| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 3.81 | 3.81 | 3.81 | 3.81 | 3.81 | 3.81 | 1.52 | 2.29 | 2.29 | 2.21 | 2.19 | 2.19 | 2.19 | 2.19 | 2.19 | 2.19 | 2.17 | 2.07 | 2.05 | 2.05 | 2.05 | 2.07 | 2.08 | 2.05 | 2.05 | 2.01 | 2.01 | 1.42 | 1.42 | 1.42 | 1.38 | 1.31 | 1.27 | 1.27 | 1.25 | 1.25 | 1.25 | 1.19 | 1.19 | 1.19 | 1.18 | NA | NA | NA | NA | 0.00 | 0.00 | 1.15 | 1.14 | 1.14 | 1.13 | NA | 1.01 | NA | NA | |

| Earnings Per Share Basic | -0.11 | -0.18 | -0.22 | -0.23 | -0.21 | 0.08 | 0.04 | 0.08 | 0.08 | 0.10 | 0.17 | 0.10 | 0.13 | -0.03 | 0.06 | 0.08 | 0.05 | -0.04 | 0.08 | 0.07 | 0.08 | 0.83 | 0.07 | 0.05 | 0.23 | 0.07 | -0.03 | 0.10 | 0.12 | 0.05 | 0.10 | 0.08 | 0.08 | 0.05 | 0.07 | 0.05 | 0.17 | 0.14 | 0.02 | 0.04 | 0.04 | 0.04 | 0.12 | 0.02 | -0.02 | -0.02 | -0.16 | 0.00 | 0.00 | 0.00 | 0.02 | 0.02 | NA | NA | NA | |

| Earnings Per Share Diluted | -0.11 | -0.18 | -0.22 | -0.23 | -0.20 | 0.08 | 0.04 | 0.08 | 0.07 | 0.10 | 0.17 | 0.10 | 0.13 | -0.03 | 0.06 | 0.08 | 0.04 | -0.04 | 0.08 | 0.06 | 0.08 | 0.82 | 0.07 | 0.05 | 0.22 | 0.07 | -0.03 | 0.09 | 0.12 | 0.04 | 0.09 | 0.08 | 0.08 | 0.05 | 0.07 | 0.05 | 0.17 | 0.14 | 0.02 | 0.04 | 0.04 | 0.04 | 0.12 | 0.02 | -0.02 | -0.02 | -0.16 | 0.00 | 0.00 | 0.00 | 0.02 | 0.02 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Excluding Assessed Tax | 3.94 | 4.66 | 4.23 | 4.62 | 4.44 | 4.06 | 2.74 | 2.48 | 2.94 | 2.97 | 2.43 | 191.49 | -544.58 | 187.33 | 178.84 | 185.78 | 176.31 | 175.00 | 171.76 | 168.97 | 172.30 | 175.13 | 173.33 | 175.66 | 173.77 | 175.99 | 139.88 | 124.35 | 122.04 | 118.34 | 113.23 | 107.31 | 102.05 | 103.94 | 99.31 | 98.52 | 95.00 | 95.53 | 89.67 | 91.30 | 83.69 | 82.54 | 77.24 | 76.43 | 74.04 | 78.10 | 76.26 | 71.24 | 65.53 | 69.94 | 67.28 | 70.89 | 57.50 | 52.50 | 46.52 | |

| Revenues | 330.44 | 342.26 | 338.14 | 332.93 | 338.06 | 306.35 | 145.33 | 202.00 | 195.70 | 191.26 | 188.62 | 191.49 | 187.02 | 187.33 | 178.84 | 185.78 | 176.31 | 175.00 | 171.76 | 168.97 | 172.30 | 175.13 | 173.33 | 175.66 | 173.77 | 175.99 | 139.88 | 124.35 | 122.04 | 118.34 | 113.23 | 107.31 | 102.05 | 103.94 | 99.31 | 98.52 | 95.00 | 95.53 | 89.67 | 91.30 | 83.69 | 82.54 | 77.24 | 76.43 | 74.04 | 78.10 | 76.26 | 71.24 | 65.53 | 69.94 | 67.28 | 70.89 | 57.50 | 52.50 | 46.52 | |

