| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | NA | NA | NA | 0.53 | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 52.11 | 52.08 | 51.96 | NA | 51.74 | 51.74 | 51.63 | NA | 51.59 | 51.45 | 51.27 | NA | 51.36 | 51.29 | 51.27 | NA | 51.48 | 51.68 | 51.63 | NA | 52.71 | 53.08 | 53.15 | NA | 52.78 | 52.72 | 52.68 | NA | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 52.02 | 52.01 | 51.84 | NA | 51.65 | 51.65 | 51.53 | NA | 51.42 | 51.45 | 51.27 | NA | 51.19 | 51.19 | 51.11 | NA | 51.35 | 51.55 | 51.51 | NA | 52.71 | 53.05 | 53.15 | NA | 52.78 | 52.72 | 52.68 | NA | NA | NA | |

| Earnings Per Share Basic | 1.64 | 1.58 | 3.52 | 1.93 | 1.91 | 5.75 | 2.84 | 2.70 | 0.75 | -0.09 | -0.42 | -0.66 | -0.28 | -0.18 | 0.42 | 0.41 | 0.88 | 2.43 | 2.14 | 7.13 | 1.00 | 1.72 | 3.36 | 1.83 | 2.27 | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | 1.64 | 1.58 | 3.51 | 1.92 | 1.90 | 5.74 | 2.83 | 2.69 | 0.74 | -0.09 | -0.42 | -0.66 | -0.28 | -0.18 | 0.42 | 0.41 | 0.87 | 2.43 | 2.14 | 7.11 | 1.00 | 1.72 | 3.36 | 1.83 | 2.27 | NA | NA | NA | NA | NA |

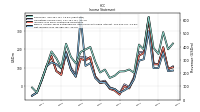

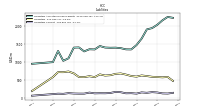

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

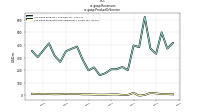

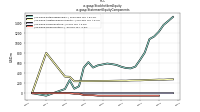

| Revenue From Contract With Customer Including Assessed Tax | 423.49 | 379.66 | 509.67 | 344.75 | 390.18 | 625.16 | 378.65 | 415.55 | 202.47 | 227.44 | 213.76 | 212.25 | 180.06 | 163.70 | 226.72 | 204.90 | 287.51 | 397.61 | 378.29 | 360.36 | 273.30 | 322.56 | 421.79 | 239.80 | 311.95 | 363.37 | 253.96 | 153.27 | 52.89 | 91.47 | |

| Revenues | 423.49 | 379.66 | 509.67 | 344.75 | 390.18 | 625.16 | 378.65 | 415.55 | 202.47 | 227.44 | 213.76 | 212.25 | 180.06 | 163.70 | 226.72 | 204.90 | 287.51 | 397.61 | 378.29 | 360.36 | 273.30 | 322.56 | 421.79 | 239.80 | 311.95 | 363.37 | 253.96 | 153.27 | 52.89 | 91.47 | |

| Cost Of Goods And Services Sold | 260.38 | 230.45 | 232.63 | 180.74 | 203.44 | 191.09 | 135.34 | 155.19 | 91.97 | 152.76 | 154.35 | 191.51 | 151.37 | 130.78 | 151.51 | 142.71 | 190.22 | 205.19 | 182.63 | 180.24 | 167.19 | 178.54 | 190.68 | 136.67 | 189.56 | 160.15 | 106.14 | NA | NA | NA | |

| Costs And Expenses | 315.74 | 289.22 | 300.01 | 227.14 | 265.74 | 252.62 | 191.80 | 231.28 | 151.22 | 230.27 | 202.69 | 250.03 | 194.59 | 169.03 | 196.22 | 180.83 | 232.91 | 249.67 | 221.51 | 203.14 | 210.59 | 221.46 | 234.53 | 173.30 | 229.19 | 200.09 | 143.11 | NA | NA | NA | |

