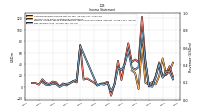

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Weighted Average Number Of Diluted Shares Outstanding | 45.27 | 44.84 | 44.96 | NA | 44.80 | 44803.28 | 45227.54 | NA | 45.04 | 45.06 | 44.70 | NA | 41.55 | 41.12 | 41.07 | NA | 41.11 | 41.00 | 40.92 | NA | 41.69 | 41.62 | 41.40 | NA | 38.64 | 35.94 | 35.65 | NA | 35.00 | 35.21 | 34.95 | NA | 33.92 | 29.50 | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 44.41 | 44.33 | 44.16 | NA | 43.91 | 43824.71 | 43701.94 | NA | 43.33 | 43.17 | 42.67 | NA | 40.54 | 40.51 | 40.33 | NA | 40.24 | 40.20 | 40.16 | NA | 40.12 | 40.03 | 39.93 | NA | 37.37 | 34.62 | 34.47 | NA | 34.21 | 34.19 | 34.18 | NA | 32.82 | 28.64 | NA | |

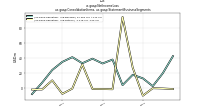

| Earnings Per Share Basic | 0.89 | 0.40 | 0.01 | 0.04 | 0.97 | 2.22 | 0.79 | 0.69 | 0.78 | 1.48 | 0.92 | 0.72 | 0.83 | 0.09 | -0.19 | 0.17 | 0.10 | 0.12 | 0.06 | 0.26 | 0.36 | 0.36 | 0.31 | 1.94 | 0.34 | 0.28 | 0.18 | 0.16 | 0.10 | 0.00 | 0.14 | 0.16 | 0.09 | 0.14 | 0.08 | |

| Earnings Per Share Diluted | 0.88 | 0.39 | 0.01 | 0.04 | 0.96 | 2.16 | 0.76 | 0.66 | 0.76 | 1.41 | 0.88 | 0.70 | 0.81 | 0.09 | -0.19 | 0.17 | 0.09 | 0.12 | 0.06 | 0.26 | 0.34 | 0.34 | 0.30 | 1.87 | 0.33 | 0.27 | 0.17 | 0.15 | 0.10 | 0.00 | 0.13 | 0.17 | 0.09 | 0.13 | 0.08 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

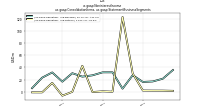

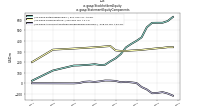

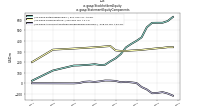

| Interest And Fee Income Loans And Leases | 162.72 | 152.36 | 139.05 | 127.31 | 107.88 | 94.16 | 89.20 | 88.58 | 89.39 | 84.78 | 84.99 | 79.17 | 70.62 | 62.02 | 58.96 | 57.02 | 55.94 | 49.91 | 44.97 | 40.63 | 37.72 | 36.27 | 32.69 | 29.34 | 26.98 | 23.56 | 19.75 | 16.24 | 14.96 | 12.90 | 11.01 | 10.53 | 8.70 | 7.39 | 5.91 | |

| Marketing And Advertising Expense | 3.45 | 3.01 | 3.60 | 3.89 | 2.62 | 2.30 | 1.73 | 1.84 | 1.63 | 0.88 | 0.65 | 0.97 | 0.55 | 0.62 | 1.36 | 1.63 | 1.28 | 1.67 | 1.36 | 1.02 | 1.46 | 1.87 | 1.66 | 1.39 | 1.52 | 1.98 | 1.49 | 1.11 | 1.10 | 1.36 | 0.96 | 1.16 | 1.05 | 1.12 | 1.03 | |

| Interest Expense | 91.20 | 85.41 | 69.40 | 50.71 | 31.95 | 19.31 | 15.00 | 14.56 | 15.05 | 16.54 | 18.27 | 20.74 | 23.71 | 25.92 | 23.31 | 23.80 | 23.58 | 21.20 | 19.32 | 15.96 | 14.17 | 13.93 | 10.55 | 7.56 | 7.15 | 5.95 | 4.78 | 4.52 | 3.93 | 3.48 | 2.69 | 2.31 | 2.39 | 2.25 | 1.84 | |

| Interest Income Expense Net | 89.41 | 84.30 | 82.02 | 85.90 | 83.89 | 79.93 | 77.78 | 77.64 | 77.73 | 71.46 | 69.95 | 62.30 | 51.36 | 40.90 | 40.16 | 38.01 | 37.53 | 33.94 | 30.61 | 28.80 | 27.72 | 27.05 | 24.48 | 22.98 | 21.02 | 18.39 | 15.64 | 12.39 | 11.63 | 9.92 | 8.71 | 8.53 | 6.61 | 5.42 | 4.29 | |

| Interest Paid Net | 91.37 | 84.70 | 69.03 | 50.54 | 32.12 | 19.59 | 15.26 | 15.00 | 16.16 | 17.22 | 18.47 | 19.90 | 22.50 | 25.54 | 23.86 | 24.32 | 23.57 | 21.55 | 17.84 | 15.51 | 14.29 | 13.94 | 10.37 | 7.46 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 2.97 | 1.43 | 3.21 | -1.07 | 1.52 | 25.28 | 8.39 | 17.63 | 9.39 | 12.59 | 4.18 | -17.55 | 11.70 | 1.47 | -7.78 | 2.08 | 2.37 | 0.66 | 0.32 | -3.01 | -3.20 | 0.49 | 0.32 | 1.61 | -5.06 | 0.41 | 0.80 | -2.99 | 2.56 | 0.56 | 3.31 | 3.52 | 2.23 | 2.77 | 1.41 | |

| Income Taxes Paid Net | -3.54 | 5.05 | 0.18 | 7.58 | 10.35 | 6.77 | 0.01 | 3.18 | 7.50 | 8.69 | 0.35 | 2.44 | 8.59 | 0.10 | 0.36 | -1.20 | -23.53 | 26.09 | -13.65 | 2.13 | 0.16 | -0.79 | 0.25 | -0.01 | -0.78 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | 39.79 | 17.54 | 0.40 | 1.79 | 42.87 | 97.04 | 34.51 | 30.15 | 33.84 | 63.58 | 39.43 | 29.59 | 33.78 | 3.78 | -7.60 | 6.83 | 3.90 | 4.93 | 2.37 | 10.49 | 14.25 | 14.25 | 12.45 | 71.73 | 12.86 | 9.79 | 6.11 | 5.48 | 3.48 | 0.12 | 4.68 | 5.71 | 2.90 | 3.94 | 2.45 | |

| Other Comprehensive Income Loss Net Of Tax | NA | NA | NA | NA | NA | -22.78 | -38.45 | -6.12 | -5.06 | 4.00 | -12.38 | -3.40 | -0.40 | 7.55 | 6.03 | -4.53 | 3.38 | 11.88 | 2.67 | 4.93 | -1.59 | -1.49 | -2.25 | -0.41 | -0.10 | 0.18 | -0.04 | -0.78 | -0.07 | 0.15 | 0.24 | -0.28 | 0.09 | -0.21 | 0.08 | |

| Net Income Loss | 39.79 | 17.54 | 0.40 | 1.79 | 42.87 | 97.04 | 34.51 | 30.15 | 33.84 | 63.58 | 39.43 | 29.59 | 33.78 | 3.78 | -7.60 | 6.83 | 3.90 | 4.93 | 2.37 | NA | NA | NA | NA | 71.73 | 12.86 | 9.79 | 6.11 | 5.48 | 3.48 | 0.12 | 4.69 | 5.71 | 2.90 | 3.94 | NA | |

| Comprehensive Income Net Of Tax | 19.05 | 4.36 | 8.32 | NA | 6.91 | 74.26 | -3.94 | NA | 28.78 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 39.79 | 17.54 | 0.40 | 1.79 | 42.87 | 97.04 | 34.51 | 30.15 | 33.84 | 63.58 | 39.43 | 29.59 | 33.78 | 3.78 | -7.60 | 6.83 | 3.90 | 4.93 | 2.37 | 10.49 | 14.25 | 14.25 | 12.45 | 71.73 | 12.86 | 9.79 | 6.11 | 5.48 | 3.48 | 0.12 | 4.69 | 5.71 | 2.90 | 3.94 | 2.45 | |

| Net Income Loss Available To Common Stockholders Diluted | 39.79 | 17.54 | 0.40 | 1.79 | 42.87 | 97.04 | 34.51 | 30.15 | 33.84 | 63.58 | 39.43 | 29.59 | 33.78 | 3.78 | -7.60 | 6.83 | 3.90 | 4.93 | 2.37 | 10.49 | 14.25 | 14.25 | 12.45 | 71.73 | 12.86 | 9.79 | 6.11 | 5.48 | 3.48 | 0.12 | 4.69 | 5.71 | 2.90 | 3.94 | 2.45 | |

| Interest Income Expense After Provision For Loan Loss | 79.13 | 71.27 | 63.00 | 66.23 | 69.72 | 74.67 | 75.94 | 73.72 | 73.42 | 63.62 | 70.82 | 53.67 | 41.09 | 30.94 | 28.37 | 33.20 | 30.37 | 30.47 | 27.86 | 21.97 | 27.97 | 24.96 | 20.08 | 18.92 | 18.60 | 16.84 | 14.14 | 8.55 | 7.83 | 6.46 | 7.28 | 7.06 | 5.39 | 5.37 | 2.91 | |

| Noninterest Expense | 74.26 | 76.46 | 78.96 | 84.58 | 83.05 | 80.88 | 65.71 | 59.70 | 55.46 | 57.56 | 58.27 | 52.44 | 42.65 | 48.10 | 49.49 | 44.41 | 42.74 | 39.58 | 38.20 | 32.56 | 41.24 | 40.83 | 38.07 | 41.02 | 35.86 | 33.30 | 32.98 | 32.38 | 27.22 | 25.13 | 21.71 | 22.19 | 18.04 | 16.80 | 15.28 | |

| Noninterest Income | 37.89 | 24.16 | 19.58 | 19.07 | 57.72 | 128.53 | 32.67 | 33.76 | 25.28 | 70.11 | 31.06 | 10.80 | 47.04 | 22.41 | 5.74 | 20.12 | 18.63 | 14.70 | 13.03 | 18.07 | 24.33 | 30.61 | 30.76 | 95.44 | 25.06 | 26.67 | 25.75 | 26.33 | 25.43 | 19.35 | 22.43 | 24.37 | 17.77 | 18.14 | 16.23 |

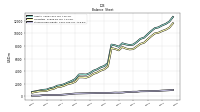

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

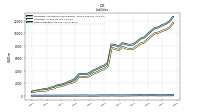

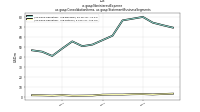

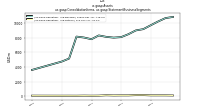

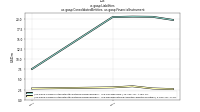

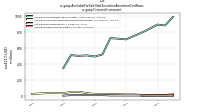

| Assets | 10950.46 | 10819.20 | 10364.30 | 9855.50 | 9314.65 | 9120.90 | 8619.97 | 8213.39 | 8137.34 | 8243.19 | 8417.88 | 7872.30 | 8093.38 | 8209.15 | 5276.32 | 4814.97 | 4603.70 | 4274.30 | 4058.05 | 3670.45 | 3444.76 | 3472.97 | 3460.86 | 2758.47 | 2432.19 | 2198.11 | 1932.12 | 1755.26 | 1669.74 | 1395.30 | 1268.54 | 1052.62 | 1012.77 | 899.41 | 673.32 | |

| Liabilities | 10100.09 | 9986.71 | 9541.49 | 9044.47 | 8512.48 | 8329.24 | 7906.64 | 7498.26 | 7447.92 | 7585.84 | 7827.52 | 7304.45 | 7509.22 | 7660.72 | 4742.54 | 4282.58 | 4075.48 | 3755.32 | 3557.67 | 3176.89 | 2967.53 | 3009.98 | 3012.03 | 2321.54 | 2067.60 | 1960.48 | 1705.94 | 1532.41 | 1455.59 | 1187.95 | 1064.11 | 853.13 | 818.67 | 796.03 | 581.50 | |

| Liabilities And Stockholders Equity | 10950.46 | 10819.20 | 10364.30 | 9855.50 | 9314.65 | 9120.90 | 8619.97 | 8213.39 | 8137.34 | 8243.19 | 8417.88 | 7872.30 | 8093.38 | 8209.15 | 5276.32 | 4814.97 | 4603.70 | 4274.30 | 4058.05 | 3670.45 | 3444.76 | 3472.97 | 3460.86 | 2758.47 | 2432.19 | 2198.11 | 1932.12 | 1755.26 | 1669.74 | 1395.30 | 1268.54 | 1052.62 | 1012.77 | 899.41 | 673.32 | |

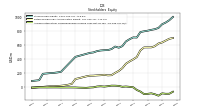

| Stockholders Equity | 850.37 | 832.49 | 822.81 | 811.03 | 802.17 | 791.66 | 713.33 | 715.13 | 689.42 | 657.35 | 590.36 | 567.85 | 584.16 | 548.43 | 533.77 | 532.39 | 528.22 | 518.99 | 500.38 | 493.56 | NA | NA | NA | 436.93 | NA | NA | NA | 222.85 | 214.15 | 207.32 | 204.41 | 199.46 | 194.06 | 103.34 | 91.81 |

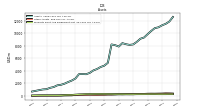

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 534.77 | 808.13 | 463.19 | 416.64 | 403.37 | 632.19 | 507.77 | 203.75 | 347.03 | NA | NA | 318.32 | NA | NA | NA | 221.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Securities Debt Securities | NA | NA | NA | NA | NA | 927.97 | 844.58 | 906.05 | 861.38 | 817.90 | 775.18 | 750.10 | 765.78 | 779.79 | 574.17 | 540.04 | 570.79 | 576.27 | 569.74 | 380.49 | 374.28 | 384.94 | 376.45 | 91.32 | 74.55 | 70.98 | 66.65 | 69.10 | 68.31 | 64.79 | 53.69 | 51.83 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

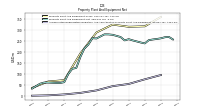

| Property Plant And Equipment Gross | NA | NA | NA | 360.12 | NA | NA | NA | 317.63 | NA | NA | NA | 315.56 | NA | NA | NA | 325.43 | NA | NA | NA | 289.63 | NA | NA | NA | 194.62 | NA | NA | NA | 73.57 | NA | NA | NA | 67.37 | NA | NA | 38.43 | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | NA | NA | NA | 96.83 | NA | NA | NA | 77.44 | NA | NA | NA | 56.30 | NA | NA | NA | 46.33 | NA | NA | NA | 27.11 | NA | NA | NA | 15.83 | NA | NA | NA | 8.91 | NA | NA | NA | 4.71 | NA | NA | 3.15 | |

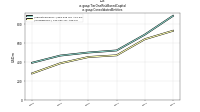

| Property Plant And Equipment Net | 258.04 | 269.49 | 268.14 | 263.29 | 260.29 | 257.93 | 254.87 | 240.20 | 244.21 | 249.07 | 253.77 | 259.27 | 253.74 | 269.06 | 274.18 | 279.10 | 280.94 | 281.13 | 271.81 | 262.52 | 263.86 | 234.82 | 216.83 | 178.79 | 129.23 | 125.01 | 101.40 | 64.66 | 60.65 | 61.06 | 61.84 | 62.65 | 62.64 | 57.31 | 35.28 | |

| Available For Sale Debt Securities Amortized Cost Basis | NA | NA | NA | NA | NA | 1005.97 | 892.61 | 903.49 | 850.76 | 800.63 | 763.17 | 721.80 | 733.01 | 746.50 | 550.81 | 524.62 | 549.41 | 559.33 | 568.43 | 382.70 | 382.98 | 391.54 | 381.01 | 92.94 | 75.51 | 71.78 | 67.73 | 70.10 | 68.13 | 64.50 | 53.63 | 52.12 | NA | NA | NA |

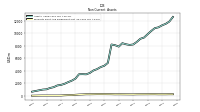

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | NA | NA | NA | 2350.67 | NA | NA | NA | 1918.84 | NA | NA | NA | 2244.54 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 10003.64 | 9879.11 | 9421.99 | 8884.93 | 8404.91 | 8155.74 | 7637.16 | 7112.04 | 6816.61 | 6520.83 | 6316.00 | 5712.83 | 5706.04 | 5873.29 | 4642.15 | 4229.12 | 4019.27 | 3721.60 | 3528.41 | 3149.58 | 2924.29 | 2969.24 | 2973.34 | 2260.26 | 2012.89 | 1871.72 | 1639.14 | 1485.08 | 1403.02 | 1140.80 | 1015.47 | 804.79 | 762.63 | 727.35 | 522.08 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 850.37 | 832.49 | 822.81 | 811.03 | 802.17 | 791.66 | 713.33 | 715.13 | 689.42 | 657.35 | 590.36 | 567.85 | 584.16 | 548.43 | 533.77 | 532.39 | 528.22 | 518.99 | 500.38 | 493.56 | NA | NA | NA | 436.93 | NA | NA | NA | 222.85 | 214.15 | 207.32 | 204.41 | 199.46 | 194.06 | 103.34 | 91.81 | |

| Retained Earnings Accumulated Deficit | 627.76 | 589.04 | 572.53 | 572.50 | 571.78 | 530.02 | 434.23 | 400.89 | 371.87 | 339.01 | 275.38 | 235.72 | 207.40 | 174.84 | 172.28 | 180.26 | 174.64 | 171.95 | 168.22 | 167.12 | 157.84 | 144.79 | 131.74 | 120.24 | 49.71 | 38.04 | 28.94 | 23.52 | 18.72 | 15.93 | 16.15 | 12.14 | 7.11 | 4.21 | -6.94 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -118.32 | -97.58 | -84.39 | -92.32 | -95.24 | -59.28 | -36.51 | 1.95 | 8.06 | 13.12 | 9.13 | 21.51 | 24.91 | 25.30 | 17.75 | 11.72 | 16.25 | 12.88 | 0.99 | -1.68 | -6.61 | -5.02 | -3.52 | -1.03 | -0.62 | -0.52 | -0.70 | -0.65 | 0.13 | 0.20 | 0.05 | -0.19 | 0.09 | 0.00 | 0.09 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

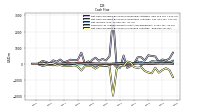

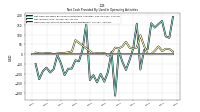

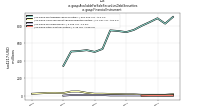

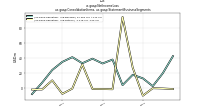

| Net Cash Provided By Used In Operating Activities | 154.89 | 136.48 | 158.46 | 26.16 | 20.66 | -78.77 | 156.44 | 29.39 | -30.07 | -80.37 | -38.66 | 19.15 | -212.80 | 12.18 | -91.52 | -141.12 | -101.10 | -144.40 | -107.31 | -132.45 | 155.75 | 24.32 | -36.10 | -31.30 | -73.75 | -74.78 | -107.70 | -47.49 | -4.05 | -76.53 | -93.89 | -68.86 | -87.48 | -128.37 | NA | |

| Net Cash Provided By Used In Investing Activities | -548.65 | -244.92 | -592.85 | -539.13 | -446.39 | -203.62 | -253.21 | -212.76 | 80.65 | 136.91 | -154.60 | -89.63 | -358.49 | -1980.12 | -179.23 | -91.18 | -130.54 | -150.04 | -301.41 | -143.33 | -132.40 | -154.29 | -420.56 | -180.63 | -90.77 | -130.49 | -133.13 | -151.38 | -77.45 | -99.47 | 8.24 | 13.62 | -24.23 | 37.47 | NA | |

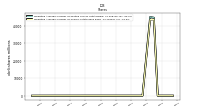

| Net Cash Provided By Used In Financing Activities | 120.41 | 453.38 | 480.95 | 526.24 | 196.92 | 406.80 | 400.79 | 40.09 | -142.37 | -253.26 | 510.49 | -245.95 | -142.10 | 2903.17 | 462.26 | 207.39 | 296.64 | 192.01 | 377.76 | 224.03 | -47.73 | -5.03 | 689.35 | 246.29 | 218.06 | 253.76 | 161.70 | 81.40 | 261.48 | 124.95 | 209.59 | 27.97 | 110.10 | 174.82 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 154.89 | 136.48 | 158.46 | 26.16 | 20.66 | -78.77 | 156.44 | 29.39 | -30.07 | -80.37 | -38.66 | 19.15 | -212.80 | 12.18 | -91.52 | -141.12 | -101.10 | -144.40 | -107.31 | -132.45 | 155.75 | 24.32 | -36.10 | -31.30 | -73.75 | -74.78 | -107.70 | -47.49 | -4.05 | -76.53 | -93.89 | -68.86 | -87.48 | -128.37 | NA | |

| Net Income Loss | 39.79 | 17.54 | 0.40 | 1.79 | 42.87 | 97.04 | 34.51 | 30.15 | 33.84 | 63.58 | 39.43 | 29.59 | 33.78 | 3.78 | -7.60 | 6.83 | 3.90 | 4.93 | 2.37 | NA | NA | NA | NA | 71.73 | 12.86 | 9.79 | 6.11 | 5.48 | 3.48 | 0.12 | 4.69 | 5.71 | 2.90 | 3.94 | NA | |

| Profit Loss | 39.79 | 17.54 | 0.40 | 1.79 | 42.87 | 97.04 | 34.51 | 30.15 | 33.84 | 63.58 | 39.43 | 29.59 | 33.78 | 3.78 | -7.60 | 6.83 | 3.90 | 4.93 | 2.37 | 10.49 | 14.25 | 14.25 | 12.45 | 71.73 | 12.86 | 9.79 | 6.11 | 5.48 | 3.48 | 0.12 | 4.68 | 5.71 | 2.90 | 3.94 | 2.45 | |

| Deferred Income Tax Expense Benefit | -3.44 | -4.18 | -5.54 | 9.87 | -0.18 | 10.66 | 6.78 | 15.31 | 3.01 | 10.46 | -3.98 | -9.91 | 3.63 | -12.43 | 1.26 | 0.93 | 0.95 | 0.21 | -0.63 | -3.54 | -3.20 | 0.49 | 0.32 | 11.60 | -1.01 | -0.62 | 2.05 | -3.78 | 0.95 | -2.20 | 0.74 | 0.00 | 0.09 | 0.62 | 0.84 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

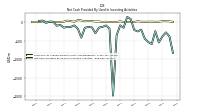

| Net Cash Provided By Used In Investing Activities | -548.65 | -244.92 | -592.85 | -539.13 | -446.39 | -203.62 | -253.21 | -212.76 | 80.65 | 136.91 | -154.60 | -89.63 | -358.49 | -1980.12 | -179.23 | -91.18 | -130.54 | -150.04 | -301.41 | -143.33 | -132.40 | -154.29 | -420.56 | -180.63 | -90.77 | -130.49 | -133.13 | -151.38 | -77.45 | -99.47 | 8.24 | 13.62 | -24.23 | 37.47 | NA | |

| Payments To Acquire Property Plant And Equipment | 8.26 | 6.56 | 10.40 | 8.12 | 7.40 | 8.20 | 20.04 | 1.42 | 0.43 | 0.56 | 0.67 | 19.68 | 0.12 | 0.46 | 0.74 | 7.19 | 2.18 | 14.51 | 13.31 | 23.49 | 26.61 | 19.53 | 41.69 | 52.72 | 7.94 | 25.82 | 37.66 | 9.70 | 0.76 | 0.18 | 0.25 | 1.16 | 6.23 | 19.79 | 3.04 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2014-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 120.41 | 453.38 | 480.95 | 526.24 | 196.92 | 406.80 | 400.79 | 40.09 | -142.37 | -253.26 | 510.49 | -245.95 | -142.10 | 2903.17 | 462.26 | 207.39 | 296.64 | 192.01 | 377.76 | 224.03 | -47.73 | -5.03 | 689.35 | 246.29 | 218.06 | 253.76 | 161.70 | 81.40 | 261.48 | 124.95 | 209.59 | 27.97 | 110.10 | 174.82 | NA | |

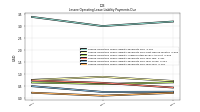

| Payments Of Dividends | 1.33 | 1.33 | 1.33 | 1.32 | 1.32 | 1.31 | 1.31 | 1.31 | 1.30 | 1.30 | 1.28 | 1.26 | 1.22 | 1.22 | 1.21 | 1.21 | 1.21 | 1.21 | 1.21 | 1.21 | 1.20 | 1.20 | 1.20 | 1.20 | 1.20 | 0.69 | 0.69 | 0.69 | 0.68 | 0.34 | 1.03 | 0.51 | 0.00 | 0.86 | 5.57 |