| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | ||

|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.80 | 0.78 | 0.76 | NA | 0.71 | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 79.55 | NA | 75.04 | 71.71 | NA | 69.02 | |

| Weighted Average Number Of Shares Outstanding Basic | 79.55 | NA | 75.04 | 71.71 | NA | 69.02 | |

| Earnings Per Share Basic | 1.02 | 0.98 | 0.83 | 0.73 | 0.73 | 0.71 | |

| Earnings Per Share Diluted | 1.02 | 0.98 | 0.83 | 0.73 | 0.73 | 0.71 |

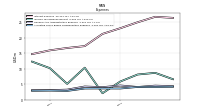

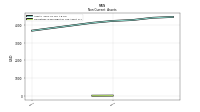

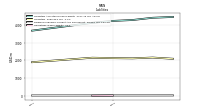

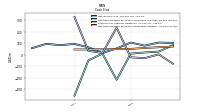

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | ||

|---|---|---|---|---|---|---|---|

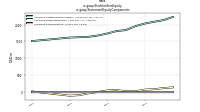

| Net Investment Income | 80.97 | 75.94 | 62.45 | 52.21 | 51.21 | 49.30 | |

| General And Administrative Expense | 4.08 | 4.57 | 4.02 | 3.23 | 3.06 | 3.05 | |

| Interest Expense | 25.00 | 23.06 | 21.23 | 16.69 | 15.92 | 14.71 | |

| Interest Expense Debt | 25.00 | 23.06 | 21.23 | 16.69 | 15.92 | 14.71 | |

| Interest Paid Net | 22.12 | 22.33 | 18.80 | 13.75 | 16.83 | NA | |

| Allocated Share Based Compensation Expense | 4.10 | 3.60 | 3.62 | 2.82 | 2.93 | 2.87 | |

| Income Tax Expense Benefit | 8.11 | 5.85 | 2.06 | 5.10 | 10.17 | 12.28 | |

| Income Taxes Paid | 2.73 | 1.70 | -0.02 | 2.87 | 0.19 | NA | |

| Net Income Loss | 79.59 | 106.32 | 55.34 | 65.20 | 94.35 | 83.96 |

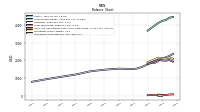

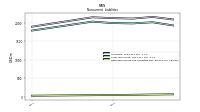

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | ||

|---|---|---|---|---|---|---|---|

| Assets | 4293.26 | 4241.89 | 4134.97 | NA | 3690.29 | NA | |

| Liabilities | 2120.33 | 2133.30 | 2155.55 | NA | 1901.44 | NA | |

| Liabilities And Stockholders Equity | 4293.26 | 4241.89 | 4134.97 | NA | 3690.29 | NA | |

| Stockholders Equity | 2172.92 | 2108.59 | 1979.42 | 1873.65 | 1788.85 | 1684.31 |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | ||

|---|---|---|---|---|---|---|---|

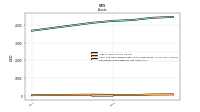

| Cash And Cash Equivalents At Carrying Value | 39.75 | 49.12 | 61.16 | NA | 32.63 | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 39.75 | 49.12 | 61.16 | 17.95 | 32.63 | 59.57 |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | ||

|---|---|---|---|---|---|---|---|

| Long Term Debt | 1989.64 | 1999.10 | 2038.38 | NA | 1796.06 | NA | |

| Deferred Income Tax Liabilities Net | 54.23 | 47.85 | 43.54 | NA | 29.72 | NA |

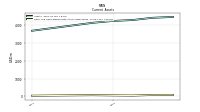

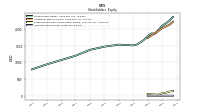

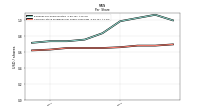

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | ||

|---|---|---|---|---|---|---|---|

| Stockholders Equity | 2172.92 | 2108.59 | 1979.42 | 1873.65 | 1788.85 | 1684.31 | |

| Common Stock Value | 0.80 | 0.78 | 0.76 | NA | 0.71 | NA | |

| Additional Paid In Capital | 2083.18 | 2030.53 | 1952.99 | NA | 1736.35 | NA | |

| Retained Earnings Accumulated Deficit | 88.95 | 77.27 | 25.66 | NA | 51.79 | NA | |

| Stock Issued During Period Value New Issues | 40.90 | NA | 105.35 | 63.52 | NA | 31.82 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 4.10 | NA | 3.62 | 2.82 | NA | 2.87 |

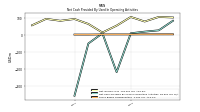

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | ||

|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 19.97 | 10.39 | -217.89 | -49.68 | -356.66 | NA | |

| Net Cash Provided By Used In Financing Activities | -29.34 | -22.43 | 235.67 | 35.00 | 329.72 | NA |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | ||

|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 19.97 | 10.39 | -217.89 | -49.68 | -356.66 | NA | |

| Net Income Loss | 79.59 | 106.32 | 55.34 | 65.20 | 94.35 | 83.96 | |

| Deferred Income Tax Expense Benefit | 6.38 | 4.31 | 0.52 | 3.79 | 6.68 | 11.33 | |

| Share Based Compensation | 4.10 | 3.60 | 3.62 | 2.82 | 2.93 | NA | |

| Amortization Of Financing Costs | 0.75 | 0.80 | 0.70 | 0.69 | 0.72 | NA |

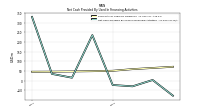

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | ||

|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -29.34 | -22.43 | 235.67 | 35.00 | 329.72 | NA | |

| Payments Of Dividends Common Stock | 53.60 | 51.10 | 48.10 | 46.00 | 44.00 | 42.30 |

| 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | ||

|---|---|---|---|---|---|---|---|

| External Investment Manager | 8.93 | 8.06 | 5.44 | 5.73 | 5.56 | 4.61 | |

| External Investment Manager | NA | NA | 5.44 | NA | NA | NA | |

| Administrative Service, External Investment Manager | 0.15 | 0.15 | 0.15 | 0.15 | NA | NA | |

| Management Service Base, External Investment Manager | 5.47 | 5.44 | 5.47 | 5.44 | 4.96 | 4.59 | |

| Management Service Incentive, External Investment Manager | 3.30 | 2.47 | -0.18 | 0.14 | 0.60 | 0.02 | |

| Administrative Service, External Investment Manager | NA | NA | 0.15 | NA | NA | NA | |

| Management Service Base, External Investment Manager | NA | NA | 5.47 | NA | NA | NA | |

| Management Service Incentive, External Investment Manager | NA | NA | -0.18 | NA | NA | NA |