| Selling General And Administrative Expense | 11.14 | 13.17 | 14.52 | 11.81 | 10.56 | 12.50 | 13.93 | 9.41 | 7.43 | 11.12 | 7.64 | 7.77 | 8.19 | 8.46 | 8.46 | 7.96 | 9.36 | 10.78 | 8.90 | 7.57 | 7.36 | 13.46 | 8.23 | 13.38 | 9.24 | 8.66 | 5.17 | NA | NA | NA | |

| Operating Income Loss | 107.75 | 90.44 | 209.66 | 117.61 | 124.44 | 372.53 | 186.85 | 184.26 | 51.24 | -2.83 | 11.08 | -37.78 | -14.53 | -5.33 | 30.50 | 24.07 | 54.60 | 147.94 | 156.78 | 157.22 | 62.72 | 101.10 | 187.25 | 66.50 | 82.77 | 163.28 | 110.85 | 34.63 | -32.95 | -49.63 | |

| Interest Income Expense Nonoperating Net | 7.27 | 6.19 | 1.46 | 1.71 | -5.70 | -7.18 | -7.82 | -9.44 | -8.78 | -8.48 | -8.69 | -8.46 | -8.06 | -8.26 | -7.53 | -6.54 | -7.25 | -6.95 | -8.59 | -8.84 | -10.13 | -9.78 | -8.56 | -5.06 | -0.64 | -0.64 | -0.61 | NA | NA | NA | |

| Gains Losses On Extinguishment Of Debt | -11.70 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -9.80 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | NA | NA | NA | NA | NA | NA | 6.30 | NA | NA | 4.10 | NA | NA | NA | NA | NA | NA | NA | NA | 0.50 | NA | 0.60 | 0.60 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 16.84 | 14.53 | 29.06 | 19.66 | 20.33 | 68.36 | 33.45 | 26.66 | 5.43 | -6.63 | 23.63 | -10.81 | -8.15 | -4.42 | 3.24 | -3.22 | 7.60 | 33.06 | 27.98 | -225.81 | 0.00 | 0.00 | 0.00 | -35.71 | -37.59 | 32.77 | 1.94 | NA | NA | NA | |

| Net Income Loss | 85.38 | 82.09 | 182.28 | 99.65 | 98.40 | 296.99 | 146.25 | 138.49 | 38.43 | -4.68 | -21.36 | -33.71 | -14.43 | -9.16 | 21.55 | 20.75 | 45.02 | 125.48 | 110.45 | 374.19 | 52.59 | 91.31 | 178.69 | 97.16 | 119.72 | 129.87 | 108.31 | 34.03 | -33.64 | -50.06 |

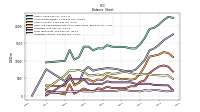

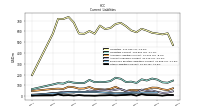

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

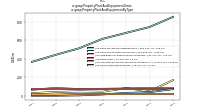

| Assets | 2219.25 | 2244.08 | 2150.99 | 2028.10 | 1935.28 | 1898.92 | 1643.35 | 1464.21 | 1344.61 | 1347.08 | 1379.99 | 1393.94 | 1391.01 | 1397.19 | 1439.17 | 1344.26 | 1349.58 | 1290.48 | 1400.00 | 1395.04 | 1100.12 | 1029.78 | 1301.61 | 993.32 | NA | NA | NA | 947.63 | NA | NA | |

| Liabilities | 474.04 | 582.78 | 572.70 | 580.58 | 587.65 | 607.86 | 624.74 | 592.23 | 609.24 | 648.92 | 679.69 | 668.70 | 631.30 | 622.23 | 654.05 | 578.68 | 603.64 | 577.82 | 580.94 | 682.43 | 734.42 | 714.91 | 716.70 | 580.29 | NA | NA | NA | 194.66 | NA | NA | |

| Liabilities And Stockholders Equity | 2219.25 | 2244.08 | 2150.99 | 2028.10 | 1935.28 | 1898.92 | 1643.35 | 1464.21 | 1344.61 | 1347.08 | 1379.99 | 1393.94 | 1391.01 | 1397.19 | 1439.17 | 1344.26 | 1349.58 | 1290.48 | 1400.00 | 1395.04 | 1100.12 | 1029.78 | 1301.61 | 993.32 | NA | NA | NA | 947.63 | NA | NA | |

| Stockholders Equity | 1745.21 | 1661.30 | 1578.29 | 1447.52 | 1347.63 | 1291.06 | 1018.61 | 871.98 | 735.36 | 698.15 | 700.30 | 725.24 | 759.71 | 774.96 | 785.12 | 765.58 | 745.94 | 712.66 | 819.06 | 712.61 | 365.69 | 314.87 | 584.91 | 413.02 | NA | NA | NA | 752.97 | NA | NA |

