| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | NA | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | NA | NA | NA | 0.00 | NA | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 209.30 | 209.50 | 209.20 | NA | 209.40 | 196.50 | 191.40 | 191.60 | 161.60 | 192.70 | 146.50 | 146.30 | 146.30 | 146.20 | 146.10 | 146.70 | 146.50 | 146.50 | 146.50 | 141.60 | 123.00 | 123.00 | 123.00 | 123.00 | 123.00 | 123.00 | 123.00 | |

| Weighted Average Number Of Shares Outstanding Basic | 179.70 | 179.70 | 179.60 | NA | 179.30 | 166.60 | 161.70 | 161.70 | 161.60 | 148.70 | 146.50 | 146.30 | 146.30 | 146.20 | 146.10 | 146.00 | 146.00 | 146.00 | 146.00 | 141.60 | 123.00 | 123.00 | 123.00 | 123.00 | 123.00 | 123.00 | 123.00 | |

| Earnings Per Share Basic | 0.49 | 0.50 | 0.64 | 0.46 | 0.43 | 0.36 | 0.33 | 0.05 | -0.08 | 40000.00 | -10000.00 | -30000.00 | -0.08 | 0.00 | -0.01 | 0.00 | 0.12 | 0.11 | 0.12 | 0.18 | 0.24 | 0.31 | 0.26 | -0.09 | 0.21 | 0.14 | 0.08 | |

| Earnings Per Share Diluted | 0.42 | 0.43 | 0.55 | 0.40 | 0.37 | 0.31 | 0.28 | 0.04 | -0.08 | 30000.00 | -10000.00 | -30000.00 | -0.08 | 0.00 | -0.01 | 0.00 | 0.12 | 0.11 | 0.12 | 0.18 | 0.24 | 0.31 | 0.26 | -0.09 | 0.21 | 0.14 | 0.08 |

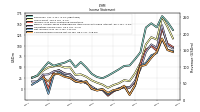

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Excluding Assessed Tax | 211.40 | 235.80 | 253.50 | 219.40 | 231.60 | 218.70 | 143.50 | 122.90 | 103.60 | 102.20 | 91.70 | 82.20 | 72.60 | 64.90 | 68.50 | 78.40 | 97.70 | 114.00 | 98.30 | 119.80 | 112.00 | 107.90 | 102.80 | 113.40 | 94.40 | 73.90 | 65.70 | |

| Revenues | 211.40 | 235.80 | 253.50 | 219.40 | 231.60 | 218.70 | 143.50 | 122.90 | 103.60 | 102.20 | 91.70 | 82.20 | 72.60 | 64.90 | 68.50 | 78.40 | 97.70 | 114.00 | 98.30 | 119.80 | 112.00 | 107.90 | 102.80 | 113.40 | 94.40 | 73.90 | 65.70 | |

| Cost Of Revenue | 94.90 | 92.40 | 87.50 | 105.50 | 112.20 | 116.20 | 83.60 | 86.50 | 85.30 | 81.80 | 78.40 | 73.00 | 69.80 | 54.70 | 53.90 | 58.30 | 69.40 | 80.20 | 65.60 | 69.60 | 62.50 | 54.10 | 50.60 | 63.60 | 52.30 | NA | NA | |

| Cost Of Goods And Services Sold | 94.90 | 92.40 | 87.50 | 105.50 | 112.20 | 116.20 | 83.60 | 86.50 | 85.30 | 81.80 | 78.40 | 73.00 | 69.80 | 54.70 | 53.90 | 58.30 | 69.40 | 80.20 | 65.60 | 69.00 | 62.50 | 54.10 | 50.60 | 64.60 | 52.30 | NA | NA | |

