodwill | 363.71 | 363.71 | 363.71 | 360.41 | 303.33 | 303.33 | 303.33 | 303.33 | 303.33 | 303.33 | 303.33 | 303.33 | 303.33 | 303.30 | 303.30 | 303.30 | 303.33 | 274.20 | 274.20 | 274.20 | 274.20 | 274.41 | 255.18 | 255.35 | 255.52 | 255.36 | 186.48 | 186.50 | 164.44 | 164.50 | 164.50 | 164.50 | 161.43 | 161.43 | 161.43 | 161.43 | 159.37 | 159.37 | 159.37 | 159.96 | 159.96 | 159.96 | 159.96 | 159.96 | 159.96 | 159.96 | 159.96 | 159.96 | 159.96 | 159.96 | 159.96 | |

| Intangible Assets Net Excluding Goodwill | 22.82 | 23.61 | 24.74 | 25.58 | 9.21 | 9.62 | 10.12 | 10.74 | 11.19 | 11.76 | 12.17 | 12.82 | 13.49 | 14.10 | 14.74 | 15.56 | 16.37 | 12.34 | 12.88 | 13.04 | 13.83 | 14.64 | 14.22 | 15.01 | 15.83 | 16.67 | 11.44 | 12.01 | 0.91 | 0.98 | 1.09 | 1.23 | 1.20 | 1.35 | 1.51 | 1.67 | 0.78 | 0.95 | 1.13 | 1.31 | 1.53 | 1.72 | 2.02 | 2.38 | 2.73 | 3.10 | 3.47 | 3.84 | 4.21 | 4.60 | 5.38 | |

| Finite Lived Intangible Assets Net | 18.73 | NA | NA | NA | 6.18 | NA | NA | NA | 8.69 | NA | NA | NA | 11.63 | NA | NA | NA | 15.03 | NA | NA | 12.56 | NA | NA | NA | 14.93 | NA | NA | NA | 12.01 | NA | NA | NA | 1.23 | NA | NA | NA | 1.67 | NA | NA | NA | 1.31 | NA | NA | NA | 2.38 | NA | NA | NA | 3.84 | NA | NA | NA | |

| Equity Securities Fv Ni | 6.20 | NA | NA | NA | 1.20 | NA | NA | NA | 1.20 | NA | NA | NA | 1.70 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 68.41 | 87.91 | 75.31 | 69.54 | 74.96 | 79.63 | 54.35 | 35.98 | 8.43 | 5.96 | 3.90 | 5.76 | 0.01 | 0.02 | 0.00 | 0.00 | 0.48 | 1.54 | 5.22 | 10.25 | 15.69 | 12.91 | 10.94 | 4.19 | 1.97 | 2.40 | 3.44 | 3.96 | -0.03 | 0.00 | -0.01 | 2.31 | -0.05 | -1.33 | -0.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 350.60 | 341.65 | 364.62 | 381.74 | 386.20 | 395.16 | 437.88 | 477.09 | 536.65 | 547.34 | 555.82 | 408.12 | 369.85 | 276.99 | 307.87 | 327.59 | 338.72 | 373.33 | 380.44 | 383.99 | 373.93 | 390.17 | 399.53 | 418.25 | 434.88 | 449.13 | 383.74 | 368.62 | 396.99 | 414.77 | 400.96 | 382.34 | 154.84 | 130.45 | 30.17 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities | 419.01 | 429.56 | 439.92 | 451.28 | 461.16 | 474.79 | 492.23 | 512.91 | 541.31 | 548.06 | 554.23 | 407.83 | 361.84 | 268.64 | 297.99 | 318.26 | 337.12 | 373.45 | 384.91 | 393.86 | 389.62 | 403.02 | 410.43 | 422.10 | 436.08 | 450.89 | 386.95 | 372.51 | 389.51 | 405.98 | 396.44 | 384.32 | 154.03 | 131.78 | 30.25 | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 1138.42 | 978.69 | 877.91 | 876.30 | 898.70 | 926.88 | 956.87 | NA | 1045.58 | NA | NA | NA | 805.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 68.41 | 87.91 | 75.31 | 69.54 | 74.96 | 79.63 | 54.35 | 35.98 | 8.43 | 5.96 | 3.90 | 5.76 | 0.01 | 0.02 | 0.00 | 0.00 | 0.48 | 1.54 | 5.22 | 10.25 | 15.69 | 12.91 | 10.94 | 4.19 | 1.97 | 2.40 | 3.44 | 3.96 | -0.03 | 0.00 | -0.01 | 2.31 | -0.05 | -1.33 | -0.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After One Through Five Years Fair Value | 11.77 | 10.93 | 11.18 | 9.46 | 9.31 | 7.88 | 6.09 | 7.00 | 7.65 | 5.62 | 4.83 | 5.18 | 7.74 | 11.31 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Within One Year Fair Value | 0.66 | 1.14 | 1.14 | 1.15 | 1.14 | 0.61 | 0.61 | 0.71 | 0.92 | 1.81 | 3.48 | 2.90 | 2.52 | 4.97 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Five Through Ten Years Fair Value | 29.59 | 28.80 | 30.07 | 32.30 | 31.57 | 33.42 | 37.70 | 39.75 | 42.85 | 42.77 | 43.56 | 44.72 | 20.69 | 20.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Ten Years Fair Value | 0.45 | 0.39 | 0.43 | 0.45 | 0.43 | 0.40 | 0.44 | 0.48 | 0.57 | 3.52 | 3.84 | 3.77 | 4.94 | 7.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | 1051.31 | NA | NA | NA | 230.24 | NA | NA | NA | 276.01 | NA | NA | NA | 419.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 9192.31 | 9241.07 | 9146.28 | 9234.95 | 8005.47 | 8077.65 | 8053.55 | 8171.85 | 7982.50 | 7936.48 | 7885.02 | 7869.26 | 7438.67 | 7703.91 | 7782.20 | 6923.09 | 6677.61 | 6155.97 | 6130.76 | 5897.99 | 5895.14 | 5913.57 | 5703.52 | 5580.70 | 5555.06 | 5533.14 | 4969.73 | 4947.41 | 4458.98 | 4394.52 | 4301.65 | 4195.89 | 4161.49 | 4210.11 | 4293.75 | 4315.51 | 4372.39 | 4460.42 | 4647.82 | 4603.86 | 4617.80 | 4733.05 | 4711.58 | 4557.88 | 4494.43 | 4461.96 | 4633.83 | 4504.68 | 4484.88 | 4536.15 | 4617.85 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt And Capital Lease Obligations | 186.76 | 187.02 | 187.28 | 187.53 | 181.22 | 181.49 | 181.75 | NA | 182.27 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

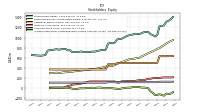

| Stockholders Equity | 1314.27 | 1240.53 | 1232.42 | 1225.01 | 1052.07 | 1022.58 | 1049.16 | 1067.62 | 1109.37 | 1112.86 | 1106.42 | 1087.48 | 1068.62 | 1072.83 | 1075.70 | 1057.92 | 1055.66 | 1021.83 | 998.02 | 975.39 | 972.93 | 960.78 | 899.35 | 888.13 | 894.30 | 879.47 | 761.00 | 749.93 | 751.79 | 741.79 | 733.31 | 719.55 | 722.77 | 711.21 | 712.86 | 716.14 | 709.48 | 724.50 | 716.78 | 711.70 | 711.36 | 710.67 | 747.73 | 746.01 | 773.89 | 772.49 | 767.36 | 758.54 | 768.99 | 762.08 | 749.78 | |

| Common Stock Value | 123.60 | 123.60 | 123.60 | 123.60 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 113.92 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.56 | 105.52 | |

| Additional Paid In Capital | 630.15 | 630.25 | 630.25 | 630.20 | 497.43 | 497.43 | 497.43 | 496.63 | 496.12 | 495.93 | 495.90 | 495.72 | 494.68 | 494.68 | 494.68 | 494.18 | 493.74 | 493.74 | 493.66 | 492.27 | 492.26 | 492.26 | 471.77 | 470.12 | 470.12 | 470.12 | 367.61 | 366.43 | 366.29 | 366.18 | 366.09 | 365.98 | 365.95 | 365.93 | 365.87 | 365.62 | 365.58 | 365.55 | 365.47 | 365.33 | 365.34 | 365.35 | 365.35 | 365.35 | 365.39 | 365.54 | 365.71 | 365.87 | 366.07 | 366.27 | 366.49 | |

| Retained Earnings Accumulated Deficit | 881.11 | 849.05 | 822.62 | 792.72 | 774.86 | 750.34 | 727.57 | 708.15 | 691.26 | 667.42 | 644.36 | 625.81 | 596.61 | 592.70 | 584.31 | 571.26 | 577.35 | 543.57 | 526.14 | 511.41 | 493.39 | 477.28 | 454.23 | 437.42 | 441.23 | 427.75 | 421.53 | 412.76 | 401.08 | 390.11 | 384.33 | 378.08 | 374.25 | 368.06 | 360.84 | 353.03 | 351.72 | 345.77 | 340.43 | 334.75 | 331.20 | 321.13 | 321.19 | 315.61 | 312.05 | 307.47 | 301.19 | 294.06 | 302.98 | 297.80 | 291.49 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -111.76 | -154.05 | -138.55 | -124.57 | -137.69 | -142.29 | -97.03 | -68.16 | -8.77 | 3.52 | 7.12 | 6.20 | 17.23 | 19.11 | 21.52 | 17.35 | 5.58 | 3.69 | -4.10 | -11.34 | -20.66 | -16.56 | -13.01 | -6.17 | -3.97 | -4.99 | -6.08 | -7.03 | 6.76 | 7.95 | 5.28 | -2.39 | 4.96 | -0.14 | 2.70 | -4.50 | -9.68 | -6.02 | -12.49 | -20.59 | -19.47 | -16.72 | -0.31 | 1.26 | 4.97 | 2.83 | 3.04 | 2.00 | 3.91 | 2.51 | -2.46 | |

| Treasury Stock Value | 208.84 | 208.31 | 205.50 | 196.94 | 196.44 | 196.82 | 192.74 | 182.91 | 183.16 | 167.93 | 154.87 | 154.16 | 153.83 | 147.58 | 138.73 | 138.78 | 134.91 | 133.08 | 131.59 | 130.87 | 105.98 | 106.11 | 127.55 | 127.15 | 127.00 | 127.33 | 127.62 | 127.80 | 127.91 | 128.01 | 127.95 | 127.69 | 127.95 | 128.21 | 122.12 | 103.56 | 103.70 | 86.36 | 82.19 | 73.36 | 71.28 | 64.65 | 44.06 | 41.78 | 13.98 | 8.31 | 7.05 | 7.34 | 7.44 | 7.46 | 7.66 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

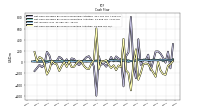

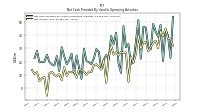

| Net Cash Provided By Used In Operating Activities | 44.02 | 20.40 | 47.74 | 38.60 | 42.73 | 48.31 | 29.17 | 31.20 | 45.62 | 46.10 | 22.09 | 51.23 | 34.88 | 19.63 | 18.07 | 33.12 | 30.80 | 11.42 | 18.69 | 41.72 | 32.93 | 39.20 | 21.40 | 25.05 | 21.51 | 14.30 | 27.44 | 29.38 | 22.42 | 17.88 | 19.59 | 20.37 | 29.73 | 6.92 | 15.73 | 24.52 | 10.88 | 25.86 | 20.88 | 17.89 | 24.15 | 30.87 | 12.82 | 24.13 | 16.99 | 17.89 | 19.71 | 25.18 | 19.77 | 19.81 | 28.03 | |

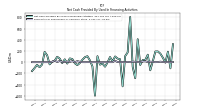

| Net Cash Provided By Used In Investing Activities | -225.28 | -212.02 | -148.08 | 11.12 | -260.34 | -183.87 | -108.64 | -35.94 | -24.29 | -33.78 | -192.54 | -314.69 | 229.16 | -12.71 | -504.39 | -195.20 | -145.36 | -91.73 | -58.53 | -141.70 | -55.70 | -103.01 | -47.35 | 35.15 | 17.05 | 22.69 | -127.69 | 604.71 | 36.65 | -24.77 | -122.82 | -112.83 | -67.31 | 10.62 | 27.09 | -14.56 | -81.64 | -86.10 | 18.24 | -85.04 | 3.57 | -68.92 | -156.89 | -36.14 | -22.01 | 26.09 | -139.33 | -221.70 | -17.75 | 67.72 | 11.58 | |

| Net Cash Provided By Used In Financing Activities | -8.82 | 79.83 | 153.41 | 191.84 | 191.08 | 16.53 | -145.53 | 134.18 | 39.37 | 37.90 | -49.73 | 411.52 | -287.55 | -84.56 | 809.87 | 174.40 | 107.77 | 52.70 | 64.78 | 102.74 | 14.96 | 92.16 | -5.72 | -80.94 | -26.44 | -44.19 | 107.68 | -599.97 | -76.14 | 32.34 | 106.94 | 89.16 | 42.90 | -15.38 | -52.08 | -19.50 | 56.82 | 66.84 | -25.14 | 51.33 | -16.45 | 64.26 | 96.85 | 25.93 | 7.58 | -39.03 | 122.69 | 185.15 | -42.68 | -90.34 | -105.17 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 44.02 | 20.40 | 47.74 | 38.60 | 42.73 | 48.31 | 29.17 | 31.20 | 45.62 | 46.10 | 22.09 | 51.23 | 34.88 | 19.63 | 18.07 | 33.12 | 30.80 | 11.42 | 18.69 | 41.72 | 32.93 | 39.20 | 21.40 | 25.05 | 21.51 | 14.30 | 27.44 | 29.38 | 22.42 | 17.88 | 19.59 | 20.37 | 29.73 | 6.92 | 15.73 | 24.52 | 10.88 | 25.86 | 20.88 | 17.89 | 24.15 | 30.87 | 12.82 | 24.13 | 16.99 | 17.89 | 19.71 | 25.18 | 19.77 | 19.81 | 28.03 | |

| Net Income Loss | 44.83 | 39.23 | 42.78 | 30.22 | 35.73 | 33.97 | 30.75 | 27.73 | 34.78 | 34.09 | 29.62 | 39.77 | 25.68 | 19.19 | 23.85 | 4.73 | 26.82 | 27.28 | 24.59 | 27.00 | 25.15 | 32.08 | 23.27 | 3.98 | 21.28 | 14.01 | 15.89 | 17.91 | 17.20 | 12.01 | 12.47 | 10.06 | 12.41 | 13.45 | 14.22 | 7.73 | 12.50 | 11.93 | 12.30 | 9.26 | 15.85 | 5.82 | 10.55 | 8.73 | 9.85 | 12.32 | 11.05 | -5.72 | 8.33 | 7.42 | 11.95 | |

| Increase Decrease In Other Operating Capital Net | -7.00 | 12.90 | -17.72 | 10.15 | -5.16 | -8.99 | -2.90 | 1.63 | -8.39 | 0.09 | 3.82 | 10.36 | -3.46 | -6.76 | 3.44 | 1.44 | 7.12 | 10.36 | 14.96 | -15.35 | -6.71 | -6.64 | 17.00 | -8.03 | 0.77 | -4.72 | 0.99 | -9.31 | 1.44 | -0.08 | 4.83 | -2.83 | -4.06 | 10.07 | 4.75 | -7.48 | 4.91 | -8.11 | 2.42 | -0.01 | -1.06 | -1.84 | 5.34 | -3.18 | -1.38 | -1.49 | 5.44 | -2.13 | 1.10 | -0.85 | 4.53 | |

| Deferred Income Tax Expense Benefit | 4.21 | -0.36 | 1.32 | 2.22 | -2.31 | -0.94 | -0.57 | 1.81 | 0.52 | -1.81 | -1.00 | 3.86 | -0.14 | -1.67 | 0.16 | -3.55 | -0.32 | -0.33 | 1.44 | 0.68 | 1.50 | 0.37 | 1.10 | 15.80 | -0.56 | 1.46 | 2.51 | 1.27 | 2.42 | 0.71 | 1.20 | 0.13 | 5.42 | 2.88 | 4.22 | -1.34 | 1.29 | 2.27 | 2.65 | 3.26 | 5.59 | 1.07 | 2.78 | 0.04 | 0.57 | 1.26 | 0.67 | -2.58 | 1.18 | 0.20 | 2.56 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -225.28 | -212.02 | -148.08 | 11.12 | -260.34 | -183.87 | -108.64 | -35.94 | -24.29 | -33.78 | -192.54 | -314.69 | 229.16 | -12.71 | -504.39 | -195.20 | -145.36 | -91.73 | -58.53 | -141.70 | -55.70 | -103.01 | -47.35 | 35.15 | 17.05 | 22.69 | -127.69 | 604.71 | 36.65 | -24.77 | -122.82 | -112.83 | -67.31 | 10.62 | 27.09 | -14.56 | -81.64 | -86.10 | 18.24 | -85.04 | 3.57 | -68.92 | -156.89 | -36.14 | -22.01 | 26.09 | -139.33 | -221.70 | -17.75 | 67.72 | 11.58 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -8.82 | 79.83 | 153.41 | 191.84 | 191.08 | 16.53 | -145.53 | 134.18 | 39.37 | 37.90 | -49.73 | 411.52 | -287.55 | -84.56 | 809.87 | 174.40 | 107.77 | 52.70 | 64.78 | 102.74 | 14.96 | 92.16 | -5.72 | -80.94 | -26.44 | -44.19 | 107.68 | -599.97 | -76.14 | 32.34 | 106.94 | 89.16 | 42.90 | -15.38 | -52.08 | -19.50 | 56.82 | 66.84 | -25.14 | 51.33 | -16.45 | 64.26 | 96.85 | 25.93 | 7.58 | -39.03 | 122.69 | 185.15 | -42.68 | -90.34 | -105.17 | |

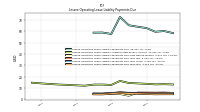

| Payments Of Dividends | 12.76 | 12.80 | 12.88 | 12.37 | 11.21 | 11.21 | 11.33 | 10.84 | 10.94 | 11.03 | 11.06 | 10.58 | 10.57 | 10.79 | 10.79 | 10.82 | 9.83 | 9.85 | 9.86 | 8.98 | 9.03 | 9.03 | 7.80 | 7.80 | 7.80 | 7.80 | 7.12 | 6.23 | 6.23 | 6.23 | 6.22 | 6.23 | 6.23 | 6.23 | 6.41 | 6.42 | 6.55 | 6.59 | 6.62 | 5.71 | 5.79 | 5.87 | 4.98 | 5.13 | 5.23 | 5.25 | 3.15 | 3.14 | 3.14 | 3.14 | 1.04 | |

| Payments For Repurchase Of Common Stock | 0.86 | 3.22 | 9.16 | 1.73 | 0.00 | 5.08 | 9.03 | 1.49 | 16.00 | 12.65 | 1.01 | 1.64 | 6.53 | 9.15 | 0.00 | 5.22 | 0.06 | 2.17 | 1.78 | 25.05 | 0.05 | 0.01 | 1.08 | 0.27 | 0.05 | 0.04 | 1.10 | 0.00 | -0.04 | 0.41 | 0.49 | 0.00 | 0.00 | 6.96 | 18.42 | 0.03 | 17.56 | 4.66 | 8.71 | 3.89 | 5.08 | 20.86 | 3.60 | 27.13 | 7.30 | 1.81 | 0.00 | 0.00 | 0.00 | NA | 0.00 |