| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 | |

| Earnings Per Share Basic | 1.46 | 1.46 | 1.45 | 1.45 | 1.47 | 1.33 | 1.42 | 1.35 | 1.18 | 1.24 | 1.21 | 1.07 | 0.91 | 0.87 | 0.73 | 0.72 | 0.79 | 0.56 | 0.31 | 0.34 | 0.24 | 0.22 | 0.18 | 0.10 | 0.08 | 0.09 | -0.13 | |

| Earnings Per Share Diluted | 1.45 | 1.45 | 1.44 | 1.43 | 1.46 | 1.32 | 1.42 | 1.32 | 1.14 | 1.20 | 1.17 | 1.05 | 0.91 | 0.86 | 0.73 | 0.72 | 0.78 | 0.55 | 0.30 | 0.33 | 0.24 | 0.21 | 0.17 | 0.09 | 0.08 | 0.09 | -0.13 |

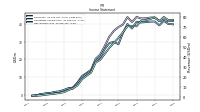

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 79.16 | 77.83 | 76.46 | 76.07 | 70.46 | 70.88 | 70.51 | 64.50 | 58.94 | 53.86 | 48.87 | 42.88 | 37.09 | 34.33 | 24.35 | 21.13 | 17.67 | 11.55 | 8.62 | 6.82 | 4.78 | 3.93 | 3.31 | 2.76 | 2.28 | 1.56 | 1.29 | |

| Operating Expenses | 35.20 | 33.98 | 33.03 | 32.71 | 29.82 | 29.53 | 26.37 | 24.63 | 20.48 | 17.56 | 15.93 | 15.21 | 14.23 | 13.90 | 10.17 | 8.85 | 7.07 | 4.73 | 4.54 | 3.38 | 2.98 | 2.35 | 2.08 | 2.04 | 1.71 | 1.26 | 1.75 | |

| General And Administrative Expense | 10.91 | 10.98 | 10.57 | 10.37 | 10.23 | 10.80 | 8.71 | 8.78 | 6.45 | 5.31 | 5.60 | 5.60 | 4.49 | 3.34 | 3.01 | 3.35 | 3.15 | 2.16 | 2.59 | 1.92 | 1.98 | 1.44 | 1.47 | 1.48 | 1.29 | 0.98 | 1.47 | |

| Operating Income Loss | 43.96 | 43.85 | 43.42 | 43.36 | 44.24 | 41.36 | 44.14 | 39.88 | 38.46 | 36.29 | 32.94 | 27.68 | 22.86 | 20.42 | 14.18 | 12.28 | 10.60 | 6.82 | 4.07 | 3.44 | 1.81 | 1.57 | 1.24 | 0.72 | 0.57 | 0.29 | -0.47 | |

| Interest Expense | 4.14 | 4.33 | 4.47 | 4.52 | 4.52 | 4.51 | 4.50 | 4.77 | 6.21 | 6.31 | 3.69 | 1.87 | 1.87 | 1.86 | 1.85 | 1.85 | 1.84 | 1.84 | 1.83 | 0.79 | NA | 0.00 | 0.00 | 0.00 | NA | NA | NA | |

| Interest Paid Net | 7.87 | -0.08 | 8.22 | 0.12 | 8.25 | 0.12 | 8.25 | 0.63 | 8.99 | 2.69 | 0.00 | 2.69 | 0.00 | 2.69 | 0.00 | 2.69 | -0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | 41.63 | 41.59 | 41.27 | 41.09 | 41.51 | 37.62 | 40.21 | 35.05 | 28.63 | 30.09 | 29.34 | 25.93 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 41.63 | 41.59 | 41.27 | 41.09 | 41.51 | 37.62 | 40.21 | 35.05 | 28.63 | 30.09 | 29.34 | 25.93 | 21.33 | 19.21 | 13.31 | 11.87 | 9.90 | 6.52 | 3.41 | 3.64 | 2.67 | 1.83 | 1.54 | 0.94 | 0.61 | 0.33 | -0.42 | |

| Preferred Stock Dividends Income Statement Impact | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.32 | 0.00 | 0.00 | |

| Net Income Loss Available To Common Stockholders Basic | 41.30 | 41.26 | 40.93 | 40.75 | 41.17 | 37.28 | 39.88 | 34.71 | 28.29 | 29.76 | 29.00 | 25.59 | 21.00 | 18.88 | 12.97 | 11.53 | 9.56 | 6.18 | 3.07 | 3.30 | 2.33 | 1.49 | 1.20 | 0.61 | 0.32 | 0.32 | -0.44 | |

| Net Income Loss Available To Common Stockholders Diluted | 40.96 | 40.93 | 40.61 | 40.46 | 41.03 | 37.14 | 39.74 | 34.84 | 30.03 | 31.49 | 30.74 | 27.34 | 20.86 | 18.74 | 12.85 | 11.42 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

