| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.69 | 0.69 | 0.69 | 0.69 | 0.69 | 0.69 | 0.70 | 0.68 | 0.61 | 0.56 | 0.56 | 0.56 | 0.56 | 0.56 | 0.56 | 0.57 | 0.57 | 0.57 | 0.57 | 0.57 | 0.58 | 0.58 | 0.53 | 0.53 | 0.54 | 0.54 | 0.54 | 0.32 | 0.24 | |

| Weighted Average Number Of Diluted Shares Outstanding | 69.38 | 69.12 | 69.12 | 69.10 | 69.11 | 69.38 | 68.55 | 69.40 | 59.45 | 56.01 | 55.91 | 55.73 | 55.67 | 55.63 | 55.50 | 57.35 | 57.60 | 57.55 | 57.51 | 57.48 | 58.25 | 55.92 | 53.07 | 53.38 | 53.69 | 53.70 | 46.63 | 26.88 | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 69.38 | 69.12 | 69.12 | 69.10 | 69.11 | 69.38 | 68.55 | 63.09 | 59.36 | 55.64 | 55.63 | 55.62 | 55.62 | 55.49 | 55.49 | 57.35 | 57.49 | 57.42 | 57.41 | 57.39 | 58.18 | 55.90 | 53.06 | 53.34 | 53.69 | 53.70 | 46.63 | 26.88 | NA | |

| Earnings Per Share Basic | -0.27 | 0.31 | -0.37 | -0.45 | 0.21 | -0.70 | 0.28 | 0.47 | 0.59 | 0.57 | 0.53 | 0.52 | 0.52 | 0.56 | 0.52 | -0.61 | 0.43 | 0.41 | 0.30 | 0.43 | 0.32 | 0.37 | 0.44 | 0.44 | 0.32 | 0.32 | 0.30 | 0.39 | 0.49 | |

| Earnings Per Share Diluted | -0.27 | 0.31 | -0.37 | -0.45 | 0.21 | -0.70 | 0.28 | 0.46 | 0.59 | 0.57 | 0.52 | 0.52 | 0.52 | 0.56 | 0.52 | -0.61 | 0.43 | 0.41 | 0.30 | 0.43 | 0.33 | 0.37 | 0.44 | 0.44 | 0.32 | 0.32 | 0.30 | 0.39 | 0.49 |

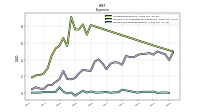

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Interest And Fee Income Loans And Leases | 165.02 | 163.23 | 159.63 | 152.53 | 143.51 | 114.63 | 90.60 | 73.23 | 72.72 | 75.32 | 67.15 | 64.77 | 63.20 | 67.69 | 67.22 | 71.08 | 72.42 | 74.22 | 62.94 | 64.75 | 59.62 | 51.90 | 40.36 | 31.69 | 28.39 | 24.41 | 17.45 | 12.91 | 11.78 | |

| Operating Costs And Expenses | 63.58 | 23.06 | 70.87 | 76.25 | 36.57 | 94.08 | 24.98 | 11.79 | 9.06 | 12.00 | 10.37 | 8.40 | 6.61 | 8.65 | 8.15 | 64.95 | 8.13 | 6.98 | 8.21 | 7.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| General And Administrative Expense | 4.60 | 4.79 | 4.71 | 4.69 | 4.58 | 4.29 | 4.31 | 4.45 | 3.38 | 3.66 | 3.69 | 3.50 | 2.86 | 3.56 | 4.05 | 3.77 | 2.68 | 2.70 | 2.78 | 2.36 | 1.81 | 1.65 | 1.69 | 2.66 | 1.68 | 1.34 | 0.96 | 0.95 | 0.52 | |

| Interest Expense | 118.53 | 118.62 | 115.68 | 105.98 | 91.59 | 67.31 | 44.73 | 32.46 | 30.27 | 29.83 | 26.96 | 27.38 | 28.84 | 28.83 | 30.56 | 39.08 | 41.33 | 45.60 | 37.09 | 34.84 | 32.19 | 23.34 | 18.80 | 10.69 | 8.63 | 5.41 | 3.23 | 3.95 | 3.46 | |

