| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.04 | 0.04 | NA | 0.04 | NA | NA | |

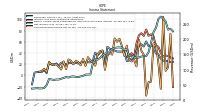

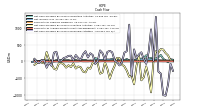

| Earnings Per Share Basic | 0.22 | 0.25 | 0.32 | 0.33 | 0.43 | 0.45 | 0.43 | 0.51 | 0.43 | 0.45 | 0.44 | 0.35 | 0.23 | 0.25 | 0.22 | 0.21 | 0.34 | 0.34 | 0.34 | 0.34 | 0.35 | 0.36 | 0.36 | 0.38 | 0.13 | 0.33 | 0.30 | 0.27 | 0.30 | 0.22 | 0.29 | 0.30 | 0.29 | 0.32 | 0.29 | 0.27 | 0.29 | 0.27 | 0.28 | 0.28 | 0.23 | 0.30 | 0.29 | 0.22 | 280.00 | 0.24 | 0.20 | 0.28 | 0.00 | 0.23 | 0.14 | 0.15 | 0.14 | 0.11 | -0.45 | |

| Earnings Per Share Diluted | 0.22 | 0.25 | 0.32 | 0.33 | 0.43 | 0.45 | 0.43 | 0.50 | 0.43 | 0.45 | 0.43 | 0.35 | 0.23 | 0.25 | 0.22 | 0.21 | 0.34 | 0.34 | 0.34 | 0.34 | 0.35 | 0.36 | 0.36 | 0.38 | 0.13 | 0.33 | 0.30 | 0.27 | 0.30 | 0.22 | 0.29 | 0.30 | 0.29 | 0.32 | 0.29 | 0.27 | 0.29 | 0.27 | 0.28 | 0.28 | 0.23 | 0.30 | 0.29 | 0.22 | 280.00 | 0.24 | 0.20 | 0.28 | 50.00 | 0.23 | 0.14 | 0.15 | 0.14 | 0.11 | -0.45 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

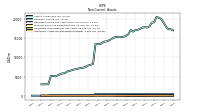

| Revenues | 269.22 | 275.79 | 267.18 | 238.40 | 224.24 | 189.18 | 157.82 | 144.87 | 145.17 | 142.87 | 140.20 | 138.29 | 141.73 | 145.22 | 145.06 | 166.87 | 165.77 | 172.42 | 173.47 | 173.13 | 172.03 | 167.83 | 159.91 | 150.41 | 153.19 | 147.64 | 138.53 | 132.74 | 135.39 | 119.55 | 83.53 | 83.46 | 82.97 | 79.06 | 77.08 | 74.55 | 75.77 | 77.08 | 76.45 | 73.35 | 74.92 | 72.03 | 69.38 | 66.74 | 66.93 | 65.45 | 66.94 | 68.56 | 48.48 | 38.93 | 37.29 | 37.19 | 38.05 | 37.13 | 36.59 | |

| Interest And Fee Income Loans And Leases | 221.02 | 229.94 | 225.67 | 215.94 | 207.96 | 175.08 | 145.02 | 132.67 | 133.82 | 132.79 | 131.82 | 129.74 | 132.12 | 134.43 | 134.19 | 154.23 | 152.79 | 158.12 | 158.63 | 158.14 | 156.61 | 153.37 | 146.19 | 137.94 | 141.13 | 136.82 | 128.51 | 123.29 | 125.79 | 112.13 | 77.09 | 77.12 | 76.81 | 73.65 | 71.25 | 69.64 | 71.00 | 72.44 | 71.69 | 68.69 | 70.44 | 67.75 | 65.47 | 63.03 | 63.11 | 61.55 | 62.50 | 63.42 | 44.42 | 34.90 | 33.15 | 33.09 | 34.09 | 33.44 | 33.51 | |

| Interest Expense | 143.31 | 140.41 | 136.50 | 104.52 | 73.72 | 36.00 | 16.29 | 11.70 | 11.85 | 12.57 | 13.63 | 15.71 | 20.97 | 27.58 | 35.25 | 47.58 | 52.27 | 56.16 | 56.24 | 53.52 | 50.13 | 44.68 | 37.09 | 30.34 | 26.79 | 24.38 | 21.71 | 17.84 | 18.18 | 16.08 | 12.47 | 11.85 | 11.21 | 10.30 | 9.68 | 9.43 | 9.53 | 9.18 | 8.96 | 8.39 | 8.04 | 7.67 | 7.28 | 7.03 | 7.29 | 7.22 | 7.44 | 7.70 | 7.93 | 7.87 | 7.96 | 8.31 | 9.33 | 9.52 | 9.79 | |