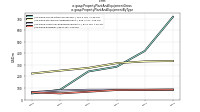

| Gross Profit | 116.50 | 143.40 | 166.00 | 113.90 | 119.40 | 102.50 | 59.90 | 36.40 | 18.30 | 20.40 | 13.30 | 9.20 | 2.80 | 10.20 | 14.60 | 20.10 | 28.30 | 33.80 | 32.70 | 50.20 | 49.50 | 53.80 | 52.20 | 49.80 | 42.10 | 30.20 | 26.80 | |

| Costs And Expenses | 118.00 | 135.20 | 106.70 | 124.50 | 128.90 | 134.00 | 97.40 | 104.10 | 99.80 | 96.80 | 90.00 | 86.10 | 85.80 | 66.80 | 70.60 | 72.70 | 83.90 | 95.90 | 77.30 | 85.70 | 76.50 | 64.70 | 62.40 | 79.50 | 61.60 | NA | NA | |

| Research And Development Expense | 1.30 | 1.00 | 1.00 | 1.30 | 0.90 | 0.80 | 0.90 | 0.80 | 0.80 | 0.70 | 0.70 | 0.90 | 1.00 | 0.80 | 1.00 | 0.80 | 0.90 | 0.80 | 0.80 | 0.90 | 0.90 | 1.00 | 1.00 | 0.80 | 0.90 | NA | NA | |

| Selling General And Administrative Expense | 13.20 | 17.60 | 16.30 | 14.60 | 15.00 | 13.80 | 11.80 | 15.70 | 11.80 | 11.70 | 10.70 | 13.50 | 10.00 | 10.30 | 10.80 | 11.30 | 10.20 | 9.80 | 9.20 | 8.40 | 4.70 | 4.40 | 3.60 | 3.30 | 3.20 | NA | NA | |

| Operating Income Loss | 93.40 | 100.60 | 146.80 | 94.90 | 102.70 | 84.70 | 46.10 | 18.80 | 3.80 | 5.40 | 1.70 | -3.90 | -13.20 | -1.90 | -2.10 | 5.70 | 13.80 | 18.10 | 21.00 | 34.10 | 35.50 | 43.20 | 40.40 | 33.90 | 32.80 | 17.40 | 17.40 | |

| Interest Paid Net | 5.50 | 0.30 | 5.50 | 0.20 | 6.00 | 0.60 | 5.50 | 0.40 | 5.60 | 0.90 | 6.40 | 0.80 | 0.60 | 2.00 | 2.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Gains Losses On Extinguishment Of Debt | NA | NA | NA | 0.00 | -0.10 | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | -0.10 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 9.30 | 14.60 | 23.90 | 5.50 | 21.50 | 30.20 | 4.70 | 9.50 | 15.40 | -2.50 | -0.90 | -0.30 | -3.50 | -2.00 | -0.30 | 5.10 | -4.20 | 2.60 | 4.10 | 7.90 | 5.90 | 5.20 | 8.00 | 11.70 | 7.70 | NA | NA | |

| Income Taxes Paid Net | 13.90 | 39.50 | 1.90 | 7.30 | 11.40 | 22.00 | 2.40 | 3.60 | 0.90 | 0.80 | -1.20 | -0.20 | 0.50 | 2.60 | -0.30 | 1.40 | 10.90 | 9.20 | 17.00 | 8.10 | 12.70 | 7.20 | 7.30 | 10.40 | NA | NA | NA | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | -0.40 | 0.40 | 0.20 | -0.40 | 0.20 | -0.10 | 0.10 | NA | -0.10 | 0.10 | NA | NA | 0.00 | -0.20 | 0.00 | -0.30 | 1.10 | 0.50 | -0.10 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 87.40 | 90.20 | 114.80 | 82.70 | 77.60 | 60.00 | 53.20 | 7.50 | -12.60 | 6.50 | -0.80 | -3.70 | -11.80 | -0.20 | -1.90 | -0.20 | 18.00 | 15.50 | 16.90 | 25.90 | 30.00 | 38.00 | 32.20 | -10.90 | 25.50 | 17.50 | 10.00 | |

