| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-08-02 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

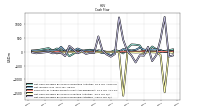

| Earnings Per Share Basic | 0.63 | 0.84 | 0.72 | 0.65 | 0.72 | 1.25 | 0.60 | 0.42 | 0.69 | 0.92 | NA | 0.10 | -0.08 | -1.81 | -0.08 | -0.56 | 0.09 | 0.83 | 0.59 | 0.43 | 0.59 | 1.25 | 0.42 | 1.10 | 0.31 | 1.85 | 0.43 | 0.51 | 0.51 | 0.39 | 0.35 | 0.48 | 0.48 | |

| Earnings Per Share Diluted | 0.62 | 0.83 | 0.71 | 0.64 | 0.70 | 1.24 | 0.60 | 0.42 | 0.68 | 0.90 | NA | 0.10 | -0.08 | -1.81 | -0.08 | -0.56 | 0.09 | 0.83 | 0.59 | 0.43 | 0.58 | 1.24 | 0.42 | 1.10 | 0.30 | 1.83 | 0.43 | 0.51 | 0.51 | 0.39 | 0.35 | 0.48 | 0.48 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-08-02 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Excluding Assessed Tax | 1019.00 | 1018.00 | 1007.00 | 934.00 | 992.00 | 1116.00 | 948.00 | 779.00 | 838.00 | 928.00 | 633.00 | 334.00 | 235.00 | 212.00 | 208.00 | 123.00 | 351.00 | 468.00 | 466.00 | 454.00 | 450.00 | 642.00 | 427.00 | 563.00 | 367.00 | 447.00 | 426.00 | 439.00 | 399.00 | 415.00 | 407.00 | 391.00 | 370.00 | |

| Revenues | 1019.00 | 1018.00 | 1007.00 | 934.00 | 992.00 | 1116.00 | 948.00 | 779.00 | 838.00 | 928.00 | 633.00 | 334.00 | 235.00 | 212.00 | 208.00 | 123.00 | 351.00 | 468.00 | 466.00 | 454.00 | 450.00 | 642.00 | 427.00 | 563.00 | 367.00 | 447.00 | 426.00 | 439.00 | 399.00 | 415.00 | 407.00 | 391.00 | 370.00 | |

| Costs And Expenses | 870.00 | 838.00 | 853.00 | 804.00 | 865.00 | 879.00 | 801.00 | 679.00 | 684.00 | 719.00 | NA | 308.00 | 234.00 | 427.00 | 210.00 | 165.00 | 337.00 | 384.00 | 384.00 | 390.00 | 365.00 | 473.00 | 364.00 | 408.00 | 320.00 | 360.00 | 350.00 | 348.00 | 316.00 | 339.00 | 333.00 | 304.00 | 284.00 | |

| General And Administrative Expense | 64.00 | 40.00 | 48.00 | 42.00 | 54.00 | 50.00 | 66.00 | 42.00 | 59.00 | 41.00 | NA | 44.00 | 36.00 | 27.00 | 22.00 | 22.00 | 21.00 | 29.00 | 28.00 | 29.00 | 25.00 | 33.00 | 31.00 | 30.00 | 23.00 | 29.00 | 23.00 | 29.00 | 23.00 | 31.00 | 24.00 | 21.00 | 16.00 | |

| Interest Expense | 45.00 | 45.00 | 44.00 | 44.00 | 37.00 | 37.00 | 35.00 | 33.00 | 31.00 | 42.00 | NA | 17.00 | 15.00 | 11.00 | 10.00 | 12.00 | 10.00 | 10.00 | 12.00 | 11.00 | 10.00 | 8.00 | 7.00 | 8.00 | 7.00 | 6.00 | 7.00 | 7.00 | 7.00 | 3.00 | 0.00 | 0.00 | 0.00 | |