| Interest Income Expense Net | 46.49 | 44.61 | 43.95 | 46.55 | 51.92 | 47.32 | 45.87 | 40.77 | 42.45 | 45.49 | 40.19 | 37.38 | 34.37 | 38.86 | 36.66 | 32.00 | 31.08 | 28.63 | 25.86 | 29.91 | 27.43 | 28.56 | 21.57 | 21.00 | 19.75 | 18.99 | 14.22 | 8.95 | 8.32 | |

| Interest Paid Net | 111.98 | 110.94 | 112.01 | 95.34 | 81.77 | 55.88 | 38.65 | 24.71 | 25.76 | 23.20 | 25.73 | 20.56 | 24.69 | 16.93 | 28.41 | 33.38 | 40.16 | 38.54 | 36.62 | 30.83 | 25.61 | 18.16 | 14.18 | 8.82 | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 0.20 | 0.17 | 0.18 | 0.17 | 0.06 | NA | NA | NA | 0.43 | 0.11 | 0.10 | 0.05 | 0.16 | 0.10 | 0.08 | 0.08 | 0.21 | 0.08 | 0.28 | 0.01 | -0.30 | 0.09 | -0.03 | 0.17 | 0.71 | 0.12 | 0.15 | 0.12 | 0.14 | |

| Income Taxes Paid | 0.00 | 0.16 | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | NA | NA | 0.07 | 0.05 | 0.00 | 0.00 | 0.03 | 0.03 | 0.21 | 0.13 | 0.00 | 0.08 | 0.58 | 0.10 | 0.55 | 0.18 | 0.06 | 0.00 | 0.06 | |

| Profit Loss | -13.11 | 26.83 | -20.12 | -25.25 | 20.10 | -42.91 | 25.00 | 35.41 | 40.34 | 35.67 | 31.08 | 30.09 | 28.86 | 31.19 | 28.93 | -34.57 | 24.51 | 23.86 | 17.35 | 24.25 | 21.43 | 20.97 | 23.98 | 23.43 | 17.18 | 17.86 | 14.40 | 10.63 | 11.68 | |

| Net Income Loss | -12.89 | 27.14 | -20.03 | -25.08 | 20.33 | -42.75 | 25.06 | 35.47 | 40.34 | 35.67 | 31.08 | 30.09 | NA | NA | NA | NA | 24.51 | 23.86 | 17.35 | 24.25 | 21.43 | 20.97 | 23.95 | 23.39 | 17.10 | 17.43 | 14.16 | 10.38 | 11.41 | |

| Preferred Stock Dividends Income Statement Impact | 5.33 | 5.33 | 5.33 | NA | 5.33 | 5.33 | 5.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 1.72 | 0.15 | 0.47 | 0.11 | 0.06 | 0.09 | 0.07 | 0.01 | 0.00 | |

| Net Income Loss Available To Common Stockholders Basic | -18.74 | 21.40 | -25.77 | -30.81 | 14.60 | -48.42 | 19.39 | 29.80 | 35.20 | 31.99 | 29.26 | 29.18 | 28.78 | 31.35 | 28.59 | -35.16 | 24.79 | 23.62 | 17.38 | 24.70 | 19.71 | 20.82 | 23.48 | 23.28 | 17.03 | 17.34 | 14.08 | 10.36 | 11.41 | |

| Net Income Loss Available To Common Stockholders Diluted | -18.74 | 21.40 | -25.77 | -30.81 | 14.60 | -48.42 | 19.39 | 31.97 | 35.20 | 31.99 | 29.26 | 29.18 | 28.78 | 31.35 | 28.59 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