| Comprehensive Income Net Of Tax | 85.20 | 89.60 | 116.50 | 85.90 | 71.70 | 55.50 | 52.30 | 9.20 | -13.80 | 7.80 | -1.10 | -2.30 | -8.80 | -0.20 | -3.70 | 1.10 | 17.20 | 15.00 | 17.80 | 25.30 | 28.20 | 34.30 | 34.70 | 17.30 | 26.70 | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 87.40 | 90.20 | 114.80 | 82.70 | 77.60 | 60.00 | 53.20 | 7.70 | -12.60 | 6.50 | -0.80 | NA | NA | -0.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Diluted | 87.40 | 90.20 | 114.80 | 82.70 | 77.60 | 60.00 | 53.20 | 7.70 | -12.60 | 6.50 | -0.80 | NA | NA | -0.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

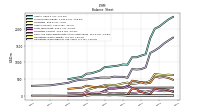

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

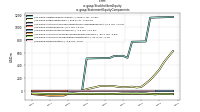

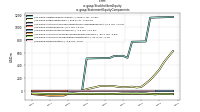

| Assets | 2361.10 | 2283.80 | 2180.30 | 2074.20 | 2007.30 | 1721.40 | 1242.60 | 1202.50 | 1151.00 | 1152.50 | 928.60 | 936.80 | 903.10 | 886.10 | 868.70 | 859.60 | 756.80 | 709.70 | 670.10 | 660.00 | 566.10 | NA | NA | 496.20 | NA | NA | NA | |

| Liabilities | 620.50 | 630.80 | 619.30 | 631.20 | 652.70 | 441.30 | 393.60 | 407.10 | 366.50 | 355.40 | 393.00 | 371.00 | 336.50 | 314.90 | 327.90 | 315.60 | NA | NA | NA | 171.90 | NA | NA | NA | NA | NA | NA | NA | |

| Liabilities And Stockholders Equity | 2361.10 | 2283.80 | 2180.30 | 2074.20 | 2007.30 | 1721.40 | 1242.60 | 1202.50 | 1151.00 | 1152.50 | 928.60 | 936.80 | 903.10 | 886.10 | 868.70 | 859.60 | 756.80 | 709.70 | 670.10 | 660.00 | 566.10 | NA | NA | 496.20 | NA | NA | NA | |

| Stockholders Equity | 1740.60 | 1653.00 | 1561.00 | 1443.00 | 1354.60 | 1280.10 | 849.00 | 795.40 | 784.50 | 797.10 | 535.60 | 565.80 | 566.60 | 571.20 | 540.80 | 544.00 | 541.90 | 523.60 | 506.90 | 487.90 | 479.50 | 463.50 | 432.50 | 385.40 | 367.70 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

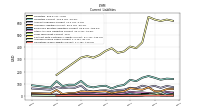

| Assets Current | 478.20 | 532.70 | 558.60 | 544.00 | 573.90 | 386.30 | 364.50 | 399.30 | 432.30 | 449.60 | 241.50 | 249.80 | 253.60 | 239.60 | 239.50 | 272.00 | 253.60 | 259.30 | 273.80 | 301.30 | 241.50 | NA | NA | 206.10 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 112.60 | 167.80 | 194.10 | 189.00 | 211.60 | 49.00 | 68.50 | 113.00 | 195.30 | 216.60 | 21.50 | 11.60 | 14.80 | 17.20 | 11.40 | 16.80 | 23.30 | 20.30 | 17.80 | 28.30 | 14.70 | NA | NA | 1.20 | 0.20 | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 112.60 | 167.80 | 194.10 | 189.00 | 211.60 | 49.00 | 68.50 | 113.00 | 195.30 | 216.60 | 21.50 | 11.60 | 14.80 | 17.20 | 11.40 | 16.80 | 23.30 | 20.30 | 17.80 | 28.30 | 14.70 | 1.50 | 1.40 | 1.20 | NA | NA | NA | |

| Accounts Receivable Net Current | 110.10 | 122.30 | 112.90 | 141.60 | NA | NA | NA | 96.40 | NA | NA | NA | 76.30 | NA | 55.70 | 56.50 | 90.00 | 86.80 | 118.00 | 115.10 | 141.40 | 144.10 | NA | NA | 122.70 | NA | NA | NA | |

| Inventory Net | 202.70 | 197.80 | 184.10 | 152.30 | 141.80 | 156.30 | 150.50 | 134.60 | 110.20 | 105.30 | 96.70 | 105.60 | 114.10 | 117.00 | 120.90 | 113.40 | 74.80 | 67.50 | 84.40 | 71.80 | 47.30 | NA | NA | 49.60 | NA | NA | NA | |

| Other Assets Current | 5.20 | 1.60 | 6.70 | 6.50 | 7.40 | 7.70 | 7.00 | 9.60 | 6.00 | 5.60 | 8.30 | 12.80 | 7.10 | 4.00 | 4.30 | 3.40 | 4.00 | 7.00 | 5.60 | 3.20 | 1.90 | NA | NA | 0.70 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 52.80 | 44.80 | 67.50 | 61.10 | 56.50 | 48.20 | 40.00 | 55.30 | 43.80 | 44.00 | 40.60 | 56.30 | 52.00 | 49.70 | 50.70 | 51.80 | 68.70 | 53.50 | 56.50 | 59.80 | 35.40 | NA | NA | 32.60 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | NA | NA | NA | 1221.40 | NA | NA | NA | 920.90 | NA | NA | NA | 767.70 | NA | NA | NA | 671.00 | 583.80 | 531.90 | 491.30 | 468.80 | 442.70 | NA | NA | 407.20 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 260.80 | 265.70 | 261.00 | 253.10 | 248.30 | 248.00 | 246.20 | 243.00 | 238.30 | 234.10 | 228.10 | 222.40 | 217.10 | 209.40 | 204.40 | 202.20 | 197.90 | 194.60 | 194.70 | 193.10 | 191.00 | NA | NA | 186.50 | NA | NA | NA | |

| Property Plant And Equipment Net | 1215.40 | 1137.40 | 1040.00 | 968.30 | 882.20 | 803.20 | 737.80 | 677.90 | 605.30 | 573.60 | 560.00 | 545.30 | 533.60 | 528.50 | 507.10 | 468.80 | 385.90 | 337.30 | 296.60 | 275.70 | 251.70 | NA | NA | 220.70 | NA | NA | NA | |

| Investments In Affiliates Subsidiaries Associates And Joint Ventures | 504.80 | 455.70 | 453.30 | 440.30 | 433.90 | 421.30 | 33.40 | 27.20 | 23.20 | 24.20 | 22.80 | 23.80 | 2.40 | 2.40 | 2.20 | 2.20 | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Noncurrent | 155.90 | 151.10 | 122.20 | 116.40 | 111.90 | 104.50 | 100.90 | 90.90 | 81.60 | 81.80 | 87.30 | 88.40 | 97.30 | 99.10 | 96.90 | 91.50 | 87.10 | 89.20 | 81.40 | 80.00 | 71.60 | NA | NA | 66.90 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

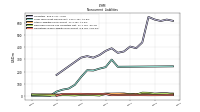

| Liabilities Current | 138.30 | 141.50 | 132.10 | 148.70 | 163.00 | 148.80 | 120.30 | 131.30 | 88.70 | 79.80 | 60.20 | 82.30 | 78.20 | 68.80 | 78.70 | 122.50 | 90.00 | 91.10 | 79.10 | 120.40 | 68.30 | NA | NA | 86.00 | NA | NA | NA | |

| Accounts Payable Current | 71.10 | 80.50 | 64.70 | 81.70 | 72.20 | 82.90 | 62.20 | 65.40 | 49.70 | 47.70 | 38.70 | 43.90 | 42.40 | 31.20 | 42.90 | 83.10 | 65.50 | 67.80 | 61.90 | 72.00 | 49.60 | NA | NA | 59.70 | NA | NA | NA | |

| Other Accrued Liabilities Current | 24.30 | 31.60 | 18.80 | 11.10 | 22.20 | 26.70 | 26.90 | 32.30 | 19.70 | 15.30 | 6.60 | 15.30 | 16.20 | 20.50 | 21.70 | 23.20 | 11.60 | 9.60 | 4.00 | 9.10 | 4.90 | NA | NA | 10.00 | NA | NA | NA | |

| Accrued Income Taxes Current | 1.40 | 3.20 | 27.60 | 13.20 | 7.40 | 1.90 | 2.80 | 3.00 | 2.30 | 0.70 | 0.40 | NA | NA | 0.00 | 0.10 | 0.90 | 0.80 | 0.60 | 2.30 | 1.60 | 1.00 | NA | NA | 3.20 | NA | NA | NA | |

| Accrued Liabilities Current | 55.00 | 54.50 | 36.20 | 37.40 | 68.90 | 49.40 | 54.20 | 61.80 | 35.70 | 30.30 | 20.40 | 36.70 | 33.80 | 35.60 | 33.80 | 36.40 | 21.80 | 21.00 | 13.40 | 46.80 | 17.70 | NA | NA | 21.30 | NA | NA | NA | |

| Contract With Customer Liability Current | 9.70 | 2.30 | 2.50 | 15.50 | 7.30 | 4.00 | 0.70 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | NA | NA | 1.80 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 243.10 | 242.70 | 242.30 | 241.90 | 241.60 | 241.20 | 240.80 | 240.40 | 240.10 | 239.70 | 298.90 | 236.70 | 224.10 | 208.70 | 211.10 | 154.60 | 90.10 | 59.10 | 50.00 | 34.00 | 0.00 | NA | NA | 0.00 | NA | NA | NA | |

| Long Term Debt Noncurrent | 243.10 | 242.70 | 242.30 | 241.90 | 241.60 | 241.20 | 240.80 | 240.40 | NA | 239.70 | 298.90 | 236.70 | 224.10 | 208.70 | 211.10 | 154.60 | 90.10 | 59.10 | 50.00 | 34.00 | 0.00 | NA | NA | 0.00 | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 11.70 | 18.50 | 17.80 | 16.10 | 23.60 | 24.90 | 7.70 | 12.70 | NA | 5.80 | 6.10 | 13.90 | 1.60 | 5.00 | 6.40 | 6.70 | 2.20 | 4.20 | 4.50 | 2.50 | 1.90 | NA | NA | 8.20 | NA | NA | NA | |

| Other Liabilities Noncurrent | 17.40 | 17.60 | 18.10 | 15.90 | 16.70 | 16.20 | 14.10 | 11.70 | 18.20 | 18.10 | 17.30 | 17.20 | 11.90 | 11.30 | 11.50 | 10.00 | 11.10 | 11.00 | 9.40 | 9.30 | 10.30 | NA | NA | 10.70 | NA | NA | NA | |

| Operating Lease Liability Noncurrent | 5.50 | 6.00 | 4.50 | 4.20 | 4.10 | 4.50 | 5.00 | 5.40 | 5.50 | 5.80 | 4.30 | 14.80 | 14.30 | 14.70 | 13.80 | 15.40 | NA | NA | 14.30 | 0.00 | NA | NA | NA | NA | NA | NA | NA |

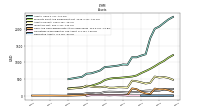

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

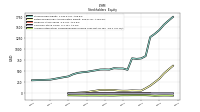

| Stockholders Equity | 1740.60 | 1653.00 | 1561.00 | 1443.00 | 1354.60 | 1280.10 | 849.00 | 795.40 | 784.50 | 797.10 | 535.60 | 565.80 | 566.60 | 571.20 | 540.80 | 544.00 | 541.90 | 523.60 | 506.90 | 487.90 | 479.50 | 463.50 | 432.50 | 385.40 | 367.70 | NA | NA | |

| Common Stock Value | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | NA | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | NA | NA | NA | 0.00 | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 1166.70 | 1164.30 | 1161.90 | 1160.40 | 1157.80 | 1155.10 | 779.40 | 778.10 | NA | 775.20 | 521.50 | 553.10 | 551.70 | 547.50 | 516.90 | 516.40 | 515.80 | 514.70 | 512.30 | 511.10 | NA | NA | NA | 0.00 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 626.80 | 539.40 | 449.20 | 334.40 | 251.70 | 174.10 | 114.10 | 60.90 | NA | 66.00 | 59.50 | 57.70 | 62.70 | 74.50 | 74.70 | 76.60 | 76.30 | 58.30 | 42.80 | 25.90 | NA | NA | NA | 0.00 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -52.10 | -49.90 | -49.30 | -51.00 | -54.20 | -48.30 | -43.80 | -42.90 | NA | -43.40 | -44.70 | -44.40 | -47.10 | -50.10 | -50.10 | -48.30 | -49.60 | -48.80 | -48.30 | -49.20 | -48.60 | NA | NA | -45.60 | NA | NA | NA | |

| Treasury Stock Value | NA | NA | NA | NA | NA | 0.90 | 0.80 | 0.80 | NA | 0.80 | 0.80 | 0.70 | 0.80 | 0.80 | 0.80 | 0.80 | 0.70 | 0.70 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 2.20 | 2.10 | 1.90 | NA | 1.80 | 1.80 | 1.70 | NA | 1.40 | 1.40 | 1.20 | NA | 1.20 | 1.00 | 1.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

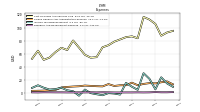

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

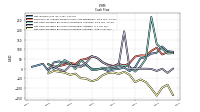

| Net Cash Provided By Used In Operating Activities | 80.20 | 78.70 | 102.90 | 126.50 | 267.00 | 50.40 | 10.80 | -14.60 | 10.40 | 17.90 | 12.70 | 4.80 | 1.80 | 5.10 | -5.40 | -6.80 | 23.60 | 42.70 | -1.40 | 29.50 | 44.50 | 18.90 | -0.90 | 24.40 | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -135.30 | -82.10 | -98.10 | -139.00 | -101.60 | -68.70 | -55.40 | -69.00 | -31.60 | -15.70 | -27.00 | -19.30 | -21.90 | -33.60 | -56.30 | -64.60 | -51.20 | -48.90 | -25.30 | -31.40 | -20.20 | -15.40 | -11.40 | -23.70 | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | 0.10 | -21.50 | -0.10 | -11.50 | -1.20 | 0.10 | 0.10 | 1.10 | 0.00 | 192.70 | 24.20 | 10.90 | 17.30 | 34.40 | 56.50 | 64.60 | 30.90 | 9.10 | 15.90 | 16.10 | -12.20 | -3.30 | 12.40 | 0.40 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 80.20 | 78.70 | 102.90 | 126.50 | 267.00 | 50.40 | 10.80 | -14.60 | 10.40 | 17.90 | 12.70 | 4.80 | 1.80 | 5.10 | -5.40 | -6.80 | 23.60 | 42.70 | -1.40 | 29.50 | 44.50 | 18.90 | -0.90 | 24.40 | NA | NA | NA | |

| Net Income Loss | 87.40 | 90.20 | 114.80 | 82.70 | 77.60 | 60.00 | 53.20 | 7.50 | -12.60 | 6.50 | -0.80 | -3.70 | -11.80 | -0.20 | -1.90 | -0.20 | 18.00 | 15.50 | 16.90 | 25.90 | 30.00 | 38.00 | 32.20 | -10.90 | 25.50 | 17.50 | 10.00 | |

| Depreciation Depletion And Amortization | 7.70 | 7.00 | 6.80 | 8.30 | 6.60 | 6.40 | 6.40 | 6.40 | 6.20 | 6.30 | 6.20 | 7.30 | 6.10 | 6.00 | 5.60 | 5.40 | 5.80 | 4.80 | 4.90 | 4.70 | 4.50 | 4.30 | 4.30 | 4.20 | NA | NA | NA | |

| Increase Decrease In Accounts Receivable | -10.90 | 11.30 | -30.30 | -25.60 | 36.00 | 31.40 | 9.30 | 12.80 | -0.60 | 0.50 | 6.30 | 2.20 | 16.30 | -0.80 | -33.00 | 2.10 | -30.00 | 3.80 | -27.30 | -2.20 | -5.10 | 11.80 | 16.30 | 22.10 | NA | NA | NA | |

| Increase Decrease In Inventories | 9.50 | 15.70 | 31.00 | 8.50 | -10.70 | 8.60 | 16.50 | 24.00 | 5.10 | 8.20 | -9.10 | -10.20 | -4.90 | -3.90 | 8.90 | 37.00 | 8.10 | -15.80 | 11.30 | 24.40 | -3.50 | 1.30 | 2.00 | -4.60 | NA | NA | NA | |

| Share Based Compensation | 2.20 | 2.10 | 1.90 | 1.60 | 1.80 | 1.80 | 1.60 | 1.30 | 1.40 | 1.50 | 1.10 | 0.70 | 1.40 | 1.00 | 1.00 | 1.00 | 1.00 | 1.10 | 1.20 | 1.00 | 1.20 | 1.10 | 1.10 | 0.70 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -135.30 | -82.10 | -98.10 | -139.00 | -101.60 | -68.70 | -55.40 | -69.00 | -31.60 | -15.70 | -27.00 | -19.30 | -21.90 | -33.60 | -56.30 | -64.60 | -51.20 | -48.90 | -25.30 | -31.40 | -20.20 | -15.40 | -11.40 | -23.70 | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 81.60 | 84.30 | 73.50 | 108.60 | 91.70 | 67.90 | 68.70 | 62.50 | 29.00 | 14.90 | 25.50 | 14.00 | 20.80 | 33.20 | 56.00 | 63.80 | 51.20 | 45.00 | 24.30 | 30.20 | 20.00 | 13.90 | 9.50 | 23.20 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 0.10 | -21.50 | -0.10 | -11.50 | -1.20 | 0.10 | 0.10 | 1.10 | 0.00 | 192.70 | 24.20 | 10.90 | 17.30 | 34.40 | 56.50 | 64.60 | 30.90 | 9.10 | 15.90 | 16.10 | -12.20 | -3.30 | 12.40 | 0.40 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

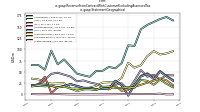

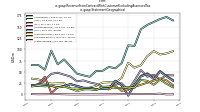

| Revenues | 211.40 | 235.80 | 253.50 | 219.40 | 231.60 | 218.70 | 143.50 | 122.90 | 103.60 | 102.20 | 91.70 | 82.20 | 72.60 | 64.90 | 68.50 | 78.40 | 97.70 | 114.00 | 98.30 | 119.80 | 112.00 | 107.90 | 102.80 | 113.40 | 94.40 | 73.90 | 65.70 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 211.40 | 235.80 | 253.50 | 219.40 | 231.60 | 218.70 | 143.50 | 122.90 | 103.60 | 102.20 | 91.70 | 82.20 | 72.60 | 64.90 | 68.50 | 78.40 | 97.70 | 114.00 | 98.30 | 119.80 | 112.00 | 107.90 | 102.80 | 113.40 | 94.40 | 73.90 | 65.70 | |

| Butyllithium | 49.60 | 62.40 | 76.30 | 74.60 | 88.20 | 81.20 | 33.70 | 29.30 | 27.40 | 22.90 | 25.90 | 24.70 | 19.60 | 21.30 | 21.50 | 22.70 | 25.60 | 24.70 | 26.90 | 23.50 | 26.30 | 24.60 | 24.60 | NA | NA | NA | NA | |

| High Purity Lithium Metaland Other Specialty Compounds | 10.00 | 14.70 | 15.00 | 8.90 | 11.90 | 16.70 | 13.40 | 9.30 | 9.80 | 9.00 | 8.90 | 8.70 | 7.10 | 4.20 | 8.00 | 13.60 | 11.70 | 14.10 | 13.00 | 14.70 | 14.50 | 15.50 | 17.80 | NA | NA | NA | NA | |

| Lithium Carbonate Lithium Chloride | 9.00 | 5.10 | 9.50 | 19.90 | 13.10 | 7.20 | 28.90 | 36.80 | 15.70 | 10.50 | 7.10 | 6.70 | 2.00 | 5.60 | 1.30 | 6.50 | 7.50 | 6.80 | 1.50 | 14.40 | 18.40 | 14.90 | 10.60 | NA | NA | NA | NA | |

| Lithium Hydroxide | 142.80 | 153.60 | 152.70 | 116.00 | 118.40 | 113.60 | 67.50 | 47.50 | 50.70 | 59.80 | 49.80 | 42.10 | 43.90 | 33.80 | 37.70 | 35.60 | 52.90 | 68.40 | 56.90 | 67.20 | 52.80 | 52.90 | 49.80 | NA | NA | NA | NA | |

| 163.80 | 171.60 | 167.00 | 160.60 | 154.00 | 144.40 | 107.50 | 108.70 | 69.40 | 57.80 | 60.90 | 52.40 | 51.80 | 39.00 | 42.30 | 46.00 | 62.20 | 77.50 | 66.50 | 97.00 | 54.70 | 65.00 | 64.80 | NA | NA | NA | NA | ||

| 95.60 | 90.80 | 88.40 | 96.10 | 85.00 | 64.60 | 59.10 | 70.10 | 36.60 | 26.20 | 27.00 | 26.20 | 19.00 | NA | NA | 6.90 | 13.40 | 24.90 | NA | 23.70 | 26.60 | 33.30 | 35.00 | NA | NA | NA | NA | ||

| 42.10 | 42.70 | 33.40 | 43.50 | 39.20 | 54.20 | 30.60 | 10.00 | 24.50 | 23.90 | 16.70 | 16.60 | 23.50 | 26.60 | 31.10 | 29.00 | 39.60 | 43.80 | 48.00 | 45.60 | 32.90 | 18.30 | 19.70 | NA | NA | NA | NA | ||

| 0.10 | 0.00 | 1.80 | 1.10 | 0.70 | 1.10 | NA | NA | NA | NA | NA | 0.10 | 0.00 | 0.00 | 0.10 | 0.00 | 0.00 | 0.30 | 0.70 | 0.60 | 0.40 | 0.30 | 0.70 | NA | NA | NA | NA | ||

| 31.90 | 40.70 | 51.90 | 36.40 | 46.80 | 41.20 | 21.30 | -2.00 | 20.00 | 30.10 | 13.30 | 12.80 | 11.00 | 14.70 | 14.80 | 19.10 | 22.70 | 18.60 | 15.80 | 2.90 | 39.20 | 22.60 | 19.80 | NA | NA | NA | NA | ||

| US | 30.00 | 39.90 | 50.20 | 33.50 | 45.10 | 39.60 | 20.80 | -2.80 | 19.70 | 29.90 | 13.10 | 12.60 | 11.00 | 14.50 | 14.60 | 18.60 | 22.80 | 18.10 | 15.80 | 18.70 | 21.40 | 22.10 | 19.80 | NA | NA | NA | NA | |

| KRW | 20.60 | 31.20 | 35.10 | NA | NA | NA | NA | NA | 7.60 | 19.40 | 11.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| EMEA | 15.60 | 23.50 | 32.80 | 21.30 | 30.10 | 32.00 | 14.70 | 16.20 | 14.20 | 14.30 | 17.50 | 16.90 | 9.80 | 11.20 | 11.30 | 13.30 | 12.80 | 17.60 | 15.30 | 19.30 | 17.70 | 20.00 | 17.50 | NA | NA | NA | NA |