| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

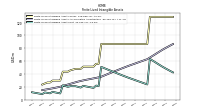

| Common Stock Value | 2.01 | 2.02 | 2.02 | 2.03 | 2.03 | 2.03 | 2.04 | 2.05 | 1.64 | 1.64 | 1.64 | 1.65 | 1.65 | 1.66 | 1.67 | 1.68 | 1.68 | 1.71 | 1.74 | 1.75 | 1.74 | 1.74 | 1.74 | 1.43 | 1.43 | 1.41 | 1.41 | 1.40 | 1.40 | 1.40 | 1.36 | 1.35 | 1.35 | 1.35 | 1.33 | 1.30 | 1.30 | 1.30 | 1.13 | 1.12 | 0.56 | 0.56 | 0.56 | |

| Weighted Average Number Of Diluted Shares Outstanding | 201.39 | NA | 202.65 | 202.92 | 203.62 | NA | 205.13 | 206.01 | 164.20 | NA | 164.60 | 165.23 | 165.45 | NA | 167.18 | 167.79 | 169.59 | NA | 174.87 | 173.94 | 174.38 | NA | 144.99 | 144.12 | 142.49 | NA | 140.70 | 140.61 | 140.69 | NA | 136.16 | 135.83 | 135.85 | NA | 133.23 | 131.09 | 131.02 | NA | 113.24 | 113.15 | 56.53 | NA | 56.68 | |

| Weighted Average Number Of Shares Outstanding Basic | 201.21 | NA | 202.53 | 202.79 | 203.46 | NA | 204.83 | 205.68 | 163.79 | NA | 164.13 | 164.78 | 165.26 | NA | 167.18 | 167.79 | 169.59 | NA | 174.44 | 173.40 | 173.76 | NA | 144.24 | 143.28 | 141.78 | NA | 140.44 | 140.38 | 140.39 | NA | 135.74 | 135.26 | 135.18 | NA | 132.45 | 130.28 | 130.25 | NA | 112.51 | 112.47 | 56.22 | NA | 56.30 | |

| Earnings Per Share Basic | 0.50 | 0.43 | 0.49 | 0.52 | 0.51 | 0.58 | 0.53 | 0.08 | 0.40 | 0.45 | 0.46 | 0.48 | 0.55 | 0.44 | 0.44 | 0.43 | 0.42 | 0.41 | 0.46 | 0.44 | 0.42 | 0.12 | 0.10 | 0.35 | 0.33 | 0.34 | 0.31 | 0.31 | 0.29 | 0.27 | 0.27 | 0.25 | 0.23 | 0.22 | 0.21 | 0.22 | 0.21 | 0.09 | 0.17 | 0.16 | 0.31 | 0.30 | 0.29 | |

| Earnings Per Share Diluted | 0.50 | 0.43 | 0.49 | 0.52 | 0.51 | 0.58 | 0.53 | 0.08 | 0.40 | 0.45 | 0.46 | 0.48 | 0.55 | 0.44 | 0.44 | 0.43 | 0.42 | 0.41 | 0.46 | 0.44 | 0.42 | 0.11 | 0.10 | 0.35 | 0.33 | 0.35 | 0.31 | 0.31 | 0.29 | 0.27 | 0.26 | 0.25 | 0.23 | 0.22 | 0.21 | 0.21 | 0.21 | 0.09 | 0.17 | 0.15 | 0.31 | 0.30 | 0.28 |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

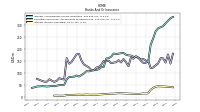

| Interest And Fee Income Loans And Leases | 265.29 | 260.00 | 249.46 | 243.15 | 237.00 | 221.28 | 195.84 | 181.78 | 129.44 | 136.75 | 142.61 | 141.68 | 150.92 | 161.21 | 167.47 | 165.82 | 163.85 | 163.20 | 166.33 | 153.00 | 148.06 | 147.43 | 113.27 | 112.73 | 105.76 | 103.11 | 102.95 | 100.42 | 96.91 | 97.77 | 88.67 | 82.36 | 75.49 | 80.01 | 75.92 | 75.40 | 75.01 | 65.34 | 45.00 | 44.04 | 44.16 | 41.20 | 39.28 | |

| Interest Income Operating | 41.03 | 41.87 | 42.39 | 42.68 | 43.25 | 41.49 | 36.34 | 28.67 | 13.79 | 12.95 | 13.33 | 12.09 | 11.32 | 12.97 | 13.54 | 13.83 | 14.09 | 13.33 | 12.44 | 12.35 | 11.98 | 10.82 | 10.10 | 9.40 | 8.42 | 8.13 | 8.30 | 7.97 | 8.27 | 8.74 | 7.95 | 7.90 | 8.29 | 8.01 | 7.46 | 7.14 | 6.79 | 6.31 | 4.15 | 3.96 | 3.88 | 4.25 | 4.14 | |

| Insurance Commissions And Fees | 0.51 | 0.48 | 0.56 | 0.52 | 0.53 | 0.45 | 0.60 | 0.66 | 0.48 | 0.39 | 0.59 | 0.48 | 0.49 | 0.55 | 0.60 | 0.52 | 0.61 | 0.44 | 0.46 | 0.53 | 0.68 | 0.47 | 0.47 | 0.47 | 0.55 | 0.49 | 0.53 | 0.62 | 0.66 | 0.51 | 0.55 | 0.64 | 0.57 | 0.98 | 0.98 | 0.93 | 1.42 | 0.78 | 0.52 | 0.44 | 0.68 | 0.37 | 0.51 | |

| Interest Expense | 112.33 | 103.45 | 92.33 | 81.99 | 70.34 | 57.23 | 29.85 | 18.25 | 13.76 | 11.96 | 12.45 | 13.23 | 14.56 | 35.35 | 39.10 | 40.30 | 40.02 | 37.50 | 34.14 | 27.95 | 24.77 | 22.01 | 17.14 | 15.51 | 9.68 | 8.18 | 7.72 | 7.45 | 7.23 | 6.49 | 5.56 | 4.86 | 4.81 | 4.69 | 4.80 | 4.54 | 4.84 | 4.66 | 2.83 | 3.24 | 3.80 | 4.23 | 4.92 | |

| Interest Income Expense Net | 204.59 | 202.77 | 201.94 | 207.64 | 214.59 | 215.67 | 213.10 | 198.76 | 131.15 | 139.02 | 144.61 | 141.25 | 148.09 | 139.78 | 142.98 | 140.99 | 139.47 | 140.28 | 145.91 | 138.61 | 136.21 | 136.97 | 106.77 | 107.35 | 104.81 | 103.21 | 103.65 | 101.04 | 98.06 | 100.10 | 91.09 | 85.45 | 79.07 | 83.37 | 78.61 | 78.04 | 77.00 | 67.06 | 46.35 | 44.84 | 44.35 | 41.28 | 38.62 | |

| Interest Paid Net | 109.59 | 98.14 | 93.57 | 76.19 | 71.70 | 49.92 | 37.52 | 19.94 | 7.67 | 16.57 | 8.33 | 17.71 | 10.72 | 40.30 | 34.89 | 44.90 | 35.57 | 40.99 | 28.99 | 31.77 | 19.30 | 27.36 | 14.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 30.28 | 26.55 | 30.84 | 31.62 | 29.95 | 32.74 | 33.25 | 3.29 | 20.03 | 20.58 | 23.21 | 25.07 | 28.90 | 23.21 | 27.20 | 22.94 | 22.73 | 21.49 | 25.35 | 24.31 | 23.97 | 72.81 | 7.54 | 30.28 | 25.37 | 29.25 | 25.48 | 26.02 | 24.74 | 22.04 | 20.20 | 19.94 | 18.12 | 17.14 | 15.01 | 16.42 | 15.55 | 7.12 | 10.59 | 10.28 | 9.96 | 9.70 | 9.01 | |

| Income Taxes Paid Net | 2.43 | 28.47 | 34.69 | 70.33 | 1.60 | 17.38 | 30.65 | 36.59 | 1.97 | 16.07 | 23.56 | 57.48 | 1.21 | 21.91 | 12.40 | 54.35 | 1.04 | 21.60 | 24.31 | 22.51 | 0.86 | 7.80 | 42.48 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | -22.35 | 101.45 | -57.85 | -36.38 | 49.16 | 2.00 | -91.55 | -111.35 | -115.02 | -15.54 | -3.12 | 9.67 | -24.67 | -3.66 | 5.11 | 19.59 | 9.45 | 16.91 | -4.11 | -3.33 | -15.87 | -7.31 | -2.55 | 5.43 | 0.61 | -7.90 | -2.63 | 4.47 | 2.29 | -3.94 | 2.23 | -4.20 | 3.07 | 1.67 | 0.65 | 4.17 | 4.65 | -2.78 | -3.35 | -8.66 | -1.36 | 0.09 | 1.77 | |

| Comprehensive Income Net Of Tax | 77.76 | 187.70 | 40.60 | 68.89 | 152.12 | 117.68 | 17.16 | -95.37 | -50.13 | 57.82 | 71.88 | 88.74 | 66.93 | 69.60 | 77.88 | 91.75 | 80.80 | 87.94 | 76.17 | 72.70 | 57.19 | 16.00 | 12.27 | 55.53 | 47.47 | 40.69 | 40.99 | 47.98 | 43.72 | 33.50 | 37.97 | 29.71 | 34.19 | 31.60 | 28.02 | 32.60 | 31.99 | 10.17 | 15.02 | 9.00 | 16.19 | 17.03 | 17.87 | |

| Net Income Loss Available To Common Stockholders Basic | 100.11 | 86.24 | 98.45 | 105.27 | 102.96 | 115.69 | 108.70 | 15.98 | 64.89 | 73.36 | 74.99 | 79.07 | 91.60 | 73.26 | 72.76 | 72.16 | 71.35 | 71.03 | 80.28 | 76.03 | 73.06 | 23.31 | 14.82 | 50.10 | 46.86 | 48.59 | 43.62 | 43.51 | 41.43 | 37.43 | 35.74 | 33.91 | 31.12 | 29.93 | 27.37 | 28.43 | 27.34 | 12.95 | 18.36 | 17.66 | 17.55 | 16.94 | 16.09 | |

| Interest Income Expense After Provision For Loan Loss | 200.09 | 197.12 | 200.64 | 203.66 | 213.40 | 210.67 | 213.10 | 140.17 | 131.15 | 139.02 | 144.61 | 146.00 | 148.09 | 139.78 | 142.98 | 139.66 | 139.47 | 140.28 | 145.91 | 135.89 | 134.61 | 132.04 | 71.75 | 106.97 | 100.90 | 101.50 | 98.12 | 95.35 | 92.38 | 91.21 | 83.98 | 80.07 | 75.28 | 78.00 | 74.36 | 71.93 | 70.06 | 62.73 | 46.35 | 43.99 | 44.35 | 40.03 | 38.46 | |

| Noninterest Expense | 111.50 | 127.17 | 114.76 | 116.28 | 114.64 | 118.90 | 114.35 | 165.48 | 76.90 | 77.05 | 75.62 | 72.98 | 72.87 | 71.34 | 67.76 | 67.62 | 69.06 | 71.27 | 66.12 | 63.23 | 63.38 | 63.22 | 70.85 | 51.00 | 55.14 | 47.49 | 51.03 | 47.59 | 45.65 | 49.00 | 44.59 | 43.25 | 40.71 | 41.15 | 42.82 | 38.62 | 39.36 | 54.87 | 26.71 | 25.86 | 25.86 | 29.58 | 23.98 | |

| Noninterest Income | 41.80 | 42.85 | 43.41 | 49.51 | 34.16 | 56.66 | 43.20 | 44.58 | 30.67 | 31.96 | 29.21 | 31.12 | 45.28 | 28.03 | 24.75 | 23.07 | 23.67 | 23.51 | 25.85 | 27.67 | 25.80 | 27.29 | 21.46 | 24.42 | 26.47 | 23.83 | 22.01 | 21.77 | 19.44 | 17.26 | 16.55 | 17.03 | 14.67 | 10.21 | 10.83 | 11.54 | 12.18 | 12.22 | 9.32 | 9.80 | 9.03 | 16.19 | 10.63 |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

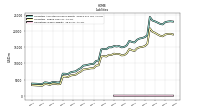

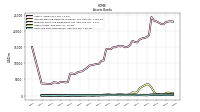

| Assets | 22835.72 | 22656.66 | 21950.64 | 22126.43 | 22518.26 | 22883.59 | 23157.37 | 24253.17 | 18617.99 | 18052.14 | 17765.06 | 17627.19 | 17240.24 | 15032.05 | 14901.93 | 15287.58 | 15179.50 | 15302.44 | 14912.74 | 14924.12 | 14323.23 | 14449.76 | 14255.97 | 10872.23 | 10717.47 | 9808.47 | 9764.24 | 9582.13 | 9397.45 | 9289.12 | 8515.55 | 8074.38 | 7513.97 | 7403.27 | 7196.37 | 6666.14 | 6780.78 | 6811.86 | 4161.31 | 4091.34 | 4225.51 | 4242.13 | 3887.91 | |

| Liabilities | 19024.32 | 18865.58 | 18295.76 | 18472.35 | 18887.37 | 19357.23 | 19697.35 | 20754.60 | 15931.29 | 15286.42 | 15028.99 | 14931.00 | 14595.04 | 12520.52 | 12432.55 | 12866.17 | 12818.02 | 12952.55 | 12571.71 | 12610.11 | 12085.05 | 12245.47 | 12049.25 | 9396.20 | 9275.90 | 8480.98 | 8468.22 | 8317.21 | 8169.67 | 8089.36 | 7424.27 | 7012.68 | 6474.41 | 6387.98 | 6237.69 | 5768.90 | 5911.91 | 5970.91 | 3616.16 | 3557.83 | 3697.11 | 3726.66 | 3377.93 | |

| Liabilities And Stockholders Equity | 22835.72 | 22656.66 | 21950.64 | 22126.43 | 22518.26 | 22883.59 | 23157.37 | 24253.17 | 18617.99 | 18052.14 | 17765.06 | 17627.19 | 17240.24 | 15032.05 | 14901.93 | 15287.58 | 15179.50 | 15302.44 | 14912.74 | 14924.12 | 14323.23 | 14449.76 | 14255.97 | 10872.23 | 10717.47 | 9808.47 | 9764.24 | 9582.13 | 9397.45 | 9289.12 | 8515.55 | 8074.38 | 7513.97 | 7403.27 | 7196.37 | 6666.14 | 6780.78 | 6811.86 | 4161.31 | 4091.34 | 4225.51 | 4242.13 | 3887.91 | |

| Stockholders Equity | 3811.40 | 3791.07 | 3654.87 | 3654.08 | 3630.89 | 3526.36 | 3460.01 | 3498.57 | 2686.70 | 2765.72 | 2736.06 | 2696.19 | 2645.20 | 2511.53 | 2469.39 | 2421.41 | 2361.48 | 2349.89 | 2341.03 | 2314.01 | 2238.18 | 2204.29 | 2206.72 | 1476.03 | 1441.57 | 1327.49 | 1296.02 | 1264.91 | 1227.78 | 1199.76 | 1091.28 | 1061.70 | 1039.56 | 1015.29 | 958.68 | 897.24 | 868.87 | 840.96 | 545.14 | 533.51 | 528.39 | 515.47 | 509.98 |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 1175.26 | 1000.21 | 488.08 | 611.19 | 688.05 | 724.79 | 1580.42 | 2816.38 | 3619.46 | 3650.32 | 3280.26 | 2941.25 | 2478.55 | 490.60 | 442.30 | 557.30 | 562.47 | 657.94 | 532.06 | 495.74 | 510.60 | 635.93 | 552.32 | 460.49 | 417.09 | 216.65 | 296.16 | 185.39 | 158.07 | 255.82 | 228.66 | 204.41 | 197.57 | 112.53 | 137.48 | 143.55 | 214.56 | 165.53 | 112.34 | 172.72 | 302.36 | 231.85 | 155.63 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 1175.26 | 1000.21 | 488.08 | 611.19 | 688.05 | 724.79 | 1580.42 | 2816.38 | 3619.46 | 3650.32 | 3280.26 | 2941.25 | 2478.55 | 490.60 | 442.30 | 557.30 | 562.47 | 657.94 | 532.06 | 495.74 | 510.60 | 635.93 | 552.32 | 460.49 | NA | 216.65 | NA | NA | NA | 255.82 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Amortization Of Intangible Assets | 2.14 | 2.25 | 2.50 | 2.50 | 2.48 | 2.48 | 2.50 | 2.50 | 1.42 | 1.42 | 1.40 | 1.40 | 1.42 | 1.56 | 1.60 | 1.59 | 1.59 | 1.59 | 1.62 | 1.62 | 1.62 | 1.63 | 0.91 | 0.87 | 0.80 | 0.76 | 0.76 | 0.76 | 0.84 | 0.86 | 0.99 | 1.10 | 1.13 | 1.16 | 1.15 | 1.15 | 1.17 | 1.22 | 0.80 | 0.80 | 0.80 | 0.74 | 0.69 | |

| Property Plant And Equipment Net | 389.62 | 393.30 | 397.09 | 397.31 | 402.09 | 405.07 | 411.48 | 415.06 | 274.50 | 275.76 | 276.97 | 278.50 | 278.62 | 280.10 | 277.97 | 278.82 | 279.01 | 233.26 | 233.65 | 234.63 | 235.61 | 237.44 | 239.99 | 207.07 | 212.81 | 205.30 | 208.14 | 207.93 | 210.76 | 212.16 | 205.50 | 209.43 | 209.33 | 206.91 | 211.73 | 196.19 | 196.39 | 197.22 | 119.64 | 119.74 | 117.53 | 113.88 | 105.13 | |

| Goodwill | 1398.25 | 1398.25 | 1398.25 | 1398.25 | 1398.25 | 1398.25 | 1394.35 | 1398.40 | 973.02 | 973.02 | 973.02 | 973.02 | 973.02 | 958.41 | 958.41 | 958.41 | 958.41 | 958.41 | 958.41 | 956.42 | 927.95 | 927.95 | 929.13 | 420.94 | 420.94 | 377.98 | 377.98 | 377.98 | 377.98 | 377.98 | 322.73 | 322.73 | 322.73 | 325.42 | 313.32 | 301.74 | 301.74 | 301.74 | 85.68 | 85.68 | 85.68 | 85.68 | 77.09 | |

| Finite Lived Intangible Assets Net | 46.63 | 48.77 | 51.02 | 53.50 | 55.98 | 58.45 | 60.93 | 63.41 | 23.62 | 25.05 | 26.47 | 27.89 | 29.31 | 36.57 | 38.14 | 39.72 | 41.31 | 42.90 | 44.48 | 46.10 | 47.73 | 49.35 | 50.98 | 21.02 | 21.89 | 18.31 | 19.07 | 19.84 | 20.60 | 21.44 | 18.83 | 19.82 | 20.92 | 20.93 | 21.00 | 19.98 | 21.13 | 22.30 | 9.65 | 10.46 | 11.26 | 12.06 | 9.79 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 121.66 | 112.06 | 180.31 | 129.68 | 117.47 | 161.75 | 149.87 | 93.53 | 0.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 1159.14 | 1170.48 | 1103.18 | 1155.77 | 1169.91 | 1126.15 | 1101.16 | 1273.28 | 499.14 | NA | NA | NA | NA | NA | NA | NA | NA | 193.61 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 0.22 | 0.56 | 0.01 | 0.29 | 1.02 | 0.20 | 0.02 | 0.03 | 0.02 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 121.66 | 112.06 | 180.31 | 129.68 | 117.47 | 161.75 | 149.87 | 93.53 | 0.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Fair Value | 1135.62 | 1132.82 | 1102.38 | 1132.79 | 1097.60 | 1102.07 | 1029.26 | 1274.58 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | 1280.59 | 1281.98 | 1283.47 | 1285.15 | 1286.37 | 1287.70 | 1251.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After One Through Five Years Fair Value | 26.49 | 26.04 | 20.88 | 16.45 | 4.62 | 4.48 | 4.53 | 4.69 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Twelve Months Or Longer Fair Value | 1082.68 | 1062.83 | 1000.26 | 977.45 | 980.32 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Less Than Twelve Months Fair Value | 52.94 | 69.99 | 102.12 | 155.34 | 117.28 | 1102.07 | 1029.26 | 1274.58 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Five Through Ten Years Fair Value | 283.30 | 278.68 | 246.41 | 238.29 | 199.00 | 190.99 | 193.35 | 168.69 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Ten Years Fair Value | 726.38 | 739.74 | 712.32 | 772.15 | 833.03 | 799.30 | 806.29 | 850.21 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | NA | 1342.05 | NA | NA | NA | 862.02 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 16866.13 | 16787.71 | 16518.74 | 16996.89 | 17445.47 | 17938.78 | 18542.32 | 19580.07 | 14580.93 | 14260.57 | 14003.37 | 13891.34 | 13512.59 | 11278.38 | 11047.37 | 11347.32 | 11067.45 | 10899.78 | 10624.74 | 10736.03 | 10396.61 | 10388.50 | 10448.77 | 7767.39 | 7567.21 | 6942.43 | 6840.29 | 6712.95 | 6577.52 | 6438.51 | 5953.01 | 5878.04 | 5902.23 | 5423.97 | 5277.27 | 5192.01 | 5338.51 | 5393.05 | 3248.82 | 3325.24 | 3465.44 | 3483.45 | 3132.47 | |

| Line Of Credit | 1590.00 | 1330.00 | 1530.00 | 1180.00 | 1150.00 | 1140.00 | 1090.00 | 1090.00 | 891.30 | 1070.00 | 1120.00 | 1150.00 | 1150.00 | 1260.00 | 1290.00 | 1290.00 | 822.70 | 821.30 | 941.30 | 915.30 | 697.30 | 695.30 | 691.30 | 566.30 | 521.30 | 516.20 | 226.20 | 266.20 | 261.20 | 261.10 | 250.10 | 144.00 | 144.00 | 144.00 | 172.00 | NA | NA | 191.00 | NA | NA | NA | NA | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

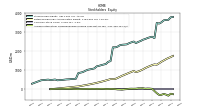

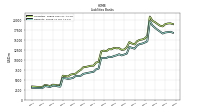

| Stockholders Equity | 3811.40 | 3791.07 | 3654.87 | 3654.08 | 3630.89 | 3526.36 | 3460.01 | 3498.57 | 2686.70 | 2765.72 | 2736.06 | 2696.19 | 2645.20 | 2511.53 | 2469.39 | 2421.41 | 2361.48 | 2349.89 | 2341.03 | 2314.01 | 2238.18 | 2204.29 | 2206.72 | 1476.03 | 1441.57 | 1327.49 | 1296.02 | 1264.91 | 1227.78 | 1199.76 | 1091.28 | 1061.70 | 1039.56 | 1015.29 | 958.68 | 897.24 | 868.87 | 840.96 | 545.14 | 533.51 | 528.39 | 515.47 | 509.98 | |

| Common Stock Value | 2.01 | 2.02 | 2.02 | 2.03 | 2.03 | 2.03 | 2.04 | 2.05 | 1.64 | 1.64 | 1.64 | 1.65 | 1.65 | 1.66 | 1.67 | 1.68 | 1.68 | 1.71 | 1.74 | 1.75 | 1.74 | 1.74 | 1.74 | 1.43 | 1.43 | 1.41 | 1.41 | 1.40 | 1.40 | 1.40 | 1.36 | 1.35 | 1.35 | 1.35 | 1.33 | 1.30 | 1.30 | 1.30 | 1.13 | 1.12 | 0.56 | 0.56 | 0.56 | |

| Additional Paid In Capital Common Stock | 2326.82 | 2348.02 | 2363.21 | 2366.56 | 2375.75 | 2386.70 | 2404.39 | 2426.27 | 1485.52 | 1487.37 | 1492.59 | 1501.62 | 1516.29 | 1537.09 | 1542.86 | 1551.00 | 1560.99 | 1609.81 | 1668.11 | 1693.34 | 1671.14 | 1675.32 | 1674.64 | 940.82 | 948.98 | 869.74 | 866.31 | 863.56 | 862.83 | 867.98 | 782.50 | 780.73 | 779.86 | 781.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 1753.99 | 1690.11 | 1640.17 | 1578.18 | 1509.40 | 1443.09 | 1361.04 | 1286.15 | 1304.10 | 1266.25 | 1215.83 | 1163.81 | 1107.82 | 956.55 | 904.98 | 853.96 | 803.63 | 752.18 | 701.90 | 642.54 | 585.59 | 530.66 | 526.45 | 527.34 | 490.14 | 455.95 | 420.00 | 389.01 | 357.79 | 326.90 | 299.98 | 274.41 | 248.95 | 226.28 | 203.11 | 182.38 | 158.84 | 136.39 | 128.32 | 114.17 | 100.73 | 86.84 | 77.19 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -271.43 | -249.07 | -350.53 | -292.68 | -256.30 | -305.46 | -307.45 | -215.91 | -104.56 | 10.46 | 26.00 | 29.12 | 19.45 | 16.22 | 19.88 | 14.77 | -4.82 | -13.81 | -30.72 | -23.61 | -20.28 | -3.42 | 3.89 | 6.44 | 1.01 | 0.40 | 8.30 | 10.94 | 6.46 | 4.18 | 8.11 | 5.88 | 10.08 | 7.01 | 5.34 | 4.69 | 0.51 | -4.14 | -1.36 | 1.98 | 10.64 | 12.00 | 11.91 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 2.27 | NA | 2.23 | 2.33 | 2.51 | NA | 2.39 | 2.34 | 2.11 | NA | 2.25 | 2.28 | 2.12 | NA | 2.65 | 2.69 | 2.84 | 2.58 | 2.62 | 1.85 | 2.04 | 1.73 | 1.55 | 1.57 | 1.85 | 1.37 | 2.45 | 1.39 | 1.43 | 1.14 | 1.56 | 0.70 | 0.52 | 0.45 | 0.48 | 0.50 | 0.64 | 0.36 | 0.34 | 0.36 | 0.24 | 0.85 | -0.17 |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

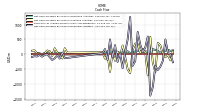

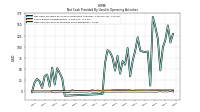

| Net Cash Provided By Used In Operating Activities | 147.54 | 115.50 | 99.12 | 47.11 | 117.95 | 144.00 | 166.55 | 13.13 | 89.49 | 87.94 | 89.02 | 91.33 | 121.08 | 59.75 | 68.10 | 39.82 | 79.75 | 46.75 | 75.13 | 87.87 | 92.47 | 63.42 | -5.72 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -9.40 | 29.14 | 41.29 | 52.02 | 15.55 | 53.10 | |

| Net Cash Provided By Used In Investing Activities | -24.98 | -100.35 | -1.81 | 299.48 | 381.14 | -602.06 | -291.83 | 586.03 | -716.41 | 55.40 | 181.74 | 45.05 | 342.48 | -84.14 | 292.89 | -74.91 | 87.82 | -224.33 | 64.96 | -599.55 | -18.98 | -152.50 | 65.63 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 50.78 | 199.88 | -147.20 | -22.63 | 54.11 | 199.72 | -60.48 | |

| Net Cash Provided By Used In Financing Activities | 52.48 | 496.99 | -220.42 | -423.45 | -535.82 | -397.58 | -1110.68 | -1402.24 | 596.07 | 226.72 | 68.24 | 326.33 | 751.20 | 72.69 | -475.99 | 29.92 | -263.03 | 303.46 | -103.78 | 496.83 | -198.83 | 172.69 | 31.92 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -137.29 | 57.68 | -148.29 | -35.62 | -139.03 | -195.52 |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 147.54 | 115.50 | 99.12 | 47.11 | 117.95 | 144.00 | 166.55 | 13.13 | 89.49 | 87.94 | 89.02 | 91.33 | 121.08 | 59.75 | 68.10 | 39.82 | 79.75 | 46.75 | 75.13 | 87.87 | 92.47 | 63.42 | -5.72 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -9.40 | 29.14 | 41.29 | 52.02 | 15.55 | 53.10 | |

| Deferred Income Tax Expense Benefit | 1.57 | -4.94 | 2.12 | -1.43 | 0.18 | 11.88 | 8.97 | -21.02 | 2.38 | -3.07 | 3.65 | 4.87 | -13.08 | 9.13 | 5.08 | 5.55 | 9.21 | -11.30 | 1.39 | 9.20 | 4.00 | 49.95 | -13.19 | -4.81 | 2.13 | 0.24 | 6.88 | 5.06 | 0.52 | 5.73 | -2.43 | 0.21 | 3.65 | 2.95 | 5.19 | 7.04 | 3.52 | 14.58 | 2.61 | -0.16 | 6.97 | 1.67 | -3.71 | |

| Share Based Compensation | 2.27 | 2.20 | 2.23 | 2.33 | 2.51 | 2.29 | 2.39 | 2.34 | 2.11 | 2.21 | 2.25 | 2.28 | 2.12 | 2.54 | 2.65 | 2.69 | 2.84 | 2.58 | 2.62 | 1.85 | 2.04 | 1.73 | 1.55 | 1.57 | 1.85 | 1.37 | 2.45 | 1.39 | 1.43 | 1.14 | 1.56 | 0.70 | 0.52 | 0.45 | 2.76 | -0.50 | -0.64 | 0.36 | 0.34 | 0.36 | 0.24 | 0.42 | 0.27 |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -24.98 | -100.35 | -1.81 | 299.48 | 381.14 | -602.06 | -291.83 | 586.03 | -716.41 | 55.40 | 181.74 | 45.05 | 342.48 | -84.14 | 292.89 | -74.91 | 87.82 | -224.33 | 64.96 | -599.55 | -18.98 | -152.50 | 65.63 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 50.78 | 199.88 | -147.20 | -22.63 | 54.11 | 199.72 | -60.48 | |

| Payments To Acquire Property Plant And Equipment | 1.68 | 1.77 | 5.35 | -0.97 | 2.40 | 4.86 | -2.44 | 4.53 | 2.07 | 2.22 | 1.81 | 3.10 | 3.15 | 5.84 | 3.77 | 2.43 | 2.85 | 2.88 | 1.65 | -0.52 | 3.94 | 0.81 | 1.96 | -3.21 | 5.64 | -0.27 | 2.92 | -0.94 | 1.38 | 3.98 | -1.12 | 2.63 | 5.04 | -3.61 | 0.18 | 1.82 | 1.68 | 2.77 | 1.29 | 3.41 | 5.25 | 5.24 | 5.95 |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 52.48 | 496.99 | -220.42 | -423.45 | -535.82 | -397.58 | -1110.68 | -1402.24 | 596.07 | 226.72 | 68.24 | 326.33 | 751.20 | 72.69 | -475.99 | 29.92 | -263.03 | 303.46 | -103.78 | 496.83 | -198.83 | 172.69 | 31.92 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -137.29 | 57.68 | -148.29 | -35.62 | -139.03 | -195.52 | |

| Payments Of Dividends Common Stock | 36.23 | 36.30 | 36.46 | 36.49 | 36.65 | 33.64 | 33.81 | 33.93 | 27.04 | 22.94 | 22.97 | 23.08 | 23.15 | 21.69 | 21.75 | 21.83 | 20.36 | 20.75 | 20.92 | 19.07 | 19.13 | 19.10 | 15.71 | 12.90 | 12.66 | 12.64 | 12.63 | 12.28 | 10.54 | 10.52 | 10.17 | 8.45 | 8.45 | 6.75 | 6.65 | 4.88 | 4.88 | 4.88 | 4.22 | 4.22 | 3.65 | 7.29 | 3.38 | |

| Payments For Repurchase Of Common Stock | 24.15 | 17.76 | 5.66 | 11.81 | 13.54 | 19.99 | 24.29 | 22.49 | 4.09 | 7.48 | 11.28 | 16.95 | 8.77 | 9.49 | 11.02 | 12.69 | 51.69 | 61.11 | 28.18 | 7.88 | 7.11 | 1.29 | 9.26 | NA | NA | 0.97 | 0.00 | 0.00 | 8.84 | 0.00 | 0.00 | 0.00 | 2.02 | NA | NA | NA | NA | NA | NA | NA | NA | 6.99 | NA |

| 2024-03-31 | 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deposit Account | 9.69 | 10.07 | 10.06 | 9.23 | 9.84 | 10.13 | 10.76 | 10.08 | 6.14 | 6.22 | 5.94 | 5.12 | 5.00 | 6.78 | 6.49 | 6.26 | 6.40 | 7.00 | 6.99 | 6.78 | 6.08 | 6.57 | 6.41 | 5.97 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Financial Service Other | 10.19 | 10.42 | 10.13 | 11.76 | 11.88 | 10.36 | 13.95 | 12.54 | 7.73 | 11.13 | 8.05 | 9.66 | 7.61 | 10.64 | 8.71 | 8.18 | 6.56 | 7.60 | 9.04 | 9.80 | 10.15 | 10.14 | 8.49 | 8.58 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Income Operating | 41.03 | 41.87 | 42.39 | 42.68 | 43.25 | 41.49 | 36.34 | 28.67 | 13.79 | 12.95 | 13.33 | 12.09 | 11.32 | 12.97 | 13.54 | 13.83 | 14.09 | 13.33 | 12.44 | 12.35 | 11.98 | 10.82 | 10.10 | 9.40 | 8.42 | 8.13 | 8.30 | 7.97 | 8.27 | 8.74 | 7.95 | 7.90 | 8.29 | 8.01 | 7.46 | 7.14 | 6.79 | 6.31 | 4.15 | 3.96 | 3.88 | 4.25 | 4.14 |