| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 3.64 | 3.64 | 2.37 | 2.37 | 2.37 | 2.37 | 2.37 | 2.37 | 2.37 | 2.37 | 2.33 | 2.29 | 2.23 | 2.23 | 2.23 | 2.23 | 2.23 | 2.23 | 2.17 | 2.17 | 2.09 | 2.05 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 1.99 | 1.99 | 1.71 | 1.69 | 1.69 | 1.69 | 1.69 | 1.69 | 1.80 | 1.78 | 1.76 | 1.72 | 0.69 | 0.16 | 0.09 | 0.05 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | |

| dei: Entity Common Stock Shares Outstanding | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

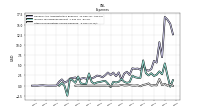

| Earnings Per Share Basic | -0.09 | -1.11 | -0.30 | -0.06 | -0.17 | 0.09 | -0.06 | 0.05 | -0.08 | 0.02 | -0.14 | -0.01 | -0.15 | -0.01 | 0.01 | 0.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | -0.09 | -1.11 | -0.30 | -0.06 | -0.17 | 0.09 | -0.06 | 0.05 | -0.08 | 0.02 | -0.14 | -0.01 | -0.15 | -0.01 | 0.01 | 0.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

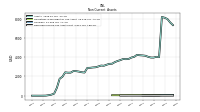

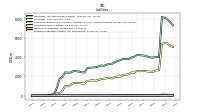

| Revenues | 206.73 | 118.17 | 95.84 | 94.33 | 93.95 | 92.60 | 95.18 | 97.13 | 106.52 | 95.76 | 99.56 | 89.39 | 87.04 | 82.71 | 81.11 | 79.24 | 76.69 | 77.94 | 76.12 | 75.47 | 71.23 | 71.92 | 70.97 | 68.09 | 66.60 | 64.87 | 64.99 | 62.84 | 52.77 | 53.25 | 53.20 | 54.95 | 56.04 | 50.25 | 49.07 | 49.97 | 42.22 | 25.90 | 13.63 | 7.55 | 2.47 | 1.23 | 0.20 | 0.04 | 0.03 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Costs And Expenses | 160.42 | 213.04 | 91.36 | 63.96 | 70.19 | 63.73 | 80.44 | 64.28 | 80.42 | 66.18 | 70.59 | 63.62 | 61.92 | 56.71 | 56.65 | 55.43 | 50.40 | 60.36 | 51.89 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| General And Administrative Expense | 16.87 | 6.98 | 10.68 | 5.66 | 6.11 | 4.06 | 3.67 | 3.89 | 4.99 | 3.91 | 4.20 | 4.13 | 4.25 | 2.64 | 3.41 | 2.96 | 1.33 | 3.25 | 2.32 | 3.21 | 2.62 | 3.21 | 2.56 | 2.05 | 2.36 | 2.47 | 2.05 | 1.77 | 1.81 | 1.71 | 1.88 | 1.70 | 1.54 | 2.01 | 1.89 | 1.75 | 1.06 | 0.74 | 1.53 | 0.98 | 0.02 | 0.02 | 0.01 | 0.00 | 0.03 | 0.09 | 0.06 | 0.00 | 0.02 | 0.00 | |

| Operating Income Loss | 45.32 | -95.56 | 4.49 | 30.37 | 23.88 | 29.01 | 14.80 | 32.85 | 26.40 | 30.78 | 28.97 | 25.77 | 25.13 | 26.00 | 24.30 | 23.81 | 35.11 | 24.56 | 31.15 | 24.08 | 2.66 | 21.37 | 20.88 | 21.82 | 23.84 | 18.49 | 23.45 | 20.27 | 8.04 | 15.22 | 18.91 | 18.11 | 21.49 | 11.48 | -21.79 | 19.08 | -2.08 | -20.74 | -4.72 | -14.60 | -2.05 | -2.76 | -1.26 | 0.01 | -0.25 | -0.09 | -0.06 | -0.00 | NA | NA | |