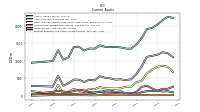

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 1104.20 | 1216.07 | 1243.58 | 1173.11 | 1141.56 | 1113.62 | 839.61 | 627.20 | 479.23 | 452.06 | 477.13 | 467.48 | 502.02 | 519.32 | 564.53 | 444.05 | 462.86 | 400.78 | 466.01 | 469.17 | 367.55 | 293.00 | 575.10 | 268.87 | NA | NA | NA | 290.77 | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 686.81 | 827.42 | 862.55 | 829.48 | 745.67 | 644.85 | 434.05 | 395.84 | 268.39 | 266.88 | 221.95 | 211.92 | 216.41 | 220.66 | 256.74 | 193.38 | 208.67 | 119.32 | 154.91 | 205.58 | 130.16 | 55.09 | 322.02 | 35.47 | NA | NA | NA | 150.04 | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 686.81 | 827.42 | 862.55 | 829.48 | 745.67 | 644.85 | 434.05 | 395.84 | 268.39 | 266.88 | 221.95 | 211.92 | 216.41 | 220.66 | 256.74 | 193.38 | 209.50 | 120.14 | 155.74 | 206.41 | 130.98 | 55.91 | 322.85 | 36.26 | 235.41 | 157.15 | 16.07 | 152.66 | NA | NA | |

| Accounts Receivable Net Current | 268.12 | 207.53 | 208.63 | 151.83 | 215.17 | 295.00 | 260.48 | 122.15 | 73.27 | 65.16 | 76.12 | 83.30 | 81.42 | 77.01 | 131.53 | 99.47 | 109.25 | 160.83 | 182.73 | 138.40 | 113.75 | 129.95 | 152.32 | 117.75 | NA | NA | NA | 65.90 | NA | NA | |

| Inventory Net | 108.76 | 137.94 | 129.41 | 154.04 | 143.79 | 140.42 | 110.53 | 59.62 | 94.03 | 76.96 | 135.70 | 118.71 | 155.67 | 153.91 | 117.56 | 97.90 | 81.92 | 69.23 | 70.36 | 56.72 | 66.77 | 59.45 | 51.28 | 54.29 | NA | NA | NA | 39.42 | NA | NA | |

| Prepaid Expense And Other Assets Current | 31.60 | 34.38 | 34.30 | 25.52 | NA | NA | NA | 33.10 | NA | NA | NA | 39.91 | NA | NA | NA | 23.84 | NA | NA | NA | 27.93 | NA | NA | NA | 29.38 | NA | NA | NA | 12.01 | NA | NA |

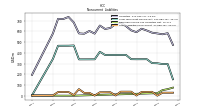

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Other Assets Noncurrent | 18.54 | 19.01 | 19.77 | 19.83 | 20.32 | 13.98 | 13.66 | 15.14 | 11.80 | 11.94 | 13.00 | 14.12 | 15.14 | 15.34 | 17.57 | 18.24 | 19.34 | 19.71 | 21.68 | 21.04 | 20.84 | 21.32 | 19.85 | 18.44 | NA | NA | NA | 16.67 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Liabilities Current | 143.96 | 124.15 | 127.72 | 153.12 | 162.95 | 144.47 | 155.68 | 122.13 | 134.39 | 130.67 | 160.96 | 170.32 | 139.28 | 131.15 | 132.73 | 128.95 | 150.18 | 121.26 | 121.50 | 124.43 | 134.75 | 115.69 | 120.03 | 108.22 | NA | NA | NA | 64.64 | NA | NA | |

