| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Earnings Per Share Basic | 0.58 | 1.12 | 1.35 | 1.45 | 1.65 | 1.56 | 1.39 | 1.40 | 1.56 | 1.46 | 1.00 | 1.21 | 1.19 | 0.90 | -1.36 | -1.28 | 1.03 | 0.77 | 1.01 | 0.91 | 1.10 | 0.96 | 0.82 | |

| Earnings Per Share Diluted | 0.58 | 1.12 | 1.35 | 1.45 | 1.65 | 1.55 | 1.38 | 1.40 | 1.55 | 1.46 | 1.00 | 1.21 | 1.19 | 0.90 | -1.36 | -1.28 | 1.03 | 0.77 | 1.01 | 0.91 | 1.11 | 0.96 | 0.82 | |

| Tier One Risk Based Capital To Risk Weighted Assets | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | |

| Capital To Risk Weighted Assets | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Interest Expense | 157.33 | 146.59 | 131.36 | 87.61 | 50.17 | 19.43 | 9.13 | 8.32 | 9.46 | 9.71 | 13.66 | 16.20 | 18.97 | 21.86 | 28.48 | 46.16 | 52.80 | 60.23 | 60.51 | 57.03 | 53.92 | 49.02 | 40.76 | |

| Interest Expense Long Term Debt | 3.06 | 3.06 | 3.09 | 3.10 | 3.08 | 3.10 | 3.12 | 3.13 | 3.14 | 3.15 | 5.04 | 5.44 | 5.40 | 5.40 | 3.59 | 2.76 | 2.91 | 3.28 | 2.82 | 2.81 | 2.68 | 3.05 | 3.47 | |

| Interest Income Expense Net | 269.46 | 269.23 | 273.91 | 284.99 | 295.50 | 280.31 | 245.73 | 228.46 | 229.30 | 234.71 | 234.64 | 234.59 | 238.29 | 235.18 | 237.87 | 231.19 | 233.16 | 222.94 | 219.87 | 219.25 | 217.43 | 214.19 | 211.55 | |

| Income Tax Expense Benefit | 11.71 | 24.30 | 29.57 | 31.95 | 36.14 | 35.35 | 32.61 | 31.00 | 27.10 | 30.74 | 20.66 | 26.34 | -0.30 | 18.80 | -74.56 | -23.52 | 16.94 | 12.39 | 19.19 | 16.85 | 8.27 | 17.77 | 15.91 | |

| Comprehensive Income Net Of Tax | 324.47 | -34.47 | 42.47 | 211.18 | 184.39 | -150.22 | -46.47 | -181.86 | 83.61 | 86.92 | 163.02 | -4.34 | 84.71 | 75.57 | -87.61 | 16.96 | 88.56 | 91.85 | 145.58 | 127.36 | 135.71 | 66.91 | 48.52 | |

| Net Income Loss Available To Common Stockholders Basic | 50.60 | 97.74 | 117.79 | 126.47 | 143.79 | 135.39 | 121.44 | 123.48 | 137.74 | 129.58 | 88.72 | 107.17 | 103.58 | 79.36 | -117.07 | -111.03 | 92.13 | 67.81 | 88.28 | 79.16 | 96.24 | 83.88 | 71.18 | |

| Interest Income Expense After Provision For Loan Loss | 252.51 | 240.74 | 266.28 | 278.97 | 293.01 | 278.90 | 255.49 | 250.99 | 257.69 | 261.66 | 251.87 | 239.50 | 214.07 | 210.18 | -69.03 | -15.61 | 224.00 | 210.52 | 211.78 | 201.21 | 209.33 | 207.32 | 202.66 | |

| Noninterest Expense | 229.15 | 204.68 | 202.14 | 200.88 | 190.15 | 193.50 | 187.10 | 179.94 | 182.46 | 194.70 | 236.77 | 193.07 | 193.14 | 195.77 | 196.54 | 203.34 | 197.86 | 213.55 | 183.57 | 175.70 | 179.37 | 181.19 | 184.40 | |

| Noninterest Income | 38.95 | 85.97 | 83.22 | 80.33 | 77.06 | 85.34 | 85.65 | 83.43 | 89.61 | 93.36 | 94.27 | 87.09 | 82.35 | 83.75 | 73.94 | 84.39 | 82.92 | 83.23 | 79.25 | 70.50 | 74.54 | 75.52 | 68.83 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

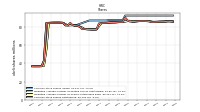

| Assets | 35578.57 | 36298.30 | 36210.15 | 37547.08 | 35183.82 | 34567.24 | 34637.53 | 36317.29 | 36531.21 | 35318.31 | 35098.71 | 35072.64 | 33638.60 | 33193.32 | 33215.40 | 31761.69 | 30600.76 | 30543.55 | 28761.86 | 28490.23 | 28235.91 | 28098.17 | 27925.45 | |

| Liabilities | 31774.91 | 32797.30 | 32655.67 | 34015.85 | 31841.20 | 31386.80 | 31287.80 | 32866.34 | 32860.85 | 31688.54 | 31535.81 | 31655.74 | 30199.58 | 29817.68 | 29899.24 | 28340.63 | 27133.07 | 26957.17 | 25442.95 | 25299.66 | 25154.57 | 25119.30 | 24995.89 | |

| Liabilities And Stockholders Equity | 35578.57 | 36298.30 | 36210.15 | 37547.08 | 35183.82 | 34567.24 | 34637.53 | 36317.29 | 36531.21 | 35318.31 | 35098.71 | 35072.64 | 33638.60 | 33193.32 | 33215.40 | 31761.69 | 30600.76 | 30543.55 | 28761.86 | 28490.23 | 28235.91 | 28098.17 | 27925.45 | |

| Stockholders Equity | 3803.66 | 3501.00 | 3554.48 | 3531.23 | 3342.63 | 3180.44 | 3349.72 | 3450.95 | 3670.35 | 3629.77 | 3562.90 | 3416.90 | 3439.03 | 3375.64 | 3316.16 | 3421.06 | 3467.68 | 3586.38 | 3318.91 | 3190.57 | 3081.34 | 2978.88 | 2929.55 | |

| Tier One Risk Based Capital | 3584.47 | NA | NA | NA | 3279.42 | NA | NA | NA | 2890.77 | NA | NA | NA | 2534.05 | NA | NA | NA | 2584.16 | NA | NA | NA | 2391.76 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 561.20 | 541.35 | 563.74 | 594.37 | 564.46 | 589.59 | 698.27 | 703.42 | 401.20 | 527.88 | 501.59 | 508.67 | 526.31 | 484.31 | 535.23 | 476.81 | 432.10 | 468.06 | 365.15 | 360.19 | 383.37 | 339.61 | 355.07 | |

| Available For Sale Securities Debt Securities | 4915.19 | 5188.16 | 5414.69 | 5565.62 | 5556.04 | 5466.84 | 5779.38 | 5993.01 | 6986.70 | 7000.92 | 7300.42 | 6630.65 | 5999.33 | 5647.31 | 4932.14 | NA | 4675.30 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 620.38 | NA | NA | NA | 632.06 | NA | NA | NA | 630.37 | NA | NA | NA | 652.32 | NA | NA | NA | 629.74 | NA | NA | NA | 579.64 | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 318.75 | 310.93 | 310.26 | 304.31 | 303.45 | 297.66 | 290.88 | 286.05 | 280.06 | 272.21 | 266.24 | 278.38 | 271.80 | 266.24 | 259.78 | 252.46 | 249.53 | 245.01 | 238.05 | 233.08 | 225.97 | 221.29 | 218.53 | |

| Amortization Of Intangible Assets | 2.67 | 2.81 | 2.96 | 3.11 | 3.27 | 3.43 | 3.59 | 3.75 | 3.92 | 4.08 | 4.25 | 4.42 | 4.61 | 4.79 | 5.17 | 5.34 | 5.77 | 4.89 | 5.05 | 5.14 | 5.47 | 5.64 | 5.32 | |

| Property Plant And Equipment Net | 301.64 | 309.91 | 326.53 | 324.11 | 328.61 | 346.57 | 352.01 | 353.44 | 350.31 | 350.55 | 353.36 | 377.51 | 380.52 | 384.33 | 380.12 | 377.64 | 380.21 | 382.93 | 360.30 | 358.20 | 353.67 | 343.83 | 336.51 | |

| Goodwill | 855.45 | 855.45 | 855.45 | 855.45 | 855.45 | 855.45 | 855.45 | 855.45 | 855.45 | 855.45 | 855.45 | 855.45 | 855.45 | 855.45 | 855.45 | 855.45 | 855.45 | 861.29 | 792.08 | 792.08 | 790.97 | 791.16 | 745.52 | |

| Finite Lived Intangible Assets Net | 44.64 | 47.31 | 50.12 | 53.08 | 56.19 | 59.46 | 62.89 | 66.48 | 70.23 | 74.15 | 78.23 | 82.47 | 86.89 | 91.50 | 96.29 | 101.46 | 106.81 | 116.08 | 85.97 | 91.01 | 96.15 | 101.44 | 79.70 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 200.29 | 297.66 | 241.50 | 204.12 | 237.87 | 260.29 | 138.18 | 67.06 | 2.39 | 0.80 | 0.56 | 1.81 | 0.00 | 0.02 | 0.02 | 0.02 | 1.11 | 2.56 | 5.44 | 23.00 | 49.47 | 94.16 | 79.05 | |

| Held To Maturity Securities Fair Value | 2485.92 | 2430.29 | 2540.26 | 2623.76 | 2615.40 | 2606.08 | 2615.80 | 2429.05 | 1631.48 | 1385.97 | 1420.11 | 1455.22 | 1467.58 | 1517.69 | 1553.59 | 1562.58 | 1611.00 | 2920.36 | 2979.40 | 2892.91 | 2935.86 | 2975.45 | 3054.47 | |

| Held To Maturity Securities | 2684.78 | 2727.95 | 2780.99 | 2825.06 | 2852.49 | 2866.35 | 2752.01 | 2488.09 | 1565.75 | 1307.70 | 1332.71 | 1375.34 | 1357.17 | 1408.96 | 1449.66 | 1480.49 | 1568.01 | 2855.06 | 2935.27 | 2896.44 | 2979.55 | 3069.26 | 3132.20 | |

| Available For Sale Debt Securities Amortized Cost Basis | 5496.72 | 6085.31 | 6151.18 | 6238.84 | 6310.21 | 6342.38 | 6358.43 | 6380.00 | 6984.53 | 6943.51 | 7190.16 | 6609.89 | 5766.23 | 5410.50 | 4698.30 | 4709.07 | 4637.61 | 3480.95 | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 1.43 | NA | 0.77 | 2.81 | 0.77 | 0.02 | 1.97 | 8.02 | 68.12 | 79.07 | 87.96 | 81.69 | 110.41 | 108.74 | 103.95 | 82.11 | 44.10 | 67.86 | 49.58 | 19.47 | 5.78 | 0.35 | 1.32 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 200.29 | 297.66 | 241.50 | 204.12 | 237.87 | 260.29 | 138.18 | 67.06 | 2.39 | 0.80 | 0.56 | 1.81 | 0.00 | 0.02 | 0.02 | 0.02 | 1.11 | 2.56 | 5.44 | 23.00 | 49.47 | 94.16 | 79.05 | |

| Held To Maturity Securities Continuous Unrealized Loss Position Fair Value | 2388.70 | 2430.29 | 2489.89 | 2336.55 | 2561.89 | 2602.29 | 2364.45 | 1622.86 | 344.50 | 28.05 | 29.98 | 78.04 | 2.38 | 3.63 | 2.89 | 4.18 | 85.41 | 486.17 | 792.56 | 1587.06 | 2122.22 | 2890.02 | 2802.52 | |

| Held To Maturity Securities Debt Maturities After One Through Five Years Fair Value | 634.46 | 602.26 | 629.03 | 520.59 | 522.35 | 516.99 | 380.05 | 379.67 | 377.42 | 354.90 | 258.19 | 239.61 | 218.50 | 201.87 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Within One Year Fair Value | 90.11 | 100.66 | 6.48 | 11.57 | 9.92 | 9.89 | 11.01 | 11.25 | 11.31 | 11.37 | 10.51 | 2.34 | 2.19 | 2.19 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Twelve Months Or Longer Fair Value | 2035.77 | 1990.78 | 1663.08 | 1659.92 | 725.30 | 401.59 | 122.65 | 131.27 | 11.84 | 0.19 | 0.19 | 0.19 | 2.38 | 2.89 | 2.89 | 4.18 | 52.25 | 434.58 | 789.53 | 1578.31 | 1720.62 | 1214.26 | 1229.62 | |

| Held To Maturity Securities Continuous Unrealized Loss Position Less Than Twelve Months Fair Value | 352.93 | 439.51 | 826.82 | 676.64 | 1836.59 | 2200.70 | 2241.80 | 1491.59 | 332.66 | 27.86 | 29.79 | 77.85 | NA | 0.74 | NA | NA | 33.16 | 51.58 | 3.03 | 8.75 | 401.59 | 1675.76 | 1572.90 | |

| Held To Maturity Securities Debt Maturities After Five Through Ten Years Fair Value | 742.93 | 718.44 | 768.35 | 851.02 | 813.73 | 782.39 | 905.11 | 873.48 | 650.53 | 587.55 | 694.20 | 704.95 | 702.41 | 701.35 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Ten Years Fair Value | 1018.42 | 1008.92 | 1136.40 | 1240.57 | 1269.40 | 1296.81 | 1319.64 | 1164.65 | 592.22 | 432.15 | 457.21 | 508.32 | 544.48 | 612.28 | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | 4835.79 | NA | NA | NA | 1388.73 | NA | NA | NA | 1003.61 | NA | NA | NA | 1735.93 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 29690.06 | 30320.34 | 30043.50 | 29613.07 | 29070.35 | 28951.27 | 29866.43 | 30499.71 | 30465.90 | 29208.16 | 29273.11 | 29210.52 | 27697.88 | 27030.66 | 27322.27 | 25008.50 | 23803.58 | 24201.30 | 23236.04 | 23380.29 | 23150.19 | 22417.81 | 22235.34 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 236.32 | 236.28 | 236.24 | 242.12 | 242.08 | 236.41 | 240.09 | 240.45 | 244.22 | 248.01 | 248.05 | 397.58 | 378.32 | 385.89 | 386.27 | 225.61 | 233.46 | 246.64 | 232.75 | 224.96 | 224.99 | 215.91 | 266.01 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 3803.66 | 3501.00 | 3554.48 | 3531.23 | 3342.63 | 3180.44 | 3349.72 | 3450.95 | 3670.35 | 3629.77 | 3562.90 | 3416.90 | 3439.03 | 3375.64 | 3316.16 | 3421.06 | 3467.68 | 3586.38 | 3318.91 | 3190.57 | 3081.34 | 2978.88 | 2929.55 | |

| Additional Paid In Capital Common Stock | 1739.67 | 1735.10 | 1727.74 | 1720.62 | 1716.88 | 1715.45 | 1710.90 | 1742.02 | 1755.70 | 1774.87 | 1770.97 | 1764.14 | 1757.94 | 1755.32 | 1747.64 | 1741.16 | 1736.66 | 1919.84 | 1737.49 | 1731.15 | 1725.74 | 1735.44 | 1729.54 | |

| Retained Earnings Accumulated Deficit | 2375.60 | 2351.39 | 2280.00 | 2188.56 | 2088.41 | 1968.26 | 1856.49 | 1758.69 | 1659.07 | 1545.18 | 1439.55 | 1374.69 | 1291.51 | 1211.88 | 1156.28 | 1297.13 | 1476.23 | 1408.18 | 1363.91 | 1299.22 | 1243.59 | 1170.90 | 1110.51 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -621.13 | -894.99 | -762.79 | -687.47 | -772.18 | -812.78 | -527.18 | -359.28 | -53.94 | 0.20 | 42.86 | -31.44 | 80.07 | 98.94 | 102.73 | 73.27 | -54.72 | -51.16 | -75.20 | -132.51 | -180.71 | -220.18 | -203.21 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 92.85 | 187.71 | 128.80 | 85.89 | 166.94 | 188.25 | 206.30 | 280.53 | 54.81 | 163.31 | 112.52 | 255.04 | 127.72 | 160.59 | 55.35 | 11.53 | 185.66 | 37.49 | 115.38 | 13.42 | 119.09 | 109.93 | 115.67 | |

| Net Cash Provided By Used In Investing Activities | 855.95 | -258.01 | 1325.61 | -2218.76 | -616.94 | -269.56 | 1473.34 | 75.52 | -1310.74 | -274.97 | 127.47 | -1766.35 | -487.68 | -48.68 | -1536.18 | -1104.93 | -212.58 | 4.56 | -208.15 | -42.85 | -101.56 | 20.09 | -571.59 | |

| Net Cash Provided By Used In Financing Activities | -928.95 | 47.91 | -1485.05 | 2162.79 | 424.87 | -27.37 | -1684.79 | -53.84 | 1129.24 | 137.94 | -247.07 | 1493.68 | 401.95 | -162.83 | 1539.25 | 1138.11 | -9.04 | 60.87 | 97.73 | 6.25 | 26.23 | -145.48 | 557.13 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 92.85 | 187.71 | 128.80 | 85.89 | 166.94 | 188.25 | 206.30 | 280.53 | 54.81 | 163.31 | 112.52 | 255.04 | 127.72 | 160.59 | 55.35 | 11.53 | 185.66 | 37.49 | 115.38 | 13.42 | 119.09 | 109.93 | 115.67 | |

| Depreciation Depletion And Amortization | 8.54 | 8.67 | 8.95 | 8.56 | 8.37 | 8.40 | 7.64 | 7.18 | 7.37 | 7.39 | 7.27 | 7.08 | 7.26 | 7.45 | 7.54 | 7.88 | 8.04 | 7.70 | 7.65 | 7.52 | 6.79 | 6.72 | 6.47 | |

| Deferred Income Tax Expense Benefit | 10.72 | -5.18 | 9.25 | -0.80 | -31.56 | -2.24 | 1.53 | 10.10 | 9.00 | -0.78 | -0.14 | 2.30 | 8.23 | 19.84 | -14.51 | -34.28 | 16.96 | 5.56 | -6.26 | 30.83 | 24.87 | -1.02 | 6.57 | |

| Share Based Compensation | 5.97 | 6.48 | 6.47 | 5.73 | 5.98 | 6.13 | 6.09 | 5.29 | 5.17 | 5.62 | 6.13 | 5.52 | 4.45 | 5.58 | 5.50 | 5.58 | 5.41 | 5.13 | 5.19 | 5.18 | 4.92 | 5.05 | 4.94 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 855.95 | -258.01 | 1325.61 | -2218.76 | -616.94 | -269.56 | 1473.34 | 75.52 | -1310.74 | -274.97 | 127.47 | -1766.35 | -487.68 | -48.68 | -1536.18 | -1104.93 | -212.58 | 4.56 | -208.15 | -42.85 | -101.56 | 20.09 | -571.59 | |

| Payments To Acquire Property Plant And Equipment | 0.45 | 6.30 | 12.78 | 5.50 | 6.79 | 4.14 | 6.86 | 11.35 | 11.14 | 4.77 | 3.37 | 4.27 | 6.66 | 11.61 | 10.15 | 9.46 | 8.97 | 11.03 | 10.28 | 12.44 | 18.08 | 14.47 | 10.21 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -928.95 | 47.91 | -1485.05 | 2162.79 | 424.87 | -27.37 | -1684.79 | -53.84 | 1129.24 | 137.94 | -247.07 | 1493.68 | 401.95 | -162.83 | 1539.25 | 1138.11 | -9.04 | 60.87 | 97.73 | 6.25 | 26.23 | -145.48 | 557.13 | |

| Payments Of Dividends Common Stock | 26.17 | 26.18 | 26.18 | 26.17 | 23.53 | 23.56 | 23.56 | 23.80 | 23.88 | 24.00 | 24.02 | 24.02 | 23.98 | 23.80 | 23.79 | 24.03 | 24.10 | 23.60 | 23.59 | 23.58 | 23.55 | 23.51 | 20.89 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Credit And Debit Card | 20.71 | 20.55 | 20.98 | 20.72 | 20.91 | 21.41 | 21.87 | 20.40 | 20.64 | 19.83 | 20.48 | 18.12 | 17.59 | 17.22 | 15.96 | 17.36 | 17.91 | 17.15 | 16.62 | 15.29 | 15.66 | 14.86 | 15.46 | |

| Deposit Account | 21.64 | 22.26 | 21.49 | 20.62 | 22.22 | 23.27 | 20.50 | 21.67 | 21.35 | 21.16 | 19.38 | 19.15 | 19.86 | 18.44 | 15.52 | 22.84 | 23.38 | 21.89 | 20.72 | 20.37 | 21.47 | 21.38 | 20.98 | |

| Fiduciary And Trust | 16.84 | 16.59 | 17.39 | 16.73 | 16.50 | 16.05 | 17.31 | 15.28 | 15.55 | 16.04 | 16.31 | 15.00 | 14.80 | 14.42 | 14.16 | 14.81 | 15.48 | 15.10 | 15.90 | 15.12 | 15.76 | 16.74 | 11.65 | |

| Investment Advisory Management And Administrative Service | 11.09 | 8.52 | 8.24 | 8.87 | 6.83 | 6.49 | 8.00 | 7.43 | 7.55 | 7.17 | 7.33 | 7.46 | 5.83 | 5.99 | 5.37 | 7.15 | 6.41 | 7.05 | 6.59 | 6.53 | 6.31 | 6.65 | 6.26 | |

| Mortgage Banking | 2.08 | 2.61 | 2.30 | 2.17 | 1.50 | 3.28 | 2.99 | 3.75 | 5.46 | 6.97 | 12.56 | 11.71 | 11.51 | 12.88 | 9.81 | 6.05 | 5.98 | 5.71 | 4.43 | 3.73 | 3.93 | 4.33 | 3.96 |