| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

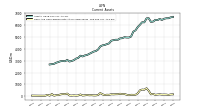

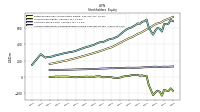

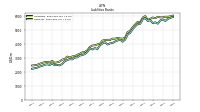

| Common Stock Value | 127.69 | 125.76 | 123.37 | 125.84 | 127.00 | 125.83 | 123.57 | 121.14 | 120.61 | 119.62 | 117.80 | 114.76 | 114.93 | 114.01 | 113.42 | 113.34 | 114.86 | 114.24 | 112.69 | 111.57 | 112.38 | 111.05 | 109.22 | 107.86 | 108.86 | 107.64 | 105.74 | 104.53 | 104.41 | 103.06 | 101.00 | 99.96 | 99.12 | 98.22 | 96.86 | 96.07 | 96.12 | 95.50 | 94.20 | 93.79 | 93.25 | 92.23 | 90.92 | 90.46 | 90.04 | 89.25 | 88.44 | 88.01 | 87.38 | 87.02 | 86.42 | NA | 85.77 | NA | NA | |

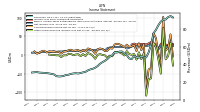

| Earnings Per Share Basic | 1.16 | 0.99 | 0.57 | 0.95 | 1.02 | 1.12 | 1.00 | 0.93 | 0.95 | 0.95 | 0.96 | 0.90 | 0.97 | 0.89 | 0.77 | 0.68 | 0.86 | 0.84 | 0.85 | 0.85 | 0.84 | 0.81 | 0.80 | 0.73 | 0.46 | 0.63 | 0.61 | 0.58 | 0.54 | 0.54 | 0.51 | 0.74 | 0.74 | 0.70 | 0.69 | 0.67 | 0.67 | 0.70 | 0.68 | 0.60 | 0.64 | 0.59 | 0.56 | 0.56 | 0.53 | 0.57 | 0.54 | 0.53 | 0.51 | 0.52 | 0.49 | 0.37 | 0.35 | 0.40 | 0.24 | |

| Earnings Per Share Diluted | 1.16 | 0.98 | 0.57 | 0.94 | 1.01 | 1.11 | 1.00 | 0.92 | 0.95 | 0.94 | 0.95 | 0.90 | 0.97 | 0.89 | 0.77 | 0.67 | 0.86 | 0.83 | 0.85 | 0.84 | 0.83 | 0.80 | 0.78 | 0.71 | 0.45 | 0.62 | 0.60 | 0.57 | 0.53 | 0.53 | 0.50 | 0.73 | 0.73 | 0.69 | 0.68 | 0.66 | 0.66 | 0.69 | 0.68 | 0.59 | 0.63 | 0.59 | 0.56 | 0.56 | 0.52 | 0.57 | 0.54 | 0.52 | 0.50 | 0.52 | 0.49 | 0.37 | 0.36 | 0.40 | 0.24 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

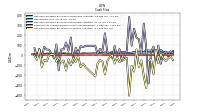

| Revenues | 90.94 | 88.62 | 84.48 | 79.22 | 75.35 | 62.56 | 53.62 | 48.03 | 48.32 | 49.30 | 47.62 | 47.98 | 49.85 | 45.98 | 46.83 | 50.44 | 52.31 | 54.77 | 54.63 | 53.49 | 53.73 | 50.38 | 48.80 | 46.07 | 44.16 | 42.59 | 40.82 | 38.13 | 36.31 | 35.08 | 34.35 | 33.21 | 31.62 | 30.97 | 30.29 | 29.66 | 30.02 | 29.75 | 29.25 | 28.27 | 28.05 | 26.97 | 26.42 | 26.29 | 26.68 | 28.66 | 29.25 | 29.77 | 30.16 | 30.43 | 30.55 | 30.75 | 31.33 | 31.12 | 30.81 | |

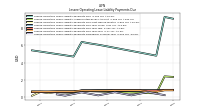

| Interest Expense | 42.34 | 40.23 | 35.96 | 27.70 | 18.52 | 10.07 | 4.94 | 3.15 | 3.31 | 3.55 | 3.96 | 4.30 | 5.14 | 6.07 | 7.30 | 11.59 | 13.43 | 15.22 | 16.22 | 15.29 | 14.14 | 12.45 | 11.26 | 9.85 | 8.77 | 7.97 | 7.00 | 6.07 | 5.40 | 5.36 | 5.08 | 4.63 | 4.17 | 4.25 | 4.23 | 3.96 | 3.92 | 3.78 | 3.70 | 3.59 | 3.75 | 4.00 | 4.51 | 5.04 | 5.82 | 6.50 | 7.10 | 7.28 | 7.38 | 7.61 | 7.60 | 7.22 | 8.01 | 7.91 | 7.66 | |

| Interest Expense Long Term Debt | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.05 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.02 | 0.40 | 0.42 | 0.44 | 0.45 | 0.43 | 0.43 | 0.42 | 0.37 | 0.35 | 0.34 | 0.33 | 0.31 | 0.31 | 0.29 | 0.29 | 0.29 | 0.25 | 0.24 | 0.26 | 0.26 | 0.26 | 0.26 | 0.26 | 0.25 | 0.23 | 0.26 | 0.26 | 0.31 | 0.39 | 0.40 | 0.40 | 0.40 | 0.38 | 0.36 | 0.36 | 0.36 | 0.51 | 0.56 | 0.54 | |

| Interest Income Expense Net | 48.60 | 48.39 | 48.52 | 51.52 | 56.84 | 52.49 | 48.68 | 44.88 | 45.01 | 45.74 | 43.66 | 43.68 | 44.71 | 39.91 | 39.53 | 38.85 | 38.88 | 39.55 | 38.41 | 38.21 | 39.59 | 37.92 | 37.53 | 36.22 | 35.39 | 34.62 | 33.82 | 32.06 | 30.91 | 29.72 | 29.27 | 28.58 | 27.45 | 26.71 | 26.06 | 25.70 | 26.10 | 25.96 | 25.55 | 24.68 | 24.30 | 22.97 | 21.91 | 21.26 | 20.87 | 22.16 | 22.15 | 22.50 | 22.78 | 22.82 | 22.95 | 23.53 | 23.32 | 23.22 | 23.15 | |

| Interest Paid Net | 37.63 | 33.89 | 31.55 | 25.46 | 17.53 | 9.81 | 5.30 | 3.47 | 3.61 | 4.51 | 4.38 | 5.97 | 5.49 | 8.21 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 6.44 | 4.48 | 1.88 | 3.77 | 4.99 | 6.24 | 5.58 | 4.54 | 5.51 | 5.47 | 5.71 | 5.03 | 6.07 | 5.38 | 4.45 | 3.64 | 5.43 | 5.12 | 5.41 | 4.38 | 5.48 | 4.68 | 5.11 | 3.26 | 11.78 | 7.57 | 7.39 | 5.56 | 6.58 | 6.50 | 6.09 | 5.96 | 5.88 | 5.84 | 5.66 | 5.46 | 5.57 | 5.67 | 5.75 | 5.41 | 5.06 | 4.75 | 5.15 | 4.60 | 3.81 | 4.74 | 4.39 | 4.24 | 3.67 | 4.42 | 4.00 | 2.63 | 2.78 | 3.13 | 3.12 | |

| Income Taxes Paid | 4.80 | 2.15 | NA | NA | 6.80 | 6.71 | NA | NA | 5.31 | 6.38 | NA | NA | 4.96 | 14.36 | NA | NA | 6.21 | 5.40 | NA | NA | 6.00 | 4.88 | 8.15 | 0.00 | 9.30 | 8.30 | 11.51 | 0.00 | 6.50 | 6.36 | 8.75 | 0.00 | 6.15 | 5.55 | 9.76 | 0.10 | 4.65 | 6.35 | 9.72 | 0.47 | 4.10 | 4.85 | 8.33 | 0.00 | 1.70 | 3.98 | 7.05 | 0.00 | 6.90 | 5.81 | 7.81 | 1.01 | 5.00 | 2.84 | NA | |

| Other Comprehensive Income Loss Net Of Tax | 72.92 | -50.47 | -10.28 | 21.55 | 32.81 | -63.20 | -64.85 | -109.78 | 5.16 | -11.34 | 7.16 | -12.63 | 2.52 | 0.42 | 2.25 | 10.49 | -1.41 | 3.97 | 7.01 | 8.68 | 7.08 | -3.57 | -1.72 | -7.08 | -1.12 | 0.08 | 2.27 | 0.48 | -10.38 | -2.17 | 2.80 | 5.22 | -2.89 | 2.31 | -3.15 | 2.04 | 1.24 | -0.77 | 2.90 | 2.95 | -1.04 | -0.83 | -5.61 | -0.70 | -0.95 | 0.15 | 0.25 | 1.10 | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 29.63 | 25.25 | 14.61 | 24.28 | 25.98 | 28.52 | 25.67 | 23.64 | 24.28 | 24.12 | 24.35 | 22.98 | 24.59 | 22.78 | 19.67 | 17.30 | 22.20 | 21.45 | 21.71 | 21.68 | 21.36 | 20.57 | 20.14 | 18.34 | 11.63 | 15.82 | 15.36 | 14.51 | 13.52 | 13.48 | 12.80 | 12.28 | 12.29 | 11.56 | 11.38 | 11.14 | 11.07 | 11.51 | 11.31 | 9.91 | 10.59 | 9.77 | 9.24 | 9.25 | 8.60 | 9.35 | 8.82 | 8.63 | 8.26 | 8.45 | 7.99 | 5.96 | 5.78 | 6.52 | 6.22 | |

| Comprehensive Income Net Of Tax | 102.54 | -25.21 | 4.34 | 45.83 | 58.78 | -34.67 | -39.17 | -86.14 | 29.44 | 12.78 | 31.51 | 10.35 | 27.11 | 23.20 | 21.92 | 27.79 | 20.79 | 25.42 | 28.73 | 30.36 | 28.45 | 17.00 | 18.42 | 11.26 | 10.51 | 15.91 | 17.64 | 15.00 | 3.14 | 11.31 | 15.61 | 17.50 | 9.39 | 13.88 | 8.23 | 13.18 | 12.31 | 10.75 | 14.21 | 12.86 | 9.55 | 8.94 | 3.62 | 8.54 | 7.65 | 9.50 | 9.07 | 9.73 | 6.60 | 11.48 | 10.33 | 6.03 | 3.45 | 9.68 | NA | |

| Interest Income Expense After Provision For Loan Loss | 48.30 | 47.99 | 47.72 | 47.17 | 47.88 | 52.49 | 48.68 | 44.46 | 45.01 | 44.44 | 45.36 | 42.20 | 43.79 | 38.16 | 34.03 | 32.25 | 38.63 | 38.55 | 37.63 | 37.01 | 39.29 | 36.83 | 35.83 | 32.92 | 33.54 | 34.17 | 33.32 | 31.86 | 29.76 | 29.72 | 29.27 | 28.58 | 27.45 | 26.71 | 26.06 | 25.70 | 26.10 | 25.96 | 25.55 | 24.68 | 24.30 | 22.97 | 21.91 | 21.26 | 19.62 | 22.16 | 21.65 | 21.70 | 19.88 | 20.42 | 20.05 | 17.93 | 16.80 | 17.07 | 17.40 | |

| Noninterest Expense | 29.45 | 29.10 | 42.73 | 29.43 | 27.43 | 27.89 | 27.91 | 26.97 | 24.93 | 25.97 | 26.65 | 26.75 | 24.91 | 23.12 | 21.08 | 22.09 | 22.12 | 22.74 | 22.09 | 22.47 | 22.55 | 22.01 | 20.27 | 21.20 | 19.60 | 20.27 | 19.35 | 20.05 | 18.39 | 18.76 | 18.45 | 17.38 | 17.36 | 17.21 | 16.74 | 16.90 | 16.63 | 16.66 | 16.08 | 16.79 | 16.53 | 16.27 | 15.09 | 14.89 | 14.51 | 14.30 | 14.25 | 14.68 | 13.48 | 13.48 | 13.97 | 14.17 | 13.33 | 13.63 | 13.43 | |

| Noninterest Income | 17.21 | 10.84 | 11.50 | 10.31 | 10.52 | 10.16 | 10.49 | 10.69 | 9.71 | 11.11 | 11.34 | 12.56 | 11.78 | 13.12 | 11.17 | 10.78 | 11.12 | 10.77 | 11.59 | 11.53 | 10.11 | 10.43 | 9.69 | 9.88 | 9.46 | 9.50 | 8.79 | 8.26 | 8.74 | 9.02 | 8.07 | 7.04 | 8.07 | 7.90 | 7.71 | 7.79 | 7.16 | 7.87 | 7.59 | 7.43 | 7.88 | 7.81 | 7.57 | 7.48 | 7.30 | 6.23 | 5.81 | 5.85 | 5.54 | 5.92 | 5.92 | 4.83 | 5.09 | 6.21 | 5.36 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

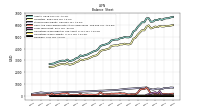

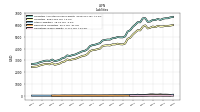

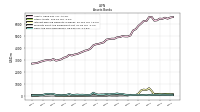

| Assets | 6524.03 | 6426.84 | 6509.55 | 6411.53 | 6432.37 | 6288.41 | 6265.09 | 6572.26 | 6557.32 | 6222.92 | 6232.91 | 6016.64 | 5830.44 | 5551.11 | 5441.09 | 5030.08 | 4946.74 | 4948.15 | 4975.52 | 4891.89 | 4875.25 | 4757.62 | 4760.87 | 4726.95 | 4682.98 | 4454.24 | 4393.00 | 4319.10 | 4290.02 | 4197.32 | 3937.30 | 3808.91 | 3766.29 | 3666.25 | 3572.11 | 3477.65 | 3443.28 | 3355.90 | 3419.11 | 3233.72 | 3175.76 | 3041.24 | 2975.46 | 2927.70 | 3064.14 | 2952.21 | 2974.44 | 2954.62 | 2889.69 | 2827.44 | 2735.02 | NA | 2681.93 | NA | NA | |

| Liabilities | 5874.24 | 5869.66 | 5917.55 | 5809.52 | 5863.48 | 5769.19 | 5703.02 | 5963.16 | 5852.42 | 5539.71 | 5555.44 | 5364.97 | 5173.25 | 4914.27 | 4820.20 | 4423.51 | 4348.65 | 4363.72 | 4410.16 | 4348.62 | 4353.55 | 4259.08 | 4274.39 | 4253.61 | 4214.31 | 3991.72 | 3942.54 | 3881.90 | 3862.96 | 3769.94 | 3518.41 | 3401.94 | 3373.39 | 3279.55 | 3196.34 | 3106.82 | 3081.90 | 3003.95 | 3075.54 | 2901.63 | 2853.80 | 2726.69 | 2667.85 | 2621.03 | 2766.32 | 2657.22 | 2686.78 | 2673.66 | 2616.40 | 2558.59 | 2475.62 | NA | 2434.84 | NA | NA | |

| Liabilities And Stockholders Equity | 6524.03 | 6426.84 | 6509.55 | 6411.53 | 6432.37 | 6288.41 | 6265.09 | 6572.26 | 6557.32 | 6222.92 | 6232.91 | 6016.64 | 5830.44 | 5551.11 | 5441.09 | 5030.08 | 4946.74 | 4948.15 | 4975.52 | 4891.89 | 4875.25 | 4757.62 | 4760.87 | 4726.95 | 4682.98 | 4454.24 | 4393.00 | 4319.10 | 4290.02 | 4197.32 | 3937.30 | 3808.91 | 3766.29 | 3666.25 | 3572.11 | 3477.65 | 3443.28 | 3355.90 | 3419.11 | 3233.72 | 3175.76 | 3041.24 | 2975.46 | 2927.70 | 3064.14 | 2952.21 | 2974.44 | 2954.62 | 2889.69 | 2827.44 | 2735.02 | NA | 2681.93 | NA | NA | |

| Stockholders Equity | 649.70 | 557.10 | 591.91 | 601.92 | 568.80 | 519.13 | 561.97 | 609.01 | 704.82 | 683.11 | 677.38 | 651.58 | 657.10 | 636.75 | 620.80 | 606.48 | 598.01 | 584.35 | 565.27 | 543.18 | 521.62 | 498.45 | 486.39 | 473.24 | 468.58 | 462.43 | 450.37 | 437.11 | 426.98 | 427.29 | 418.80 | 406.87 | 392.81 | 386.61 | 375.68 | 370.75 | 361.30 | 351.86 | 343.49 | 332.00 | 321.88 | 314.45 | 307.52 | 306.58 | 297.74 | 294.90 | 287.57 | 280.87 | 273.20 | 268.76 | 259.31 | 251.05 | 247.00 | 245.44 | 237.96 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 151.82 | 146.28 | 173.14 | 153.52 | 130.28 | 204.80 | 169.51 | 475.02 | 683.24 | 557.23 | 572.81 | 501.94 | 249.93 | 129.08 | 126.33 | 132.58 | 99.38 | 136.57 | 196.37 | 188.75 | 216.92 | 182.32 | 180.22 | 167.55 | 176.18 | 129.83 | 137.34 | 111.58 | 167.28 | 278.38 | 108.86 | 80.74 | 80.67 | 98.07 | 89.48 | 113.05 | 90.64 | 70.20 | 160.40 | 77.14 | 63.10 | 81.34 | 63.55 | 75.67 | 232.24 | 181.40 | 194.95 | 167.03 | 104.58 | 101.28 | 60.33 | 197.13 | 60.14 | 126.85 | 56.87 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 151.82 | 146.28 | 173.14 | 153.52 | 130.28 | 204.80 | 169.51 | 475.02 | 683.24 | 557.23 | 572.81 | 501.94 | 249.93 | 129.08 | 126.33 | NA | 99.38 | NA | NA | NA | 216.92 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

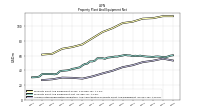

| Land | 12.47 | NA | NA | NA | 12.47 | NA | NA | NA | 12.47 | NA | NA | NA | 12.47 | NA | NA | NA | 12.51 | NA | NA | NA | 16.65 | NA | NA | NA | 16.17 | NA | NA | NA | 14.80 | NA | NA | NA | 14.58 | NA | NA | NA | 12.94 | NA | NA | NA | 12.59 | NA | NA | NA | 12.44 | NA | NA | NA | 12.29 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 113.82 | NA | NA | NA | 111.12 | NA | NA | NA | 110.47 | NA | NA | NA | 106.29 | NA | NA | NA | 104.42 | NA | NA | NA | 97.48 | NA | NA | NA | 92.22 | NA | NA | NA | 83.80 | NA | NA | NA | 75.34 | NA | NA | NA | 71.72 | NA | NA | NA | 69.39 | NA | NA | NA | 62.54 | NA | NA | NA | 61.42 | NA | NA | NA | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 55.92 | NA | NA | NA | 53.02 | NA | NA | NA | 51.16 | NA | NA | NA | 46.99 | NA | NA | NA | 44.26 | NA | NA | NA | 39.38 | NA | NA | NA | 35.75 | NA | NA | NA | 31.70 | NA | NA | NA | 28.66 | NA | NA | NA | 29.74 | NA | NA | NA | 30.05 | NA | NA | NA | 27.70 | NA | NA | NA | 26.69 | NA | NA | NA | NA | NA | NA | |

| Property Plant And Equipment Net | 57.90 | 58.51 | 58.84 | 58.71 | 58.10 | 58.49 | 58.60 | 58.88 | 59.31 | 60.00 | 59.54 | 59.88 | 59.30 | 60.31 | 60.33 | 60.95 | 60.15 | 59.63 | 58.72 | 58.76 | 58.10 | 57.64 | 57.24 | 55.74 | 56.47 | 56.39 | 56.49 | 53.21 | 52.09 | 52.17 | 49.14 | 48.63 | 46.68 | 44.01 | 43.38 | 42.44 | 41.98 | 40.52 | 39.87 | 39.58 | 39.34 | 38.51 | 35.35 | 34.50 | 34.84 | 34.97 | 34.96 | 35.02 | 34.74 | 31.66 | 30.71 | NA | 30.41 | NA | NA | |

| Held To Maturity Securities Fair Value | 119.22 | 102.63 | 114.26 | 115.53 | 111.03 | 103.33 | 113.35 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | 129.92 | 129.49 | 129.07 | 128.65 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Rolling After Ten Years Fair Value | 119.22 | 102.63 | 114.26 | 115.53 | 111.03 | 103.33 | 113.35 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | 879.30 | NA | NA | NA | 379.46 | NA | NA | NA | 591.74 | NA | NA | NA | 757.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 5720.52 | 5657.07 | 5423.06 | 5517.73 | 5460.62 | 5664.13 | 5621.58 | 5820.62 | 5735.41 | 5414.64 | 5394.66 | 5229.97 | 5036.81 | 4767.95 | 4643.43 | 4281.70 | 4133.82 | 4283.39 | 4221.30 | 4147.44 | 4044.07 | 4015.92 | 3934.95 | 4099.49 | 4008.66 | 3873.99 | 3615.94 | 3679.40 | 3577.91 | 3651.94 | 3403.45 | 3250.74 | 3183.42 | 3147.53 | 3020.15 | 2994.24 | 2873.12 | 2889.67 | 2827.74 | 2738.77 | 2546.07 | 2444.83 | 2483.49 | 2451.19 | 2581.76 | 2476.10 | 2525.49 | 2483.87 | 2412.70 | 2356.36 | 2276.50 | NA | 2201.03 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 50.00 | 90.00 | 400.00 | 200.00 | 297.00 | NA | NA | NA | 75.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

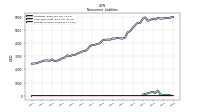

| Stockholders Equity | 649.70 | 557.10 | 591.91 | 601.92 | 568.80 | 519.13 | 561.97 | 609.01 | 704.82 | 683.11 | 677.38 | 651.58 | 657.10 | 636.75 | 620.80 | 606.48 | 598.01 | 584.35 | 565.27 | 543.18 | 521.62 | 498.45 | 486.39 | 473.24 | 468.58 | 462.43 | 450.37 | 437.11 | 426.98 | 427.29 | 418.80 | 406.87 | 392.81 | 386.61 | 375.68 | 370.75 | 361.30 | 351.86 | 343.49 | 332.00 | 321.88 | 314.45 | 307.52 | 306.58 | 297.74 | 294.90 | 287.57 | 280.87 | 273.20 | 268.76 | 259.31 | 251.05 | 247.00 | 245.44 | 237.96 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 649.79 | 557.18 | 592.00 | 602.01 | 568.89 | 519.22 | 562.06 | 609.10 | 704.91 | 683.20 | 677.47 | 651.67 | 657.18 | 636.84 | 620.89 | 606.57 | 598.10 | 584.44 | 565.36 | 543.27 | 521.70 | 498.54 | 486.48 | 473.33 | 468.67 | 462.52 | 450.46 | 437.20 | 427.07 | 427.38 | 418.89 | 406.96 | 392.90 | 386.70 | 375.76 | 370.84 | 361.38 | 351.95 | 343.57 | 332.09 | 321.96 | 314.54 | 307.61 | 306.67 | 297.83 | 294.99 | 287.66 | 280.96 | 273.29 | 268.85 | 259.40 | NA | 247.09 | NA | NA | |

| Common Stock Value | 127.69 | 125.76 | 123.37 | 125.84 | 127.00 | 125.83 | 123.57 | 121.14 | 120.61 | 119.62 | 117.80 | 114.76 | 114.93 | 114.01 | 113.42 | 113.34 | 114.86 | 114.24 | 112.69 | 111.57 | 112.38 | 111.05 | 109.22 | 107.86 | 108.86 | 107.64 | 105.74 | 104.53 | 104.41 | 103.06 | 101.00 | 99.96 | 99.12 | 98.22 | 96.86 | 96.07 | 96.12 | 95.50 | 94.20 | 93.79 | 93.25 | 92.23 | 90.92 | 90.46 | 90.04 | 89.25 | 88.44 | 88.01 | 87.38 | 87.02 | 86.42 | NA | 85.77 | NA | NA | |

| Retained Earnings Accumulated Deficit | 692.76 | 674.92 | 661.45 | 658.63 | 646.10 | 630.34 | 612.03 | 596.58 | 583.13 | 567.52 | 552.06 | 536.39 | 529.00 | 512.04 | 496.89 | 484.86 | 475.25 | 460.74 | 446.97 | 432.95 | 419.18 | 404.39 | 390.40 | 376.85 | 363.79 | 357.71 | 347.43 | 337.62 | 327.87 | 319.12 | 310.32 | 302.20 | 294.00 | 285.79 | 278.30 | 271.00 | 263.35 | 255.75 | 247.72 | 239.89 | 233.11 | 225.65 | 219.00 | 212.90 | 203.65 | 200.62 | 194.05 | 188.01 | 181.90 | 176.15 | 170.22 | NA | 161.30 | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -155.19 | -228.11 | -177.65 | -167.37 | -188.92 | -221.73 | -158.53 | -93.69 | 16.09 | 10.93 | 22.27 | 15.11 | 27.74 | 25.22 | 24.80 | 22.55 | 12.06 | 13.47 | 9.50 | 2.49 | -6.19 | -13.28 | -9.71 | -7.99 | -0.67 | 0.45 | 0.37 | -1.90 | -2.39 | 7.99 | 10.17 | 7.36 | 2.14 | 5.04 | 2.72 | 5.87 | 3.83 | 2.59 | 3.35 | 0.45 | -2.49 | -1.45 | -0.62 | 4.99 | 5.69 | 6.64 | 6.49 | 6.24 | 5.14 | 6.80 | 3.76 | NA | 1.35 | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 1.86 | 2.19 | -2.55 | 2.16 | 1.10 | 2.09 | 2.36 | 2.26 | 1.02 | 1.78 | 2.97 | 1.38 | 0.97 | 0.38 | 0.03 | 0.41 | 0.56 | 1.36 | 1.07 | 1.20 | 1.29 | 1.63 | 1.27 | 1.41 | 1.19 | 1.69 | 1.26 | 1.56 | 1.02 | 1.40 | 1.01 | 0.78 | 0.73 | 0.88 | 0.57 | 0.35 | 0.54 | 1.04 | 0.63 | 0.60 | 0.60 | 0.64 | 0.29 | 0.44 | 0.18 | 0.47 | 0.26 | 0.43 | 0.28 | 0.41 | 0.38 | 0.27 | -0.47 | 0.24 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

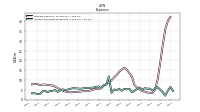

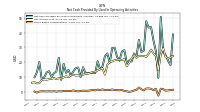

| Net Cash Provided By Used In Operating Activities | 26.50 | 50.57 | 9.46 | 27.44 | 34.49 | 43.69 | 43.45 | 47.70 | 27.79 | 26.92 | 35.16 | 23.91 | 25.96 | 20.52 | 21.23 | 19.52 | 28.16 | 27.21 | 21.00 | 23.66 | 29.81 | 29.61 | 19.61 | 25.94 | 24.11 | 17.21 | 15.17 | 20.76 | 12.73 | NA | NA | NA | 12.67 | 16.66 | 9.97 | 16.48 | 16.05 | 13.84 | 10.92 | 14.89 | 12.78 | 18.98 | 8.09 | 23.11 | 13.79 | 12.58 | 10.25 | 13.97 | 13.09 | 9.78 | 8.35 | 20.13 | 13.29 | 9.85 | NA | |

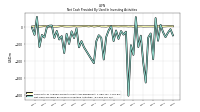

| Net Cash Provided By Used In Investing Activities | -32.53 | 10.54 | -83.30 | 50.36 | -192.21 | -40.47 | -64.63 | -329.22 | -213.84 | -53.42 | -120.25 | 55.96 | -166.30 | -109.47 | -406.51 | -29.75 | -47.24 | -26.18 | -72.50 | -22.78 | -85.04 | 2.17 | -22.34 | -61.22 | -193.61 | -65.72 | -50.70 | -86.03 | -215.15 | NA | NA | NA | -121.22 | -85.21 | -121.65 | -11.03 | -67.46 | -27.97 | -101.85 | -42.51 | -155.43 | -56.00 | -75.65 | -25.43 | -66.92 | 6.25 | 5.17 | -3.22 | -64.09 | -49.25 | -120.23 | 56.90 | -48.43 | -7.12 | NA | |

| Net Cash Provided By Used In Financing Activities | 11.57 | -87.97 | 93.46 | -54.56 | 83.20 | 32.06 | -284.34 | 73.30 | 312.06 | 10.93 | 155.96 | 172.15 | 261.18 | 91.69 | 379.04 | 43.44 | -18.12 | -60.83 | 59.11 | -29.05 | 89.84 | -29.68 | 15.40 | 26.65 | 215.85 | 41.01 | 61.28 | 9.57 | 91.31 | NA | NA | NA | 91.15 | 77.14 | 88.11 | 16.96 | 71.85 | -76.06 | 174.19 | 41.65 | 124.42 | 54.80 | 55.45 | -154.25 | 103.97 | -32.38 | 12.50 | 51.69 | 54.30 | 80.43 | -24.92 | 59.97 | -31.57 | 67.25 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 26.50 | 50.57 | 9.46 | 27.44 | 34.49 | 43.69 | 43.45 | 47.70 | 27.79 | 26.92 | 35.16 | 23.91 | 25.96 | 20.52 | 21.23 | 19.52 | 28.16 | 27.21 | 21.00 | 23.66 | 29.81 | 29.61 | 19.61 | 25.94 | 24.11 | 17.21 | 15.17 | 20.76 | 12.73 | NA | NA | NA | 12.67 | 16.66 | 9.97 | 16.48 | 16.05 | 13.84 | 10.92 | 14.89 | 12.78 | 18.98 | 8.09 | 23.11 | 13.79 | 12.58 | 10.25 | 13.97 | 13.09 | 9.78 | 8.35 | 20.13 | 13.29 | 9.85 | NA | |

| Net Income Loss | 29.63 | 25.25 | 14.61 | 24.28 | 25.98 | 28.52 | 25.67 | 23.64 | 24.28 | 24.12 | 24.35 | 22.98 | 24.59 | 22.78 | 19.67 | 17.30 | 22.20 | 21.45 | 21.71 | 21.68 | 21.36 | 20.57 | 20.14 | 18.34 | 11.63 | 15.82 | 15.36 | 14.51 | 13.52 | 13.48 | 12.80 | 12.28 | 12.29 | 11.56 | 11.38 | 11.14 | 11.07 | 11.51 | 11.31 | 9.91 | 10.59 | 9.77 | 9.24 | 9.25 | 8.60 | 9.35 | 8.82 | 8.63 | 8.26 | 8.45 | 7.99 | 5.96 | 5.78 | 6.52 | 6.22 | |

| Share Based Compensation | 1.86 | 2.19 | -2.55 | 2.16 | 1.10 | 2.09 | 2.36 | 2.26 | 1.02 | 1.78 | 2.97 | 1.38 | 0.97 | 0.38 | 0.03 | 0.41 | 0.56 | 1.36 | 1.07 | 1.20 | 1.29 | 1.63 | 1.27 | 1.41 | 1.19 | 1.69 | 1.26 | 1.56 | 1.02 | 1.40 | 1.01 | 0.78 | 0.73 | 0.88 | 0.57 | 0.35 | 0.54 | 1.04 | 0.63 | 0.60 | 0.60 | 0.64 | 0.29 | 0.44 | 0.18 | 0.47 | 0.26 | 0.43 | 0.28 | 0.41 | 0.38 | 0.27 | -0.47 | 0.24 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -32.53 | 10.54 | -83.30 | 50.36 | -192.21 | -40.47 | -64.63 | -329.22 | -213.84 | -53.42 | -120.25 | 55.96 | -166.30 | -109.47 | -406.51 | -29.75 | -47.24 | -26.18 | -72.50 | -22.78 | -85.04 | 2.17 | -22.34 | -61.22 | -193.61 | -65.72 | -50.70 | -86.03 | -215.15 | NA | NA | NA | -121.22 | -85.21 | -121.65 | -11.03 | -67.46 | -27.97 | -101.85 | -42.51 | -155.43 | -56.00 | -75.65 | -25.43 | -66.92 | 6.25 | 5.17 | -3.22 | -64.09 | -49.25 | -120.23 | 56.90 | -48.43 | -7.12 | NA | |

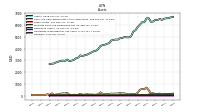

| Payments To Acquire Property Plant And Equipment | 0.98 | 1.19 | 1.67 | 2.15 | 1.14 | 1.36 | 1.22 | 1.09 | 0.90 | 1.97 | 1.13 | 2.16 | 0.56 | 1.88 | 1.15 | 2.13 | 2.02 | 2.41 | 1.47 | 2.09 | 2.54 | 1.84 | 2.91 | 0.68 | 1.49 | 1.28 | 4.53 | 2.29 | 1.18 | 4.16 | 1.56 | 2.93 | 3.58 | 2.26 | 1.91 | 1.41 | 2.85 | 1.52 | 1.12 | 1.07 | 1.64 | 3.97 | 1.55 | 0.34 | 0.63 | 0.70 | 0.61 | 0.95 | 3.69 | 1.52 | 0.68 | 0.77 | 1.74 | 0.51 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 11.57 | -87.97 | 93.46 | -54.56 | 83.20 | 32.06 | -284.34 | 73.30 | 312.06 | 10.93 | 155.96 | 172.15 | 261.18 | 91.69 | 379.04 | 43.44 | -18.12 | -60.83 | 59.11 | -29.05 | 89.84 | -29.68 | 15.40 | 26.65 | 215.85 | 41.01 | 61.28 | 9.57 | 91.31 | NA | NA | NA | 91.15 | 77.14 | 88.11 | 16.96 | 71.85 | -76.06 | 174.19 | 41.65 | 124.42 | 54.80 | 55.45 | -154.25 | 103.97 | -32.38 | 12.50 | 51.69 | 54.30 | 80.43 | -24.92 | 59.97 | -31.57 | 67.25 | NA | |

| Payments Of Dividends Common Stock | 11.78 | 11.78 | 11.78 | 11.75 | 10.21 | 10.21 | 10.21 | 10.20 | 8.67 | 8.66 | 8.66 | 8.65 | 7.63 | 7.63 | 7.62 | 7.69 | 7.69 | 7.69 | 7.68 | 6.58 | 6.58 | 6.58 | 6.58 | 5.54 | 5.54 | 5.54 | 5.54 | 4.77 | 4.77 | 4.68 | 4.67 | 4.08 | 4.08 | 4.07 | 4.07 | 3.48 | 3.48 | 3.48 | 3.47 | 3.13 | 3.13 | 3.12 | 3.12 | 0.00 | 5.56 | 2.78 | 2.77 | 2.52 | 2.51 | 2.51 | 2.51 | 2.51 | 2.49 | 2.51 | NA | |

| Payments For Repurchase Of Common Stock | 0.08 | 0.21 | 0.08 | 0.20 | 0.07 | 0.22 | 0.07 | 0.21 | 0.06 | 0.21 | 0.06 | 0.22 | 0.06 | 0.21 | 0.05 | 10.23 | 0.05 | 0.21 | 0.05 | 0.20 | 0.04 | 0.19 | 0.04 | 0.18 | 0.04 | 0.20 | 0.04 | 0.22 | 0.03 | 0.20 | 0.03 | 0.20 | 0.02 | 0.22 | 0.02 | 0.19 | 0.02 | 0.20 | 0.02 | 0.21 | 0.02 | 0.19 | 0.02 | 0.17 | 0.03 | 0.20 | 0.01 | 0.17 | 0.01 | 0.12 | 0.01 | 0.10 | 0.02 | 0.08 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 90.94 | 88.62 | 84.48 | 79.22 | 75.35 | 62.56 | 53.62 | 48.03 | 48.32 | 49.30 | 47.62 | 47.98 | 49.85 | 45.98 | 46.83 | 50.44 | 52.31 | 54.77 | 54.63 | 53.49 | 53.73 | 50.38 | 48.80 | 46.07 | 44.16 | 42.59 | 40.82 | 38.13 | 36.31 | 35.08 | 34.35 | 33.21 | 31.62 | 30.97 | 30.29 | 29.66 | 30.02 | 29.75 | 29.25 | 28.27 | 28.05 | 26.97 | 26.42 | 26.29 | 26.68 | 28.66 | 29.25 | 29.77 | 30.16 | 30.43 | 30.55 | 30.75 | 31.33 | 31.12 | 30.81 |