| 2024-03-30 | 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-09-24 | 2022-06-25 | 2022-03-26 | 2021-12-25 | 2021-09-25 | 2021-06-26 | 2021-03-27 | 2020-12-26 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-09-24 | 2016-06-25 | 2016-03-26 | 2015-12-26 | 2015-09-26 | 2015-06-27 | 2015-03-28 | 2014-12-27 | 2014-09-27 | 2014-06-28 | 2014-03-29 | 2013-12-28 | 2013-09-28 | 2013-06-29 | 2013-03-30 | 2012-12-29 | 2012-09-29 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-24 | 2011-06-25 | 2011-03-26 | 2010-12-25 | 2010-09-25 | 2010-06-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | NA | 0.05 | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 78.49 | NA | 78.41 | 77.62 | 77.25 | NA | 77.69 | 79.21 | 79.47 | NA | 79.03 | 79.47 | 79.99 | NA | 78.81 | 78.86 | 78.51 | 78.06 | 77.29 | 76.19 | 76.01 | 75.42 | 74.96 | 74.53 | 74.34 | 74.76 | 73.89 | 73.54 | 72.92 | 70.81 | 70.50 | 59.99 | 58.43 | 58.13 | 58.21 | 59.09 | 58.84 | 56.47 | 56.30 | 55.81 | 55.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 77.45 | NA | 77.57 | 77.16 | 77.07 | NA | 77.25 | 77.90 | 78.25 | NA | 77.87 | 77.46 | 77.60 | NA | 77.03 | 76.28 | 76.00 | 75.73 | 75.28 | 74.48 | 74.36 | 74.11 | 73.84 | 73.16 | 72.83 | 72.85 | 72.65 | 72.20 | 71.42 | 70.81 | 70.50 | 59.57 | 58.43 | 58.13 | 58.21 | 58.11 | 56.95 | 56.47 | 56.30 | 55.81 | 55.05 | 54.61 | 54.44 | 54.10 | 53.66 | 52.74 | 50.15 | 49.82 | 49.49 | 49.97 | 50.75 | 50.77 | 50.64 | NA | NA | NA | |

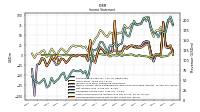

| Earnings Per Share Basic | 0.28 | 0.98 | 0.06 | 0.01 | 0.02 | -0.18 | 0.06 | 0.39 | 0.38 | 0.33 | 0.26 | 0.23 | 0.25 | 0.24 | 0.30 | 0.27 | 0.21 | 0.25 | 0.11 | 0.09 | 0.07 | 1.15 | 0.10 | 0.12 | 0.03 | 0.08 | 0.17 | 0.24 | 0.07 | -0.22 | -0.20 | 0.62 | -0.24 | -0.01 | -0.04 | 0.01 | 0.01 | -0.03 | 0.00 | -0.08 | -0.23 | -0.34 | -0.20 | -0.16 | -0.37 | 0.01 | -0.29 | -0.08 | -0.35 | -0.54 | -0.20 | -0.15 | -0.42 | NA | NA | NA | |

| Earnings Per Share Diluted | 0.28 | 0.97 | 0.06 | 0.01 | 0.02 | -0.17 | 0.06 | 0.38 | 0.38 | 0.33 | 0.26 | 0.23 | 0.25 | 0.24 | 0.29 | 0.26 | 0.20 | 0.24 | 0.11 | 0.09 | 0.07 | 1.13 | 0.10 | 0.12 | 0.03 | 0.07 | 0.17 | 0.24 | 0.07 | -0.22 | -0.20 | 0.61 | -0.24 | -0.01 | -0.04 | 0.01 | 0.01 | -0.03 | 0.00 | -0.08 | -0.23 | -0.34 | -0.20 | -0.16 | -0.37 | 0.01 | -0.29 | -0.08 | -0.35 | NA | NA | NA | NA | NA | NA | NA |

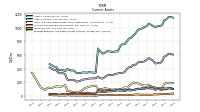

| 2024-03-30 | 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-09-24 | 2022-06-25 | 2022-03-26 | 2021-12-25 | 2021-09-25 | 2021-06-26 | 2021-03-27 | 2020-12-26 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-09-24 | 2016-06-25 | 2016-03-26 | 2015-12-26 | 2015-09-26 | 2015-06-27 | 2015-03-28 | 2014-12-27 | 2014-09-27 | 2014-06-28 | 2014-03-29 | 2013-12-28 | 2013-09-28 | 2013-06-29 | 2013-03-30 | 2012-12-29 | 2012-09-29 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-24 | 2011-06-25 | 2011-03-26 | 2010-12-25 | 2010-09-25 | 2010-06-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

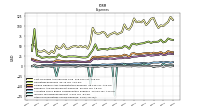

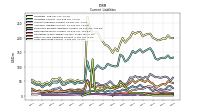

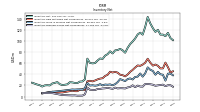

| Revenue From Contract With Customer Excluding Assessed Tax | 168.72 | 168.16 | 171.57 | 155.92 | 167.45 | 165.99 | 180.87 | 203.91 | 197.17 | 205.00 | 189.96 | 188.08 | 186.64 | 197.04 | 178.00 | 157.82 | 160.75 | 178.63 | 140.60 | 138.02 | 132.21 | 140.89 | 134.99 | 135.51 | 118.29 | 131.90 | 143.74 | 143.98 | 128.83 | 123.89 | 123.30 | 83.08 | 53.61 | 71.78 | 65.86 | 73.89 | 70.83 | 71.28 | 73.93 | 67.35 | 55.96 | 48.55 | 67.63 | 62.73 | 52.62 | 47.65 | 41.26 | 54.81 | 34.81 | 30.22 | 52.12 | 46.56 | 40.43 | 43.91 | 47.35 | 57.64 | |

| Revenues | 168.72 | 168.16 | 171.57 | 155.92 | 167.45 | 165.99 | 180.87 | 203.91 | 197.17 | 205.00 | 189.96 | 188.08 | 186.64 | 197.04 | 178.00 | 157.82 | 160.75 | 178.63 | 140.60 | 138.02 | 132.21 | 140.89 | 134.99 | 135.51 | 118.29 | 131.90 | 143.74 | 143.98 | 128.83 | 123.89 | 123.30 | 83.08 | 53.61 | 71.78 | 65.86 | 73.89 | 70.83 | 71.28 | 73.93 | 67.35 | 55.96 | 48.55 | 67.63 | 62.73 | 52.62 | 47.65 | 41.26 | 54.81 | 34.81 | 30.22 | 52.12 | 46.56 | 40.43 | 43.91 | 47.35 | 57.64 | |

| Cost Of Goods And Services Sold | 105.99 | 100.23 | 102.29 | 95.63 | 106.37 | 120.78 | 118.66 | 109.54 | 102.95 | 115.44 | 109.75 | 111.79 | 109.93 | 119.43 | 101.25 | 91.66 | 93.36 | 104.32 | 85.29 | 82.67 | 79.69 | 84.86 | 82.02 | 79.29 | 73.16 | 83.27 | 86.11 | 82.21 | 81.26 | 83.61 | 96.11 | 57.66 | 43.82 | 50.59 | 47.41 | 50.58 | 48.04 | 50.34 | 49.79 | 47.33 | 43.63 | 44.29 | 55.09 | 46.33 | 43.55 | 50.80 | 33.11 | 38.65 | 30.65 | 35.20 | 40.14 | 36.67 | 36.36 | 40.59 | 54.54 | 53.71 | |

| Gross Profit | 62.74 | 67.93 | 69.28 | 60.28 | 61.08 | 45.20 | 62.21 | 94.37 | 94.22 | 89.56 | 80.22 | 76.28 | 76.71 | 77.61 | 76.75 | 66.17 | 67.39 | 74.31 | 55.32 | 55.35 | 52.52 | 56.02 | 52.97 | 56.22 | 45.13 | 48.63 | 57.63 | 61.77 | 47.57 | 40.27 | 27.19 | 25.43 | 9.79 | 21.19 | 18.45 | 23.30 | 22.79 | 20.95 | 24.14 | 20.02 | 12.32 | 4.26 | 12.55 | 16.41 | 9.07 | -3.14 | 8.15 | 16.17 | 4.16 | -4.97 | 11.97 | 9.89 | 4.07 | 3.32 | -7.19 | 3.93 | |

| Operating Expenses | 61.71 | 59.62 | 66.58 | 61.59 | 60.99 | 61.15 | 58.19 | 61.72 | 60.04 | 57.77 | 56.97 | 55.93 | 54.06 | 56.79 | 54.71 | 43.67 | 48.96 | 50.59 | 45.98 | 46.36 | 44.91 | 44.23 | 43.60 | 44.91 | 41.49 | 43.23 | 43.36 | 42.19 | 40.51 | 54.80 | 40.35 | 32.07 | 23.36 | 21.95 | 21.81 | 22.61 | 23.47 | 24.31 | 24.62 | 24.32 | 24.74 | 23.16 | 23.41 | 24.91 | 29.59 | 21.86 | 22.79 | 22.66 | 22.13 | 23.07 | 21.98 | 20.93 | 25.34 | 27.18 | 92.98 | 38.23 | |

| Research And Development Expense | 28.63 | 28.17 | 31.01 | 28.34 | 28.25 | 27.22 | 26.55 | 28.32 | 27.13 | 25.41 | 26.03 | 25.45 | 24.05 | 23.97 | 22.88 | 20.92 | 21.27 | 21.61 | 20.10 | 20.07 | 19.72 | 18.40 | 18.86 | 19.68 | 18.05 | 18.51 | 19.34 | 18.54 | 17.41 | 18.22 | 17.25 | 11.13 | 10.85 | 11.24 | 10.64 | 11.22 | 11.09 | 10.71 | 11.20 | 11.07 | 9.75 | 9.99 | 10.30 | 10.91 | 10.93 | 9.78 | 8.57 | 10.94 | 10.85 | 10.68 | 10.42 | 10.88 | 11.56 | 11.48 | 12.82 | 16.00 | |