| Accounts Payable Current | 44.02 | 32.77 | 29.75 | 39.03 | 51.88 | 46.88 | 60.45 | 33.83 | 39.14 | 48.03 | 65.34 | 59.11 | 50.00 | 55.80 | 54.62 | 46.44 | 50.82 | 36.47 | 42.22 | 33.59 | 37.08 | 40.12 | 31.00 | 28.08 | NA | NA | NA | 6.04 | NA | NA | |

| Accrued Liabilities Current | 72.23 | 55.76 | 62.93 | 77.44 | 78.80 | 65.03 | 55.74 | 54.85 | 58.11 | 46.64 | 62.90 | 86.11 | 67.52 | 60.34 | 63.48 | 65.75 | 84.42 | 70.74 | 69.46 | 82.34 | 87.12 | 66.47 | 69.33 | 66.70 | NA | NA | NA | 47.34 | NA | NA | |

| Other Liabilities Current | 10.09 | 10.54 | 4.58 | 8.67 | 9.18 | 9.79 | 17.59 | 4.69 | 14.72 | 11.15 | 9.11 | 6.36 | 9.89 | 7.27 | 6.61 | 3.99 | 5.33 | 5.39 | 9.82 | 4.97 | 9.04 | 6.84 | 16.71 | 6.90 | NA | NA | NA | 5.31 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 152.88 | 295.31 | 295.05 | 302.59 | 303.92 | 340.36 | 340.08 | 339.81 | 340.49 | 380.29 | 380.10 | 379.91 | 379.72 | 379.54 | 409.36 | 339.19 | 339.02 | 338.85 | 338.70 | 468.99 | 467.59 | 468.12 | 468.54 | 345.91 | NA | NA | NA | 6.57 | NA | NA | |

| Long Term Debt Noncurrent | 152.88 | 295.31 | 295.05 | 302.59 | 303.92 | 340.36 | 340.08 | 339.81 | 340.49 | 380.29 | 380.10 | 379.91 | 379.72 | 379.54 | 409.36 | 339.19 | 339.02 | 338.85 | 338.70 | 468.23 | 466.08 | 465.86 | 465.55 | 342.95 | NA | NA | NA | 3.73 | NA | NA | |

| Deferred Income Tax Liabilities Net | 75.17 | 60.95 | 51.96 | 23.38 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | NA | NA | NA | 0.26 | NA | NA | NA | 1.94 | NA | NA | |

| Other Liabilities Noncurrent | 27.86 | 27.73 | 27.82 | 0.50 | 36.17 | 35.02 | 35.11 | 1.84 | 37.21 | 37.18 | 37.22 | 2.26 | 32.28 | 31.82 | 31.55 | 1.20 | 26.36 | 26.19 | 61.09 | 5.51 | 34.17 | 35.08 | 33.99 | 2.56 | NA | NA | NA | 1.15 | NA | NA |

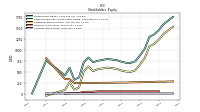

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 1745.21 | 1661.30 | 1578.29 | 1447.52 | 1347.63 | 1291.06 | 1018.61 | 871.98 | 735.36 | 698.15 | 700.30 | 725.24 | 759.71 | 774.96 | 785.12 | 765.58 | 745.94 | 712.66 | 819.06 | 712.61 | 365.69 | 314.87 | 584.91 | 413.02 | NA | NA | NA | 752.97 | NA | NA | |

| Common Stock Value | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.54 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | NA | NA | NA | 0.53 | NA | NA | |

| Additional Paid In Capital | 275.29 | 273.07 | 268.47 | 269.96 | 266.58 | 263.99 | 259.56 | 256.06 | 255.32 | 253.92 | 248.77 | 249.75 | 247.91 | 246.13 | 244.53 | 243.93 | 242.46 | 241.02 | 240.41 | 239.83 | 239.03 | 238.16 | 325.87 | 329.99 | NA | NA | NA | 802.11 | NA | NA | |

| Retained Earnings Accumulated Deficit | 1519.96 | 1438.26 | 1359.86 | 1227.60 | 1131.09 | 1077.11 | 809.09 | 665.96 | 530.09 | 494.27 | 501.57 | 525.54 | 561.85 | 578.88 | 590.64 | 571.69 | 553.52 | 511.11 | 618.12 | 510.28 | 138.23 | 88.27 | 258.50 | 82.50 | NA | NA | NA | -49.67 | NA | NA | |

| Treasury Stock Value | NA | NA | NA | 50.58 | NA | NA | 50.58 | 50.58 | 50.58 | 50.58 | 50.58 | 50.58 | 50.58 | 50.58 | 50.58 | 50.58 | 50.58 | 40.00 | 40.00 | 38.03 | 12.10 | 12.10 | NA | 0.00 | NA | NA | NA | NA | NA | NA |

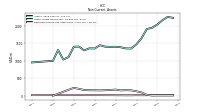

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

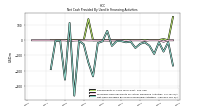

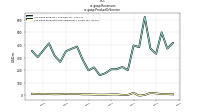

| Net Cash Provided By Used In Operating Activities | 138.57 | 124.51 | 192.93 | 194.99 | 247.18 | 329.58 | 70.14 | 174.71 | 62.93 | 68.68 | 45.22 | 30.47 | 29.17 | 31.96 | 21.02 | 24.55 | 150.43 | 231.43 | 126.41 | 130.80 | 102.34 | 132.52 | 193.74 | 91.45 | 116.11 | 161.40 | 65.55 | NA | NA | NA | |

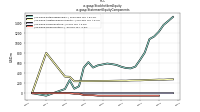

| Net Cash Provided By Used In Investing Activities | -112.35 | -147.38 | -85.02 | -98.47 | -55.88 | -82.91 | -17.89 | -23.73 | -10.50 | -15.13 | -21.79 | -29.11 | -27.83 | -31.03 | -20.22 | -33.90 | -42.45 | -28.12 | -29.74 | -28.41 | -23.80 | -32.88 | -22.54 | -29.95 | -34.41 | -16.89 | -11.38 | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -166.84 | -12.25 | -74.85 | -12.71 | -90.49 | -35.87 | -14.04 | -23.54 | -50.91 | -8.62 | -13.40 | -5.86 | -5.59 | -37.01 | 62.56 | -6.77 | -18.61 | -238.91 | -147.33 | -26.97 | -3.47 | -366.58 | 115.39 | -260.63 | -3.44 | -3.44 | -190.76 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 138.57 | 124.51 | 192.93 | 194.99 | 247.18 | 329.58 | 70.14 | 174.71 | 62.93 | 68.68 | 45.22 | 30.47 | 29.17 | 31.96 | 21.02 | 24.55 | 150.43 | 231.43 | 126.41 | 130.80 | 102.34 | 132.52 | 193.74 | 91.45 | 116.11 | 161.40 | 65.55 | NA | NA | NA | |

| Net Income Loss | 85.38 | 82.09 | 182.28 | 99.65 | 98.40 | 296.99 | 146.25 | 138.49 | 38.43 | -4.68 | -21.36 | -33.71 | -14.43 | -9.16 | 21.55 | 20.75 | 45.02 | 125.48 | 110.45 | 374.19 | 52.59 | 91.31 | 178.69 | 97.16 | 119.72 | 129.87 | 108.31 | 34.03 | -33.64 | -50.06 | |

| Depreciation Depletion And Amortization | 34.02 | 30.55 | 37.21 | 28.31 | 30.80 | 30.37 | 25.80 | 39.40 | 28.97 | 40.15 | 32.90 | 39.28 | 27.96 | 22.16 | 28.69 | 23.68 | 25.74 | 25.68 | 22.23 | 25.46 | 26.07 | 21.13 | 24.55 | 17.79 | 23.39 | 19.65 | 14.58 | NA | NA | NA | |

| Increase Decrease In Accounts Receivable | 60.59 | -1.10 | 56.80 | -63.35 | -79.83 | 34.52 | 138.33 | 48.88 | 8.11 | -10.96 | -7.18 | 1.88 | 4.41 | -54.52 | 32.05 | -9.77 | -51.59 | -21.89 | 44.33 | 24.65 | -16.20 | -22.38 | 34.58 | -10.79 | 35.99 | -3.63 | 30.28 | NA | NA | NA | |

| Increase Decrease In Inventories | -27.13 | 8.91 | -17.41 | 6.59 | 4.31 | 29.50 | 39.45 | -26.99 | 14.35 | -49.16 | 16.11 | -30.42 | -1.71 | 28.27 | 17.33 | 10.20 | 9.65 | -0.19 | 10.82 | -9.26 | 5.68 | 7.17 | -1.78 | 17.80 | -37.00 | 4.34 | 28.59 | NA | NA | NA | |

| Increase Decrease In Accounts Payable | 10.23 | 5.30 | -8.46 | -12.05 | 7.61 | -14.09 | 13.09 | -3.58 | -4.43 | -17.28 | 4.96 | 4.19 | -6.21 | 1.76 | 15.61 | -5.34 | 12.93 | -4.82 | 10.64 | -6.57 | -3.84 | 12.54 | 2.93 | 3.84 | 2.77 | -2.46 | 10.24 | NA | NA | NA | |

| Deferred Income Tax Expense Benefit | 14.42 | 8.88 | 29.06 | 19.60 | 20.33 | 68.49 | 33.38 | 26.66 | 5.43 | -6.63 | 23.63 | -10.81 | -8.11 | -4.43 | 3.28 | -0.07 | 7.60 | 32.97 | 27.98 | -223.04 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 2.20 | 4.57 | 7.70 | 3.37 | 2.60 | 4.43 | 7.22 | 0.61 | 1.52 | 5.54 | 1.70 | 1.97 | 1.91 | 1.99 | 1.73 | 1.60 | 1.57 | 1.46 | 1.19 | 0.81 | 0.92 | 4.48 | 0.20 | 3.03 | 0.23 | 0.92 | 0.00 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -112.35 | -147.38 | -85.02 | -98.47 | -55.88 | -82.91 | -17.89 | -23.73 | -10.50 | -15.13 | -21.79 | -29.11 | -27.83 | -31.03 | -20.22 | -33.90 | -42.45 | -28.12 | -29.74 | -28.41 | -23.80 | -32.88 | -22.54 | -29.95 | -34.41 | -16.89 | -11.38 | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 106.53 | 136.12 | 68.18 | 85.22 | 41.32 | 68.17 | 10.53 | 23.74 | 10.50 | 14.17 | 9.48 | 15.43 | 23.30 | 25.98 | 22.77 | 28.91 | 26.27 | 27.70 | 24.39 | 22.04 | 24.16 | 32.88 | 22.54 | 29.95 | 34.41 | 16.89 | 11.38 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -166.84 | -12.25 | -74.85 | -12.71 | -90.49 | -35.87 | -14.04 | -23.54 | -50.91 | -8.62 | -13.40 | -5.86 | -5.59 | -37.01 | 62.56 | -6.77 | -18.61 | -238.91 | -147.33 | -26.97 | -3.47 | -366.58 | 115.39 | -260.63 | -3.44 | -3.44 | -190.76 | NA | NA | NA | |

| Payments Of Dividends | 3.69 | 3.69 | 50.02 | 3.14 | 44.42 | 28.97 | 3.13 | 2.61 | 2.61 | 2.62 | 2.61 | 2.60 | 2.60 | 2.60 | 2.60 | 2.58 | 2.60 | 232.60 | 2.61 | 2.65 | 2.63 | 352.67 | 2.69 | 601.55 | 2.68 | 2.67 | 190.00 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 423.49 | 379.66 | 509.67 | 344.75 | 390.18 | 625.16 | 378.65 | 415.55 | 202.47 | 227.44 | 213.76 | 212.25 | 180.06 | 163.70 | 226.72 | 204.90 | 287.51 | 397.61 | 378.29 | 360.36 | 273.30 | 322.56 | 421.79 | 239.80 | 311.95 | 363.37 | 253.96 | 153.27 | 52.89 | 91.47 | |

| Material Reconciling Items | 6.60 | 8.63 | 9.18 | 14.84 | 18.24 | 1.87 | -3.78 | 18.75 | 2.72 | 2.68 | 6.78 | 5.99 | 4.83 | 4.66 | 5.38 | 6.85 | 6.67 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Mining | 416.89 | 371.03 | 500.49 | 329.91 | 371.94 | 623.29 | 382.43 | 396.79 | 199.75 | 224.76 | 206.99 | 206.26 | 175.23 | 159.04 | 221.34 | 198.05 | 280.84 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Xcoal Energy And Resources, Sales Revenue Net, Customer Concentration Risk | 36.70 | 59.20 | 30.90 | 48.80 | 69.80 | 128.00 | 83.50 | 155.80 | 122.30 | 141.80 | 106.20 | 64.20 | 38.70 | 0.00 | 44.30 | NA | 57.80 | 68.10 | 94.90 | NA | 12.80 | 42.20 | 86.20 | NA | 63.20 | 74.70 | NA | NA | NA | NA | |

| Product | 416.89 | 371.03 | 500.49 | 329.91 | 371.94 | 623.29 | 382.43 | 396.79 | 199.75 | 224.76 | 206.99 | 206.26 | 175.23 | 159.04 | 221.34 | 198.05 | 280.84 | 387.43 | 369.68 | 349.85 | 264.91 | 315.05 | 412.88 | NA | 302.96 | 351.79 | NA | NA | NA | NA | |

| Product And Service Other | 6.60 | 8.63 | 9.18 | 14.84 | 18.24 | 1.87 | -3.78 | 18.75 | 2.72 | 2.68 | 6.78 | 5.99 | 4.83 | 4.66 | 5.38 | 6.85 | 6.67 | 10.18 | 8.61 | 10.51 | 8.40 | 7.51 | 8.91 | 10.96 | 9.00 | 11.58 | NA | NA | NA | NA | |

| Revenue From Contract With Customer Including Assessed Tax | 423.49 | 379.66 | 509.67 | 344.75 | 390.18 | 625.16 | 378.65 | 415.55 | 202.47 | 227.44 | 213.76 | 212.25 | 180.06 | 163.70 | 226.72 | 204.90 | 287.51 | 397.61 | 378.29 | 360.36 | 273.30 | 322.56 | 421.79 | 239.80 | 311.95 | 363.37 | 253.96 | 153.27 | 52.89 | 91.47 | |

| Material Reconciling Items | 6.60 | 8.63 | 9.18 | 14.84 | 18.24 | 1.87 | -3.78 | 18.75 | 2.72 | 2.68 | 6.78 | 5.99 | 4.83 | 4.66 | 5.38 | 6.85 | 6.67 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Mining | 416.89 | 371.03 | 500.49 | 329.91 | 371.94 | 623.29 | 382.43 | 396.79 | 199.75 | 224.76 | 206.99 | 206.26 | 175.23 | 159.04 | 221.34 | 198.05 | 280.84 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Xcoal Energy And Resources, Sales Revenue Net, Customer Concentration Risk | 36.70 | 59.20 | 30.90 | 48.80 | 69.80 | 128.00 | 83.50 | 155.80 | 122.30 | 141.80 | 106.20 | 64.20 | 38.70 | 0.00 | 44.30 | NA | 57.80 | 68.10 | 94.90 | NA | 12.80 | 42.20 | 86.20 | NA | 63.20 | 74.70 | NA | NA | NA | NA | |

| Product | 416.89 | 371.03 | 500.49 | 329.91 | 371.94 | 623.29 | 382.43 | 396.79 | 199.75 | 224.76 | 206.99 | 206.26 | 175.23 | 159.04 | 221.34 | 198.05 | 280.84 | 387.43 | 369.68 | 349.85 | 264.91 | 315.05 | 412.88 | NA | 302.96 | 351.79 | NA | NA | NA | NA | |

| Product And Service Other | 6.60 | 8.63 | 9.18 | 14.84 | 18.24 | 1.87 | -3.78 | 18.75 | 2.72 | 2.68 | 6.78 | 5.99 | 4.83 | 4.66 | 5.38 | 6.85 | 6.67 | 10.18 | 8.61 | 10.51 | 8.40 | 7.51 | 8.91 | 10.96 | 9.00 | 11.58 | NA | NA | NA | NA |