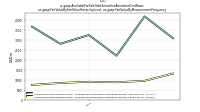

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.23 | 0.23 | 0.18 | 0.18 | 0.17 | 0.17 | 0.17 | 0.17 | 0.16 | NA | NA | 0.00 | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 2284.45 | 1912.46 | 1831.73 | NA | 1690.96 | 1686.82 | 1654.32 | NA | 1217.03 | 36.30 | 32.65 | NA | 24.28 | |

| Weighted Average Number Of Shares Outstanding Basic | 2284.45 | 1912.46 | 1831.73 | NA | 1676.05 | 1669.30 | 1654.32 | NA | 1217.03 | 36.30 | 32.65 | NA | 24.28 | |

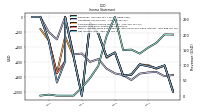

| Earnings Per Share Basic | -0.28 | -0.40 | -0.43 | -0.28 | -0.32 | -0.13 | -0.05 | 2.15 | -0.43 | -7.21 | -89.29 | -8.88 | -6.64 | |

| Earnings Per Share Diluted | -0.28 | -0.40 | -0.43 | -0.42 | -0.40 | -0.33 | -0.05 | 2.15 | -0.43 | -7.21 | -89.29 | -8.88 | -6.64 |

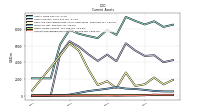

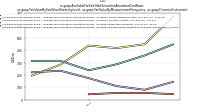

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

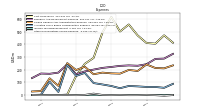

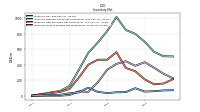

| Revenues | 137.81 | 150.87 | 149.43 | 257.71 | 195.46 | 97.34 | 57.67 | 26.39 | 0.23 | 0.17 | 0.31 | 3.63 | 0.33 | |

| Cost Of Revenue | 469.72 | 555.80 | 500.52 | 615.29 | 492.48 | 292.34 | 245.97 | 151.47 | 3.32 | 0.02 | 0.09 | 2.52 | 0.61 | |

| Costs And Expenses | 890.69 | 988.56 | 921.59 | 1007.45 | 882.98 | 656.53 | 655.21 | 512.08 | 497.28 | 249.09 | 299.11 | NA | NA | |

| Research And Development Expense | 230.76 | 233.47 | 229.80 | 221.29 | 213.76 | 200.38 | 186.08 | 163.61 | 242.41 | 176.80 | 167.37 | 169.52 | 133.89 | |

| Selling General And Administrative Expense | 189.69 | 197.75 | 168.77 | 170.87 | 176.74 | 163.81 | 223.16 | 197.00 | 251.55 | 72.27 | 131.65 | 31.30 | 27.93 | |

| Operating Income Loss | -752.88 | -837.68 | -772.16 | -749.74 | -687.52 | -559.20 | -597.53 | -485.68 | -497.05 | -0.56 | -298.79 | -199.71 | -0.33 | |

| Interest Expense | 3.34 | 6.69 | 7.11 | 8.07 | 7.61 | 7.19 | 7.71 | 1.26 | 0.08 | 0.90 | 0.30 | 0.04 | 0.01 | |

| Interest Paid Net | -3.37 | 10.45 | 0.86 | 11.89 | -0.97 | 11.97 | 0.31 | 0.30 | 0.13 | 0.14 | 0.06 | 0.03 | NA | |

| Allocated Share Based Compensation Expense | 68.24 | 71.38 | 53.82 | 71.25 | 83.30 | 94.39 | 174.55 | 150.56 | 236.96 | 24.45 | 104.80 | 1.36 | 1.28 | |

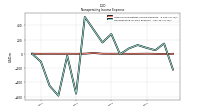

| Income Tax Expense Benefit | 0.30 | 0.59 | 0.13 | -0.16 | 0.15 | 0.07 | 0.32 | 0.02 | 0.02 | 0.00 | 0.00 | 0.06 | -0.01 | |

| Income Taxes Paid Net | 0.01 | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | -630.89 | -764.23 | -779.53 | -472.65 | -530.10 | -220.43 | -81.29 | -1045.68 | -524.40 | -588.82 | -871.80 | -311.27 | -0.16 | |

| Comprehensive Income Net Of Tax | -631.31 | -766.64 | -775.49 | -470.95 | -542.68 | -221.12 | -81.29 | -1045.68 | -524.40 | -261.73 | -747.95 | -311.27 | -161.24 | |

| Net Income Loss Available To Common Stockholders Basic | -630.89 | -764.23 | -779.53 | -472.65 | -530.10 | -220.43 | -81.29 | -1045.68 | -524.40 | -588.82 | -2915.28 | -297.49 | -0.16 | |

| Net Income Loss Available To Common Stockholders Diluted | -630.89 | -764.23 | -779.53 | -728.55 | -670.25 | -555.27 | -81.29 | -1045.68 | -524.40 | -261.73 | -2915.28 | NA | NA |