| Interest Expense | 83.58 | 41.16 | 27.71 | 26.96 | 25.73 | 24.21 | 23.45 | 24.12 | 24.10 | 24.86 | 24.02 | 21.37 | 19.16 | 18.68 | 17.53 | 16.44 | 17.19 | 16.15 | 15.69 | 15.16 | 15.48 | 15.10 | 14.41 | 12.97 | 12.81 | 12.48 | 11.63 | 11.53 | 9.00 | 8.91 | 10.63 | 10.57 | 10.06 | 9.04 | 7.95 | 7.81 | 6.47 | 4.08 | 2.61 | 1.69 | 0.56 | 0.35 | 0.05 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 | NA | NA | |

| Gains Losses On Extinguishment Of Debt | -0.82 | 0.00 | -0.40 | NA | -1.66 | -0.04 | -0.34 | NA | NA | NA | NA | NA | -3.29 | 0.00 | -0.31 | NA | 0.38 | -0.56 | -0.77 | NA | 0.00 | -2.61 | -1.28 | NA | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 5.46 | 2.80 | 3.51 | 2.71 | 2.37 | 3.05 | 2.52 | 3.10 | 6.21 | 1.93 | 1.93 | 2.08 | 2.46 | 0.86 | 0.69 | 0.96 | 1.65 | 0.94 | 0.78 | 0.96 | -0.37 | 0.53 | 1.20 | 1.07 | 0.90 | 0.80 | 0.50 | 0.91 | 2.99 | 0.45 | 0.43 | 0.55 | 2.24 | 0.70 | 1.30 | 1.64 | -2.46 | -0.07 | 0.66 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | -48.58 | -136.18 | -26.26 | -0.89 | -12.64 | 14.84 | -0.72 | 10.54 | -2.80 | 7.39 | 2.59 | 4.18 | -8.49 | 4.14 | 5.53 | 9.60 | 12.93 | 9.94 | 15.33 | 8.28 | -4.29 | 2.63 | 7.74 | 4.81 | 8.45 | 2.49 | 5.20 | 7.45 | 16.07 | 9.02 | 15.93 | 6.56 | 12.45 | 5.49 | -45.81 | 25.86 | -5.21 | -24.56 | -7.48 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | -14.44 | -0.94 | -2.92 | -3.96 | 0.10 | 15.32 | 2.92 | 10.05 | 4.87 | 2.98 | 1.53 | 3.79 | 1.65 | 0.04 | -3.39 | -7.15 | 4.45 | -3.03 | -3.91 | -4.94 | -2.55 | 1.72 | 1.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | -13.49 | -12.20 | 7.89 | 2.56 | 26.05 | -15.38 | -24.82 | -0.24 | 5.02 | -6.78 | 3.42 | 5.81 | 13.70 | -0.21 | -5.91 | -19.70 | 34.81 | -10.64 | -4.20 | -6.26 | -10.29 | -2.01 | -15.48 | 15.15 | 10.28 | 11.81 | 10.71 | 3.31 | -1.43 | 0.57 | -3.98 | -8.32 | 0.71 | -5.31 | 13.41 | 7.53 | 6.85 | -0.63 | 1.48 | -1.61 | 0.46 | -0.30 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Comprehensive Income Net Of Tax | -73.01 | -154.68 | -23.47 | -3.43 | 8.31 | -5.65 | -30.67 | 5.25 | -2.79 | -4.40 | 0.99 | 4.98 | 0.43 | -0.71 | -4.95 | -14.66 | 44.08 | -3.78 | 8.43 | -0.47 | -17.04 | -1.84 | -10.19 | 17.51 | 16.33 | 13.91 | 15.90 | 10.74 | 14.51 | 9.50 | 11.82 | -1.74 | 12.79 | 0.21 | -32.13 | 18.86 | -10.35 | -25.19 | -6.01 | -17.96 | -2.14 | -3.39 | -1.12 | 0.02 | -0.30 | -0.09 | -0.06 | -0.00 | -0.02 | 0.00 | |

| Preferred Stock Dividends Income Statement Impact | 10.94 | 6.30 | 5.10 | 5.10 | 5.10 | 5.10 | 5.13 | 5.06 | 5.02 | 5.02 | 5.02 | 5.02 | 4.78 | 4.64 | 4.56 | 4.56 | 3.67 | 3.08 | 2.71 | 2.48 | 2.45 | 2.46 | 2.46 | 2.45 | 2.45 | 0.38 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | -59.51 | -142.49 | -31.36 | -5.99 | -17.74 | 9.74 | -5.85 | 5.48 | -7.81 | 2.37 | -2.43 | -0.83 | -13.28 | -0.50 | 0.97 | 5.04 | 9.26 | 6.86 | 12.62 | 5.79 | -6.74 | 0.18 | 5.29 | 2.36 | 6.00 | 2.10 | 5.20 | 7.43 | 15.95 | 8.94 | 15.76 | 6.49 | 12.31 | 5.43 | -45.66 | 25.86 | -5.21 | -24.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Diluted | -59.75 | -145.66 | -31.59 | -6.23 | -17.98 | 9.47 | -6.06 | 5.26 | -8.04 | 2.14 | -13.17 | -0.98 | -13.38 | -0.60 | 0.84 | 4.90 | 9.11 | 6.68 | 12.45 | 5.63 | -6.91 | -0.14 | 5.26 | 2.18 | 5.81 | 1.92 | 5.01 | 7.24 | 15.75 | 8.75 | 15.57 | 6.29 | 12.12 | 5.18 | -45.66 | 25.86 | -5.21 | -24.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

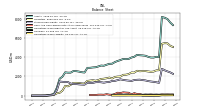

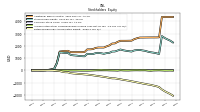

| Assets | 8098.98 | 8184.71 | 4001.88 | 4041.50 | 3961.83 | 3965.57 | 4044.54 | 4152.74 | 4182.96 | 4203.05 | 4241.02 | 4043.86 | 3967.01 | 3824.47 | 3792.99 | 3815.35 | 3701.61 | 3608.60 | 3494.76 | 3323.76 | 3309.48 | 3217.06 | 3111.09 | 3133.12 | 3038.59 | 2953.30 | 2932.98 | 2897.64 | 2891.47 | 2406.22 | 2436.31 | 2501.33 | 2547.97 | 2562.24 | 2393.76 | 2390.89 | 2428.80 | 1965.46 | 1762.67 | 819.99 | 214.93 | 107.48 | 50.86 | 9.25 | 2.93 | 0.07 | 0.03 | 0.87 | 0.56 | NA | |

| Liabilities | 5459.83 | 5391.49 | 2646.71 | 2629.88 | 2507.91 | 2480.99 | 2516.62 | 2557.40 | 2556.32 | 2534.65 | 2588.42 | 2396.63 | 2412.74 | 2242.57 | 2181.44 | 2165.40 | 1991.65 | 1983.25 | 1949.13 | 1786.20 | 1880.73 | 1811.11 | 1762.49 | 1738.63 | 1624.35 | 1551.65 | 1605.40 | 1566.42 | 1535.49 | 1255.42 | 1265.89 | 1312.42 | 1327.85 | 1325.04 | 1127.69 | 970.53 | 1012.13 | 523.78 | 293.56 | 248.68 | 92.21 | 40.20 | 12.50 | 3.74 | 3.73 | NA | NA | NA | 0.38 | NA | |

| Liabilities And Stockholders Equity | 8098.98 | 8184.71 | 4001.88 | 4041.50 | 3961.83 | 3965.57 | 4044.54 | 4152.74 | 4182.96 | 4203.05 | 4241.02 | 4043.86 | 3967.01 | 3824.47 | 3792.99 | 3815.35 | 3701.61 | 3608.60 | 3494.76 | 3323.76 | 3309.48 | 3217.06 | 3111.09 | 3133.12 | 3038.59 | 2953.30 | 2932.98 | 2897.64 | 2891.47 | 2406.22 | 2436.31 | 2501.33 | 2547.97 | 2562.24 | 2393.76 | 2390.89 | 2428.80 | 1965.46 | 1762.67 | 819.99 | 214.93 | 107.48 | 50.86 | 9.25 | 2.93 | 0.07 | 0.03 | 0.87 | 0.56 | NA | |

| Stockholders Equity | 2637.75 | 2791.94 | 1335.78 | 1394.47 | 1439.02 | 1471.92 | 1517.51 | 1587.18 | 1620.72 | 1664.73 | 1651.18 | 1623.11 | 1532.52 | 1562.50 | 1594.51 | 1635.27 | 1697.63 | 1615.38 | 1538.02 | 1532.31 | 1425.49 | 1404.02 | 1348.60 | 1394.37 | 1413.17 | 1399.43 | 1324.70 | 1323.56 | 1347.78 | 1143.69 | 1155.65 | 1173.75 | 1205.39 | 1221.83 | 1252.64 | 1420.36 | 1416.67 | 1441.68 | 1469.11 | 571.32 | 122.72 | 67.28 | 38.37 | 5.51 | -0.80 | -2.02 | 1.42 | 0.18 | 0.18 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash | 121.60 | NA | NA | NA | 103.30 | NA | NA | NA | 89.70 | NA | NA | NA | 124.20 | NA | NA | NA | 270.30 | NA | NA | NA | 100.32 | NA | NA | NA | 102.42 | 71.30 | 67.41 | 72.35 | 69.80 | 50.27 | 40.50 | 45.79 | 69.90 | 32.08 | 61.64 | 76.33 | 64.68 | 263.95 | 936.54 | 280.38 | 11.50 | 14.58 | 28.07 | 6.36 | 0.26 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Cash And Cash Equivalents At Carrying Value | 121.57 | 133.44 | 100.92 | 119.16 | 103.33 | 128.01 | 111.21 | 123.50 | 89.67 | 176.39 | 174.86 | 262.87 | 124.25 | 300.00 | 316.82 | 343.45 | 270.30 | 305.96 | 178.72 | 95.27 | 100.32 | 155.19 | 93.33 | 106.73 | 102.42 | 71.30 | 67.41 | 72.35 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 162.40 | 178.44 | 105.19 | 120.59 | 104.44 | 134.65 | 117.14 | 128.07 | 93.31 | 179.06 | 176.91 | 264.22 | 125.69 | 300.81 | 317.58 | 347.80 | 274.29 | 309.91 | 191.68 | 98.64 | 103.69 | 158.68 | 96.20 | 109.42 | 107.73 | 76.61 | 72.55 | 77.50 | 77.33 | NA | NA | NA | 73.26 | NA | NA | NA | 70.79 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Land | 1430.61 | 1432.51 | 505.20 | 502.23 | 494.10 | 480.99 | 496.19 | 505.82 | 511.58 | 503.14 | 498.92 | 474.54 | 476.60 | 443.56 | 434.31 | 429.16 | 414.45 | 388.27 | 389.59 | 400.56 | 398.91 | 411.34 | 408.18 | NA | 402.32 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

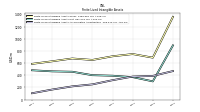

| Amortization Of Intangible Assets | 53.90 | 20.72 | 13.13 | 13.21 | 13.51 | 14.04 | 14.98 | 15.31 | 17.84 | 17.72 | 16.21 | 17.22 | 14.90 | 14.63 | 14.28 | 14.27 | 10.90 | 14.27 | 17.00 | 14.57 | 13.38 | 13.94 | 13.77 | 13.65 | 13.24 | 14.78 | 12.81 | 12.83 | 10.84 | 11.01 | 11.12 | 11.15 | 11.17 | 10.54 | 10.48 | 10.23 | 8.05 | 6.17 | 3.36 | 1.96 | 0.77 | 0.42 | 0.07 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 | NA | NA | |

| Goodwill | 46.98 | 51.02 | 21.56 | 21.55 | 21.36 | 20.36 | 21.07 | 21.81 | 22.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 891.01 | NA | NA | NA | 299.77 | NA | NA | NA | 369.56 | NA | NA | NA | 392.64 | NA | NA | NA | 401.37 | NA | NA | NA | 457.80 | NA | NA | NA | 464.15 | NA | NA | NA | 482.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

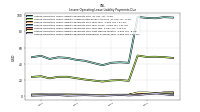

| Deferred Finance Costs Noncurrent Net | 15.41 | 16.81 | 11.10 | 11.95 | 12.81 | 13.66 | 14.52 | 4.17 | 4.92 | 5.71 | 6.50 | 7.27 | 7.88 | 8.65 | 9.42 | 10.18 | 10.94 | 14.65 | 5.09 | 5.70 | 6.31 | 6.93 | 5.83 | 6.54 | 6.77 | 7.41 | 0.32 | 0.63 | 1.09 | 3.82 | 0.54 | 2.46 | 11.86 | 13.79 | 12.71 | 12.93 | 15.27 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Senior Notes | 886.04 | 881.32 | 493.81 | 493.46 | 493.12 | 492.77 | 492.42 | 492.08 | 491.74 | 491.39 | 491.04 | 490.69 | 490.35 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 6.01 | 6.03 | 6.39 | 6.39 | 7.26 | 6.42 | 7.20 | 7.98 | 8.25 | 11.36 | 11.70 | 12.16 | 12.16 | 15.15 | 14.56 | 14.29 | 14.97 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 1.40 | 1.29 | 19.39 | 17.14 | 14.90 | 12.65 | 10.41 | 8.16 | 5.92 | 3.67 | 1.42 | 24.12 | 21.76 | 19.40 | 17.04 | 14.69 | 12.33 | 9.97 | 7.61 | 5.25 | 3.26 | 1.92 | 0.00 | 0.12 | 1.08 | 2.21 | 2.88 | 7.66 | 8.20 | 7.11 | 14.77 | 15.16 | 14.73 | 15.36 | 13.43 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

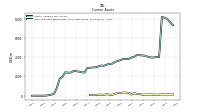

| Stockholders Equity | 2637.75 | 2791.94 | 1335.78 | 1394.47 | 1439.02 | 1471.92 | 1517.51 | 1587.18 | 1620.72 | 1664.73 | 1651.18 | 1623.11 | 1532.52 | 1562.50 | 1594.51 | 1635.27 | 1697.63 | 1615.38 | 1538.02 | 1532.31 | 1425.49 | 1404.02 | 1348.60 | 1394.37 | 1413.17 | 1399.43 | 1324.70 | 1323.56 | 1347.78 | 1143.69 | 1155.65 | 1173.75 | 1205.39 | 1221.83 | 1252.64 | 1420.36 | 1416.67 | 1441.68 | 1469.11 | 571.32 | 122.72 | 67.28 | 38.37 | 5.51 | -0.80 | -2.02 | 1.42 | 0.18 | 0.18 | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 2639.15 | 2793.23 | 1355.17 | 1411.61 | 1453.92 | 1484.57 | 1527.92 | 1595.34 | 1626.63 | 1668.40 | 1652.60 | 1647.23 | 1554.28 | 1581.90 | 1611.56 | 1649.96 | 1709.96 | 1625.35 | 1545.63 | 1537.56 | 1428.75 | 1405.95 | 1348.60 | 1394.49 | 1414.24 | 1401.65 | 1327.58 | 1331.22 | 1355.98 | 1150.80 | 1170.42 | 1188.90 | 1220.12 | 1237.20 | 1266.07 | NA | 1416.67 | NA | NA | NA | 122.72 | NA | NA | NA | -0.80 | NA | NA | NA | NA | NA | |

| Common Stock Value | 3.64 | 3.64 | 2.37 | 2.37 | 2.37 | 2.37 | 2.37 | 2.37 | 2.37 | 2.37 | 2.33 | 2.29 | 2.23 | 2.23 | 2.23 | 2.23 | 2.23 | 2.23 | 2.17 | 2.17 | 2.09 | 2.05 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 1.99 | 1.99 | 1.71 | 1.69 | 1.69 | 1.69 | 1.69 | 1.69 | 1.80 | 1.78 | 1.76 | 1.72 | 0.69 | 0.16 | 0.09 | 0.05 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | |

| Additional Paid In Capital | 4350.11 | 4349.40 | 2690.38 | 2683.83 | 2683.17 | 2682.60 | 2680.74 | 2678.03 | 2675.15 | 2674.71 | 2616.38 | 2540.52 | 2418.66 | 2413.12 | 2408.53 | 2408.45 | 2408.35 | 2322.42 | 2196.18 | 2183.83 | 2031.98 | 1954.26 | 1859.99 | 1859.75 | 1860.06 | 1826.24 | 1729.60 | 1708.87 | 1708.54 | 1489.00 | 1480.38 | 1480.28 | 1480.16 | 1479.88 | 1480.59 | 1591.78 | 1575.59 | 1558.51 | 1529.35 | 606.35 | 133.59 | 74.02 | 40.48 | 6.05 | -0.31 | -1.84 | 1.34 | 0.20 | 0.20 | NA | |

| Retained Earnings Accumulated Deficit | -1702.14 | -1560.74 | -1368.68 | -1295.55 | -1247.78 | -1188.27 | -1156.20 | -1108.64 | -1072.46 | -1022.99 | -984.96 | -933.70 | -896.55 | -847.32 | -810.92 | -776.00 | -733.25 | -694.71 | -656.41 | -653.96 | -615.45 | -569.45 | -532.57 | -502.03 | -468.40 | -437.96 | -404.21 | -373.92 | -346.06 | -331.75 | -310.60 | -296.34 | -272.81 | -255.46 | -230.58 | -160.62 | -155.12 | -118.14 | -62.14 | -34.42 | -11.35 | -6.68 | -2.33 | -0.53 | -0.45 | NA | NA | NA | -0.02 | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -14.10 | -0.60 | 11.59 | 3.70 | 1.15 | -24.90 | -9.51 | 15.31 | 15.55 | 10.53 | 17.30 | 13.88 | 8.07 | -5.63 | -5.42 | 0.49 | 20.20 | -14.62 | -3.98 | 0.21 | 6.81 | 17.10 | 19.12 | 34.59 | 19.45 | 9.12 | -2.69 | -13.39 | -16.70 | -15.26 | -15.82 | -11.88 | -3.65 | -4.28 | 0.94 | -12.59 | -5.59 | -0.45 | 0.18 | -1.29 | 0.32 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 1.40 | 1.29 | 19.39 | 17.14 | 14.90 | 12.65 | 10.41 | 8.16 | 5.92 | 3.67 | 1.42 | 24.12 | 21.76 | 19.40 | 17.04 | 14.69 | 12.33 | 9.97 | 7.61 | 5.25 | 3.26 | 1.92 | 0.00 | 0.12 | 1.08 | 2.21 | 2.88 | 7.66 | 8.20 | 7.11 | 14.77 | 15.16 | 14.73 | 15.36 | 13.43 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 0.04 | 2.96 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.26 | 0.10 | 10.70 | 0.10 | 0.10 | 0.10 | 0.08 | 0.16 | 0.14 | 0.14 | 0.14 | 0.13 | 0.14 | 0.29 | 0.00 | 0.16 | 0.17 | 0.16 | 0.16 | 0.26 | 0.26 | 0.41 | 0.48 | 0.48 | 0.48 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

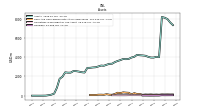

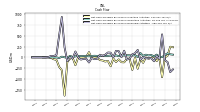

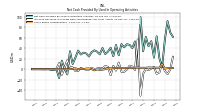

| Net Cash Provided By Used In Operating Activities | 55.79 | 3.59 | 21.34 | 63.02 | 22.21 | 53.71 | 44.07 | 61.82 | 34.43 | 100.17 | 4.68 | 53.22 | 40.52 | 46.61 | 47.82 | 41.90 | 48.15 | 26.61 | 46.49 | 24.75 | 41.20 | 33.71 | 29.01 | 40.68 | 28.45 | 33.58 | 36.19 | 32.73 | 24.35 | 30.13 | 31.78 | 28.13 | 35.75 | 21.96 | 9.95 | 34.49 | -10.04 | 1.12 | 16.12 | -16.89 | -0.30 | -1.32 | -1.29 | 0.21 | -0.19 | -0.16 | -0.04 | -0.02 | 0.00 | 0.00 | |

| Net Cash Provided By Used In Investing Activities | 1.88 | -461.26 | -3.72 | -88.80 | 30.68 | -11.78 | -33.66 | -1.78 | -126.79 | -39.99 | -265.34 | -4.45 | -292.13 | -31.35 | -31.10 | -115.95 | -112.27 | -46.71 | -108.85 | -26.64 | -206.93 | -82.95 | -97.05 | -71.02 | -63.73 | 3.14 | -0.15 | -18.24 | 120.93 | 13.41 | -0.09 | -0.11 | -0.25 | -183.19 | -8.58 | -30.26 | -108.56 | -889.05 | -299.57 | -220.00 | -58.83 | -44.07 | -9.55 | 0.00 | -1.36 | 0.00 | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -68.03 | 532.82 | -35.32 | 39.54 | -90.81 | -19.27 | -16.32 | -23.35 | 10.51 | -56.85 | 171.92 | 92.75 | 71.23 | -33.96 | -50.13 | 153.54 | 3.93 | 142.93 | 150.76 | 2.39 | 108.08 | 111.73 | 59.80 | 32.57 | 59.81 | -34.86 | -42.61 | -13.00 | -119.94 | -33.54 | -35.58 | -51.83 | 4.71 | 135.69 | -26.67 | 7.89 | -89.81 | 231.05 | 936.84 | 504.82 | 55.30 | 30.30 | 32.72 | 5.89 | 1.80 | 0.16 | 0.04 | 0.02 | 0.00 | 0.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 55.79 | 3.59 | 21.34 | 63.02 | 22.21 | 53.71 | 44.07 | 61.82 | 34.43 | 100.17 | 4.68 | 53.22 | 40.52 | 46.61 | 47.82 | 41.90 | 48.15 | 26.61 | 46.49 | 24.75 | 41.20 | 33.71 | 29.01 | 40.68 | 28.45 | 33.58 | 36.19 | 32.73 | 24.35 | 30.13 | 31.78 | 28.13 | 35.75 | 21.96 | 9.95 | 34.49 | -10.04 | 1.12 | 16.12 | -16.89 | -0.30 | -1.32 | -1.29 | 0.21 | -0.19 | -0.16 | -0.04 | -0.02 | 0.00 | 0.00 | |

| Profit Loss | -48.58 | -136.18 | -26.26 | -0.89 | -12.64 | 14.84 | -0.72 | 10.54 | -2.80 | 7.39 | 2.59 | 4.18 | -8.49 | 4.14 | 5.53 | 9.60 | 12.93 | 9.94 | 15.33 | 8.28 | -4.29 | 2.63 | 7.74 | 4.81 | 8.45 | 2.49 | 5.20 | 7.45 | 16.07 | 9.02 | 15.93 | 6.56 | 12.45 | 5.49 | -45.81 | 25.86 | -5.21 | -24.56 | -7.48 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 1.06 | 10.44 | 2.87 | 2.92 | 2.85 | 3.13 | 3.36 | 2.73 | 2.73 | 2.72 | 3.01 | 2.58 | 2.58 | 2.48 | 2.51 | 2.49 | 2.49 | 2.50 | 2.43 | 2.11 | 1.45 | 2.05 | -0.02 | -0.83 | -1.18 | -0.39 | -2.23 | 0.02 | 1.34 | 1.29 | 0.07 | 1.04 | -0.09 | 1.79 | 0.61 | 0.04 | 0.01 | 0.07 | 0.02 | 0.01 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Amortization Of Financing Costs | 2.41 | 2.05 | 2.08 | 2.08 | 2.24 | 2.32 | 2.34 | 2.60 | 2.61 | 2.59 | 2.40 | 2.28 | 2.08 | 2.08 | 1.85 | 1.81 | 1.79 | 1.91 | 1.18 | 1.74 | 1.46 | 1.34 | 1.50 | 0.90 | 1.40 | 1.20 | 0.94 | 0.88 | 0.93 | 0.95 | 2.39 | 2.42 | 2.47 | 2.14 | 2.00 | 1.92 | 1.72 | 1.23 | 0.50 | 0.31 | 0.14 | 0.10 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 1.88 | -461.26 | -3.72 | -88.80 | 30.68 | -11.78 | -33.66 | -1.78 | -126.79 | -39.99 | -265.34 | -4.45 | -292.13 | -31.35 | -31.10 | -115.95 | -112.27 | -46.71 | -108.85 | -26.64 | -206.93 | -82.95 | -97.05 | -71.02 | -63.73 | 3.14 | -0.15 | -18.24 | 120.93 | 13.41 | -0.09 | -0.11 | -0.25 | -183.19 | -8.58 | -30.26 | -108.56 | -889.05 | -299.57 | -220.00 | -58.83 | -44.07 | -9.55 | 0.00 | -1.36 | 0.00 | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -68.03 | 532.82 | -35.32 | 39.54 | -90.81 | -19.27 | -16.32 | -23.35 | 10.51 | -56.85 | 171.92 | 92.75 | 71.23 | -33.96 | -50.13 | 153.54 | 3.93 | 142.93 | 150.76 | 2.39 | 108.08 | 111.73 | 59.80 | 32.57 | 59.81 | -34.86 | -42.61 | -13.00 | -119.94 | -33.54 | -35.58 | -51.83 | 4.71 | 135.69 | -26.67 | 7.89 | -89.81 | 231.05 | 936.84 | 504.82 | 55.30 | 30.30 | 32.72 | 5.89 | 1.80 | 0.16 | 0.04 | 0.02 | 0.00 | 0.00 | |

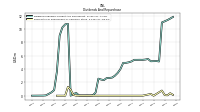

| Payments Of Dividends Common Stock | 81.71 | 41.96 | 41.66 | 41.66 | 41.66 | 42.06 | 41.56 | 41.57 | 41.56 | 40.30 | 38.14 | 36.21 | 35.84 | 35.79 | 35.78 | 47.64 | 47.64 | 44.99 | 14.88 | 43.27 | 39.09 | 36.69 | 35.83 | 35.83 | 36.15 | 35.83 | 35.47 | 35.29 | 30.25 | 30.10 | 30.02 | 30.02 | 29.67 | 30.28 | 23.52 | 14.27 | 13.78 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 0.10 | 0.77 | NA | NA | -0.00 | 0.26 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.11 | 0.88 | 1.32 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 206.73 | 118.17 | 95.84 | 94.33 | 93.95 | 92.60 | 95.18 | 97.13 | 106.52 | 95.76 | 99.56 | 89.39 | 87.04 | 82.71 | 81.11 | 79.24 | 76.69 | 77.94 | 76.12 | 75.47 | 71.23 | 71.92 | 70.97 | 68.09 | 66.60 | 64.87 | 64.99 | 62.84 | 52.77 | 53.25 | 53.20 | 54.95 | 56.04 | 50.25 | 49.07 | 49.97 | 42.22 | 25.90 | 13.63 | 7.55 | 2.47 | 1.23 | 0.20 | 0.04 | 0.03 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Operating | 206.73 | 118.17 | NA | NA | 93.95 | 92.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Industrial And Distribution | 62.22 | 53.77 | NA | NA | 52.59 | 52.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Multi Tenant Retail | 66.41 | 13.39 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Office | 37.95 | 38.80 | NA | NA | 38.36 | 37.39 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Single Tenant Retail | 40.14 | 12.21 | NA | NA | 3.00 | 3.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Industrial And Distribution | 62.22 | 53.77 | NA | NA | 52.59 | 52.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Multi Tenant Retail | 66.41 | 13.39 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Office | 37.95 | 38.80 | NA | NA | 38.36 | 37.39 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Single Tenant Retail | 40.14 | 12.21 | NA | NA | 3.00 | 3.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |