| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.41 | 0.41 | 0.41 | 0.41 | 0.41 | 0.41 | 0.41 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.44 | 0.31 | 0.30 | 0.30 | 0.28 | 0.28 | 0.28 | 0.28 | 0.19 | 0.19 | 0.18 | 0.18 | 0.18 | 0.18 | 0.17 | 0.17 | 0.17 | 0.17 | 0.16 | 0.16 | 0.13 | 0.12 | 0.12 | 0.12 | 0.08 | 0.08 | |

| Earnings Per Share Basic | 0.36 | 0.79 | 0.80 | -0.91 | 1.00 | 1.27 | 1.25 | 1.19 | 1.27 | 1.22 | 1.35 | 1.39 | 1.35 | 1.39 | 0.90 | 1.03 | 1.17 | 1.30 | 1.15 | 0.85 | 1.11 | 1.17 | 1.02 | 1.02 | 0.67 | 0.85 | 0.65 | 0.83 | 0.79 | 0.78 | 0.64 | 0.67 | 0.59 | 0.48 | 0.61 | 0.55 | 0.60 | 0.54 | 0.32 | 0.38 | 0.34 | 0.33 | 0.49 | 0.69 | 0.76 | |

| Earnings Per Share Diluted | 0.35 | 0.79 | 0.80 | -0.91 | 0.99 | 1.27 | 1.25 | 1.18 | 1.26 | 1.21 | 1.35 | 1.39 | 1.36 | 1.39 | 0.90 | 1.03 | 1.17 | 1.30 | 1.15 | 0.85 | 1.12 | 1.17 | 1.02 | 1.02 | 0.67 | 0.84 | 0.65 | 0.82 | 0.79 | 0.78 | 0.64 | 0.67 | 0.58 | 0.47 | 0.61 | 0.55 | 0.60 | 0.54 | 0.32 | 0.38 | 0.34 | 0.33 | 0.49 | 0.68 | 0.76 |

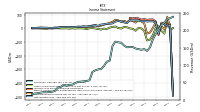

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Interest And Fee Income Loans And Leases | 212.03 | 202.72 | 193.61 | 184.29 | 174.44 | 160.16 | 138.43 | 129.18 | 135.62 | 134.54 | 137.62 | 140.15 | 144.44 | 144.14 | 143.41 | 147.10 | 153.96 | 154.66 | 157.43 | 145.53 | 106.80 | 103.10 | 91.61 | 83.28 | 82.09 | 79.33 | 75.19 | 53.74 | 52.05 | 51.19 | 50.42 | 49.91 | 46.15 | 42.15 | 41.62 | 39.58 | 41.82 | 35.63 | 33.88 | 24.12 | 22.00 | 21.14 | 20.45 | 20.76 | 19.60 | |

| Marketing And Advertising Expense | 0.41 | 0.59 | 1.00 | 0.60 | 0.52 | 0.42 | 0.70 | 0.46 | 0.22 | 0.27 | 0.38 | 0.24 | 0.45 | 0.49 | 0.86 | 0.61 | 0.58 | 0.47 | 0.81 | 0.66 | 0.61 | 0.58 | 0.33 | 0.39 | 0.46 | 0.38 | 0.32 | 0.30 | 0.33 | 0.23 | 0.25 | 0.29 | 0.13 | 0.31 | 0.25 | 0.35 | 0.22 | 0.20 | 0.18 | 0.23 | 0.06 | 0.22 | 0.19 | 0.22 | 0.10 | |

| Litigation Settlement Expense | 0.00 | 0.00 | 0.00 | 102.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Expense | 126.22 | 113.69 | 101.69 | 73.25 | 47.98 | 26.41 | 12.70 | 9.72 | 13.30 | 15.39 | 16.51 | 18.04 | 19.24 | 19.79 | 22.87 | 33.16 | 36.32 | 39.91 | 38.02 | 33.92 | 25.70 | 23.02 | 18.17 | 14.15 | 12.17 | 11.81 | 10.38 | 8.07 | 7.38 | 7.00 | 6.06 | 5.80 | 5.26 | 5.04 | 4.97 | 4.66 | 4.78 | 4.51 | 3.67 | 3.03 | 2.89 | 2.93 | 3.25 | 3.21 | 3.42 | |

| Interest Income Expense Net | 106.31 | 109.05 | 113.61 | 127.92 | 141.79 | 147.27 | 138.00 | 131.15 | 132.65 | 128.65 | 129.30 | 129.73 | 132.83 | 132.01 | 128.37 | 123.24 | 128.07 | 125.39 | 129.64 | 121.65 | 87.11 | 86.27 | 78.91 | 73.97 | 75.25 | 72.86 | 69.50 | 47.87 | 46.53 | 45.74 | 45.88 | 45.66 | 42.15 | 38.09 | 37.78 | 36.08 | 38.17 | 32.43 | 31.40 | 22.14 | 19.95 | 18.91 | 17.85 | 18.21 | 16.79 | |

| Interest Paid Net | 117.11 | 104.23 | 87.43 | 72.03 | 42.35 | 27.80 | 9.90 | 12.46 | 11.13 | 19.08 | 13.35 | 21.79 | 16.78 | 22.61 | 22.45 | 35.40 | 34.72 | 43.04 | 34.35 | 32.67 | 24.43 | 23.67 | 16.08 | 15.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 2.08 | 2.11 | 2.10 | 1.96 | 3.68 | 2.61 | 2.54 | 2.03 | 2.37 | 2.09 | 2.03 | 2.50 | 2.12 | 1.97 | 2.48 | 1.88 | 1.97 | 1.91 | 1.75 | 2.17 | 1.57 | 1.54 | 1.54 | 1.41 | 1.25 | 1.28 | 1.20 | 0.97 | 0.90 | 0.89 | 2.42 | 1.22 | 1.10 | 1.11 | 1.00 | 1.10 | 0.90 | 0.84 | 0.78 | 0.39 | 0.42 | 0.46 | 0.41 | 0.18 | 0.20 | |

| Income Tax Expense Benefit | 3.46 | 8.25 | 8.70 | -11.28 | 10.65 | 13.48 | 13.59 | 12.28 | 13.64 | 12.63 | 15.47 | 15.74 | 15.37 | 16.07 | 8.90 | 10.84 | 14.11 | 14.90 | 13.39 | 11.13 | 8.27 | 9.14 | 7.52 | 6.80 | 18.19 | 11.70 | 8.56 | 6.73 | 7.42 | 7.16 | 5.86 | 6.16 | 5.35 | 3.92 | 5.20 | 4.54 | 5.36 | 4.54 | 2.68 | 2.34 | 2.49 | 1.93 | 0.24 | 0.00 | 0.00 | |

| Income Taxes Paid | 7.00 | 11.53 | 7.23 | 0.02 | 12.93 | 18.60 | 15.01 | 0.03 | 13.25 | 16.65 | 28.18 | 0.01 | 19.30 | 14.28 | 21.26 | 0.00 | 13.82 | 13.77 | 12.92 | 0.00 | 7.95 | 8.15 | 9.01 | 0.00 | 12.25 | 7.40 | 14.51 | 0.00 | 6.92 | 7.55 | 11.25 | 0.76 | 7.85 | 3.70 | 6.75 | 6.15 | 0.00 | 2.10 | 2.92 | 2.70 | 2.81 | 3.10 | 0.00 | 0.00 | 0.00 | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | 2.62 | -0.48 | -1.22 | 1.45 | 0.68 | -2.96 | -1.66 | -4.08 | -0.86 | -0.27 | 0.31 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | 69.52 | -38.21 | -17.82 | 17.85 | 2.48 | -49.46 | -82.56 | -88.27 | -17.25 | -0.01 | 3.21 | -17.04 | -2.78 | 0.19 | 8.26 | 11.36 | -0.63 | 2.82 | 13.65 | 11.78 | 5.92 | -4.06 | -0.99 | -8.45 | -3.96 | -0.14 | 3.42 | 1.30 | -4.70 | -0.48 | 0.91 | 0.78 | -0.48 | 0.92 | -1.36 | 0.90 | 0.29 | 0.27 | 1.40 | 1.58 | -0.57 | 0.65 | -2.90 | -0.88 | -0.27 | |

| Net Income Loss | 14.86 | 32.77 | 33.08 | -37.51 | 40.75 | 52.44 | 52.36 | 50.74 | 54.19 | 52.34 | 58.24 | 59.98 | 58.27 | 60.08 | 38.69 | 44.17 | 50.24 | 55.63 | 49.74 | 37.13 | 33.96 | 35.70 | 29.64 | 28.96 | 19.19 | 23.51 | 18.13 | 15.67 | 14.78 | 14.50 | 11.81 | 12.45 | 10.56 | 8.20 | 10.57 | 9.45 | 10.10 | 8.96 | 5.12 | 4.80 | 4.28 | 3.96 | 5.87 | 5.69 | 6.09 | |

| Comprehensive Income Net Of Tax | 84.38 | -5.44 | 15.26 | -19.66 | 43.23 | 2.98 | -30.20 | -37.53 | 36.93 | 52.33 | 61.45 | 42.95 | 55.49 | 60.26 | 46.95 | 55.53 | 49.61 | 58.45 | 63.39 | 48.91 | 39.88 | 31.63 | 28.64 | 20.52 | 15.23 | 23.37 | 21.55 | 16.97 | 10.08 | 14.03 | 12.72 | 13.23 | 10.08 | 9.12 | 9.21 | 10.35 | 10.38 | 9.22 | 6.52 | 6.38 | 3.71 | 4.61 | 2.97 | 4.80 | 5.82 | |

| Net Income Loss Available To Common Stockholders Basic | 14.83 | 32.72 | 33.01 | -37.37 | 40.44 | 52.04 | 51.93 | 50.35 | 53.72 | 51.89 | 57.66 | 59.36 | 57.68 | 59.45 | 38.45 | 43.89 | 49.93 | 55.23 | 49.37 | 36.87 | 33.68 | 35.40 | 29.38 | 28.69 | 19.11 | 23.31 | 17.98 | 15.47 | 14.57 | 14.28 | 11.61 | 12.21 | 10.30 | 7.98 | 10.30 | 9.18 | 9.91 | 8.72 | 4.97 | 4.73 | 4.19 | 3.88 | 5.76 | 5.59 | 5.97 | |

| Interest Income Expense After Provision For Loan Loss | 102.83 | 108.71 | 113.39 | 127.83 | 138.95 | 144.17 | 138.00 | 132.59 | 132.65 | 128.65 | 135.80 | 132.23 | 128.96 | 124.39 | 105.25 | 114.86 | 126.46 | 120.16 | 124.90 | 118.43 | 84.20 | 84.74 | 76.18 | 71.27 | 73.36 | 70.98 | 67.03 | 45.84 | 44.33 | 43.61 | 43.76 | 42.66 | 40.18 | 34.16 | 36.12 | 34.41 | 36.42 | 31.45 | 30.02 | 20.88 | 19.07 | 18.09 | 16.77 | 17.18 | 15.86 | |

| Noninterest Expense | 95.12 | 81.33 | 85.70 | 189.38 | 98.77 | 91.73 | 85.92 | 82.46 | 79.91 | 80.57 | 78.01 | 75.11 | 75.23 | 73.41 | 83.03 | 74.37 | 80.34 | 76.95 | 77.98 | 86.59 | 51.85 | 52.66 | 49.16 | 44.96 | 49.55 | 47.90 | 51.33 | 28.03 | 27.36 | 26.89 | 31.02 | 28.52 | 28.53 | 25.83 | 24.45 | 24.39 | 24.93 | 22.16 | 25.34 | 16.08 | 15.71 | 14.65 | 13.38 | 13.92 | 13.33 | |

| Noninterest Income | 10.61 | 13.65 | 14.10 | 12.75 | 11.23 | 13.48 | 13.88 | 12.88 | 15.09 | 16.90 | 15.93 | 18.61 | 19.91 | 25.16 | 25.38 | 14.51 | 18.23 | 27.32 | 16.20 | 16.42 | 9.89 | 12.75 | 10.13 | 9.46 | 13.58 | 12.13 | 10.99 | 4.58 | 5.22 | 4.93 | 4.93 | 4.47 | 4.25 | 3.80 | 4.11 | 3.97 | 3.96 | 4.21 | 3.12 | 2.33 | 3.41 | 2.45 | 2.73 | 2.43 | 3.56 |

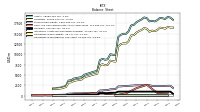

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

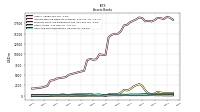

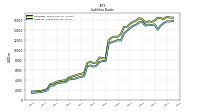

| Assets | 19035.10 | 18519.87 | 18719.80 | 18798.35 | 18258.41 | 17944.49 | 18107.09 | 17963.25 | 18732.65 | 18918.22 | 18447.72 | 18115.34 | 17753.48 | 17117.01 | 16986.03 | 15573.87 | 14958.21 | 14959.13 | 14708.92 | 14145.38 | 9849.97 | 9891.46 | 10017.04 | 8811.01 | 8684.46 | 8891.11 | 8593.98 | 6022.61 | 5852.80 | 5667.19 | 5446.80 | 5261.97 | 5055.00 | 4478.34 | 4375.73 | 4258.36 | 4132.64 | 3746.68 | 3654.31 | 2353.68 | 2163.98 | 1954.75 | 1905.85 | 1764.13 | 1740.06 | |

| Liabilities | 16632.51 | 16187.77 | 16366.76 | 16447.50 | 15873.03 | 15590.15 | 15742.76 | 15440.79 | 16156.00 | 16351.53 | 15904.84 | 15622.22 | 15238.10 | 14640.63 | 14561.07 | 13187.58 | 12618.43 | 12660.19 | 12459.58 | 11911.18 | 8243.53 | 8324.28 | 8478.77 | 7456.31 | 7348.44 | 7609.65 | 7334.39 | 5334.15 | 5180.44 | 5023.94 | 4817.17 | 4645.71 | 4427.69 | 3910.08 | 3816.28 | 3707.64 | 3591.79 | 3246.37 | 3163.22 | 2101.17 | 1930.21 | 1736.24 | 1691.67 | 1639.99 | 1615.55 | |

| Liabilities And Stockholders Equity | 19035.10 | 18519.87 | 18719.80 | 18798.35 | 18258.41 | 17944.49 | 18107.09 | 17963.25 | 18732.65 | 18918.22 | 18447.72 | 18115.34 | 17753.48 | 17117.01 | 16986.03 | 15573.87 | 14958.21 | 14959.13 | 14708.92 | 14145.38 | 9849.97 | 9891.46 | 10017.04 | 8811.01 | 8684.46 | 8891.11 | 8593.98 | 6022.61 | 5852.80 | 5667.19 | 5446.80 | 5261.97 | 5055.00 | 4478.34 | 4375.73 | 4258.36 | 4132.64 | 3746.68 | 3654.31 | 2353.68 | 2163.98 | 1954.75 | 1905.85 | 1764.13 | 1740.06 | |

| Stockholders Equity | 2402.59 | 2332.10 | 2353.04 | 2350.86 | 2385.38 | 2354.34 | 2364.34 | 2522.46 | 2576.65 | 2566.69 | 2542.89 | 2493.12 | 2515.37 | 2476.37 | 2424.96 | 2386.28 | 2339.77 | 2298.93 | 2249.34 | 2234.20 | 1606.43 | 1567.18 | 1538.27 | 1354.70 | 1336.02 | 1281.46 | 1259.59 | 688.47 | 672.37 | 643.25 | 629.63 | 616.26 | 603.37 | 568.26 | 559.45 | 550.73 | 540.85 | 500.31 | 491.09 | 252.51 | 233.77 | 218.51 | 214.18 | 124.14 | 124.51 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 721.99 | NA | NA | NA | 654.32 | NA | NA | NA | 2608.44 | NA | NA | NA | 1813.99 | NA | NA | NA | 565.17 | NA | NA | NA | 130.78 | 290.17 | 447.05 | 398.10 | 431.10 | 763.02 | 579.90 | 515.12 | 505.03 | 589.60 | 436.61 | 356.53 | 293.28 | 353.95 | 424.20 | 358.80 | 324.05 | 249.77 | 192.53 | 97.72 | 93.05 | 120.28 | 126.52 | 80.89 | 102.29 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 721.99 | 711.71 | 902.88 | 1048.59 | 654.32 | 516.16 | 776.13 | 1604.26 | 2608.44 | 3059.83 | 2794.70 | 2416.87 | 1813.99 | 1453.73 | 1605.91 | 948.91 | 565.17 | 570.10 | 579.45 | 431.80 | 130.78 | 290.17 | 447.05 | 398.10 | 431.10 | NA | NA | NA | 505.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Land | 81.22 | NA | NA | NA | 81.57 | NA | NA | NA | 78.90 | NA | NA | NA | 65.10 | NA | NA | NA | 58.64 | NA | NA | NA | 43.75 | NA | NA | NA | 45.05 | NA | NA | NA | 19.80 | NA | NA | NA | 20.08 | NA | NA | NA | 19.42 | NA | NA | NA | 14.55 | NA | NA | NA | 14.55 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 450.99 | NA | NA | NA | 434.80 | NA | NA | NA | 380.00 | NA | NA | NA | 311.99 | NA | NA | NA | 298.33 | NA | NA | NA | 218.12 | NA | NA | NA | 194.62 | NA | NA | NA | 129.19 | NA | NA | NA | 126.32 | NA | NA | NA | 116.76 | NA | NA | NA | 95.62 | NA | NA | NA | 89.86 | |

| Furniture And Fixtures Gross | 68.46 | NA | NA | NA | 59.98 | NA | NA | NA | 47.58 | NA | NA | NA | 39.28 | NA | NA | NA | 39.85 | NA | NA | NA | 34.60 | NA | NA | NA | 31.29 | NA | NA | NA | 27.26 | NA | NA | NA | 23.63 | NA | NA | NA | 21.36 | NA | NA | NA | 16.24 | NA | NA | NA | 13.88 | |

| Leasehold Improvements Gross | 9.30 | NA | NA | NA | 6.42 | NA | NA | NA | 5.83 | NA | NA | NA | 5.80 | NA | NA | NA | 5.47 | NA | NA | NA | 4.64 | NA | NA | NA | 2.08 | NA | NA | NA | 1.75 | NA | NA | NA | 1.71 | NA | NA | NA | 1.42 | NA | NA | NA | 0.64 | NA | NA | NA | 0.72 | |

| Construction In Progress Gross | 7.22 | NA | NA | NA | 3.67 | NA | NA | NA | 45.26 | NA | NA | NA | 0.92 | NA | NA | NA | 0.83 | NA | NA | NA | 32.40 | NA | NA | NA | 0.25 | NA | NA | NA | 0.02 | NA | NA | NA | 0.64 | NA | NA | NA | 0.03 | NA | NA | NA | 0.04 | NA | NA | NA | 7.35 | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 95.16 | NA | NA | NA | 79.43 | NA | NA | NA | 71.97 | NA | NA | NA | 62.52 | NA | NA | NA | 55.46 | NA | NA | NA | 50.26 | NA | NA | NA | 46.78 | NA | NA | NA | 39.29 | NA | NA | NA | 33.31 | NA | NA | NA | 27.86 | NA | NA | NA | 22.88 | NA | NA | NA | 19.27 | |

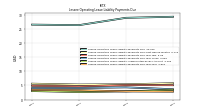

| Amortization Of Intangible Assets | 3.11 | 3.11 | 3.11 | 3.11 | 3.11 | 3.12 | 3.12 | 3.15 | 3.15 | 3.15 | 3.15 | 3.15 | 3.15 | 3.17 | 3.17 | 3.18 | 3.17 | 3.23 | 3.23 | 3.23 | 1.50 | 1.52 | 1.39 | 1.33 | 1.33 | 1.41 | 1.41 | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.45 | 0.36 | 0.37 | 0.37 | 0.42 | 0.36 | 0.30 | 0.20 | 0.18 | 0.17 | 0.18 | 0.18 | 0.18 | |

| Property Plant And Equipment Net | 355.83 | 355.53 | 354.94 | 354.54 | 355.37 | 343.00 | 337.68 | 324.00 | 308.02 | 262.77 | 252.88 | 250.00 | 249.47 | 242.72 | 243.31 | 245.54 | 242.87 | 240.99 | 244.52 | 242.56 | 167.87 | 156.32 | 155.19 | 147.37 | 147.84 | 155.74 | 151.18 | 88.29 | 89.90 | 89.93 | 93.15 | 92.60 | 93.02 | 91.15 | 88.12 | 88.16 | 88.90 | 81.79 | 81.29 | 74.46 | 72.73 | 73.51 | 73.62 | 72.90 | 70.58 | |

| Goodwill | 994.02 | 994.02 | 994.02 | 994.02 | 994.02 | 994.02 | 994.02 | 994.02 | 994.02 | 994.02 | 994.02 | 994.02 | 994.02 | 994.02 | 994.02 | 994.02 | 994.02 | 994.02 | 994.10 | 992.38 | 721.80 | 721.78 | 721.58 | 621.46 | 621.46 | 606.70 | 607.26 | 258.32 | 258.32 | 258.32 | 258.32 | 258.32 | 258.64 | 229.82 | 229.82 | 229.64 | 229.46 | 207.61 | 207.18 | 42.58 | 34.70 | 28.74 | 28.74 | 28.74 | 28.74 | |

| Intangible Assets Net Excluding Goodwill | 50.56 | 53.67 | 56.78 | 59.89 | 63.00 | 66.11 | 69.23 | 72.34 | 75.49 | 78.64 | 81.78 | 84.92 | 88.07 | 91.22 | 94.39 | 97.56 | 100.74 | 106.86 | 110.09 | 113.33 | 45.04 | 46.53 | 48.05 | 41.91 | 43.24 | 47.20 | 48.99 | 13.69 | 14.18 | 14.67 | 15.16 | 15.65 | 16.36 | 11.35 | 11.72 | 12.08 | 12.46 | 10.42 | 10.78 | 3.81 | 3.15 | 2.72 | 2.90 | 3.08 | 3.25 | |

| Finite Lived Intangible Assets Net | 50.56 | NA | NA | NA | 63.00 | NA | NA | NA | 75.49 | NA | NA | NA | 88.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 171.00 | 148.50 | 166.25 | 167.75 | 162.24 | 156.51 | 167.48 | 173.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | 205.23 | 205.69 | 206.15 | 206.60 | 207.06 | 207.52 | 207.97 | 188.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Ten Years Fair Value | 171.00 | 148.50 | 166.25 | 167.75 | 162.24 | 156.51 | 167.48 | 173.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | 4040.40 | NA | NA | NA | 951.73 | NA | NA | NA | 928.26 | NA | NA | NA | 1263.63 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 15723.03 | 15340.97 | 14873.51 | 14055.69 | 15121.42 | 14961.01 | 15063.95 | 14850.27 | 15553.91 | 15524.18 | 15063.79 | 14803.79 | 14398.93 | 13797.56 | 13299.03 | 11882.77 | 11941.34 | 11727.89 | 11530.59 | 11239.43 | 7737.79 | 7782.85 | 7533.40 | 6794.66 | 6632.82 | 6872.63 | 6669.29 | 4722.20 | 4577.11 | 4416.49 | 4208.40 | 4171.95 | 4028.28 | 3534.04 | 3467.48 | 3386.68 | 3249.60 | 2813.66 | 2853.42 | 1890.68 | 1710.32 | 1540.75 | 1485.13 | 1415.10 | 1390.74 |

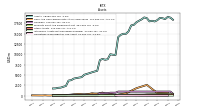

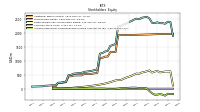

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 2402.59 | 2332.10 | 2353.04 | 2350.86 | 2385.38 | 2354.34 | 2364.34 | 2522.46 | 2576.65 | 2566.69 | 2542.89 | 2493.12 | 2515.37 | 2476.37 | 2424.96 | 2386.28 | 2339.77 | 2298.93 | 2249.34 | 2234.20 | 1606.43 | 1567.18 | 1538.27 | 1354.70 | 1336.02 | 1281.46 | 1259.59 | 688.47 | 672.37 | 643.25 | 629.63 | 616.26 | 603.37 | 568.26 | 559.45 | 550.73 | 540.85 | 500.31 | 491.09 | 252.51 | 233.77 | 218.51 | 214.18 | 124.14 | 124.51 | |

| Common Stock Value | 0.41 | 0.41 | 0.41 | 0.41 | 0.41 | 0.41 | 0.41 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.44 | 0.31 | 0.30 | 0.30 | 0.28 | 0.28 | 0.28 | 0.28 | 0.19 | 0.19 | 0.18 | 0.18 | 0.18 | 0.18 | 0.17 | 0.17 | 0.17 | 0.17 | 0.16 | 0.16 | 0.13 | 0.12 | 0.12 | 0.12 | 0.08 | 0.08 | |

| Additional Paid In Capital | 1966.69 | 1964.76 | 1964.34 | 1961.64 | 1959.19 | 1955.10 | 1951.32 | 1947.91 | 1945.50 | 1942.78 | 1940.36 | 1938.01 | 1934.81 | 1932.69 | 1930.72 | 1928.24 | 1926.36 | 1924.38 | 1922.47 | 1920.72 | 1317.62 | 1313.98 | 1312.43 | 1153.55 | 1151.99 | 1109.88 | 1108.61 | 556.35 | 555.33 | 534.45 | 533.37 | 531.24 | 530.11 | 479.62 | 478.50 | 477.56 | 476.61 | 445.38 | 444.34 | 235.22 | 222.12 | 209.84 | 209.40 | 88.97 | 88.79 | |

| Retained Earnings Accumulated Deficit | 616.72 | 617.67 | 600.83 | 583.53 | 638.35 | 613.89 | 578.20 | 657.15 | 625.48 | 600.99 | 579.59 | 535.38 | 543.80 | 504.13 | 454.88 | 426.94 | 393.67 | 354.18 | 309.31 | 309.57 | 296.82 | 267.12 | 235.69 | 210.03 | 184.23 | 167.82 | 147.09 | 131.73 | 117.95 | 105.02 | 92.00 | 81.67 | 70.70 | 61.67 | 54.90 | 45.75 | 37.73 | 28.71 | 20.80 | 16.71 | 12.66 | 9.11 | 5.87 | 33.62 | 33.29 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -181.23 | -250.75 | -212.54 | -194.72 | -212.58 | -215.06 | -165.59 | -83.03 | 5.24 | 22.49 | 22.51 | 19.30 | 36.33 | 39.12 | 38.93 | 30.67 | 19.31 | 19.94 | 17.12 | 3.47 | -8.30 | -14.22 | -10.16 | -9.17 | -0.49 | 3.48 | 3.62 | 0.20 | -1.10 | 3.60 | 4.08 | 3.17 | 2.38 | 2.86 | 1.95 | 3.30 | 2.40 | 2.12 | 1.85 | 0.45 | -1.13 | -0.56 | -1.21 | 1.69 | 2.58 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 1.92 | 0.42 | 2.70 | 2.44 | 4.10 | 3.78 | 3.41 | 2.41 | 2.71 | 2.42 | 2.35 | 3.21 | 2.12 | 1.97 | 2.48 | 1.88 | 1.97 | 1.91 | 1.75 | 2.17 | 1.57 | 1.54 | 1.54 | 1.41 | 1.25 | 1.28 | 1.20 | 0.97 | 0.90 | 0.89 | 2.42 | 1.22 | 1.10 | 1.11 | 1.00 | 1.10 | 0.90 | 0.84 | 0.78 | 0.39 | 0.42 | 0.46 | 0.41 | 0.18 | 0.20 |

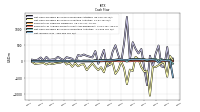

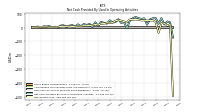

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

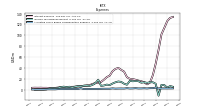

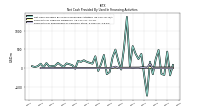

| Net Cash Provided By Used In Operating Activities | 44.72 | 23.30 | 69.00 | 28.25 | 68.61 | 68.00 | 59.31 | 21.31 | 67.72 | 62.84 | 68.98 | 77.89 | 68.19 | 51.18 | -5.49 | 40.42 | 34.43 | 60.99 | 40.29 | 37.61 | 53.14 | 29.03 | 35.09 | 41.49 | 12.55 | 39.06 | 4.26 | 26.92 | 19.46 | 26.20 | 10.63 | 24.00 | 9.16 | 18.07 | 14.76 | 4.31 | 16.64 | 15.66 | 1.27 | 7.04 | 2.39 | 10.81 | 8.13 | 9.43 | 1.77 | |

| Net Cash Provided By Used In Investing Activities | -475.70 | -32.08 | -59.32 | -120.99 | -174.62 | -165.34 | -1059.84 | -288.84 | -320.68 | -177.71 | 65.35 | 138.57 | -297.16 | -255.00 | -706.51 | -212.72 | -1.57 | -259.59 | -387.80 | -25.02 | -110.27 | -25.47 | -337.91 | -183.06 | -270.15 | -173.07 | -59.05 | -160.06 | -272.71 | -84.16 | -98.92 | -153.52 | -53.49 | -166.42 | -52.97 | -96.25 | 22.13 | -38.75 | -46.41 | -64.29 | -87.21 | -60.06 | -97.72 | -51.28 | -59.92 | |

| Net Cash Provided By Used In Financing Activities | 441.26 | -182.39 | -155.39 | 487.01 | 244.17 | -162.64 | 172.40 | -736.66 | -198.42 | 379.99 | 243.50 | 386.42 | 589.23 | 51.64 | 1369.01 | 556.03 | -37.79 | 189.25 | 495.16 | 288.44 | -102.25 | -160.44 | 351.77 | 108.57 | -74.32 | 317.12 | 119.57 | 143.24 | 168.68 | 210.96 | 168.37 | 192.77 | -16.34 | 78.11 | 103.61 | 126.69 | 35.51 | 80.34 | 139.94 | 61.92 | 57.59 | 43.02 | 135.22 | 20.45 | 117.65 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 44.72 | 23.30 | 69.00 | 28.25 | 68.61 | 68.00 | 59.31 | 21.31 | 67.72 | 62.84 | 68.98 | 77.89 | 68.19 | 51.18 | -5.49 | 40.42 | 34.43 | 60.99 | 40.29 | 37.61 | 53.14 | 29.03 | 35.09 | 41.49 | 12.55 | 39.06 | 4.26 | 26.92 | 19.46 | 26.20 | 10.63 | 24.00 | 9.16 | 18.07 | 14.76 | 4.31 | 16.64 | 15.66 | 1.27 | 7.04 | 2.39 | 10.81 | 8.13 | 9.43 | 1.77 | |

| Net Income Loss | 14.86 | 32.77 | 33.08 | -37.51 | 40.75 | 52.44 | 52.36 | 50.74 | 54.19 | 52.34 | 58.24 | 59.98 | 58.27 | 60.08 | 38.69 | 44.17 | 50.24 | 55.63 | 49.74 | 37.13 | 33.96 | 35.70 | 29.64 | 28.96 | 19.19 | 23.51 | 18.13 | 15.67 | 14.78 | 14.50 | 11.81 | 12.45 | 10.56 | 8.20 | 10.57 | 9.45 | 10.10 | 8.96 | 5.12 | 4.80 | 4.28 | 3.96 | 5.87 | 5.69 | 6.09 | |

| Share Based Compensation | 1.92 | 0.42 | 2.70 | 2.44 | 4.10 | 3.78 | 3.41 | 2.41 | 2.71 | 2.42 | 2.35 | 3.21 | 2.12 | 1.97 | 2.48 | 1.88 | 1.97 | 1.91 | 1.75 | 2.17 | 1.57 | 1.54 | 1.54 | 1.41 | 1.25 | 1.28 | 1.20 | 0.97 | 0.90 | 0.89 | 2.42 | 1.22 | 1.10 | 1.11 | 1.00 | 1.10 | 0.90 | 0.84 | 0.78 | 0.39 | 0.42 | 0.46 | 0.41 | 0.18 | 0.20 |

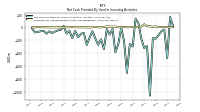

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -475.70 | -32.08 | -59.32 | -120.99 | -174.62 | -165.34 | -1059.84 | -288.84 | -320.68 | -177.71 | 65.35 | 138.57 | -297.16 | -255.00 | -706.51 | -212.72 | -1.57 | -259.59 | -387.80 | -25.02 | -110.27 | -25.47 | -337.91 | -183.06 | -270.15 | -173.07 | -59.05 | -160.06 | -272.71 | -84.16 | -98.92 | -153.52 | -53.49 | -166.42 | -52.97 | -96.25 | 22.13 | -38.75 | -46.41 | -64.29 | -87.21 | -60.06 | -97.72 | -51.28 | -59.92 | |

| Payments To Acquire Property Plant And Equipment | 5.17 | 5.38 | 6.69 | 3.75 | 16.99 | 9.65 | 16.88 | 19.44 | 48.61 | 12.96 | 5.98 | 3.81 | 10.01 | 2.65 | 2.53 | 5.95 | 4.99 | 0.41 | 14.69 | 11.60 | 13.61 | 14.56 | 8.34 | 1.59 | 1.57 | 9.87 | 1.60 | 0.15 | 1.46 | 1.12 | 2.29 | 1.27 | 2.28 | 7.21 | 1.51 | 2.78 | 1.43 | 1.85 | 1.29 | 0.28 | 0.63 | 1.13 | 1.75 | 3.28 | 3.42 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 441.26 | -182.39 | -155.39 | 487.01 | 244.17 | -162.64 | 172.40 | -736.66 | -198.42 | 379.99 | 243.50 | 386.42 | 589.23 | 51.64 | 1369.01 | 556.03 | -37.79 | 189.25 | 495.16 | 288.44 | -102.25 | -160.44 | 351.77 | 108.57 | -74.32 | 317.12 | 119.57 | 143.24 | 168.68 | 210.96 | 168.37 | 192.77 | -16.34 | 78.11 | 103.61 | 126.69 | 35.51 | 80.34 | 139.94 | 61.92 | 57.59 | 43.02 | 135.22 | 20.45 | 117.65 | |

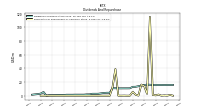

| Payments For Repurchase Of Common Stock | 0.12 | 0.42 | 0.02 | 1.62 | 0.58 | 1.05 | 115.32 | 2.79 | 14.21 | 16.26 | 0.18 | 1.49 | 5.66 | 0.01 | 0.00 | 0.14 | 0.01 | 0.04 | 39.10 | 12.51 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | NA | NA | 0.00 |