| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.65 | 0.65 | 0.66 | 0.67 | 0.67 | 0.68 | 0.69 | 0.71 | 0.73 | 0.76 | 0.79 | 0.82 | 0.85 | 0.90 | 0.84 | 0.84 | 0.85 | 0.87 | 0.89 | 0.92 | 0.94 | 0.98 | 1.00 | 0.79 | 0.80 | 0.81 | 0.84 | 0.87 | 0.89 | 0.89 | 0.92 | 0.94 | 0.94 | 0.94 | 0.94 | 7.38 | |

| Weighted Average Number Of Diluted Shares Outstanding | 62.30 | 63.06 | NA | 64.78 | 65.04 | 65.76 | NA | 69.82 | 72.04 | 74.56 | 77.68 | 80.69 | 85.12 | 86.01 | 80.68 | 81.36 | 82.88 | 84.79 | 87.13 | 89.53 | 92.48 | 95.18 | 98.10 | 75.54 | 77.24 | 79.71 | 82.43 | 84.62 | 85.26 | 86.30 | 89.48 | 89.72 | 89.67 | 89.62 | 89.29 | 91.42 | |

| Weighted Average Number Of Shares Outstanding Basic | 62.30 | 63.01 | NA | 64.77 | 65.03 | 65.74 | NA | 69.79 | 72.01 | 74.54 | 77.66 | 80.67 | 85.12 | 86.01 | 80.68 | 81.34 | 82.83 | 84.76 | 87.09 | 89.49 | 92.43 | 95.13 | 98.05 | 75.49 | 77.17 | 79.65 | 82.37 | 84.54 | 85.17 | 86.25 | 89.44 | 89.69 | 89.64 | 89.59 | 89.27 | 90.82 | |

| Earnings Per Share Basic | -0.22 | 0.16 | 0.19 | 0.16 | 0.03 | 0.25 | 0.17 | 0.25 | 0.26 | 0.26 | 0.24 | 0.20 | 0.20 | 0.13 | 0.17 | 0.11 | 0.13 | 0.13 | 0.10 | 0.13 | 0.12 | 0.12 | 0.08 | 0.07 | 0.02 | 0.07 | 0.05 | 0.05 | 0.06 | 0.05 | 0.05 | 0.05 | 0.04 | 0.03 | -0.04 | 0.03 | |

| Earnings Per Share Diluted | -0.22 | 0.16 | 0.19 | 0.16 | 0.03 | 0.25 | 0.17 | 0.25 | 0.26 | 0.26 | 0.24 | 0.20 | 0.20 | 0.13 | 0.17 | 0.11 | 0.13 | 0.13 | 0.10 | 0.13 | 0.12 | 0.12 | 0.08 | 0.07 | 0.02 | 0.07 | 0.05 | 0.05 | 0.06 | 0.05 | 0.05 | 0.05 | 0.04 | 0.03 | -0.04 | 0.03 |

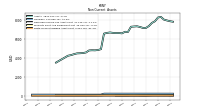

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Interest And Fee Income Loans And Leases | 63.38 | 62.77 | 62.04 | 60.17 | 58.00 | 52.94 | 48.87 | 45.85 | 47.58 | 48.23 | 47.56 | 49.31 | 49.47 | 52.18 | 46.19 | 46.60 | 45.61 | 48.60 | 47.82 | 48.12 | 49.02 | 47.44 | 46.62 | 30.73 | 30.61 | 30.47 | 29.84 | 28.23 | 27.41 | 25.70 | 25.70 | 25.59 | 24.64 | 22.03 | 20.32 | NA | |

| Marketing And Advertising Expense | 0.30 | 0.23 | 0.23 | 0.41 | 0.73 | 0.75 | 0.70 | 0.52 | 0.45 | 0.39 | 0.58 | 0.57 | 0.51 | 0.50 | 0.75 | 0.61 | 0.89 | 0.54 | 0.95 | 0.74 | 0.79 | 0.58 | 0.76 | 0.74 | 0.75 | 0.71 | 0.94 | 0.75 | 0.39 | 0.55 | 0.49 | 0.54 | 0.56 | 0.43 | 0.41 | NA | |

| Interest Expense | 46.79 | 42.01 | 39.51 | 34.80 | 27.66 | 15.89 | 7.95 | 6.87 | 7.22 | 7.62 | 8.61 | 10.68 | 13.84 | 16.72 | 16.90 | 21.17 | 22.57 | 23.21 | 22.30 | 21.02 | 20.67 | 18.03 | 16.67 | 11.49 | 11.20 | 10.78 | 10.23 | 8.80 | 8.70 | 8.79 | 8.54 | 8.42 | 7.89 | 7.06 | 6.62 | 5.96 | |

| Interest Income Expense Net | 35.84 | 39.16 | 40.18 | 42.37 | 44.78 | 48.53 | 50.60 | 47.73 | 48.69 | 49.59 | 48.16 | 47.63 | 44.55 | 44.16 | 40.45 | 37.61 | 34.61 | 36.69 | 37.15 | 38.64 | 39.35 | 40.18 | 40.59 | 27.06 | 26.84 | 26.81 | 26.73 | 26.21 | 25.62 | 24.02 | 24.23 | 24.46 | 23.94 | 22.36 | 20.95 | 18.67 | |

| Interest Paid Net | 49.22 | 39.87 | 38.81 | 32.43 | 24.37 | 12.91 | 7.15 | 6.88 | 7.18 | 7.61 | 8.84 | 10.85 | 14.14 | 16.66 | 18.55 | 21.31 | 25.00 | 23.88 | 21.97 | 19.66 | 19.80 | 16.69 | 16.68 | 11.21 | 10.97 | 10.71 | 9.96 | 8.71 | 8.63 | 8.75 | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 1.78 | 3.31 | 3.38 | 2.90 | 0.03 | 5.25 | 4.21 | 6.52 | 6.80 | 7.27 | 7.03 | 5.73 | 5.61 | 2.88 | 4.70 | 0.23 | 3.55 | 3.82 | 2.31 | 4.30 | 3.65 | 3.66 | 4.26 | 2.26 | 5.13 | 2.76 | 2.11 | 1.55 | 2.97 | 2.19 | 2.83 | 1.67 | 1.43 | 0.85 | -3.35 | 1.21 | |

| Income Taxes Paid Net | 0.25 | 4.07 | 1.26 | 0.30 | 2.30 | 6.02 | 6.05 | -0.13 | 3.62 | 6.01 | 6.06 | 4.49 | 3.82 | 5.37 | 3.78 | 1.65 | 3.95 | 2.43 | 2.06 | 1.44 | 3.43 | -0.24 | 3.16 | -3.98 | 5.69 | 4.47 | 2.88 | 2.67 | 2.08 | 1.85 | 3.67 | 2.67 | 1.18 | 1.66 | 0.08 | NA | |

| Other Comprehensive Income Loss Net Of Tax | 22.65 | -17.02 | NA | -4.03 | 7.32 | -20.61 | -32.78 | -24.52 | -0.76 | -3.81 | 4.79 | -5.10 | 2.48 | 2.72 | 5.38 | -12.08 | -0.73 | 5.85 | -4.74 | -1.22 | -10.02 | 0.28 | 3.36 | 7.38 | 3.27 | 2.10 | 0.34 | 4.75 | 8.73 | 4.01 | 1.31 | -4.83 | 0.16 | -5.66 | -1.52 | NA | |

| Net Income Loss | -13.83 | 9.84 | 12.01 | 10.31 | 1.95 | 16.54 | 11.37 | 17.69 | 18.77 | 19.71 | 18.48 | 16.42 | 16.95 | 11.38 | 13.69 | 9.25 | 10.65 | 11.37 | 8.81 | 11.42 | 10.77 | 11.15 | 7.72 | 5.38 | 1.27 | 5.23 | 4.40 | 4.07 | 5.46 | 4.67 | 4.88 | 4.17 | 3.80 | 2.98 | -3.34 | 2.83 | |

| Comprehensive Income Net Of Tax | 8.82 | -7.18 | 15.61 | 6.28 | 9.27 | -4.08 | -21.41 | -6.83 | 18.01 | 15.91 | 23.27 | 11.33 | 19.43 | 14.10 | 19.07 | -2.83 | 9.92 | 17.22 | 4.07 | 10.19 | 0.75 | 11.43 | 11.08 | 12.76 | 4.54 | 7.33 | 4.75 | 8.82 | 14.19 | 8.68 | 6.19 | -0.67 | 3.96 | -2.68 | -4.86 | NA | |

| Interest Income Expense After Provision For Loan Loss | 33.73 | 38.91 | 40.49 | 41.92 | 43.11 | 47.86 | 46.38 | 51.65 | 51.11 | 54.99 | 53.10 | 46.51 | 45.92 | 40.10 | 40.28 | 31.34 | 36.07 | 37.47 | 36.48 | 38.82 | 38.38 | 38.08 | 39.87 | 26.63 | 25.90 | 26.18 | 25.54 | 24.40 | 24.36 | 22.89 | 22.18 | 21.88 | 20.52 | 19.71 | 19.19 | 17.89 | |

| Noninterest Expense | 29.77 | 29.77 | 28.76 | 30.35 | 32.65 | 31.99 | 33.61 | 30.62 | 29.67 | 31.80 | 31.99 | 29.82 | 30.51 | 33.57 | 26.89 | 28.06 | 26.43 | 26.24 | 28.75 | 26.77 | 27.27 | 26.46 | 31.26 | 22.54 | 22.76 | 21.29 | 22.05 | 21.03 | 19.37 | 18.66 | 17.68 | 18.65 | 17.70 | 18.38 | 27.40 | 15.80 | |

| Noninterest Income | -16.01 | 4.01 | 3.67 | 1.65 | -8.48 | 5.92 | 2.81 | 3.19 | 4.13 | 3.80 | 4.40 | 5.47 | 7.15 | 7.73 | 5.00 | 6.20 | 4.55 | 3.96 | 3.39 | 3.68 | 3.31 | 3.18 | 3.36 | 3.55 | 3.26 | 3.09 | 3.02 | 2.25 | 3.45 | 2.63 | 3.21 | 2.61 | 2.41 | 2.49 | 1.52 | 1.95 |

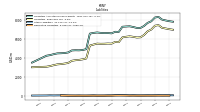

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

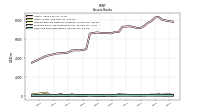

| Assets | 7897.83 | 7974.87 | 8064.81 | 8349.34 | 8289.32 | 7889.59 | 7719.88 | 7389.89 | 7186.22 | 7183.69 | 7283.73 | 7357.99 | 7335.15 | 7310.21 | 6758.18 | 6773.83 | 6610.40 | 6641.01 | 6634.83 | 6658.75 | 6702.44 | 6656.21 | 6579.87 | 4933.70 | 4843.85 | 4808.15 | 4818.13 | 4796.24 | 4585.31 | 4523.28 | 4500.06 | 4486.01 | 4405.05 | 4301.94 | 4237.19 | 3510.01 | |

| Liabilities | 7049.85 | 7125.33 | 7195.53 | 7483.11 | 7416.68 | 7014.62 | 6825.88 | 6434.72 | 6190.75 | 6169.27 | 6240.79 | 6294.18 | 6242.81 | 6186.15 | 5674.00 | 5704.16 | 5515.83 | 5530.22 | 5507.67 | 5500.64 | 5519.18 | 5420.13 | 5311.13 | 3942.50 | 3854.57 | 3793.92 | 3760.95 | 3702.23 | 3470.66 | 3403.75 | 3352.43 | 3321.26 | 3238.57 | 3138.33 | 3069.81 | 3015.33 | |

| Liabilities And Stockholders Equity | 7897.83 | 7974.87 | 8064.81 | 8349.34 | 8289.32 | 7889.59 | 7719.88 | 7389.89 | 7186.22 | 7183.69 | 7283.73 | 7357.99 | 7335.15 | 7310.21 | 6758.18 | 6773.83 | 6610.40 | 6641.01 | 6634.83 | 6658.75 | 6702.44 | 6656.21 | 6579.87 | 4933.70 | 4843.85 | 4808.15 | 4818.13 | 4796.24 | 4585.31 | 4523.28 | 4500.06 | 4486.01 | 4405.05 | 4301.94 | 4237.19 | 3510.01 | |

| Stockholders Equity | 847.98 | 849.53 | 869.28 | 866.23 | 872.64 | 874.97 | 894.00 | 955.17 | 995.47 | 1014.42 | 1042.94 | 1063.81 | 1092.34 | 1124.06 | 1084.18 | 1069.67 | 1094.57 | 1110.79 | 1127.16 | 1158.11 | 1183.26 | 1236.08 | 1268.75 | 991.20 | 989.27 | 1014.23 | 1057.18 | 1094.01 | 1114.65 | 1119.53 | 1147.63 | 1164.75 | 1166.48 | 1163.61 | 1167.38 | 494.68 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 73.86 | 57.22 | 70.52 | 194.57 | 75.66 | 96.08 | 101.61 | 62.38 | 60.45 | 54.07 | 67.86 | 108.99 | 129.69 | 145.82 | 180.97 | 59.45 | 41.80 | 129.31 | 38.94 | 54.16 | 51.48 | 44.49 | 128.86 | 38.28 | 50.69 | 38.82 | 78.24 | 170.59 | 37.03 | 72.59 | 199.20 | 114.96 | 112.86 | 102.63 | 340.14 | 135.03 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 73.86 | 57.22 | 70.52 | 194.57 | 75.66 | 96.08 | 101.61 | 62.38 | 60.45 | 54.07 | 67.86 | 108.99 | 129.69 | 145.82 | 180.97 | 59.45 | 41.80 | 129.31 | 38.94 | 54.16 | 51.48 | 44.49 | 128.86 | NA | NA | NA | 78.24 | NA | NA | NA | 199.20 | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Amortization Of Intangible Assets | 0.13 | 0.13 | 0.13 | 0.14 | 0.14 | 0.14 | 0.15 | 0.18 | 0.18 | 0.18 | 0.18 | 0.26 | 0.27 | 0.27 | 0.25 | 0.30 | 0.31 | 0.31 | 0.31 | 0.27 | 0.27 | 0.28 | 0.28 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.07 | NA | |

| Property Plant And Equipment Net | 45.93 | 46.87 | 48.31 | 49.59 | 50.95 | 52.64 | 53.28 | 53.73 | 54.07 | 55.24 | 56.34 | 60.36 | 61.18 | 61.81 | 57.39 | 58.98 | 56.54 | 56.60 | 56.85 | 58.27 | 58.41 | 57.63 | 56.24 | 42.86 | 41.83 | 40.13 | 39.59 | 38.90 | 38.34 | 38.12 | 38.38 | 38.60 | 39.16 | 39.26 | 39.18 | 40.10 | |

| Goodwill | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 210.90 | 108.59 | 108.59 | 108.59 | 108.59 | 108.59 | 108.59 | 108.59 | 108.59 | 108.59 | 108.59 | 108.59 | 108.59 | 108.59 | |

| Finite Lived Intangible Assets Net | 2.19 | 2.32 | 2.46 | NA | NA | NA | 3.00 | NA | NA | NA | 3.70 | NA | NA | NA | 4.00 | NA | NA | NA | 5.16 | NA | NA | NA | 6.29 | NA | NA | NA | 0.29 | NA | NA | NA | 0.43 | NA | NA | NA | 0.60 | 0.79 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 14.09 | 20.70 | 15.30 | 13.76 | 15.39 | 16.39 | 10.22 | 4.96 | 0.07 | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.01 | 0.71 | 2.48 | 6.56 | 13.79 | 10.37 | 8.20 | 2.84 | 1.42 | 1.58 | 2.27 | 2.44 | 0.04 | 0.01 | 0.06 | 2.26 | 0.38 | 2.31 | 5.09 | |

| Held To Maturity Securities Fair Value | 127.88 | 123.03 | 131.17 | 136.12 | 138.39 | 99.55 | 108.12 | 117.02 | 54.06 | 38.67 | 39.61 | 28.41 | 31.06 | 33.14 | 34.07 | 35.43 | 36.97 | 38.68 | 584.68 | 592.81 | 592.15 | 589.13 | 579.50 | 451.28 | 470.53 | 485.44 | 495.79 | 501.72 | 517.13 | 552.25 | 592.48 | 603.18 | 599.06 | 665.52 | 663.87 | 507.25 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 0.00 | NA | NA | 0.12 | NA | NA | 0.04 | 0.12 | 0.99 | 1.18 | 1.47 | 1.24 | 1.51 | 1.56 | 1.51 | 0.82 | 0.90 | 0.80 | 8.73 | 3.09 | 0.39 | 0.09 | 0.14 | 0.10 | 1.92 | 3.93 | 4.06 | 2.00 | 1.75 | 13.97 | 15.21 | 10.82 | 2.93 | 7.39 | 2.83 | 0.27 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 14.09 | 20.70 | 15.30 | 13.76 | 15.39 | 16.39 | 10.22 | 4.96 | 0.07 | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.01 | 0.71 | 2.48 | 6.56 | 13.79 | 10.37 | 8.20 | 2.84 | 1.42 | 1.58 | 2.27 | 2.44 | 0.04 | 0.01 | 0.06 | 2.26 | 0.38 | 2.31 | 5.09 | |

| Held To Maturity Securities Continuous Unrealized Loss Position Fair Value | 90.03 | 123.03 | 131.17 | 95.53 | 137.93 | 99.55 | 95.67 | 98.27 | 16.07 | NA | NA | NA | NA | NA | NA | 1.28 | 1.85 | 3.44 | 95.91 | 218.64 | 499.42 | 560.37 | 555.47 | 432.33 | 223.83 | 182.58 | 204.33 | 290.70 | 285.42 | 43.72 | 14.63 | 43.23 | 281.36 | 128.06 | 368.78 | 417.98 | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | 141.96 | 143.73 | 146.47 | 149.76 | 153.79 | 115.94 | 118.29 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Twelve Months Or Longer Fair Value | 85.91 | 81.92 | 79.39 | 82.10 | 26.80 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.47 | 0.47 | 95.20 | 195.91 | 348.56 | 135.10 | 78.83 | 85.49 | 93.28 | 36.88 | 12.16 | 12.35 | 12.36 | 12.45 | 12.73 | 38.00 | 66.78 | 103.08 | 151.01 | 295.91 | |

| Held To Maturity Securities Continuous Unrealized Loss Position Less Than Twelve Months Fair Value | 4.12 | 41.11 | 51.78 | 13.43 | 111.12 | 99.55 | 95.67 | 98.27 | 16.07 | NA | NA | NA | NA | NA | NA | 1.28 | 1.38 | 2.98 | 0.71 | 22.73 | 150.86 | 425.27 | 476.64 | 346.84 | 130.54 | 145.71 | 192.17 | 278.35 | 273.06 | 31.28 | 1.90 | 5.24 | 214.58 | 24.97 | 217.77 | 122.06 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

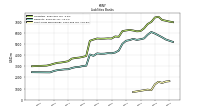

| Deposits | 5319.63 | 5434.17 | 5629.18 | 5803.40 | 5971.37 | 6108.28 | 5862.26 | 5528.66 | 5454.02 | 5395.14 | 5485.31 | 5374.45 | 5312.61 | 5039.91 | 4430.28 | 4253.25 | 4188.82 | 4197.25 | 4147.61 | 4137.57 | 4173.43 | 3954.82 | 4073.60 | 3067.80 | 3033.77 | 2953.27 | 2930.13 | 2853.26 | 2746.02 | 2733.96 | 2694.83 | 2660.77 | 2583.18 | 2463.89 | 2465.65 | 2479.94 |

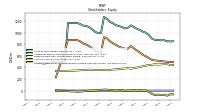

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 847.98 | 849.53 | 869.28 | 866.23 | 872.64 | 874.97 | 894.00 | 955.17 | 995.47 | 1014.42 | 1042.94 | 1063.81 | 1092.34 | 1124.06 | 1084.18 | 1069.67 | 1094.57 | 1110.79 | 1127.16 | 1158.11 | 1183.26 | 1236.08 | 1268.75 | 991.20 | 989.27 | 1014.23 | 1057.18 | 1094.01 | 1114.65 | 1119.53 | 1147.63 | 1164.75 | 1166.48 | 1163.61 | 1167.38 | 494.68 | |

| Common Stock Value | 0.65 | 0.65 | 0.66 | 0.67 | 0.67 | 0.68 | 0.69 | 0.71 | 0.73 | 0.76 | 0.79 | 0.82 | 0.85 | 0.90 | 0.84 | 0.84 | 0.85 | 0.87 | 0.89 | 0.92 | 0.94 | 0.98 | 1.00 | 0.79 | 0.80 | 0.81 | 0.84 | 0.87 | 0.89 | 0.89 | 0.92 | 0.94 | 0.94 | 0.94 | 0.94 | 7.38 | |

| Additional Paid In Capital Common Stock | 493.30 | 497.27 | 503.33 | 509.36 | 515.33 | 520.25 | 528.40 | 561.18 | 587.39 | 616.89 | 654.40 | 691.28 | 724.39 | 769.27 | 722.87 | 721.47 | 737.54 | 758.38 | 787.39 | 817.67 | 848.14 | 897.55 | 922.71 | 653.04 | 662.09 | 690.20 | 728.79 | 768.37 | 795.77 | 813.65 | 849.17 | 871.16 | 870.91 | 870.70 | 870.48 | 231.87 | |

| Retained Earnings Accumulated Deficit | 439.75 | 460.46 | 457.61 | 452.61 | 449.49 | 454.71 | 445.45 | 441.52 | 431.55 | 420.70 | 408.37 | 397.59 | 388.38 | 378.13 | 387.91 | 380.67 | 377.90 | 373.00 | 366.68 | 363.07 | 356.99 | 350.84 | 359.10 | 355.27 | 353.54 | 354.12 | 361.04 | 359.08 | 357.54 | 353.76 | 350.81 | 347.72 | 345.34 | 343.33 | 342.15 | 336.36 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -63.83 | -86.48 | -69.46 | -73.05 | -69.02 | -76.34 | -55.73 | -22.95 | 1.57 | 2.34 | 6.14 | 1.36 | 6.45 | 3.97 | 1.26 | -4.12 | 7.96 | 8.69 | 2.84 | 7.58 | 8.80 | 18.82 | 18.54 | 15.17 | 6.41 | 3.14 | 1.04 | 0.70 | -4.04 | -12.77 | -16.79 | -18.09 | -13.26 | -13.42 | -7.76 | -2.28 |

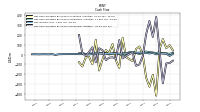

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 6.86 | 12.28 | 11.65 | 21.84 | 15.35 | 20.70 | 24.15 | 30.64 | 21.11 | 5.41 | 17.69 | 26.90 | 24.68 | 6.14 | -10.29 | 5.37 | 13.79 | 10.95 | 0.90 | 14.36 | 10.99 | 13.67 | 17.92 | 12.20 | 8.68 | 6.29 | 14.49 | 12.81 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | 96.06 | 64.73 | 157.28 | 49.53 | -418.84 | -205.90 | -327.38 | -233.89 | -0.38 | 81.70 | 55.67 | -67.24 | -47.03 | -25.37 | 171.88 | -135.73 | -58.54 | 107.36 | 15.77 | 46.20 | -48.99 | -161.85 | 151.18 | -98.99 | -24.21 | -29.43 | -121.30 | -78.44 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -86.28 | -90.31 | -292.99 | 47.53 | 383.07 | 179.65 | 342.47 | 205.18 | -14.34 | -100.90 | -114.50 | 19.64 | 6.22 | -15.92 | -40.07 | 148.01 | -42.76 | -27.93 | -31.90 | -57.89 | 45.00 | 63.80 | -78.52 | 74.39 | 27.38 | -16.27 | 14.46 | 199.19 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 6.86 | 12.28 | 11.65 | 21.84 | 15.35 | 20.70 | 24.15 | 30.64 | 21.11 | 5.41 | 17.69 | 26.90 | 24.68 | 6.14 | -10.29 | 5.37 | 13.79 | 10.95 | 0.90 | 14.36 | 10.99 | 13.67 | 17.92 | 12.20 | 8.68 | 6.29 | 14.49 | 12.81 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | -13.83 | 9.84 | 12.01 | 10.31 | 1.95 | 16.54 | 11.37 | 17.69 | 18.77 | 19.71 | 18.48 | 16.42 | 16.95 | 11.38 | 13.69 | 9.25 | 10.65 | 11.37 | 8.81 | 11.42 | 10.77 | 11.15 | 7.72 | 5.38 | 1.27 | 5.23 | 4.40 | 4.07 | 5.46 | 4.67 | 4.88 | 4.17 | 3.80 | 2.98 | -3.34 | 2.83 | |

| Deferred Income Tax Expense Benefit | 1.21 | 2.43 | -0.36 | -0.39 | 0.23 | 3.31 | -1.92 | 1.46 | 2.36 | 3.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 1.28 | 1.28 | 0.90 | 1.30 | 1.31 | 1.36 | 1.28 | 1.34 | 1.68 | 2.04 | 2.03 | 1.95 | 1.90 | 1.86 | 1.89 | 2.07 | 2.17 | 2.10 | 2.17 | 2.23 | 2.18 | 2.22 | 2.23 | 2.25 | 2.36 | 2.35 | 2.36 | 2.40 | 1.33 | 0.74 | 0.77 | 0.73 | 0.70 | 0.71 | 0.67 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 96.06 | 64.73 | 157.28 | 49.53 | -418.84 | -205.90 | -327.38 | -233.89 | -0.38 | 81.70 | 55.67 | -67.24 | -47.03 | -25.37 | 171.88 | -135.73 | -58.54 | 107.36 | 15.77 | 46.20 | -48.99 | -161.85 | 151.18 | -98.99 | -24.21 | -29.43 | -121.30 | -78.44 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -86.28 | -90.31 | -292.99 | 47.53 | 383.07 | 179.65 | 342.47 | 205.18 | -14.34 | -100.90 | -114.50 | 19.64 | 6.22 | -15.92 | -40.07 | 148.01 | -42.76 | -27.93 | -31.90 | -57.89 | 45.00 | 63.80 | -78.52 | 74.39 | 27.38 | -16.27 | 14.46 | 199.19 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments Of Dividends | 6.81 | 7.01 | 6.98 | 7.17 | 7.11 | 7.24 | 7.40 | 7.71 | 8.23 | 7.36 | 7.67 | 7.19 | 6.92 | 6.88 | 6.40 | 6.43 | 6.11 | 5.19 | 5.34 | 5.48 | 20.14 | 3.79 | 3.99 | 2.26 | 11.98 | 2.33 | 2.41 | 2.48 | 1.69 | 1.71 | 1.79 | 1.79 | 1.79 | 1.79 | NA | NA |