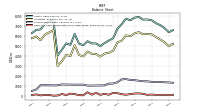

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

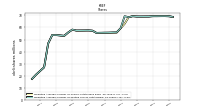

| Assets | 7547.62 | 7625.44 | 7609.24 | 7876.03 | 7802.32 | 7541.05 | 7713.61 | 7149.76 | 6703.24 | 5753.50 | 5523.34 | 5272.88 | 4965.61 | 5231.86 | 5235.61 | 5455.68 | 5057.02 | 5211.43 | 6184.90 | 5094.03 | 5231.85 | 4611.92 | 4031.73 | 7604.88 | 7394.89 | 7164.00 | 6630.37 | 6583.56 | 6265.40 | |

| Liabilities | 6143.44 | 6172.15 | 6149.51 | 6362.89 | 6230.89 | 5945.84 | 6037.16 | 5500.04 | 5341.66 | 4516.32 | 4296.53 | 4219.50 | 3920.21 | 4190.81 | 4203.10 | 4423.38 | 3933.31 | 4087.36 | 5060.87 | 3963.15 | 4096.66 | 3465.22 | 2979.34 | 6552.30 | 6331.71 | 6098.05 | 5553.66 | 5925.85 | 5757.34 | |

| Liabilities And Stockholders Equity | 7547.62 | 7625.44 | 7609.24 | 7876.03 | 7802.32 | 7541.05 | 7713.61 | 7149.76 | 6703.24 | 5753.50 | 5523.34 | 5272.88 | 4965.61 | 5231.86 | 5235.61 | 5455.68 | 5057.02 | 5211.43 | 6184.90 | 5094.03 | 5231.85 | 4611.92 | 4031.73 | 7604.88 | 7394.89 | 7164.00 | 6630.37 | 6583.56 | 6265.40 | |

| Stockholders Equity | 1404.77 | 1453.72 | 1459.86 | 1513.17 | 1571.54 | 1595.26 | 1676.33 | 1649.54 | 1361.43 | 1234.59 | 1224.49 | 1050.82 | 1043.55 | 1039.11 | 1030.23 | 1030.20 | 1122.02 | 1121.97 | 1122.00 | 1128.65 | 1132.34 | 1146.30 | 1051.11 | 1050.30 | 1059.14 | 1061.95 | 1065.23 | 646.91 | 497.70 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 135.90 | 108.04 | 207.70 | 254.10 | 239.79 | 183.34 | 118.02 | 173.18 | 271.49 | 307.73 | 119.17 | 209.35 | 110.83 | 301.38 | 127.25 | 369.87 | 67.62 | 74.52 | 182.73 | 228.44 | 86.53 | 192.77 | 40.76 | 23.12 | 103.12 | 89.98 | 57.01 | 153.62 | 96.19 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 148.31 | 121.63 | 222.92 | 266.32 | 250.62 | 190.64 | 125.67 | 174.89 | 273.77 | 309.32 | 119.17 | 209.35 | 110.83 | 301.38 | 127.25 | 369.87 | 67.62 | 74.52 | 182.73 | 228.44 | 86.53 | 192.77 | 40.76 | 23.12 | 103.52 | 90.58 | 57.91 | NA | 96.35 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Amortization Of Intangible Assets | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Minority Interest | -0.58 | -0.43 | -0.12 | -0.02 | -0.10 | -0.04 | 0.12 | 0.18 | 0.15 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 7.47 | 7.40 | 7.34 |

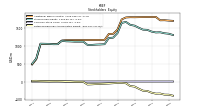

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 1404.77 | 1453.72 | 1459.86 | 1513.17 | 1571.54 | 1595.26 | 1676.33 | 1649.54 | 1361.43 | 1234.59 | 1224.49 | 1050.82 | 1043.55 | 1039.11 | 1030.23 | 1030.20 | 1122.02 | 1121.97 | 1122.00 | 1128.65 | 1132.34 | 1146.30 | 1051.11 | 1050.30 | 1059.14 | 1061.95 | 1065.23 | 646.91 | 497.70 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 1404.18 | 1453.30 | 1459.73 | 1513.14 | 1571.44 | 1595.21 | 1676.44 | 1649.72 | 1361.58 | 1234.59 | 1224.49 | 1050.82 | 1043.55 | 1039.11 | 1030.23 | 1030.20 | 1122.02 | 1121.97 | 1122.00 | 1128.65 | 1132.34 | 1146.30 | 1051.11 | 1050.30 | 1059.14 | 1061.95 | 1072.69 | 654.31 | 505.04 | |

| Common Stock Value | 0.69 | 0.69 | 0.69 | 0.69 | 0.69 | 0.69 | 0.70 | 0.68 | 0.61 | 0.56 | 0.56 | 0.56 | 0.56 | 0.56 | 0.56 | 0.57 | 0.57 | 0.57 | 0.57 | 0.57 | 0.58 | 0.58 | 0.53 | 0.53 | 0.54 | 0.54 | 0.54 | 0.32 | 0.24 | |

| Additional Paid In Capital | 1815.08 | 1815.49 | 1813.31 | 1811.13 | 1808.98 | 1810.15 | 1802.72 | 1747.34 | 1459.96 | 1341.99 | 1339.96 | 1171.69 | 1169.69 | 1170.11 | 1168.72 | 1167.60 | 1165.99 | 1166.02 | 1164.98 | 1164.32 | 1163.85 | 1154.11 | 1055.54 | 1053.87 | 1052.85 | 1052.83 | 1053.05 | 626.65 | 479.42 | |

| Retained Earnings Accumulated Deficit | -314.37 | -265.83 | -257.51 | -202.02 | -141.50 | -126.39 | -48.16 | -37.62 | -38.21 | -47.02 | -55.09 | -60.43 | -65.70 | -70.56 | -78.05 | -82.78 | -8.59 | -8.66 | -7.59 | -0.28 | -0.23 | 5.76 | 9.01 | 8.33 | 6.28 | 9.11 | 11.64 | 19.82 | 17.91 | |

| Treasury Stock Value | NA | NA | NA | NA | 96.76 | 89.32 | 79.07 | 61.00 | 61.00 | 61.00 | 61.00 | 61.00 | 61.00 | 61.00 | 61.00 | 55.20 | 35.96 | 35.96 | 35.96 | 35.96 | 31.85 | 14.15 | 13.97 | 12.44 | 0.52 | 0.52 | NA | NA | 0.00 | |

| Minority Interest | -0.58 | -0.43 | -0.12 | -0.02 | -0.10 | -0.04 | 0.12 | 0.18 | 0.15 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 7.47 | 7.40 | 7.34 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | NA | NA | NA | NA | NA | NA | NA | 2.13 | NA | NA | NA | 1.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.29 | -0.13 | 1.02 | 0.03 | 0.03 | NA | NA | NA |

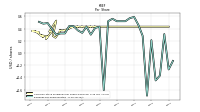

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

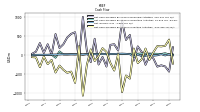

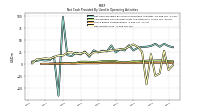

| Net Cash Provided By Used In Operating Activities | 36.84 | 41.77 | 35.47 | 41.63 | 37.17 | 35.57 | 35.25 | 33.13 | 27.93 | 38.75 | 27.84 | 30.27 | 23.64 | 38.38 | 25.67 | 27.38 | 23.47 | 28.06 | 14.57 | 25.61 | 19.40 | 23.36 | 15.99 | 18.07 | 97.73 | -66.55 | 14.95 | 7.67 | 6.86 | |

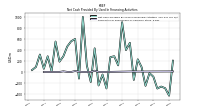

| Net Cash Provided By Used In Investing Activities | 76.47 | -122.38 | 172.48 | -113.08 | -206.54 | 173.47 | -613.59 | -530.47 | -967.65 | 31.48 | -403.44 | -201.23 | 84.57 | 181.93 | -23.20 | -154.59 | 151.59 | -255.00 | -1059.41 | 236.51 | -725.15 | -429.14 | -460.67 | -382.25 | -272.19 | -453.52 | -123.25 | -234.72 | -33.26 | |

| Net Cash Provided By Used In Financing Activities | -86.63 | -20.68 | -251.35 | 87.14 | 229.35 | -144.07 | 529.12 | 398.46 | 904.17 | 119.91 | 285.42 | 269.48 | -298.75 | -46.18 | -245.09 | 429.46 | -181.96 | 118.72 | 999.13 | -120.21 | 599.51 | 557.78 | 462.31 | 283.78 | 187.41 | 552.74 | 12.08 | 284.82 | 58.24 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 36.84 | 41.77 | 35.47 | 41.63 | 37.17 | 35.57 | 35.25 | 33.13 | 27.93 | 38.75 | 27.84 | 30.27 | 23.64 | 38.38 | 25.67 | 27.38 | 23.47 | 28.06 | 14.57 | 25.61 | 19.40 | 23.36 | 15.99 | 18.07 | 97.73 | -66.55 | 14.95 | 7.67 | 6.86 | |

| Net Income Loss | -12.89 | 27.14 | -20.03 | -25.08 | 20.33 | -42.75 | 25.06 | 35.47 | 40.34 | 35.67 | 31.08 | 30.09 | NA | NA | NA | NA | 24.51 | 23.86 | 17.35 | 24.25 | 21.43 | 20.97 | 23.95 | 23.39 | 17.10 | 17.43 | 14.16 | 10.38 | 11.41 | |

| Profit Loss | -13.11 | 26.83 | -20.12 | -25.25 | 20.10 | -42.91 | 25.00 | 35.41 | 40.34 | 35.67 | 31.08 | 30.09 | 28.86 | 31.19 | 28.93 | -34.57 | 24.51 | 23.86 | 17.35 | 24.25 | 21.43 | 20.97 | 23.98 | 23.43 | 17.18 | 17.86 | 14.40 | 10.63 | 11.68 | |

| Share Based Compensation | 1.56 | 2.18 | 2.17 | 2.15 | 1.49 | 2.17 | 2.04 | 2.13 | 1.41 | 2.03 | 1.99 | 1.99 | 1.30 | 1.39 | 1.37 | 1.61 | 1.02 | 1.04 | 1.04 | 0.99 | 0.78 | 0.29 | -0.12 | 1.02 | 0.03 | 0.03 | 0.01 | 0.00 | 0.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 76.47 | -122.38 | 172.48 | -113.08 | -206.54 | 173.47 | -613.59 | -530.47 | -967.65 | 31.48 | -403.44 | -201.23 | 84.57 | 181.93 | -23.20 | -154.59 | 151.59 | -255.00 | -1059.41 | 236.51 | -725.15 | -429.14 | -460.67 | -382.25 | -272.19 | -453.52 | -123.25 | -234.72 | -33.26 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -86.63 | -20.68 | -251.35 | 87.14 | 229.35 | -144.07 | 529.12 | 398.46 | 904.17 | 119.91 | 285.42 | 269.48 | -298.75 | -46.18 | -245.09 | 429.46 | -181.96 | 118.72 | 999.13 | -120.21 | 599.51 | 557.78 | 462.31 | 283.78 | 187.41 | 552.74 | 12.08 | 284.82 | 58.24 | |

| Payments Of Dividends Common Stock | 29.72 | 29.72 | 29.71 | 29.71 | 29.82 | 29.95 | 29.21 | 26.39 | 23.92 | 23.92 | 23.92 | 23.92 | 23.86 | 23.86 | 24.01 | 24.72 | 24.69 | 24.69 | 24.68 | 24.90 | 24.95 | 22.80 | 21.23 | 19.86 | 19.86 | 13.43 | 8.83 | 8.46 | 5.56 | |

| Dividends | NA | 0.00 | 0.01 | 29.71 | -0.10 | -0.14 | 0.74 | 29.21 | 2.21 | 0.00 | 0.23 | 24.12 | 0.15 | 0.04 | -0.11 | 24.20 | 0.06 | 0.06 | 0.07 | 24.85 | -0.14 | 2.21 | 1.57 | 21.46 | -0.01 | 6.56 | 13.41 | 0.01 | NA | |

| Payments For Repurchase Of Common Stock | NA | NA | NA | NA | 7.45 | 10.26 | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 1.81 | 23.25 | 0.00 | 0.00 | 0.00 | 4.11 | 17.71 | 0.18 | 1.54 | 11.92 | 0.00 | 0.52 | 0.00 | 0.00 | 0.00 |