| General And Administrative Expense | 14.61 | 13.40 | 15.46 | 14.94 | 14.42 | 16.74 | 10.54 | 12.45 | 17.49 | 10.77 | 10.93 | 10.56 | 10.62 | 10.67 | 10.16 | 11.52 | 10.20 | 9.79 | 10.08 | 11.29 | 8.91 | 8.77 | 8.72 | 8.79 | 8.22 | 8.28 | 8.47 | 8.42 | 7.89 | 7.29 | 6.81 | 6.77 | 6.35 | 6.43 | 6.22 | 6.58 | 6.81 | 5.93 | 5.90 | 6.30 | 5.80 | 5.98 | 6.22 | 6.45 | 5.66 | 5.16 | 4.91 | 8.15 | 6.47 | 8.16 | 6.75 | 7.31 | 5.97 | 5.10 | 3.07 | |

| Interest Expense | 63.19 | 66.30 | 65.33 | 63.76 | 64.44 | 53.04 | 15.54 | 23.94 | 23.31 | 23.33 | 23.13 | 22.99 | 23.33 | 23.14 | 24.28 | 23.87 | 24.03 | 24.62 | 24.01 | 23.97 | 24.46 | 24.83 | 26.30 | 26.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 12.24 | NA | NA | NA | 10.37 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Paid Net | 30.63 | 78.42 | 31.90 | 75.08 | 29.31 | 56.74 | -12.38 | 39.02 | 1.25 | 39.29 | 1.22 | 38.60 | 1.49 | 37.66 | 10.17 | 34.06 | 10.51 | 37.96 | 12.80 | 33.40 | 13.86 | 35.04 | 14.74 | 37.52 | 13.92 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Gains Losses On Extinguishment Of Debt | 0.00 | 0.06 | NA | NA | 0.12 | -1.09 | 0.00 | -1.43 | NA | NA | NA | NA | 0.00 | -27.73 | NA | NA | 0.00 | -21.65 | NA | NA | 1.33 | -1.09 | 0.00 | 0.00 | 0.00 | -0.77 | -10.39 | -0.03 | -0.00 | -3.00 | -0.02 | 0.00 | 0.02 | -0.01 | 0.12 | NA | 0.00 | -5.03 | 0.36 | NA | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | -41.67 | -68.60 | -83.73 | -88.08 | -36.28 | 28.62 | 6.13 | 18.67 | 16.61 | 22.04 | 38.74 | 22.39 | 28.51 | -6.93 | 13.72 | 18.21 | 9.04 | -8.58 | 16.60 | 13.70 | 15.61 | 176.35 | 15.66 | 10.02 | 43.47 | 13.96 | -5.85 | 14.00 | 17.15 | 6.64 | 13.52 | 10.04 | 10.57 | 6.55 | 9.49 | 6.94 | 21.46 | 16.22 | 2.88 | 5.43 | 4.06 | 5.00 | 14.23 | 1.38 | -1.82 | -2.93 | -19.31 | -0.31 | 2.01 | 0.23 | 1.16 | 2.19 | -8.69 | 1.01 | 0.24 | |

| Other Comprehensive Income Loss Net Of Tax | -28.15 | 7.85 | 18.10 | -10.82 | -3.42 | 6.85 | 2.49 | 8.82 | 4.36 | 1.44 | 1.52 | 2.79 | 1.80 | 2.05 | -3.23 | -22.50 | 2.80 | 2.29 | -0.38 | -0.39 | -0.35 | -0.73 | 0.21 | 0.90 | 0.91 | 0.20 | -0.75 | -0.09 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | -40.53 | -67.84 | -82.76 | -87.12 | -35.76 | 28.30 | 6.13 | 18.32 | 16.30 | 21.67 | 38.01 | 22.03 | 28.05 | -6.83 | 13.49 | 17.90 | 8.92 | -8.46 | 16.26 | 13.44 | 15.33 | 172.99 | 15.35 | 9.80 | 42.53 | 13.76 | -5.92 | 13.54 | 16.55 | 6.43 | 13.07 | 9.86 | 10.37 | 6.46 | 9.29 | 6.80 | 21.19 | 16.03 | 2.85 | 5.29 | 4.06 | 4.82 | 14.03 | 1.35 | -1.84 | -2.95 | -19.32 | -0.32 | 2.00 | 0.23 | 1.17 | 2.15 | -8.73 | 1.13 | 0.24 | |

| Comprehensive Income Net Of Tax | -68.35 | -60.09 | -64.88 | -97.82 | -39.15 | 35.08 | 8.62 | 27.08 | 20.59 | 23.08 | 39.51 | 24.78 | 29.82 | -4.80 | 10.31 | -4.24 | 11.67 | -6.22 | 15.92 | 13.09 | 15.01 | 172.28 | 15.57 | 10.72 | 43.46 | 13.99 | -6.63 | 13.49 | 16.64 | 6.43 | 13.07 | 9.89 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