| Income Tax Expense Benefit | 40.00 | 44.00 | 35.00 | 17.00 | 14.00 | 54.00 | 41.00 | 20.00 | 47.00 | 49.00 | NA | -3.00 | -6.00 | -67.00 | -5.00 | -8.00 | 1.00 | 2.00 | 20.00 | 15.00 | 20.00 | 41.00 | 15.00 | 39.00 | 10.00 | -103.00 | 28.00 | 33.00 | 26.00 | 27.00 | 33.00 | 33.00 | 32.00 | |

| Net Income Loss | 68.00 | 92.00 | 80.00 | 73.00 | 78.00 | 150.00 | 73.00 | 51.00 | 75.00 | 99.00 | NA | 9.00 | -7.00 | -154.00 | -7.00 | -48.00 | 8.00 | 72.00 | 50.00 | 39.00 | 55.00 | 120.00 | 40.53 | 106.86 | 30.17 | 183.00 | 42.70 | 51.00 | 50.00 | 38.00 | 34.60 | 47.40 | 48.00 | |

| Comprehensive Income Net Of Tax | 61.00 | 92.00 | 75.00 | 63.00 | 85.00 | 156.00 | 77.00 | 73.00 | 75.00 | 99.00 | NA | 9.00 | -7.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-08-02 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 8685.00 | 8009.00 | 8151.00 | 8478.00 | 8004.00 | 8046.00 | 8132.00 | 8442.00 | 8008.00 | 8097.00 | NA | 4507.00 | 3114.00 | 3134.00 | 3544.00 | 3635.00 | 3704.00 | 3079.00 | 3038.00 | 2989.00 | 2961.00 | 2753.00 | 2813.00 | 2608.00 | 2365.00 | 2384.00 | 2348.00 | 2287.00 | 2307.00 | 2180.00 | NA | NA | NA | |

| Liabilities | 6570.00 | 5861.00 | 6046.00 | 6346.00 | 5853.00 | 5889.00 | 6055.00 | 6377.00 | 6020.00 | 6203.00 | NA | 4111.00 | 2745.00 | 2760.00 | 3022.00 | 3112.00 | 3141.00 | 2509.00 | 2544.00 | 2539.00 | 2386.00 | 2137.00 | 2251.00 | 2091.00 | 1965.00 | 1866.00 | 2015.00 | 2004.00 | 2081.00 | 2013.00 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 8685.00 | 8009.00 | 8151.00 | 8478.00 | 8004.00 | 8046.00 | 8132.00 | 8442.00 | 8008.00 | 8097.00 | NA | 4507.00 | 3114.00 | 3134.00 | 3544.00 | 3635.00 | 3704.00 | 3079.00 | 3038.00 | 2989.00 | 2961.00 | 2753.00 | 2813.00 | 2608.00 | 2365.00 | 2384.00 | 2348.00 | 2287.00 | 2307.00 | 2180.00 | NA | NA | NA | |

| Stockholders Equity | 2115.00 | 2148.00 | 2105.00 | 2132.00 | 2151.00 | 2157.00 | 2077.00 | 2065.00 | 1988.00 | 1894.00 | NA | 396.00 | 369.00 | 374.00 | 522.00 | 523.00 | 563.00 | 570.00 | 494.00 | 450.00 | 575.00 | 616.00 | 562.00 | 517.00 | 400.00 | 518.00 | 333.00 | NA | NA | 167.00 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-08-02 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 589.00 | 227.00 | 252.00 | 389.00 | 223.00 | 425.00 | 374.00 | 514.00 | 432.00 | 334.00 | NA | 318.00 | 400.00 | 428.00 | 625.00 | 733.00 | 669.00 | 67.00 | 113.00 | 120.00 | 158.00 | 108.00 | 145.00 | 131.00 | 85.00 | 246.00 | 226.00 | 191.00 | 196.00 | 48.00 | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 885.00 | 535.00 | 588.00 | 752.00 | 555.00 | 744.00 | 666.00 | 817.00 | 695.00 | 564.00 | NA | 1780.00 | 505.00 | 526.00 | 717.00 | 823.00 | 759.00 | 152.00 | 211.00 | 187.00 | 222.00 | 180.00 | 212.00 | 203.00 | 154.00 | 297.00 | 284.00 | 253.00 | NA | 151.00 | NA | NA | NA | |