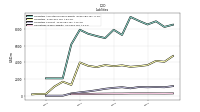

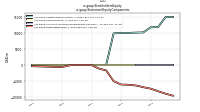

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

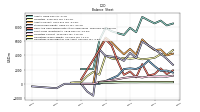

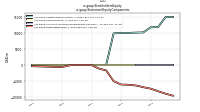

| Assets | 8941.23 | 9415.05 | 7260.93 | 7879.24 | 6887.81 | 7129.42 | 7401.84 | 7881.71 | 6139.18 | 2071.97 | 2073.18 | 2074.62 | NA | |

| Liabilities | 3535.22 | 3455.21 | 3629.08 | 3529.54 | 3656.56 | 3419.03 | 3572.37 | 3972.36 | 1294.03 | 1674.15 | 1086.54 | 216.18 | 207.89 | |

| Liabilities And Stockholders Equity | 8941.23 | 9415.05 | 7260.93 | 7879.24 | 6887.81 | 7129.42 | 7401.84 | 7881.71 | 6139.18 | 2071.97 | 2073.18 | 2074.62 | NA | |

| Stockholders Equity | 5406.02 | 5959.84 | 3631.85 | 4349.70 | 3231.25 | 3710.39 | 3829.47 | 3909.36 | 4845.16 | -1672.18 | -1083.36 | 5.00 | 5.00 |

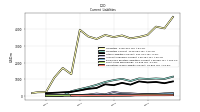

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 5391.49 | 6256.93 | 4119.83 | 4912.03 | 4156.43 | 4966.49 | 5864.43 | 6506.98 | 4986.80 | 1.68 | 2.91 | 4.53 | NA | |

| Cash | 1164.39 | 2775.34 | 900.04 | 1735.77 | 1264.14 | 3157.45 | 5391.84 | 6262.90 | 4796.88 | 1.00 | 2.07 | 3.59 | 4.22 | |

| Cash And Cash Equivalents At Carrying Value | 1164.39 | 2775.34 | 900.04 | 1735.77 | 1264.14 | 3157.45 | 5391.84 | 6262.90 | 4796.88 | NA | NA | 614.41 | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 1165.95 | 2776.88 | 901.60 | 1737.32 | 1265.69 | 3192.41 | 5430.99 | 6298.02 | 4832.57 | 592.21 | 838.01 | 640.42 | 538.96 | |

| Short Term Investments | 3258.21 | 2473.95 | 2078.38 | 2177.23 | 2078.05 | 1136.63 | NA | NA | 0.51 | NA | NA | 0.51 | NA | |

| Accounts Receivable Net Current | 23.37 | 20.57 | 2.58 | 19.54 | 2.66 | 1.29 | 0.87 | 3.15 | 0.26 | NA | NA | 0.26 | NA | |

| Inventory Net | 798.97 | 849.78 | 1017.57 | 834.40 | 685.32 | 553.04 | 333.91 | 127.25 | 61.16 | NA | NA | 1.04 | NA | |

| Other Assets Current | 70.19 | 63.83 | 58.90 | 81.54 | 69.01 | 69.11 | 95.49 | 43.33 | 20.21 | NA | NA | 24.50 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Investments | 479.73 | 288.08 | 441.73 | 529.97 | 513.74 | 278.06 | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Noncurrent | 175.30 | 171.59 | 163.29 | 55.30 | 51.49 | 71.23 | 43.24 | 30.61 | 42.70 | NA | NA | 26.85 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

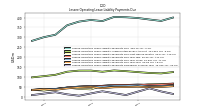

| Liabilities Current | 1037.86 | 885.59 | 1014.96 | 937.56 | 825.12 | 654.10 | 511.94 | 396.10 | 269.41 | 2.05 | 1.82 | 1.53 | NA | |

| Accounts Payable Current | 104.60 | 140.08 | 145.75 | 229.08 | 79.78 | 129.07 | 66.44 | 41.34 | 8.91 | NA | NA | 17.33 | NA | |

| Other Liabilities Current | 862.75 | 666.86 | 774.11 | 634.57 | 686.55 | 464.82 | 412.26 | 318.21 | 228.28 | NA | NA | 151.75 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

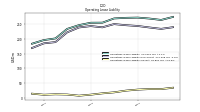

| Long Term Debt Noncurrent | 1995.67 | 1994.39 | 1993.11 | 1991.84 | 1990.57 | 1989.20 | 1988.05 | 1986.79 | NA | NA | NA | NA | NA | |

| Other Liabilities Noncurrent | 345.72 | 356.85 | 360.77 | 378.21 | 365.01 | 233.72 | 194.87 | 188.57 | 183.10 | NA | NA | 39.14 | NA | |

| Operating Lease Liability Noncurrent | 246.82 | 250.55 | 239.59 | 243.84 | 239.17 | 222.46 | 189.52 | 185.32 | 169.43 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 5406.02 | 5959.84 | 3631.85 | 4349.70 | 3231.25 | 3710.39 | 3829.47 | 3909.36 | 4845.16 | -1672.18 | -1083.36 | 5.00 | 5.00 | |

| Common Stock Value | 0.23 | 0.23 | 0.18 | 0.18 | 0.17 | 0.17 | 0.17 | 0.17 | 0.16 | NA | NA | 0.00 | NA | |

| Additional Paid In Capital | 14981.85 | 14904.37 | 11809.78 | 11752.14 | 10162.75 | 10099.21 | 9997.18 | 9995.78 | 9865.19 | NA | NA | 68.46 | 59.30 | |

| Retained Earnings Accumulated Deficit | -9544.99 | -8914.09 | -8149.86 | -7370.33 | -6897.68 | -6367.58 | -6147.16 | -6065.87 | -5020.19 | -1672.19 | -1083.37 | 63.47 | 54.30 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -10.36 | -9.95 | -7.54 | -11.57 | -13.27 | -0.69 | NA | NA | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 79.59 | 83.63 | 61.96 | 71.25 | 83.30 | 94.39 | 174.55 | 150.56 | 236.96 | 3.75 | 1.88 | 1.36 | 1.28 |

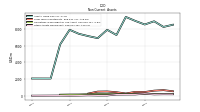

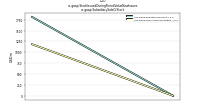

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

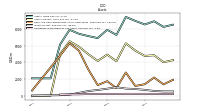

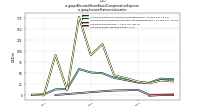

| Net Cash Provided By Used In Operating Activities | -513.58 | -700.36 | -801.26 | -648.51 | -569.47 | -513.63 | -494.65 | -312.73 | -741.31 | 214.63 | -218.73 | -192.79 | NA | |

| Net Cash Provided By Used In Investing Activities | -1132.44 | -437.97 | -28.72 | -392.66 | -1374.90 | -1729.04 | -185.08 | -121.40 | -92.78 | -111.73 | -94.78 | -103.72 | NA | |

| Net Cash Provided By Used In Financing Activities | 35.09 | 3013.61 | -5.75 | 1512.80 | 17.64 | 4.09 | -187.30 | 1899.59 | 5235.34 | -509.60 | 511.10 | 397.97 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -513.58 | -700.36 | -801.26 | -648.51 | -569.47 | -513.63 | -494.65 | -312.73 | -741.31 | 214.63 | -218.73 | -192.79 | NA | |

| Net Income Loss | -630.89 | -764.23 | -779.53 | -472.65 | -530.10 | -220.43 | -81.29 | -1045.68 | -524.40 | -588.82 | -871.80 | -311.27 | -0.16 | |

| Increase Decrease In Accounts Receivable | 2.80 | 17.99 | -17.01 | 16.99 | 1.12 | 0.67 | -2.28 | 2.89 | -0.22 | -0.16 | 0.38 | -0.31 | NA | |

| Increase Decrease In Inventories | 127.97 | 93.81 | 354.15 | 350.30 | 302.20 | 300.83 | 303.02 | 114.98 | 32.93 | 21.91 | 5.27 | -1.50 | NA | |

| Increase Decrease In Accounts Payable | -18.81 | -29.82 | -66.17 | 128.25 | 2.62 | 43.88 | 5.71 | 18.53 | -2.30 | 2.67 | -14.54 | -39.75 | NA | |

| Share Based Compensation | 68.24 | 71.38 | 53.82 | 71.25 | 83.30 | 94.39 | 174.55 | 150.56 | 236.96 | 24.45 | 104.80 | 1.36 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -1132.44 | -437.97 | -28.72 | -392.66 | -1374.90 | -1729.04 | -185.08 | -121.40 | -92.78 | -111.73 | -94.78 | -103.72 | NA | |

| Payments To Acquire Property Plant And Equipment | 192.52 | 203.72 | 241.77 | 289.89 | 290.06 | 309.82 | 185.08 | 121.91 | 92.78 | NA | NA | NA | NA | |

| Payments To Acquire Productive Assets | NA | NA | NA | NA | NA | NA | 185.08 | 121.91 | NA | NA | 94.78 | 103.72 | NA | |

| Payments To Acquire Investments | 1438.00 | 1304.71 | 842.54 | 1127.45 | 1307.45 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

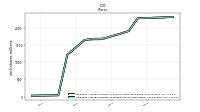

| Net Cash Provided By Used In Financing Activities | 35.09 | 3013.61 | -5.75 | 1512.80 | 17.64 | 4.09 | -187.30 | 1899.59 | 5235.34 | -509.60 | 511.10 | 397.97 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

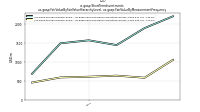

| Revenues | 137.81 | 150.87 | 149.43 | 257.71 | 195.46 | 97.34 | 57.67 | 26.39 | 0.23 | 0.17 | 0.31 | 3.63 | 0.33 | |

| Vehicle Sales With R V G | 56.50 | 36.80 | 18.70 | 21.00 | 10.10 | NA | NA | NA | NA | NA | NA | NA | NA |