| Selling General And Administrative Expense | 33.08 | 31.45 | 35.56 | 33.26 | 32.74 | 33.93 | 31.64 | 33.41 | 32.91 | 32.36 | 30.94 | 30.48 | 30.02 | 32.82 | 31.83 | 22.75 | 27.69 | 28.98 | 25.89 | 26.28 | 25.18 | 25.67 | 24.75 | 25.23 | 23.45 | 24.24 | 24.01 | 23.60 | 22.83 | 23.89 | 23.01 | 14.03 | 12.52 | 10.72 | 11.11 | 11.38 | 11.88 | 12.63 | 13.31 | 13.19 | 12.25 | 12.16 | 12.95 | 13.49 | 14.62 | 14.96 | 11.59 | 11.53 | 11.15 | 11.96 | 11.20 | 11.15 | 12.39 | 14.40 | 16.22 | 18.73 | |

| Operating Income Loss | 21.30 | 81.27 | 2.71 | -1.31 | 0.09 | -15.95 | 4.03 | 32.65 | 34.18 | 31.79 | 23.25 | 20.35 | 22.64 | 20.83 | 22.04 | 22.49 | 18.43 | 23.72 | 9.34 | 8.99 | 7.61 | 11.80 | 9.37 | 11.31 | 3.63 | 5.40 | 14.27 | 19.58 | 7.06 | -14.53 | -13.16 | -6.65 | -13.57 | -0.76 | -3.36 | 0.70 | -0.68 | -3.36 | -0.48 | -4.30 | -12.42 | -18.91 | -10.87 | -8.51 | -20.51 | -25.01 | -14.64 | -6.50 | -17.97 | -28.05 | -10.01 | -11.04 | -21.27 | -23.86 | -100.18 | -34.30 | |

| Interest Income Expense Net | 3.16 | NA | 1.66 | 1.48 | 1.28 | NA | 0.56 | 0.18 | -0.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Paid Net | 0.10 | 0.10 | 0.10 | 0.11 | 0.11 | 0.08 | 0.16 | 0.13 | 0.16 | 0.15 | 0.16 | 0.17 | 0.17 | 0.18 | 0.21 | 0.18 | 0.29 | 0.28 | 0.35 | 0.48 | 0.30 | 0.81 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 10.40 | 9.28 | 10.84 | 9.20 | 9.29 | 9.46 | 8.00 | 6.36 | 7.52 | 7.80 | 7.92 | 6.59 | 7.08 | 7.06 | 5.51 | 5.64 | 5.62 | 6.09 | 6.50 | 5.29 | 5.29 | 5.41 | 4.54 | 4.13 | 3.76 | NA | 4.59 | 3.39 | 3.30 | NA | 3.20 | 1.54 | 2.73 | NA | 3.10 | 2.51 | 2.91 | NA | 3.93 | 3.52 | 2.57 | NA | 2.96 | 3.13 | 3.04 | 3.56 | 2.97 | 3.48 | 3.04 | NA | 3.34 | 2.35 | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 3.20 | 6.25 | 0.79 | -0.21 | 0.05 | -1.73 | 1.27 | 3.14 | 4.45 | 6.30 | 2.78 | 2.28 | 3.21 | 2.17 | -0.50 | 2.16 | 2.82 | 5.81 | 1.58 | 2.29 | 2.03 | -73.44 | 1.39 | 1.65 | 0.29 | -1.14 | 1.03 | 1.04 | 0.37 | 0.03 | 0.05 | -43.74 | 0.03 | -0.11 | 0.21 | 0.02 | 0.12 | -1.27 | 0.10 | -0.05 | 0.31 | 0.05 | -0.15 | 0.20 | -0.21 | -25.14 | 0.17 | -1.55 | 0.10 | 0.15 | 0.16 | -2.41 | 0.21 | -2.59 | 0.23 | 0.20 | |

| Income Taxes Paid Net | 1.42 | 5.32 | 2.64 | 2.04 | 7.39 | 1.01 | 3.44 | 5.58 | 0.89 | 1.16 | 2.24 | 3.52 | 1.03 | 1.68 | 3.34 | 1.71 | 2.42 | 1.45 | 1.18 | 0.62 | 1.08 | 2.06 | 1.33 | 0.41 | 0.77 | 0.33 | 1.32 | 1.12 | 0.41 | 2.17 | 1.27 | 0.20 | 0.02 | 0.12 | 0.72 | 0.13 | -0.94 | 0.16 | 0.67 | 0.09 | 0.04 | 0.09 | -1.84 | -5.31 | 0.91 | 0.80 | 0.00 | -0.94 | 0.10 | 0.15 | -0.01 | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | -0.23 | 0.49 | -1.00 | -0.05 | -0.04 | 2.88 | -0.88 | -0.12 | 0.87 | -0.10 | -0.32 | -0.09 | -0.23 | 0.63 | 0.30 | 0.08 | 0.18 | 0.49 | -0.54 | -0.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | -2.71 | NA | -4.06 | -0.26 | 1.39 | NA | -8.90 | -4.52 | -3.03 | NA | -1.90 | 0.45 | -2.74 | NA | 2.02 | 1.37 | -0.25 | 1.52 | -2.34 | 0.76 | -1.38 | -0.38 | -0.53 | -3.49 | 2.16 | 1.03 | 1.49 | 2.64 | 1.60 | -3.85 | 0.77 | 0.92 | 0.64 | -0.06 | -0.17 | -0.30 | 0.06 | -1.16 | -0.81 | 0.32 | 0.14 | -0.55 | 0.28 | -0.56 | -1.13 | -1.08 | 0.48 | 0.28 | -0.66 | -0.28 | 0.17 | 0.52 | NA | NA | NA | NA | |

| Net Income Loss | 21.78 | 75.85 | 4.37 | 0.83 | 1.34 | -13.73 | 4.35 | 30.24 | 29.87 | 25.90 | 20.50 | 17.91 | 19.62 | 19.27 | 22.89 | 20.47 | 15.89 | 18.64 | 8.28 | 6.95 | 5.48 | 85.10 | 7.69 | 9.12 | 2.12 | 5.59 | 12.56 | 17.58 | 5.18 | -15.44 | -14.20 | 36.88 | -13.80 | -0.62 | -2.52 | 0.84 | 0.78 | -1.87 | -0.28 | -4.33 | -12.71 | -18.79 | -10.71 | -8.41 | -19.77 | 0.60 | -14.48 | -4.22 | -17.45 | -26.98 | -9.90 | -7.68 | -21.42 | NA | NA | NA | |

| Comprehensive Income Net Of Tax | 19.07 | 80.30 | 0.31 | 0.57 | 2.73 | -1.41 | -4.55 | 25.72 | 26.84 | 22.75 | 18.60 | 18.35 | 16.89 | 22.68 | 24.91 | 21.84 | 15.64 | 20.16 | 5.94 | 7.71 | 4.10 | 84.72 | 7.16 | 5.63 | 4.29 | 6.61 | 14.05 | 20.22 | 6.79 | -19.30 | -13.43 | 37.80 | -13.16 | -0.68 | -2.69 | 0.54 | 0.85 | -3.03 | -1.09 | -4.01 | -12.57 | -19.34 | -10.44 | -8.97 | -20.90 | -0.48 | -14.00 | -3.94 | -18.11 | -27.26 | -9.73 | -7.16 | -21.16 | NA | NA | NA |

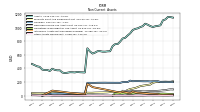

| 2024-03-30 | 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-09-24 | 2022-06-25 | 2022-03-26 | 2021-12-25 | 2021-09-25 | 2021-06-26 | 2021-03-27 | 2020-12-26 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-09-24 | 2016-06-25 | 2016-03-26 | 2015-12-26 | 2015-09-26 | 2015-06-27 | 2015-03-28 | 2014-12-27 | 2014-09-27 | 2014-06-28 | 2014-03-29 | 2013-12-28 | 2013-09-28 | 2013-06-29 | 2013-03-30 | 2012-12-29 | 2012-09-29 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-24 | 2011-06-25 | 2011-03-26 | 2010-12-25 | 2010-09-25 | 2010-06-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

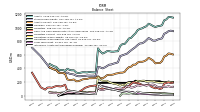

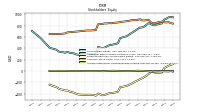

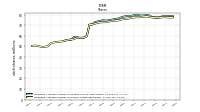

| Assets | 1119.80 | 1106.79 | 1032.97 | 1025.14 | 1019.76 | 1008.23 | 1022.36 | 1042.45 | 1056.88 | 1020.52 | 1006.59 | 988.55 | 980.21 | 963.22 | 915.61 | 884.23 | 849.38 | 839.88 | 793.61 | 757.57 | 756.62 | 728.22 | 652.47 | 651.22 | 646.19 | 646.57 | 653.55 | 653.40 | 632.67 | 618.98 | 650.31 | 695.26 | 340.53 | 342.72 | 344.21 | 348.75 | 341.52 | 344.24 | 344.53 | 337.13 | 332.18 | 340.71 | 372.94 | 372.28 | 379.03 | 395.68 | 362.83 | 378.35 | 376.19 | 383.07 | 423.95 | 431.59 | NA | 466.05 | NA | NA | |