| Accounts Receivable Net Current | 507.00 | 441.00 | 485.00 | 503.00 | 511.00 | 398.00 | 413.00 | 447.00 | 302.00 | 278.00 | NA | 220.00 | 111.00 | 119.00 | 109.00 | 74.00 | 158.00 | 174.00 | 137.00 | NA | NA | 153.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-08-02 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 981.00 | NA | NA | NA | 967.00 | 963.00 | 979.00 | 919.00 | 911.00 | 975.00 | NA | 649.00 | 636.00 | 632.00 | 617.00 | 606.00 | 587.00 | 888.00 | 869.00 | 769.00 | 733.00 | 642.00 | 618.00 | 485.00 | NA | 303.00 | NA | NA | NA | 312.00 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 223.00 | NA | NA | NA | 169.00 | 187.00 | 178.00 | 165.00 | 155.00 | 153.00 | NA | 141.00 | 135.00 | 131.00 | 129.00 | 122.00 | 114.00 | 110.00 | 104.00 | 96.00 | 89.00 | 83.00 | 80.00 | 74.00 | NA | 65.00 | NA | NA | NA | 56.00 | NA | NA | NA | |

| Amortization Of Intangible Assets | 45.00 | 40.00 | 38.00 | 40.00 | 45.00 | 50.00 | 49.00 | 48.00 | 42.00 | 38.00 | NA | 5.00 | 4.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Property Plant And Equipment Net | 758.00 | 789.00 | 807.00 | 797.00 | 798.00 | 776.00 | 801.00 | 754.00 | 756.00 | 822.00 | NA | 508.00 | 501.00 | 501.00 | 488.00 | 484.00 | 473.00 | 778.00 | 765.00 | 673.00 | 644.00 | 559.00 | 538.00 | 411.00 | 235.00 | 238.00 | 266.00 | 255.00 | 254.00 | 256.00 | NA | NA | NA | |

| Goodwill | 1418.00 | 1416.00 | 1416.00 | 1416.00 | 1416.00 | 1416.00 | 1357.00 | 1351.00 | 1377.00 | 820.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 1158.00 | 1186.00 | 1213.00 | 1244.00 | 1277.00 | 1318.00 | 1358.00 | 1400.00 | 1441.00 | 1953.00 | NA | 80.00 | 80.00 | 81.00 | 80.00 | 79.00 | 78.00 | 89.00 | 87.00 | 84.00 | 80.00 | 81.00 | 73.00 | 73.00 | 73.00 | 72.00 | 72.00 | 71.00 | 69.00 | 70.00 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-08-02 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 3049.00 | 2730.00 | 2942.00 | 2940.00 | 2651.00 | 2612.00 | 2787.00 | 2913.00 | 2913.00 | 2929.00 | NA | 2431.00 | 1156.00 | 1159.00 | 1262.00 | 1263.00 | 1266.00 | 828.00 | 815.00 | 937.00 | 800.00 | 604.00 | 530.00 | 637.00 | 479.00 | 482.00 | 484.00 | 486.00 | 488.00 | 490.00 | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 631.00 | 657.00 | 658.00 | 656.00 | 659.00 | 703.00 | 698.00 | 691.00 | 670.00 | 798.00 | NA | 147.00 | 118.00 | 137.00 | 209.00 | 228.00 | NA | 257.00 | NA | NA | NA | 255.00 | NA | NA | NA | 250.00 | 374.00 | 380.00 | 385.00 | 389.00 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-08-02 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 2115.00 | 2148.00 | 2105.00 | 2132.00 | 2151.00 | 2157.00 | 2077.00 | 2065.00 | 1988.00 | 1894.00 | NA | 396.00 | 369.00 | 374.00 | 522.00 | 523.00 | 563.00 | 570.00 | 494.00 | 450.00 | 575.00 | 616.00 | 562.00 | 517.00 | 400.00 | 518.00 | 333.00 | NA | NA | 167.00 | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 1504.00 | 1535.00 | 1541.00 | 1559.00 | 1582.00 | 1607.00 | 1626.00 | 1634.00 | 1630.00 | 1611.00 | NA | 212.00 | 194.00 | 192.00 | 186.00 | 180.00 | 172.00 | 179.00 | 174.00 | 169.00 | 170.00 | 174.00 | 174.00 | 170.00 | 161.00 | 162.00 | 160.00 | NA | NA | 138.00 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 593.00 | 588.00 | 539.00 | 543.00 | 529.00 | 517.00 | 424.00 | 408.00 | 357.00 | 282.00 | NA | 183.00 | 174.00 | 181.00 | 335.00 | 342.00 | 390.00 | 390.00 | 319.00 | 280.00 | 404.00 | 441.00 | 387.00 | 346.00 | 238.00 | 355.00 | 172.00 | 129.00 | 78.00 | 28.00 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 17.00 | 24.00 | 24.00 | 29.00 | 39.00 | 32.00 | 26.00 | 22.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Treasury Stock Value | 640.00 | 541.00 | 478.00 | 357.00 | 272.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-08-02 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