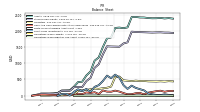

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 2391.09 | 2389.42 | 2396.26 | 2413.24 | 2414.84 | 2430.73 | 2425.68 | 2108.11 | 2084.60 | 2102.09 | 2090.85 | 1797.93 | 1768.08 | 1499.85 | 1179.15 | 1080.47 | 745.86 | 623.15 | 430.72 | 420.41 | 281.47 | 166.21 | 161.70 | 158.90 | 80.03 | 70.14 | 63.91 | |

| Liabilities | 438.12 | 440.75 | 443.04 | 455.09 | 452.94 | 463.82 | 449.91 | 461.45 | 472.90 | 590.95 | 575.68 | 280.31 | 243.11 | 229.85 | 209.18 | 221.49 | 197.85 | 173.37 | 164.53 | 152.03 | 17.17 | 15.12 | 10.11 | 7.18 | 6.48 | 10.18 | 3.93 | |

| Liabilities And Stockholders Equity | 2391.09 | 2389.42 | 2396.26 | 2413.24 | 2414.84 | 2430.73 | 2425.68 | 2108.11 | 2084.60 | 2102.09 | 2090.85 | 1797.93 | 1768.08 | 1499.85 | 1179.15 | 1080.47 | 745.86 | 623.15 | 430.72 | 420.41 | 281.47 | 166.21 | 161.70 | 158.90 | 80.03 | 70.14 | 63.91 | |

| Stockholders Equity | 1952.97 | 1948.67 | 1953.22 | 1958.15 | 1961.89 | 1966.91 | 1975.77 | 1646.66 | 1611.70 | 1511.13 | 1515.17 | 1517.62 | 1524.97 | 1270.00 | 969.97 | 858.98 | 548.01 | 449.78 | 266.19 | 268.38 | 264.29 | 151.09 | 151.59 | 151.71 | 73.55 | 59.96 | 59.98 |

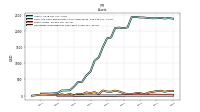

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 140.25 | 117.03 | 92.60 | 37.65 | 87.12 | 76.94 | 45.43 | 43.09 | 81.10 | 127.30 | 156.31 | 122.13 | 126.01 | 161.07 | 50.17 | 108.26 | 82.24 | 99.92 | 47.43 | 59.22 | 13.05 | 53.02 | 21.18 | 42.08 | 11.76 | 22.20 | 25.76 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 141.70 | 118.48 | 94.05 | 39.10 | 88.57 | 78.52 | 45.96 | 45.02 | 86.42 | 127.30 | 156.31 | 122.13 | 126.01 | 161.07 | 61.64 | 131.29 | 117.32 | 109.27 | 57.45 | 59.22 | 13.05 | 53.02 | 21.18 | NA | 11.76 | NA | NA | |

| Short Term Investments | 21.95 | 41.88 | 72.73 | 163.97 | 200.94 | 239.67 | 309.44 | 209.94 | 324.89 | 554.42 | 649.35 | 539.32 | 619.27 | 451.18 | 323.25 | 272.91 | 119.59 | 208.83 | 138.73 | 197.73 | 120.44 | 3.98 | 57.42 | 48.86 | 0.00 | NA | NA | |

| Land | 142.52 | 142.52 | 142.52 | 142.52 | 139.95 | 140.19 | 136.12 | 131.93 | 122.39 | 98.93 | 91.66 | 79.99 | 75.66 | 68.03 | 58.47 | 51.71 | 48.65 | 37.96 | 28.49 | 22.56 | 20.48 | 17.81 | 14.82 | 11.51 | 11.51 | 10.38 | 10.38 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Construction In Progress Gross | 117.77 | 107.77 | 117.41 | 108.46 | 54.11 | 60.55 | 68.91 | NA | NA | 4.58 | 3.83 | 2.43 | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.67 | 6.30 | 4.68 | 4.37 | NA | 0.00 | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 0.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

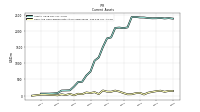

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 1952.97 | 1948.67 | 1953.22 | 1958.15 | 1961.89 | 1966.91 | 1975.77 | 1646.66 | 1611.70 | 1511.13 | 1515.17 | 1517.62 | 1524.97 | 1270.00 | 969.97 | 858.98 | 548.01 | 449.78 | 266.19 | 268.38 | 264.29 | 151.09 | 151.59 | 151.71 | 73.55 | 59.96 | 59.98 | |

| Common Stock Value | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 | |

| Additional Paid In Capital Common Stock | 2095.79 | 2081.29 | 2076.36 | 2071.47 | 2065.25 | 2060.94 | 2056.57 | 1718.23 | 1672.88 | 1562.10 | 1559.91 | 1557.78 | 1559.06 | 1295.35 | 988.22 | 870.43 | 553.93 | 452.63 | 266.36 | 265.73 | 250.27 | 137.22 | 139.55 | 141.22 | 64.00 | 65.03 | 65.38 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

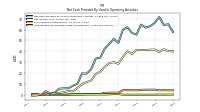

| Net Cash Provided By Used In Operating Activities | 66.08 | 63.08 | 61.76 | 64.62 | 55.35 | 56.79 | 62.10 | 59.88 | 47.79 | 51.57 | 46.78 | 42.61 | 34.24 | 33.47 | 23.54 | 19.57 | 19.85 | 10.47 | 8.46 | 6.16 | 6.14 | 5.86 | 2.34 | 1.35 | 3.52 | -0.00 | 0.88 | |

| Net Cash Provided By Used In Investing Activities | -0.79 | 12.43 | 44.25 | -62.68 | 5.54 | 25.23 | -345.88 | -81.09 | -50.62 | -46.32 | -274.12 | -13.03 | -305.83 | -220.24 | -192.75 | -308.30 | -103.20 | -138.19 | -5.39 | -93.84 | -157.31 | 28.01 | -21.20 | -48.76 | -27.45 | -3.02 | -8.17 | |

| Net Cash Provided By Used In Financing Activities | -42.08 | -51.08 | -51.06 | -51.41 | -50.84 | -49.47 | 284.72 | -20.18 | -38.05 | -34.26 | 261.52 | -33.45 | 236.53 | 286.20 | 99.56 | 302.70 | 91.40 | 179.54 | -4.84 | 133.86 | 111.20 | -2.03 | -2.03 | 77.73 | 13.48 | -0.53 | -0.30 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 66.08 | 63.08 | 61.76 | 64.62 | 55.35 | 56.79 | 62.10 | 59.88 | 47.79 | 51.57 | 46.78 | 42.61 | 34.24 | 33.47 | 23.54 | 19.57 | 19.85 | 10.47 | 8.46 | 6.16 | 6.14 | 5.86 | 2.34 | 1.35 | 3.52 | -0.00 | 0.88 | |

| Net Income Loss | 41.63 | 41.59 | 41.27 | 41.09 | 41.51 | 37.62 | 40.21 | 35.05 | 28.63 | 30.09 | 29.34 | 25.93 | 21.33 | 19.21 | 13.31 | 11.87 | 9.90 | 6.52 | 3.41 | 3.64 | 2.67 | 1.83 | 1.54 | 0.94 | 0.61 | 0.33 | -0.42 | |

| Profit Loss | 41.63 | 41.59 | 41.27 | 41.09 | 41.51 | 37.62 | 40.21 | 35.05 | 28.63 | 30.09 | 29.34 | 25.93 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Depreciation Depletion And Amortization | 17.10 | 16.68 | 16.70 | 16.71 | 16.30 | 15.90 | 15.23 | 13.87 | 12.21 | 10.89 | 9.84 | 8.84 | 8.73 | 7.65 | 6.75 | 4.91 | 3.54 | 2.22 | 1.61 | 1.22 | 0.91 | 0.70 | 0.54 | 0.48 | 0.36 | 0.22 | 0.17 | |

| Share Based Compensation | 4.93 | 4.93 | 4.88 | 4.83 | 4.31 | 4.38 | 4.44 | 4.38 | 2.19 | 2.19 | 2.13 | 2.10 | 0.84 | 0.84 | 0.82 | 0.82 | 0.65 | 0.66 | 0.62 | 0.56 | 0.39 | 0.39 | 0.36 | 0.33 | 0.17 | 0.17 | 0.60 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -0.79 | 12.43 | 44.25 | -62.68 | 5.54 | 25.23 | -345.88 | -81.09 | -50.62 | -46.32 | -274.12 | -13.03 | -305.83 | -220.24 | -192.75 | -308.30 | -103.20 | -138.19 | -5.39 | -93.84 | -157.31 | 28.01 | -21.20 | -48.76 | -27.45 | -3.02 | -8.17 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

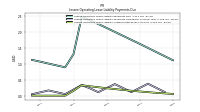

| Net Cash Provided By Used In Financing Activities | -42.08 | -51.08 | -51.06 | -51.41 | -50.84 | -49.47 | 284.72 | -20.18 | -38.05 | -34.26 | 261.52 | -33.45 | 236.53 | 286.20 | 99.56 | 302.70 | 91.40 | 179.54 | -4.84 | 133.86 | 111.20 | -2.03 | -2.03 | 77.73 | 13.48 | -0.53 | -0.30 | |

| Payments Of Dividends Common Stock | 50.74 | 50.74 | 50.73 | 50.50 | 50.50 | 49.10 | 45.83 | 38.51 | 35.98 | 33.58 | 31.66 | 29.73 | 25.99 | 19.77 | 17.07 | 12.64 | 8.87 | 5.88 | 4.41 | 3.42 | 2.38 | 1.70 | 1.70 | 0.88 | 0.53 | 0.53 | 0.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 79.16 | 77.83 | 76.46 | 76.07 | 70.46 | 70.88 | 70.51 | 64.50 | 58.94 | 53.86 | 48.87 | 42.88 | 37.09 | 34.33 | 24.35 | 21.13 | 17.67 | 11.55 | 8.62 | 6.82 | 4.78 | 3.93 | 3.31 | 2.76 | 2.28 | 1.56 | 1.29 |