| Liabilities | 196.05 | 197.99 | 192.28 | 190.88 | 195.38 | 199.94 | 214.06 | 212.46 | 210.21 | 204.74 | 220.20 | 219.00 | 213.68 | 219.13 | 201.47 | 193.51 | 182.96 | 198.88 | 179.06 | 153.47 | 163.63 | 148.06 | 162.42 | 172.55 | 175.18 | 187.94 | 198.70 | 218.79 | 217.32 | 217.93 | 234.69 | 271.67 | 54.32 | 48.04 | 50.68 | 53.74 | 46.15 | 54.81 | 55.30 | 52.11 | 46.66 | 46.62 | 62.26 | 55.40 | 56.42 | 56.42 | 40.38 | 45.95 | 43.32 | 36.42 | 46.61 | 44.30 | NA | 54.85 | NA | NA | |

| Liabilities And Stockholders Equity | 1119.80 | 1106.79 | 1032.97 | 1025.14 | 1019.76 | 1008.23 | 1022.36 | 1042.45 | 1056.88 | 1020.52 | 1006.59 | 988.55 | 980.21 | 963.22 | 915.61 | 884.23 | 849.38 | 839.88 | 793.61 | 757.57 | 756.62 | 728.22 | 652.47 | 651.22 | 646.19 | 646.57 | 653.55 | 653.40 | 632.67 | 618.98 | 650.31 | 695.26 | 340.53 | 342.72 | 344.21 | 348.75 | 341.52 | 344.24 | 344.53 | 337.13 | 332.18 | 340.71 | 372.94 | 372.28 | 379.03 | 395.68 | 362.83 | 378.35 | 376.19 | 383.07 | 423.95 | 431.59 | NA | 466.05 | NA | NA | |

| Stockholders Equity | 923.75 | 908.80 | 840.69 | 834.26 | 824.37 | 808.28 | 808.30 | 829.99 | 846.67 | 815.78 | 786.39 | 769.55 | 766.53 | 744.08 | 714.14 | 690.72 | 666.42 | 641.00 | 614.55 | 604.10 | 592.99 | 580.16 | 490.05 | 478.67 | 471.01 | 458.64 | 454.85 | 434.61 | 415.35 | 401.06 | 415.62 | 423.58 | 286.21 | 294.68 | 293.53 | 295.01 | 295.37 | 289.44 | 289.23 | 285.01 | 285.51 | 294.09 | 310.68 | 316.88 | 322.61 | 339.26 | 322.45 | 332.41 | 332.87 | 346.65 | 377.34 | NA | NA | 411.20 | NA | NA |

| 2024-03-30 | 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-09-24 | 2022-06-25 | 2022-03-26 | 2021-12-25 | 2021-09-25 | 2021-06-26 | 2021-03-27 | 2020-12-26 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-09-24 | 2016-06-25 | 2016-03-26 | 2015-12-26 | 2015-09-26 | 2015-06-27 | 2015-03-28 | 2014-12-27 | 2014-09-27 | 2014-06-28 | 2014-03-29 | 2013-12-28 | 2013-09-28 | 2013-06-29 | 2013-03-30 | 2012-12-29 | 2012-09-29 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-24 | 2011-06-25 | 2011-03-26 | 2010-12-25 | 2010-09-25 | 2010-06-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

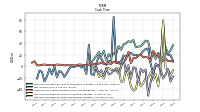

| Assets Current | 588.50 | 573.78 | 506.58 | 478.25 | 480.92 | 474.55 | 516.31 | 537.06 | 556.15 | 524.04 | 506.50 | 497.49 | 498.11 | 487.07 | 456.19 | 455.41 | 426.25 | 419.04 | 389.79 | 347.65 | 338.38 | 337.82 | 329.67 | 324.32 | 311.80 | 305.85 | 306.74 | 300.73 | 274.20 | 254.71 | 260.08 | 284.44 | 258.34 | 258.02 | 256.05 | 256.61 | 245.46 | 244.27 | 239.39 | 224.15 | 213.30 | 211.65 | 237.87 | 231.58 | 230.80 | 239.17 | 320.20 | 333.91 | 331.35 | 336.98 | 377.38 | 383.75 | NA | 416.29 | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 186.30 | 177.81 | 108.73 | 97.98 | 112.36 | 109.13 | 120.60 | 136.40 | 167.18 | 151.01 | 153.78 | 160.27 | 173.62 | 187.22 | 185.37 | 199.93 | 169.61 | 144.54 | 122.95 | 124.81 | 105.76 | 98.47 | 91.99 | 95.62 | 93.70 | 91.18 | 103.08 | 107.82 | 114.44 | 101.41 | 99.91 | 100.22 | 151.91 | 146.26 | 142.19 | 137.09 | 125.99 | 113.94 | 89.26 | 69.86 | 49.20 | 59.20 | 59.47 | 57.16 | 77.38 | 72.24 | 162.06 | 144.82 | 135.54 | 139.05 | 140.93 | 130.09 | 116.14 | 121.21 | 118.55 | 89.08 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 194.38 | 181.27 | 113.71 | 101.39 | 115.85 | 112.98 | 123.70 | 140.30 | 171.26 | 155.34 | 157.47 | 163.97 | 178.31 | 191.10 | 188.24 | 202.72 | 173.07 | 147.94 | 124.74 | 126.69 | 107.71 | 100.55 | 93.15 | 96.81 | 95.38 | 92.73 | 103.85 | 108.59 | 115.56 | 102.60 | NA | NA | NA | 146.70 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Marketable Securities Current | 162.86 | 150.51 | 135.69 | 138.94 | 123.89 | 129.01 | 130.99 | 129.92 | 129.17 | 125.06 | 110.90 | 95.96 | 94.09 | 67.81 | 56.10 | 61.18 | NA | 76.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accounts Receivable Net Current | 96.41 | 102.96 | 88.97 | 94.01 | 103.97 | 88.14 | 110.50 | 107.73 | 113.50 | 115.54 | 105.81 | 108.27 | 103.50 | 107.60 | 96.95 | 86.62 | 90.10 | 97.87 | 84.75 | 71.29 | 81.49 | 95.33 | 88.87 | 84.78 | 78.52 | 81.52 | 87.95 | 91.71 | 79.44 | 70.22 | 77.53 | 86.14 | 35.74 | 36.73 | 36.68 | 43.98 | 41.05 | 45.15 | 47.78 | 41.96 | 37.06 | 30.19 | 46.32 | 38.96 | 33.45 | 28.92 | 16.89 | 27.73 | 21.20 | 12.66 | 29.14 | 28.02 | NA | 28.60 | NA | NA | |

| Inventory Net | 108.77 | 111.69 | 111.63 | 120.30 | 116.55 | 123.16 | 132.03 | 143.47 | 125.59 | 111.55 | 115.10 | 111.89 | 104.73 | 99.23 | 94.62 | 87.81 | 78.98 | 83.26 | 85.99 | 83.85 | 83.22 | 77.71 | 81.54 | 76.38 | 73.78 | 67.85 | 68.67 | 64.95 | 60.37 | 59.81 | 60.68 | 68.36 | 30.99 | 27.22 | 27.00 | 24.25 | 24.57 | 25.55 | 25.90 | 22.05 | 21.32 | 20.71 | 22.37 | 26.13 | 24.69 | 23.62 | 20.05 | 20.51 | 20.15 | 18.09 | 20.65 | 21.80 | NA | 25.00 | NA | NA | |

| Prepaid Expense And Other Assets Current | 28.29 | 29.67 | 26.68 | 25.88 | 22.94 | 23.89 | 20.93 | 17.45 | 18.67 | 18.65 | 18.89 | 19.24 | 19.37 | 23.30 | 21.69 | 18.46 | 15.70 | 15.06 | 17.83 | 14.28 | 11.75 | 13.67 | 15.72 | 18.82 | 14.45 | 13.71 | 13.38 | 13.00 | 11.35 | 14.28 | 12.95 | 10.09 | 4.42 | 6.48 | 6.50 | 7.60 | 6.15 | 6.92 | 7.73 | 7.48 | 7.37 | 6.11 | 7.84 | 6.19 | 9.48 | 10.57 | 6.36 | 7.23 | 7.01 | 7.46 | 11.25 | 9.02 | NA | 14.74 | NA | NA | |

| Available For Sale Securities Debt Securities | NA | 150.51 | NA | NA | NA | 129.01 | NA | NA | NA | 125.06 | NA | NA | NA | 67.81 | NA | NA | NA | 76.33 | NA | NA | NA | 50.53 | NA | NA | NA | 48.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

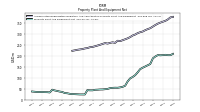

| 2024-03-30 | 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-09-24 | 2022-06-25 | 2022-03-26 | 2021-12-25 | 2021-09-25 | 2021-06-26 | 2021-03-27 | 2020-12-26 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-09-24 | 2016-06-25 | 2016-03-26 | 2015-12-26 | 2015-09-26 | 2015-06-27 | 2015-03-28 | 2014-12-27 | 2014-09-27 | 2014-06-28 | 2014-03-29 | 2013-12-28 | 2013-09-28 | 2013-06-29 | 2013-03-30 | 2012-12-29 | 2012-09-29 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-24 | 2011-06-25 | 2011-03-26 | 2010-12-25 | 2010-09-25 | 2010-06-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 497.92 | 495.28 | 492.87 | 489.08 | 483.88 | 478.10 | 453.40 | 449.32 | 443.93 | 433.33 | 381.72 | 376.69 | 368.88 | 353.33 | 346.13 | 332.20 | NA | 319.89 | NA | NA | NA | 306.78 | NA | NA | NA | 296.48 | NA | NA | NA | 278.71 | 277.69 | 273.25 | 253.75 | 251.44 | 251.27 | 249.84 | 247.96 | 247.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Construction In Progress Gross | 69.72 | 67.14 | 64.43 | 64.62 | 57.11 | 47.46 | 37.87 | 32.27 | 26.97 | 25.92 | 67.97 | 54.01 | 42.29 | 45.24 | 38.54 | 33.00 | NA | 11.86 | NA | NA | NA | 10.38 | NA | NA | NA | 6.03 | NA | NA | NA | 5.90 | 5.53 | 7.21 | 5.00 | 4.42 | 2.98 | 3.43 | 3.47 | 2.46 | 1.20 | 1.90 | 1.01 | 3.99 | 3.97 | 4.12 | 7.09 | 13.40 | 9.68 | 11.30 | NA | 12.50 | NA | NA | NA | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 361.87 | 358.02 | 353.80 | 349.12 | 342.76 | 335.71 | 327.88 | 323.78 | 318.73 | 312.70 | 309.59 | 305.36 | 298.87 | 294.47 | 287.14 | 281.54 | 277.02 | 273.00 | 268.49 | 270.57 | 260.61 | 263.10 | 260.61 | 257.37 | 259.61 | 255.75 | 251.94 | 248.39 | NA | 241.94 | 240.54 | 236.66 | 235.04 | 232.00 | 230.43 | 228.79 | 226.35 | 224.13 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