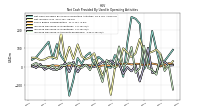

| Net Cash Provided By Used In Operating Activities | 0.00 | 92.00 | 194.00 | 26.00 | -16.00 | 233.00 | 260.00 | 270.00 | 132.00 | -56.00 | NA | 30.00 | 62.00 | -7.00 | -2.00 | 35.00 | 53.00 | -3.00 | 76.00 | 58.00 | 14.00 | 46.00 | -71.00 | -159.00 | 25.00 | 57.00 | 122.00 | 42.00 | 135.00 | NA | NA | 50.00 | 36.00 | |

| Net Cash Provided By Used In Investing Activities | -111.00 | -22.00 | -14.00 | -11.00 | -46.00 | -16.00 | -21.00 | -14.00 | -21.00 | -1597.00 | NA | -8.00 | -5.00 | -9.00 | -9.00 | -7.00 | -8.00 | -19.00 | -16.00 | -20.00 | -10.00 | -27.00 | -12.00 | -9.00 | -14.00 | -10.00 | -56.00 | -11.00 | -10.00 | NA | NA | -7.00 | -10.00 | |

| Net Cash Provided By Used In Financing Activities | 453.00 | -118.00 | -335.00 | 183.00 | -138.00 | -126.00 | -385.00 | -133.00 | 24.00 | 437.00 | NA | 1253.00 | -78.00 | -175.00 | -95.00 | 36.00 | 562.00 | -37.00 | -36.00 | -73.00 | 38.00 | -51.00 | 92.00 | 217.00 | -154.00 | -34.00 | -35.00 | -52.00 | -2.00 | NA | NA | -52.00 | -21.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-08-02 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 0.00 | 92.00 | 194.00 | 26.00 | -16.00 | 233.00 | 260.00 | 270.00 | 132.00 | -56.00 | NA | 30.00 | 62.00 | -7.00 | -2.00 | 35.00 | 53.00 | -3.00 | 76.00 | 58.00 | 14.00 | 46.00 | -71.00 | -159.00 | 25.00 | 57.00 | 122.00 | 42.00 | 135.00 | NA | NA | 50.00 | 36.00 | |

| Net Income Loss | 68.00 | 92.00 | 80.00 | 73.00 | 78.00 | 150.00 | 73.00 | 51.00 | 75.00 | 99.00 | NA | 9.00 | -7.00 | -154.00 | -7.00 | -48.00 | 8.00 | 72.00 | 50.00 | 39.00 | 55.00 | 120.00 | 40.53 | 106.86 | 30.17 | 183.00 | 42.70 | 51.00 | 50.00 | 38.00 | 34.60 | 47.40 | 48.00 | |

| Depreciation Depletion And Amortization | 57.00 | 53.00 | 52.00 | 51.00 | 63.00 | 57.00 | 64.00 | 60.00 | 55.00 | 48.00 | NA | 12.00 | 11.00 | 11.00 | 11.00 | 11.00 | 12.00 | 14.00 | 14.00 | 13.00 | 10.00 | 11.00 | 9.00 | 8.00 | 8.00 | 8.00 | 7.00 | 7.00 | 7.00 | 7.00 | 6.00 | 6.00 | 5.00 | |

| Increase Decrease In Accounts Receivable | 60.00 | -44.00 | -18.00 | -8.00 | 113.00 | -9.00 | -34.00 | 107.00 | 22.00 | 1.00 | NA | 109.00 | -8.00 | 9.00 | 35.00 | -84.00 | -16.00 | 37.00 | -20.00 | 10.00 | -7.00 | 2.00 | 13.00 | 21.00 | 5.00 | 7.00 | -19.00 | 8.00 | -8.00 | 2.00 | 0.00 | 20.00 | 8.00 | |

| Increase Decrease In Inventories | 27.00 | -30.00 | -34.00 | 101.00 | 1.00 | -81.00 | 6.00 | -26.00 | -4.00 | -40.00 | NA | 15.00 | 14.00 | 32.00 | 23.00 | 26.00 | 10.00 | -2.00 | -5.00 | 8.00 | 3.00 | -31.00 | 26.00 | -30.00 | 19.00 | -9.00 | -16.00 | -16.00 | -6.00 | -17.00 | 13.00 | -7.00 | 4.00 | |

| Share Based Compensation | 2.00 | 12.00 | 16.00 | 10.00 | 6.00 | 14.00 | 15.00 | 11.00 | 16.00 | 14.00 | NA | 14.00 | 4.00 | 5.00 | 6.00 | 6.00 | -2.00 | 4.00 | 6.00 | 7.00 | 5.00 | 3.00 | 5.00 | 5.00 | 3.00 | 2.00 | 5.00 | 5.00 | 3.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Amortization Of Financing Costs | 11.00 | 8.00 | 7.00 | 7.00 | 18.00 | 9.00 | 13.00 | 12.00 | 20.00 | 9.00 | NA | 4.00 | 6.00 | 5.00 | 4.00 | 5.00 | 4.00 | 3.00 | 2.00 | 3.00 | 2.00 | 1.00 | 1.00 | 2.00 | 1.00 | 1.00 | 1.00 | 2.00 | 1.00 | 2.00 | 1.00 | 1.00 | 1.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-08-02 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

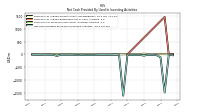

| Net Cash Provided By Used In Investing Activities | -111.00 | -22.00 | -14.00 | -11.00 | -46.00 | -16.00 | -21.00 | -14.00 | -21.00 | -1597.00 | NA | -8.00 | -5.00 | -9.00 | -9.00 | -7.00 | -8.00 | -19.00 | -16.00 | -20.00 | -10.00 | -27.00 | -12.00 | -9.00 | -14.00 | -10.00 | -56.00 | -11.00 | -10.00 | NA | NA | -7.00 | -10.00 | |

| Payments To Acquire Property Plant And Equipment | 13.00 | 9.00 | 4.00 | 5.00 | 33.00 | 6.00 | 11.00 | 8.00 | 7.00 | 7.00 | NA | 3.00 | 1.00 | 2.00 | 2.00 | 1.00 | 3.00 | 12.00 | 8.00 | 11.00 | 6.00 | 15.00 | 9.00 | 6.00 | 14.00 | 10.00 | 10.00 | 7.00 | 8.00 | 10.00 | 2.00 | 5.00 | 9.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-08-02 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

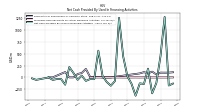

| Net Cash Provided By Used In Financing Activities | 453.00 | -118.00 | -335.00 | 183.00 | -138.00 | -126.00 | -385.00 | -133.00 | 24.00 | 437.00 | NA | 1253.00 | -78.00 | -175.00 | -95.00 | 36.00 | 562.00 | -37.00 | -36.00 | -73.00 | 38.00 | -51.00 | 92.00 | 217.00 | -154.00 | -34.00 | -35.00 | -52.00 | -2.00 | NA | NA | -52.00 | -21.00 | |

| Payments For Repurchase Of Common Stock | 100.00 | 62.00 | 121.00 | 85.00 | 110.00 | 84.00 | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 10.00 | 0.00 | 12.00 | 179.00 | 92.00 | 71.00 | 0.00 | 0.00 | 112.00 | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-08-02 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 1019.00 | 1018.00 | 1007.00 | 934.00 | 992.00 | 1116.00 | 948.00 | 779.00 | 838.00 | 928.00 | 633.00 | 334.00 | 235.00 | 212.00 | 208.00 | 123.00 | 351.00 | 468.00 | 466.00 | 454.00 | 450.00 | 642.00 | 427.00 | 563.00 | 367.00 | 447.00 | 426.00 | 439.00 | 399.00 | 415.00 | 407.00 | 391.00 | 370.00 | |

| Intersegment Elimination | -16.00 | -13.00 | 14.00 | 13.00 | 62.00 | -10.00 | -8.00 | -7.00 | -5.00 | -5.00 | NA | -5.00 | -3.00 | -3.00 | -2.00 | 0.00 | -8.00 | -7.00 | -9.00 | -11.00 | -9.00 | -8.00 | -8.00 | -8.00 | -8.00 | -6.00 | -8.00 | -10.00 | -6.00 | -5.00 | -8.00 | -6.00 | -6.00 | |

| Material Reconciling Items | 97.00 | 97.00 | 97.00 | 95.00 | 82.00 | 82.00 | 67.00 | 66.00 | 71.00 | 58.00 | NA | 38.00 | 35.00 | 32.00 | 33.00 | 23.00 | 49.00 | 40.00 | 43.00 | 43.00 | 42.00 | 37.00 | 36.00 | 38.00 | 36.00 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating | 938.00 | 934.00 | 924.00 | 852.00 | 922.00 | 1044.00 | 889.00 | 720.00 | 772.00 | 875.00 | NA | 301.00 | 203.00 | 183.00 | 177.00 | 100.00 | 310.00 | 435.00 | 432.00 | 422.00 | 417.00 | 613.00 | 399.00 | 533.00 | 339.00 | 420.00 | 400.00 | 415.00 | 371.00 | 388.00 | 382.00 | 365.00 | 347.00 | |

| Intersegment Elimination, Billing And Collection Services | -16.00 | -13.00 | -14.00 | -13.00 | -12.00 | -10.00 | -8.00 | 7.00 | -31.00 | 5.00 | NA | 5.00 | -3.00 | -3.00 | -2.00 | 0.00 | -8.00 | -6.00 | -9.00 | -11.00 | -9.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Real Estate Sales And Financing | 591.00 | 612.00 | 604.00 | 550.00 | 595.00 | 745.00 | 586.00 | 452.00 | 475.00 | 659.00 | NA | 194.00 | 123.00 | 116.00 | 116.00 | 56.00 | 206.00 | 313.00 | 324.00 | 308.00 | 307.00 | 495.00 | 291.00 | 435.00 | 241.00 | 323.00 | 310.00 | 323.00 | 283.00 | 300.00 | 301.00 | 276.00 | 266.00 | |

| Operating, Resort Operations And Club Management | 347.00 | 322.00 | 320.00 | 302.00 | 327.00 | 299.00 | 303.00 | 268.00 | 297.00 | 216.00 | NA | 107.00 | 80.00 | 67.00 | 61.00 | 44.00 | 104.00 | 122.00 | 108.00 | 114.00 | 110.00 | 118.00 | 108.00 | 98.00 | 98.00 | 97.00 | 90.00 | 92.00 | 88.00 | 88.00 | 81.00 | 89.00 | 81.00 | |

| Cost Reimbursements | 97.00 | 97.00 | 97.00 | 95.00 | 82.00 | 82.00 | 67.00 | 66.00 | 71.00 | 58.00 | NA | 38.00 | 35.00 | 32.00 | 33.00 | 23.00 | 49.00 | 40.00 | 43.00 | 43.00 | 42.00 | 37.00 | 36.00 | 38.00 | 36.00 | 33.00 | 34.00 | 34.00 | NA | NA | NA | NA | NA | |

| Financing | 82.00 | 75.00 | 76.00 | 74.00 | 71.00 | 68.00 | 64.00 | 64.00 | 56.00 | 53.00 | NA | 37.00 | 37.00 | 38.00 | 40.00 | 43.00 | 44.00 | 43.00 | 43.00 | 43.00 | 41.00 | 41.00 | 40.00 | 39.00 | 38.00 | 38.00 | 38.00 | 36.00 | NA | NA | NA | NA | NA | |

| Rental And Ancillary Service | 164.00 | 171.00 | 173.00 | 158.00 | 160.00 | 159.00 | 171.00 | 136.00 | 144.00 | 112.00 | NA | 54.00 | 32.00 | 20.00 | 20.00 | 5.00 | 52.00 | 54.00 | 54.00 | 60.00 | 59.00 | 54.00 | 60.00 | 53.00 | 51.00 | 41.00 | 45.00 | 47.00 | NA | NA | NA | NA | NA | |

| Resort And Club Management | 167.00 | 138.00 | 133.00 | 131.00 | 155.00 | 130.00 | 124.00 | 125.00 | 148.00 | 99.00 | NA | 48.00 | 45.00 | 44.00 | 39.00 | 39.00 | 44.00 | 61.00 | 45.00 | 43.00 | 42.00 | 56.00 | 40.00 | 37.00 | 39.00 | 50.00 | 37.00 | 35.00 | NA | NA | NA | NA | NA | |

| Sales Marketing Brand And Other Fees | 133.00 | 170.00 | 173.00 | 158.00 | 163.00 | 177.00 | 161.00 | 119.00 | 133.00 | 118.00 | NA | 81.00 | 53.00 | 50.00 | 52.00 | 13.00 | 106.00 | 144.00 | 143.00 | 145.00 | 141.00 | 147.00 | 152.00 | 146.00 | 125.00 | 143.00 | 127.00 | 144.00 | NA | NA | NA | NA | NA | |

| Sales Of Vacation Ownership Intervals Net | 376.00 | 367.00 | 355.00 | 318.00 | 361.00 | 500.00 | 361.00 | 269.00 | 286.00 | 488.00 | NA | 76.00 | 33.00 | 28.00 | 24.00 | 0.00 | 56.00 | 126.00 | 138.00 | 120.00 | 125.00 | 307.00 | 99.00 | 250.00 | 78.00 | 142.00 | 145.00 | 143.00 | NA | NA | NA | NA | NA | |

| Related Party | 45.00 | 51.00 | 56.00 | NA | 67.00 | 52.00 | 47.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Real Estate Sales And Financing | 591.00 | 612.00 | 604.00 | 550.00 | 595.00 | 745.00 | 586.00 | 452.00 | 475.00 | 659.00 | NA | 194.00 | 123.00 | 116.00 | 116.00 | 56.00 | 206.00 | 313.00 | 324.00 | 308.00 | 307.00 | 495.00 | 291.00 | 435.00 | 241.00 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Resort Operations And Club Management | 331.00 | 309.00 | 306.00 | 289.00 | 315.00 | 289.00 | 295.00 | 261.00 | 292.00 | 211.00 | NA | 102.00 | 77.00 | 65.00 | 59.00 | 44.00 | 96.00 | 115.00 | 99.00 | 103.00 | 101.00 | 110.00 | 100.00 | 90.00 | 98.00 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | 1019.00 | 1018.00 | 1007.00 | 934.00 | 992.00 | 1116.00 | 948.00 | 779.00 | 838.00 | 928.00 | 633.00 | 334.00 | 235.00 | 212.00 | 208.00 | 123.00 | 351.00 | 468.00 | 466.00 | 454.00 | 450.00 | 642.00 | 427.00 | 563.00 | 367.00 | 447.00 | 426.00 | 439.00 | 399.00 | 415.00 | 407.00 | 391.00 | 370.00 |