| Interest Income Expense Net | 125.92 | 135.38 | 130.69 | 133.88 | 150.52 | 153.19 | 141.54 | 133.18 | 133.32 | 130.30 | 126.58 | 122.58 | 120.76 | 117.64 | 109.81 | 119.29 | 113.51 | 116.26 | 117.22 | 119.61 | 121.89 | 123.15 | 122.82 | 120.07 | 126.39 | 123.26 | 116.82 | 114.91 | 117.21 | 103.47 | 71.06 | 71.61 | 71.77 | 68.76 | 67.39 | 65.12 | 66.23 | 67.91 | 67.49 | 64.97 | 66.88 | 64.36 | 62.10 | 59.72 | 59.65 | 58.23 | 59.50 | 60.86 | 40.55 | 31.05 | 29.33 | 28.88 | 28.72 | 27.61 | 26.81 | |

| Interest Paid Net | 141.65 | 82.50 | 78.94 | 76.82 | 58.22 | 27.86 | 16.46 | 10.61 | 12.41 | 11.62 | 16.76 | 21.28 | 26.67 | 30.11 | 38.03 | 49.41 | 55.12 | 53.44 | 55.27 | 47.18 | 49.35 | 36.43 | 31.57 | 26.77 | 24.66 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Gains Losses On Extinguishment Of Debt | 0.00 | 0.00 | 0.17 | 0.24 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 3.50 | 3.00 | 3.40 | 2.40 | 3.00 | 3.20 | 3.50 | 2.60 | 1.60 | 2.20 | 2.10 | 2.60 | 2.10 | 2.20 | 1.80 | 2.00 | 1.40 | 1.60 | 1.50 | 0.81 | 0.80 | 1.10 | 0.92 | 0.95 | 0.90 | 0.79 | 0.76 | 0.75 | 0.98 | 1.92 | 0.08 | 0.02 | 0.16 | 0.26 | 0.42 | 0.21 | 0.21 | 0.21 | 0.18 | 0.10 | 0.14 | 0.12 | 0.30 | 0.71 | 0.56 | 0.82 | 0.74 | 0.40 | 0.05 | 0.01 | 0.01 | NA | NA | NA | NA | |

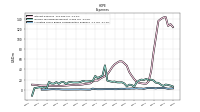

| Income Tax Expense Benefit | 7.12 | 9.96 | 13.45 | 13.68 | 18.21 | 19.68 | 18.63 | 21.25 | 19.06 | 19.91 | 17.77 | 13.96 | 5.29 | 9.25 | 9.77 | 6.46 | 12.05 | 14.57 | 14.26 | 14.44 | 16.07 | 15.46 | 16.63 | 17.73 | 48.23 | 27.71 | 25.45 | 23.00 | 27.24 | 17.17 | 16.83 | 16.21 | 16.04 | 17.50 | 15.32 | 14.24 | 14.23 | 14.18 | 14.94 | 14.56 | 11.05 | 15.12 | 14.82 | 11.41 | 14.95 | 11.83 | 12.10 | 15.54 | 2.01 | 5.20 | 3.76 | 4.69 | 3.62 | 3.06 | -12.14 | |

| Income Taxes Paid | 33.82 | 2.10 | 3.40 | 1.67 | 25.92 | 15.25 | 53.91 | 1.32 | -0.95 | 7.20 | 34.71 | 1.24 | 13.86 | 33.59 | 0.00 | 1.78 | 12.62 | 9.33 | 33.43 | 1.73 | 13.71 | 28.93 | 13.97 | 1.25 | 18.77 | 24.07 | 60.15 | 1.16 | 17.35 | 12.68 | 14.84 | 20.86 | 20.23 | 11.46 | 14.02 | 15.85 | 9.00 | 4.18 | 11.63 | 2.61 | 0.00 | 4.13 | 3.23 | 16.29 | 4.63 | 7.64 | 14.77 | 4.25 | -33.05 | 0.01 | 15.21 | -0.04 | 1.31 | -0.67 | NA | |

| Net Income Loss | 26.48 | 30.05 | 38.02 | 39.12 | 51.70 | 53.75 | 52.09 | 60.74 | 51.62 | 55.50 | 53.76 | 43.69 | 28.32 | 30.49 | 26.75 | 25.95 | 43.01 | 42.59 | 42.68 | 42.76 | 44.45 | 46.38 | 47.53 | 51.23 | 17.98 | 44.56 | 40.69 | 36.21 | 40.63 | 26.11 | 23.39 | 23.62 | 22.87 | 25.09 | 22.94 | 21.36 | 22.69 | 21.42 | 22.31 | 22.20 | 18.07 | 23.55 | 22.67 | 17.46 | 21.53 | 18.40 | 19.36 | 23.93 | 4.24 | 9.81 | 6.32 | 6.75 | 6.07 | 5.10 | -15.88 | |

| Comprehensive Income Net Of Tax | 104.43 | -23.75 | 23.39 | 55.72 | 57.38 | -11.08 | -11.45 | -36.02 | 36.67 | 43.99 | 63.59 | 16.16 | 28.39 | 25.02 | 28.45 | 53.25 | 34.88 | 52.44 | 65.46 | 60.10 | 66.06 | 37.18 | 41.05 | 34.09 | 10.01 | 44.44 | 43.45 | 38.02 | 17.56 | 23.55 | 27.21 | 32.61 | 17.03 | 29.47 | 18.08 | 24.14 | 25.89 | 19.76 | 26.21 | 28.64 | 11.28 | 25.17 | 10.71 | 15.34 | 19.80 | 20.37 | 19.90 | 23.27 | 6.61 | 11.91 | 8.37 | 6.58 | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Diluted | 26.48 | 30.05 | 38.02 | 39.12 | 51.70 | 53.75 | 52.09 | 60.74 | 51.62 | 55.50 | 53.76 | 43.69 | 28.32 | 30.49 | 26.75 | 25.95 | 43.01 | 42.59 | 42.68 | 42.76 | 44.45 | 46.38 | 47.53 | 51.23 | 17.98 | 44.56 | 40.69 | 36.21 | 40.63 | 26.11 | 23.39 | 23.62 | 22.87 | 25.09 | 22.94 | 21.36 | 22.69 | 21.42 | 22.31 | 22.20 | 18.07 | 23.55 | 22.67 | 17.46 | 21.53 | 18.40 | 15.59 | 22.07 | 2.90 | 8.74 | 5.24 | NA | NA | NA | NA | |

| Interest Income Expense After Provision For Loan Loss | 124.22 | 118.58 | 121.79 | 132.18 | 142.32 | 143.99 | 138.34 | 144.18 | 131.82 | 140.30 | 133.58 | 119.28 | 93.26 | 95.64 | 92.31 | 91.29 | 112.51 | 114.16 | 116.02 | 116.61 | 119.09 | 115.85 | 120.52 | 117.57 | 122.79 | 117.86 | 114.06 | 109.31 | 116.41 | 96.97 | 69.86 | 71.11 | 66.87 | 68.16 | 66.39 | 63.62 | 63.87 | 63.65 | 64.49 | 61.94 | 55.93 | 63.62 | 61.30 | 52.21 | 57.22 | 51.33 | 52.32 | 58.26 | 31.40 | 27.57 | 19.28 | 23.62 | 22.92 | 16.51 | -15.52 | |

| Noninterest Expense | 99.89 | 86.87 | 87.33 | 90.35 | 84.52 | 83.91 | 80.36 | 75.37 | 74.24 | 75.50 | 73.12 | 70.43 | 71.06 | 73.41 | 67.03 | 72.14 | 70.43 | 70.00 | 71.37 | 70.83 | 70.19 | 67.45 | 71.63 | 68.45 | 73.03 | 61.84 | 64.04 | 67.70 | 66.73 | 67.85 | 40.35 | 40.05 | 38.94 | 38.80 | 38.70 | 39.23 | 39.01 | 39.42 | 37.74 | 36.27 | 38.16 | 35.75 | 34.43 | 33.27 | 30.61 | 28.77 | 31.08 | 30.43 | 31.84 | 16.82 | 16.89 | 16.70 | 17.53 | 15.69 | 15.97 | |

| Noninterest Income | 9.28 | 8.30 | 17.01 | 10.98 | 12.11 | 13.36 | 12.75 | 13.19 | 13.10 | 10.62 | 11.08 | 8.80 | 11.41 | 17.51 | 11.24 | 13.26 | 12.98 | 12.99 | 12.29 | 11.42 | 11.61 | 13.45 | 15.27 | 19.85 | 16.45 | 16.25 | 16.11 | 17.60 | 18.19 | 14.15 | 10.71 | 8.78 | 10.98 | 13.23 | 10.57 | 11.21 | 12.05 | 11.37 | 10.49 | 11.10 | 11.36 | 10.80 | 10.62 | 9.94 | 9.86 | 7.66 | 10.22 | 11.64 | 6.68 | 4.26 | 7.68 | 4.51 | 4.30 | 7.34 | 3.46 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

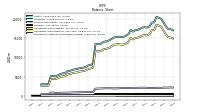

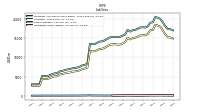

| Assets | 19131.52 | 20076.36 | 20366.14 | 20568.88 | 19164.49 | 19083.39 | 18089.06 | 17803.81 | 17889.06 | 17799.03 | 17469.63 | 17198.86 | 17106.66 | 16733.77 | 17169.06 | 16021.43 | 15667.44 | 15379.88 | 15338.83 | 15398.67 | 15305.95 | 15229.50 | 14870.01 | 14507.13 | 14206.72 | 14150.02 | 13859.22 | 13481.43 | 13441.42 | 13510.63 | 8336.83 | 8063.75 | 7912.65 | 7583.00 | 7333.32 | 7267.90 | 7140.33 | 6927.81 | 6866.29 | 6667.55 | 6475.20 | 6340.99 | 5863.01 | 5833.60 | 5640.66 | 5331.98 | 5049.40 | 5169.31 | 5166.60 | 3016.13 | 2967.29 | NA | 2963.30 | NA | NA | |

| Liabilities | 17010.28 | 18045.94 | 18298.14 | 18510.30 | 17145.16 | 17107.66 | 16088.69 | 15762.76 | 15796.08 | 15724.63 | 15376.76 | 15153.28 | 15052.92 | 14693.21 | 15138.29 | 14003.35 | 13631.43 | 13348.59 | 13343.66 | 13452.46 | 13402.74 | 13324.92 | 12964.33 | 12561.79 | 12278.46 | 12215.59 | 11952.92 | 11603.38 | 11585.95 | 11656.06 | 7365.09 | 7101.77 | 6974.55 | 6653.43 | 6424.73 | 6368.71 | 6257.56 | 6063.16 | 6013.68 | 5835.39 | 5665.82 | 5539.76 | 5081.99 | 5061.32 | 4889.56 | 4597.52 | 4333.94 | 4351.15 | 4370.66 | 2632.51 | 2594.75 | NA | 2604.73 | NA | NA | |

| Liabilities And Stockholders Equity | 19131.52 | 20076.36 | 20366.14 | 20568.88 | 19164.49 | 19083.39 | 18089.06 | 17803.81 | 17889.06 | 17799.03 | 17469.63 | 17198.86 | 17106.66 | 16733.77 | 17169.06 | 16021.43 | 15667.44 | 15379.88 | 15338.83 | 15398.67 | 15305.95 | 15229.50 | 14870.01 | 14507.13 | 14206.72 | 14150.02 | 13859.22 | 13481.43 | 13441.42 | 13510.63 | 8336.83 | 8063.75 | 7912.65 | 7583.00 | 7333.32 | 7267.90 | 7140.33 | 6927.81 | 6866.29 | 6667.55 | 6475.20 | 6340.99 | 5863.01 | 5833.60 | 5640.66 | 5331.98 | 5049.40 | 5169.31 | 5166.60 | 3016.13 | 2967.29 | NA | 2963.30 | NA | NA | |

| Stockholders Equity | 2121.24 | 2030.42 | 2068.00 | 2058.58 | 2019.33 | 1975.72 | 2000.37 | 2041.06 | 2092.98 | 2074.40 | 2092.87 | 2045.58 | 2053.74 | 2040.56 | 2030.78 | 2018.09 | 2036.01 | 2031.28 | 1995.17 | 1946.21 | 1903.21 | 1900.00 | 1910.00 | 1950.00 | 1930.00 | 1930.00 | 1910.00 | 1878.05 | 1860.00 | 1850.00 | 971.74 | 961.98 | 938.10 | 929.57 | 908.59 | 899.20 | 882.77 | 864.65 | 852.61 | 832.16 | 809.37 | 801.23 | 781.02 | 772.27 | 751.10 | 734.46 | 715.46 | 818.17 | 795.94 | 383.62 | 372.54 | NA | 358.56 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 1928.97 | 2500.32 | 2302.34 | 2212.64 | 506.78 | 331.34 | 197.06 | 280.37 | 316.27 | 627.35 | 836.96 | 376.67 | 350.58 | 629.13 | 1468.95 | 802.03 | 698.57 | 549.36 | 609.79 | 612.88 | 459.61 | 522.71 | 466.36 | 612.35 | 492.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Equity Securities Fv Ni | 43.75 | 43.18 | 42.96 | 42.71 | 42.40 | 42.32 | 62.87 | 56.67 | 57.86 | 58.51 | 59.03 | 59.05 | 59.70 | 49.71 | 49.87 | 49.57 | 49.09 | 49.05 | 48.75 | NA | 49.84 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

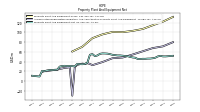

| Property Plant And Equipment Gross | 121.76 | NA | NA | NA | 114.50 | NA | NA | NA | 106.76 | NA | NA | NA | 102.88 | NA | NA | NA | 100.28 | NA | NA | NA | 100.70 | NA | NA | NA | 95.73 | NA | NA | NA | 87.93 | NA | NA | NA | 70.37 | NA | NA | NA | 60.64 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 71.15 | NA | NA | NA | 67.64 | NA | NA | NA | 61.09 | NA | NA | NA | 54.47 | NA | NA | NA | 48.26 | NA | NA | NA | 46.90 | NA | NA | NA | 39.02 | NA | NA | NA | 32.62 | 35.16 | 36.60 | 35.13 | 35.79 | 34.55 | 33.30 | 28.50 | -29.91 | 28.50 | 27.57 | 27.15 | 25.85 | 24.93 | 23.20 | 23.20 | 22.20 | 21.47 | 20.27 | 20.31 | 19.02 | NA | NA | NA | NA | NA | NA | |

| Property Plant And Equipment Net | 50.61 | 51.76 | 50.51 | 47.89 | 46.86 | 46.17 | 46.09 | 45.64 | 45.67 | 45.31 | 45.30 | 47.92 | 48.41 | 49.55 | 51.03 | 51.39 | 52.01 | 52.60 | 52.55 | 53.22 | 53.79 | 55.18 | 56.24 | 56.56 | 56.71 | 55.84 | 52.56 | 51.12 | 55.32 | 53.97 | 37.66 | 35.13 | 34.58 | 34.80 | 35.32 | 30.07 | 30.72 | 31.00 | 30.70 | 31.29 | 30.89 | 29.75 | 23.23 | 22.96 | 22.61 | 22.67 | 21.80 | 20.35 | 20.91 | 9.41 | 9.94 | NA | 10.91 | NA | NA | |

| Goodwill | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 464.45 | 463.98 | 463.00 | 464.42 | 105.40 | 105.40 | 105.40 | 105.40 | 105.40 | 105.40 | 105.40 | 105.40 | 105.40 | 105.40 | 105.40 | 119.88 | 92.29 | 93.40 | 89.88 | 89.88 | 89.88 | 89.88 | 90.47 | 2.51 | 2.51 | 2.51 | 2.51 | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 3.94 | 4.38 | 4.83 | 5.28 | 5.73 | 6.21 | 6.70 | 7.18 | 7.67 | 8.18 | 8.69 | 9.20 | 9.71 | 10.24 | 10.77 | 11.30 | 11.83 | 12.39 | 12.95 | 13.50 | 14.06 | 14.68 | 15.29 | 15.91 | 16.52 | 17.20 | 17.87 | 18.55 | 19.23 | 19.97 | 2.40 | 2.61 | 2.82 | 3.09 | 3.35 | 3.62 | 3.89 | 4.21 | 4.54 | 4.86 | 5.18 | 5.56 | 3.12 | 3.40 | 3.03 | 3.33 | 3.64 | 3.94 | 4.28 | 0.30 | 0.38 | NA | 0.53 | NA | NA | |

| Equity Securities Fv Ni | 43.75 | 43.18 | 42.96 | 42.71 | 42.40 | 42.32 | 62.87 | 56.67 | 57.86 | 58.51 | 59.03 | 59.05 | 59.70 | 49.71 | 49.87 | 49.57 | 49.09 | 49.05 | 48.75 | NA | 49.84 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 13.39 | 26.84 | 14.42 | 9.46 | 12.66 | 12.51 | 0.44 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 250.52 | 239.77 | 255.34 | 263.09 | 258.41 | 258.68 | 257.67 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities | 263.91 | 266.61 | 269.76 | 272.27 | 271.07 | 271.19 | 252.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 13.39 | 26.84 | 14.42 | 9.46 | 12.66 | 12.51 | 0.44 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After One Through Five Years Fair Value | 24.97 | 24.52 | 25.59 | 18.50 | 7.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Five Through Ten Years Fair Value | 8.32 | 7.84 | 8.12 | 16.17 | 27.24 | 35.68 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Ten Years Fair Value | 217.23 | 207.40 | 221.63 | 228.42 | 223.60 | 223.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | 5910.48 | NA | NA | NA | 4973.02 | NA | NA | NA | 2726.49 | NA | NA | NA | 3885.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 14753.75 | 15739.86 | 15619.35 | 15828.21 | 15738.80 | 15502.21 | 15029.63 | 14515.13 | 15040.45 | 15062.53 | 14726.23 | 14301.27 | 14333.91 | 14008.36 | 14123.53 | 12836.57 | 12527.36 | 12234.75 | 12172.38 | 12249.20 | 12155.66 | 12045.62 | 11734.59 | 11510.57 | 10846.61 | 10993.32 | 10955.10 | 10703.78 | 10642.03 | 10702.50 | 6637.52 | 6467.41 | 6340.98 | 6028.86 | 5758.29 | 5803.25 | 5693.45 | 5509.75 | 5470.39 | 5334.56 | 5148.06 | 5021.10 | 4576.80 | 4555.67 | 4384.03 | 4052.52 | 3882.68 | 3920.46 | 3940.89 | 2267.20 | 2232.18 | NA | 2176.11 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

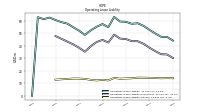

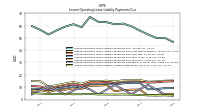

| Operating Lease Liability Noncurrent | 38.38 | 41.50 | 43.60 | 43.60 | 45.32 | 45.70 | 48.80 | 42.50 | 44.62 | 42.90 | 39.50 | 35.20 | 38.34 | 41.10 | NA | NA | 47.70 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

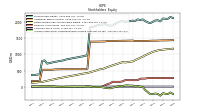

| Stockholders Equity | 2121.24 | 2030.42 | 2068.00 | 2058.58 | 2019.33 | 1975.72 | 2000.37 | 2041.06 | 2092.98 | 2074.40 | 2092.87 | 2045.58 | 2053.74 | 2040.56 | 2030.78 | 2018.09 | 2036.01 | 2031.28 | 1995.17 | 1946.21 | 1903.21 | 1900.00 | 1910.00 | 1950.00 | 1930.00 | 1930.00 | 1910.00 | 1878.05 | 1860.00 | 1850.00 | 971.74 | 961.98 | 938.10 | 929.57 | 908.59 | 899.20 | 882.77 | 864.65 | 852.61 | 832.16 | 809.37 | 801.23 | 781.02 | 772.27 | 751.10 | 734.46 | 715.46 | 818.17 | 795.94 | 383.62 | 372.54 | NA | 358.56 | NA | NA | |

| Common Stock Value | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.04 | 0.04 | NA | 0.04 | NA | NA | |

| Additional Paid In Capital | 1439.96 | 1436.77 | 1433.79 | 1430.98 | 1431.00 | 1428.05 | 1424.89 | 1422.60 | 1421.70 | 1420.15 | 1418.13 | 1417.14 | 1434.92 | 1432.77 | 1430.76 | 1429.28 | 1428.07 | 1426.67 | 1425.26 | 1424.03 | 1423.40 | 1422.68 | 1421.68 | 1405.81 | 1405.01 | 1403.59 | 1402.30 | 1401.28 | 1400.49 | 1400.91 | 541.69 | 541.62 | 541.60 | 541.35 | 541.09 | 541.82 | 541.59 | 541.41 | 541.17 | 540.98 | 540.88 | 538.06 | 537.09 | 535.09 | 525.35 | 524.61 | 525.99 | 525.12 | 524.64 | 172.06 | 172.07 | NA | 171.36 | NA | NA | |

| Retained Earnings Accumulated Deficit | 1150.55 | 1140.87 | 1127.62 | 1106.39 | 1083.71 | 1048.74 | 1011.72 | 976.48 | 932.56 | 897.77 | 859.55 | 823.09 | 785.94 | 774.97 | 761.73 | 752.23 | 762.48 | 737.21 | 712.35 | 687.40 | 662.38 | 636.08 | 607.94 | 578.03 | 544.89 | 540.92 | 513.95 | 489.49 | 469.50 | 445.10 | 419.00 | 413.12 | 398.25 | 384.13 | 367.79 | 352.81 | 339.40 | 324.66 | 311.19 | 294.84 | 278.60 | 266.48 | 248.87 | 230.15 | 216.59 | 198.96 | 180.57 | 164.97 | 142.91 | 140.01 | 131.28 | NA | 120.36 | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -204.74 | -282.69 | -228.88 | -214.26 | -230.86 | -236.53 | -171.71 | -108.17 | -11.41 | 3.54 | 15.05 | 5.22 | 32.75 | 32.68 | 38.15 | 36.45 | 9.15 | 17.27 | 7.42 | -15.36 | -32.70 | -54.32 | -45.12 | -38.64 | -21.78 | -10.21 | -10.09 | -12.85 | -14.66 | 8.42 | 10.97 | 7.16 | -1.83 | 4.01 | -0.38 | 4.49 | 1.71 | -1.50 | 0.16 | -3.74 | -10.19 | -3.39 | -5.00 | 6.96 | 9.08 | 10.80 | 8.83 | 8.30 | 8.96 | 6.58 | 4.48 | NA | 2.60 | NA | NA | |

| Treasury Stock Value | 264.67 | NA | NA | 264.67 | 264.67 | 264.67 | 264.67 | 250.00 | 250.00 | 247.20 | 200.00 | 200.00 | 200.00 | 200.00 | 200.00 | 200.00 | 163.82 | 150.00 | 150.00 | 150.00 | 150.00 | 100.00 | 78.96 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 3.19 | 2.98 | 2.81 | -0.03 | 2.95 | 3.16 | 2.29 | 0.37 | 1.54 | 2.02 | 0.99 | 0.50 | 2.14 | 2.02 | 1.48 | 1.21 | 1.39 | 1.40 | 1.23 | 0.62 | 0.72 | 0.75 | 0.73 | 0.68 | 0.84 | 0.65 | 0.63 | 0.53 | -0.58 | 1.87 | 0.08 | 0.02 | 0.16 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

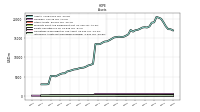

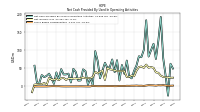

| Net Cash Provided By Used In Operating Activities | 78.56 | 192.80 | 126.27 | 76.14 | 118.29 | 100.65 | 82.93 | 183.66 | 101.33 | 81.04 | 83.71 | 58.12 | 43.64 | 22.52 | 27.89 | 71.87 | 35.00 | 59.44 | 16.59 | 72.83 | 39.55 | 74.84 | 53.30 | 52.25 | 65.60 | 44.41 | 22.69 | 71.22 | 98.07 | 4.06 | 23.62 | 4.86 | 42.39 | 47.55 | 16.70 | 16.25 | 39.98 | 49.02 | 10.96 | 35.58 | 33.43 | 33.20 | 48.10 | 19.48 | 38.99 | 7.21 | 22.70 | 35.57 | 29.43 | 25.84 | 31.60 | 9.71 | 11.15 | 57.47 | NA | |

| Net Cash Provided By Used In Investing Activities | 353.38 | 365.81 | 265.80 | 304.91 | 44.32 | -921.17 | -449.05 | -147.72 | -470.69 | -562.29 | 170.00 | -130.06 | -680.49 | -426.16 | -455.36 | -272.62 | -147.46 | -94.34 | 100.15 | 104.83 | -129.53 | -290.19 | -514.57 | -213.18 | -24.56 | -331.99 | -364.06 | -46.73 | -29.96 | -33.63 | -214.91 | -184.86 | -325.72 | -302.30 | -171.46 | -150.31 | -211.00 | -57.34 | -169.02 | -115.61 | -183.99 | -83.32 | -47.32 | -62.78 | -243.84 | -216.02 | -77.91 | 62.81 | 281.98 | -56.01 | -36.27 | 0.60 | -49.35 | -102.67 | NA | |

| Net Cash Provided By Used In Financing Activities | -1003.29 | -360.62 | -302.37 | 1324.81 | 12.84 | 954.79 | 282.81 | -71.83 | 58.27 | 271.64 | 206.58 | 98.02 | 358.29 | -436.17 | 1094.39 | 304.22 | 261.67 | -25.54 | -119.82 | -24.38 | 26.87 | 271.69 | 315.28 | 281.28 | 45.66 | 246.47 | 326.71 | -0.76 | -74.68 | 187.30 | 241.36 | 117.71 | 303.35 | 211.86 | 46.15 | 101.78 | 189.86 | 36.72 | 169.87 | 166.44 | 121.91 | 99.14 | 14.74 | 11.20 | 288.12 | 258.83 | -130.84 | -32.82 | -187.13 | 34.87 | 40.45 | -47.30 | -23.64 | 76.23 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 78.56 | 192.80 | 126.27 | 76.14 | 118.29 | 100.65 | 82.93 | 183.66 | 101.33 | 81.04 | 83.71 | 58.12 | 43.64 | 22.52 | 27.89 | 71.87 | 35.00 | 59.44 | 16.59 | 72.83 | 39.55 | 74.84 | 53.30 | 52.25 | 65.60 | 44.41 | 22.69 | 71.22 | 98.07 | 4.06 | 23.62 | 4.86 | 42.39 | 47.55 | 16.70 | 16.25 | 39.98 | 49.02 | 10.96 | 35.58 | 33.43 | 33.20 | 48.10 | 19.48 | 38.99 | 7.21 | 22.70 | 35.57 | 29.43 | 25.84 | 31.60 | 9.71 | 11.15 | 57.47 | NA | |

| Net Income Loss | 26.48 | 30.05 | 38.02 | 39.12 | 51.70 | 53.75 | 52.09 | 60.74 | 51.62 | 55.50 | 53.76 | 43.69 | 28.32 | 30.49 | 26.75 | 25.95 | 43.01 | 42.59 | 42.68 | 42.76 | 44.45 | 46.38 | 47.53 | 51.23 | 17.98 | 44.56 | 40.69 | 36.21 | 40.63 | 26.11 | 23.39 | 23.62 | 22.87 | 25.09 | 22.94 | 21.36 | 22.69 | 21.42 | 22.31 | 22.20 | 18.07 | 23.55 | 22.67 | 17.46 | 21.53 | 18.40 | 19.36 | 23.93 | 4.24 | 9.81 | 6.32 | 6.75 | 6.07 | 5.10 | -15.88 | |

| Share Based Compensation | 3.58 | 3.03 | 3.38 | 2.35 | 2.98 | 3.23 | 3.46 | 2.60 | 1.56 | 2.19 | 2.07 | 2.57 | 2.15 | 2.18 | 1.81 | 1.99 | 1.39 | 1.57 | 1.51 | 0.81 | 0.73 | 1.06 | 0.92 | 0.95 | 0.86 | 0.79 | 0.76 | 0.75 | 1.00 | 1.87 | 0.08 | 0.02 | 0.16 | 0.26 | 0.39 | 0.23 | 0.22 | 0.19 | 0.19 | 0.10 | 0.09 | 0.12 | 0.30 | 0.71 | 0.60 | 0.82 | 0.74 | 0.40 | 0.05 | 0.01 | 0.01 | 0.03 | 0.10 | 0.03 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

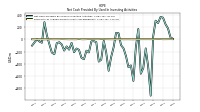

| Net Cash Provided By Used In Investing Activities | 353.38 | 365.81 | 265.80 | 304.91 | 44.32 | -921.17 | -449.05 | -147.72 | -470.69 | -562.29 | 170.00 | -130.06 | -680.49 | -426.16 | -455.36 | -272.62 | -147.46 | -94.34 | 100.15 | 104.83 | -129.53 | -290.19 | -514.57 | -213.18 | -24.56 | -331.99 | -364.06 | -46.73 | -29.96 | -33.63 | -214.91 | -184.86 | -325.72 | -302.30 | -171.46 | -150.31 | -211.00 | -57.34 | -169.02 | -115.61 | -183.99 | -83.32 | -47.32 | -62.78 | -243.84 | -216.02 | -77.91 | 62.81 | 281.98 | -56.01 | -36.27 | 0.60 | -49.35 | -102.67 | NA | |

| Payments To Acquire Property Plant And Equipment | 2.00 | 3.40 | 4.73 | 2.99 | 2.56 | 2.02 | 2.38 | 2.15 | 2.47 | 2.08 | 1.17 | 1.50 | 0.93 | 0.94 | 1.71 | 1.40 | 1.43 | 2.09 | 1.56 | 1.54 | 1.33 | 1.19 | 2.03 | 2.30 | 4.51 | 5.65 | 2.13 | 2.49 | 3.53 | 4.20 | 4.28 | 2.30 | 1.50 | 1.30 | 7.02 | 1.10 | 1.47 | 1.97 | 1.02 | 1.97 | 2.67 | 3.18 | 1.68 | 1.67 | 1.26 | 2.08 | 2.74 | 0.75 | 0.34 | 0.25 | 0.19 | 0.40 | 0.52 | 1.00 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

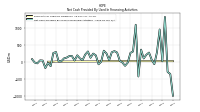

| Net Cash Provided By Used In Financing Activities | -1003.29 | -360.62 | -302.37 | 1324.81 | 12.84 | 954.79 | 282.81 | -71.83 | 58.27 | 271.64 | 206.58 | 98.02 | 358.29 | -436.17 | 1094.39 | 304.22 | 261.67 | -25.54 | -119.82 | -24.38 | 26.87 | 271.69 | 315.28 | 281.28 | 45.66 | 246.47 | 326.71 | -0.76 | -74.68 | 187.30 | 241.36 | 117.71 | 303.35 | 211.86 | 46.15 | 101.78 | 189.86 | 36.72 | 169.87 | 166.44 | 121.91 | 99.14 | 14.74 | 11.20 | 288.12 | 258.83 | -130.84 | -32.82 | -187.13 | 34.87 | 40.45 | -47.30 | -23.64 | 76.23 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 269.22 | 275.79 | 267.18 | 238.40 | 224.24 | 189.18 | 157.82 | 144.87 | 145.17 | 142.87 | 140.20 | 138.29 | 141.73 | 145.22 | 145.06 | 166.87 | 165.77 | 172.42 | 173.47 | 173.13 | 172.03 | 167.83 | 159.91 | 150.41 | 153.19 | 147.64 | 138.53 | 132.74 | 135.39 | 119.55 | 83.53 | 83.46 | 82.97 | 79.06 | 77.08 | 74.55 | 75.77 | 77.08 | 76.45 | 73.35 | 74.92 | 72.03 | 69.38 | 66.74 | 66.93 | 65.45 | 66.94 | 68.56 | 48.48 | 38.93 | 37.29 | 37.19 | 38.05 | 37.13 | 36.59 |