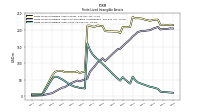

| Amortization Of Intangible Assets | 0.64 | 0.81 | 1.28 | 2.39 | 2.38 | 2.33 | 2.35 | 2.33 | 2.37 | 2.38 | 2.46 | 7.09 | 6.80 | 7.74 | 6.53 | 6.45 | 7.26 | 7.42 | 6.08 | 7.08 | 7.09 | 7.50 | 7.51 | 7.17 | 7.19 | 7.43 | 7.52 | 7.64 | 8.35 | 10.08 | 19.90 | 2.73 | 2.73 | 3.28 | 3.32 | 3.32 | 3.19 | 3.57 | 5.07 | 5.07 | 5.07 | 4.03 | 4.13 | NA | 4.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Property Plant And Equipment Net | 205.77 | 204.40 | 203.51 | 204.58 | 198.23 | 189.85 | 163.38 | 157.81 | 152.18 | 146.56 | 140.10 | 125.35 | 112.31 | 104.10 | 97.53 | 83.66 | 63.74 | 58.75 | 56.24 | 54.44 | 54.70 | 54.05 | 52.86 | 49.16 | 47.85 | 46.75 | 46.55 | 45.67 | 45.15 | 42.66 | 42.68 | 43.79 | 23.71 | 23.85 | 23.82 | 24.48 | 25.08 | 25.50 | 26.61 | 29.21 | 30.05 | 35.19 | 36.95 | 39.63 | 42.05 | 45.52 | 32.91 | 34.23 | 34.38 | 35.13 | 34.87 | 35.08 | NA | 37.31 | NA | NA | |

| Goodwill | 199.65 | 201.09 | 200.49 | 211.93 | 211.77 | 211.44 | 209.10 | 212.36 | 211.55 | 212.30 | 213.29 | 214.55 | 214.22 | 212.76 | 220.76 | 200.29 | 200.38 | 199.20 | 188.56 | 189.12 | 188.93 | 189.21 | 189.43 | 189.53 | 190.37 | 189.92 | 189.70 | 189.19 | 188.19 | 188.01 | 188.78 | 188.52 | 30.73 | 30.70 | 30.73 | 30.73 | 30.73 | 30.73 | 30.73 | 30.73 | 30.73 | 30.73 | 30.73 | 29.96 | 31.10 | 30.99 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 12.30 | 12.94 | 13.58 | 22.15 | 24.49 | 26.75 | 28.21 | 30.87 | 33.64 | 36.34 | 39.20 | 41.91 | 48.79 | 59.15 | 37.94 | 43.78 | 50.14 | 57.61 | 47.05 | 53.40 | 60.38 | 67.64 | 75.28 | 82.86 | 90.65 | 97.48 | 104.74 | 111.78 | 118.44 | 126.61 | 152.40 | 172.15 | 22.82 | 25.55 | 28.87 | 32.19 | 35.50 | 38.69 | 42.26 | 47.33 | 52.40 | 57.47 | 61.49 | 65.62 | 69.88 | 74.28 | NA | NA | NA | 3.24 | NA | NA | NA | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 12.30 | 12.94 | 13.58 | 22.15 | 24.49 | 26.75 | 28.21 | 30.87 | 33.64 | 36.34 | 39.20 | 41.91 | 48.79 | 59.15 | 37.94 | 43.78 | 50.14 | 57.61 | 47.05 | 53.40 | 60.38 | 67.64 | 75.28 | 82.86 | 90.65 | 97.48 | 104.74 | 111.78 | 118.44 | 126.61 | 140.00 | 159.75 | 22.82 | 25.55 | 24.37 | 27.69 | 28.60 | 31.79 | 35.35 | 40.43 | 45.50 | 50.57 | 54.59 | 58.73 | 58.88 | 53.18 | NA | NA | NA | 3.24 | NA | NA | NA | 4.42 | NA | NA | |

| Other Assets Noncurrent | 2.81 | 2.79 | 3.27 | 3.79 | 3.69 | 3.99 | 4.23 | 3.98 | 2.80 | 1.98 | 1.93 | 1.98 | 1.87 | 1.17 | 1.01 | 0.97 | 1.02 | 1.20 | 1.36 | 1.34 | 1.41 | 0.97 | 1.16 | 1.20 | 1.36 | 2.26 | 1.75 | 1.96 | 2.25 | 2.60 | 1.98 | 2.00 | 1.16 | 0.85 | 0.86 | 0.86 | 0.83 | 1.15 | 1.23 | 1.29 | 1.27 | 1.27 | 1.00 | 0.99 | 0.59 | 1.20 | 3.50 | 4.08 | 4.36 | 4.69 | 3.99 | 5.11 | NA | 6.71 | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | NA | 150.79 | NA | NA | NA | 131.25 | NA | NA | NA | 125.33 | NA | NA | NA | 67.49 | NA | NA | NA | 76.23 | NA | NA | NA | 50.75 | NA | NA | NA | 49.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

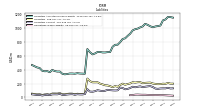

| 2024-03-30 | 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-09-24 | 2022-06-25 | 2022-03-26 | 2021-12-25 | 2021-09-25 | 2021-06-26 | 2021-03-27 | 2020-12-26 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-09-24 | 2016-06-25 | 2016-03-26 | 2015-12-26 | 2015-09-26 | 2015-06-27 | 2015-03-28 | 2014-12-27 | 2014-09-27 | 2014-06-28 | 2014-03-29 | 2013-12-28 | 2013-09-28 | 2013-06-29 | 2013-03-30 | 2012-12-29 | 2012-09-29 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-24 | 2011-06-25 | 2011-03-26 | 2010-12-25 | 2010-09-25 | 2010-06-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

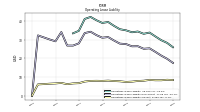

| Liabilities Current | 130.56 | 131.09 | 129.53 | 124.10 | 128.17 | 149.67 | 163.76 | 159.59 | 154.66 | 148.75 | 160.00 | 153.85 | 146.65 | 154.57 | 136.27 | 123.24 | 117.49 | 136.56 | 141.91 | 102.81 | 100.64 | 102.52 | 105.40 | 110.36 | 96.63 | 92.16 | 97.19 | 104.62 | 90.85 | 82.71 | 85.03 | 118.76 | 49.65 | 43.58 | 44.03 | 47.05 | 39.30 | 47.86 | 46.46 | 43.32 | 37.80 | 37.77 | 51.89 | 45.05 | 45.87 | 45.05 | 34.80 | 40.45 | 34.91 | 28.59 | 38.25 | 35.99 | NA | 45.52 | NA | NA | |

| Long Term Debt Current | 1.08 | 1.07 | 1.07 | 1.15 | 1.14 | 1.04 | 2.73 | 4.72 | 6.79 | 8.93 | 9.21 | 9.36 | 9.26 | 9.52 | 9.12 | 21.32 | 31.54 | 42.85 | 46.19 | 33.66 | 33.62 | 29.84 | 26.06 | 33.52 | 29.73 | 18.44 | 22.16 | 18.38 | 14.60 | 125.47 | 8.96 | 7.08 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accounts Payable Current | 66.00 | 63.86 | 61.59 | 63.77 | 63.76 | 69.31 | 75.02 | 60.93 | 65.38 | 57.86 | 64.92 | 62.45 | 67.72 | 62.05 | 62.90 | 44.33 | 40.14 | 40.91 | 50.97 | 26.25 | 31.55 | 40.01 | 49.67 | 42.05 | 38.89 | 35.05 | 37.10 | 43.18 | 43.32 | 34.08 | 41.58 | 54.06 | 28.61 | 18.07 | 21.16 | 21.45 | 16.14 | 20.27 | 21.27 | 18.39 | 15.92 | 16.31 | 28.68 | 24.18 | 24.19 | 21.02 | 10.86 | 17.83 | 15.17 | 9.73 | 18.12 | 16.02 | NA | 14.95 | NA | NA | |

| Other Accrued Liabilities Current | 3.25 | 5.32 | 4.45 | 2.23 | 2.93 | 3.40 | 5.31 | 4.01 | 3.15 | 3.07 | 2.84 | 5.20 | 2.66 | 3.09 | 3.27 | 2.76 | 2.72 | 2.99 | 3.93 | 3.01 | 3.02 | 2.63 | 3.59 | 4.53 | 6.14 | 4.65 | NA | NA | NA | 5.68 | NA | NA | NA | 5.22 | NA | NA | NA | 3.71 | NA | NA | NA | 3.18 | NA | NA | NA | 2.97 | NA | NA | NA | 2.96 | NA | NA | NA | NA | NA | NA | |

| Accrued Liabilities Current | 37.72 | 41.04 | 36.49 | 31.41 | 31.98 | 42.12 | 46.33 | 54.84 | 47.44 | 50.84 | 54.62 | 51.49 | 43.47 | 55.34 | 44.03 | 37.62 | 29.18 | 36.44 | 30.02 | 29.50 | 22.56 | 27.73 | 24.88 | 29.86 | 23.50 | 32.89 | 30.75 | 33.44 | 26.29 | 30.18 | 29.47 | 51.09 | 17.48 | 21.51 | 18.49 | 19.66 | 17.03 | 21.22 | 19.10 | 17.20 | 13.81 | 13.98 | 15.31 | 13.81 | 14.38 | 17.27 | 17.41 | 16.11 | 14.11 | 13.97 | 14.17 | 15.18 | NA | 24.05 | NA | NA |

| 2024-03-30 | 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-09-24 | 2022-06-25 | 2022-03-26 | 2021-12-25 | 2021-09-25 | 2021-06-26 | 2021-03-27 | 2020-12-26 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-09-24 | 2016-06-25 | 2016-03-26 | 2015-12-26 | 2015-09-26 | 2015-06-27 | 2015-03-28 | 2014-12-27 | 2014-09-27 | 2014-06-28 | 2014-03-29 | 2013-12-28 | 2013-09-28 | 2013-06-29 | 2013-03-30 | 2012-12-29 | 2012-09-29 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-24 | 2011-06-25 | 2011-03-26 | 2010-12-25 | 2010-09-25 | 2010-06-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | NA | 14.39 | NA | NA | NA | 15.43 | NA | NA | NA | 24.36 | NA | NA | NA | 34.49 | 35.99 | 50.05 | NA | 58.48 | NA | 58.48 | NA | 64.81 | NA | NA | NA | 105.67 | NA | NA | NA | 138.18 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Long Term Debt Noncurrent | 13.04 | 13.31 | 13.59 | 13.77 | 14.03 | 14.39 | 14.65 | 14.91 | 15.18 | 15.43 | 17.74 | 20.12 | 22.39 | 24.98 | 26.87 | 28.73 | 13.64 | 15.64 | 0.00 | 12.50 | 23.74 | 34.97 | 46.19 | 51.14 | 67.31 | 87.23 | 92.12 | 104.51 | 116.87 | 125.47 | 137.78 | 141.42 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deferred Finance Costs Noncurrent Net | NA | 0.06 | NA | NA | NA | 0.06 | NA | NA | NA | 0.07 | NA | NA | NA | 0.07 | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.06 | 0.03 | 0.06 | 0.11 | 0.18 | 0.27 | NA | NA | NA | 0.78 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

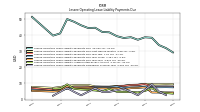

| Operating Lease Liability Noncurrent | 23.43 | 25.33 | 25.10 | 26.46 | 26.41 | 27.59 | 27.86 | 29.51 | 31.37 | 31.01 | 32.40 | 34.21 | 33.48 | 28.00 | 26.79 | 26.82 | 34.03 | 29.09 | 30.07 | 31.17 | 32.24 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2024-03-30 | 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-09-24 | 2022-06-25 | 2022-03-26 | 2021-12-25 | 2021-09-25 | 2021-06-26 | 2021-03-27 | 2020-12-26 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-09-24 | 2016-06-25 | 2016-03-26 | 2015-12-26 | 2015-09-26 | 2015-06-27 | 2015-03-28 | 2014-12-27 | 2014-09-27 | 2014-06-28 | 2014-03-29 | 2013-12-28 | 2013-09-28 | 2013-06-29 | 2013-03-30 | 2012-12-29 | 2012-09-29 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-24 | 2011-06-25 | 2011-03-26 | 2010-12-25 | 2010-09-25 | 2010-06-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 923.75 | 908.80 | 840.69 | 834.26 | 824.37 | 808.28 | 808.30 | 829.99 | 846.67 | 815.78 | 786.39 | 769.55 | 766.53 | 744.08 | 714.14 | 690.72 | 666.42 | 641.00 | 614.55 | 604.10 | 592.99 | 580.16 | 490.05 | 478.67 | 471.01 | 458.64 | 454.85 | 434.61 | 415.35 | 401.06 | 415.62 | 423.58 | 286.21 | 294.68 | 293.53 | 295.01 | 295.37 | 289.44 | 289.23 | 285.01 | 285.51 | 294.09 | 310.68 | 316.88 | 322.61 | 339.26 | 322.45 | 332.41 | 332.87 | 346.65 | 377.34 | NA | NA | 411.20 | NA | NA | |

| Common Stock Value | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | NA | 0.05 | NA | NA | |

| Additional Paid In Capital Common Stock | 857.33 | 861.45 | 873.63 | 867.52 | 858.20 | 844.84 | 843.45 | 860.58 | 902.99 | 898.95 | 892.30 | 894.06 | 915.14 | 903.84 | 896.58 | 898.07 | 895.60 | 885.82 | 879.53 | 875.02 | 871.62 | 862.90 | 857.50 | 853.28 | 851.25 | 843.12 | 845.94 | 839.75 | 840.71 | 833.34 | 828.61 | 823.15 | 723.59 | 718.90 | 717.08 | 715.86 | 716.76 | 711.68 | 708.44 | 703.13 | 699.63 | 695.63 | 692.88 | 688.65 | 685.41 | 681.16 | 663.87 | 659.83 | 656.36 | 652.02 | 655.45 | 655.67 | NA | 651.26 | NA | NA | |

| Retained Earnings Accumulated Deficit | 73.11 | 51.33 | -24.52 | -28.89 | -29.71 | -31.06 | -17.33 | -21.68 | -51.92 | -81.79 | -107.69 | -128.19 | -146.09 | -165.72 | -184.99 | -207.88 | -228.35 | -244.24 | -262.88 | -271.16 | -278.10 | -283.59 | -368.69 | -376.38 | -385.50 | -387.57 | -393.16 | -405.73 | -423.30 | -428.62 | -413.17 | -398.98 | -435.86 | -422.06 | -421.44 | -418.92 | -419.75 | -420.54 | -418.67 | -418.39 | -414.06 | -401.35 | -382.56 | -371.85 | -363.44 | -343.67 | -344.27 | -329.79 | -325.58 | -308.12 | -281.15 | -271.24 | NA | -242.14 | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -6.76 | -4.05 | -8.51 | -4.45 | -4.19 | -5.58 | -17.90 | -9.00 | -4.48 | -1.45 | 1.70 | 3.60 | 3.15 | 5.89 | 2.48 | 0.46 | -0.91 | -0.66 | -2.18 | 0.16 | -0.60 | 0.78 | 1.16 | 1.69 | 5.18 | 3.02 | 2.00 | 0.51 | -2.13 | -3.74 | 0.11 | -0.66 | -1.58 | -2.22 | -2.17 | -2.00 | -1.70 | -1.76 | -0.60 | 0.21 | -0.11 | -0.25 | 0.30 | 0.03 | 0.59 | 1.72 | 2.80 | 2.32 | 2.04 | 2.70 | 2.98 | 2.81 | NA | 2.03 | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 10.17 | 8.95 | 11.21 | 9.39 | 8.72 | 10.38 | 8.53 | 6.69 | 7.83 | 7.73 | 7.84 | 6.57 | 6.95 | 6.91 | 5.44 | 5.46 | 5.65 | 6.00 | 6.44 | 5.26 | 5.26 | 5.38 | 4.51 | 4.12 | 3.74 | 5.02 | 4.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2024-03-30 | 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-09-24 | 2022-06-25 | 2022-03-26 | 2021-12-25 | 2021-09-25 | 2021-06-26 | 2021-03-27 | 2020-12-26 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-09-24 | 2016-06-25 | 2016-03-26 | 2015-12-26 | 2015-09-26 | 2015-06-27 | 2015-03-28 | 2014-12-27 | 2014-09-27 | 2014-06-28 | 2014-03-29 | 2013-12-28 | 2013-09-28 | 2013-06-29 | 2013-03-30 | 2012-12-29 | 2012-09-29 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-24 | 2011-06-25 | 2011-03-26 | 2010-12-25 | 2010-09-25 | 2010-06-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

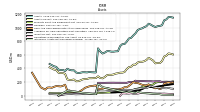

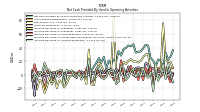

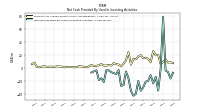

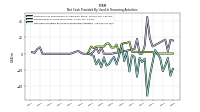

| Net Cash Provided By Used In Operating Activities | 33.01 | 9.25 | 20.57 | 22.47 | 12.31 | 20.74 | 24.25 | 42.65 | 44.16 | 38.93 | 34.28 | 33.80 | 32.36 | 45.05 | 41.76 | 43.11 | 39.34 | 37.67 | 28.00 | 34.74 | 20.64 | 22.56 | 16.08 | 20.74 | 9.32 | 26.45 | 17.59 | 24.48 | 17.80 | NA | 6.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -3.82 | 79.04 | -1.53 | -34.92 | -13.54 | -23.69 | -10.90 | -20.03 | -21.08 | -29.77 | -35.16 | -19.89 | -39.92 | -42.73 | -35.22 | -15.54 | -5.44 | -26.30 | -27.58 | -3.14 | -9.33 | -7.83 | -6.50 | -3.57 | -3.39 | -21.63 | -15.82 | -18.52 | -3.45 | NA | -6.89 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -14.49 | -21.40 | -5.36 | -0.33 | 4.38 | -10.97 | -27.70 | -51.25 | -6.02 | -10.33 | -4.95 | -28.15 | -3.77 | -1.97 | -21.70 | 1.81 | -9.07 | 12.40 | -1.94 | -13.11 | -3.93 | -7.60 | -12.78 | -14.60 | -4.35 | -16.62 | -7.11 | -13.08 | -2.65 | NA | 0.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2024-03-30 | 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-09-24 | 2022-06-25 | 2022-03-26 | 2021-12-25 | 2021-09-25 | 2021-06-26 | 2021-03-27 | 2020-12-26 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-09-24 | 2016-06-25 | 2016-03-26 | 2015-12-26 | 2015-09-26 | 2015-06-27 | 2015-03-28 | 2014-12-27 | 2014-09-27 | 2014-06-28 | 2014-03-29 | 2013-12-28 | 2013-09-28 | 2013-06-29 | 2013-03-30 | 2012-12-29 | 2012-09-29 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-24 | 2011-06-25 | 2011-03-26 | 2010-12-25 | 2010-09-25 | 2010-06-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 33.01 | 9.25 | 20.57 | 22.47 | 12.31 | 20.74 | 24.25 | 42.65 | 44.16 | 38.93 | 34.28 | 33.80 | 32.36 | 45.05 | 41.76 | 43.11 | 39.34 | 37.67 | 28.00 | 34.74 | 20.64 | 22.56 | 16.08 | 20.74 | 9.32 | 26.45 | 17.59 | 24.48 | 17.80 | NA | 6.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 21.78 | 75.85 | 4.37 | 0.83 | 1.34 | -13.73 | 4.35 | 30.24 | 29.87 | 25.90 | 20.50 | 17.91 | 19.62 | 19.27 | 22.89 | 20.47 | 15.89 | 18.64 | 8.28 | 6.95 | 5.48 | 85.10 | 7.69 | 9.12 | 2.12 | 5.59 | 12.56 | 17.58 | 5.18 | -15.44 | -14.20 | 36.88 | -13.80 | -0.62 | -2.52 | 0.84 | 0.78 | -1.87 | -0.28 | -4.33 | -12.71 | -18.79 | -10.71 | -8.41 | -19.77 | 0.60 | -14.48 | -4.22 | -17.45 | -26.98 | -9.90 | -7.68 | -21.42 | NA | NA | NA | |

| Increase Decrease In Accounts Receivable | -6.47 | 15.51 | 0.97 | -9.10 | 15.93 | -24.37 | 3.88 | -4.56 | -0.97 | 10.24 | -2.35 | 4.77 | -3.58 | 9.26 | 5.65 | -3.56 | -7.80 | 10.10 | 13.60 | -10.37 | -13.80 | 6.26 | 4.24 | 6.68 | -3.35 | -6.45 | -3.90 | 12.11 | 8.89 | -6.12 | -8.69 | 22.92 | -1.26 | 0.07 | -7.25 | 3.10 | -4.17 | -1.97 | 6.29 | 4.85 | 6.78 | -15.89 | 7.33 | 5.86 | 4.81 | -9.37 | -10.92 | 6.39 | 8.74 | 17.26 | 0.61 | 4.27 | -5.34 | -1.44 | -9.31 | NA | |

| Increase Decrease In Inventories | 4.93 | 0.58 | 3.03 | 7.25 | -1.38 | -4.24 | 0.76 | 15.19 | 17.08 | 1.32 | 9.95 | 10.48 | 9.91 | 3.62 | 7.48 | 12.02 | -0.93 | -2.95 | 5.67 | 2.92 | 8.66 | -0.51 | 8.12 | 6.28 | 7.41 | 1.36 | 5.42 | 5.50 | 3.35 | 3.00 | 0.76 | 2.23 | 5.75 | 1.83 | 4.67 | 1.18 | 0.48 | 1.25 | 5.55 | 1.95 | 3.22 | 1.23 | -0.81 | 3.78 | 3.78 | -5.28 | 1.39 | 1.44 | 3.37 | -1.73 | 0.15 | 0.27 | 0.17 | -30.87 | 0.74 | NA | |

| Increase Decrease In Accounts Payable | 4.95 | 0.84 | -3.10 | 5.40 | -1.82 | -13.71 | 10.09 | -2.63 | 10.15 | -8.08 | 3.52 | -7.75 | 5.72 | -1.27 | 12.81 | 4.48 | 0.76 | -10.10 | 21.19 | -3.97 | -7.15 | -7.38 | 4.19 | 3.25 | 2.99 | -2.30 | -4.28 | 0.10 | 7.22 | -7.45 | -10.30 | 12.35 | 8.82 | -3.28 | 0.19 | 6.00 | -4.95 | -1.84 | 3.60 | 1.78 | 0.62 | -13.06 | 5.62 | 1.53 | 3.60 | -7.35 | -6.33 | 2.45 | 5.33 | 1.80 | 1.81 | -0.30 | 1.75 | 15.30 | -3.49 | NA | |

| Deferred Income Tax Expense Benefit | -1.29 | -5.82 | -2.64 | -3.49 | -0.14 | 0.54 | -3.18 | NA | NA | 4.74 | NA | NA | NA | NA | NA | NA | -0.20 | 4.92 | 0.00 | 0.04 | 0.00 | -74.98 | 0.00 | 0.01 | 0.06 | -0.71 | 0.02 | 0.02 | 0.08 | -1.27 | 0.11 | -43.86 | 0.00 | -0.02 | 0.00 | 0.00 | 0.01 | 0.27 | 0.00 | -0.05 | 0.00 | 0.30 | 0.00 | 0.02 | 0.13 | -24.53 | 0.02 | 0.06 | 0.00 | 4.50 | 0.11 | -2.58 | -0.04 | 2.19 | 0.00 | NA | |

| Share Based Compensation | 10.40 | 9.28 | 10.84 | 9.20 | 9.29 | 9.46 | 8.00 | 6.36 | 7.52 | 7.80 | 7.92 | 6.59 | 7.08 | 7.06 | 5.51 | 5.64 | 5.62 | 6.09 | 6.50 | 5.29 | 5.29 | 5.41 | 4.54 | 4.13 | 3.76 | 5.06 | 4.59 | 3.39 | 3.30 | 3.25 | 3.20 | 1.54 | 2.73 | 3.06 | 3.10 | 2.51 | 2.91 | 3.26 | 3.93 | 3.52 | 2.57 | 3.00 | 2.96 | 3.13 | 3.04 | 3.56 | 2.97 | 3.48 | 3.04 | -23.51 | 3.34 | 2.35 | 3.97 | -30.98 | 4.22 | NA |

| 2024-03-30 | 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-09-24 | 2022-06-25 | 2022-03-26 | 2021-12-25 | 2021-09-25 | 2021-06-26 | 2021-03-27 | 2020-12-26 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-09-24 | 2016-06-25 | 2016-03-26 | 2015-12-26 | 2015-09-26 | 2015-06-27 | 2015-03-28 | 2014-12-27 | 2014-09-27 | 2014-06-28 | 2014-03-29 | 2013-12-28 | 2013-09-28 | 2013-06-29 | 2013-03-30 | 2012-12-29 | 2012-09-29 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-24 | 2011-06-25 | 2011-03-26 | 2010-12-25 | 2010-09-25 | 2010-06-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -3.82 | 79.04 | -1.53 | -34.92 | -13.54 | -23.69 | -10.90 | -20.03 | -21.08 | -29.77 | -35.16 | -19.89 | -39.92 | -42.73 | -35.22 | -15.54 | -5.44 | -26.30 | -27.58 | -3.14 | -9.33 | -7.83 | -6.50 | -3.57 | -3.39 | -21.63 | -15.82 | -18.52 | -3.45 | NA | -6.89 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 13.44 | 9.93 | 5.92 | 20.48 | 19.70 | 26.23 | 8.91 | 14.51 | 15.61 | 15.14 | 20.03 | 17.85 | 13.47 | 13.98 | 5.14 | 24.69 | 12.05 | 6.61 | 2.78 | 5.43 | 6.03 | 7.54 | 3.78 | 4.71 | 3.83 | 3.84 | 6.16 | 4.29 | 3.46 | 3.30 | 4.58 | 2.52 | 1.11 | 2.00 | 2.40 | 2.80 | 1.44 | 1.13 | 1.54 | 1.36 | 1.64 | 1.17 | 2.29 | 2.35 | 2.73 | 1.83 | 2.19 | 2.12 | 1.80 | 2.83 | 2.14 | 1.20 | 1.54 | 8.44 | 6.00 | NA |

| 2024-03-30 | 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-09-24 | 2022-06-25 | 2022-03-26 | 2021-12-25 | 2021-09-25 | 2021-06-26 | 2021-03-27 | 2020-12-26 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-09-24 | 2016-06-25 | 2016-03-26 | 2015-12-26 | 2015-09-26 | 2015-06-27 | 2015-03-28 | 2014-12-27 | 2014-09-27 | 2014-06-28 | 2014-03-29 | 2013-12-28 | 2013-09-28 | 2013-06-29 | 2013-03-30 | 2012-12-29 | 2012-09-29 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-24 | 2011-06-25 | 2011-03-26 | 2010-12-25 | 2010-09-25 | 2010-06-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -14.49 | -21.40 | -5.36 | -0.33 | 4.38 | -10.97 | -27.70 | -51.25 | -6.02 | -10.33 | -4.95 | -28.15 | -3.77 | -1.97 | -21.70 | 1.81 | -9.07 | 12.40 | -1.94 | -13.11 | -3.93 | -7.60 | -12.78 | -14.60 | -4.35 | -16.62 | -7.11 | -13.08 | -2.65 | NA | 0.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 17.33 | NA | NA | NA | NA | 8.85 | 19.15 | 44.93 | 9.40 | 0.09 | 0.00 | 18.21 | 5.74 | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | 8.01 | 0.83 | 7.40 | 2.73 | 0.00 | 0.00 | 0.00 | 0.00 | 1.21 | 3.49 | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | -0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 7.88 | 5.53 | 1.04 | 1.97 | NA | NA | NA |

| 2024-03-30 | 2023-12-30 | 2023-09-30 | 2023-07-01 | 2023-04-01 | 2022-12-31 | 2022-09-24 | 2022-06-25 | 2022-03-26 | 2021-12-25 | 2021-09-25 | 2021-06-26 | 2021-03-27 | 2020-12-26 | 2020-09-26 | 2020-06-27 | 2020-03-28 | 2019-12-28 | 2019-09-28 | 2019-06-29 | 2019-03-30 | 2018-12-29 | 2018-09-29 | 2018-06-30 | 2018-03-31 | 2017-12-30 | 2017-09-30 | 2017-07-01 | 2017-04-01 | 2016-12-31 | 2016-09-24 | 2016-06-25 | 2016-03-26 | 2015-12-26 | 2015-09-26 | 2015-06-27 | 2015-03-28 | 2014-12-27 | 2014-09-27 | 2014-06-28 | 2014-03-29 | 2013-12-28 | 2013-09-28 | 2013-06-29 | 2013-03-30 | 2012-12-29 | 2012-09-29 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-24 | 2011-06-25 | 2011-03-26 | 2010-12-25 | 2010-09-25 | 2010-06-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 168.72 | 168.16 | 171.57 | 155.92 | 167.45 | 165.99 | 180.87 | 203.91 | 197.17 | 205.00 | 189.96 | 188.08 | 186.64 | 197.04 | 178.00 | 157.82 | 160.75 | 178.63 | 140.60 | 138.02 | 132.21 | 140.89 | 134.99 | 135.51 | 118.29 | 131.90 | 143.74 | 143.98 | 128.83 | 123.89 | 123.30 | 83.08 | 53.61 | 71.78 | 65.86 | 73.89 | 70.83 | 71.28 | 73.93 | 67.35 | 55.96 | 48.55 | 67.63 | 62.73 | 52.62 | 47.65 | 41.26 | 54.81 | 34.81 | 30.22 | 52.12 | 46.56 | 40.43 | 43.91 | 47.35 | 57.64 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 168.72 | 168.16 | 171.57 | 155.92 | 167.45 | 165.99 | 180.87 | 203.91 | 197.17 | 205.00 | 189.96 | 188.08 | 186.64 | 197.04 | 178.00 | 157.82 | 160.75 | 178.63 | 140.60 | 138.02 | 132.21 | 140.89 | 134.99 | 135.51 | 118.29 | 131.90 | 143.74 | 143.98 | 128.83 | 123.89 | 123.30 | 83.08 | 53.61 | 71.78 | 65.86 | 73.89 | 70.83 | 71.28 | 73.93 | 67.35 | 55.96 | 48.55 | 67.63 | 62.73 | 52.62 | 47.65 | 41.26 | 54.81 | 34.81 | 30.22 | 52.12 | 46.56 | 40.43 | 43.91 | 47.35 | 57.64 | |

| Operating, Probe Cards | 136.70 | 126.93 | 128.34 | 115.30 | 127.33 | 124.37 | 139.37 | 167.71 | 159.98 | 165.89 | 154.85 | 153.64 | 158.90 | 162.47 | 150.77 | 133.78 | 134.72 | 153.18 | 116.45 | 113.64 | 108.10 | 116.15 | 111.61 | 111.59 | 94.93 | 107.23 | 119.44 | 121.62 | 106.50 | 98.61 | 102.67 | 83.08 | 53.61 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Systems | 32.02 | 41.23 | 43.24 | 40.61 | 40.12 | 41.62 | 41.50 | 36.20 | 37.19 | 39.11 | 35.11 | 34.44 | 27.74 | 34.58 | 27.22 | 24.04 | 26.04 | 25.45 | 24.16 | 24.38 | 24.11 | 24.74 | 23.38 | 23.92 | 23.36 | 24.67 | 24.30 | 22.35 | 22.33 | 25.28 | 20.63 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| D R A M Product Group | 45.90 | 35.95 | 27.48 | 30.46 | 19.89 | 27.24 | 34.92 | 36.84 | 34.44 | 40.25 | 39.82 | 42.09 | 33.90 | 34.61 | 31.38 | 19.05 | 24.70 | 42.90 | 39.42 | 36.04 | 28.89 | 29.62 | 37.36 | 38.09 | 30.27 | 31.89 | 32.37 | 31.47 | 28.96 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Flash Product Group | 4.04 | 7.34 | 4.50 | 2.87 | 5.88 | 15.03 | 13.84 | 8.48 | 11.43 | 11.61 | 10.39 | 7.83 | 11.59 | 5.18 | 10.98 | 5.38 | 4.27 | 5.17 | 8.59 | 4.15 | 7.64 | 9.89 | 12.98 | 11.38 | 6.22 | 6.59 | 5.15 | 1.43 | 3.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Foundry Logic Product Group | 86.77 | 83.64 | 96.37 | 81.97 | 101.56 | 82.09 | 90.61 | 122.38 | 114.12 | 114.04 | 104.64 | 103.73 | 113.41 | 122.68 | 108.41 | 109.35 | 105.75 | 105.10 | 68.43 | 73.44 | 71.58 | 76.64 | 61.27 | 62.11 | 58.44 | 68.76 | 81.91 | 88.73 | 74.31 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Systems Product Group | 32.02 | 41.23 | 43.24 | 40.61 | 40.12 | 41.62 | 41.50 | 36.20 | 37.19 | 39.11 | 35.11 | 34.44 | 27.74 | 34.58 | 27.22 | 24.04 | 26.04 | 25.45 | 24.16 | 24.38 | 24.11 | 24.74 | 23.38 | 23.92 | 23.36 | 24.67 | 24.30 | 22.35 | 22.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| D R A M Product Group, Probe Cards | 45.90 | NA | 27.48 | 30.46 | 19.89 | NA | 34.92 | 36.84 | 34.44 | NA | 39.82 | 42.09 | 33.90 | NA | 31.38 | 19.05 | 24.70 | NA | 39.42 | 36.04 | 28.89 | NA | 37.36 | 38.09 | 30.27 | NA | 32.37 | 31.47 | 28.96 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Flash Product Group, Probe Cards | 4.04 | NA | 4.50 | 2.87 | 5.88 | NA | 13.84 | 8.48 | 11.43 | NA | 10.39 | 7.83 | 11.59 | NA | 10.98 | 5.38 | 4.27 | NA | 8.59 | 4.15 | 7.64 | NA | 12.98 | 11.38 | 6.22 | NA | 5.15 | 1.43 | 3.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Foundry Logic Product Group, Probe Cards | 86.77 | NA | 96.37 | 81.97 | 101.56 | NA | 90.61 | 122.38 | 114.12 | NA | 104.64 | 103.73 | 113.41 | NA | 108.41 | 109.35 | 105.75 | NA | 68.43 | 73.44 | 71.58 | NA | 61.27 | 62.11 | 58.44 | NA | 81.91 | 88.73 | 74.31 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Systems Product Group, Systems | 32.02 | NA | 43.24 | 40.61 | 40.12 | NA | 41.50 | 36.20 | 37.19 | NA | 35.11 | 34.44 | 27.74 | NA | 27.22 | 24.04 | 26.04 | NA | 24.16 | 24.38 | 24.11 | NA | 23.38 | 23.92 | 23.36 | NA | 24.30 | 22.35 | 22.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Probe Cards | 136.70 | 126.93 | 128.34 | 115.30 | 127.33 | 124.37 | 139.37 | 167.71 | 159.98 | 165.89 | 154.85 | 153.64 | 158.90 | 162.47 | 150.77 | 133.78 | 134.72 | 153.18 | 116.45 | 113.64 | 108.10 | 116.15 | 111.61 | 111.59 | 94.93 | 107.23 | 119.44 | 121.62 | 106.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Systems | 32.02 | 41.23 | 43.24 | 40.61 | 40.12 | 41.62 | 41.50 | 36.20 | 37.19 | 39.11 | 35.11 | 34.44 | 27.74 | 34.58 | 27.22 | 24.04 | 26.04 | 25.45 | 24.16 | 24.38 | 24.11 | 24.74 | 23.38 | 23.92 | 23.36 | 24.67 | 24.30 | 22.35 | 22.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Probe Cards, Transferred At Point In Time | 135.64 | 125.69 | 127.73 | 112.98 | 126.68 | 123.60 | 138.60 | 166.70 | 158.84 | 164.22 | 154.22 | 153.13 | 158.48 | 162.04 | 150.25 | 133.21 | 134.07 | 153.87 | 115.32 | 113.03 | 107.49 | 115.54 | 111.02 | 111.04 | 94.43 | 106.75 | 119.00 | 121.15 | 106.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Probe Cards, Transferred Over Time | 1.06 | 1.25 | 0.61 | 2.32 | 0.65 | 0.77 | 0.76 | 1.01 | 1.15 | 1.68 | 0.63 | 0.51 | 0.42 | 0.43 | 0.52 | 0.58 | 0.65 | -0.69 | 1.12 | 0.61 | 0.61 | 0.61 | 0.59 | 0.55 | 0.49 | 0.48 | 0.44 | 0.48 | 0.45 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Systems, Transferred At Point In Time | 28.78 | 38.16 | 41.78 | 40.04 | 36.71 | 38.12 | 37.84 | 33.08 | 35.42 | 35.67 | 33.56 | 30.88 | 24.67 | 31.46 | 25.99 | 22.55 | 24.86 | 23.01 | 23.56 | 23.34 | 23.14 | 23.72 | 22.42 | 22.97 | 22.52 | 23.72 | 23.37 | 21.59 | 21.54 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Systems, Transferred Over Time | 3.24 | 3.07 | 1.46 | 0.57 | 3.41 | 3.50 | 3.66 | 3.12 | 1.77 | 3.44 | 1.55 | 3.55 | 3.07 | 3.11 | 1.24 | 1.49 | 1.18 | 2.45 | 0.60 | 1.04 | 0.97 | 1.02 | 0.96 | 0.96 | 0.84 | 0.95 | 0.93 | 0.77 | 0.79 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| 15.61 | NA | 21.75 | 23.51 | 27.10 | NA | 36.73 | 49.73 | 38.40 | NA | 51.05 | 31.83 | 42.62 | NA | 28.55 | 48.76 | 43.64 | NA | 31.38 | 20.36 | 21.84 | NA | 22.08 | 14.61 | 12.27 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| 8.85 | NA | 9.30 | 10.82 | 9.43 | NA | 11.80 | 8.09 | 8.39 | NA | 10.49 | 12.01 | 10.00 | NA | 16.98 | 14.13 | 21.04 | NA | 9.55 | 10.65 | 9.49 | NA | 9.13 | 9.52 | 11.50 | NA | 12.09 | 10.63 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| 8.54 | NA | 6.96 | 7.93 | 10.98 | NA | 7.69 | 9.94 | 9.38 | NA | 10.73 | 7.70 | 9.32 | NA | 17.14 | 10.06 | 8.37 | NA | 16.93 | 16.09 | 10.43 | NA | 14.73 | 13.54 | 13.67 | NA | 10.46 | 9.38 | 15.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| 50.72 | NA | 35.08 | 27.86 | 20.77 | NA | 28.94 | 28.75 | 27.50 | NA | 28.97 | 36.18 | 19.09 | NA | 29.57 | 15.11 | 14.09 | NA | 23.60 | 28.17 | 26.72 | NA | 21.10 | 26.11 | 15.36 | NA | 21.76 | 22.72 | 18.74 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| 1.86 | NA | 5.96 | 6.68 | 11.27 | NA | 6.51 | 16.24 | 22.20 | NA | 11.63 | 3.19 | 19.93 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| 4.76 | NA | 3.68 | 2.82 | 5.34 | NA | 10.36 | 7.11 | 10.90 | NA | 7.55 | 9.96 | 8.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| 29.88 | NA | 42.98 | 29.51 | 40.33 | NA | 36.84 | 50.02 | 53.07 | NA | 41.57 | 51.88 | 45.58 | NA | 36.94 | 33.17 | 31.78 | NA | 18.25 | 14.87 | 22.39 | NA | 19.68 | 29.65 | 27.65 | NA | 17.81 | 29.80 | 19.55 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| US | 45.77 | NA | 43.73 | 42.67 | 37.73 | NA | 38.09 | 31.24 | 25.65 | NA | 25.47 | 32.65 | 29.49 | NA | 36.33 | 28.12 | 31.92 | NA | 33.66 | 38.37 | 34.26 | NA | 40.13 | 33.76 | 32.93 | NA | 57.26 | 50.35 | 39.84 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Rest Of The World | 2.74 | NA | 2.15 | 4.11 | 4.50 | NA | 3.92 | 2.77 | 1.69 | NA | 1.81 | 1.54 | 1.58 | NA | 3.54 | 1.97 | 2.05 | NA | 1.56 | 1.83 | 3.81 | NA | 1.00 | 1.65 | 0.45 | NA | 0.55 | 0.69 | 0.72 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| , Probe Cards | 8.69 | NA | 10.78 | 16.52 | 18.48 | NA | 27.97 | 40.58 | 32.79 | NA | 46.01 | 24.00 | 37.83 | NA | 24.85 | 45.62 | 37.28 | NA | 24.43 | 16.30 | 18.15 | NA | 16.93 | 11.04 | 9.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| , Systems | 6.93 | NA | 10.97 | 6.99 | 8.62 | NA | 8.76 | 9.16 | 5.61 | NA | 5.04 | 7.83 | 4.79 | NA | 3.69 | 3.13 | 6.36 | NA | 6.96 | 4.05 | 3.69 | NA | 5.15 | 3.58 | 3.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| , Probe Cards | 3.53 | NA | 2.58 | 2.42 | 3.43 | NA | 3.68 | 3.82 | 2.38 | NA | 3.60 | 6.47 | 2.83 | NA | 11.68 | 8.77 | 16.21 | NA | 5.75 | 4.47 | 5.37 | NA | 5.50 | 4.11 | 5.57 | NA | 6.01 | 7.15 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| , Systems | 5.32 | NA | 6.71 | 8.40 | 6.00 | NA | 8.12 | 4.27 | 6.01 | NA | 6.89 | 5.54 | 7.17 | NA | 5.30 | 5.37 | 4.83 | NA | 3.79 | 6.17 | 4.12 | NA | 3.63 | 5.41 | 5.93 | NA | 6.08 | 3.48 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| , Probe Cards | 4.35 | NA | 2.98 | 3.90 | 7.14 | NA | 4.53 | 6.72 | 4.79 | NA | 5.77 | 3.48 | 5.25 | NA | 12.29 | 6.68 | 5.54 | NA | 13.64 | 12.87 | 5.30 | NA | 10.46 | 10.83 | 10.13 | NA | 8.42 | 7.61 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| , Systems | 4.20 | NA | 3.99 | 4.03 | 3.84 | NA | 3.16 | 3.22 | 4.60 | NA | 4.96 | 4.23 | 4.07 | NA | 4.86 | 3.38 | 2.83 | NA | 3.29 | 3.23 | 5.13 | NA | 4.27 | 2.71 | 3.54 | NA | 2.04 | 1.77 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| , Probe Cards | 50.67 | NA | 31.80 | 26.45 | 19.57 | NA | 28.12 | 27.42 | 24.88 | NA | 27.89 | 35.43 | 18.00 | NA | 28.34 | 14.25 | 13.69 | NA | 22.78 | 27.36 | 25.02 | NA | 19.66 | 24.30 | 13.92 | NA | 21.22 | 20.94 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| , Systems | 0.04 | NA | 3.27 | 1.41 | 1.20 | NA | 0.82 | 1.34 | 2.62 | NA | 1.08 | 0.75 | 1.08 | NA | 1.23 | 0.86 | 0.40 | NA | 0.82 | 0.81 | 1.71 | NA | 1.44 | 1.81 | 1.07 | NA | 0.55 | 1.78 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| , Probe Cards | 1.61 | NA | 5.78 | 6.18 | 10.32 | NA | 6.27 | 16.16 | 21.52 | NA | 11.35 | 3.03 | 19.89 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| , Systems | 0.26 | NA | 0.19 | 0.50 | 0.95 | NA | 0.24 | 0.09 | 0.68 | NA | 0.28 | 0.16 | 0.04 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| , Probe Cards | 3.52 | NA | 2.75 | 1.72 | 3.20 | NA | 7.98 | 5.13 | 10.28 | NA | 6.84 | 8.60 | 7.63 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| , Systems | 1.24 | NA | 0.93 | 1.10 | 2.14 | NA | 2.37 | 1.98 | 0.61 | NA | 0.71 | 1.36 | 0.93 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| , Probe Cards | 27.18 | NA | 39.16 | 25.32 | 38.90 | NA | 32.23 | 45.19 | 42.52 | NA | 34.10 | 46.74 | 44.73 | NA | 33.35 | 29.81 | 30.44 | NA | 16.51 | 12.83 | 21.26 | NA | 18.90 | 26.50 | 25.97 | NA | 15.95 | 27.46 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| , Systems | 2.70 | NA | 3.82 | 4.20 | 1.43 | NA | 4.61 | 4.83 | 10.55 | NA | 7.47 | 5.15 | 0.85 | NA | 3.58 | 3.37 | 1.34 | NA | 1.74 | 2.05 | 1.13 | NA | 0.78 | 3.15 | 1.75 | NA | 1.86 | 2.34 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| US, Probe Cards | 35.60 | NA | 31.18 | 31.13 | 24.64 | NA | 25.91 | 21.54 | 19.98 | NA | 18.53 | 24.17 | 21.31 | NA | 31.60 | 22.37 | 25.61 | NA | 28.40 | 32.07 | 27.66 | NA | 34.40 | 29.00 | 26.49 | NA | 48.54 | 44.83 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| US, Systems | 10.17 | NA | 12.54 | 11.54 | 13.09 | NA | 12.18 | 9.70 | 5.67 | NA | 6.94 | 8.48 | 8.18 | NA | 4.73 | 5.75 | 6.30 | NA | 5.26 | 6.30 | 6.61 | NA | 5.73 | 4.76 | 6.38 | NA | 8.71 | 5.52 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Rest Of The World, Probe Cards | 1.57 | NA | 1.33 | 1.67 | 1.66 | NA | 2.67 | 1.16 | 0.84 | NA | 0.39 | 0.80 | 1.06 | NA | 3.17 | 1.94 | 1.49 | NA | 1.42 | 1.47 | 2.56 | NA | 0.29 | 0.42 | 0.33 | NA | 0.16 | 0.53 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Rest Of The World, Systems | 1.17 | NA | 0.82 | 2.44 | 2.85 | NA | 1.25 | 1.62 | 0.84 | NA | 1.42 | 0.74 | 0.52 | NA | 0.37 | 0.03 | 0.56 | NA | 0.14 | 0.35 | 1.25 | NA | 0.71 | 1.22 | 0.12 | NA | 0.40 | 0.15 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Transferred At Point In Time | 164.43 | 163.85 | 169.51 | 153.03 | 163.39 | 161.72 | 176.44 | 199.78 | 194.25 | 199.88 | 187.78 | 184.01 | 183.15 | 193.50 | 176.24 | 155.76 | 158.93 | 176.88 | 138.88 | 136.37 | 130.63 | 139.26 | 133.44 | 134.01 | 116.95 | 130.47 | 142.37 | 142.73 | 127.59 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Transferred Over Time | 4.30 | 4.31 | 2.07 | 2.89 | 4.06 | 4.27 | 4.42 | 4.12 | 2.92 | 5.11 | 2.18 | 4.06 | 3.49 | 3.54 | 1.76 | 2.07 | 1.83 | 1.75 | 1.72 | 1.65 | 1.58 | 1.63 | 1.55 | 1.50 | 1.33 | 1.43 | 1.37 | 1.24 | 1.24 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |