| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 1.12 | 1.11 | 1.07 | 0.92 | 0.91 | 0.89 | 0.88 | 0.87 | 0.85 | 0.84 | 0.78 | 0.78 | 0.77 | 0.74 | 0.73 | 0.71 | 0.66 | 0.65 | 0.65 | 0.63 | 0.60 | 0.53 | 0.53 | 0.52 | 0.52 | 0.52 | 0.52 | 0.50 | 0.47 | 0.42 | 0.42 | 0.37 | 0.37 | 0.31 | 0.31 | 0.26 | 0.26 | 0.22 | 0.22 | 0.16 | 0.16 | 0.16 | 0.16 | 0.00 | 0.00 | NA | NA | NA | NA | |

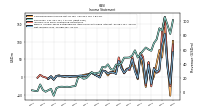

| Earnings Per Share Basic | 0.86 | 0.20 | 0.14 | 0.26 | -0.23 | 0.39 | -0.21 | 0.53 | 0.76 | -0.04 | 0.20 | 0.65 | 0.33 | 0.28 | 0.16 | 0.36 | 0.70 | 0.14 | 0.20 | 0.22 | 0.16 | 0.30 | 0.32 | -0.03 | 0.05 | 0.14 | 0.23 | 0.14 | 0.09 | 0.07 | 0.09 | 0.07 | 0.05 | 0.06 | 0.04 | 0.07 | 0.05 | 0.11 | 0.13 | 0.17 | -0.48 | 0.11 | -0.32 | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | 0.83 | 0.20 | 0.14 | 0.26 | -0.22 | 0.38 | -0.21 | 0.51 | 0.72 | -0.04 | 0.20 | 0.61 | 0.32 | 0.28 | 0.16 | 0.35 | 0.66 | 0.13 | 0.19 | 0.21 | 0.16 | 0.30 | 0.32 | -0.03 | 0.05 | 0.14 | 0.23 | 0.14 | 0.09 | 0.07 | 0.09 | 0.07 | 0.05 | 0.06 | 0.04 | 0.07 | 0.05 | 0.11 | 0.13 | 0.17 | -0.48 | 0.11 | -0.32 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 86.58 | 89.85 | 74.33 | 69.10 | 58.31 | 60.15 | 62.80 | 58.48 | 53.70 | 48.88 | 58.89 | 51.70 | 48.89 | 48.59 | 48.59 | 40.83 | 38.33 | 38.84 | 31.27 | 32.89 | 39.19 | 34.88 | 35.83 | 27.91 | 27.09 | 26.40 | 28.27 | 23.80 | 19.86 | 19.01 | 21.84 | 20.48 | 8.75 | 8.35 | 7.43 | 7.76 | 7.54 | 7.81 | 7.57 | 5.70 | -4.79 | 4.80 | 2.86 | 0.76 | 3.27 | 10.98 | 1.54 | 2.01 | 2.76 | |

| Interest Income Operating | 62.17 | 54.30 | 48.22 | 43.11 | 36.75 | 34.30 | 33.36 | 30.24 | 30.54 | 26.24 | 25.02 | 25.10 | 24.51 | 23.51 | 23.65 | 23.89 | 21.93 | 19.32 | 15.12 | 15.52 | 27.53 | 14.58 | 12.76 | 12.85 | 13.61 | 15.37 | 13.64 | 14.12 | 12.02 | 12.04 | 12.65 | 11.49 | 10.79 | 10.06 | 8.22 | 8.33 | 7.10 | 6.23 | 5.23 | 4.62 | NA | NA | NA | NA | 2.83 | NA | NA | NA | NA | |

| Other Income | 0.58 | 1.49 | 0.50 | 0.35 | 1.13 | 0.34 | 0.37 | 1.90 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.01 | 0.00 | 0.00 | 0.00 | 0.01 | 0.02 | 0.00 | 0.01 | 0.01 | NA | 0.01 | |

| General And Administrative Expense | 6.46 | 6.71 | 10.10 | 8.02 | 7.24 | 8.15 | 7.41 | 7.14 | 5.09 | 4.96 | 4.97 | 4.88 | 3.67 | 3.92 | 3.85 | 3.41 | 3.88 | 3.74 | 3.74 | 3.09 | 4.12 | 3.05 | 3.54 | 2.80 | 3.07 | 2.37 | 3.14 | 2.19 | 2.16 | 1.99 | 2.32 | 1.93 | 1.69 | 1.71 | 1.56 | 1.50 | 1.52 | 1.43 | 1.45 | 1.15 | 1.05 | 0.87 | 1.24 | 0.69 | 0.58 | 1.91 | 0.91 | NA | 0.63 | |

| Interest Expense | 50.59 | 43.30 | 39.90 | 37.22 | 30.52 | 29.56 | 28.83 | 26.65 | 26.31 | 27.35 | 40.46 | 27.58 | 26.30 | 26.09 | 21.66 | 18.14 | 17.38 | 16.56 | 14.87 | 15.43 | 19.45 | 19.68 | 19.03 | 18.71 | 18.74 | 17.58 | 15.36 | 13.78 | 12.30 | 10.63 | 11.03 | 11.28 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Paid Net | 46.43 | 23.82 | 47.82 | 20.34 | 36.11 | 14.19 | 35.26 | 13.14 | 33.30 | 14.88 | 30.06 | 30.02 | 18.62 | 23.78 | 8.10 | 25.44 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Loss From Continuing Operations Before Income Taxes Minority Interest And Income Loss From Equity Method Investments | 14.37 | 13.76 | 9.67 | 3.61 | 0.63 | 11.97 | -3.74 | 9.14 | 11.57 | 2.87 | 0.14 | 3.51 | 3.92 | 7.12 | 11.24 | 9.74 | 9.58 | 3.32 | 6.01 | 6.93 | 7.94 | 5.84 | 6.92 | 1.07 | 1.31 | 1.10 | 4.12 | 3.10 | 1.02 | 2.06 | 2.73 | 2.97 | 2.24 | 1.98 | 1.85 | 2.18 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 36.92 | -5.13 | -1.60 | 1.43 | -6.41 | 7.58 | -4.79 | 11.00 | 5.65 | -1.25 | 5.98 | 6.78 | -5.64 | 2.35 | -1.41 | 1.92 | 9.40 | 0.13 | 0.84 | -2.27 | 1.03 | 0.90 | 0.15 | 0.02 | 0.77 | 0.01 | 0.08 | 0.03 | 0.02 | 0.04 | 0.04 | 0.05 | 0.04 | 0.02 | 0.08 | -0.02 | 0.19 | 0.61 | -0.83 | 0.06 | -0.25 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | 90.99 | 21.65 | 13.52 | 24.60 | -20.20 | 34.94 | -18.54 | 45.70 | 62.82 | -3.10 | 16.41 | 51.22 | 25.01 | 21.28 | 12.06 | 24.41 | 46.24 | 9.18 | 12.79 | 13.71 | 9.10 | 16.57 | 17.35 | -1.23 | 3.41 | 7.97 | 12.41 | 7.24 | 4.44 | 3.35 | 3.77 | 3.20 | 2.26 | 2.14 | 1.48 | 2.15 | 1.48 | 2.60 | 2.88 | 2.81 | -7.54 | 1.89 | -5.77 | -1.22 | 0.95 | 6.22 | -2.24 | -0.30 | 0.11 | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | -64.72 | 76.60 | 30.65 | -31.77 | 11.49 | 20.11 | 11.51 | 0.29 | -0.66 | -2.70 | 4.81 | 1.24 | 1.01 | 0.99 | -5.42 | 0.36 | 0.17 | -2.48 | -3.25 | -0.68 | -7.56 | 0.14 | 2.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 89.76 | 21.45 | 13.52 | 24.11 | -19.93 | 34.53 | -18.45 | 45.35 | 62.42 | -2.84 | 15.97 | 51.02 | 24.93 | 21.18 | 12.01 | 24.31 | 46.08 | 9.10 | 12.74 | 13.65 | 9.05 | 16.50 | 17.30 | -1.22 | 3.38 | 7.93 | 12.34 | 7.20 | 4.41 | 3.33 | 3.75 | 3.17 | 2.25 | 2.12 | 1.47 | 2.12 | 1.46 | 2.56 | 2.83 | 2.75 | -7.33 | 1.84 | -4.97 | NA | NA | NA | NA | NA | NA | |

| Comprehensive Income Net Of Tax | 55.66 | 76.71 | 38.34 | 1.68 | -15.56 | 41.90 | -28.24 | 23.10 | 64.58 | -6.43 | 32.67 | 33.03 | 26.08 | 23.03 | 10.55 | 32.09 | 40.63 | 16.88 | 14.08 | 14.95 | 4.34 | 15.65 | 19.03 | 1.93 | 3.33 | 7.22 | 11.70 | 8.65 | 7.31 | 5.86 | 2.01 | -0.01 | 1.20 | 1.34 | 0.90 | 2.20 | 1.08 | 1.05 | 5.04 | 2.74 | -7.15 | 1.59 | -4.88 | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 89.50 | 21.20 | 13.30 | 23.80 | -20.10 | 34.40 | -18.50 | 45.00 | 62.20 | -3.00 | 15.80 | 50.60 | 24.70 | 21.00 | 11.80 | 24.00 | 45.60 | 8.80 | 12.40 | 13.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -4.97 | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Diluted | 96.10 | 21.40 | 13.60 | 24.10 | -19.70 | 34.70 | -18.50 | 45.40 | 67.50 | -3.00 | 16.10 | 52.80 | 25.00 | 21.10 | 11.80 | 25.80 | 45.60 | 8.80 | NA | 13.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 1.76 | -4.97 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

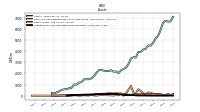

| Assets | 6552.35 | 5908.14 | 5375.23 | 5139.87 | 4760.15 | 4497.89 | 4519.02 | 4221.73 | 4148.31 | 3940.86 | 3935.53 | 3431.49 | 3459.07 | 3344.50 | 2836.94 | 2524.49 | 2387.27 | 2279.17 | 2027.42 | 2186.87 | 2154.91 | 2295.11 | 2218.01 | 2220.72 | 2250.17 | 2310.68 | 2288.53 | 2043.19 | 1745.89 | 1556.16 | 1476.14 | 1476.98 | 1469.62 | 1207.57 | 1181.44 | 994.67 | 1010.26 | 703.65 | 664.13 | 590.38 | 571.43 | 520.64 | 391.30 | NA | 212.79 | 232.46 | NA | NA | NA | |

| Liabilities | 4410.73 | 3808.25 | 3381.32 | 3481.05 | 3095.40 | 2846.87 | 2927.50 | 2607.74 | 2581.80 | 2467.48 | 2612.98 | 2120.17 | 2248.92 | 2246.76 | 1768.98 | 1487.93 | 1447.36 | 1396.62 | 1142.68 | 1344.81 | 1350.39 | 1648.50 | 1571.61 | 1593.76 | 1607.39 | 1655.99 | 1625.27 | 1406.39 | 1171.55 | 1059.03 | 973.91 | 1053.31 | 1037.52 | 866.18 | 835.15 | 724.02 | 736.22 | 484.04 | 441.99 | 439.88 | 420.81 | 356.57 | 228.05 | NA | 206.93 | 213.30 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 6552.35 | 5908.14 | 5375.23 | 5139.87 | 4760.15 | 4497.89 | 4519.02 | 4221.73 | 4148.31 | 3940.86 | 3935.53 | 3431.49 | 3459.07 | 3344.50 | 2836.94 | 2524.49 | 2387.27 | 2279.17 | 2027.42 | 2186.87 | 2154.91 | 2295.11 | 2218.01 | 2220.72 | 2250.17 | 2310.68 | 2288.53 | 2043.19 | 1745.89 | 1556.16 | 1476.14 | 1476.98 | 1469.62 | 1207.57 | 1181.44 | 994.67 | 1010.26 | 703.65 | 664.13 | 590.38 | 571.43 | 520.64 | 391.30 | 0.01 | 0.01 | 232.46 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 62.63 | 155.50 | 126.91 | 142.49 | 155.71 | 272.81 | 279.46 | 133.32 | 226.20 | 413.26 | 583.22 | 232.33 | 286.25 | 881.49 | 541.83 | 173.03 | 6.21 | 186.15 | 37.89 | 62.09 | 21.42 | 34.42 | 41.81 | 47.00 | 57.27 | 90.75 | 41.70 | 16.33 | 29.43 | 72.97 | 19.28 | 26.59 | 42.65 | 30.68 | 21.67 | 65.46 | 58.20 | 60.91 | 38.69 | 39.58 | 31.85 | 24.22 | 14.81 | 3.32 | 8.02 | 20.95 | 0.72 | NA | 7.64 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 75.08 | 169.53 | 151.78 | 164.20 | 175.97 | 298.21 | 304.20 | 155.17 | 251.07 | 438.79 | 609.38 | 253.04 | 310.33 | 905.57 | 570.04 | 200.32 | 106.59 | 229.00 | 82.29 | 106.14 | 59.35 | 96.94 | 110.13 | 116.56 | 118.18 | 159.48 | 105.58 | 82.81 | 59.14 | NA | NA | NA | 79.22 | NA | NA | NA | 70.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 7.17 | 9.37 | 10.21 | 10.50 | 10.20 | 10.60 | 11.64 | 16.50 | 17.70 | 17.64 | 17.88 | 26.15 | 55.38 | 51.64 | 45.93 | 63.17 | 74.53 | 113.18 | 124.37 | 177.64 | 170.00 | 162.00 | 154.00 | NA | 151.21 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 59.60 | 43.60 | 20.70 | 3.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Finite Lived Intangible Assets Net | 14.00 | 14.00 | 82.00 | 83.00 | 84.00 | 83.00 | 84.00 | 85.00 | 87.00 | 88.00 | 89.00 | 89.00 | 90.00 | 91.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 30.92 | 30.72 | 31.03 | 26.93 | 25.84 | 25.48 | 24.79 | 23.06 | NA | NA | NA | 1.71 | NA | NA | NA | NA | 2.06 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

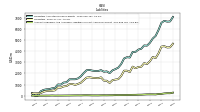

| Line Of Credit | 400.86 | 486.72 | 282.86 | 358.73 | 50.70 | 100.63 | 201.03 | 100.46 | 100.47 | 25.48 | 44.83 | 19.51 | 22.59 | 22.57 | 30.38 | 153.07 | 31.20 | 37.82 | 209.65 | 283.38 | 258.59 | 289.29 | 102.94 | 69.95 | 69.92 | 174.74 | 392.48 | 406.49 | 283.35 | 356.42 | 245.57 | 321.94 | 247.35 | 378.10 | 420.50 | 321.18 | 315.75 | 212.76 | 166.19 | 117.14 | 77.11 | 83.84 | NA | NA | 4.17 | 4.60 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Minority Interest | 49.36 | 46.99 | 44.00 | 41.52 | 35.51 | 34.86 | 33.47 | 22.81 | 21.80 | 18.98 | 16.86 | 8.72 | 6.85 | 5.69 | 5.36 | 4.33 | 3.43 | 3.17 | 3.26 | 3.41 | 3.42 | 3.51 | 3.51 | 3.48 | 3.60 | 3.65 | 3.69 | 3.70 | 3.73 | 3.76 | 3.79 | 3.84 | 3.91 | 3.97 | 4.01 | 4.05 | 4.74 | 4.79 | NA | 1.22 | 4.10 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

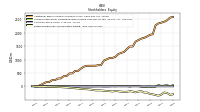

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 2141.62 | 2099.89 | 1993.90 | 1658.82 | 1664.75 | 1651.03 | 1591.52 | 1613.99 | 1566.52 | 1473.38 | 1322.55 | 1311.32 | 1210.15 | 1097.74 | 1067.96 | 1036.56 | 939.91 | 882.54 | 884.74 | 842.06 | 804.52 | 646.61 | 646.40 | 626.95 | 642.78 | 654.70 | 663.26 | 636.80 | 574.34 | 497.13 | 502.23 | 423.67 | 432.11 | 341.38 | 346.30 | 270.65 | 274.04 | 219.61 | 217.23 | 147.38 | 150.62 | 164.06 | 163.25 | NA | 5.85 | 19.16 | NA | NA | NA | |

| Common Stock Value | 1.12 | 1.11 | 1.07 | 0.92 | 0.91 | 0.89 | 0.88 | 0.87 | 0.85 | 0.84 | 0.78 | 0.78 | 0.77 | 0.74 | 0.73 | 0.71 | 0.66 | 0.65 | 0.65 | 0.63 | 0.60 | 0.53 | 0.53 | 0.52 | 0.52 | 0.52 | 0.52 | 0.50 | 0.47 | 0.42 | 0.42 | 0.37 | 0.37 | 0.31 | 0.31 | 0.26 | 0.26 | 0.22 | 0.22 | 0.16 | 0.16 | 0.16 | 0.16 | 0.00 | 0.00 | NA | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 2381.51 | 2353.45 | 2283.26 | 1946.90 | 1924.20 | 1861.47 | 1811.89 | 1783.94 | 1727.67 | 1671.75 | 1487.10 | 1489.17 | 1394.01 | 1282.74 | 1250.98 | 1206.22 | 1102.30 | 1063.10 | 1060.09 | 1009.35 | 965.38 | 791.38 | 789.13 | 770.92 | 770.98 | 768.66 | 766.89 | 734.62 | 663.74 | 578.11 | 576.04 | 485.76 | 482.43 | 381.42 | 379.18 | 296.00 | 293.63 | 233.17 | 231.62 | 160.65 | 160.12 | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -303.54 | -348.93 | -326.41 | -297.71 | -285.47 | -231.42 | -232.59 | -181.28 | -193.71 | -225.93 | -193.53 | -181.99 | -204.11 | -202.91 | -198.72 | -185.79 | -169.79 | -193.12 | -180.22 | -170.95 | -163.21 | -151.83 | -150.62 | -150.05 | -131.25 | -117.12 | -107.26 | -102.09 | -92.21 | -80.86 | -71.20 | -61.20 | -52.70 | -43.47 | -37.13 | -30.15 | -25.01 | -19.36 | -16.92 | -14.74 | -13.86 | -0.59 | -1.44 | NA | 5.51 | 8.44 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 13.16 | 47.26 | -8.00 | -32.82 | -10.40 | -14.77 | -22.13 | -12.34 | 9.90 | 7.75 | 11.34 | -5.36 | 12.63 | 11.47 | 9.62 | 11.08 | 3.30 | 8.75 | 0.97 | -0.38 | -1.68 | 3.02 | 3.85 | 2.09 | -1.06 | -1.01 | -0.57 | 0.06 | -1.39 | -4.29 | -6.82 | -5.09 | -1.91 | -0.86 | -0.08 | 0.48 | 0.41 | 0.79 | 2.31 | 0.10 | 0.11 | -0.07 | 0.19 | NA | 0.27 | 0.25 | NA | NA | NA | |

| Minority Interest | 49.36 | 46.99 | 44.00 | 41.52 | 35.51 | 34.86 | 33.47 | 22.81 | 21.80 | 18.98 | 16.86 | 8.72 | 6.85 | 5.69 | 5.36 | 4.33 | 3.43 | 3.17 | 3.26 | 3.41 | 3.42 | 3.51 | 3.51 | 3.48 | 3.60 | 3.65 | 3.69 | 3.70 | 3.73 | 3.76 | 3.79 | 3.84 | 3.91 | 3.97 | 4.01 | 4.05 | 4.74 | 4.79 | NA | 1.22 | 4.10 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Stock Issued During Period Value New Issues | 27.36 | 107.42 | 335.72 | 23.26 | 62.05 | 49.03 | 27.93 | 49.86 | 49.14 | 48.81 | -0.04 | 102.93 | 109.67 | 29.25 | 44.19 | 115.36 | 41.13 | 0.08 | 50.37 | 46.81 | 171.50 | -0.01 | 15.36 | 0.04 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

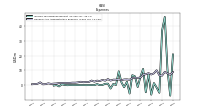

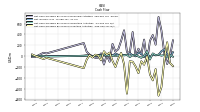

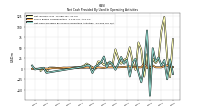

| Net Cash Provided By Used In Operating Activities | 7.35 | 26.61 | 16.92 | 48.80 | -63.74 | 90.86 | 5.05 | -31.94 | -8.38 | 23.88 | 15.99 | -18.18 | 21.42 | 12.27 | 27.94 | 11.65 | -2.10 | 11.10 | 17.04 | 3.45 | 29.00 | 15.28 | 9.17 | 5.35 | -9.74 | 7.81 | 8.40 | 5.24 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -9.39 | 2.46 | NA | NA | -1.45 | 7.73 | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -573.62 | -730.77 | -239.68 | -448.73 | -338.24 | 1.68 | -160.06 | -95.49 | -315.17 | -189.62 | -103.61 | -95.00 | -693.44 | -152.16 | 59.41 | -45.47 | -201.68 | -89.62 | 63.58 | 26.58 | 88.83 | -78.35 | 14.49 | 25.83 | -26.70 | 17.62 | -66.97 | -221.82 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -31.52 | -54.02 | NA | NA | 6.03 | 29.97 | NA | NA | NA | |

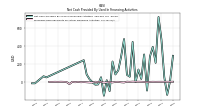

| Net Cash Provided By Used In Financing Activities | 471.82 | 721.91 | 210.33 | 388.15 | 279.75 | -98.54 | 304.04 | 31.53 | 135.83 | -4.86 | 443.97 | 55.89 | 76.78 | 475.42 | 282.37 | 127.54 | 81.36 | 225.23 | -104.47 | 16.76 | -155.42 | 49.89 | -30.09 | -32.80 | -4.86 | 28.48 | 81.33 | 240.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 48.54 | 60.97 | NA | NA | -17.51 | -17.47 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 7.35 | 26.61 | 16.92 | 48.80 | -63.74 | 90.86 | 5.05 | -31.94 | -8.38 | 23.88 | 15.99 | -18.18 | 21.42 | 12.27 | 27.94 | 11.65 | -2.10 | 11.10 | 17.04 | 3.45 | 29.00 | 15.28 | 9.17 | 5.35 | -9.74 | 7.81 | 8.40 | 5.24 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -9.39 | 2.46 | NA | NA | -1.45 | 7.73 | NA | NA | NA | |

| Net Income Loss | 89.76 | 21.45 | 13.52 | 24.11 | -19.93 | 34.53 | -18.45 | 45.35 | 62.42 | -2.84 | 15.97 | 51.02 | 24.93 | 21.18 | 12.01 | 24.31 | 46.08 | 9.10 | 12.74 | 13.65 | 9.05 | 16.50 | 17.30 | -1.22 | 3.38 | 7.93 | 12.34 | 7.20 | 4.41 | 3.33 | 3.75 | 3.17 | 2.25 | 2.12 | 1.47 | 2.12 | 1.46 | 2.56 | 2.83 | 2.75 | -7.33 | 1.84 | -4.97 | NA | NA | NA | NA | NA | NA | |

| Profit Loss | 90.99 | 21.65 | 13.52 | 24.60 | -20.20 | 34.94 | -18.54 | 45.70 | 62.82 | -3.10 | 16.41 | 51.22 | 25.01 | 21.28 | 12.06 | 24.41 | 46.24 | 9.18 | 12.79 | 13.71 | 9.10 | 16.57 | 17.35 | -1.23 | 3.41 | 7.97 | 12.41 | 7.24 | 4.44 | 3.35 | 3.77 | 3.20 | 2.26 | 2.14 | 1.48 | 2.15 | 1.48 | 2.60 | 2.88 | 2.81 | -7.54 | 1.89 | -5.77 | -1.22 | 0.95 | 6.22 | -2.24 | -0.30 | 0.11 | |

| Depreciation Depletion And Amortization | 0.38 | 0.88 | 0.94 | 0.93 | 1.05 | 1.01 | 0.94 | 0.99 | 0.99 | 0.97 | 0.94 | 0.89 | 0.90 | 0.90 | 0.90 | 0.90 | 0.90 | 0.90 | 0.66 | 1.14 | 3.80 | 4.02 | 3.71 | 3.73 | 3.64 | 3.47 | 3.31 | 2.75 | 2.31 | 1.78 | 1.79 | 1.79 | 1.23 | 1.16 | 0.80 | 0.76 | 0.19 | -0.77 | 0.60 | 0.50 | 0.06 | NA | NA | NA | 0.10 | NA | NA | NA | NA | |

| Share Based Compensation | 3.41 | 3.50 | 3.58 | 7.90 | 2.11 | 2.06 | 12.39 | 3.54 | 3.54 | 3.72 | 4.29 | 5.50 | 5.18 | 4.09 | 3.98 | 3.55 | 3.77 | 3.40 | 3.41 | 3.58 | 2.19 | 2.66 | 3.38 | 1.84 | 2.95 | 2.80 | 2.98 | 2.57 | 2.60 | 2.53 | 2.91 | 2.01 | 2.91 | 2.70 | 2.83 | 2.20 | 1.56 | 1.66 | 1.52 | 0.45 | 0.45 | 0.45 | NA | NA | 0.00 | -0.00 | NA | NA | NA | |

| Amortization Of Financing Costs | 3.61 | 3.03 | 3.07 | 3.25 | 3.02 | 3.03 | 2.92 | 2.72 | 2.87 | 2.87 | 2.23 | 3.35 | 1.97 | 2.36 | 1.37 | 2.10 | 1.36 | 1.71 | 1.69 | 1.67 | 2.84 | 2.77 | 2.51 | 2.62 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -573.62 | -730.77 | -239.68 | -448.73 | -338.24 | 1.68 | -160.06 | -95.49 | -315.17 | -189.62 | -103.61 | -95.00 | -693.44 | -152.16 | 59.41 | -45.47 | -201.68 | -89.62 | 63.58 | 26.58 | 88.83 | -78.35 | 14.49 | 25.83 | -26.70 | 17.62 | -66.97 | -221.82 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -31.52 | -54.02 | NA | NA | 6.03 | 29.97 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 471.82 | 721.91 | 210.33 | 388.15 | 279.75 | -98.54 | 304.04 | 31.53 | 135.83 | -4.86 | 443.97 | 55.89 | 76.78 | 475.42 | 282.37 | 127.54 | 81.36 | 225.23 | -104.47 | 16.76 | -155.42 | 49.89 | -30.09 | -32.80 | -4.86 | 28.48 | 81.33 | 240.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 48.54 | 60.97 | NA | NA | -17.51 | -17.47 | NA | NA | NA | |

| Payments Of Dividends | 44.70 | 42.96 | 36.99 | 35.14 | 33.89 | 33.38 | 33.12 | 31.81 | 30.16 | 27.84 | 27.82 | 27.69 | 25.57 | 25.27 | 24.66 | 24.36 | 22.17 | 22.17 | 21.55 | 20.52 | 17.93 | 17.79 | 17.67 | 17.61 | 17.61 | 17.61 | 17.17 | 15.85 | 13.08 | 13.08 | 11.76 | 11.57 | 8.53 | 8.52 | 7.34 | 7.20 | 5.00 | -0.15 | 5.08 | 3.71 | 5.94 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 86.58 | 89.85 | 74.33 | 69.10 | 58.31 | 60.15 | 62.80 | 58.48 | 53.70 | 48.88 | 58.89 | 51.70 | 48.89 | 48.59 | 48.59 | 40.83 | 38.33 | 38.84 | 31.27 | 32.89 | 39.19 | 34.88 | 35.83 | 27.91 | 27.09 | 26.40 | 28.27 | 23.80 | 19.86 | 19.01 | 21.84 | 20.48 | 8.75 | 8.35 | 7.43 | 7.76 | 7.54 | 7.81 | 7.57 | 5.70 | -4.79 | 4.80 | 2.86 | 0.76 | 3.27 | 10.98 | 1.54 | 2.01 | 2.76 | |

| Interest Income Operating | 62.17 | 54.30 | 48.22 | 43.11 | 36.75 | 34.30 | 33.36 | 30.24 | 30.54 | 26.24 | 25.02 | 25.10 | 24.51 | 23.51 | 23.65 | 23.89 | 21.93 | 19.32 | 15.12 | 15.52 | 27.53 | 14.58 | 12.76 | 12.85 | 13.61 | 15.37 | 13.64 | 14.12 | 12.02 | 12.04 | 12.65 | 11.49 | 10.79 | 10.06 | 8.22 | 8.33 | 7.10 | 6.23 | 5.23 | 4.62 | NA | NA | NA | NA | 2.83 | NA | NA | NA | NA | |

| Related Party Commercial Receivables Loans, Equity Method Investee | 19.00 | 18.00 | 16.00 | NA | 15.00 | 14.00 | 15.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |