| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.03 | 0.03 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | |

| Weighted Average Number Of Diluted Shares Outstanding | 56.45 | 56.43 | 56.41 | NA | 56.45 | 56.52 | 56.57 | NA | 45.00 | 45.10 | 45.01 | NA | 44.89 | 44.81 | 44.95 | NA | 44.94 | 44.89 | 44.80 | NA | 44.85 | 41.33 | 39.12 | NA | 35.26 | 34.56 | 33.96 | NA | 16.79 | 16.57 | 16.47 | NA | 13.07 | 8.45 | 8.21 | NA | 8.24 | 8.15 | |

| Weighted Average Number Of Shares Outstanding Basic | 56.44 | 56.43 | 56.38 | NA | 56.39 | 56.47 | 56.47 | NA | 44.82 | 44.79 | 44.71 | NA | 44.63 | 44.62 | 44.67 | NA | 44.64 | 44.63 | 44.54 | NA | 44.41 | 40.82 | 38.58 | NA | 34.57 | 33.62 | 32.81 | NA | 16.26 | 16.13 | 16.00 | NA | 12.62 | 8.07 | 7.86 | NA | 7.74 | 7.73 | |

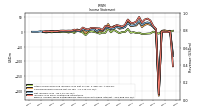

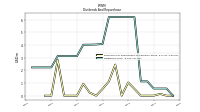

| Earnings Per Share Basic | 0.04 | -3.76 | 0.15 | 0.31 | 0.51 | 0.59 | 0.55 | 0.51 | 0.83 | 0.58 | 0.50 | 0.50 | 0.69 | 0.40 | 0.30 | 0.34 | 0.39 | 0.28 | 0.25 | 0.32 | 0.33 | 0.13 | 0.23 | 0.06 | 0.28 | 0.29 | 0.19 | 0.20 | 0.60 | 0.21 | 0.24 | 0.32 | 0.22 | 0.36 | 0.33 | 0.39 | 0.34 | 0.16 | |

| Earnings Per Share Diluted | 0.04 | -3.76 | 0.15 | 0.31 | 0.51 | 0.59 | 0.55 | 0.51 | 0.83 | 0.58 | 0.50 | 0.50 | 0.69 | 0.40 | 0.29 | 0.34 | 0.39 | 0.28 | 0.25 | 0.31 | 0.33 | 0.12 | 0.23 | 0.06 | 0.27 | 0.28 | 0.18 | 0.19 | 0.58 | 0.20 | 0.23 | 0.31 | 0.21 | 0.35 | 0.32 | 0.37 | 0.32 | 0.16 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

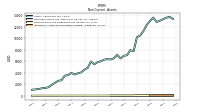

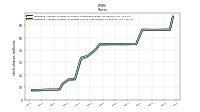

| Revenue From Contract With Customer Excluding Assessed Tax | 8.81 | 9.02 | 8.80 | 9.72 | 8.97 | 9.89 | 10.20 | 9.61 | 9.31 | 8.75 | 8.35 | 7.60 | 7.37 | 6.73 | 7.76 | 7.42 | 7.30 | 7.14 | 6.79 | 7.25 | 7.23 | 7.09 | 7.18 | 7.04 | 6.90 | 6.56 | 6.21 | 6.26 | 6.14 | 5.99 | 6.00 | 5.84 | 5.87 | 5.92 | 5.85 | 4.41 | 6.31 | 5.20 | |

| Revenues | 8.81 | 9.02 | 8.80 | 9.72 | 8.97 | 9.89 | 10.20 | 9.61 | 9.31 | 8.75 | 8.35 | 7.60 | 7.37 | 6.73 | 7.76 | 7.42 | 7.30 | 7.14 | 6.79 | 7.25 | 7.23 | 7.09 | 7.18 | 7.04 | 6.90 | 6.56 | 6.21 | 6.26 | 6.14 | 5.99 | 6.00 | 5.84 | 5.87 | 5.92 | 5.85 | 4.41 | 6.31 | 5.20 | |

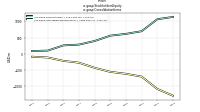

| Interest And Fee Income Loans And Leases | 124.36 | 123.47 | 120.64 | 115.04 | 100.98 | 82.03 | 72.03 | 58.53 | 56.78 | 55.98 | 53.53 | 51.55 | 55.23 | 55.13 | 54.88 | 54.12 | 56.48 | 56.51 | 53.84 | 50.36 | 53.34 | 43.53 | 38.97 | 34.00 | 31.24 | 29.98 | 26.49 | 23.72 | 22.23 | 20.96 | 18.17 | 16.38 | 15.63 | 13.36 | 12.10 | 12.40 | 11.40 | 10.23 | |

| Operating Expenses | 64.21 | 57.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Expense | 92.69 | 96.34 | 78.25 | 51.30 | 21.07 | 8.17 | 4.65 | 2.73 | 2.80 | 3.49 | 4.91 | 6.22 | 10.07 | 13.48 | 17.47 | 18.41 | 19.48 | 21.42 | 19.50 | 16.08 | 14.32 | 12.25 | 9.05 | 6.69 | 6.44 | 5.76 | 4.30 | 3.36 | 2.84 | 2.65 | 2.34 | 1.78 | 1.65 | 1.57 | 1.29 | 1.31 | 1.24 | 1.11 | |

| Interest Income Expense Net | 52.07 | 48.98 | 58.76 | 74.72 | 87.67 | 81.81 | 74.49 | 61.96 | 59.19 | 57.91 | 54.23 | 51.71 | 51.62 | 48.45 | 44.87 | 43.89 | 43.13 | 41.89 | 41.05 | 41.37 | 43.73 | 36.25 | 34.27 | 31.23 | 28.44 | 27.89 | 26.06 | 25.00 | 23.16 | 21.92 | 19.36 | 17.43 | 15.46 | 13.42 | 11.87 | 12.10 | 11.15 | 9.82 | |

| Interest Paid Net | 81.03 | 76.91 | 65.72 | 43.60 | 21.52 | 6.67 | 3.89 | 2.40 | 2.85 | 3.80 | 6.22 | 15.49 | 11.21 | 10.48 | 19.80 | 19.36 | 18.33 | 20.01 | 17.45 | 14.41 | 12.57 | 10.53 | 8.53 | 6.35 | 5.92 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | -0.60 | -0.30 | 2.20 | 3.59 | 10.53 | 12.91 | 12.26 | 8.47 | 14.66 | 10.23 | 8.91 | 9.57 | 12.18 | 7.26 | 5.40 | 6.50 | 6.89 | 5.09 | 4.77 | 5.73 | 6.15 | 1.66 | 3.60 | 10.77 | 4.63 | 4.67 | 2.95 | 4.08 | 5.80 | 2.41 | 2.74 | 3.30 | 2.04 | 2.17 | 1.94 | 2.15 | 2.13 | 1.09 | |

| Income Taxes Paid | NA | NA | NA | 10.00 | 8.52 | NA | NA | 11.83 | 10.26 | 12.21 | 5.21 | 11.94 | 19.18 | NA | NA | 9.19 | 5.65 | 8.63 | 0.15 | 5.37 | 0.18 | 11.07 | 0.02 | 3.52 | 5.73 | 5.15 | 0.26 | 7.11 | 2.90 | 5.00 | 2.15 | 2.40 | 2.70 | 4.20 | 0.75 | 2.89 | 1.08 | 1.32 | |

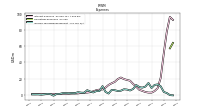

| Profit Loss | 2.18 | -212.29 | 8.50 | 17.35 | 29.01 | 33.32 | 30.84 | 23.88 | 37.23 | 26.05 | 22.36 | 22.37 | 30.94 | 17.85 | 13.21 | 15.21 | 17.36 | 12.41 | 11.26 | 14.13 | 14.71 | 5.15 | 8.98 | 2.27 | 9.58 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | 2.04 | -5.31 | -2.59 | 1.61 | -4.48 | -5.14 | -6.21 | -6.49 | -2.01 | -3.29 | -0.02 | -2.15 | 10.93 | 0.48 | 0.55 | -3.82 | 2.04 | 7.97 | -0.76 | 13.42 | -2.40 | -1.82 | -5.26 | -1.65 | 0.62 | 2.50 | -0.46 | -10.34 | -1.20 | 2.19 | 5.23 | -3.07 | 1.58 | -1.46 | 0.74 | 1.15 | -0.41 | 1.26 | |

| Net Income Loss | 2.18 | -212.29 | 8.50 | 17.35 | 29.01 | 33.32 | 30.84 | 23.88 | 37.23 | 26.05 | 22.36 | 22.37 | 30.94 | 17.85 | 13.21 | 15.21 | 17.36 | 12.41 | 11.26 | 14.13 | 14.71 | 5.15 | 8.98 | 2.27 | 9.58 | 9.62 | 6.11 | 6.52 | 9.68 | 3.32 | 3.79 | 5.05 | 2.76 | 2.94 | 2.63 | 3.01 | 2.66 | 1.27 | |

| Comprehensive Income Net Of Tax | 4.22 | -217.59 | 5.90 | 18.96 | 24.53 | 28.18 | 24.63 | 17.38 | 35.22 | 22.76 | 22.34 | 20.22 | 41.87 | 18.33 | 13.76 | 11.39 | 19.39 | 20.38 | 10.50 | 27.55 | 12.31 | 3.32 | 3.71 | 0.62 | 10.20 | 12.12 | 5.66 | -3.83 | 8.47 | 5.52 | 9.02 | 1.97 | 4.34 | 1.48 | 3.37 | 4.15 | 2.25 | 2.53 | |

| Net Income Loss Available To Common Stockholders Basic | 2.18 | -212.29 | 8.50 | 17.35 | 29.01 | 33.32 | 30.84 | 23.88 | 37.23 | 26.05 | 22.36 | 22.37 | 30.94 | 17.85 | 13.21 | 15.21 | 17.36 | 12.41 | 11.26 | 14.13 | 14.71 | 5.15 | 8.98 | 2.27 | 9.58 | 9.62 | 6.11 | 6.52 | 9.68 | 3.32 | 3.79 | 5.05 | 2.76 | 2.94 | 2.63 | 3.01 | 2.66 | 1.27 | |

| Net Income Loss Available To Common Stockholders Diluted | 2.18 | -212.29 | 8.50 | 17.35 | 29.01 | 33.32 | 30.84 | 23.88 | 37.23 | 26.05 | 22.36 | 22.37 | 30.94 | 17.85 | 13.21 | 15.21 | 17.36 | 12.41 | 11.26 | 14.13 | 14.71 | 5.15 | 8.98 | 2.27 | 9.58 | 9.62 | 6.11 | 6.52 | 9.68 | 3.32 | 3.79 | 5.05 | 2.76 | 2.94 | 2.63 | 3.01 | 2.66 | 1.27 | |

| Interest Income Expense After Provision For Loan Loss | 54.09 | 48.10 | 58.34 | 73.55 | 87.69 | 81.63 | 75.29 | 58.08 | 59.60 | 57.87 | 53.87 | 51.95 | 50.07 | 47.08 | 40.79 | 43.19 | 42.96 | 40.66 | 40.51 | 41.29 | 43.72 | 33.80 | 32.58 | 30.32 | 27.74 | 26.80 | 25.99 | 23.20 | 21.93 | 20.67 | 18.96 | 16.23 | 14.89 | 12.67 | 11.72 | 12.10 | 11.15 | 9.82 | |

| Noninterest Expense | 64.21 | 272.76 | 59.34 | 59.82 | 60.34 | 48.80 | 47.62 | 39.56 | 38.39 | 35.62 | 34.51 | 31.37 | 30.59 | 30.94 | 32.86 | 31.67 | 32.69 | 32.28 | 32.95 | 30.14 | 33.97 | 33.98 | 28.99 | 28.66 | 23.39 | 22.21 | 24.71 | 20.19 | 21.54 | 19.85 | 19.42 | 17.17 | 16.96 | 13.97 | 13.36 | 12.99 | 13.10 | 13.87 | |

| Noninterest Income | 11.70 | 12.08 | 11.70 | 7.22 | 12.18 | 13.40 | 15.43 | 13.83 | 30.68 | 14.04 | 11.91 | 11.36 | 23.64 | 8.97 | 10.68 | 10.20 | 13.98 | 9.13 | 8.46 | 8.70 | 11.10 | 6.98 | 8.98 | 11.38 | 9.86 | 9.70 | 7.78 | 7.59 | 15.08 | 4.91 | 6.99 | 9.28 | 6.87 | 6.42 | 6.20 | 6.04 | 6.74 | 6.42 | |

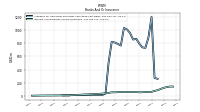

| Goodwill Impairment Loss | 0.00 | 215.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

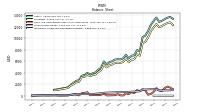

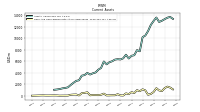

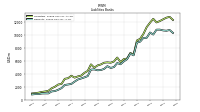

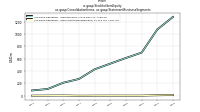

| Assets | 13051.56 | 12840.55 | 13616.18 | 13014.18 | 12328.86 | 11249.24 | 10474.80 | 10196.20 | 7735.06 | 7939.13 | 7051.83 | 6957.16 | 6481.94 | 7141.29 | 6513.71 | 6314.44 | 6358.35 | 6285.95 | 6001.20 | 5840.41 | 5466.28 | 5966.00 | 4842.18 | 4541.19 | 4051.06 | 3903.23 | 3687.92 | 3975.40 | 3593.67 | 3492.94 | 2690.17 | 2592.58 | 2248.75 | 1869.68 | 1466.60 | 1355.42 | 1284.51 | 1164.39 | |

| Liabilities | 12132.36 | 11925.02 | 12482.45 | 11879.80 | 11206.90 | 10146.33 | 9392.22 | 9132.15 | 6968.23 | 7205.12 | 6337.40 | 6261.45 | 5804.00 | 6502.57 | 5890.62 | 5700.57 | 5753.99 | 5699.24 | 5432.96 | 5281.23 | 4935.28 | 5448.03 | 4430.07 | 4146.23 | 3710.61 | 3586.31 | 3396.14 | 3691.14 | 3306.37 | 3215.43 | 2419.99 | 2332.84 | 1991.45 | 1747.68 | 1363.08 | 1255.93 | 1190.65 | 1072.87 | |

| Liabilities And Stockholders Equity | 13051.56 | 12840.55 | 13616.18 | 13014.18 | 12328.86 | 11249.24 | 10474.80 | 10196.20 | 7735.06 | 7939.13 | 7051.83 | 6957.16 | 6481.94 | 7141.29 | 6513.71 | 6314.44 | 6358.35 | 6285.95 | 6001.20 | 5840.41 | 5466.28 | 5966.00 | 4842.18 | 4541.19 | 4051.06 | 3903.23 | 3687.92 | 3975.40 | 3593.67 | 3492.94 | 2690.17 | 2592.58 | 2248.75 | 1869.68 | 1466.60 | 1355.42 | 1284.51 | 1164.39 | |

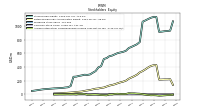

| Stockholders Equity | 919.21 | 915.53 | 1133.74 | 1134.38 | 1121.96 | 1102.91 | 1082.58 | 1064.05 | 766.83 | 734.02 | 714.43 | 695.71 | 677.94 | 638.72 | 623.08 | 613.87 | 604.36 | 586.70 | 568.24 | 559.18 | 531.00 | 517.97 | 412.11 | 394.95 | 340.45 | 316.93 | 291.78 | 284.26 | 287.29 | 277.51 | 270.18 | 259.74 | 257.30 | 122.00 | 103.52 | 99.50 | 93.86 | 91.53 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 818.50 | 926.08 | 1317.13 | 656.49 | 317.82 | 173.52 | 931.71 | 1121.76 | 783.38 | 969.65 | 468.03 | 629.71 | 282.98 | 414.18 | 40.36 | 65.39 | 268.45 | 85.00 | 80.69 | 67.31 | 54.94 | 370.39 | 177.36 | 120.39 | 123.21 | 128.94 | 75.97 | 597.95 | 496.81 | 444.52 | 52.82 | 215.75 | 206.34 | 172.84 | 35.32 | 29.69 | 28.84 | 19.41 | |

| Equity Securities Fv Ni | 9.77 | 9.77 | 9.76 | 9.77 | 16.03 | 16.02 | 8.57 | 16.02 | 0.54 | 0.46 | 0.43 | 0.34 | 0.28 | 0.30 | 0.29 | 0.43 | 0.36 | 0.39 | 0.40 | 0.35 | 1.31 | 0.42 | NA | 0.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Securities Debt Securities | NA | NA | NA | NA | NA | 240.27 | 258.29 | 1191.38 | 891.65 | 736.73 | 749.22 | 807.43 | 882.93 | 861.41 | 961.48 | 1014.97 | 1042.94 | 773.77 | 788.16 | 809.57 | 799.87 | 492.88 | 39.59 | 19.49 | NA | NA | NA | 0.30 | NA | NA | NA | 16.31 | 16.54 | 16.37 | 10.74 | 10.58 | 10.47 | 10.51 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

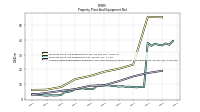

| Property Plant And Equipment Gross | NA | NA | NA | 55.18 | NA | NA | NA | 55.40 | NA | NA | NA | 23.23 | NA | NA | NA | 20.36 | NA | NA | NA | 18.39 | NA | NA | NA | 15.47 | NA | NA | NA | 13.40 | NA | NA | NA | 8.06 | NA | NA | NA | 6.24 | NA | NA | |

| Furniture And Fixtures Gross | NA | NA | NA | 3.98 | NA | NA | NA | 3.92 | NA | NA | NA | 3.50 | NA | NA | NA | 3.37 | NA | NA | NA | 3.29 | NA | NA | NA | 3.18 | NA | NA | NA | 3.17 | NA | NA | NA | 2.23 | NA | NA | NA | 1.97 | NA | NA | |

| Leasehold Improvements Gross | NA | NA | NA | 22.21 | NA | NA | NA | 22.33 | NA | NA | NA | 7.76 | NA | NA | NA | 7.42 | NA | NA | NA | 7.27 | NA | NA | NA | 5.11 | NA | NA | NA | 4.52 | NA | NA | NA | 1.47 | NA | NA | NA | 1.20 | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | NA | NA | NA | 19.04 | NA | NA | NA | 17.48 | NA | NA | NA | 15.21 | NA | NA | NA | 12.01 | NA | NA | NA | 9.24 | NA | NA | NA | 8.89 | NA | NA | NA | 6.67 | NA | NA | NA | 5.41 | NA | NA | NA | 4.06 | NA | NA | |

| Property Plant And Equipment Net | 39.20 | 36.58 | 37.53 | 36.14 | 36.61 | 37.16 | 35.90 | 37.92 | 8.09 | 8.18 | 7.82 | 8.01 | 8.27 | 8.19 | 8.57 | 8.36 | 8.69 | 8.85 | 9.26 | 9.14 | 8.89 | 9.01 | 6.72 | 6.58 | 6.73 | 7.22 | 6.87 | 6.73 | 5.34 | 4.77 | 4.45 | 2.65 | 2.40 | 2.35 | 2.48 | 2.19 | 2.45 | 2.67 | |

| Intangible Assets Net Excluding Goodwill | 5.34 | NA | NA | 6.58 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Intangible Assets Net Including Goodwill | NA | 5.73 | 221.40 | 221.84 | 222.29 | 222.75 | 223.24 | 222.12 | 94.08 | 94.45 | 94.86 | 95.30 | 95.73 | 96.18 | 96.67 | 97.19 | 97.72 | 98.25 | 98.85 | 99.48 | 99.72 | 100.37 | 33.55 | 33.58 | 2.02 | 2.07 | 2.12 | 2.18 | 2.23 | 2.29 | 2.35 | 2.42 | 2.48 | 1.73 | NA | 0.20 | NA | NA | |

| Equity Securities Fv Ni | 9.77 | 9.77 | 9.76 | 9.77 | 16.03 | 16.02 | 8.57 | 16.02 | 0.54 | 0.46 | 0.43 | 0.34 | 0.28 | 0.30 | 0.29 | 0.43 | 0.36 | 0.39 | 0.40 | 0.35 | 1.31 | 0.42 | NA | 0.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 106.25 | 90.55 | 80.13 | 89.48 | 99.25 | 70.93 | 39.66 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 694.50 | 724.11 | 766.91 | 773.06 | 784.81 | 859.64 | 880.75 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities | NA | NA | NA | NA | NA | 930.56 | 920.41 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | NA | NA | NA | NA | NA | 262.62 | 273.55 | 1198.56 | 889.35 | 730.62 | 738.21 | 794.76 | 868.04 | 856.28 | 954.66 | 1008.92 | 1031.49 | 765.21 | 790.86 | 811.20 | 820.47 | 510.09 | 39.50 | 19.50 | NA | NA | NA | NA | NA | NA | NA | 16.41 | 16.47 | 16.47 | 10.80 | 10.80 | 10.80 | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 106.25 | 90.55 | 80.13 | 89.48 | 99.25 | 70.93 | 39.66 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Fair Value | 694.50 | 724.11 | 766.91 | 773.06 | NA | 859.64 | 880.75 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | 800.74 | 814.66 | 847.04 | 862.54 | 884.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After One Through Five Years Fair Value | 3.18 | 1.91 | 0.54 | 0.19 | 0.11 | 0.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Twelve Months Or Longer Fair Value | 694.50 | 724.11 | 690.61 | 378.44 | NA | 31.86 | 36.24 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Less Than Twelve Months Fair Value | NA | NA | 76.30 | 394.62 | NA | 827.77 | 844.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Five Through Ten Years Fair Value | 12.73 | 15.35 | 17.45 | 16.15 | 16.89 | 17.94 | 17.93 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Ten Years Fair Value | 678.58 | 706.85 | 748.92 | 756.72 | 767.80 | 841.58 | 862.82 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

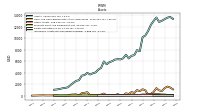

| Deposits | 10812.19 | 10806.99 | 10051.71 | 10362.61 | 9549.86 | 9538.74 | 8957.52 | 8811.96 | 6844.98 | 7106.80 | 6245.82 | 5913.43 | 5463.81 | 5647.84 | 5030.83 | 4891.14 | 5170.57 | 4743.94 | 4568.70 | 4532.97 | 4668.71 | 4632.95 | 3636.19 | 3443.53 | 3268.73 | 3107.40 | 2780.38 | 2426.80 | 2338.74 | 2265.60 | 1773.11 | 1522.18 | 1321.53 | 1266.32 | 961.16 | 962.95 | 951.16 | 857.16 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

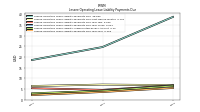

| Debt And Capital Lease Obligations | NA | 975.54 | 2294.60 | 1369.94 | 1496.46 | 493.73 | 325.97 | 210.13 | 12.50 | 20.00 | 12.00 | 269.00 | 269.00 | 764.60 | 794.00 | 743.00 | 520.00 | 882.00 | 800.00 | 708.00 | 232.00 | 791.00 | 769.00 | 678.00 | 421.00 | 461.04 | 602.00 | 1250.00 | 951.00 | 938.00 | 633.00 | 796.00 | 660.00 | 472.25 | 393.00 | 282.89 | 228.68 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

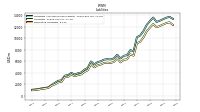

| Stockholders Equity | 919.21 | 915.53 | 1133.74 | 1134.38 | 1121.96 | 1102.91 | 1082.58 | 1064.05 | 766.83 | 734.02 | 714.43 | 695.71 | 677.94 | 638.72 | 623.08 | 613.87 | 604.36 | 586.70 | 568.24 | 559.18 | 531.00 | 517.97 | 412.11 | 394.95 | 340.45 | 316.93 | 291.78 | 284.26 | 287.29 | 277.51 | 270.18 | 259.74 | 257.30 | 122.00 | 103.52 | 99.50 | 93.86 | 91.53 | |

| Common Stock Value | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.03 | 0.03 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | |

| Additional Paid In Capital Common Stock | 720.36 | 719.78 | 719.26 | 719.61 | 719.96 | 719.22 | 720.85 | 720.74 | 436.83 | 435.20 | 434.35 | 433.94 | 433.26 | 432.79 | 432.36 | 433.77 | 433.43 | 432.93 | 432.62 | 431.83 | 431.20 | 430.48 | 327.95 | 314.50 | 260.63 | 247.30 | 234.27 | 232.43 | 231.63 | 230.32 | 228.51 | 227.26 | 226.80 | 95.85 | NA | 78.20 | NA | NA | |

| Retained Earnings Accumulated Deficit | 216.59 | 215.54 | 428.96 | 426.66 | 415.51 | 392.70 | 365.60 | 340.98 | 321.18 | 288.00 | 265.97 | 247.64 | 228.40 | 200.58 | 185.85 | 175.77 | 162.79 | 147.67 | 137.49 | 128.46 | 114.33 | 99.62 | 94.48 | 85.50 | 82.37 | 72.79 | 63.18 | 57.06 | 50.55 | 40.87 | 37.55 | 33.76 | 28.71 | 25.95 | 23.01 | 20.38 | 17.38 | 14.72 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -17.80 | -19.84 | -14.54 | -11.94 | -13.55 | -9.07 | -3.93 | 2.27 | 8.77 | 10.78 | 14.07 | 14.09 | 16.23 | 5.30 | 4.82 | 4.28 | 8.10 | 6.06 | -1.91 | -1.15 | -14.58 | -12.18 | -10.36 | -5.09 | -2.58 | -3.20 | -5.70 | -5.25 | 5.10 | 6.30 | 4.11 | -1.30 | 1.77 | 0.19 | 1.65 | 0.90 | -0.25 | 0.17 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 0.58 | 0.52 | 0.03 | 0.70 | 0.73 | 0.83 | 1.20 | 0.55 | 0.57 | 0.63 | 0.99 | 0.42 | 0.47 | 0.43 | 0.77 | 0.30 | 0.35 | 0.30 | 0.69 | 0.46 | 0.51 | 0.51 | 1.17 | 0.93 | 0.25 | 0.22 | 0.44 | 0.19 | 0.22 | 0.17 | 0.32 | 0.23 | 0.13 | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

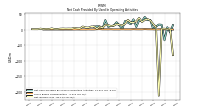

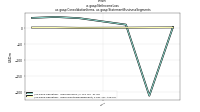

| Net Cash Provided By Used In Operating Activities | 15.04 | 15.93 | 9.48 | 0.81 | 29.88 | 30.02 | 40.34 | 26.80 | 29.49 | 8.04 | 32.62 | 17.05 | 22.31 | 27.19 | 0.88 | 13.29 | 23.31 | 12.64 | 11.19 | 8.59 | 30.18 | 2.13 | 10.08 | 10.24 | 9.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

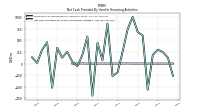

| Net Cash Provided By Used In Investing Activities | -308.83 | 157.93 | 43.97 | -341.19 | -893.22 | -1528.51 | -483.37 | 500.75 | 56.55 | -371.59 | -265.07 | -116.46 | 540.71 | -237.86 | -211.28 | -157.75 | 117.48 | -263.36 | -123.41 | -336.66 | 177.40 | -271.22 | -249.06 | -26.38 | -149.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | 186.20 | -564.91 | 607.18 | 679.05 | 1007.64 | 740.30 | 252.98 | -189.16 | -272.30 | 865.17 | 70.78 | 446.13 | -694.22 | 584.49 | 185.37 | -58.60 | 42.66 | 255.02 | 125.60 | 340.44 | -523.03 | 462.13 | 295.95 | 13.32 | 134.36 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 15.04 | 15.93 | 9.48 | 0.81 | 29.88 | 30.02 | 40.34 | 26.80 | 29.49 | 8.04 | 32.62 | 17.05 | 22.31 | 27.19 | 0.88 | 13.29 | 23.31 | 12.64 | 11.19 | 8.59 | 30.18 | 2.13 | 10.08 | 10.24 | 9.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 2.18 | -212.29 | 8.50 | 17.35 | 29.01 | 33.32 | 30.84 | 23.88 | 37.23 | 26.05 | 22.36 | 22.37 | 30.94 | 17.85 | 13.21 | 15.21 | 17.36 | 12.41 | 11.26 | 14.13 | 14.71 | 5.15 | 8.98 | 2.27 | 9.58 | 9.62 | 6.11 | 6.52 | 9.68 | 3.32 | 3.79 | 5.05 | 2.76 | 2.94 | 2.63 | 3.01 | 2.66 | 1.27 | |

| Profit Loss | 2.18 | -212.29 | 8.50 | 17.35 | 29.01 | 33.32 | 30.84 | 23.88 | 37.23 | 26.05 | 22.36 | 22.37 | 30.94 | 17.85 | 13.21 | 15.21 | 17.36 | 12.41 | 11.26 | 14.13 | 14.71 | 5.15 | 8.98 | 2.27 | 9.58 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deferred Income Tax Expense Benefit | -10.41 | 1.89 | 2.76 | -0.46 | -1.00 | -1.49 | 3.43 | -1.13 | -0.80 | -1.31 | 1.67 | -0.56 | -2.48 | -0.26 | 1.72 | 0.03 | -0.79 | -0.05 | 0.73 | 0.42 | 0.33 | 0.05 | 0.39 | 4.49 | -0.25 | -0.45 | 0.73 | 0.58 | 0.76 | -0.54 | 0.53 | -0.80 | -0.38 | -0.50 | -0.18 | 0.09 | -0.09 | 0.05 | |

| Share Based Compensation | 0.58 | 0.52 | 0.03 | 0.70 | 0.73 | 0.83 | 1.20 | 0.55 | 0.57 | 0.63 | 0.99 | 0.41 | 0.47 | 0.43 | 0.77 | 0.30 | 0.35 | 0.30 | 0.69 | 0.46 | 0.51 | 0.51 | 1.17 | 0.93 | 0.25 | 0.22 | 0.44 | 0.19 | 0.22 | 0.17 | 0.32 | 0.23 | 0.13 | 0.10 | 0.15 | 0.06 | 0.09 | 0.15 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -308.83 | 157.93 | 43.97 | -341.19 | -893.22 | -1528.51 | -483.37 | 500.75 | 56.55 | -371.59 | -265.07 | -116.46 | 540.71 | -237.86 | -211.28 | -157.75 | 117.48 | -263.36 | -123.41 | -336.66 | 177.40 | -271.22 | -249.06 | -26.38 | -149.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 3.70 | 0.11 | 2.49 | 0.58 | 0.48 | 2.30 | 1.22 | 0.65 | 0.73 | 1.20 | 0.63 | 0.58 | 0.90 | 0.40 | 0.98 | 0.42 | 0.62 | 0.33 | 0.85 | 0.59 | 0.65 | 0.67 | 0.80 | 0.47 | 0.11 | 0.96 | 0.69 | 1.91 | 1.05 | 0.78 | 2.19 | 0.61 | 0.39 | 0.13 | 0.62 | 0.02 | 0.08 | 0.02 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 186.20 | -564.91 | 607.18 | 679.05 | 1007.64 | 740.30 | 252.98 | -189.16 | -272.30 | 865.17 | 70.78 | 446.13 | -694.22 | 584.49 | 185.37 | -58.60 | 42.66 | 255.02 | 125.60 | 340.44 | -523.03 | 462.13 | 295.95 | 13.32 | 134.36 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments Of Dividends | 1.13 | 1.13 | 6.20 | 6.20 | 6.20 | 6.22 | 6.21 | 4.08 | 4.04 | 4.03 | 4.02 | 3.12 | 3.12 | 3.12 | 3.13 | 2.23 | 2.23 | 2.23 | 2.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 0.00 | 0.00 | 0.53 | 1.05 | 0.00 | 2.46 | 1.12 | 0.53 | 0.00 | 0.24 | 0.94 | 0.00 | 0.00 | 0.00 | 2.82 | 0.00 | -0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 8.81 | 9.02 | 8.80 | 9.72 | 8.97 | 9.89 | 10.20 | 9.61 | 9.31 | 8.75 | 8.35 | 7.60 | 7.37 | 6.73 | 7.76 | 7.42 | 7.30 | 7.14 | 6.79 | 7.25 | 7.23 | 7.09 | 7.18 | 7.04 | 6.90 | 6.56 | 6.21 | 6.26 | 6.14 | 5.99 | 6.00 | 5.84 | 5.87 | 5.92 | 5.85 | 4.41 | 6.31 | 5.20 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 8.81 | 9.02 | 8.80 | 9.72 | 8.97 | 9.89 | 10.20 | 9.61 | 9.31 | 8.75 | 8.35 | 7.60 | 7.37 | 6.73 | 7.76 | 7.42 | 7.30 | 7.14 | 6.79 | 7.25 | 7.23 | 7.09 | 7.18 | 7.04 | 6.90 | 6.56 | 6.21 | 6.26 | 6.14 | 5.99 | 6.00 | 5.84 | 5.87 | 5.92 | 5.85 | 4.41 | 6.31 | 5.20 |