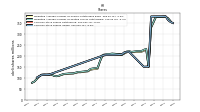

| Assets | 12637.13 | 13103.73 | 13394.35 | 13568.88 | 13849.63 | 14195.44 | 4548.88 | 6814.91 | 6889.69 | 6775.63 | 6725.40 | 6696.59 | 6790.69 | 6774.57 | 6644.50 | 6824.18 | 6638.75 | 6323.00 | 6240.48 | 6242.55 | 6188.48 | 6328.68 | 6302.13 | 6359.84 | 6449.58 | 6413.52 | 6366.76 | 3753.02 | 3747.84 | 3715.89 | 3532.29 | 3310.52 | 3172.30 | 3179.59 | 3218.11 | 3049.09 | 3041.65 | 2986.80 | 3014.57 | 2735.25 | 2752.33 | 2681.52 | 2574.75 | 2590.20 | 2414.09 | 2403.91 | 2436.87 | 2457.60 | 2291.63 | 2334.07 | 2380.33 | NA | 2271.80 | NA | NA | |

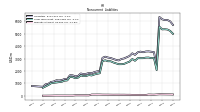

| Liabilities | 5714.35 | 5994.94 | 6108.44 | 6102.05 | 6167.80 | 6356.42 | 2371.01 | 3518.54 | 3545.37 | 3576.29 | 3565.52 | 3507.60 | 3555.77 | 3500.22 | 3295.73 | 3419.23 | 3208.11 | 3108.53 | 3009.47 | 2961.26 | 2847.02 | 2888.55 | 2966.73 | 3041.80 | 3079.40 | 3148.52 | 3055.01 | 1998.50 | 1962.77 | 1903.42 | 1810.62 | 1837.04 | 1760.90 | 1741.48 | 1793.49 | 1598.21 | 1561.50 | 1642.88 | 1653.05 | 1360.48 | 1349.32 | 1259.43 | 1227.72 | 1244.64 | 1145.93 | 1107.86 | 958.22 | 918.15 | 720.50 | 733.15 | 748.16 | NA | 780.68 | NA | NA | |

| Liabilities And Stockholders Equity | 12637.13 | 13103.73 | 13394.35 | 13568.88 | 13849.63 | 14195.44 | 4548.88 | 6814.91 | 6889.69 | 6775.63 | 6725.40 | 6696.59 | 6790.69 | 6774.57 | 6644.50 | 6824.18 | 6638.75 | 6323.00 | 6240.48 | 6242.55 | 6188.48 | 6328.68 | 6302.13 | 6359.84 | 6449.58 | 6413.52 | 6366.76 | 3753.02 | 3747.84 | 3715.89 | 3532.29 | 3310.52 | 3172.30 | 3179.59 | 3218.11 | 3049.09 | 3041.65 | 2986.80 | 3014.57 | 2735.25 | 2752.33 | 2681.52 | 2574.75 | 2590.20 | 2414.09 | 2403.91 | 2436.87 | 2457.60 | 2291.63 | 2334.07 | 2380.33 | NA | 2271.80 | NA | NA | |

| Stockholders Equity | 6822.66 | 7003.70 | 7179.40 | 7358.63 | 7571.08 | 7727.21 | 2177.87 | 3212.69 | 3257.60 | 3106.17 | 3101.05 | 3129.34 | 3174.24 | 3212.39 | 3284.79 | 3340.28 | 3358.01 | 3141.69 | 3152.94 | 3197.49 | 3256.02 | 3353.63 | 3251.06 | 3230.12 | 3278.78 | 3175.57 | 3221.07 | 1657.00 | 1687.27 | 1712.01 | 1619.76 | 1444.11 | 1379.42 | 1406.42 | 1392.45 | 1418.26 | 1447.14 | 1329.10 | 1346.57 | 1359.20 | 1387.21 | 1405.81 | 1330.52 | 1328.85 | 1254.27 | 1286.59 | 1475.01 | 1535.76 | 1567.34 | 1597.14 | 1628.39 | 1656.70 | 1487.25 | 1336.90 | 1208.81 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 25.70 | 24.67 | 35.90 | 49.94 | 60.96 | 57.58 | 34.31 | 10.94 | 52.35 | 12.84 | 19.80 | 29.99 | 115.41 | 227.14 | 75.20 | 216.51 | 32.71 | 12.75 | 23.19 | 61.07 | 126.22 | 225.52 | 26.19 | 56.24 | 100.36 | 9.41 | 91.44 | 16.03 | 11.23 | 17.94 | 8.15 | 13.83 | 13.07 | 11.15 | 16.58 | 13.52 | 10.41 | 18.41 | 132.72 | 27.36 | 18.08 | 82.18 | 120.87 | 120.96 | 15.96 | 8.34 | 23.98 | 35.12 | 69.49 | 122.30 | 154.29 | 207.41 | 29.27 | 221.19 | 176.89 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 25.70 | 24.67 | 35.90 | 49.94 | 60.96 | 57.58 | 34.31 | 15.42 | 57.07 | 19.46 | 90.34 | 33.09 | 118.77 | 231.25 | 80.00 | 221.47 | 37.62 | 17.82 | 29.14 | 68.47 | 133.53 | 240.16 | 39.60 | 68.94 | 118.56 | 26.88 | 124.62 | 24.08 | 25.05 | NA | NA | NA | 28.96 | NA | NA | NA | 31.21 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Land | 1343.27 | 1387.82 | 1424.45 | 1412.81 | 1439.80 | 1449.55 | 456.31 | 644.19 | 640.38 | 625.09 | 596.08 | 596.08 | 596.27 | 587.36 | 587.36 | 587.36 | 584.55 | 513.95 | 492.77 | 483.85 | 481.87 | 483.54 | 486.40 | 486.40 | 485.32 | 480.85 | 461.34 | 392.71 | 386.53 | 381.75 | 357.60 | 321.02 | 303.71 | 298.51 | 299.00 | 288.50 | 287.75 | 272.92 | 249.12 | 203.01 | 197.89 | 195.12 | 182.31 | 181.88 | 183.65 | 171.87 | 171.46 | NA | 168.06 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Goodwill | 250.53 | 250.53 | 250.53 | 260.82 | 223.20 | 148.89 | NA | NA | 3.49 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

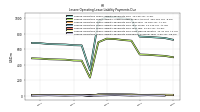

| Long Term Debt | 4994.86 | 5227.41 | 5340.27 | 5361.70 | 5351.83 | 5570.14 | 2063.76 | 3053.88 | 3028.12 | 3079.19 | 3073.47 | 3027.73 | 3027.00 | 3026.53 | 2818.70 | 2959.72 | 2749.78 | 2665.69 | 2567.01 | 2541.62 | 2541.23 | 2609.70 | 2683.53 | 2780.30 | 2781.00 | 2856.76 | 2784.16 | 1811.21 | 1768.90 | 1712.60 | 1631.60 | 1667.32 | 1590.70 | 1575.96 | 1639.00 | 1458.60 | 1412.46 | 1497.14 | 1520.44 | 1232.28 | 1214.24 | 1125.79 | NA | NA | 1037.36 | 1000.48 | 859.32 | NA | 639.15 | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 96.25 | 101.89 | 104.02 | 106.21 | 108.74 | 111.81 | NA | 83.67 | 86.71 | 93.17 | 58.83 | 59.65 | 60.68 | 61.96 | 63.98 | 64.67 | 72.64 | 72.78 | 78.06 | 77.28 | 78.89 | 79.90 | 77.70 | 81.14 | 84.67 | 84.74 | 86.02 | 92.85 | 93.14 | 91.25 | 92.44 | 24.94 | 27.53 | 27.93 | 28.44 | 28.82 | 29.28 | 11.56 | 11.69 | 12.29 | 12.54 | 12.90 | 13.09 | 14.80 | 10.33 | 5.85 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 6822.66 | 7003.70 | 7179.40 | 7358.63 | 7571.08 | 7727.21 | 2177.87 | 3212.69 | 3257.60 | 3106.17 | 3101.05 | 3129.34 | 3174.24 | 3212.39 | 3284.79 | 3340.28 | 3358.01 | 3141.69 | 3152.94 | 3197.49 | 3256.02 | 3353.63 | 3251.06 | 3230.12 | 3278.78 | 3175.57 | 3221.07 | 1657.00 | 1687.27 | 1712.01 | 1619.76 | 1444.11 | 1379.42 | 1406.42 | 1392.45 | 1418.26 | 1447.14 | 1329.10 | 1346.57 | 1359.20 | 1387.21 | 1405.81 | 1330.52 | 1328.85 | 1254.27 | 1286.59 | 1475.01 | 1535.76 | 1567.34 | 1597.14 | 1628.39 | 1656.70 | 1487.25 | 1336.90 | 1208.81 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 6918.91 | 7105.59 | 7283.42 | 7464.84 | 7679.82 | 7839.03 | 2177.87 | 3296.37 | 3344.32 | 3199.34 | 3159.89 | 3188.99 | 3234.92 | 3274.35 | 3348.76 | 3404.95 | 3430.64 | 3214.47 | 3231.00 | 3274.78 | 3334.91 | 3433.53 | 3328.75 | 3311.26 | 3363.45 | 3260.31 | 3307.09 | 1749.86 | 1780.42 | 1803.25 | 1712.20 | 1469.05 | 1406.96 | 1434.35 | 1420.88 | 1447.08 | 1476.42 | 1340.66 | 1358.26 | 1371.50 | 1399.75 | 1418.71 | 1343.61 | 1343.66 | 1264.60 | 1292.44 | 1475.01 | 1535.76 | 1567.34 | 1597.14 | NA | NA | 1487.25 | NA | NA | |

| Common Stock Value | 3.81 | 3.81 | 3.81 | 3.81 | 3.81 | 3.81 | 1.52 | 2.29 | 2.29 | 2.21 | 2.19 | 2.19 | 2.19 | 2.19 | 2.19 | 2.19 | 2.17 | 2.07 | 2.05 | 2.05 | 2.05 | 2.07 | 2.08 | 2.05 | 2.05 | 2.01 | 2.01 | 1.42 | 1.42 | 1.42 | 1.38 | 1.31 | 1.27 | 1.27 | 1.25 | 1.25 | 1.25 | 1.19 | 1.19 | 1.19 | 1.18 | NA | NA | NA | NA | 0.00 | 0.00 | 1.15 | 1.14 | 1.14 | 1.13 | NA | 1.01 | NA | NA | |

| Additional Paid In Capital Common Stock | 9602.59 | 9597.63 | 9595.03 | 9591.19 | 9587.64 | 9586.56 | 4002.53 | 5180.58 | 5178.13 | 4973.00 | 4919.35 | 4917.13 | 4916.78 | 4914.77 | 4912.42 | 4909.40 | 4854.04 | 4581.18 | 4521.10 | 4517.96 | 4525.97 | 4574.91 | 4580.37 | 4511.74 | 4508.53 | 4386.22 | 4384.48 | 2754.23 | 2754.82 | 2753.57 | 2625.27 | 2422.14 | 2328.81 | 2328.70 | 2283.74 | 2282.55 | 2281.93 | 2147.69 | 2146.55 | 2127.71 | 2126.90 | 2115.60 | 2011.33 | 1991.22 | 1885.84 | 1885.45 | 2039.92 | 2042.53 | 2032.31 | 2022.40 | 2012.45 | NA | 1795.41 | NA | NA | |

| Minority Interest | 96.25 | 101.89 | 104.02 | 106.21 | 108.74 | 111.81 | NA | 83.67 | 86.71 | 93.17 | 58.83 | 59.65 | 60.68 | 61.96 | 63.98 | 64.67 | 72.64 | 72.78 | 78.06 | 77.28 | 78.89 | 79.90 | 77.70 | 81.14 | 84.67 | 84.74 | 86.02 | 92.85 | 93.14 | 91.25 | 92.44 | 24.94 | 27.53 | 27.93 | 28.44 | 28.82 | 29.28 | 11.56 | 11.69 | 12.29 | 12.54 | 12.90 | 13.09 | 14.80 | 10.33 | 5.85 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | |

| Stock Issued During Period Value New Issues | 0.02 | 0.03 | 0.03 | 0.05 | 0.05 | 0.08 | 0.11 | 22.66 | 10.51 | 53.73 | 116.19 | NA | NA | NA | NA | 50.02 | NA | 51.80 | 2.60 | NA | 0.00 | 0.00 | 72.81 | NA | 122.73 | 0.00 | NA | NA | 0.00 | 125.48 | 200.42 | 91.27 | 0.00 | NA | NA | NA | 134.27 | 0.00 | NA | NA | 11.03 | 103.91 | 19.84 | 104.56 | NA | NA | NA | NA | 3.01 | 0.00 | 1.42 | 210.21 | 216.44 | 171.41 | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 2.82 | 2.56 | 3.92 | 4.99 | 3.57 | 9.72 | 3.36 | 2.02 | -0.92 | -0.37 | 2.06 | 3.34 | NA | 1.83 | 2.10 | 3.20 | NA | 2.34 | 2.10 | 3.39 | 1.93 | 2.54 | 2.20 | 3.51 | 1.38 | 1.65 | 1.31 | 2.53 | 1.94 | 2.10 | 1.23 | 1.80 | 1.26 | 1.36 | 1.19 | 1.91 | 1.10 | 1.02 | 0.87 | 1.39 | 0.59 | 0.47 | 0.34 | 4.32 | 5.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

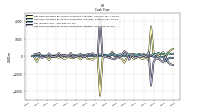

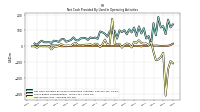

| Net Cash Provided By Used In Operating Activities | 127.32 | 118.18 | 185.13 | 69.19 | 146.09 | 12.54 | 64.81 | 49.31 | 114.00 | 80.69 | 125.57 | 65.35 | 118.29 | 87.48 | 106.76 | 75.42 | 102.01 | 89.64 | 100.18 | 48.55 | 96.64 | 84.64 | 95.23 | 60.88 | 79.00 | 88.02 | 93.51 | 47.01 | 55.44 | 51.86 | 55.95 | 40.45 | 52.44 | 51.49 | 49.97 | 37.20 | 38.95 | 56.34 | 39.76 | 33.45 | 29.15 | 46.86 | 43.88 | 27.94 | 32.98 | 35.94 | 21.76 | 26.11 | 25.55 | 25.47 | 35.68 | 25.11 | 8.88 | 17.85 | NA | |

| Net Cash Provided By Used In Investing Activities | 236.68 | 118.61 | -47.70 | 41.56 | 208.53 | 1707.00 | -247.99 | -33.18 | -142.52 | -138.98 | -42.05 | -76.30 | -159.34 | -45.23 | -38.06 | -76.62 | -372.08 | -160.52 | -98.64 | -36.05 | -18.54 | 264.36 | -27.14 | -42.37 | 32.38 | -174.83 | -2275.56 | -37.08 | -65.23 | -205.44 | -167.34 | -168.31 | -35.10 | -1.24 | -190.78 | -42.15 | -36.72 | -103.30 | -113.72 | -5.97 | -123.41 | -150.40 | -8.77 | -92.12 | -31.31 | -27.05 | -4.38 | -220.81 | -36.17 | -7.25 | 5.93 | -28.47 | -322.74 | -77.69 | NA | |

| Net Cash Provided By Used In Financing Activities | -362.96 | -248.03 | -151.46 | -121.77 | -351.24 | -1696.27 | 245.96 | -57.77 | 66.13 | -12.58 | -26.27 | -74.73 | -71.43 | 108.99 | -210.17 | 185.06 | 289.87 | 59.55 | -40.87 | -77.56 | -184.74 | -148.45 | -97.42 | -68.14 | -16.04 | 4.78 | 2257.46 | -5.13 | 3.09 | 163.37 | 105.71 | 128.61 | -15.41 | -55.69 | 143.87 | 8.05 | -10.23 | -67.35 | 179.32 | -18.20 | 30.16 | 64.85 | -35.20 | 169.19 | 5.94 | -24.53 | -28.52 | 160.34 | -42.19 | -50.21 | -94.72 | 181.50 | 121.94 | 104.14 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 127.32 | 118.18 | 185.13 | 69.19 | 146.09 | 12.54 | 64.81 | 49.31 | 114.00 | 80.69 | 125.57 | 65.35 | 118.29 | 87.48 | 106.76 | 75.42 | 102.01 | 89.64 | 100.18 | 48.55 | 96.64 | 84.64 | 95.23 | 60.88 | 79.00 | 88.02 | 93.51 | 47.01 | 55.44 | 51.86 | 55.95 | 40.45 | 52.44 | 51.49 | 49.97 | 37.20 | 38.95 | 56.34 | 39.76 | 33.45 | 29.15 | 46.86 | 43.88 | 27.94 | 32.98 | 35.94 | 21.76 | 26.11 | 25.55 | 25.47 | 35.68 | 25.11 | 8.88 | 17.85 | NA | |

| Net Income Loss | -40.53 | -67.84 | -82.76 | -87.12 | -35.76 | 28.30 | 6.13 | 18.32 | 16.30 | 21.67 | 38.01 | 22.03 | 28.05 | -6.83 | 13.49 | 17.90 | 8.92 | -8.46 | 16.26 | 13.44 | 15.33 | 172.99 | 15.35 | 9.80 | 42.53 | 13.76 | -5.92 | 13.54 | 16.55 | 6.43 | 13.07 | 9.86 | 10.37 | 6.46 | 9.29 | 6.80 | 21.19 | 16.03 | 2.85 | 5.29 | 4.06 | 4.82 | 14.03 | 1.35 | -1.84 | -2.95 | -19.32 | -0.32 | 2.00 | 0.23 | 1.17 | 2.15 | -8.73 | 1.13 | 0.24 | |

| Profit Loss | -41.67 | -68.60 | -83.73 | -88.08 | -36.28 | 28.62 | 6.13 | 18.67 | 16.61 | 22.04 | 38.74 | 22.39 | 28.51 | -6.93 | 13.72 | 18.21 | 9.04 | -8.58 | 16.60 | 13.70 | 15.61 | 176.35 | 15.66 | 10.02 | 43.47 | 13.96 | -5.85 | 14.00 | 17.15 | 6.64 | 13.52 | 10.04 | 10.57 | 6.55 | 9.49 | 6.94 | 21.46 | 16.22 | 2.88 | 5.43 | 4.06 | 5.00 | 14.23 | 1.38 | -1.82 | -2.93 | -19.31 | -0.31 | 2.01 | 0.23 | 1.16 | 2.19 | -8.69 | 1.01 | 0.24 | |

| Depreciation Depletion And Amortization | 180.05 | 182.99 | 183.19 | 184.48 | 185.19 | 158.12 | 55.73 | 54.04 | 51.81 | 51.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 18.20 | NA | NA | NA | 16.70 | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 2.82 | 2.55 | 3.92 | 4.99 | 3.57 | 9.72 | 5.03 | 2.02 | 2.23 | -0.37 | 2.06 | 3.34 | 1.78 | 1.83 | 2.10 | 3.20 | 2.30 | 2.34 | 2.10 | 3.39 | 1.93 | 2.13 | 2.20 | 3.51 | 1.38 | 1.65 | 1.31 | 2.53 | 1.94 | 2.10 | 1.23 | 1.80 | 1.26 | 1.36 | 1.19 | 1.91 | 1.10 | 1.02 | 0.87 | 1.39 | 0.52 | 0.47 | 0.34 | 4.32 | 5.12 | 4.64 | 6.64 | 1.00 | 0.54 | 1.14 | 0.65 | 0.90 | 0.43 | 0.51 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 236.68 | 118.61 | -47.70 | 41.56 | 208.53 | 1707.00 | -247.99 | -33.18 | -142.52 | -138.98 | -42.05 | -76.30 | -159.34 | -45.23 | -38.06 | -76.62 | -372.08 | -160.52 | -98.64 | -36.05 | -18.54 | 264.36 | -27.14 | -42.37 | 32.38 | -174.83 | -2275.56 | -37.08 | -65.23 | -205.44 | -167.34 | -168.31 | -35.10 | -1.24 | -190.78 | -42.15 | -36.72 | -103.30 | -113.72 | -5.97 | -123.41 | -150.40 | -8.77 | -92.12 | -31.31 | -27.05 | -4.38 | -220.81 | -36.17 | -7.25 | 5.93 | -28.47 | -322.74 | -77.69 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -362.96 | -248.03 | -151.46 | -121.77 | -351.24 | -1696.27 | 245.96 | -57.77 | 66.13 | -12.58 | -26.27 | -74.73 | -71.43 | 108.99 | -210.17 | 185.06 | 289.87 | 59.55 | -40.87 | -77.56 | -184.74 | -148.45 | -97.42 | -68.14 | -16.04 | 4.78 | 2257.46 | -5.13 | 3.09 | 163.37 | 105.71 | 128.61 | -15.41 | -55.69 | 143.87 | 8.05 | -10.23 | -67.35 | 179.32 | -18.20 | 30.16 | 64.85 | -35.20 | 169.19 | 5.94 | -24.53 | -28.52 | 160.34 | -42.19 | -50.21 | -94.72 | 181.50 | 121.94 | 104.14 | NA | |

| Payments Of Dividends Common Stock | 118.07 | 118.07 | 118.05 | 118.05 | 117.98 | 71.96 | 19.40 | 74.38 | 71.77 | 70.03 | 70.02 | 70.00 | 69.94 | 68.83 | 68.82 | 68.23 | 65.26 | 63.47 | 63.70 | 63.69 | 64.24 | 63.29 | 62.58 | 62.55 | 61.21 | 60.19 | 43.15 | 42.54 | 42.52 | 40.64 | 38.55 | 37.47 | 37.48 | 36.31 | 36.31 | 36.27 | 34.65 | 34.34 | 34.11 | 34.05 | 33.76 | 32.50 | 32.24 | 30.86 | 30.82 | 11.22 | 28.99 | 22.25 | 21.80 | 21.99 | 21.69 | 19.32 | 17.31 | 15.67 | NA | |

| Payments For Repurchase Of Common Stock | 0.46 | -0.01 | 0.11 | 1.73 | 2.30 | 0.04 | -0.79 | 1.64 | 0.03 | 0.01 | 0.13 | 3.25 | 0.10 | 0.30 | 0.17 | 4.62 | 0.02 | 0.06 | 0.17 | 11.93 | 50.89 | 7.88 | 8.84 | 2.71 | 0.00 | 0.07 | 0.22 | 3.12 | 0.22 | 0.14 | 0.39 | 1.90 | 0.34 | 0.02 | 0.01 | 1.29 | 0.48 | 0.00 | 0.00 | 0.57 | 0.23 | 0.01 | 0.00 | 0.27 | 0.20 | 150.46 | 22.02 | 9.92 | 9.96 | 10.03 | 9.77 | 7.92 | 20.68 | 12.02 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 330.44 | 342.26 | 338.14 | 332.93 | 338.06 | 306.35 | 145.33 | 202.00 | 195.70 | 191.26 | 188.62 | 191.49 | 187.02 | 187.33 | 178.84 | 185.78 | 176.31 | 175.00 | 171.76 | 168.97 | 172.30 | 175.13 | 173.33 | 175.66 | 173.77 | 175.99 | 139.88 | 124.35 | 122.04 | 118.34 | 113.23 | 107.31 | 102.05 | 103.94 | 99.31 | 98.52 | 95.00 | 95.53 | 89.67 | 91.30 | 83.69 | 82.54 | 77.24 | 76.43 | 74.04 | 78.10 | 76.26 | 71.24 | 65.53 | 69.94 | 67.28 | 70.89 | 57.50 | 52.50 | 46.52 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 3.94 | 4.66 | 4.23 | 4.62 | 4.44 | 4.06 | 2.74 | 2.48 | 2.94 | 2.97 | 2.43 | 191.49 | -544.58 | 187.33 | 178.84 | 185.78 | 176.31 | 175.00 | 171.76 | 168.97 | 172.30 | 175.13 | 173.33 | 175.66 | 173.77 | 175.99 | 139.88 | 124.35 | 122.04 | 118.34 | 113.23 | 107.31 | 102.05 | 103.94 | 99.31 | 98.52 | 95.00 | 95.53 | 89.67 | 91.30 | 83.69 | 82.54 | 77.24 | 76.43 | 74.04 | 78.10 | 76.26 | 71.24 | 65.53 | 69.94 | 67.28 | 70.89 | 57.50 | 52.50 | 46.52 | |

| Management Fee Income | 2.43 | 1.55 | 1.60 | 1.97 | 1.80 | 1.43 | 0.78 | 0.66 | 0.67 | 0.72 | 0.42 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Parking Income | 2.39 | 2.75 | 2.37 | 2.39 | 2.41 | 2.43 | 1.92 | 1.75 | 2.13 | 2.19 | 1.88 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Notes Receivable | 2.30 | 2.30 | 2.20 | 2.00 | 2.10 | 1.30 | NA | 1.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |